Академический Документы

Профессиональный Документы

Культура Документы

Mitchell v. Commissioner of Internal Revenue, 187 F.2d 706, 2d Cir. (1951)

Загружено:

Scribd Government DocsАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mitchell v. Commissioner of Internal Revenue, 187 F.2d 706, 2d Cir. (1951)

Загружено:

Scribd Government DocsАвторское право:

Доступные форматы

187 F.

2d 706

MITCHELL

v.

COMMISSIONER OF INTERNAL REVENUE.

No. 27.

Docket 21665.

United States Court of Appeals Second Circuit.

Argued February 7, 1951.

Decided March 14, 1951.

To the facts stated in the opinion of the Tax Court, reported in 13 T.C.

368, the following should be added: The letter of December 5, 1944 from

Lawrence Whipple's lawyer to taxpayer reads as follows:

"On behalf of my client Lawrence Whipple of 15 Exchange Place, Jersey

City, N. J. I am authorized to offer you the sum of Five hundred ($500.)

dollars for the full and complete redemption of the notes of John Whipple

now held by you. As you know, or have been definitely informed John

Whipple is unable to make any payment on account of these notes at this

time. His liabilities are far in excess of his assets and his income is

insufficient to permit such payment. Your acceptance of this offer,

together with the check for Five hundred ($500.) dollars tendered

herewith, as evidenced by your signature affixed to the copy of this letter,

shall indicate the termination of John Whipple's obligation to you on the

notes and his release from further liability thereunder." The letter of

December 1, 1944, from taxpayer to Irving Sprague, reads thus: "I accept

your offer of $1,000 for the notes of C. O. M. Sprague which I hold

aggregating approximately $22,000. I enclose you the notes which I have

endorsed without recourse. Please send me your check for $1,000 to my

order in payment." The taxpayer testified that in the Spring of 1944 he had

negotiations with C. O. M. Sprague to "see * * * whether we could arrive

at a composition of the notes."

R. E. Lee, New York City, (Charles L. Kades, John F. B. Mitchell, Jr. and

Edwin A. Margolius, all of New York City, of counsel), for petitioner.

Theron Lamar Caudle, Washington, D. C., (Ellis N. Slack and Harry

Baum, Washington, D. C., of counsel), for respondent.

Before L. HAND, Chief Judge, and SWAN and FRANK, Circuit Judges.

FRANK, Circuit Judge.

The Tax Court made this ruling: Where a taxpayer partially charges off a note

and later in the same taxable year sells the note at a price equal to the reduced

value remaining after the charge-off, the taxpayer may not deduct the amount

of the charge-off under 26 U.S.C.A. 23(k) but is entitled solely to a capital

loss deduction on the sale. We do not agree with this blanket generalization.

The situation is not the equivalent of a sale followed in the same year by a

partial charge-off.1 For in such a case, after the sale, the taxpayer owns no debt

which he can charge off, whereas, when the sale is the later event, there is no

reason why the charge-off, if independent of the sale, should not be deductible.

The fact that both transactions occur in the same year is irrelevant; the

requirement of accounting for income tax purposes, on an annual basis is, we

think, immaterial in this context.

But the result is different if the taxpayer has arranged for the sale before he

makes the charge-off; for then, in reality, he is charging off a debt he no longer

owns. Obviously that was the case here, if the seeming sales were actual sales,

since the charge-offs and the sales occurred the same day and, patently,

pursuant to previous negotiations. We would, therefore, sustain the Tax Court,

were there no more to this case.

However, taxpayer urges that the apparent sales were not in fact sales but

compositions with the debtors which resulted in deductible charge-offs. It

seems most likely that such was the nature of the Whipple transaction, as the

letter written on behalf of Lawrence Whipple, brother of the debtor John

Whipple, speaks of the "full and complete redemption of the notes of John

Whipple." The Sprague transaction is perhaps somewhat less clear, since

taxpayer's letter to Irving Sprague, the brother of the debtor, C. O. M. Sprague,

shows that the debtor's notes were endorsed, without recourse, and delivered to

the brother; but taxpayer's testimony concerning the earlier Sprague

negotiations supports the composition contention.

