Академический Документы

Профессиональный Документы

Культура Документы

Cost Accounting MUIT

Загружено:

SHAILESH KUMAR SINGH0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров2 страницыB.Com 2nd year

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документB.Com 2nd year

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров2 страницыCost Accounting MUIT

Загружено:

SHAILESH KUMAR SINGHB.Com 2nd year

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Roll No.

Annual Examination

B.Com. (IInd Year)

Cost Accounting

Time: 3 Hours.

INSTRUCTIONS:

Max. Marks: 100

Question paper is divided into three groups.

Figure to the right in bracket indicates mark.

Assume suitable data if necessary.

GROUP A: Answer any three questions. (Question No. 1st is compulsory)

3x10=30

Q.1 State the five objectives of cost accounting.

Q.2 How are costs classified on the basis of behavior?

Q.3 What do you mean by B.E.P. (Break-Even Point)?

Q.4 Distinguish between Marginal and Absorption costing.

Q.5 What do you understand by zero based budgeting? Explain.

GROUP B: Answer any three questions. (Question No. 10th is

compulsory)

3x15=45

Q.6 Explain the features of cost-sheet. What advantages accrue

from a cost-sheet? Discuss in detail.

Q.12 Multiple question. ( Each question carries 2 marks) 2X5=10

Q.7 What are the advantages of cost accounting?

Q.8 Do you agree with the view that Management Accounting and

Cost Accounting is indistinguishable? Explain the difference

between Management Accounting and Cost Accounting.

Q.9 What are the various method by which you would split semivariable cost into fixed and variable elements?

Q.10 Mrs. Neetu & Anchal furnishes the following data relating to

the manufacturing of a product during the month of Aprail,2015.

Particular

Raw Materials consumed

Machine Hours Rate(Rs.)

Machine Hours Worked

Direct Labour Charges

Rs.

15,000

5

900

9,000

Particular

Rs.

Selling Overheads

Administrative Overhead

Units Produced

Units sold Rs. 4/unit

0.50 /unit

20% on work cost

17,100

16,000

You are required to prepare a costsheet from the above data

showing (i) Profit /unit (ii) Cost of production and profit for the

period.

GROUP C: All questions are compulsory.

Q.11 Fill in the blanks. (Each question carries 2 marks)

I.

II.

III.

IV.

V.

(i) Cost sheet is based on system.

(a) Double entry (b) Output (c) None of the above

(ii) P/V ratio can be improved by ..the selling price.

(a) Decreasing

(b) Increasing (c) None of the above

(iii) Differential costing is a form of..

(a) Controlling

(b) None of the above (c) Budgeting

(iv) How many elements of cost?

(a) 1

(b) 3

(c) 5

(v) Classification of accounting is.parts.

(a) 2

(b) 3

(c) 5

Q.13 True or false. (Each question carries 1 Marks)

With the help of cost sheet, to teal cost and ..can be easily

found out.

is usually a long term budget.

Cost sheet is prepared for a period.

Direct materials + Direct labour + Direct expenses=..

Salesman salary is cost.

1x5=5

a) Cost accounting is useful only in such organizations as have profit

as the aim.

b) Supervisors salary is a direct labour cost.

c) Cost sheet is generally prepared under single or system.

d) Cost sheet does not help in making comparative study.

e) A firm earns profit when sales are above the B.E.P.

***

2x5=10

Вам также может понравиться

- Chapter 18. Lease Analysis (Ch18boc-ModelДокумент16 страницChapter 18. Lease Analysis (Ch18boc-Modelsardar hussainОценок пока нет

- Foundations of Macroeconomics 8th Edition Bade Test BankДокумент118 страницFoundations of Macroeconomics 8th Edition Bade Test Bankdavidjohnsonjnwtikocax100% (13)

- Marketing Analysis of Gap Fast Fashion BrandДокумент35 страницMarketing Analysis of Gap Fast Fashion BrandZFОценок пока нет

- Data Visualization with Excel Dashboards and ReportsОт EverandData Visualization with Excel Dashboards and ReportsРейтинг: 4 из 5 звезд4/5 (1)

- MA1 Mock Exam 1Документ11 страницMA1 Mock Exam 1138.Mehreen “79” Faisal50% (2)

- Assignment - 2 - Accounting - DeepaliДокумент16 страницAssignment - 2 - Accounting - DeepaliChinmoyОценок пока нет

