Академический Документы

Профессиональный Документы

Культура Документы

Appendix Scanner Gr. I Green

Загружено:

Mayank GoyalАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Appendix Scanner Gr. I Green

Загружено:

Mayank GoyalАвторское право:

Доступные форматы

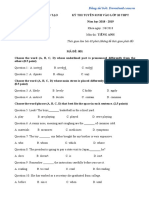

Free of Cost

ISBN : 978-93-5034-541-2

Scanner Appendix

CA Final Gr. I

Questions of May - 2013

INDEX

Paper

Paper

Paper

Paper

1

2

3

4

Financial Reporting

Strategic Financial Management

Advanced Auditing and Professional Ethics

Corporate and Allied Laws

I-1

I-8

I-14

I-18

PAPER'S

Paper - 1 : Financial Reporting

Chapter :- 1 Accounting Standards & Guidance Notes

2013 - May [1] {C} (a) J Ltd. purchased a machinery from K Ltd. on 31-08-2012. Quoted

price was ` 275 lakhs. The vendor offers 2% trade discount. Sales tax on quoted price

is 6%. J Ltd. spent ` 60,000 for transportation and ` 45,000 for architects fees. They

borrowed money from HDFC Bank of ` 250 lakhs for acquisition of asset @ 15% p.a.

They also spent ` 15,000 for material, ` 10,000 for labour and ` 4,000 as overheads

during trial run of the machine. The machine was ready for use on 15-01-2013 but it was

put to use on 15-3-2013. Find out the original cost of the machine. Also suggest the

accounting treatment for between the date, the machine was ready for use and the date

at which it was actually put to use.

(5 marks)

(b) A Ltd. had acquired 80% shares in the B Ltd. for ` 15 lakhs. The net assets of B

Ltd. on the day are ` 22 lakhs. During the year A Ltd. sold the investment for ` 30

lakhs and net assets of B Ltd. on the date of disposal was ` 35 lakhs. Calculate the

profit or loss on disposal of this investment to be recognized in Consolidated

Financial Statem ent.

(5 marks)

(c) On 1 st January, 2011 Santa Ltd. sold equipm ent for ` 6,14,460. The carrying

amount of the equipment on that date was ` 1,00,000. The sale was a part of the

package under which Banta Ltd. leased the asset to Santa Ltd. for Ten Year term.

The economic life of the asset is estimated at 10 years. The minimum lease rents

payable by the leaser has been fixed at ` 1,00,000 payable annually beginning 31 st

December, 2011. The incremental borrowing interest rate of Santa Ltd. is

estim ated at 10% p.a. Calculate the net effect on the profit and loss account.

(5 marks)

I-1

Scanner Appendix CA Final Gr. I

I-2

(d) X Ltd. purchased a fixed asset four years ago for ` 150 lakhs and depreciates it at

10% p.a. on straight line method. At the end of the fourth year it has revalued the

asset at ` 75 lakhs and has written off the loss on revaluation to the profit and loss

account. However on the date of revaluation, the market price is ` 67.50 lakhs and

expected disposal costs are ` 3 lakhs. W hat will be the treatment in respect of

impairment loss on the basis that fair value for revaluation purpose is determined

by market value and the value in use is estimated at ` 60 lakhs?

(5 marks)

st

2013 - May [5] (b) On 1 April, 2011, the fair value of plan assets were ` 2,50,000 in

respect of a pension plan of Q Ltd.

On 30 th September, the plan paid out benefits of ` 47,500 and received further

contribution of ` 1,22,500.

On 31 st March, 2012, the fair value of plan asset was ` 3,75,000 and the present value

of the benefit obligation was ` 3,69,800. Actuarial losses on the obligation for 2011-12

were ` 1,500.

On 1 st April, 2011, the company had made the following estimates:

Particulars

%

(i) Interest and dividend income after tax payable by the fund

9.25

(ii) Realised and un-realised gain on plan asset (after tax)

2.00

(iii) Fund expenses.

(1.00)

Expected rate of return

10.25

Find out the expected and unexpected return on plan assets.

(6 marks)

2013 - May [7] Answer the following:

(b) From the following information relating to W Ltd., calculate diluted earnings per

share as per AS-20.

(i) Net profit for the current year

` 5,00,00,000

(ii) Number of equity shares outstanding

1,00,00,000

(iii) 11% convertible debentures of ` 100 each (Nos.)

1,25,000

(iv) Interest expenses for current year

` 13,75,000

(v) Tax saving relating to interest expense

30%

(vi) Each debenture is convertible into eight equity shares.

(4 marks)

(c) W Ltd. purchased machinery for ` 80 lakhs from X Ltd. during 2010-11 and

installed the same immediately. Price includes excise duty of ` 8 lakhs. During the

year 2010-11, the company produced exciseable goods on which excise duty of

` 7.20 lakhs was charged.

Give necessary entries explaining the treatm ent of Cenvat Credit.

(4 marks)

(d) W rite short notes on Disclosure of carrying amounts of financial assets and

financial liabilities in balance sheet.

(4 marks)

(e) Vishnu Company has at its financial year ended 31st March, 2013, fifteen law suits

outstanding none of which has been settled by the time the accounts are approved

by the directors. The directors have estimated that the possible outcomes as

below:

Scanner Appendix CA Final Gr. I

Result

For first ten cases:

W in

Loss-low damages

Loss-high damages

For remaining five cases:

W in

Loss-low damages

Loss-high damages

I-3

Probability

Amount of loss

0.6

0.3

0.1

90,000

1,60,000

0.5

0.3

0.2

60,000

95,000

The directors believe that the outcome of each case is independent of the outcome

of all the others.

Estimate the amount of contingent loss and state the accounting treatment of such

contingent loss.

(4 marks)

Chapter :- 4 Accounting for Corporate Restructuring

2013 - May [3] Sun Limited agreed to absorb Moon Limited on 31st March 2012 whose

Summ arized Balance Sheet stood as follows:

`

`

Equity and Liabilities

Assets

Share Capital

1,20,000 shares of ` 10 each

fully paid

Reserve & Surplus

General reserve

Secured Loan

Unsecured Loan

Current Liabilities & Provisions

Sundry Creditors

12,00,000

1,50,000

1,50,000

15,00,000

Fixed Assets

Investments

Current Assets,

Loans &

Advances

Stock in Trade

Sundry Debtors

10,50,000

1,50,000

3,00,000

15,00,000

The consideration was agreed to be paid as follows:

(a) A payment in cash of ` 5 per share in Moon Ltd. and

(b) The issue of shares of ` 10 each in Sun Ltd. on the basis of two equity shares

(valued at ` 15) and one 10% cum. preference share (valued at ` 10) for every five

shares held in Moon Ltd.

Scanner Appendix CA Final Gr. I

I-4

The whole of the share capital consists of shareholdings in exact multiple of five

except the following holding:

P

174

Q

114

R

108

S

42

Other Individuals

12 (Twelve members holding one share each)

It was agreed that Sun Ltd. will pay in cash for fractional shares equivalent at

agreed value of shares in Moon Ltd. i.e. ` 65 for five shares of ` 50 paid.

Prepare a statement showing the purchase consideration receivables in shares

and cash.

(16 marks)

Chapter :- 5 Consolidated Financial Statements of Group Companies

2013 - May [2] The summarized balance sheets of two companies, Major Ltd. and

Minor Ltd. as at 31 st December, 2012 are given below:

Particulars

Assets:

Plant and Machinery

Furniture

18,000, ordinary shares in Minor Ltd.

