Академический Документы

Профессиональный Документы

Культура Документы

What Is The Best Technical Indicator in Forex?: Trading Cost

Загружено:

Anonymous E4XxqQfsОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

What Is The Best Technical Indicator in Forex?: Trading Cost

Загружено:

Anonymous E4XxqQfsАвторское право:

Доступные форматы

LOWER YOUR

TRADING COST

FOREIGN EXCHANGE AND OTHER LEVERAGED

TRADING INVOLVES SIGNIFICANT RISK OF

LOSS

1.2

Learn How to Trade Forex. A Beginner's Guide to Forex Trading.

MAR

2016

Sign In

LEARN MORE

Join

Search...

BabyPips.com > School > Elementary > Popular Chart Indicators > What is the Best Technical Indicator in Forex?

Preschool

0%

Kindergarten

0%

Elementary

0%

Middle School

0%

Summer School

0%

High School

0%

Undergraduate

0%

Graduation

0%

What is the Best Technical

Indicator in Forex?

Now on to the good stuff: Just how profitable is each technical indicator on

its own? After all, forex traders dont include these technical indicators just to

make their charts look nicer. Traders are in the business of making money!

If these indicators generate signals that dont translate into a profitable

bottom line over time, then theyre simply not the way to go for your needs!

In order to give yall a comparison of the effectiveness of each technical

indicator, weve decided to backtest each of the indicators on their own for

the past 5 years.

Backtesting, the expertise of our resident forex robot Robopip, involves

retroactively testing the parameters of the indicators against historical price

action. Youll learn more about this in your future studies. For now, just take

a look at the parameters we used for our backtest.

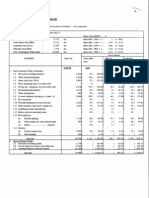

Indicator

Bollinger

Bands

MACD

Parabolic

SAR

Stochastic

RSI

Ichimoku

Kinko Hyo

Parameters Rules

(30,2,2)

Cover and go long when daily closing price crosses below

lower band. Cover and go short when daily closing price

crosses above upper band.

(12,26,9)

Cover and go long when MACD1 (fast) crosses above

MACD2 (slow). Cover and go short when MACD1 crosses

below MACD2.

(.02,.02,.2)

Cover and go long when daily closing price crosses above

ParSAR. Cover and go short when daily closing price

crosses below ParSAR.

(14,3,3)

Cover and go long when Stoch % crosses above 20. Cover

and go short when Stoch % crosses below 80.

(9)

Cover and go long when RSI crosses above 30. Cover and

go short when RSI crosses below 70

(9,26,52,1)

Cover and go long when conversion line crosses above

baseline. Cover and go short when conversion line crosses

below base line

Using these parameters, we tested each of the technical indicators on its

own on the daily time frame of EUR/USD over the past 5 years. We are

trading 1 lot (thats 100,000 units) at a time with no set stop losses or take

profit points. We simply cover and switch position once a new signal appears.

This means if we initially had a long position when the indicator told us to

sell, we would cover and establish a new short position.

Also, we were assuming we were well capitalized (as suggested in our

Leverage lesson) and started with an example balance of $100,000. Aside

from the actual profit and loss of each strategy, we included total pips

gained/lost and the max drawdown.

Again, let us just remind you that we DO NOT SUGGEST trading forex

without any stop losses. This is just for illustrative purposes only! Moving on,

here are the results of our backtest:

School Sponsors

Strategy

Number of Trades P/L in Pips

P/L in % Max Drawdown

Buy And Hold

-3,416.66

-3.42

25.44

Bollinger Bands

20

-19,535.97

-19.54

37.99

MACD

110

3,937.67

3.94

27.55

Parabolic SAR

128

-9,746.29

-9.75

21.96

Stochastic

74

-20,716.40

-20.72

30.64

RSI

-18,716.69

-18.72

34.57

Ichimoku Kinko Hyo

53

30,341.22

30.34

19.51

The data showed that over the past 5-years, the indicator that performed

the best on its own was the Ichimoku Kinko Hyo indicator. It generated a

total profit of $30,341, or 30.35%. Over 5 years, that gives us an average of

just over 6% per year!

Surprisingly, the rest of the technical indicators were a lot less profitable,

with the Stochastic indicator showing a return of negative 20.72%.

Furthermore, all of the indicators led to substantial drawdowns of between

20% to 30%. However, this does not mean that the Ichimoku Kinko Hyo

indicator is the best or that technical indicators as a whole are useless.

Rather, this just goes to show that they arent that useful on their own.

Think of all those martial arts movies you watched growing up. Aside from

The Rock and the Peoples Elbow, no one relied on just one move to beat all

the bad guys. Each of them used a combination of moves to get the job

done. Forex trading is similar. It is an art and as traders, we need to learn

how to use and combine the tools at hand in order to come up with a system

that works for us. This brings us to our next lesson: putting all these

indicators together!

Previous

Lesson

Mark Lesson

Complete

Next

Lesson

Save your progress by signing in and marking the lesson complete!

