Академический Документы

Профессиональный Документы

Культура Документы

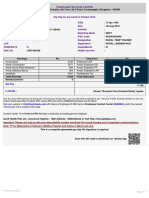

Payslip On Deputation

Загружено:

Anonymous pKsr5vОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Payslip On Deputation

Загружено:

Anonymous pKsr5vАвторское право:

Доступные форматы

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Turbine Basement U-1 - TPS CHANDRAPUR

Name

: SANTOSH

Empl ID

VITHALRAO

DESG/ESG

Junior Engineer

Birth Date

:07.03.1969

PG/EG

Grade C Employee

CPF No./UAN: 02193906 / 100337630549

Retire Due

:31.03.2027

LAP Avl/Bal:

/ 155

PAN No.

Due Incr Dt :06.07.2016

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 30,390.00

HAP Avl/Bal:

/ 283

Bank Ac No : 5249

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF INDIA

Seniority No:

EOL Avl

Pay Scale

: MG11 - 19110-840-23310-885-46320

Absent(C/P):

917

: AEIPA9992D

AHIRKAR

79 JR ENGINEER

0.00

Earnings

Deductions

Loan Balances

Basic Salary

30,390.00

Ee PF contribution

7,986.00

Computer Principal

25,875.00

Dearness Allow

36,164.00

Er Pension contribution

1,250.00

CPF Loan Principal

183,315.00

Special Compen Allow

140.00

Prof Tax - split period

200.00

Elec. Charges Allow

215.00

Ee LWF contribution

Washing Allow

60.00

7,796.00

2,063.00

Conveyence Allowance

1,053.00

Electricity Charges

Sp. Incentive

1,500.00

Staff

Allow

12.00

Income Tax

Welfare Fund

10.00

Edu. Assist. Allow

250.00

Revenue Stamp

Tech J A / Book Allow

440.00

LIC

Entertainment Allow

335.00

Emp Dep Wel T Fund

30.00

475.00

Computer Principal

1,125.00

13,000.32

CPF Loan Principal

5,555.00

CSTPS ECCSoc Chandrapur

8,946.00

FB Generation Allow

Ar. Over Time(Double)

1.00

2,628.00

BA CCSoc Chandrapur

Deductions not taken in the month

600.00

WRC Chandrapur

20.00

Engineer CCSoc Nagpur

14,406.00

Total

51,378.00

Adjustments

Total

84,022.32

Perks/Exemption

CEA Annual Ex

Other Income/Deduction

Form 16 summary

800.00

Ann Reg Incom 852264.00

Gross Salary

Ann Irr Incom 94,593.18

Exemption U/S 10

Other Exempti

Prev Yr Incom 29,442.14

Balance

Gross Salary

Empmnt tax (Prof Tax)

976299.32

32,645.00

Form 16 summary

Conveyance An 12,636.00

9,300.00

0.68

Take Home Pay

976,299.32

22,736.00

953,563.32

2,400.00

Incm under Hd Salary

951,163.32

Gross Tot Income

951,163.32

Agg of Chapter VI

127,368.00

Total Income

823,800.00

Tax on total Income

89,760.00

Tax payable and surcharg

92,453.00

Tax payable by Ee.

92,453.00

Tax deducted so far

14,498.00

Income Tax

7,796.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

BM-I SECTION OFFICE - TPS CHANDRAPUR

Name

: WARLU

Empl ID

RAGHUNATH

DESG/ESG

Technician II

Birth Date

:01.07.1958

PG/EG

Grade C Employee

CPF No./UAN: 01090186 / 100413933395

Retire Due

:30.06.2016

LAP Avl/Bal:

/ 62

PAN No.

Due Incr Dt :21.07.2008

SCL Avl/Bal:

/ 24

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 18,515.00

HAP Avl/Bal:

/ 85

Bank Ac No : 10880

Emp.Status

:Pay not drawn

Comm Avl

Bank Name

: BANK OF INDIA

Seniority No:

EOL Avl

Pay Scale

: MG05 - 11965-410-14015-450-18515-490-34195

Absent(C/P):

1529

: APPPC9942K

CHIWANDE

0.00

Earnings

Gratuity F & F

Emp Wel Fund-Reward

Deductions

678,399.00

2,000.00

Loan Balances

Prof Tax - split period

200.00

Electricity Charges

Staff

11,740.00

Welfare Fund

10.00

Revenue Stamp

1.00

Gratuity Retain

30,000.00

Excess payment adjusted

26,661.00

1/3rd Gratuity Deduction

227,876.00

CPF Loan Principal

24,990.00

CPF Interest

10,152.00

Deductions not taken in the month

Adjustments

Total

680,399.00

Perks/Exemption

Gratuity Cont 678399.00

Total

331,630.00

Other Income/Deduction

Form 16 summary

Take Home Pay

0.00

348,769.00

Form 16 summary

Ann Irr Incom 678399.00

Gross Salary

681,673.46

Prev Yr Incom

3,274.46

Exemption U/S 10

678,399.00

Gross Salary

681673.46

Balance

Empmnt tax (Prof Tax)

3,274.46

200.00

Incm under Hd Salary

3,074.46

Gross Tot Income

3,074.46

Agg of Chapter VI

Total Income

392.00

2,683.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

MAJOR STORE - TPS CHANDRAPUR

Name

: DINESHDATTA

Empl ID

INDRADATTA

DESG/ESG

Dy

Birth Date

:21.10.1973

PG/EG

Grade B Employee

CPF No./UAN: 02278618 / 100139674250

Retire Due

:31.10.2031

LAP Avl/Bal:

/ 279

PAN No.

