Академический Документы

Профессиональный Документы

Культура Документы

United States v. Yaman Sencan, 11th Cir. (2015)

Загружено:

Scribd Government DocsИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

United States v. Yaman Sencan, 11th Cir. (2015)

Загружено:

Scribd Government DocsАвторское право:

Доступные форматы

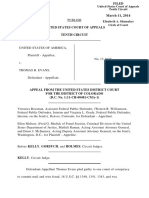

Case: 14-12577

Date Filed: 10/23/2015

Page: 1 of 18

[DO NOT PUBLISH]

IN THE UNITED STATES COURT OF APPEALS

FOR THE ELEVENTH CIRCUIT

________________________

No. 14-12577

________________________

D.C. Docket No. 1:13-cr-00117-WS-C-1

UNITED STATES OF AMERICA,

Plaintiff-Appellee,

versus

YAMAN SENCAN,

DAVID PETERSEN,

Defendants-Appellants.

________________________

Appeals from the United States District Court

for the Southern District of Alabama

________________________

(October 23, 2015)

Before JORDAN and JULIE CARNES, Circuit Judges, and ROBRENO, * District

Judge.

Honorable Eduardo C. Robreno, United States District Judge for the Eastern District of

Pennsylvania, sitting by designation.

Case: 14-12577

Date Filed: 10/23/2015

Page: 2 of 18

PER CURIAM:

Yaman Sencan, David Petersen, Stephen Merry, and Timothy Durkin were

charged in a 20-count indictment for crimes related to a Ponzi scheme. The

indictment charged them with conspiracy to commit securities and wire fraud, in

violation of 18 U.S.C. 371 (Count 1), one count of aiding and abetting securities

fraud, in violation of 15 U.S.C. 77q and 18 U.S.C. 2 (Count 2), and 18 counts

of aiding and abetting wire fraud, in violation of 18 U.S.C. 2 and 1343 (Counts

3-20).

Durkin fled the country and has yet to be apprehended. The other three

(collectively referred to as Defendants) pled not guilty and proceeded to trial. At

the close of the Governments case, and again at the close of all the evidence,

Defendants unsuccessfully moved for judgments of acquittal. Defendants were

convicted on all counts and each sentenced to 60 months imprisonment. Sencan

appeals his conviction; Petersen appeals his conviction and sentence.1 After a

careful review of the record and with the benefit of oral argument, we AFFIRM.

I.

BACKGROUND

Defendants operated a classic Ponzi scheme between 2009 and 2012. The

modus operandi of a Ponzi scheme is to use newly invested money to pay off old

1

Because Defendant Merry died while the appeal was pending, this Court dismissed his appeal

as moot.

2

Case: 14-12577

Date Filed: 10/23/2015

Page: 3 of 18

investors and convince them that they are earning profits rather than losing their

shirts. In re Rothstein, Rosenfeldt, Adler, P.A., 717 F.3d 1205, 1207 n.5 (11th Cir.

2013) (internal quotations omitted). To that end, Defendant Sencan, the projects

go-to man, explained to potential investors that a company named Westover

Energy Trading, LLC (Westover) 2 had developed a computer algorithm to make

rapid, highly profitable stock trades. By investing in Westover, Sencan boasted

that investors would earn 25% returns with virtually no risk. The truth was that

only a fraction of investors funds were transferred to Westover and invested. The

rest was distributed to earlier investors as profits from stock trades, or kept by

Defendants.

Sencan got each new investor to enter into a co-investment agreement

with RAMCO and Associates, LLC (RAMCO), a company that Defendant

Merry and his wife owned. According to the agreement, RAMCO had an

ongoing relationship with Westover permitting it to invest funds in Westovers

automated proprietary trading platform. Under the agreement, investors would

wire their money to RAMCO, which in turn would transfer all funds to Westover

for investment. RAMCO was authorized to receive 50% of the net profits

generated from Westovers trading program, but it was not authorized to take any

Defendant Durkin, the fugitive, was Westovers managing partner.

3

Case: 14-12577

Date Filed: 10/23/2015

Page: 4 of 18

of the investors principal, nor was it entitled to any fees until actual profits were

earned. Sencan provided all potential investors with a copy of this agreement.

Instead of complying with the agreement, Sencan instructed investors to

wire their funds to an entity called RAMCO 1 Business Trust (RAMCO 1), a

Nevada business trust formed by Petersen and Merry. Petersen served as RAMCO

1s accountant, and he and Merry exercised exclusive control over the trusts bank

account. The victims, however, were never informed that their investments were

going to a trust that gave Petersen and Merry untethered control over their money.

After investors wired their money to the RAMCO 1 account, Sencan would

tell Petersen how to divert the funds. Instead of investing the funds with Westover,

Petersen would transfer them from RAMCO 1 into various business and personal

accounts that he, Sencan, and other conspirators controlled. At that point,

Defendants would distribute some of the funds to investors, who believed they

were receiving profits, and would use the rest for personal expenses.