4,000 ordinary shares in Major Ltd.

Stock in Trade

Sundry Debtors

Cash at Bank

Liabilities:

Ordinary shares of ` 10 each

7.5% preference shares of ` 10 each

Reserves

Sundry Creditors

Profit and Loss account

Major Ltd.

4,14,000

14,000

2,40,000

96,000

1,40,000

34,000

9,38,000

Minor Ltd.

1,00,800

9,200

48,000

2,28,000

1,70,000

26,000

5,82,000

3,60,000

2,00,000

3,00,000

1,60,000

52,000

60,000

1,06,000

1,22,000

1,20,000

40,000

9,38,000

5,82,000

Major Ltd. acquired the shares of Minor Ltd. on 1st July, 2012. As on 31st December,

2011, the plant & machinery stood in the books at ` 1,12,000, the reserve at ` 60,000

and the profit and loss account at ` 16,000. The plant and machinery was revalued by

Major Ltd. on the date of acquisition of shares of Minor Ltd. at ` 1,20,000 but no

adjustments were made in the books of Minor Ltd.

On 31 st December, 2011, the debit balance of profit and loss account was ` 45,500

in the books of Major Ltd.

Scanner Appendix CA Final Gr. I

I-5

Both the companies have provided depreciation on all their fixed assets at 10% p.a.

You are required to prepare a Consolidated Balance Sheet as on 31st December

2012 as per Revised Schedule-VI and Supporting Schedule for Computation.

(16 marks)

Chapter :- 7 Share Based Payments

2013 - May [4] (b) On 1st April 2012, A company offered 100 shares to each of its

employees at ` 40 per share. The employees are given a month to decide whether or

not to accept the offer. The shares issued under this plan will be subject to each in

transfer for three years from the grant date. The market price on the grant date is ` 50

per share. However the fair value of shares issued under this plan is estim ated at ` 48

per share. On 30-04-2012, 400 employees accepted the offer and paid ` 40 per share.

Nominal value of each share is ` 10.

Record the issue of shares in the books of the company under the aforesaid plan.

(4 marks)

Chapter :- 8 Financial Reporting for Financial Institutions

2013 - May [6] (b) The investment portfolio of a mutual fund scheme includes 5,000

shares of X Ltd. and 4,000 shares of Y Ltd. acquired on 31-12-2010. The cost of X Ltd.

shares is ` 40 while that of Y Ltd. shares is ` 60. The market value of these shares at the

end of 2010-11 were ` 38 and ` 64 respectively. On 30-06-2011, shares of both the

companies were disposed off realizing ` 37 per X Ltd. shares and ` 67 per Y Ltd. shares.

Show important accounting entries in the books of the fund for the accounting year

2010-11 and 2011-12.

(8 marks)

2013 - May [7] Answer the following:

(a) W hile closing its books of account on 31st March, 2012 a non-banking finance

company has its advances classified as follows:

Particulars

` in Lakhs

Standard Assets

16,800

Sub-Standard Assets

1,340

Secured portion of doubtful debts:

Upto one year

320

One year to three years

90

More than three years

30

Unsecured portion of doubtful debts

97

Loss Assets

48

Calculate the amount of provision, which must be made against the advances.

(4 marks)

Chapter :- 10 Valuation of Intangibles & Liabilities

2013 - May [5] (a) The Balance Sheet of Domestic Ltd. as on 31st March, 2013 is as

under:

Scanner Appendix CA Final Gr. I

I-6

(` in Lacs)

Liabilities

Equity Shares ` 10 each

Reserves (including provision for

taxation of ` 300 lacs)

5% Debentures

Secured Loans

Sundry Creditors

Profit & Loss a/c:

Balance from previous year ` 32

Profit for the year

(after taxation)

` 1,100

Assets

3,000

1,000

2,000

200

300

1,132

7,632

1.

2.

3.

4.

5.

6.

7.

8.

Goodwill

Premises and Land at cost

Plant and Machinery

Motor vehicles

(Purchased on 1.10.12)

Raw materials at cost

W ork-in-progress at cost

Finished goods at cost

Book Debts

Inves tment (meant for replacement of Plant & Machinery)

Cash at Bank & Cash in Hand

Discount on Debentures

Underwriting Commission

744

400

3,000

40

920

130

180

400

1,600

192

10

16

7,632

The resale value of Premises and Land is ` 1,200 lacs and that of Plant and

Machinery is ` 2,400 lacs.

Depreciation @ 20% is applicable to Motor vehicles.

Applicable depreciation on Premises and Land is 2% and that on Plant and

Machinery is 10%.

Market value of the investments is ` 1,500 lacs.

10% of book debts is bad.

The company also revealed that the depreciation was not charged to Profit and

Loss account and the provision for taxation already made is sufficient.

In a similar company the market value of equity shares of the same denomination

is ` 25 per share and in such company dividend is consistently paid during last 5

years @ 25%. Contrary to this, Domestic Ltd. is having a marked upward or

downward trend in the case of dividend paym ent.

In 2007-08 and in 2008-09 the normal business was hampered. The profit earned

during 2007-08 is ` 67 lacs, but during 2008-09 the company incurred a loss of

` 1,305 lacs.

Past 3 years profits of the company were as under:

2009-10

` 469 lacs

2010-11

` 546 lacs

Scanner Appendix CA Final Gr. I

I-7

2011-12

` 405 lacs

The unusual negative profitability of the company during 2008-09 was due to the

lock out in the major manufacturing unit of the company which happened in the

beginning of the second quarter of the year 2007-08 and continued till the last

quarter of 2008-09.

Value the goodwill of the company on the basis of 4 years purchase of the super

profit.

(10 marks)

Chapter :- 11 Valuation of Shares & Business

2013 - May [4] (a) The capital structure of VW X Ltd. is as follows as on 31st March,

2012:

Particulars

(`)

45,000, equity shares of ` 100 each fully paid

12,500, 12% preference shares of ` 100 each fully paid

12% secured debentures

Reserves

Profit before interest and tax during the year

Tax rate

45,00,000

12,50,000

12,50,000

12,50,000

18,00,000

40%

Normally the return on equity shares in this type of industry is 15%.

Find out the value of the equity shares subject to the following:

(i) Profit after tax covers fixed interest and fixed dividend at least 4 times.

(ii) Debt equity ratio is at least 2.

(iii) Yield on shares is calculated at 60% of distributed profits and 10% on

undistributed profits.

(iv) The company has been paying regularly an equity dividend of 15%.

(v) Risk premium for dividends is generally assumed at 1%.

(12 marks)

Chapter :- 12 Statements of Value Addition

2013 - May [6] (a) From the following Profit and Loss account of B. Co. Ltd. prepare a

gross value added statem ent for the year ended 31-12-2012. Show also the

reconciliation between gross value added and profit before taxation.

Profit and Loss account for the year ended 31-12-2012

Notes

Income:

Sales

Other income

Expenditure:

Production and operational expenses

(` in 000)

(` in 000)

6,240

55

6,295

4,320

Scanner Appendix CA Final Gr. I

Adm inistrative expenses (Factory)

Interest & Other charges

Depreciation

I-8

2

3

180

624

16

(5,140)

1,155

(55)

1,100

60

1,160

Profit before tax

Provision for tax

Balance as per last Balance Sheet

Transferred to Fixed assets

Replacem ent Reserve

Dividend Paid

Surplus carried to Balance Sheet

Notes:

1. Production and Operation Expenses:

Consumption of Raw materials

Consumption of stores

Local Tax

Salaries to Administrative staff

Other Manufacturing Expenses

2.