Due Incr Dt :18.03.2017

SCL Avl/Bal:

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 32,010.00

HAP Avl/Bal:

/ 101

Bank Ac No : 961710110002107

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF INDIA

Seniority No: 408 DY EXE ENG -GRA

EOL Avl

Pay Scale

: MG16 - 26710-1060-32010-1125-60135

Absent(C/P):

2644

: AYXPS5896H

SHUKLA

Exe Engineer

0.00

Earnings

Deductions

Loan Balances

Basic Salary

32,010.00

Ee PF contribution

8,412.00

Dearness Allow

38,092.00

Er Pension contribution

1,250.00

Income Tax

6,379.00

Elec. Charges Allow

265.00

Conveyence Allowance

2,000.00

Electricity Charges

Sp. Incentive

1,500.00

Staff

Allow

370.00

Welfare Fund

Tech J A / Book Allow

440.00

Revenue Stamp

Entertainment Allow

335.00

LIC

FB Generation Allow

640.00

Emp Dep Wel T Fund

10.00

1.00

3,062.00

30.00

CSTPS ECCSoc Chandrapur

13,745.00

ORC Chandrapur

Deductions not taken in the month

240.00

Adjustments

Total

75,282.00

Perks/Exemption

Total

32,249.00

Other Income/Deduction

Form 16 summary

0.00

Take Home Pay

43,033.00

Form 16 summary

Conveyance An 24,000.00

Ann Reg Incom 903384.00

Gross Salary

Other Exempti

Prev Yr Incom 12,999.00

Exemption U/S 10

Gross Salary

Balance

883,083.00

Incm under Hd Salary

883,083.00

Gross Tot Income

883,083.00

Agg of Chapter VI

137,688.00

Total Income

745,400.00

9,300.00

916383.00

916,383.00

33,300.00

Tax on total Income

74,080.00

Tax payable and surcharg

76,303.00

Tax payable by Ee.

76,303.00

Tax deducted so far

12,514.00

Income Tax

6,379.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-6 (250 MW) - TPS PARLI

Name

: SANTOSH

Empl ID

LATARI

JUNGHARE

DESG/ESG

Technician II

Birth Date

:24.10.1975

PG/EG

Grade C Employee

CPF No./UAN: 02376245 / 100337176263

Retire Due

:31.10.2033

LAP Avl/Bal:

PAN No.

Due Incr Dt :17.04.2017

SCL Avl/Bal:

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 13,885.00

HAP Avl/Bal:

Bank Ac No : 60043491241

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No: 161 TECH II

EOL Avl

Pay Scale

: MG04 - 11625-370-13475-410-17575-450-31975

Absent(C/P):

9618

: AOOPJ9697Q

0.00

Earnings

Deductions

Loan Balances

Basic Salary

13,885.00

Ee PF contribution

3,649.00

Computer Principal

32,375.00

Dearness Allow

16,523.00

Er Pension contribution

1,250.00

CPF Loan 2

35,850.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Income Tax

180.00

Risk Allow

175.00

Electricity Charges

Elec. Charges Allow

215.00

Staff

Washing Allow

1,627.00

Welfare Fund

10.00

60.00

Revenue Stamp

Conveyence Allowance

567.00

Water Charges

1.00

Tech J A / Book Allow

115.00

Quarter Rent

41.00

FB Generation Allow

185.00

LIC

375.00

Emp Dep Wel T Fund

30.00

5,960.16

Computer Principal

875.00

Night Shift Allow (IT15)

Ar. Over Time(Double)

1.00

Deductions not taken in the month

1,910.00

CPF Loan Principal 2

2,390.00

RVKSPM Parli-Vaijnath

10,820.00

Total

21,734.00

Adjustments

Total

38,260.16

Perks/Exemption

Other Income/Deduction

Form 16 summary

6,804.00

Ann Reg Incom 383100.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

Exemption U/S 10

Prev Yr Incom 10,338.61

Balance

Gross Salary

Empmnt tax (Prof Tax)

399848.77

16,527.00

Form 16 summary

Conveyance An

6,410.16

0.84

Take Home Pay

399,848.77

8,184.00

391,664.77

2,400.00

Incm under Hd Salary

389,264.77

Gross Tot Income

389,264.77

Agg of Chapter VI

67,381.00

Total Income

321,884.00

Tax on total Income

7,188.40

Tax Credit

5,000.00

Tax payable and surcharg

2,255.00

Tax payable by Ee.

2,255.00

Tax deducted so far

454.00

Income Tax

180.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-6 (250 MW) - TPS PARLI

Name

: GANESH

Empl ID

ARJUN

KOLI

DESG/ESG

Technician III

Birth Date

:09.09.1991

PG/EG

Grade C Employee

CPF No./UAN: 02516829 / 100150018482

Retire Due

:30.09.2049

LAP Avl/Bal:

/ 20

PAN No.

Due Incr Dt :28.08.2016

SCL Avl/Bal:

/ 68

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,650.00

HAP Avl/Bal:

/ 57

Bank Ac No : 68000139301

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

9944

: CGMPK5827P

39 TECH III

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,650.00

Ee PF contribution

3,324.00

Dearness Allow

15,054.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

175.00

Income Tax

Elec. Charges Allow

215.00

Electricity Charges

46.00

Staff

20.00

60.00

3,000.00

12.00

Risk Allow

Washing Allow

Festival Advance

119.00

Welfare Fund

Tech J A / Book Allow

115.00

Revenue Stamp

FB Generation Allow

165.00

Water Charges

1.00

1.00

Quarter Rent

47.00

LIC

Deductions not taken in the month

444.00

Emp Dep Wel T Fund

30.00

Festival Advance

500.00

Adjustments

Total

28,634.00

Perks/Exemption

Other Exempti

Total

4,744.00

Other Income/Deduction

1,380.00

Form 16 summary

Gross Salary

Ann Irr Incom

Exemption U/S 10

Prev Yr Incom 11,168.61

Balance

Gross Salary

Empmnt tax (Prof Tax)

364397.01

23,890.00

Form 16 summary

Ann Reg Incom 343608.00

9,620.40

0.00

Take Home Pay

364,397.01

1,380.00

363,017.01

2,400.00

Incm under Hd Salary

360,617.01

Gross Tot Income

360,617.01

Agg of Chapter VI

45,812.00

Total Income

314,810.00

Tax on total Income

6,481.00

Tax Credit

5,000.00

Tax payable and surcharg

1,526.00

Tax payable by Ee.

1,526.00

Tax deducted so far

335.00

Income Tax

119.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

CHP OPERATION (210 MW) - TPS PARLI

Name

: GIRISH

Empl ID

DESG/ESG

Technician III

10992

SHANTARAM

Birth Date

:27.07.1983

PG/EG

Grade C Employee

CPF No./UAN: 02615487 / 100153737960

Retire Due

:31.07.2041

LAP Avl/Bal:

/ 73

PAN No.

