Академический Документы

Профессиональный Документы

Культура Документы

Do 5-1959

Загружено:

Florescinda Mae Napa0 оценок0% нашли этот документ полезным (0 голосов)

10 просмотров1 страницаThis document outlines regulations for levying and collecting a 10% tax on imports by new industries granted tax exemptions under Republic Acts Nos. 35 and 901 from January 1, 1959 to December 31, 1959. Specifically, it states that:

1) Machinery and raw materials imported by exempt industries will be fully exempt from the special import tax.

2) Exempt industry imports will be liable for 10% payment of other taxes and duties, unless the import arrived and necessary documents were filed by December 31, 1958.

3) The presentation of related documents can occur on the next business day if the deadline falls on a holiday.

Исходное описание:

DEpt Order 9-1959

Оригинальное название

DO 5-1959

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document outlines regulations for levying and collecting a 10% tax on imports by new industries granted tax exemptions under Republic Acts Nos. 35 and 901 from January 1, 1959 to December 31, 1959. Specifically, it states that:

1) Machinery and raw materials imported by exempt industries will be fully exempt from the special import tax.

2) Exempt industry imports will be liable for 10% payment of other taxes and duties, unless the import arrived and necessary documents were filed by December 31, 1958.

3) The presentation of related documents can occur on the next business day if the deadline falls on a holiday.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

10 просмотров1 страницаDo 5-1959

Загружено:

Florescinda Mae NapaThis document outlines regulations for levying and collecting a 10% tax on imports by new industries granted tax exemptions under Republic Acts Nos. 35 and 901 from January 1, 1959 to December 31, 1959. Specifically, it states that:

1) Machinery and raw materials imported by exempt industries will be fully exempt from the special import tax.

2) Exempt industry imports will be liable for 10% payment of other taxes and duties, unless the import arrived and necessary documents were filed by December 31, 1958.

3) The presentation of related documents can occur on the next business day if the deadline falls on a holiday.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

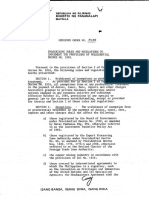

January 8, 1959

DLTARTVI Vf 03_^E N0.

5i

By authority of section 11 of Republic At No. 903, the following

ryhes and regulations are hereby promulgated for the guidance of the

Burman of Custaas and the Bureau of Internal Revenue and all concerned

An respect to the levy and collection, during the period beginning

January 1. 1959 and ending December 31, 1959, of. ten per centum (10%)

Z

CFt e

of all t.xes and customs duties on importations of new and necessary

industries granted tax exemption under Republic Acts Nos. 35 and 901:

Paragraph I. Machinery and/or raw materials as may be allowed 'by

the Department of Finance to be imported by new. and necessary industries

in connection with their tax-exempt industries shall be exempt in full

from the payment of the special import tax;

. Par. Il. With the exception of special import tar-, leportations of

tax-exempt industries skill be liable to the p;EVment of ten per centum

(10%) of all other taxes and customs duties directly payable by 'tax-exempt

industries, unless all of the following. Condit ions are prose-it: (a) the

importation arrived within the limits of the corresponding port of entry

-in the Philippines before midnight of. December 31f 1958; (b) the specified

entry form together with arty related documents such as Central Bank and/or

No-Dollar Import Office release certificates or de1i.ver

its from

ship ads, which are required by any provision of existirg law or regulatiaa to be filed with such ant ry form at the time of entry, has been

duly filed at the port or station and accepted before midnight of December

31, 1958 by the customs officer designated to receive such entry form and

related documents; and (c) the articles have legally or at least constructively left the jurisdiction of the Bureau of 9ustans by the issuance of

delivery permits and/or any fees and other lawful charges were paid or

secured to be paid before midnight of December 31; 1958 to the customs

officer designated to receive such monies.

However, the following provisions of Section 31 of the Revised Administrative Code shall be taken into account with respect to the;presentation of the related documents mentioned in condition (b) above:,

"Preterition of holidpZ. - Where the day, or the last days'

for doing any act required or permitted by law falls on a

holiday, the act may be done on the next succeeding business day,."