3.

400

160

(560)

600

3,210

40

8

620

442

4,320

Administration expenses include

salaries and commission to directors

5

Interest and other charges include:

(a) Interest on bank overdraft

(overdraft is of temporary nature)

109

(b) Fixed loan from I.C.I.C.I.

51

(c) W orking capital loan from I.F.C.I.

20

(d) Excise duties amounts to one-tenth of total value added by manufacturing and

trading activities.

(8 marks)

Paper - 2 : Strategic Financial Management

Chapter:- 2 Project Planning and Capital Budgeting

2013 - May [1] {C} (c) Ramesh owns a plot of land on which he intends to construct

apartment units for sale. No. of apartment units to be constructed may be either 10 or

15. Total construction costs for these alternatives are estimated to be ` 600 lakhs or

` 1025 lakhs respectively. Current market price for each apartment unit is ` 80 lakhs.

The market price after a year for apartment units will depend upon the conditions of

market. If the market is buoyant, each apartment unit will be sold for ` 91 lakhs, if it is

Scanner Appendix CA Final Gr. I

I-9

sluggish, the sale price for the same will be ` 75 lakhs. Determine the current value of

vacant plot of land. Should Ramesh start construction now or keep the land vacant? The

yearly rental per apartment unit is ` 7 lakhs and the risk free interest rate is 10% p.a.

Assume that the construction cost will remain unchanged.

(5 marks)

2013 - May [2] (a) XYZ Ltd. is planning to procure a machine at an investment of ` 40

lakhs.

The expected cash flow after tax for next three years is as follows:

` (in lakh)

Year - 1

Year - 2

Year - 3

CFAT

Probability

CFAT

Probability

CFAT

Probability

12

.1

12

.1

18

.2

15

.2

18

.3

20

.5

18

.4

30

.4

32

.2

32

.3

40

.2

45

.1

The Company wishes to consider all possible risks factors relating to the machine.

The Company wants to know:

(i) the expected NPV of this proposal assuming independent probability

distribution with 7% risk free rate of interest.

(ii) the possible deviations on expected values.

(8 marks)

2013 - May [5] (b) XY Limited is engaged in large retail business in India. It is

contemplating for expansion into a country of Africa by acquiring a group of stores

having the same line of operation as that of India.

The exchange rate for the currency of the proposed African country is extremely volatile.

Rate of inflation is presently 40% a year. Inflation in India is currently 10% a year.

Management of XY Limited expects these rates likely to continue for the foreseeable

future.

Estimated projected cash flows, in real terms, in India as well as African country for the

first three years of the project are as follows:

Year-0

Year-1

Year-2

Year-3

Cash flows in Indian

-50,000

-1,500

-2,000

-2,500

` (000)

Cash flows in African

-2,00,000

+50,000

+70,000

+90,000

Rands (000)

XY Ltd. assumes the year 3 nominal cash flows will continue to be earned each year

indefinitely. It evaluates all investments using nominal cash flows and a nominal

discounting rate. The present exchange rate is African Rand 6 to ` 1.

You are required to calculate the net present value of the proposed investment

considering the following:

Scanner Appendix CA Final Gr. I

(i)

(ii)

(iii)

I-10

African Rand cash flows are converted into rupees and discounted at a risk

adjusted rate.

All cash flows for these projects will be discounted at a rate of 20% to reflect it's

high risk.

Ignore taxation.

Year- 1

Year- 2

Year- 3

PVIF @ 20%

.833

.694

.579

(10 marks)

Chapter:- 4 Dividend Decisions

2013 - May [3] (b) ABC Limited has a capital of ` 10 lakhs in equity shares of `100 each.

The shares are currently quoted at par. The company proposes to declare a dividend

of `15 per share at the end of the current financial year. The capitalisation rate for the

risk class of which the company belongs is 10%. What will be the market price of share

at the end of the year, if

(i) a dividend is declared?

(ii) a dividend is not declared?

(iii) assuming that the company pays the dividend and has net profits of ` 6,00,000

and makes new investment of ` 12,00,000 during the period, how many new

shares should be issued? Use the MM model.

(6 marks)

2013 - May [4] (a) X Limited, just declared a dividend of ` 14.00 per share. Mr. B is

planning to purchase the share of X Limited, anticipating increase in growth rate from

8% to 9%, which will continue for three years. He also expects the market price of this

share to be ` 360.00 after three years.

You are required to determine:

(i) the maximum amount Mr. B should pay for shares, if he requires a rate of return

of 13% per annum.

(4 marks)

(ii) the maximum price Mr. B will be willing to pay for share, if he is of the opinion

that the 9% growth rate can be maintained indefinitely and require 13% rate of

return per annum.

(2 marks)

(iii) the price of share at the end of three years, if 9% growth rate is achieved and

assuming other conditions remaining same as in (ii) above.

Calculate rupee amount up to two decimal points.

Year-1

Year-2

Year-3

FVIF @ 9%

1.090

1.188

1.295

FVIF @ 13%

1.130

1.277

1.443

PVIF @ 13%

0.885

0.783

0.693

(2 marks)

Chapter:- 5 Indian Capital Market and Security Analysis

2013 - May [5] (a) M/s. Earth Limited has 11% bond worth of ` 2 crores outstanding with

10 years remaining to maturity.

Scanner Appendix CA Final Gr. I

I-11

The company is contemplating the issue of a ` 2 crores 10 year bond carrying the

coupon rate of 9% and use the proceeds to liquidate the old bonds.

The unamortized portion of issue cost on the old bonds is ` 3 lakhs which can be written

off no sooner the old bonds are called. The company is paying 30% tax and its after tax

cost of debt is 7%. Should Earth Limited liquidate the old bonds?

You may assume that the issue cost of the new bonds will be ` 2.5 lakhs and the call

premium is 5%.

(6 marks)

2013 - May [6] (b) M/s. Parker & Co. is contem plating to borrow an amount of ` 60

crores for a period of 3 months in the coming 6 month's time from now. The current rate

of interest is 9% p.a., but it may go up in 6 months' time. The company wants to hedge

itself against the likely increase in interest rate.

The Company's Bankers quoted an FRA (Forward Rate Agreement) at 9.30% p.a.

W hat will be the effect of FRA and actual rate of interest cost to the company, if the

actual rate of interest after 6 months happens to be (i) 9.60% p.a. and (ii) 8.80% p.a.?

(8 marks)

Chapter:- 6 Portfolio Theory

2013 - May [2] (b) On January 1, 2013 an investor has a portfolio of 5 shares as given

below:

Security

Price

No. of Shares

Beta

A

349.30

5,000

1.15

B

480.50

7,000

0.40

C

593.52

8,000

0.90

D

734.70

10,000

0.95

E

824.85

2,000

0.85

The cost of capital to the investor is 10.5% per annum.

You are required to calculate:

(i) The beta of his portfolio.

(ii) The theoretical value of the NIFTY futures for February 2013.

(iii) The number of contracts of NIFTY the investor needs to sell to get a full

hedge until February for his portfolio if the current value of NIFTY is 5900

and NIFTY futures have a minimum trade lot requirement of 200 units.

Assume that the futures are trading at their fair value.

(iv) The number of future contracts the investor should trade if he desires to

reduce the beta of his portfolios to 0.6.

No. of days in a year be treated as 365.