Due Incr Dt :06.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016284795

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: BKVPP8749M

PATIL

12 TECH III

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

Risk Allow

175.00

Income Tax

88.00

Elec. Charges Allow

215.00

Electricity Charges

46.00

Staff

10.00

Washing Allow

60.00

Welfare Fund

Conveyence Allowance

567.00

Revenue Stamp

Tech J A / Book Allow

115.00

Emp Dep Wel T Fund

1.00

FB Generation Allow

165.00

30.00

Deductions not taken in the month

Adjustments

Total

28,598.00

Perks/Exemption

Total

3,639.00

Other Income/Deduction

Form 16 summary

6,804.00

Ann Reg Incom 343176.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

Exemption U/S 10

Prev Yr Incom 11,304.80

Balance

Gross Salary

Empmnt tax (Prof Tax)

362089.44

24,959.00

Form 16 summary

Conveyance An

7,608.64

0.00

Take Home Pay

362,089.44

8,184.00

353,905.44

2,400.00

Incm under Hd Salary

351,505.44

Gross Tot Income

351,505.44

Agg of Chapter VI

39,633.00

Total Income

311,873.00

Tax on total Income

6,187.30

Tax Credit

5,000.00

Tax payable and surcharg

1,223.00

Tax payable by Ee.

1,223.00

Tax deducted so far

Income Tax

342.00

88.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

CHP OPERATION (210 MW) - TPS PARLI

Name

: MADHAV

Empl ID

DESG/ESG

Technician III

11006

UMAKANT

PATIL

Birth Date

:29.07.1987

PG/EG

Grade C Employee

CPF No./UAN: 02615568 / 100394858547

Retire Due

:31.07.2045

LAP Avl/Bal:

/ 56

PAN No.

Due Incr Dt :30.01.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016284784

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: BJBPP4425M

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Ee VPF contribution

2,500.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Electricity Charges

46.00

Staff

10.00

Washing Allow

60.00

Welfare Fund

Tech J A / Book Allow

115.00

Revenue Stamp

FB Generation Allow

165.00

Emp Dep Wel T Fund

1.00

30.00

Deductions not taken in the month

Adjustments

Total

28,031.00

Perks/Exemption

Other Exempti

Total

6,051.00

Other Income/Deduction

1,380.00

Form 16 summary

Take Home Pay

Form 16 summary

Ann Reg Incom 336285.83

Gross Salary

Ann Irr Incom

Exemption U/S 10

6,618.12

Prev Yr Incom 12,024.50

Balance

Gross Salary

Empmnt tax (Prof Tax)

354928.45

0.00

21,980.00

354,928.45

1,380.00

353,548.45

2,400.00

Incm under Hd Salary

351,148.45

Gross Tot Income

351,148.45

Agg of Chapter VI

Total Income

69,024.00

282,125.00

Tax on total Income

3,212.50

Tax Credit

3,212.50

Tax deducted so far

2.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-3 (210 MW) - TPS PARLI

Name

: AKASH

Empl ID

DESG/ESG

Technician III

11064

NARENDRA

Birth Date

:16.09.1993

PG/EG

Grade C Employee

CPF No./UAN: 02615614 / 100076728252

Retire Due

:30.09.2051

LAP Avl/Bal:

/ 49

PAN No.

Due Incr Dt :01.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016284808

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AZFPJ7960G

JANGALE

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Ee VPF contribution

4,000.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Staff

10.00

Factory Allowance

250.00

Revenue Stamp

1.00

60.00

Quarter Rent

41.00

Emp Dep Wel T Fund

30.00

Washing Allow

Conveyence Allowance

567.00

Tech J A / Book Allow

115.00

FB Generation Allow

165.00

Welfare Fund

Deductions not taken in the month

Adjustments

Total

28,848.00

Perks/Exemption

Total

7,546.00

Other Income/Deduction

Form 16 summary

Take Home Pay

0.00

21,302.00

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 345676.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

6,168.12

Exemption U/S 10

Prev Yr Incom

8,525.34

Balance

Gross Salary

360369.46

Empmnt tax (Prof Tax)

360,369.46

8,184.00

352,185.46

2,400.00

Incm under Hd Salary

349,785.46

Gross Tot Income

349,785.46

Agg of Chapter VI

Total Income

87,633.00

262,153.00

Tax on total Income

1,215.30

Tax Credit

1,215.30

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-4 (210 MW) - TPS PARLI

Name

: PRAVIN

Empl ID

DESG/ESG

Technician III

11065

DEOCHAND

Birth Date

:21.05.1982

PG/EG

Grade C Employee

CPF No./UAN: 02615622 / 100279664216

Retire Due

:31.05.2040

LAP Avl/Bal:

/ 51

PAN No.

Due Incr Dt :31.01.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016375626

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AHVPT2267Q

TAYADE

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Ee VPF contribution

5,000.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Staff

10.00

Factory Allowance

250.00

Revenue Stamp

60.00

Quarter Rent

Washing Allow

Conveyence Allowance

567.00

Tech J A / Book Allow

115.00

FB Generation Allow

165.00

Welfare Fund

1.00

123.00

Emp Dep Wel T Fund

30.00

Deductions not taken in the month

Adjustments

Total

28,848.00

Perks/Exemption

Total

8,628.00

Other Income/Deduction

Form 16 summary

Take Home Pay

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 345676.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

Exemption U/S 10

7,999.16

Prev Yr Incom 12,042.98

Balance

Gross Salary

Empmnt tax (Prof Tax)

365718.14

0.00

20,220.00

365,718.14

8,184.00

357,534.14

2,400.00

Incm under Hd Salary

355,134.14

Gross Tot Income

355,134.14

Agg of Chapter VI

Total Income

99,635.00

255,500.00

Tax on total Income

550.00

Tax Credit

550.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-4 (210 MW) - TPS PARLI

Name

: SUSHIL

Empl ID

DESG/ESG

Technician III

11066

RAJU

WADHAI

Birth Date

:19.08.1991

PG/EG

Grade C Employee

CPF No./UAN: 02615690 / 100376146494

Retire Due

:31.08.2049

LAP Avl/Bal:

/ 12

PAN No.