To convince investors that Westovers trading technology was profitable,

Petersen prepared weekly financial statements and sent them to Sencan, who then

forwarded them to investors. Because the statements falsely reported steady

Case: 14-12577

Date Filed: 10/23/2015

Page: 5 of 18

profits, they were instrumental in swaying investors to sink additional money into

the scamand to encourage their friends and family to do likewise.3

In January 2012, Sencan told investors that RAMCO and Westover were

ending their investment relationship and that RAMCO would return all

investments, including profits, after the final trades. But the investors never saw

their money again. As investors repeatedly demanded their money back, Sencan

reassured them that he was trying to solve the problem and blamed Westover for

the delay in releasing the funds. Of course, Sencan knew that little if any of the

money went to Westover in the first place.

As these events unfolded, investors became suspicious that they were

victims of a Ponzi scheme. Indeed, between November 2011 and July 2012,

Sencan had been warned several times by different investors, and ultimately even

by the FBI, that he was actively involved in a Ponzi scheme. Yet, this news did

not slow him down, and he continued to send financial statements and reassure

investors until the scheme finally imploded and this criminal prosecution followed.

In the end, investors placed $4.6 million in the RAMCO 1 account, from

which Sencan, Petersen, and other conspirators stole $1.5 million and distributed

3

Sencan also told investors that he had invested his own life savings in Westover, which it

turned out amounted to around $40,000 from the sale of a piano. In contrast, many investors

were transferring hundreds of thousands of dollars to RAMCO 1. Tellingly, Petersen never

invested his own money in the scheme, even as he prepared financial reports showing 25%

returns.

5

Case: 14-12577

Date Filed: 10/23/2015

Page: 6 of 18

$3.1 million, as Ponzi payments, to earlier investors. Sencan used $102,000 of the

investors money for personal expenses and transferred $175,000 to his wife, for a

total haul of $277,000. Petersen spent $252,000 of investor funds on personal

expenses, including mortgage payments, credit card payments, and car payments.

II.

DISCUSSION

A. Defendant Sencan

Sencans only argument on appeal is a challenge to the sufficiency of the

evidence to sustain his convictions. We review challenges to the sufficiency of

evidence de novo. United States v. Gamory, 635 F.3d 480, 497 (11th Cir. 2011).

We review the evidence in the light most favorable to the Government and resolve

all reasonable inferences in favor of the jurys verdict. United States v. Doe, 661

F.3d 550, 560 (11th Cir. 2011). A conviction must be upheld unless the jury

could not have found the defendant guilty under any reasonable construction of

evidence. United States v. Byrd, 403 F.3d 1278, 1288 (11th Cir. 2005).

To sustain a conviction for conspiracy to commit a fraud, the Government

must prove that a defendant knew of and willfully joined the unlawful scheme to

defraud. United States v. Maxwell, 579 F.3d 1282, 1299 (11th Cir. 2009).

Circumstantial evidence can be used to prove knowledge of a scheme. Id.

Furthermore, [a] scheme to defraud requires proof of a material

misrepresentation, or the omission or concealment of a material fact calculated to

6

Case: 14-12577

Date Filed: 10/23/2015

Page: 7 of 18

deceive another out of money or property. Id. Sencan argues that the record is

devoid of evidence that he intentionally participated in a fraudulent scheme, or that

he knowingly made a material misrepresentation. We find the evidence to be more

than adequate.4

As described above, Sencan regularly instructed investors to wire money to

RAMCO 1, after which he instructed Petersen to divert the money into other

accounts, not to Westover. For example, in July 2011, an investor wired $100,000

to RAMCO 1 expecting it to be invested using Westovers advanced computer

program. That same day, Sencan instead told Petersen to distribute the sum to

various investor accounts. Consistent with those instructions, Petersen moved

$12,800 into a business account that he and Merry controlled. He also wired

$86,980 to Sencan, who used those funds to pay two investors, keeping a cut of

$17,000 for himself. None of the money was moved to Westover as promised in

the co-investment agreement. Despite knowing that these funds were not being

invested with Westovermeaning there was no chance that investors would earn a

profit or necessarily even get their principal backSencan continued to send

investors weekly emails falsely showing they were earning major profits. Then,

Our sufficiency-of-the-evidence analysis also applies to both the substantive securities and

wire-fraud charges because these crimes require proof of the underlying scheme to defraud. See

15 U.S.C. 77q (criminalizing the use of interstate communications in the offer or sale of

securities in a scheme to defraud) and 18 U.S.C. 1343 (criminalizing the use of wire

communications in interstate commerce in the course of a scheme to defraud).

7

Case: 14-12577

Date Filed: 10/23/2015

Page: 8 of 18

when investors began to make requests for their money, Sencan reassured investors

by telling them that he was in the same situation they were, even though he had

earned back his $40,000 investment several times over, funneling nearly $300,000

of investors money to his personal account and to his wife.

These acts alone demonstrate Sencans knowledge that he was part of a

fraudulent scheme. Further, the Government presented evidence confirming that

Sencan was on notice of his wrongdoing as he continued to participate in the fraud.

Specifically, even when Sencan was warned several times by investors and the FBI

that he was involved in a Ponzi scheme, he failed to heed the warnings and

continued to send monthly statements to investors. Based on the evidence, the jury

reasonably concluded that Sencan knew he was involved in a Ponzi scheme and

knowingly made material misrepresentations to investors. 5 Sencans convictions

are therefore AFFIRMED.

B. Defendant Petersen

Sencan argues that he was even more persuasively entitled to a . . . judgment of acquittal

after investor Bill Abrams, who had warned Sencan about being involved in a Ponzi scheme,

testified that he did not believe that Sencan intended to deceive him. Essentially, this argument

asks us to weigh the persuasiveness of various pieces of evidence, which is the wrong inquiry.