Given: in (1.105) = 0.0998

e (0.015858) = 1.01598

(8 marks)

Chapter:- 7 Financial Services in India

Scanner Appendix CA Final Gr. I

2013 - May [7] W rite short notes on the following:

(a) Credit Rating

I-12

(4 marks)

Chapter:- 8 Mutual Funds

2013 - May [3] (a) Mr. Suhail has invested in three Mutual Fund Schemes as given

below:

Particulars

Scheme A Scheme B Scheme C

Date of investment

1-4-2011

1-5-2011

1-7-2011

Amount of Investment

`

12,00,000

4,00,000

2,50,000

Net Asset Value (NAV) at entry date `

10.25

10.15

10.00

Dividend received up to 31-7-2011

`

23,000

6,000

Nil

NAV as at 31-7-2011

`

10.20

10.25

9.90

You are required to calculate the effective yield on per annum basis in respect of

each of the three Schemes to Mr. Suhail up to 31-7-2011.

Take one year = 365 days.

Show calculations up to two decimal points.

(10 marks)

2013 - May [4] (b) On 1-4-2012 ABC Mutual Fund issued 20 lakh units at ` 10 per unit.

Relevant initial expenses involved were ` 12 lakhs. It invested the fund so raised in

capital market instruments to build a portfolio of ` 185 lakhs. During the month of April

2012 it disposed off some of the instruments costing ` 60 lakhs for ` 63 lakhs and used

the proceeds in purchasing securities for ` 56 lakhs. Fund management expenses for

the month of April 2012 was ` 8 lakhs of which 10% was in arrears. In April 2012 the

fund earned dividends amounting to ` 2 lakhs and it distributed 80% of the realized

earnings. On 30-4-2012 the market value of the portfolio was `198 lakhs.

Mr. Akash, an investor, subscribed to 100 units on 1-4-2012 and disposed off the same

at closing NAV on 30-4-2012. What was his annual rate of earning?

(8 marks)

Chapter:- 9 Money Market Operations

2013 - May [7] W rite short notes on the following:

(b) Asset Securitization

(c) Call Money

Chapter:- 10 FDI, FII and International Financial Management

2013 - May [7] W rite short notes on the following:

(d) Euro Convertible Bonds

(4marks each)

(4 marks)

Chapter:- 11 Foreign Exchange Exposure and Risk Management

2013 - May [1] {C} (a) A Bank sold Hong Kong Dollars 40,00,000 value spot to its

customer at ` 7.15 and covered itself in London Market on the same day, when the

exchange rates were:

Scanner Appendix CA Final Gr. I

I-13

US$ = HK$ 7.9250

7.9290

Local interbank market rates for US$ were

Spot US$ 1 = ` 55.00

55.20

You are required to calculate rate and ascertain the gain or loss in the transaction.

Ignore brokerage.

You have to show the calculations for exchange rate up to four decimal points.

(5 marks)

(d) XYZ Limited borrows 15 Million of six months LIBOR + 10.00% for a period of 24

months. The company anticipates a rise in LIBOR, hence it proposes to buy a Cap

Option from its Bankers at the strike rate of 8.00%. The lump sum premium is 1.00%

for the entire reset periods and the fixed rate of interest is 7.00% per annum. The actual

position of LIBOR during the forthcoming reset period is as under:

Reset

PeriodLIBOR

1

9.00%

2

9.50%

3

10.00%

You are required to show how far interest rate risk is hedged through Cap Option.

For calculation, work out figures at each stage up to four decimal points and amount

nearest to . It should be part of working notes.

(5 marks)

Chapter:- 12 Mergers, Acquisition Restructuring & Business Valuation

2013 - May [1] {C} (b) ABC Limited is considering acquisition of DEF Ltd., which has

3.10 crore shares issued and outstanding. The market price per share is ` 440.00 at

present. ABC Ltd.s average cost of capital is 12%. The cash inflows of DEF Ltd. for the

next three years are as under:

Year

` in crores

1

460.00

2

600.00

3

740.00

You are required to calculate the range of valuation that ABC Ltd. has to consider.

Take P.V.F. (12%, 3) = 0.893, 0.797, 0.712

(5 marks)

2013 - May [6] (a) Longitude Limited is in the process of acquiring Latitude Limited on

a share exchange basis. Following relevant data are available:

Longitude

Latitude

Limited

Limited

Profit after Tax (PAT)

` in Lakhs

140

60

Number of Shares

Lakhs

15

16

Earning per Share (EPS)

`

8

5

Price Earnings Ratio (P/E Ratio)

15

10

(Ignore Synergy)

Scanner Appendix CA Final Gr. I

I-14

You are required to determine:

(i) Pre-merger Market Value per Share, and

(ii) The maximum exchange ratio Longitude Limited can offer without the dilution of

(1) EPS and

(2) Market Value per Share

Calculate Ratio/s up to four decim al points and am ounts and number of shares

up to two decimal points.

(8 marks)

2013 - May [7] W rite short notes on the following:

(e) Financial Restructuring

(4 marks)

Paper - 3 : Advanced Auditing & Professional Ethics

Chapter:- 1 Auditing and Assurance Standards & Guidance Notes

2013 - May [3] (c) The auditor of H Ltd. wanted to obtain confirmation from its creditors.

But the management made a request to the auditor not to seek confirmation from

certain creditors citing disputes. Can the auditor of H Ltd. accede to this request?

(4 marks)

Chapter:- 2 Accounting Standards & Schedule VI

2013 - May [1] {C} (a) The Balance Sheet of G Ltd. as at 31st March 13 is as under.

Comment on the presentation in terms of revised Schedule VI and Accounting

Standards issued by NACAS.

Heading

Equity & Liabilities

Share Capital

Reserves & Surplus

Employee stock option outstanding

Share application money refundable

Non-Current Liabilities

Deferred tax liability (Arising from Indian

Income Tax)

Current Liabilities

Trade Payables

Total

Assets

Non-Current Assets

Note

No.

31 st

March 13

31 st

March 12

1

2

3

4

xxx

0

xxx

xxx

xxx

xxx

xxx

0

xxx

xxx

xxx

xxx

xxx

xxxx

xxx

xxxx

Scanner Appendix CA Final Gr. I

Fixed Assets - Tangible

CW IP (including capital advances)

Current Assets

Trade Receivables

Deferred Tax Asset (Arising from Indian

Income Tax)

P & L Debit balance

Total

I-15

7

8

xxx

xxx

xxx

xxx

9

10

xxx

xxx

xxx

xxx

xxx

xxxx

xxx

xxxx

(b) Z Ltd. changed its employee remuneration policy from 1st of April 2012 to provide

for 12% contribution to provident fund on leave encashm ent also. As per the leave

encashment policy the employees can either utilize or encash it. As at 31 st March

13 the company obtained an actuarial valuation for leave encashm ent liability.

However it did not provide for 12% PF contribution on it. The auditor of the

company wants it to be provided but the management replied that as and when the

employees availed leave encashment, the provident fund contribution was made.

The company further contends that this is the correct treatment as it is not sure

whether the em ployees will avail leave encashment or utilize It. Comment.

(c) T Ltd. commenced its manufacturing activities from 1st April 2012. In the course

of production the company generated certain by - products. As at 31st March 13 the

company did not value the by-products considering the value as insignificant. The

auditor of the company is of the opinion that the by-products are inventory of the

company and it should be valued and brought into books of account . Comment.