- 2012 HONDA INSIGHT Receipt 13955290 PDFДокумент1 страница2012 HONDA INSIGHT Receipt 13955290 PDFNatalia GabrielОценок пока нет

- 10 Letter of Intent To Perform As SubcontractorДокумент1 страница10 Letter of Intent To Perform As SubcontractorRicardo CesárioОценок пока нет

- CH 5 - Limiting Factor Questions & SolutionДокумент26 страницCH 5 - Limiting Factor Questions & SolutionMuhammad Azam75% (8)

- BMW StrategyДокумент38 страницBMW Strategysanmithsshetty100% (1)

- Managerial EconomicsДокумент3 страницыManagerial EconomicsGuruKPOОценок пока нет

- MA1 Mock Exam 3Документ12 страницMA1 Mock Exam 3138.Mehreen “79” FaisalОценок пока нет

- Automobile IndustryДокумент12 страницAutomobile Industrykhushi13sepОценок пока нет

- Data Interpretation Guide: Tables, Graphs for Competitive ExamsДокумент884 страницыData Interpretation Guide: Tables, Graphs for Competitive ExamsDayanandhi ElangovanОценок пока нет

- Managing Mining Capital ProjectsДокумент43 страницыManaging Mining Capital Projectspuput utomoОценок пока нет

- Republic v. Vda de Castellvi DigestДокумент3 страницыRepublic v. Vda de Castellvi DigestAlthea M. SuerteОценок пока нет

- Income TaxДокумент2 страницыIncome TaxSourya Pratap SinghОценок пока нет

- Excel, Accounting and Tally conceptsДокумент2 страницыExcel, Accounting and Tally conceptsThomas Raju0% (1)

- Basic Informatics For Management - March 2020Документ2 страницыBasic Informatics For Management - March 2020Thomas BabyОценок пока нет

- 2004Документ20 страниц2004Mohammad Salim HossainОценок пока нет

- CMA Model Exam QPДокумент3 страницыCMA Model Exam QPsatisa123Оценок пока нет

- 50 Excel MCQs For Practice - Sep - 17 AttemptДокумент9 страниц50 Excel MCQs For Practice - Sep - 17 AttempttasleemfcaОценок пока нет

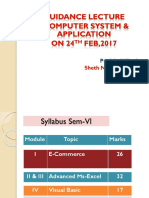

- Sheth N.K.T.T College, ThaneДокумент60 страницSheth N.K.T.T College, ThaneAnonymous eijaJFKОценок пока нет

- Executive M.B.A. exam papers on management topicsДокумент27 страницExecutive M.B.A. exam papers on management topicsAnonymous 5lbkhbОценок пока нет

- 12 ItДокумент12 страниц12 ItSudha ManogaranОценок пока нет

- 加拿大数学十年级 (高一) 省考模拟试题A PDFДокумент38 страниц加拿大数学十年级 (高一) 省考模拟试题A PDFTommyОценок пока нет

- CM121.Question September-2023 Exam.Документ8 страницCM121.Question September-2023 Exam.Arif HossainОценок пока нет

- ECON111Документ32 страницыECON111julieОценок пока нет

- Test MKT Code 1Документ2 страницыTest MKT Code 1yohanes getnetОценок пока нет

- ECON111 - Individual Assignment 02Документ7 страницECON111 - Individual Assignment 02Anh Thư PhạmОценок пока нет

- (For Those Who Joined in July 2007 and After) Time: Three Hours Maximum: 100 MarksДокумент18 страниц(For Those Who Joined in July 2007 and After) Time: Three Hours Maximum: 100 MarksshareefahaneefОценок пока нет

- Higher Secondary Model Examination: EconomicsДокумент4 страницыHigher Secondary Model Examination: EconomicsBinu Kayanna KОценок пока нет

- 6th Sem CA Tally-2Документ2 страницы6th Sem CA Tally-2anupamaОценок пока нет

- Bca Apr2011Документ55 страницBca Apr2011lalitmunawatОценок пока нет

- Model Question Paper - Industrial Engineering and Management - First Semester - DraftДокумент24 страницыModel Question Paper - Industrial Engineering and Management - First Semester - Draftpammy313Оценок пока нет

- Bca Apr2010Документ125 страницBca Apr2010lalitmunawatОценок пока нет

- Xi Eco 2023Документ4 страницыXi Eco 2023sindhuОценок пока нет

- EconomicsДокумент2 страницыEconomicssahidabanuОценок пока нет

- EXERCISE Before FinalДокумент15 страницEXERCISE Before FinalNursakinah Nadhirah Md AsranОценок пока нет