Rather, we are to accept all reasonable inferences and credibility determinations made by the

jury, as [t]he jury is free to choose between or among the reasonable conclusions to be drawn

from the evidence presented at trial. United States v. Sellers, 871 F.2d 1019, 1021 (11th Cir.

1989). Because the jury could have reasonably believed that Abrams was wrong about Sencans

intentions or simply determined that Abrams was not credible on this point, Abrams testimony

does not somehow make the evidence insufficient to support Sencans conviction.

8

Case: 14-12577

Date Filed: 10/23/2015

Page: 9 of 18

Petersen argues that (1) there was insufficient evidence to support his

conviction, (2) the evidence at trial materially varied from the indictment, (3)

prosecutorial misconduct warrants reversal, (4) the Government failed to turn over

financial documents to the defense before trial, (5) the court erred in not applying

the minor participant reduction under the Sentencing Guidelines, (6) the court

erred in calculating the loss and restitution amounts, and (7) appointed appellate

counsel was prejudiced because he was only permitted 35 days to review the

record.

1. Sufficiency of the Evidence

Defendant Petersen similarly mounts a sufficiency challenge, arguing that he

merely used the weekly data supplied by Westover to prepare the charts he sent to

Sencan, who in turn sent them to investors. Nevertheless, there was sufficient

evidence to convict Petersen.

First, Petersen committed acts that were necessary for the ongoing success

of the scheme. He co-owned RAMCO 1, served as its accountant, received

monthly account statements, diverted investor funds that were supposed to go to

Westover, and generated the account statements sent to investors that falsely

reported profits on their investments. Indeed, these false financial statements he

prepared were crucial to recruiting investors and keeping them in the dark. See

United States v. Bradley, 644 F.3d 1213, 1239 (11th Cir. 2011) (A

9

Case: 14-12577

Date Filed: 10/23/2015

Page: 10 of 18

misrepresentation is material if it has a natural tendency to influence, or is capable

of influencing, the decision maker to whom it is addressed. (internal quotations

omitted)).

As to his knowledge that he was facilitating a fraudulent scheme, Petersen

was necessarily aware that the account statements he was creating contained false

information because there were, in fact, no profits being earned by the victims

investments. Moreover, he was necessarily aware that instead of being invested,

the victims funds were either being used to make payments to earlier investors or

were being diverted to coconspirators. In fact, he clearly knew that he had

received a substantial sum of money skimmed from the investments. The jury

therefore could reasonably have concluded that the material misrepresentations

found in the financial statements created by Petersen were made knowingly by

him. 6

Further, even if Petersen, himself, did not make material misrepresentations

to investors, 7 he was convicted of wire and securities fraud under an aiding and

abetting theory. To prove aiding and abetting, the government must demonstrate

that a substantive offense was committed, that the defendant associated himself

6

As noted, Petersen invested none of his own money in Westover even though it supposedly

promised high returns at low risk. This fact further suggests that he knew the fraudulent nature

of the scheme.

Although Petersen states that he never directly communicated with investors, there was

evidence he communicated with and personally lured at least one investor into the scam.

10

Case: 14-12577

Date Filed: 10/23/2015

Page: 11 of 18

with the criminal venture, and that he committed some act which furthered the

crime. United States v. Hamblin, 911 F.2d 551, 557 (11th Cir. 1990). In short,

there was sufficient evidence to allow the jury to conclude that Petersen both

furthered the scheme and did so knowingly.

2. Material Variance

Petersen next argues that his convictions should be reversed due to a

material variance between the indictment and the evidence presented at trial. The

standard of review for whether there is a material variance between the allegations

in the indictment and the facts established at trial is twofold: First, whether a

material variance did occur, and, second, whether the defendant suffered

substantial prejudice as a result. United States v. Chastain, 198 F.3d 1338, 1349

(11th Cir. 1999). In evaluating substantial prejudice, we consider whether the

proof at trial differed so greatly from the charges that appellant was unfairly

surprised and was unable to prepare an adequate defense. United States v.

Calderon, 127 F.3d 1314, 1328 (11th Cir. 1997).

According to Petersen, the evidence at trial materially varied from the

indictment in three ways: (1) the indictment alleged that Defendants falsely

represented that a New York real estate mogul was a principal investor in

Westover, yet the trial evidence showed that the investor was actually associated

with the firm; the Government changed its theory of the conspiracy at trial by

11

Case: 14-12577

Date Filed: 10/23/2015

Page: 12 of 18

showing evidence of a separate conspiracy without Defendant Durkin, the fugitive;

and (3) the Government turned the trial into a tax case by introducing tax

documents into evidence.

First, the trial evidence was consistent with the indictments allegations that

the New York real estate mogul was not a major investor and had not authorized

his name to be associated with Westover. More to the point, any variance on this

issue could not have affected Petersens ability to prepare an adequate defense, for

the evidence of his guilt stemmed from his ownership of the RAMCO 1 account

and the preparation of false investor statements, not anything specifically related to

this investor.

Next, the Government did not seek to prove a different conspiracy at trial.

The Government mentioned Durkins participation in the scheme throughout trial.

Naturally, because Durkin had absconded and was not on trial, the Government

spent much less time focusing on his participation in the fraud.