(d) K Ltd. had 5 subsidiaries as at 31st March 2013 and the investments in subsidiaries

are considered as long term and valued at cost. Two of the subsidiaries net worth

eroded as at 31st March 13 and the prospects of their recovery are very bleak and

the other three subsidiaries are doing exceptionally well. The company did not

provide for the decline in the value of investments in two subsidiaries because the

overall investment portfolio in subsidiaries did not suffer any decline as the other

three subsidiaries are doing exceptionally well. Comm ent.

( 5 marks each)

2013 - May [7] W rite short notes on the following:

(c) Corresponding figures

(4 marks)

Chapter:- 3 Audit Strategy, Planning Programming & Techniques

2013 - May [3] (b) In audit plan for T Ltd, as the audit partner you want to highlight the

sources of misstatements, arising from other than fraud, to your audit team and caution

them. Identify the sources of misstatements.

(d) R & Co, a firm of Chartered Accountants have not revised the terms of engagements and obtained confirmation from the clients, for last 5 years despite changes

Scanner Appendix CA Final Gr. I

I-16

in business and professional environment. Please elucidate the circumstances that

may warrant the revision in terms of engagement.

(4 marks each)

Chapter:- 4 Risk Assessment and Internal Control

2013 - May [3] (a) In the course of audit of Z Ltd, its auditor wants to rely on audit

evidence obtained in previous audit in respect of effectiveness of internal controls

instead of retesting the same during the current audit. As an advisor to the auditor kindly

caution him about the factors that may warrant a re-test of controls.

(4 marks)

2013 - May [5] (d) As the auditor of a large multi locational company, in the planning

process, you are requested to identify the inherent audit risk at the account balance and

class of transaction level.

(4 marks)

Chapter:- 5 Audit under CIS Environment

2013 - May [5] (c) E & Co, a firm of Chartered Accountants, requires your help in

identifying the audit procedures that can be performed using CAATs. Please guide

them.

(4 marks)

Chapter:- 9 Audit Report

2013 - May [6] (a) H Private Ltd. had taken overdrafts from two banks with a limit of `10

lacs each against the security of fixed deposit it had with those banks and an unsecured

overdraft from a financial institution of ` 9 lacs. The said loans were outstanding as at

31 st March 13. The paid up capital and reserves of the company as at that date was `40

lacs and its turnover during the financial year ended on 31st March 13 was ` 3 crores.

The management of the company is of the opinion that CARO 03 is not applicable to

it because turnover and paid up capital were within the limits prescribed and loans taken

against the fixed deposits cannot be considered. The company further contended that

loan limit is to be reckoned per bank or financial institution and not cumulatively.

Comm ent.

(4 marks)

(b) XYZ Ltd. has significant operations in a foreign country. Due to civil and political

unrest in that country physical verification of inventory and fixed assets could not carried

out and you are not in a position to obtain audit evidence through other audit procedures

also. The value of fixed assets and inventory forms part of 80% of the asset value of the

company. As the auditor of XYZ Ltd. what factors do you consider in your reporting

responsibility. Also draft a suitable report that will be incorporated in the main audit

report (Reporting under CARO 03 need not be considered).

(8 marks)

(c) R Ltd. as at 31st March 2013 defaulted in the repayment of interest and principal due

to a financial institution. The due date was 28th February 2013. However the defaulted

amount was paid on 5th April 2013. The companys management is of the opinion that

Scanner Appendix CA Final Gr. I

I-17

since the default is set right before the audit completion these need not be reported in

CARO 03. Comment and draft a suitable report

(4 marks)

Chapter:- 11 Audit of Banks

2013 - May [4] (a) In course of audit of Good Samaritan Bank as at 31st March 13 you

observed the following:

(i) In a particular account there was no recovery in the past 18 months. The bank

has not applied the NPA norms as well as income recognition norms to this

particular account. When queried the bank management replied that this account

was guaranteed by the Central Government and hence these norms were not

applicable. The bank has not invoked the guarantee. Please respond. W ould

your answer be different if the advance is guaranteed by a State Government?

(5 marks)

(ii) The banks advance portfolio comprised of significant loans against Life

Insurance Policies. W rite suitable audit program to verify these advances.

(3 marks)

Chapter:- 12 Audit of General Insurance Company

2013 - May [4] (b) As at 31 st March 2013 while auditing Safe Insurance Ltd. you

observed that a policy has been issued on 25th March 2013 for fire risk favouring one

of the leading corporate houses in the country without the actual receipt of premium and

it was reflected as premium receivable. The company maintained that it is a usual

practice in respect of big customers and the money was collected on 5th April 2013. You

further noticed that there was a fire accident in the premises of the insured on 31st

March 2013 and a claim was lodged for the same. The insurance company also made

a provision for claim. Please respond.

(4 marks)

Chapter:- 13 Audit of Co-operative Societies

2013 - May [7] W rite short notes on the following:

(a) Restrictions on investments of funds of a central co-operative society. (4 marks)

Chapter:- 15 Audit under Fiscal Laws

2013 - May [4] (c) While writing the audit program for tax audit in respect of A Ltd. you

wish to include possible instances of capital receipt if not credited to Profit & Loss

Account which needs to be reported under clause 13(e) of form 3CD. Please elucidate

possible instances.

(4 marks)

Chapter:- 17 Special Audit Assignments

2013 - May [7] W rite short notes on the following:

(e) Volatility Margin, its computation and its application.

(4 marks)

Scanner Appendix CA Final Gr. I

I-18

Chapter:- 19 Internal Managem ent and Operational Audit

2013 - May [5] (b) The Managing Director of X Ltd. is concerned about high employee

attrition rate in his company. As the internal auditor of the company he requests you to

analyze the causes for the same. W hat factors would you consider in such analysis?

(4 marks)

Chapter:- 20 Investigation and Due Diligence

2013 - May [5] (a) J Ltd is interested in acquiring S Ltd. The valuation of S Ltd. is

dependent on future maintainable sales. As the person entrusted to value S Ltd. what

factors would you consider in assessing the future m aintainable turnover? (4 marks)

Chapter:- 21 Peer Review

2013 - May [7] W rite short notes on the following:

(b) Technical, ethical and professional standards as per statement on peer review.

(4 marks)

Chapter:- 22 Professional Ethics

2013 - May [2] Give your comments with reference to Chartered Accountants Act, 1949

and Schedules thereto.

(a) Mr. A, a practicing Chartered Accountant, failed to return the books of account and

other documents of a client despite many reminders from the client. The client had

settled his entire fees dues also.

(b) Mr. B, a practicing Chartered Accountant as well as a qualified lawyer, was

permitted by the bar council to practice as a lawyer also. He printed his visiting card

where he mentioned his designation as Chartered Accountant and Advocate.

(c) Mr. C, a practicing Chartered Accountant, in the course of the audit of a listed

company discovered serious violations of the provisions of the Companies Act

1956, informed the Registrar of Companies out of public interest.

(d) Mr. D, a practicing Chartered Accountant, did not com plete his work relating to the

audit of the accounts of a com pany and had not submitted his audit report in due

time to enable the company to comply with the statutory requirements.

(4 marks each)

Chapter:- 23 Audit of Consolidated Financial Statements

2013 - May [7] W rite short notes on the following:

(d) Permanent Consolidated Adjustm ents

(4 marks)

Paper-4 : Corporate and Allied Laws

Chapter - 1 : Account & Audit

2013 - May [1] {C} (a) Mr. Ramanujam, one of the Directors in Debari Food Processing

Limited was not satisfied with the performance of the company in financial matters. He

Scanner Appendix CA Final Gr. I

I-19

requested Mr. Anandaraja, a Chartered Accountant, to inspect the books of accounts

of the company on his behalf. Decide, under the provisions of the Companies Act, 1956

whether the said company can refuse to allow Mr. Anandaraja to inspect the books of

accounts?