Para III: Philippine custmts and internal revenue

give due publicity to the provisions of this Order.

rltrhished

he Commissioner of Internal Revenue

The-Commissioner of Customs

t,

Вам также может понравиться

- Tariff and Customs Code - OutlineДокумент7 страницTariff and Customs Code - OutlineKyle BollozosОценок пока нет

- RA07651 TaxДокумент7 страницRA07651 TaxSuiОценок пока нет

- Section 1Документ46 страницSection 1Luke CruzОценок пока нет

- Chevron Philippines, Inc. vs. Commissioner of The Bureau of Customs 561 SCRA 710, August 11, 2008Документ11 страницChevron Philippines, Inc. vs. Commissioner of The Bureau of Customs 561 SCRA 710, August 11, 2008Francise Mae Montilla MordenoОценок пока нет

- G.R. No. L-24192 May 22, 1968 COMMISSIONER OF CUSTOMS, Petitioner, CALTEX (PHILIPPINES), INC., and COURT of TAX APPEALS, RespondentsДокумент12 страницG.R. No. L-24192 May 22, 1968 COMMISSIONER OF CUSTOMS, Petitioner, CALTEX (PHILIPPINES), INC., and COURT of TAX APPEALS, RespondentsVenusОценок пока нет

- CMTAДокумент11 страницCMTAJaya RhysОценок пока нет

- Ra 7651Документ7 страницRa 7651Joseph Santos GacayanОценок пока нет

- Republic Act No. 7651Документ7 страницRepublic Act No. 7651Joseph Santos GacayanОценок пока нет

- CM ReviewerДокумент10 страницCM ReviewerJerick OrnedoОценок пока нет

- Automobiles RR 2-2016Документ3 страницыAutomobiles RR 2-2016Romer LesondatoОценок пока нет

- RR 9-99Документ2 страницыRR 9-99matinikkiОценок пока нет

- cs22 2013Документ7 страницcs22 2013stephin k jОценок пока нет

- Excise Taxes On Certain GoodsДокумент4 страницыExcise Taxes On Certain GoodsshakiraОценок пока нет

- Assignment 1 (New)Документ8 страницAssignment 1 (New)adil_lodhiОценок пока нет

- Customs Vs CaltexДокумент4 страницыCustoms Vs CaltexKatipunan I DistrictОценок пока нет

- Title ViДокумент30 страницTitle Vimiss independentОценок пока нет

- Procter and Gamble Vs Commissioner of CustomsДокумент11 страницProcter and Gamble Vs Commissioner of CustomsJustin HarrisОценок пока нет

- Changes Under The Customs Modernization and Tariff ActДокумент6 страницChanges Under The Customs Modernization and Tariff Actmami mingОценок пока нет

- 57241-1959-Income Tax of New and Necessary Industries20210519-11-PfpfswДокумент2 страницы57241-1959-Income Tax of New and Necessary Industries20210519-11-PfpfswJM CBОценок пока нет

- 4 - T-4 Import ClearanceДокумент13 страниц4 - T-4 Import ClearanceKesTerJeeeОценок пока нет

- Customs Modernization and Tariff ActДокумент6 страницCustoms Modernization and Tariff ActGabriel SantosОценок пока нет

- CMO No.24 2015 Procedures in The Processing of Importer or Consignees Request For Exemption of Period To File Entry DeclarationДокумент4 страницыCMO No.24 2015 Procedures in The Processing of Importer or Consignees Request For Exemption of Period To File Entry DeclarationPortCalls100% (4)

- Cir Vs TelefunkenДокумент3 страницыCir Vs TelefunkenAiken Alagban LadinesОценок пока нет

- Title VДокумент5 страницTitle VErica Mae GuzmanОценок пока нет

- SRO FBR Capital Goods Procedure Updated-CustomsДокумент4 страницыSRO FBR Capital Goods Procedure Updated-CustomsfaisalОценок пока нет