Finally, the Governments introduction of tax returns into evidence did not

turn the proceeding into a tax case. Petersen could not have been unfairly

surprised that the Government used RAMCO 1 tax documents to prove that he

moved money in and out of the trust account. In sum, there was no material

variance at trial causing substantial prejudice.

12

Case: 14-12577

Date Filed: 10/23/2015

Page: 13 of 18

3. Prosecutorial Misconduct

Petersen argues that his conviction should be reversed because of

prosecutorial misconduct. He specifically asserts that the lead investigative agent

(1) gave incomplete and misleading trial testimony, (2) failed to investigate a

primary witness; and (3) failed to zealously seek the extradition of Durkin.

To establish a prosecutorial misconduct claim, Petersen must show the

Governments conduct was improper and prejudiced his substantial rights.

United States v. Hasner, 340 F.3d 1261, 1275 (11th Cir. 2003). A defendants

substantial rights are prejudiced if there is a reasonable probability that, but for

the misconduct, the outcome of the trial would have been different. United

States v. Capers, 708 F.3d 1286, 130809 (11th Cir. 2013). Because Petersen did

not object to the alleged improper conduct below, we review only for plain error

that is so obvious that failure to correct it would jeopardize the fairness and

integrity of the trial. United States v. Bailey, 123 F.3d 1381, 1400 (11th Cir.

1997).

With respect to the lead agent, Defendants cross-examined him about his

investigation and had the opportunity to clarify any incomplete or misleading

aspects of his testimony. We find nothing improper about his testimony or

investigation. Nor was there misconduct surrounding efforts to extradite Durkin.

In fact, the Government had taken numerous steps to alert domestic and

13

Case: 14-12577

Date Filed: 10/23/2015

Page: 14 of 18

international law enforcement agencies to Durkins pending arrest warrant.

Finally, Petersen failed to articulate how the outcome of his trial would have been

different absent this alleged misconduct, given the ample evidence supporting his

conviction. We find no plain error.

4. Brady Issue

Petersen makes a passing reference in his brief to a Brady 8 violation, stating

that some financial documents were not turned over to the defense until the parties

were preparing for sentencing. A passing reference to an issue in a brief is not

enough [to preserve it for appellate review], and the failure to make arguments and

cite authorities in support of an issue waives it. Hamilton v. Southland Christian

Sch., Inc., 680 F.3d 1316, 1319 (11th Cir. 2012). Because Petersen supplies no

facts or legal arguments to support his Brady claim, we cannot meaningfully

examine it.

5. Minor Role Reduction

Petersen contends that he was entitled to a minor role adjustment 9 for

sentencing purposes in view of the total conduct of the conspiracy and his role

relative to his coconspirators. A determination that a defendant is not qualified for

8

Under the rule first announced in Brady v. Maryland, 373 U.S. 83, 87 (1963), prosecutors are

required to disclose evidence favorable to a defendant where the evidence is material to the

defendants guilt or punishment.

9

Under U.S.S.G. 3B1.2(b), the defendant may receive a two-point reduction [i]f the

defendant was a minor participant in any criminal activity.

14

Case: 14-12577

Date Filed: 10/23/2015

Page: 15 of 18

a role reduction is a finding of fact reviewed for clear error. United States v.

Rodriguez De Varon, 175 F.3d 930, 937 (11th Cir. 1999) (en banc). In

determining whether to grant a minor role reduction, (1) the court must compare

the defendants role in the offense with the relevant conduct attributed to him in

calculating his base offense level; and (2) the court may compare the defendants

conduct to that of other participants involved in the offense. United States v.

Alvarez-Coria, 447 F.3d 1340, 1343 (11th Cir. 2006). [A] defendant is not

automatically entitled to a minor role adjustment merely because [he] was

somewhat less culpable than the other discernable participants. United States v.

Bernal-Benitez, 594 F.3d 1303, 132021 (11th Cir. 2010) (quotations omitted).

The district court did not clearly err by denying a minor role reduction. In

light of Petersens involvement, the court reasonably concluded that Petersen was

not substantially less culpable than the other participants. See Alvarez-Coria, 447

F.3d at 1343. In any event, any error was harmless. An error in calculating the

Guidelines range is harmless if (1) the district court would have imposed the same

sentence regardless of its ruling on the Guidelines issue, and (2) the sentence

would be reasonable even if that issue had been decided in the defendants favor.

See United States v. Keene, 470 F.3d 1347, 1349 (11th Cir. 2006).

Here, the Guidelines range was 135 to 168 months imprisonment, yet the

court imposed a below-Guidelines sentence of only 60 months. Further, the court

15

Case: 14-12577

Date Filed: 10/23/2015

Page: 16 of 18

declared that it would have imposed the same 60-month sentence even if it had

granted the role reduction. In fact, had the court granted the requested two-point

reduction, the adjusted range would have been 108 to 135 months. The 60-month

sentence imposed was well below the range to which Defendant contends he was

entitled. Further, we conclude that a 60-month sentence was reasonable no matter

the Guidelines range. In fact, the district court considered all the relevant factors

under 18 U.S.C. 3553(a) and made findings supported by the record. Based on

these findings, the resulting below-Guidelines sentence of 60 months

imprisonment was within the range of reasonable sentences dictated by the facts

of the case. United States v. Pugh, 515 F.3d 1179, 1191 (11th Cir. 2008)

(quotation marks omitted). Thus, even were there any error, it would have been

harmless.