Due Incr Dt :31.01.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285143

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: ACTPWO198E

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

Risk Allow

175.00

Electricity Charges

294.00

Elec. Charges Allow

215.00

Staff

Factory Allowance

250.00

Revenue Stamp

1.00

60.00

Quarter Rent

41.00

Washing Allow

Welfare Fund

Tech J A / Book Allow

115.00

LIC

FB Generation Allow

165.00

Emp Dep Wel T Fund

Ar.Risk Allow

10.00

3,829.00

22.58- RVKSPM Parli-Vaijnath

Ar.Washing Allow

Night Shift Allow (IT15)

Ar. Over Time(Double)

Deductions not taken in the month

30.00

6,890.00

7.74450.00

7,206.08

Adjustments

Total

35,906.76

Perks/Exemption

Other Exempti

Total

14,559.00

Other Income/Deduction

1,380.00

Form 16 summary

Take Home Pay

0.24

21,348.00

Form 16 summary

Ann Reg Incom 338841.68

Gross Salary

Ann Irr Incom 36,021.98

Exemption U/S 10

Prev Yr Incom

7,691.54

Balance

Gross Salary

382555.20

Empmnt tax (Prof Tax)

382,555.20

1,380.00

381,175.20

2,400.00

Incm under Hd Salary

378,775.20

Gross Tot Income

378,775.20

Agg of Chapter VI

Total Income

85,583.00

293,193.00

Tax on total Income

4,319.30

Tax Credit

4,319.30

Tax deducted so far

60.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-5 (210 MW) - TPS PARLI

Name

: SWAPNIL

Empl ID

DESG/ESG

Technician III

11071

RAJDHAR

KOLI

Birth Date

:09.12.1984

PG/EG

Grade C Employee

CPF No./UAN: 02615592 / 100377089551

Retire Due

:31.12.2042

LAP Avl/Bal:

/ 31

PAN No.

Due Incr Dt :24.02.2017

SCL Avl/Bal:

/ 18

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 23

Bank Ac No : 68016285483

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: CPPPK4915J

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

10.00

Risk Allow

175.00

Staff

Elec. Charges Allow

215.00

Revenue Stamp

Factory Allowance

250.00

LIC

Washing Allow

60.00

Tech J A / Book Allow

115.00

FB Generation Allow

165.00

Welfare Fund

Festival Advance

1.00

3,515.00

Emp Dep Wel T Fund

30.00

Festival Advance

1,000.00

Total

8,020.00

Deductions not taken in the month

Adjustments

Total

28,281.00

Perks/Exemption

Other Exempti

Other Income/Deduction

1,380.00

5,000.00

Form 16 summary

Take Home Pay

0.00

20,261.00

Form 16 summary

Ann Reg Incom 338872.00

Gross Salary

Ann Irr Incom

9,305.20

Exemption U/S 10

Prev Yr Incom

5,426.86

Balance

Gross Salary

353604.06

Empmnt tax (Prof Tax)

353,604.06

1,380.00

352,224.06

2,400.00

Incm under Hd Salary

349,824.06

Gross Tot Income

349,824.06

Agg of Chapter VI

Total Income

81,799.00

268,030.00

Tax on total Income

1,803.00

Tax Credit

1,803.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-5 (210 MW) - TPS PARLI

Name

: MANOHAR

Empl ID

DESG/ESG

Technician III

11077

RAMDAS

BARHE

Birth Date

:15.12.1970

PG/EG

Grade C Employee

CPF No./UAN: 02615533 / 100220893966

Retire Due

:31.12.2028

LAP Avl/Bal:

/ 78

PAN No.

Due Incr Dt :30.01.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285154

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: BBRPB5346R

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

Risk Allow

175.00

Income Tax

14.00

Elec. Charges Allow

215.00

Electricity Charges

46.00

Factory Allowance

250.00

Staff

10.00

Washing Allow

Welfare Fund

60.00

Revenue Stamp

1.00

Conveyence Allowance

567.00

Quarter Rent

74.00

Edu. Assist. Allow

250.00

LIC

Tech J A / Book Allow

115.00

Emp Dep Wel T Fund

FB Generation Allow

165.00

Small Savings Scheme

Festival Advance

1,500.00

Deductions not taken in the month

1,959.00

30.00

3,000.00

Festival Advance

500.00

Adjustments

Total

29,098.00

Perks/Exemption

Total

9,098.00

Other Income/Deduction

Form 16 summary

20,000.00

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 348676.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom 15,398.32

Exemption U/S 10

Prev Yr Incom 11,669.80

Balance

Gross Salary

Empmnt tax (Prof Tax)

375744.12

0.00

Take Home Pay

375,744.12

8,184.00

367,560.12

2,400.00

Incm under Hd Salary

365,160.12

Gross Tot Income

365,160.12

Agg of Chapter VI

63,143.00

Total Income

302,020.00

Tax on total Income

5,202.00

Tax Credit

5,000.00

Tax payable and surcharg

209.00

Tax payable by Ee.

209.00

Tax deducted so far

74.00

Income Tax

14.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-4 (210 MW) - TPS PARLI

Name

: MAHESH

Empl ID

DESG/ESG

Technician III

11078

PUNJO

BARHATE

Birth Date

:01.06.1975

PG/EG

Grade C Employee

CPF No./UAN: 02615576 / 100214905374

Retire Due

:31.05.2033

LAP Avl/Bal:

/ 73

PAN No.