(4 marks)

2013 - May [3] (a) The statutory auditors of Ghosunda Refinery Limited, did not verify

the correctness of the particulars furnished in the Boards Report in respect of certain

employees under Clause (2A) of Section 217 of the Companies Act, 1956. State the

particulars which are required to be furnished under Clause (2A) of Section 217 of the

said Act and also explain the legal position relating to verification of these particulars

by the auditors of the said Company.

(8 marks)

Chapter - 3 : Meetings of Directors and Related Party Transactions

2013 - May [1] {C} (c) Mr. Gopalasunderam, a Director in Fatehnagar Textiles Limited,

took a loan from the company without obtaining the approval of the Central

Government. Examine, under the provisions of the Companies Act, 1956 whether it is

possible for him to avoid prosecution by applying to the Central Government for

approval or by refunding the loan taken by him from the company.

(5 marks)

2013 - May [4] (a) Mr. Kishore is a Director of AB Limited and PQ Limited. AB Limited

was regular in filing the Annual Returns but did not file annual accounts for the years

ended 31 st March, 2009, 2010 and 2011. AB Limited did not pay interest on loans taken

from a public financial institution from 1st April, 2011 and also failed to repay matured

deposits taken from public on due dates from 1 st April, 2012 onwards.

Answer the following in the light of relevant provisions of the Companies Act, 1956:(i) W hether Mr. Kishore is disqualified under Section 274 (1) (g) of the Companies

Act, 1956 and if so, whether he can continue as a Director in AB Limited and

also seeks reappointment when he retires by rotation at the Annual General

Meeting of PQ Limited to be held in September, 2013?

(ii) Mr. Kishore is proposed to be appointed as Additional Director of XY Limited in

June, 2013. Is he eligible to be appointed as Additional Director in XY Limited?

(8 marks)

2013 - May [2] (b) State the legal requirements to be complied with by a public

company in respect of a Board Meeting.

Examine with reference to the provisions of the Companies Act, 1956 whether notice

of a Board Meeting is required to be sent to the following persons:

(i) Alternative Director;

(ii) An interested Director;

(iii) A Director who has expressed his inability to attend a particular Board Meeting;

(iv) A Director who has gone abroad.

(8 marks)

Chapter - 7 : Compromise, Arrangements & Reconstructions

2013 - May [2] (a) Hi-tech Engineering Limited engaged in the business of engineering

construction and cement manufacturing, decided to concentrate on its core business

Scanner Appendix CA Final Gr. I

I-20

of engineering construction and hive off (demerge) its cement business in favour of

Premier Cement Limited. State the steps to be taken by Hi-tech Engineering Limited to

give effect to the proposed demerger under the provisions of the Companies Act, 1956.

(8 marks)

Chapter - 8 : Prevention of Oppression and Mismanagement

2013 - May [1] {C} (b) The issued, subscribed and paid-up capital of Supreme Chemicals Limited is ` 2 crore consisting of 20,00,000 equity shares of ` 10 each. The said

company has 800 members. For the purpose of relief against oppression and

mismanagement, a petition was submitted before the appropriate authority duly signed

by 90 members holding 1,00,000 equity shares of the said company. Subsequently, 30

members, who signed the petition, withdrew their consent. Decide, under the provisions

of the Companies Act, 1956 whether the said petition is maintainable?

(5 marks)

Chapter - 10 : Corporate Winding up and Dissolution

2013 - May [5] (a) What is meant by misfeasance? Who can initiate misfeasance

proceedings and is there any time limit for initiating such proceedings? Examine the

extent to which the legal representatives of a deceased Director, against whom

misfeasance proceedings were initiated, can be held liable under the provisions of the

Companies Act, 1956.

(8 marks)

Chapter - 11 : Producer Companies

2013 - May [6] (a) Southern India Sugar Producer Company Limited, having paid-up

capital of ` 5 lakh and free reserves of ` 3 lakh, propose to make the following loans and

investments:

(i) Loan of ` 2 lakh to Mr. Ram, a member of the Com pany, for a period of one year

and a loan of ` 1 lakh to Mr. Shekhar, a Director of the Company for a period of

six months;

(ii) Investment of ` 3 lakh in the equity shares of XYZ Marketing Limited.

State the restrictions, if any, in this regard and also the legal requirements to be

complied with by the Company under the provisions of the Companies Act, 1956.

(8 marks)

Chapter - 12 : Foreign Companies

2013 - May [6] (b) Examine in the light of the provisions of the Companies Act, 1956

whether the following companies can be considered as Foreign Companies:(i) A company incorporated outside India having a share registration office at New

Delhi;

(ii) A company incorporated outside India having shareholders who are all Indian

citizens;

(iii) A company incorporated in India but all the shares are held by foreigners.

Also exam ine whether the above companies can issue Indian Depository Receipts

under the provisions of the Companies Act, 1956?

(8 marks)

Chapter - 16 : Corporate Secretarial Practice

Scanner Appendix CA Final Gr. I

I-21

2013 - May [4] (b) Morbani Woods Limited decide to appoint Mr. Wahid as its Managing

Director for a period of 5 years with effect from 1st May, 2013. Mr. Wahid fulfils all the

conditions as specified in Part I and Part II of Schedule XIII of the Companies Act, 1956.

The terms of appointm ent are as under:

(i) Salary ` 1 lakh per month;

(ii) Com mission, as may be decided by the Board of Directors of the company;

(iii) Perquisites:

Free Housing,

Medical reimbursement upto ` 10,000 per month,

Leave Travel concession for the family,

Club membership fee,

Personal Accident Insurance ` 10 lakh,

Gratuity, and

Provident Fund as per Companys policy.

You, being the Secretary of the said Com pany, are required to draft a resolution to give

effect to the above, assuming that Mr. Wahid is already the Managing Director in a

public limited company.

(8 marks)

Chapter - 17 : SEBI Act, 1992

2013 - May [3] (b) Modern Chemicals Limited, a listed company, propose to make a

preferential issue of equity shares to the promoters of the Company. You are required

to answer the following with reference to the Securities and Exchange Board of India

(Issue of Capital and Disclosure Requirements) Regulations, 2009:(i) W hat are the conditions to be complied with by the Company to give effect to the

proposed preferential issue?

(ii) W hat is the price at which the proposed issue can be made?

(iii) W hat is the lock-in period in respect of shares allotted on preferential basis to

promoters?

(8 marks)

Chapter - 18 : SCRA, 1956

2013 - May [1] {C} (d) The Securities and Exchange Board of India received serious

complaints against Mr. Satyanarayan, a member of Mavli Stock Exchange. State as to

what powers can be exercised by the Securities and Exchange Board of India to make

enquiries and to take action in this matter, under the provisions of the Securities

Contracts (Regulation) Act, 1956?

(6 marks)

Chapter - 19 : FEMA, 1999

2013 - May [7] Attempt:

(a) Mr. Kishore resided in India during the Financial Year 2009-2010 for less than 182

days. He came to India on 1st April, 2010 for business. He closed down his

business on 30th April, 2011 and left India on 30 th June, 2011 for the purpose of

employment outside India. Decide the residential status of Mr. Kishore during the

Scanner Appendix CA Final Gr. I

I-22

Financial Years 2010-2011 and 2011-2012 under the provisions of the Foreign

Exchange Management Act, 1999.