6. Loss-Amount Calculation

Petersen also argues that the court double-counted the loss suffered by one

of the victims and thus overstated the total loss by at least $683,000. Based on

calculations asserted for the first time on appeal, he states that the correct loss

amount should have earned him a 16-level sentencing enhancement, not the 18level enhancement shown in the presentence report and applied by the district

court.

16

Case: 14-12577

Date Filed: 10/23/2015

Page: 17 of 18

We review the district courts loss determination for clear error. See United

States v. Grant, 431 F.3d 760, 762 (11th Cir. 2005). However, a party may not

challenge as error a ruling or other trial proceeding invited by that party. United

States v. Ross, 131 F.3d 970, 988 (11th Cir. 1997) (quotations omitted). Invited

error exists when a partys statements or actions induce the district court into

making an error. United States v. Love, 449 F.3d 1154, 1157 (11th Cir. 2006).

An insurmountable problem for Petersen is the fact that he not only failed to

make this argument below, but he also acquiesced to the correctness of the loss

calculation made by the district court. Specifically, prior to sentencing, defense

counsel had expressed concern that victims who had invested in the Ponzi scheme,

both individually and through corporate investor EMR, might receive double

restitution under the wording of the proposed judgment. To eliminate that risk,

Petersens counsel suggested that the district court strike Spellmeyer from the

phrase EMR/Spellmeyer in the table of losses to clarify that EMR alone was

entitled to restitution for the corresponding loss. Articulating no objection to the

total loss amount, counsel said the court should enter the judgment with his

proposed modification, and the court did so, making clear that the loss amount in

the PSR remained unchanged. In fact, had Petersen wanted to object to the loss

amount, the Government indicated that it had a witness prepared to testify about

that amount. In short, even assuming that the district court erred in its calculation

17

Case: 14-12577

Date Filed: 10/23/2015

Page: 18 of 18

of loss, Petersen invited the error. Moreover, as discussed above with regard to the

minor role adjustment, the district court indicated that its 60-month sentence was

the sentence it would have imposed, based on 3553 factors, regardless of the

Guidelines calculations.

7. Time Permitted for Counsel on Appeal

Lastly, Petersen argues that he was prejudiced because his appointed

appellate counsel was afforded only 35 days to review the trial record. Petersen

was granted a one-week extension and then was granted leave to file his brief out

of time. Petersen fails to show that he was prejudiced.

III.

CONCLUSION

For the foregoing reasons, we affirm Sencan and Petersens convictions, and

we affirm Petersens sentence.

AFFIRMED.

18

Вам также может понравиться

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsОт EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsРейтинг: 5 из 5 звезд5/5 (12)

- Your Driver's License Is A ContractДокумент12 страницYour Driver's License Is A ContractVen Geancia100% (7)

- Villanueva Vs JBCДокумент1 страницаVillanueva Vs JBCJanskie Mejes Bendero LeabrisОценок пока нет

- Filed: Patrick FisherДокумент16 страницFiled: Patrick FisherScribd Government DocsОценок пока нет

- United States Court of Appeals, Seventh CircuitДокумент9 страницUnited States Court of Appeals, Seventh CircuitScribd Government DocsОценок пока нет

- PublishedДокумент23 страницыPublishedScribd Government DocsОценок пока нет

- Santillo (Perry) PleaДокумент5 страницSantillo (Perry) PleaWXXI NewsОценок пока нет

- Razorback FundingДокумент147 страницRazorback FundingFloridaLegalBlogОценок пока нет

- Bank of The Philippine Islands v.20210426-11-1kq1l5bДокумент9 страницBank of The Philippine Islands v.20210426-11-1kq1l5bMaeОценок пока нет

- UNITED STATES of America v. John G. BENNETT, JR., AppellantДокумент41 страницаUNITED STATES of America v. John G. BENNETT, JR., AppellantScribd Government DocsОценок пока нет

- United States v. Schmidt, 10th Cir. (2007)Документ13 страницUnited States v. Schmidt, 10th Cir. (2007)Scribd Government DocsОценок пока нет

- Squadron MadoffДокумент31 страницаSquadron MadoffadamlisbergОценок пока нет

- Baker & McKenzie Attorney, Martin Weisberg, Who Was IEAM's Securities Counsel, Was Indicted 5/27/08Документ7 страницBaker & McKenzie Attorney, Martin Weisberg, Who Was IEAM's Securities Counsel, Was Indicted 5/27/08ValueSearcher70Оценок пока нет

- United States v. Second National Bank of North Miami, 502 F.2d 535, 2d Cir. (1974)Документ20 страницUnited States v. Second National Bank of North Miami, 502 F.2d 535, 2d Cir. (1974)Scribd Government DocsОценок пока нет

- Commercial Bank of Pa. v. Armstrong, 148 U.S. 50 (1893)Документ6 страницCommercial Bank of Pa. v. Armstrong, 148 U.S. 50 (1893)Scribd Government DocsОценок пока нет

- Suit Against Yellowstone PartnersДокумент17 страницSuit Against Yellowstone PartnersJeff RobinsonОценок пока нет

- Advisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupДокумент24 страницыAdvisors Mortgage V Real Source Title, John C. Povejsil, Jason E. Fischer, Frank T. Griebenow, New Millennium GroupCamdenCanaryОценок пока нет

- Nate Paul IndictmentДокумент23 страницыNate Paul IndictmentCBS 11 NewsОценок пока нет

- United States v. Edward H. Heller and Robert M. Adler, 866 F.2d 1336, 11th Cir. (1989)Документ12 страницUnited States v. Edward H. Heller and Robert M. Adler, 866 F.2d 1336, 11th Cir. (1989)Scribd Government DocsОценок пока нет

- BPI Vs CaДокумент2 страницыBPI Vs Cagianfranco0613Оценок пока нет

- United States v. Ismael Rodriguez-Alvarado, 952 F.2d 586, 1st Cir. (1991)Документ8 страницUnited States v. Ismael Rodriguez-Alvarado, 952 F.2d 586, 1st Cir. (1991)Scribd Government DocsОценок пока нет

- Petitioner vs. vs. Respondents Pacis & Reyes Law Office Ernesto T. Zshornack, JRДокумент8 страницPetitioner vs. vs. Respondents Pacis & Reyes Law Office Ernesto T. Zshornack, JRKizzy EspiОценок пока нет

- Holotrck Vs PLFXДокумент76 страницHolotrck Vs PLFXtriguy_2010Оценок пока нет

- Defendants - S YC 12 2000 R: U. L) 161 Rict Co Urt F - D.N.YДокумент30 страницDefendants - S YC 12 2000 R: U. L) 161 Rict Co Urt F - D.N.YovertcapОценок пока нет

- Superior Court of The State of California For The County of Los AngelesДокумент31 страницаSuperior Court of The State of California For The County of Los AngelesmelaniesandlinОценок пока нет

- First Texas Savings Association, and First Gibraltar Savings Association, FSB, Intervening v. Reliance Insurance Co., 950 F.2d 1171, 1st Cir. (1992)Документ13 страницFirst Texas Savings Association, and First Gibraltar Savings Association, FSB, Intervening v. Reliance Insurance Co., 950 F.2d 1171, 1st Cir. (1992)Scribd Government DocsОценок пока нет

- Resci Cases On TrustДокумент10 страницResci Cases On TrustResci Angelli Rizada-NolascoОценок пока нет

- Guingona, Jr. vs. City Fiscal of ManilaДокумент10 страницGuingona, Jr. vs. City Fiscal of Manila유니스Оценок пока нет

- United States Court of Appeals, Third CircuitДокумент16 страницUnited States Court of Appeals, Third CircuitScribd Government DocsОценок пока нет

- Fed. Sec. L. Rep. P 97,166, 5 Fed. R. Evid. Serv. 368 United States of America v. Bruce A. Jensen, 608 F.2d 1349, 10th Cir. (1979)Документ10 страницFed. Sec. L. Rep. P 97,166, 5 Fed. R. Evid. Serv. 368 United States of America v. Bruce A. Jensen, 608 F.2d 1349, 10th Cir. (1979)Scribd Government DocsОценок пока нет

- Desai Trustee LawsuitДокумент19 страницDesai Trustee LawsuitLaw Med BlogОценок пока нет

- Vinick v. Commissioner, 110 F.3d 168, 1st Cir. (1997)Документ9 страницVinick v. Commissioner, 110 F.3d 168, 1st Cir. (1997)Scribd Government DocsОценок пока нет

- SPOUSES CONSUELO and ARTURO ARANETA, Petitioners, v. THE COURT OF APPEALS, PILIPINAS BANK and DELTA MOTOR CORPORATIONДокумент2 страницыSPOUSES CONSUELO and ARTURO ARANETA, Petitioners, v. THE COURT OF APPEALS, PILIPINAS BANK and DELTA MOTOR CORPORATIONjemsОценок пока нет

- Deposit Case 1 BPI vs. IACДокумент9 страницDeposit Case 1 BPI vs. IAChernandezmarichu88Оценок пока нет

- Ie Elsa Bank Fraud Case Revised 28 FebДокумент51 страницаIe Elsa Bank Fraud Case Revised 28 FebgusztinadlerОценок пока нет

- Class ComplaintДокумент13 страницClass ComplaintForeclosure Fraud100% (3)

- United States v. James Allen Ratchford, 942 F.2d 702, 10th Cir. (1991)Документ8 страницUnited States v. James Allen Ratchford, 942 F.2d 702, 10th Cir. (1991)Scribd Government DocsОценок пока нет

- United States v. Artemus E. Ward, JR., 486 F.3d 1212, 11th Cir. (2007)Документ21 страницаUnited States v. Artemus E. Ward, JR., 486 F.3d 1212, 11th Cir. (2007)Scribd Government DocsОценок пока нет

- Prenda Sealed Motion RedactedДокумент197 страницPrenda Sealed Motion RedactedJ DoeОценок пока нет

- United States v. Evans, 10th Cir. (2014)Документ15 страницUnited States v. Evans, 10th Cir. (2014)Scribd Government DocsОценок пока нет

- Joe Roosevans United States Court of Appealsfor The Fourth CircuitДокумент4 страницыJoe Roosevans United States Court of Appealsfor The Fourth CircuitJames HolderОценок пока нет

- United States v. Wood, 10th Cir. (2004)Документ11 страницUnited States v. Wood, 10th Cir. (2004)Scribd Government DocsОценок пока нет