Due Incr Dt :30.01.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016284819

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AJJPB6520G

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Ee VPF contribution

2,000.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Electricity Charges

46.00

Factory Allowance

250.00

Staff

10.00

Washing Allow

60.00

Conveyence Allowance

567.00

Edu. Assist. Allow

125.00

Tech J A / Book Allow

115.00

FB Generation Allow

165.00

Welfare Fund

Revenue Stamp

1.00

Emp Dep Wel T Fund

30.00

Deductions not taken in the month

Adjustments

Total

28,973.00

Perks/Exemption

Total

5,551.00

Other Income/Deduction

Form 16 summary

Take Home Pay

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 347176.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

Exemption U/S 10

5,722.00

Prev Yr Incom 11,616.64

Balance

Gross Salary

Empmnt tax (Prof Tax)

364514.64

0.00

23,422.00

364,514.64

8,184.00

356,330.64

2,400.00

Incm under Hd Salary

353,930.64

Gross Tot Income

353,930.64

Agg of Chapter VI

Total Income

63,024.00

290,910.00

Tax on total Income

4,091.00

Tax Credit

4,091.00

Tax deducted so far

57.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-6 (250 MW) - TPS PARLI

Name

: MUKUND

Empl ID

DESG/ESG

Technician III

11080

PANDIT

BHIRUD

Birth Date

:26.02.1975

PG/EG

Grade C Employee

CPF No./UAN: 02615509 / 100237876338

Retire Due

:28.02.2033

LAP Avl/Bal:

/ 27

PAN No.

Due Incr Dt :06.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016284706

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AYHPB5198D

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Ee VPF contribution

8,000.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Staff

10.00

Factory Allowance

250.00

Revenue Stamp

Washing Allow

60.00

Tech J A / Book Allow

115.00

FB Generation Allow

165.00

Night Shift Allow (IT15)

600.00

Welfare Fund

1.00

Emp Dep Wel T Fund

30.00

Small Savings Scheme

5,000.00

Deductions not taken in the month

Adjustments

Total

28,881.00

Perks/Exemption

Other Exempti

Total

16,505.00

Other Income/Deduction

1,380.00

Form 16 summary

Take Home Pay

Form 16 summary

Ann Reg Incom 338872.00

Gross Salary

Ann Irr Incom

Exemption U/S 10

6,922.00

Prev Yr Incom 11,298.54

Balance

Gross Salary

Empmnt tax (Prof Tax)

357092.54

0.00

12,376.00

357,092.54

1,380.00

355,712.54

2,400.00

Incm under Hd Salary

353,312.54

Gross Tot Income

353,312.54

Agg of Chapter VI

135,633.00

Total Income

217,680.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

CHP OPERATION (210 MW) - TPS PARLI

Name

: NARESH

Empl ID

DESG/ESG

Technician III

11091

TARACHAND

Birth Date

:10.06.1981

PG/EG

Grade C Employee

CPF No./UAN: 02617510 / 100251569385

Retire Due

:30.06.2039

LAP Avl/Bal:

/ 47

PAN No.

Due Incr Dt :11.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285507

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AVGPD2768M

DEOGADE

15 TECH III

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

Risk Allow

175.00

Electricity Charges

46.00

Elec. Charges Allow

215.00

Staff

10.00

Washing Allow

60.00

Welfare Fund

Revenue Stamp

1.00

Conveyence Allowance

567.00

LIC

Tech J A / Book Allow

115.00

Emp Dep Wel T Fund

FB Generation Allow

165.00

Ar. Over Time(Double)

958.00

30.00

Deductions not taken in the month

7,088.00

Adjustments

Total

35,686.00

Perks/Exemption

Total

4,509.00

Other Income/Deduction

Form 16 summary

Take Home Pay

0.00

31,177.00

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 343176.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

7,088.00

Exemption U/S 10

Prev Yr Incom

8,521.94

Balance

Gross Salary

358785.94

Empmnt tax (Prof Tax)

358,785.94

8,184.00

350,601.94

2,400.00

Incm under Hd Salary

348,201.94

Gross Tot Income

348,201.94

Agg of Chapter VI

Total Income

51,129.00

297,073.00

Tax on total Income

4,707.30

Tax Credit

4,707.30

Tax deducted so far

125.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-3 (210 MW) - TPS PARLI

Name

: PANKAJ

Empl ID

DESG/ESG

Technician III

11101

KASHINATH

Birth Date

:23.01.1987

PG/EG

Grade C Employee

CPF No./UAN: 02617374 / 100266435841

Retire Due

:31.01.2045

LAP Avl/Bal:

/ 76

PAN No.

Due Incr Dt :07.02.2016

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285212

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: CROPK0105R

KALE

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

Dearness Allow

14,726.00

Ar. Emp. PF contribution

Special Compen Allow

Heavy Duty Allow

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

175.00

Ee LWF contribution

Elec. Charges Allow

215.00

Income Tax

Factory Allowance

250.00

Staff

60.00

Conveyence Allowance

567.00

Tech J A / Book Allow

115.00

FB Generation Allow

1,100.00

Ar.Dearness Allow

1,308.00

Ar. Over Time(Double)

12.00

105.00

Welfare Fund

10.00

Revenue Stamp

1.00

Emp Dep Wel T Fund

30.00

Deductions not taken in the month

165.00

Ar.Basic Salary

Night Shift Allow (IT15)

288.00

140.00

Risk Allow

Washing Allow

3,252.00

450.00

5,558.16

Adjustments

Total

37,264.16

Perks/Exemption

Total

3,898.00

Other Income/Deduction

Form 16 summary

6,804.00

Ann Reg Incom 345676.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

Exemption U/S 10

Prev Yr Incom 10,163.60

Balance

Gross Salary

Empmnt tax (Prof Tax)

362264.64

33,367.00

Form 16 summary

Conveyance An

6,425.04

0.84

Take Home Pay

362,264.64

8,184.00

354,080.64

2,400.00

Incm under Hd Salary

351,680.64

Gross Tot Income

351,680.64

Agg of Chapter VI

39,777.00

Total Income

311,904.00

Tax on total Income

6,190.40

Tax Credit

5,000.00

Tax payable and surcharg

1,227.00

Tax payable by Ee.

1,227.00

Tax deducted so far

175.00

Income Tax

105.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-6 (250 MW) - TPS PARLI

Name

: NILIMA

Empl ID

DESG/ESG

Technician III

11110

ANUPKUMAR

Birth Date

:16.07.1984

PG/EG

Grade C Employee

CPF No./UAN: 02617846 / 100255730647

Retire Due

:31.07.2042

LAP Avl/Bal:

/ 72

PAN No.