- Eo 226 & Ra 7918Документ25 страницEo 226 & Ra 7918Tet DomingoОценок пока нет

- RR No. 13-2018 CorrectedДокумент20 страницRR No. 13-2018 CorrectedRap BaguioОценок пока нет

- Train Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsДокумент2 страницыTrain Law Section 32. Section 107 of The NIRC, As Amended, Is Hereby Further Amended To Read As FollowsReynaldo YuОценок пока нет

- Customs Act, 1962 - FA'17 - Sec 25-43Документ24 страницыCustoms Act, 1962 - FA'17 - Sec 25-43Vikash KumarОценок пока нет

- PAL ActДокумент8 страницPAL ActsudumalliОценок пока нет

- Title V: - Other Percentage TaxesДокумент9 страницTitle V: - Other Percentage TaxesArnold BernasОценок пока нет

- Ra 10378Документ6 страницRa 10378Dorothy PuguonОценок пока нет

- Sro 565-2006Документ44 страницыSro 565-2006Abdullah Jathol100% (1)

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledДокумент8 страницBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledCkey ArОценок пока нет

- Tariff and Customs CodeДокумент22 страницыTariff and Customs CodeAbby ReyesОценок пока нет

- Ra 9400Документ8 страницRa 9400HjktdmhmОценок пока нет

- 2019 P T D 484Документ19 страниц2019 P T D 484Saveeza Kabsha AbbasiОценок пока нет

- Asturias Sugar Central Inc. vs. Commissioner of Customs 29 SCRA 617 GR L 19337 Sep 30 1969Документ6 страницAsturias Sugar Central Inc. vs. Commissioner of Customs 29 SCRA 617 GR L 19337 Sep 30 1969Rhodail Andrew CastroОценок пока нет

- Overview CMTAДокумент12 страницOverview CMTAAnileto BolecheОценок пока нет

- PLDT v. City of Bacolod, G.R. No. 149179, July 15, 2005Документ7 страницPLDT v. City of Bacolod, G.R. No. 149179, July 15, 2005JamieОценок пока нет

- 1126 1130Документ31 страница1126 1130Reise MendozaОценок пока нет

- Sro 327-2008Документ22 страницыSro 327-2008abid205Оценок пока нет

- Payments To Non-ResidentsДокумент8 страницPayments To Non-Residentssmyns.bwОценок пока нет

- Government of Pakistan Ministry of Finance, Revenue and Economic Affairs (Revenue Division) Notification (Customs/Sales Tax)Документ5 страницGovernment of Pakistan Ministry of Finance, Revenue and Economic Affairs (Revenue Division) Notification (Customs/Sales Tax)MOHSINОценок пока нет

- I. Abandonment: Customs Administrative Order (CAO) No. 17-2019Документ5 страницI. Abandonment: Customs Administrative Order (CAO) No. 17-2019Arya Padrino100% (1)

- 148 Garcia vs. Executive SecretaryДокумент6 страниц148 Garcia vs. Executive SecretaryAMIDA ISMAEL. SALISAОценок пока нет

- Balmaceda Vs CorominasДокумент9 страницBalmaceda Vs Corominaskoey100% (1)

- SEC 23 & 24, RA 7916 SEC. 23. Fiscal Incentives. - Business Establishments Operating Within TheДокумент2 страницыSEC 23 & 24, RA 7916 SEC. 23. Fiscal Incentives. - Business Establishments Operating Within TheFrances Ann TevesОценок пока нет

- Changes Under The Customs Modernization and Tariff Act: An OverviewДокумент2 страницыChanges Under The Customs Modernization and Tariff Act: An OverviewJay-r PlazaОценок пока нет

- CMO No.24 2015 AbandonmentДокумент4 страницыCMO No.24 2015 AbandonmentDeb BagaporoОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент4 страницыBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJen AnchetaОценок пока нет

- Title XV Miscellaneous ProvisionsДокумент3 страницыTitle XV Miscellaneous ProvisionsVertine Paul Fernandez BelerОценок пока нет