As the taxpayer did not make this contention in the Tax Court, the

Commissioner should have an opportunity, if he desires, to present evidence

bearing on that argument. We therefore reverse and remand for a further

hearing, at which, of course, taxpayer may also present further evidence in

support of his contention.2

5

Reversed and remanded.

Notes:

1

As in Levy v. Commissioner, 2 Cir., 131 F.2d 544

See 26 U.S.C.A. 1141(c); Hormel v. Helvering, 312 U.S. 552, 560, 61 S.Ct.

719, 85 L.Ed. 1037; cf. Ford Motor Co. v. National Labor Relations Board, 305

U.S. 364, 373, 59 S.Ct. 301, 83 L.Ed. 221; Estho v. Lear, 7 Pet. 130, 8 L. Ed.

632; Armstrong v. Lear, 8 Pet. 52, 74, 8 L.Ed. 863; United States v. Rio Grande

Dam & Irrigation Co., 184 U. S. 416, 423, 424, 22 S.Ct. 428, 46 L.Ed. 619;

Security Mortg. Co. v. Powers, 278 U.S. 149, 159, 49 S.Ct. 84, 73 L.Ed. 236;

Levesque v. F. H. McGraw & Co., 2 Cir., 165 F.2d 585, 587; Kreste v. United

States, 2 Cir., 158 F.2d 575, 580; Nachman Spring-Filled Corp. v. Kay Mfg.

Co., 2 Cir., 139 F.2d 781, 787; Zalkind v. Scheinman, 2 Cir., 139 F.2d 895,

904; Phelan v. Middle States Oil Corp., 2 Cir., 154 F.2d 978, 1000; Benz v.

Celeste Fur Dyeing & Dressing Corp., 2 Cir., 136 F.2d 845, 848; Wyant v.

Caldwell, 4 Cir., 67 F.2d 374; Columbus Gas & Fuel Co. v. City of Columbus,

6 Cir., 55 F.2d 56, 58; Pfeil v. Jamison, 3 Cir., 245 F. 119

Вам также может понравиться

- The Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5От EverandThe Self-Help Guide to the Law: Contracts and Sales Agreements for Non-Lawyers: Guide for Non-Lawyers, #5Оценок пока нет

- MacIas v. Klein Appeal of Oakland Truck Sales, Inc, 203 F.2d 205, 3rd Cir. (1953)Документ4 страницыMacIas v. Klein Appeal of Oakland Truck Sales, Inc, 203 F.2d 205, 3rd Cir. (1953)Scribd Government DocsОценок пока нет

- Richards v. Holmes, 59 U.S. 143 (1856)Документ7 страницRichards v. Holmes, 59 U.S. 143 (1856)Scribd Government DocsОценок пока нет

- Leo L. Lowy v. Commissioner of Internal Revenue, 288 F.2d 517, 2d Cir. (1961)Документ4 страницыLeo L. Lowy v. Commissioner of Internal Revenue, 288 F.2d 517, 2d Cir. (1961)Scribd Government DocsОценок пока нет

- Wilbur Buff v. Commissioner of Internal Revenue, 496 F.2d 847, 2d Cir. (1974)Документ5 страницWilbur Buff v. Commissioner of Internal Revenue, 496 F.2d 847, 2d Cir. (1974)Scribd Government DocsОценок пока нет

- Nitterhouse v. United States, 207 F.2d 618, 3rd Cir. (1953)Документ4 страницыNitterhouse v. United States, 207 F.2d 618, 3rd Cir. (1953)Scribd Government DocsОценок пока нет

- Falk v. Moebs, 127 U.S. 597 (1888)Документ6 страницFalk v. Moebs, 127 U.S. 597 (1888)Scribd Government DocsОценок пока нет

- Jones v. Trapp, 186 F.2d 951, 10th Cir. (1950)Документ6 страницJones v. Trapp, 186 F.2d 951, 10th Cir. (1950)Scribd Government DocsОценок пока нет

- United States v. Joseph Frank, 245 F.2d 284, 3rd Cir. (1957)Документ5 страницUnited States v. Joseph Frank, 245 F.2d 284, 3rd Cir. (1957)Scribd Government DocsОценок пока нет