Due Incr Dt :16.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285461

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: ADOPU6761H

UIKE

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

Risk Allow

175.00

Electricity Charges

46.00

Elec. Charges Allow

215.00

Staff

10.00

Washing Allow

Tech J A / Book Allow

FB Generation Allow

Ar. Over Time(Double)

Welfare Fund

60.00

Revenue Stamp

1.00

115.00

Quarter Rent

41.00

165.00

LIC

5,316.00

3,163.00

Emp Dep Wel T Fund

Deductions not taken in the month

30.00

RVKSPM Parli-Vaijnath

1,000.00

Total

7,755.00

Adjustments

Total

33,347.00

Perks/Exemption

Other Exempti

Other Income/Deduction

1,380.00

Form 16 summary

Take Home Pay

Form 16 summary

Ann Reg Incom 336372.00

Gross Salary

Ann Irr Incom

Exemption U/S 10

8,978.08

Prev Yr Incom 23,666.40

Balance

Gross Salary

Empmnt tax (Prof Tax)

369016.48

0.00

25,592.00

369,016.48

1,380.00

367,636.48

2,400.00

Incm under Hd Salary

365,236.48

Gross Tot Income

365,236.48

Agg of Chapter VI

Total Income

77,589.00

287,650.00

Tax on total Income

3,765.00

Tax Credit

3,765.00

Tax deducted so far

33.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-4 (210 MW) - TPS PARLI

Name

: SUBHASH

Empl ID

DESG/ESG

Technician III

11114

BARSU

PAWAR

Birth Date

:01.05.1973

PG/EG

Grade C Employee

CPF No./UAN: 02615762 / 100363952393

Retire Due

:30.04.2031

LAP Avl/Bal:

/ 56

PAN No.

Due Incr Dt :02.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285381

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: CAVPP7601K

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Ee VPF contribution

3,000.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Staff

10.00

Factory Allowance

250.00

Revenue Stamp

1.00

60.00

Quarter Rent

41.00

Washing Allow

Welfare Fund

Tech J A / Book Allow

115.00

LIC

FB Generation Allow

165.00

Emp Dep Wel T Fund

1,510.00

Deductions not taken in the month

30.00

Adjustments

Total

28,281.00

Perks/Exemption

Other Exempti

Total

8,056.00

Other Income/Deduction

1,380.00

Form 16 summary

Take Home Pay

Form 16 summary

Ann Reg Incom 338872.00

Gross Salary

Ann Irr Incom

Exemption U/S 10

6,693.12

Prev Yr Incom 11,289.68

Balance

Gross Salary

Empmnt tax (Prof Tax)

356854.80

0.00

20,225.00

356,854.80

1,380.00

355,474.80

2,400.00

Incm under Hd Salary

353,074.80

Gross Tot Income

353,074.80

Agg of Chapter VI

Total Income

92,243.00

260,832.00

Tax on total Income

1,083.20

Tax Credit

1,083.20

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Vehical Maintenance (210 MW) - TPS PARLI

Name

: ROSHAN

Empl ID

DESG/ESG

Technician III

11120

PRADEEP

WAGH

Birth Date

:14.05.1993

PG/EG

Grade C Employee

CPF No./UAN: 02615495 / 100315780089

Retire Due

:31.05.2051

LAP Avl/Bal:

/ 48

PAN No.

Due Incr Dt :30.01.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285187

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: ACHPW2910J

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Ee VPF contribution

2,000.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Electricity Charges

46.00

Factory Allowance

250.00

Staff

10.00

Washing Allow

Welfare Fund

60.00

Revenue Stamp

Conveyence Allowance

567.00

Water Charges

Tech J A / Book Allow

115.00

Quarter Rent

FB Generation Allow

165.00

LIC

Festival Advance

1.00

1.00

Deductions not taken in the month

141.00

2,675.00

Emp Dep Wel T Fund

30.00

Festival Advance

500.00

Adjustments

Total

28,848.00

Perks/Exemption

1,500.00

Total

8,868.00

Other Income/Deduction

Form 16 summary

Take Home Pay

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 345676.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

Exemption U/S 10

7,924.16

Prev Yr Incom 11,389.16

Balance

Gross Salary

Empmnt tax (Prof Tax)

364989.32

0.00

19,980.00

364,989.32

8,184.00

356,805.32

2,400.00

Incm under Hd Salary

354,405.32

Gross Tot Income

354,405.32

Agg of Chapter VI

Total Income

95,735.00

258,671.00

Tax on total Income

867.10

Tax Credit

867.10

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Turbine Mentenance (250 MW) - TPS PARLI

Name

: MUKUNDA

Empl ID

DESG/ESG

Technician III

11127

AMRUT

BARHE

Birth Date

:29.11.1980

PG/EG

Grade C Employee

CPF No./UAN: 02615541 / 100237889555

Retire Due

:30.11.2038

LAP Avl/Bal:

/ 30

PAN No.

Due Incr Dt :30.01.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285289

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: BDIPB9304A

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

Risk Allow

175.00

Income Tax

17.00

Elec. Charges Allow

215.00

Staff

10.00

Factory Allowance

250.00

Revenue Stamp

Washing Allow

60.00

Welfare Fund

Festival Advance

1,500.00

1.00

LIC

3,777.00

Edu. Assist. Allow

250.00

Emp Dep Wel T Fund

Tech J A / Book Allow

115.00

Festival Advance

30.00

FB Generation Allow

165.00

RVKSPM Parli-Vaijnath

Deductions not taken in the month

500.00

3,020.00

Adjustments

Total

28,531.00

Perks/Exemption

Other Exempti

Total

10,819.00

Other Income/Deduction

1,380.00

Form 16 summary

17,712.00

Form 16 summary

Ann Reg Incom 341872.00

Gross Salary

Ann Irr Incom 36,215.06

Exemption U/S 10

Prev Yr Incom 12,103.02

Balance

Gross Salary

Empmnt tax (Prof Tax)

390190.08

0.00

Take Home Pay

390,190.08

1,380.00

388,810.08

2,400.00

Incm under Hd Salary

386,410.08

Gross Tot Income

386,410.08

Agg of Chapter VI

84,789.00

Total Income

301,622.00

Tax on total Income

5,162.20

Tax Credit

5,000.00

Tax payable and surcharg

168.00

Tax payable by Ee.