- United States v. Leonard W. Evans, 42 F.3d 586, 10th Cir. (1994)Документ11 страницUnited States v. Leonard W. Evans, 42 F.3d 586, 10th Cir. (1994)Scribd Government DocsОценок пока нет

- Facts:: Bank of The Philippine Islands V Court of Appeals G.R. No 112392, February 29,2000Документ15 страницFacts:: Bank of The Philippine Islands V Court of Appeals G.R. No 112392, February 29,2000Kenneth AgustinОценок пока нет

- Chapter 8 Case Digests - Lawyer - S Fiduciary ObligationsДокумент12 страницChapter 8 Case Digests - Lawyer - S Fiduciary ObligationsMiguel C. SollerОценок пока нет

- FEB v. Querimit Case DigestДокумент2 страницыFEB v. Querimit Case DigestKian FajardoОценок пока нет

- 3rd Set Credit Trans CasesДокумент20 страниц3rd Set Credit Trans Caseskatrinaelauria5815Оценок пока нет

- 20 PNB Vs CAДокумент14 страниц20 PNB Vs CAJanine RegaladoОценок пока нет

- 10580Документ2 страницы10580Edwin VillaОценок пока нет

- United States v. Philip Stanley, 12 F.3d 17, 2d Cir. (1993)Документ7 страницUnited States v. Philip Stanley, 12 F.3d 17, 2d Cir. (1993)Scribd Government DocsОценок пока нет

- United States v. Troy Titus, 4th Cir. (2012)Документ31 страницаUnited States v. Troy Titus, 4th Cir. (2012)Scribd Government DocsОценок пока нет

- Durkin Et Al IndictmentДокумент19 страницDurkin Et Al IndictmentTori MarlanОценок пока нет

- Robert Madsen Whistle-Blower CaseДокумент220 страницRobert Madsen Whistle-Blower CaseDealBook100% (1)

- Intengan v. Court of AppealsДокумент11 страницIntengan v. Court of AppealssescuzarОценок пока нет

- John Pinson v. JP Morgan Chase Bank, National Association, 11th Cir. (2016)Документ7 страницJohn Pinson v. JP Morgan Chase Bank, National Association, 11th Cir. (2016)Scribd Government DocsОценок пока нет

- Guingona Vs City Fiscal of ManilaДокумент4 страницыGuingona Vs City Fiscal of ManilaLouОценок пока нет

- Dr. Jerome Swartz and Three Other Defendants Accused of Fraud of $17.7 Million.Документ12 страницDr. Jerome Swartz and Three Other Defendants Accused of Fraud of $17.7 Million.MongooseОценок пока нет

- BPI v. Court of Appeals 255 SCRA 571 G.R. No. 116792 March 29 1996Документ2 страницыBPI v. Court of Appeals 255 SCRA 571 G.R. No. 116792 March 29 1996Hurjae Soriano Lubag100% (4)

- CD Intengan v. Court of Appeals G.R. No. 128996 February 15 2002Документ5 страницCD Intengan v. Court of Appeals G.R. No. 128996 February 15 2002Dan ChuaОценок пока нет

- Banking DigestsДокумент9 страницBanking DigestsEm DavidОценок пока нет

- CT Proposed FindingsДокумент95 страницCT Proposed Findingsjmaglich1Оценок пока нет

- The Vigilant Investor: A Former SEC Enforcer Reveals How to Fraud-Proof Your InvestmentsОт EverandThe Vigilant Investor: A Former SEC Enforcer Reveals How to Fraud-Proof Your InvestmentsОценок пока нет

- United States v. Olden, 10th Cir. (2017)Документ4 страницыUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Документ21 страницаCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Kieffer, 10th Cir. (2017)Документ20 страницUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Garcia-Damian, 10th Cir. (2017)Документ9 страницUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Coyle v. Jackson, 10th Cir. (2017)Документ7 страницCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Pecha v. Lake, 10th Cir. (2017)Документ25 страницPecha v. Lake, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Apodaca v. Raemisch, 10th Cir. (2017)Документ15 страницApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Muhtorov, 10th Cir. (2017)Документ15 страницUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Документ22 страницыConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Документ100 страницHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент10 страницPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsОценок пока нет

- United States v. Roberson, 10th Cir. (2017)Документ50 страницUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент24 страницыPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsОценок пока нет

- United States v. Voog, 10th Cir. (2017)Документ5 страницUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент14 страницPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Windom, 10th Cir. (2017)Документ25 страницUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Kearn, 10th Cir. (2017)Документ25 страницUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Henderson, 10th Cir. (2017)Документ2 страницыUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент17 страницPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsОценок пока нет

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Документ9 страницNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Robles v. United States, 10th Cir. (2017)Документ5 страницRobles v. United States, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Chevron Mining v. United States, 10th Cir. (2017)Документ42 страницыChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Magnan, 10th Cir. (2017)Документ4 страницыUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Magnan, 10th Cir. (2017)Документ27 страницUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Kundo, 10th Cir. (2017)Документ7 страницUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Jimenez v. Allbaugh, 10th Cir. (2017)Документ5 страницJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Coburn v. Wilkinson, 10th Cir. (2017)Документ9 страницCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Northern New Mexicans v. United States, 10th Cir. (2017)Документ10 страницNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Pledger v. Russell, 10th Cir. (2017)Документ5 страницPledger v. Russell, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Purify, 10th Cir. (2017)Документ4 страницыUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Level 6 - The Chamber PDFДокумент121 страницаLevel 6 - The Chamber PDFFelipe Gáfaro JáureguiОценок пока нет