How to Use Bollinger Bands

How to Use the MACD Indicator

How to Use Parabolic SAR

How to Use the Stochastic Indicator

How to Use RSI (Relative Strength Index)

How to Use ADX (Average Directional Index)

Ichimoku Kinko Hyo

Trading with Multiple Chart Indicators

What is the Best Technical Indicator in Forex?

Summary: Popular Chart Indicators

BabyPips.com

Learn How to Trade Forex. BabyPips.com Is

The Beginner's Guide to Forex Trading.

LEARN FOREX

FOREX TOOLS

COMPANY

WEBSITE

What is Forex?

Forex Articles and

News

Forex Tutorials

Forex Calendar

Forex Calculators

Choose a Forex Broker

About Us

Contact Us

Advertise

Contribute

Privacy Policy

Risk Disclosure

Terms of Use

FAQ

Your Best Source for Forex Education on

the Web.

Forex Quizzes

Forex Forums

Forex Glossary

Copyright 2005-2016 BabyPips.com LLC. All rights reserved.

Google+

Testimonials

"When life gives you lemons, make lemonade."

Origin Unknown

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Shopify Investor Deck Q3 2021Документ33 страницыShopify Investor Deck Q3 2021Faris RahmanОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Pricing Strat LGДокумент3 страницыPricing Strat LGVishnu v nathОценок пока нет

- Commercial ExhibitionДокумент11 страницCommercial ExhibitionDavid Mercury HolguínОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Book of Abstracts - 2012 BorДокумент230 страницBook of Abstracts - 2012 BorMilena Marijanović IlićОценок пока нет

- Smbp14 Caseim Section C Case 09Документ37 страницSmbp14 Caseim Section C Case 09Hum92re50% (2)

- Jollibee HistoryДокумент5 страницJollibee Historytan2masОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Malhotra MR6e 06Документ28 страницMalhotra MR6e 06Tabish BhatОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Marketer's Bible To CHATGPTДокумент201 страницаThe Marketer's Bible To CHATGPTMaikon DouglasОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- HVSFeasibilityStudy0308Report - Source.prod Affiliate.56Документ210 страницHVSFeasibilityStudy0308Report - Source.prod Affiliate.56Harris U. AliОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- New Venture Creation Business Plan: Bhumika Patidar 114208Документ16 страницNew Venture Creation Business Plan: Bhumika Patidar 114208yogesh jainОценок пока нет

- SME Roving Academy Operations ManualДокумент29 страницSME Roving Academy Operations ManualDenzel Edward CariagaОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- 04 Mas - CVPДокумент8 страниц04 Mas - CVPKarlo D. ReclaОценок пока нет

- Brand Track: IndiGo AirlinesДокумент35 страницBrand Track: IndiGo AirlinesShivangi TripathiОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Google Search ParametersДокумент3 страницыGoogle Search Parametersjon56ssОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Introduction To EntrepreneurshipДокумент153 страницыIntroduction To EntrepreneurshipCherokee Tuazon Rodriguez100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Gmail - Madame Tussauds London Booking Confirmation Order NumbeДокумент2 страницыGmail - Madame Tussauds London Booking Confirmation Order Numbeapi-75518386Оценок пока нет

- 2 Literature ReviewДокумент2 страницы2 Literature ReviewArun Girish0% (1)

- European Statistics Handbook FRUIT LOGISTICA 2018Документ32 страницыEuropean Statistics Handbook FRUIT LOGISTICA 2018Anonymous 0SEqqyjqmОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- External Works - Cost Estimate PDFДокумент29 страницExternal Works - Cost Estimate PDFtony fungОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Architectural AlchemyДокумент1 страницаArchitectural AlchemymarjoriejanevellaОценок пока нет

- Copiute Pentru Examen La Limba Engleza. (Conspecte - MD)Документ2 страницыCopiute Pentru Examen La Limba Engleza. (Conspecte - MD)Xiusha XiuОценок пока нет

- FF0262 01 Pest Analysis Diagram For PowerpointДокумент7 страницFF0262 01 Pest Analysis Diagram For PowerpointsilvanaОценок пока нет

- My Lecture On Intellectual Property Rights in IndiaДокумент24 страницыMy Lecture On Intellectual Property Rights in IndiaSuresh NaiduОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- RaymondДокумент45 страницRaymondKing Nitin AgnihotriОценок пока нет

- CMO Marketing Communications VP in New York Resume Jean WiskowskiДокумент3 страницыCMO Marketing Communications VP in New York Resume Jean WiskowskiJeanWiskowskiОценок пока нет

- ENT Business Plan 07122022 121053pmДокумент56 страницENT Business Plan 07122022 121053pmAreej IftikharОценок пока нет

- Table of ContentДокумент21 страницаTable of Contenthritik guptaОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Presentasi Asuransi FinalДокумент64 страницыPresentasi Asuransi FinalMs. PotatoОценок пока нет

- CaseStudy Online Shopping CartДокумент22 страницыCaseStudy Online Shopping Carttranhoangnam2005Оценок пока нет

- Marketing PlanДокумент35 страницMarketing PlanWensen ChuОценок пока нет