168.00

Income Tax

17.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-7 (250 MW) - TPS PARLI

Name

: NIVRUTTI

Empl ID

DESG/ESG

Technician III

11129

CHANNU

CHAUDHARI

Birth Date

:25.11.1975

PG/EG

Grade C Employee

CPF No./UAN: 02615711 / 100258107024

Retire Due

:30.11.2033

LAP Avl/Bal:

/ 61

PAN No.

Due Incr Dt :23.02.2017

SCL Avl/Bal:

/ 18

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016284842

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AJTPC8727C

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

Dearness Allow

14,726.00

Ee VPF contribution

Special Compen Allow

Heavy Duty Allow

3,252.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Electricity Charges

46.00

Staff

10.00

Washing Allow

60.00

Festival Advance

Welfare Fund

Conveyence Allowance

567.00

Revenue Stamp

Edu. Assist. Allow

250.00

LIC

Tech J A / Book Allow

115.00

Emp Dep Wel T Fund

FB Generation Allow

165.00

Small Savings Scheme

3,000.00

Festival Advance

1,000.00

1.00

3,460.00

Deductions not taken in the month

30.00

Adjustments

Total

28,848.00

Perks/Exemption

Total

11,511.00

Other Income/Deduction

5,000.00

500.00

Form 16 summary

Take Home Pay

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 346176.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

Exemption U/S 10

4,412.08

Prev Yr Incom 11,125.90

Balance

Gross Salary

Empmnt tax (Prof Tax)

361713.98

0.00

17,337.00

361,713.98

8,184.00

353,529.98

2,400.00

Incm under Hd Salary

351,129.98

Gross Tot Income

351,129.98

Agg of Chapter VI

Total Income

87,150.00

263,980.00

Tax on total Income

1,398.00

Tax Credit

1,398.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Turbine Mentenance (250 MW) - TPS PARLI

Name

: SUJIT

Empl ID

DESG/ESG

Technician III

11131

KACHRUJI

Birth Date

:16.12.1987

PG/EG

Grade C Employee

CPF No./UAN: 02615835 / 100367067329

Retire Due

:31.12.2045

LAP Avl/Bal:

/ 55

PAN No.

Due Incr Dt :03.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285427

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AVSPN5340B

NALE

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Ee VPF contribution

2,000.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Electricity Charges

46.00

Staff

10.00

Washing Allow

60.00

Welfare Fund

Tech J A / Book Allow

115.00

Revenue Stamp

FB Generation Allow

165.00

LIC

Night Shift Allow (IT15)

525.00

Emp Dep Wel T Fund

Ar. Over Time(Double)

1.00

3,602.00

Deductions not taken in the month

30.00

5,316.00

Adjustments

Total

33,872.00

Perks/Exemption

Other Exempti

Total

9,153.00

Other Income/Deduction

1,380.00

Form 16 summary

Take Home Pay

Form 16 summary

Ann Reg Incom 336372.00

Gross Salary

Ann Irr Incom

Exemption U/S 10

6,366.00

Prev Yr Incom 10,963.86

Balance

Gross Salary

Empmnt tax (Prof Tax)

353701.86

0.00

24,719.00

353,701.86

1,380.00

352,321.86

2,400.00

Incm under Hd Salary

349,921.86

Gross Tot Income

349,921.86

Agg of Chapter VI

106,857.00

Total Income

243,065.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Instument & Control (250MW) - TPS PARLI

Name

: HITESH

Empl ID

DESG/ESG

Technician III

11134

ANANTRAO

Birth Date

:05.07.1980

PG/EG

Grade C Employee

CPF No./UAN: 02617854 / 100165038546

Retire Due

:31.07.2038

LAP Avl/Bal:

/ 51

PAN No.

Due Incr Dt :15.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016375966

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AASPW3022C

WASANKAR

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

Risk Allow

175.00

Income Tax

Elec. Charges Allow

215.00

Electricity Charges

Washing Allow

60.00

Staff

96.00

567.00

Revenue Stamp

Tech J A / Book Allow

115.00

Emp Dep Wel T Fund

FB Generation Allow

165.00

Ar. Over Time(Double)

1,780.00

Welfare Fund

Conveyence Allowance

Night Shift Allow (IT15)

12.00

10.00

1.00

30.00

Deductions not taken in the month

675.00

7,088.00

Adjustments

Total

36,361.00

Perks/Exemption

Total

5,381.00

Other Income/Deduction

Form 16 summary

0.00

Take Home Pay

30,980.00

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 343176.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

9,969.04

Exemption U/S 10

Prev Yr Incom

8,703.12

Balance

Gross Salary

361848.16

361,848.16

8,184.00

353,664.16

Empmnt tax (Prof Tax)

2,400.00

Incm under Hd Salary

351,264.16

Gross Tot Income

351,264.16

Agg of Chapter VI

39,633.00

Total Income

311,632.00

Tax on total Income

6,163.20

Tax Credit

5,000.00

Tax payable and surcharg

1,199.00

Tax payable by Ee.

1,199.00

Tax deducted so far

Income Tax

241.00

96.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Instument & Control (250MW) - TPS PARLI

Name

: PRAKASH

Empl ID

DESG/ESG

Technician III

11135

PARMESHWAR

Birth Date

:31.07.1989

PG/EG

Grade C Employee

CPF No./UAN: 02617625 / 100276008698

Retire Due

:31.07.2047

LAP Avl/Bal:

/ 47

PAN No.

Due Incr Dt :08.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016375659

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AOIPT9448P

TAJANE

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

Risk Allow

175.00

Electricity Charges

869.00

Elec. Charges Allow

215.00

Staff

Washing Allow

60.00

Welfare Fund

10.00

Revenue Stamp

1.00

Tech J A / Book Allow

115.00

LIC

2,244.00

FB Generation Allow

165.00

Emp Dep Wel T Fund

Night Shift Allow (IT15)

600.00

30.00

Deductions not taken in the month

Adjustments

Total

28,631.00

Perks/Exemption

Other Exempti

Total

6,618.00

Other Income/Deduction

1,380.00

Form 16 summary

Take Home Pay

0.00

22,013.00

Form 16 summary

Ann Reg Incom 336372.00

Gross Salary

Ann Irr Incom

1,050.00

Exemption U/S 10

Prev Yr Incom

5,957.96

Balance

Gross Salary

343379.96

Empmnt tax (Prof Tax)

343,379.96

1,380.00

341,999.96

2,400.00

Incm under Hd Salary

339,599.96

Gross Tot Income

339,599.96

Agg of Chapter VI

Total Income

66,561.00

273,040.00

Tax on total Income

2,304.00

Tax Credit

2,304.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-6 (250 MW) - TPS PARLI

Name

: VINEET

Empl ID

DESG/ESG

Technician III

11141

SHANKAR

RAMTEKE

Birth Date

:30.09.1986

PG/EG

Grade C Employee

CPF No./UAN: 02615797 / 100407561973

Retire Due

:30.09.2044

LAP Avl/Bal:

/ 38

PAN No.