- Answer ALL The Questions QUESTION 1 (30 Marks) : InstructionДокумент3 страницыAnswer ALL The Questions QUESTION 1 (30 Marks) : Instruction....Оценок пока нет

- Mca 103Документ2 страницыMca 103kola0123Оценок пока нет

- Business Math and Stats Exam ReviewДокумент7 страницBusiness Math and Stats Exam ReviewggillОценок пока нет

- Computer Science: SECTION A (20 Marks)Документ4 страницыComputer Science: SECTION A (20 Marks)somenath_senguptaОценок пока нет

- excel and tableau 70 mcqДокумент16 страницexcel and tableau 70 mcqavprasadarao1950Оценок пока нет

- XIComp SC H Y 373Документ4 страницыXIComp SC H Y 373Prajjwal mishraОценок пока нет

- SpreadsheetsДокумент24 страницыSpreadsheetsFarrukh AliОценок пока нет

- CM231.MAC (IL-II) Question CMA May-2023 Exam.Документ7 страницCM231.MAC (IL-II) Question CMA May-2023 Exam.Md FahadОценок пока нет

- Class 601 - Maths - QPPДокумент5 страницClass 601 - Maths - QPP5'B' NITIN SAURABHОценок пока нет

- 11TH Set BДокумент5 страниц11TH Set Bpavanlakhera000Оценок пока нет

- Important Question Paper For ISC 2013 Class 12 Computer ScienceДокумент6 страницImportant Question Paper For ISC 2013 Class 12 Computer ScienceSampuran DeОценок пока нет

- Answer Any ONE Question.: Section - CДокумент2 страницыAnswer Any ONE Question.: Section - CRavi KrishnanОценок пока нет

- CVP Analysis FormulaДокумент1 страницаCVP Analysis Formulasamuel debebeОценок пока нет

- CBSE SAMPLE PAPER 2 (Unsolved) Economics Class - XIIДокумент3 страницыCBSE SAMPLE PAPER 2 (Unsolved) Economics Class - XIIVijay DhanakodiОценок пока нет

- KMS Computer Science Xii 2Документ9 страницKMS Computer Science Xii 2AdityaОценок пока нет

- EF113.EIBF .L Question CMA September 2022 Exam.Документ9 страницEF113.EIBF .L Question CMA September 2022 Exam.MD Mahmudul HasanОценок пока нет

- Class-X (Two Hours) : Section BДокумент4 страницыClass-X (Two Hours) : Section Bsamanway_banerjeeОценок пока нет

- Midterm IДокумент10 страницMidterm Iİrem KaleОценок пока нет

- CM121.COAIL I Question CMA September 2022 Exam.Документ8 страницCM121.COAIL I Question CMA September 2022 Exam.newazОценок пока нет

- CVP Analysis FormulaДокумент1 страницаCVP Analysis Formulasamuel debebeОценок пока нет

- CVP Analysis Notes: P (S - VC) Q - FCДокумент1 страницаCVP Analysis Notes: P (S - VC) Q - FCSamuel DebebeОценок пока нет

- Data Interpretation 06 (1) .06.05Документ12 страницData Interpretation 06 (1) .06.05Rajat RathОценок пока нет

- Notes 240312 124828Документ3 страницыNotes 240312 124828Dokta UrameОценок пока нет

- QuestionPaper 20210628 09 31 12 AM 00TY - OMДокумент2 страницыQuestionPaper 20210628 09 31 12 AM 00TY - OMNitin S MОценок пока нет

- Project Management - 2Документ1 страницаProject Management - 2Lavanya JainОценок пока нет

- Fr111.Ffa (F.L) Question Cma May-2023 Exam.Документ7 страницFr111.Ffa (F.L) Question Cma May-2023 Exam.sshahed007Оценок пока нет

- Computer Lab - Practical Question BankДокумент8 страницComputer Lab - Practical Question BankSaif UddinОценок пока нет

- Managerial Economics MUITДокумент2 страницыManagerial Economics MUITSHAILESH KUMAR SINGHОценок пока нет

- Contentpage Tafssp 157 21Документ3 страницыContentpage Tafssp 157 21Anonymous rePT5rCrОценок пока нет

- Business Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideОт EverandBusiness Management for Scientists and Engineers: How I Overcame My Moment of Inertia and Embraced the Dark SideОценок пока нет