(4 marks)

Chapter - 20 : Competition Act, 2002

2013 - May [7] Attempt:

(b) Bombay Textiles Limited and Gujarat Textiles Limited marketing their products in

India propose to be amalgamated. The enterprise created as a result of the said

amalgamation will have assets of value of ` 300 crore and turnover of `1,000 crore.

Examine whether the proposed amalgamation attracts the provisions of the

Competition Act, 2002?

(4 marks)

Chapter - 21 : Banking Regulation Act, 1949

2013 - May [5] (b) The Board of Directors of a newly incorporated Banking Company

is required to file the accounts and Balance sheet. Advise the Board of Directors about

the law relating to preparation, signing and filing of accounts and Balance sheet under

the provisions of the Banking Regulation Act, 1949. Also state the applicability of the

provisions of the Companies Act, 1956 in this regard.

(8 marks)

Chapter - 23 : SRFAESI Act, 2002

2013 - May [7] Attempt :

(d) Explain briefly the concept of Securitisation under the provisions of the

Securitisation and Reconstruction of Financial Assets and Enforcem ent of Security

Interest Act, 2002.

(4 marks)

Chapter - 24 : Prevention of Money Laundering Act, 2002

2013 - May [7] Attempt :

(c) Money Laundering does not mean just siphoning of fund.

Comment on this statement explaining the significance and aim of the Prevention

of Money Laundering Act, 2002.

(4 marks)

Chapter - 25 : Interpretation of Statutes, Deeds and Documents

2013 - May [7] Attempt :

(e) Section 294 (2) of the Companies Act, 1956 provides that the Board shall not

appoint a Sole Selling Agent for any area except subject to the condition that the

appointment shall cease to be valid if it is not approved by the company in the First

General Meeting held after the date on which the appointment is made.

Examine whether the procedure under the above provision is mandatory or

directory?

State also the distinction between a mandatory provision and a directory provision.

(4 marks)

Scanner Appendix CA Final Gr. I

I-23

Shuchita Prakashan (P) Ltd.

25/19, L.I.C. Colony, Tagore Town,

Allahabad - 211002

Visit us : www.shuchita.com

FOR NOTES

Scanner Appendix CA Final Gr. I

I-24

FOR NOTES

Scanner Appendix CA Final Gr. I

I-25

Вам также может понравиться

- P5 Syl2012 InterДокумент12 страницP5 Syl2012 InterVimal ShuklaОценок пока нет

- Advanced Corporate AccountingДокумент6 страницAdvanced Corporate Accountingamensinkai3133Оценок пока нет

- Institute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsДокумент3 страницыInstitute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsAli SheikhОценок пока нет

- SA Dec 14 P18Документ28 страницSA Dec 14 P18ChandrikaprasdОценок пока нет

- Cma Advanced AccountingДокумент127 страницCma Advanced AccountingAli RizwanОценок пока нет

- RTP Nov 15Документ46 страницRTP Nov 15Aaquib ShahiОценок пока нет

- Intermediate Group I Test Papers FOR 2014 DECДокумент88 страницIntermediate Group I Test Papers FOR 2014 DECwaterloveОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент38 страниц© The Institute of Chartered Accountants of IndiaSarah HolmesОценок пока нет

- Financial Accounting Mock Test PaperДокумент7 страницFinancial Accounting Mock Test PaperBharathFrnzbookОценок пока нет

- E-14 AfrДокумент5 страницE-14 AfrInternational Iqbal ForumОценок пока нет

- Caf 7 Far2Документ4 страницыCaf 7 Far2askermanОценок пока нет

- 07 11 2014 CA FINAL FR Nov 14 Guideline AnswersДокумент16 страниц07 11 2014 CA FINAL FR Nov 14 Guideline AnswersAmol TambeОценок пока нет

- P5 Syl2012 InterДокумент27 страницP5 Syl2012 InterViswanathan SrkОценок пока нет

- RTP Nov 14Документ127 страницRTP Nov 14sathish_61288@yahooОценок пока нет

- No.............................. MAY'2011: Ipco Group-I Paper-1 AccountingДокумент12 страницNo.............................. MAY'2011: Ipco Group-I Paper-1 AccountingSamson KoshyОценок пока нет

- 19696ipcc Acc Vol2 Chapter14Документ41 страница19696ipcc Acc Vol2 Chapter14Shivam TripathiОценок пока нет

- Extra AfaДокумент5 страницExtra AfaJesmon RajОценок пока нет

- 29234rtp May13 Ipcc Atc 1Документ50 страниц29234rtp May13 Ipcc Atc 1rahulkingdonОценок пока нет

- Institute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsДокумент3 страницыInstitute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsHaseeb KhanОценок пока нет

- ICMA. Pakistan Extra Reading Time: Writing Time: (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) 15 Minutes 02 Hours 30 MinutesMODEL PAPER FINANCIAL ACCOUNTING – (AF-301Документ5 страницICMA. Pakistan Extra Reading Time: Writing Time: (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) 15 Minutes 02 Hours 30 MinutesMODEL PAPER FINANCIAL ACCOUNTING – (AF-301Muhammad BilalОценок пока нет

- Accounting concepts and principles in financial statementsДокумент6 страницAccounting concepts and principles in financial statementskartikbhaiОценок пока нет

- Intermediate Exam Suggested Answers Dec 2015 Paper 5Документ25 страницIntermediate Exam Suggested Answers Dec 2015 Paper 5Muhammed Nuz-hadОценок пока нет

- Ca Ipcc May 2011 Qustion Paper 5Документ11 страницCa Ipcc May 2011 Qustion Paper 5Asim DasОценок пока нет

- P5 Syl2012 Set2Документ22 страницыP5 Syl2012 Set2JOLLYОценок пока нет

- Suggested Answer - Syl12 - Jun2014 - Paper - 18 Final Examination: Suggested Answers To QuestionsДокумент32 страницыSuggested Answer - Syl12 - Jun2014 - Paper - 18 Final Examination: Suggested Answers To QuestionsMdAnjum1991Оценок пока нет

- B.Com Corporate Accounting II exam questionsДокумент5 страницB.Com Corporate Accounting II exam questionsjeganrajrajОценок пока нет

- Corporate Accounting QUESTIONSДокумент4 страницыCorporate Accounting QUESTIONSsubba1995333333100% (1)

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFДокумент11 страницACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainОценок пока нет

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsДокумент3 страницыAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhОценок пока нет

- Pid6012 MBMДокумент4 страницыPid6012 MBMSukumar ManiОценок пока нет

- CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Документ5 страницCBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Manish SahuОценок пока нет

- Institute of Cost and Management Accountants of Pakistan Fall 2012 ExamsДокумент4 страницыInstitute of Cost and Management Accountants of Pakistan Fall 2012 Examsmagnetbox8Оценок пока нет

- MOCK EXAMINATION PAPER 4 AccountancyДокумент18 страницMOCK EXAMINATION PAPER 4 AccountancyRОценок пока нет

- MTP 2 AccountsДокумент8 страницMTP 2 AccountssuzalaggarwalllОценок пока нет

- Accounting RTPДокумент40 страницAccounting RTPMayur KundarОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент56 страниц© The Institute of Chartered Accountants of IndiaTejaОценок пока нет

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingДокумент27 страницQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarОценок пока нет

- Sa Dec 15 Set 2 p18Документ25 страницSa Dec 15 Set 2 p18ChandrikaprasdОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент0 страниц© The Institute of Chartered Accountants of IndiaamitmdeshpandeОценок пока нет