Due Incr Dt :06.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285165

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: APCPR9273D

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

Risk Allow

175.00

Income Tax

48.00

Elec. Charges Allow

215.00

Electricity Charges

46.00

Staff

10.00

Washing Allow

60.00

Welfare Fund

Conveyence Allowance

567.00

Revenue Stamp

Tech J A / Book Allow

115.00

Emp Dep Wel T Fund

FB Generation Allow

165.00

RVKSPM Parli-Vaijnath

1,000.00

Total

4,599.00

Ar. Over Time(Double)

1.00

30.00

Deductions not taken in the month

7,088.00

Adjustments

Total

35,686.00

Perks/Exemption

Other Income/Deduction

Form 16 summary

0.00

Take Home Pay

31,087.00

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 343176.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom

7,538.00

Exemption U/S 10

Prev Yr Incom

6,149.68

Balance

Gross Salary

356863.68

356,863.68

8,184.00

348,679.68

Empmnt tax (Prof Tax)

2,400.00

Incm under Hd Salary

346,279.68

Gross Tot Income

346,279.68

Agg of Chapter VI

39,633.00

Total Income

306,650.00

Tax on total Income

5,665.00

Tax Credit

5,000.00

Tax payable and surcharg

685.00

Tax payable by Ee.

685.00

Tax deducted so far

206.00

Income Tax

48.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Chemical Lab (250MW) - TPS PARLI

Name

: VILAS

Empl ID

DESG/ESG

Technician III

11143

MAROTI

RAIPURE

Birth Date

:10.01.1972

PG/EG

Grade C Employee

CPF No./UAN: 02617838 / 100406623292

Retire Due

:31.01.2030

LAP Avl/Bal:

/ 69

PAN No.

Due Incr Dt :14.02.2017

SCL Avl/Bal:

/ 19

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 40

Bank Ac No : 68016285438

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: BUEPR9096N

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Ee VPF contribution

5,000.00

140.00

Er Pension contribution

1,250.00

60.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

Risk Allow

175.00

Ee LWF contribution

12.00

Elec. Charges Allow

215.00

Electricity Charges

516.00

Washing Allow

60.00

Staff

Welfare Fund

Conveyence Allowance

567.00

Revenue Stamp

Tech J A / Book Allow

115.00

LIC

FB Generation Allow

165.00

Emp Dep Wel T Fund

Night Shift Allow (IT15)

2,100.00

Ar. Over Time(Double)

21,928.50

Total

52,626.50

10.00

1.00

1,434.00

Deductions not taken in the month

30.00

RVKSPM Parli-Vaijnath

1,000.00

Adjustments

Perks/Exemption

Total

11,455.00

Other Income/Deduction

Form 16 summary

Take Home Pay

Form 16 summary

Conveyance An

6,804.00

Ann Reg Incom 343176.00

Gross Salary

Other Exempti

1,380.00

Ann Irr Incom 18,166.08

Exemption U/S 10

Prev Yr Incom 15,286.90

Balance

Gross Salary

Empmnt tax (Prof Tax)

376628.98

0.50

41,172.00

376,628.98

8,184.00

368,444.98

2,400.00

Incm under Hd Salary

366,044.98

Gross Tot Income

366,044.98

Agg of Chapter VI

116,841.00

Total Income

249,204.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! PLEASE CHECK YOUR SENIORITY NUMBER, IT SHOULD BE CORRECT !

Date:30.06.2016

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Operation Unit-4 (210 MW) - TPS PARLI

Name

: SACHIN

Empl ID

DESG/ESG

Technician III

11146

MAHADEO

NANNAWARE

Birth Date

:28.01.1987

PG/EG

Grade C Employee

CPF No./UAN: 02617757 / 100326079397

Retire Due

:31.01.2045

LAP Avl/Bal:

/ 42

PAN No.

Due Incr Dt :05.04.2017

SCL Avl/Bal:

/ 17

Pay Period : 01.06.2016 - 30.06.2016

Basic Rate

: 12,375.00

HAP Avl/Bal:

/ 20

Bank Ac No : 68016285052

Emp.Status

:Active

Comm Avl

Bank Name

: BANK OF MAHARASHTRA

Seniority No:

EOL Avl

Pay Scale

: MG03 - 11275-275-12650-370-16350-410-28240

Absent(C/P):

: AOYPN3572N

0.00

Earnings

Deductions

Loan Balances

Basic Salary

12,375.00

Ee PF contribution

3,252.00

Dearness Allow

14,726.00

Er Pension contribution

1,250.00

140.00

Prof Tax - split period

200.00

Special Compen Allow

Heavy Duty Allow

60.00

Ee LWF contribution

12.00

Risk Allow

175.00

Electricity Charges

2,034.00

Elec. Charges Allow

215.00

Staff

Washing Allow

60.00

Welfare Fund

Festival Advance

10.00

Revenue Stamp

1.00

Tech J A / Book Allow

115.00

Emp Dep Wel T Fund

FB Generation Allow

165.00

Festival Advance

30.00

500.00

RVKSPM Parli-Vaijnath

Deductions not taken in the month

5,800.00

Adjustments

Total

28,031.00

Perks/Exemption

Other Exempti

Total

11,839.00

Other Income/Deduction

1,380.00

1,500.00

Form 16 summary

Take Home Pay

0.00

16,192.00

Form 16 summary

Ann Reg Incom 336372.00

Gross Salary

Prev Yr Incom

5,098.47

Exemption U/S 10

Gross Salary

341470.47

Balance