- Tomas Eugenio, Sr. vs. Hon. Alejandro M. VelezДокумент3 страницыTomas Eugenio, Sr. vs. Hon. Alejandro M. VelezDerick TorresОценок пока нет

- State v. OkumuraДокумент23 страницыState v. OkumuraJohn Winchester PalmonesОценок пока нет

- People Vs VeridianoДокумент2 страницыPeople Vs VeridianoMiguel Rey RamosОценок пока нет

- Principles of Natural JusticeДокумент20 страницPrinciples of Natural JusticeHeracles PegasusОценок пока нет

- 2020BALLB19Документ12 страниц2020BALLB19Hrithik ChormareОценок пока нет

- POLITICAL SYSTEM of USAДокумент23 страницыPOLITICAL SYSTEM of USAMahtab HusaainОценок пока нет

- (Steve Nodine Case) Motion To Dismiss - Interests of JusticeДокумент10 страниц(Steve Nodine Case) Motion To Dismiss - Interests of JusticeWKRGTVОценок пока нет

- Obligation of The Agent: Abantas. Abinal. Ignalig. Jaranilla. TiosenДокумент12 страницObligation of The Agent: Abantas. Abinal. Ignalig. Jaranilla. TiosenOmsimОценок пока нет

- Complaint: Republic of The Philippines Third Judicial Region Macabebe, Pampanga BranchДокумент12 страницComplaint: Republic of The Philippines Third Judicial Region Macabebe, Pampanga BranchGlass EyesОценок пока нет

- Hon. Justice T. A. Kume-Judge 08069263555Документ9 страницHon. Justice T. A. Kume-Judge 08069263555ChrisOkachiОценок пока нет

- Motion For Early Resolution - Branch 17 - Roberto SalanДокумент3 страницыMotion For Early Resolution - Branch 17 - Roberto SalanKarren Cacabelos SurОценок пока нет

- Amjad Pervez v. Eric Holder, JR., 4th Cir. (2013)Документ10 страницAmjad Pervez v. Eric Holder, JR., 4th Cir. (2013)Scribd Government DocsОценок пока нет

- Gertrude McCall v. Bernard Shapiro, Commissioner, Connecticut Welfare Department, 416 F.2d 246, 2d Cir. (1969)Документ7 страницGertrude McCall v. Bernard Shapiro, Commissioner, Connecticut Welfare Department, 416 F.2d 246, 2d Cir. (1969)Scribd Government DocsОценок пока нет

- In The District Court of Tulsa County,: IntervenorsДокумент18 страницIn The District Court of Tulsa County,: IntervenorsAmy JohnsonОценок пока нет

- OPLE Vs TORRESДокумент10 страницOPLE Vs TORRESSu Kings AbetoОценок пока нет

- Complaint CTB SingleДокумент4 страницыComplaint CTB SingleEppie SeverinoОценок пока нет

- Constitutional Law Estrada V Desierto, 356 SCRA 108, GR 146710-15, March 2, 2001Документ2 страницыConstitutional Law Estrada V Desierto, 356 SCRA 108, GR 146710-15, March 2, 2001Lu CasОценок пока нет

- Heir Has Right To Sell His Proportionate Estate ShareДокумент2 страницыHeir Has Right To Sell His Proportionate Estate Shareyurets929Оценок пока нет

- Disorientation Guide - FinalДокумент36 страницDisorientation Guide - FinalFaiza MalikОценок пока нет

- FF Cruz v. HR ConstructionДокумент28 страницFF Cruz v. HR ConstructionMariel QuinesОценок пока нет

- MAYOR ANWAR BERUA BALINDONG VДокумент5 страницMAYOR ANWAR BERUA BALINDONG Vjeanette4hijada100% (1)

- Chavez vs. CAДокумент1 страницаChavez vs. CAVince LeidoОценок пока нет

- Foreign CorporationsДокумент62 страницыForeign CorporationsAgnesОценок пока нет

- Gerochi Vs DoeДокумент3 страницыGerochi Vs DoeWinly SupnetОценок пока нет

- Laurie Fitzgerald and Aaron Hazard v. The Mountain States Telephone and Telegraph Company, D/B/A U.S. West Communications, Inc., 46 F.3d 1034, 10th Cir. (1995)Документ19 страницLaurie Fitzgerald and Aaron Hazard v. The Mountain States Telephone and Telegraph Company, D/B/A U.S. West Communications, Inc., 46 F.3d 1034, 10th Cir. (1995)Scribd Government DocsОценок пока нет

- P&G v. CIR (2017) DigestДокумент2 страницыP&G v. CIR (2017) DigestFrancis GuinooОценок пока нет

- Goodall-Sanford, Inc. v. United Textile Workers of America, Afl, Local 1802, 233 F.2d 104, 1st Cir. (1956)Документ9 страницGoodall-Sanford, Inc. v. United Textile Workers of America, Afl, Local 1802, 233 F.2d 104, 1st Cir. (1956)Scribd Government DocsОценок пока нет