- Getting Great Results with Excel Pivot Tables, PowerQuery and PowerPivotОт EverandGetting Great Results with Excel Pivot Tables, PowerQuery and PowerPivotОценок пока нет

- Business Economics, BbaДокумент2 страницыBusiness Economics, BbaSHAILESH KUMAR SINGHОценок пока нет

- BUSINESS Orgnization. BBA 1stДокумент2 страницыBUSINESS Orgnization. BBA 1stSHAILESH KUMAR SINGHОценок пока нет

- Sourya Pratap Singh LeaderДокумент2 страницыSourya Pratap Singh LeaderSHAILESH KUMAR SINGHОценок пока нет

- Managerial Economics MUITДокумент2 страницыManagerial Economics MUITSHAILESH KUMAR SINGHОценок пока нет

- Mba (1st) Managerial Economics MUITДокумент2 страницыMba (1st) Managerial Economics MUITSHAILESH KUMAR SINGHОценок пока нет

- Managerial Economics MUITДокумент2 страницыManagerial Economics MUITSHAILESH KUMAR SINGHОценок пока нет

- Rural Development, MBA (3rd Semester)Документ2 страницыRural Development, MBA (3rd Semester)SHAILESH KUMAR SINGHОценок пока нет

- Principle of Business EconomicsДокумент2 страницыPrinciple of Business EconomicsSHAILESH KUMAR SINGHОценок пока нет

- Lepanto Consolidated Mining Company vs. Ambanloc PDFДокумент9 страницLepanto Consolidated Mining Company vs. Ambanloc PDFGiuliana FloresОценок пока нет

- Financial Statement Analysis of Target and TescoДокумент15 страницFinancial Statement Analysis of Target and TesconormaltyОценок пока нет

- PatanjaliДокумент35 страницPatanjaliMansi AgrahariОценок пока нет

- Chap 12Документ59 страницChap 12Anonymous lW5is17xPОценок пока нет

- EMH AssignmentДокумент8 страницEMH AssignmentJonathanОценок пока нет

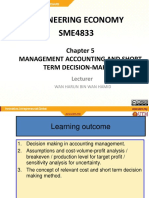

- Engineering Economy SME4833: Management Accounting and Short Term Decision-MakingДокумент33 страницыEngineering Economy SME4833: Management Accounting and Short Term Decision-Makinghaza toriqiyОценок пока нет

- Intellinews - Romania Construction Materials ReportДокумент9 страницIntellinews - Romania Construction Materials ReportmumuletОценок пока нет

- Media Training - Eugen TerchilaДокумент24 страницыMedia Training - Eugen TerchilaLaurian100% (1)

- Chapter 24 Measuring The Cost of LivingДокумент11 страницChapter 24 Measuring The Cost of LivingHIỀN HOÀNG BẢO MỸОценок пока нет

- Invoice for Yearbook and Brochure PrintingДокумент1 страницаInvoice for Yearbook and Brochure PrintingManiarОценок пока нет

- Instructions For Form 8810: Corporate Passive Activity Loss and Credit LimitationsДокумент12 страницInstructions For Form 8810: Corporate Passive Activity Loss and Credit LimitationsIRSОценок пока нет

- Strengths Strength Opportunities (SO) Strategies Strength Threats (ST) StrategiesДокумент5 страницStrengths Strength Opportunities (SO) Strategies Strength Threats (ST) StrategiesHerald CiprianoОценок пока нет

- 12 Business Stud Comp Outsidedelhi Set1 2Документ12 страниц12 Business Stud Comp Outsidedelhi Set1 2Ashish GangwalОценок пока нет

- Bollinger BandsДокумент14 страницBollinger BandskrishnaОценок пока нет

- Cost Accounting Assignment1Документ6 страницCost Accounting Assignment1Kiran HasnaniОценок пока нет

- Comparision - VCD, NRD, FDДокумент8 страницComparision - VCD, NRD, FDMAZHAR ALIОценок пока нет

- ASSIGNMENT On Investment Analysis and Lockheed Tristar: SUBMITTED TO: Dr. Debaditya Mohanty Submitted byДокумент7 страницASSIGNMENT On Investment Analysis and Lockheed Tristar: SUBMITTED TO: Dr. Debaditya Mohanty Submitted byAbhisek SarkarОценок пока нет

- Revenue Budget: Borolene 5000 Shovolene 4000Документ16 страницRevenue Budget: Borolene 5000 Shovolene 4000Rahul BasuОценок пока нет