- PD 1705Документ23 страницыPD 1705Jobi BryantОценок пока нет

- Tiu Vs CAДокумент6 страницTiu Vs CARodney Cho TimbolОценок пока нет

- Cir & Coc v. PALДокумент11 страницCir & Coc v. PALHi Law SchoolОценок пока нет

- RR 09-99Документ1 страницаRR 09-99saintkarriОценок пока нет

- RA 7369-Tax Exemption, Duty, & Tax Credit On Capital EquipmentДокумент4 страницыRA 7369-Tax Exemption, Duty, & Tax Credit On Capital EquipmentCrislene CruzОценок пока нет

- Bar Review Companion: Taxation: Anvil Law Books Series, #4От EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Оценок пока нет

- National Budget Circular: Department of Budget and ManagementДокумент6 страницNational Budget Circular: Department of Budget and ManagementIsaias S. Pastrana Jr.Оценок пока нет

- Ao2018 0012 PDFДокумент11 страницAo2018 0012 PDFFlorescinda Mae NapaОценок пока нет

- Ao2018 0012 PDFДокумент11 страницAo2018 0012 PDFFlorescinda Mae NapaОценок пока нет

- Ao2018 0012 PDFДокумент11 страницAo2018 0012 PDFFlorescinda Mae NapaОценок пока нет

- Ao2018 0012 PDFДокумент11 страницAo2018 0012 PDFFlorescinda Mae NapaОценок пока нет

- Office: The of The SecretaryДокумент8 страницOffice: The of The SecretaryFlorescinda Mae NapaОценок пока нет

- Tax Subsidy As An Instrument of Fiscal DisciplineДокумент16 страницTax Subsidy As An Instrument of Fiscal DisciplineFlorescinda Mae NapaОценок пока нет

- Writing Economics Duke PDFДокумент67 страницWriting Economics Duke PDFFlorescinda Mae NapaОценок пока нет

- 2016 Concise Preweek MaterialsДокумент46 страниц2016 Concise Preweek MaterialsFlorescinda Mae NapaОценок пока нет

- FIRB Secretariat - Citizens CharterДокумент4 страницыFIRB Secretariat - Citizens CharterFlorescinda Mae NapaОценок пока нет

- Sample Legal OpinionДокумент2 страницыSample Legal Opinionfamigo451100% (1)

- NEP 2017 - General ProvisionДокумент20 страницNEP 2017 - General ProvisionFlorescinda Mae NapaОценок пока нет

- Estate Tax Computation SampleДокумент3 страницыEstate Tax Computation SampleFlorescinda Mae NapaОценок пока нет

- Do 94-1963Документ1 страницаDo 94-1963Florescinda Mae NapaОценок пока нет

- Letter To Hon. Franklin Drilon (Rationalization of Fiscal Incentives Bill) PDFДокумент23 страницыLetter To Hon. Franklin Drilon (Rationalization of Fiscal Incentives Bill) PDFFlorescinda Mae NapaОценок пока нет

- Overview GOCC Governance Act of 2011Документ108 страницOverview GOCC Governance Act of 2011Florescinda Mae NapaОценок пока нет

- Do 23-1960Документ2 страницыDo 23-1960Florescinda Mae NapaОценок пока нет

- Do 17-2009Документ5 страницDo 17-2009Florescinda Mae NapaОценок пока нет

- 2015 SALN FormДокумент4 страницы2015 SALN Formwyclef_chin100% (6)

- Mo 38-1980Документ3 страницыMo 38-1980Florescinda Mae NapaОценок пока нет

- Kagawaran NG Pananalapi Tanggapan NG Kalihim Re,. Aic of The Philippines Department C PranceДокумент2 страницыKagawaran NG Pananalapi Tanggapan NG Kalihim Re,. Aic of The Philippines Department C PranceFlorescinda Mae NapaОценок пока нет

- Ministry Order No. 35Документ2 страницыMinistry Order No. 35Florescinda Mae NapaОценок пока нет

- Personal Data SheetДокумент4 страницыPersonal Data SheetLeonil Estaño100% (7)

- 10659Документ1 страница10659Florescinda Mae NapaОценок пока нет

- 10659Документ1 страница10659Florescinda Mae NapaОценок пока нет