- CA IPCC Nov 2010 Accounts Solved AnswersДокумент13 страницCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerОценок пока нет

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsДокумент4 страницыInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanОценок пока нет

- Final Examination: Group IvДокумент30 страницFinal Examination: Group Ivmknatoo1963Оценок пока нет

- PA1 Mock ExamДокумент18 страницPA1 Mock Examyciamyr67% (3)

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Документ8 страницCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- IPCC MTP2 AccountingДокумент7 страницIPCC MTP2 AccountingBalaji SiddhuОценок пока нет

- BcomtrywalaokДокумент7 страницBcomtrywalaokSãúrâßh JáðhàvОценок пока нет

- Accounting Test Paper 1: Key ConceptsДокумент30 страницAccounting Test Paper 1: Key ConceptsSatyajit PandaОценок пока нет

- Disclaimer: © The Institute of Chartered Accountants of IndiaДокумент35 страницDisclaimer: © The Institute of Chartered Accountants of IndiajaimaakalikaОценок пока нет

- FM Assignment: Liabilities 2010 (') 2011 (') Assets 2010 (') 2011 (')Документ2 страницыFM Assignment: Liabilities 2010 (') 2011 (') Assets 2010 (') 2011 (')Avinash ToraneОценок пока нет

- MTP - Final - Syllabus 2016 - Dec 2019 - Set2: Paper 17-Corporate Financial ReportingДокумент6 страницMTP - Final - Syllabus 2016 - Dec 2019 - Set2: Paper 17-Corporate Financial ReportingBhupen SharmaОценок пока нет

- 106 1648004706 PDFДокумент15 страниц106 1648004706 PDFMohd AmanullahОценок пока нет

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Документ7 страницCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsОценок пока нет

- CFASДокумент2 страницыCFASNamelyka GarciaОценок пока нет

- Credit Union Revenues World Summary: Market Values & Financials by CountryОт EverandCredit Union Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryОт EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryОт EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Sales Financing Revenues World Summary: Market Values & Financials by CountryОт EverandSales Financing Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryОт EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОт EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryОт EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- AccДокумент16 страницAccMayank GoyalОценок пока нет

- CT2 QP 1113Документ10 страницCT2 QP 1113Mayank GoyalОценок пока нет

- Solved Scanner CA Final Paper 6Документ77 страницSolved Scanner CA Final Paper 6Mayank GoyalОценок пока нет

- Solved Scanner CA Final Paper 4Документ41 страницаSolved Scanner CA Final Paper 4Mayank GoyalОценок пока нет

- CT6 QP 0507Документ5 страницCT6 QP 0507Nilotpal ChattorajОценок пока нет

- ISI KolkataДокумент32 страницыISI KolkatagaurishkorpalОценок пока нет

- Solved Scanner CA Final Paper 5 PDFДокумент80 страницSolved Scanner CA Final Paper 5 PDFMayank GoyalОценок пока нет

- Solved Scanner CA Final Paper 2Документ3 страницыSolved Scanner CA Final Paper 2Mayank Goyal0% (1)

- Appendix CA Final Solved Scanner Paper-8 GreenДокумент23 страницыAppendix CA Final Solved Scanner Paper-8 GreenMayank GoyalОценок пока нет

- Appendix CA Final Solved Scanner Paper-2 GreenДокумент24 страницыAppendix CA Final Solved Scanner Paper-2 GreenMayank GoyalОценок пока нет

- AXA BrochureДокумент4 страницыAXA BrochureMayank GoyalОценок пока нет

- Journalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesДокумент24 страницыJournalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesVarsha YenareОценок пока нет

- TallerДокумент102 страницыTallerMarie RodriguezОценок пока нет

- Chap1 HRM581 Oct Feb 2023Документ20 страницChap1 HRM581 Oct Feb 2023liana bahaОценок пока нет

- 1Документ1 страница1MariaMagubatОценок пока нет

- 3.1.bauer Martin-Resistance To New Technology Nuclear Power, Information Technology and Biotechnology 1995Документ436 страниц3.1.bauer Martin-Resistance To New Technology Nuclear Power, Information Technology and Biotechnology 1995Anonymous 2o0az0zOJОценок пока нет

- VI Sem. BBA - HRM Specialisation - Human Resource Planning and Development PDFДокумент39 страницVI Sem. BBA - HRM Specialisation - Human Resource Planning and Development PDFlintameyla50% (2)

- Đề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangДокумент5 страницĐề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangHaiОценок пока нет

- History of Cisco and IBMДокумент1 страницаHistory of Cisco and IBMSven SpenceОценок пока нет

- Quicho - Civil Procedure DoctrinesДокумент73 страницыQuicho - Civil Procedure DoctrinesDeanne ViОценок пока нет

- Mixed 14Документ2 страницыMixed 14Rafi AzamОценок пока нет

- Understanding Culture, Society and PoliticsДокумент3 страницыUnderstanding Culture, Society and PoliticsแซคОценок пока нет

- The Princess AhmadeeДокумент6 страницThe Princess AhmadeeAnnette EdwardsОценок пока нет

- International HR Management at Buro HappoldДокумент10 страницInternational HR Management at Buro HappoldNishan ShettyОценок пока нет

- HRM Assessment (Final Copy) - Home Loan Experts Nepal - EMBA Fall 2020Документ33 страницыHRM Assessment (Final Copy) - Home Loan Experts Nepal - EMBA Fall 2020Rajkishor YadavОценок пока нет

- Customer Based Brand EquityДокумент13 страницCustomer Based Brand EquityZeeshan BakshiОценок пока нет

- IEC 60050-151-2001 Amd2-2014Документ8 страницIEC 60050-151-2001 Amd2-2014mameri malekОценок пока нет

- Sweetlines v. TevesДокумент6 страницSweetlines v. TevesSar FifthОценок пока нет

- Winny Chepwogen CVДокумент16 страницWinny Chepwogen CVjeff liwaliОценок пока нет

- Aikido NJKS PDFДокумент105 страницAikido NJKS PDFdimitaring100% (5)

- Festive FeastДокумент25 страницFestive FeastLina LandazábalОценок пока нет

- Effective Team Performance - FinalДокумент30 страницEffective Team Performance - FinalKarthigeyan K KarunakaranОценок пока нет

- The Last LeafДокумент6 страницThe Last LeafNam KhaОценок пока нет

- Hold On To HopeДокумент2 страницыHold On To HopeGregory J PagliniОценок пока нет

- (Julian v. Roberts) The Virtual Prison CommunityДокумент233 страницы(Julian v. Roberts) The Virtual Prison CommunityTaok CrokoОценок пока нет

- Fe en Accion - Morris VendenДокумент734 страницыFe en Accion - Morris VendenNicolas BertoaОценок пока нет

- JNMF Scholarship Application Form-1Документ7 страницJNMF Scholarship Application Form-1arudhayОценок пока нет

- Website Vulnerability Scanner Report (Light)Документ6 страницWebsite Vulnerability Scanner Report (Light)Stevi NangonОценок пока нет

- MUN Resolution For The North Korean Missile CrisisДокумент2 страницыMUN Resolution For The North Korean Missile CrisissujalachamОценок пока нет

- Hackers Speaking Test ReviewДокумент21 страницаHackers Speaking Test ReviewMark Danniel SaludОценок пока нет

- (Cooperative) BOD and Secretary CertificateДокумент3 страницы(Cooperative) BOD and Secretary Certificateresh lee100% (1)