- United States v. Max Herman, and Joseph Harris and Sadie Schwartz, Defendants-Appellants, 310 F.2d 846, 2d Cir. (1962)Документ4 страницыUnited States v. Max Herman, and Joseph Harris and Sadie Schwartz, Defendants-Appellants, 310 F.2d 846, 2d Cir. (1962)Scribd Government DocsОценок пока нет

- Estate Counseling Service, Inc., A Corporation v. Merrill Lynch, Pierce, Fenner & Smith, Incorporated, A Corporation, 303 F.2d 527, 10th Cir. (1962)Документ8 страницEstate Counseling Service, Inc., A Corporation v. Merrill Lynch, Pierce, Fenner & Smith, Incorporated, A Corporation, 303 F.2d 527, 10th Cir. (1962)Scribd Government DocsОценок пока нет

- Kock v. Emmerling, 63 U.S. 69 (1860)Документ5 страницKock v. Emmerling, 63 U.S. 69 (1860)Scribd Government DocsОценок пока нет

- United States v. Joseph G. Lease, 346 F.2d 696, 2d Cir. (1965)Документ10 страницUnited States v. Joseph G. Lease, 346 F.2d 696, 2d Cir. (1965)Scribd Government DocsОценок пока нет

- Egbert J. Miles, Jr. v. M. Eli Livingstone, D/B/A Livingstone & Co., 301 F.2d 99, 1st Cir. (1962)Документ5 страницEgbert J. Miles, Jr. v. M. Eli Livingstone, D/B/A Livingstone & Co., 301 F.2d 99, 1st Cir. (1962)Scribd Government DocsОценок пока нет

- Tayloe v. Riggs, 26 U.S. 591 (1828)Документ12 страницTayloe v. Riggs, 26 U.S. 591 (1828)Scribd Government DocsОценок пока нет

- Feine v. McGowan Collector of Internal Revenue, 188 F.2d 738, 2d Cir. (1951)Документ4 страницыFeine v. McGowan Collector of Internal Revenue, 188 F.2d 738, 2d Cir. (1951)Scribd Government DocsОценок пока нет

- William P. Gray v. Occidental Life Insurance Company of California, 387 F.2d 935, 3rd Cir. (1968)Документ4 страницыWilliam P. Gray v. Occidental Life Insurance Company of California, 387 F.2d 935, 3rd Cir. (1968)Scribd Government DocsОценок пока нет

- Treat v. White, 181 U.S. 264 (1901)Документ5 страницTreat v. White, 181 U.S. 264 (1901)Scribd Government DocsОценок пока нет

- Mary Marie Eaves v. United States, 433 F.2d 1296, 10th Cir. (1970)Документ3 страницыMary Marie Eaves v. United States, 433 F.2d 1296, 10th Cir. (1970)Scribd Government DocsОценок пока нет

- National Bank of Commonwealth v. Mechanics' Nat. Bank, 94 U.S. 437 (1877)Документ4 страницыNational Bank of Commonwealth v. Mechanics' Nat. Bank, 94 U.S. 437 (1877)Scribd Government DocsОценок пока нет

- Not PrecedentialДокумент7 страницNot PrecedentialScribd Government DocsОценок пока нет

- Joseph B. and Josephine L. Simon v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Joseph B. and Josephine L. Simon, 285 F.2d 422, 3rd Cir. (1961)Документ6 страницJoseph B. and Josephine L. Simon v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Joseph B. and Josephine L. Simon, 285 F.2d 422, 3rd Cir. (1961)Scribd Government DocsОценок пока нет

- Richard L. Phillips v. United States, 346 F.2d 999, 2d Cir. (1965)Документ3 страницыRichard L. Phillips v. United States, 346 F.2d 999, 2d Cir. (1965)Scribd Government DocsОценок пока нет

- Cook v. MOFFAT, 46 U.S. 295 (1847)Документ25 страницCook v. MOFFAT, 46 U.S. 295 (1847)Scribd Government DocsОценок пока нет

- Curtis v. Innerarity, 47 U.S. 146 (1848)Документ17 страницCurtis v. Innerarity, 47 U.S. 146 (1848)Scribd Government DocsОценок пока нет

- Mickel-Hopkins, Inc. v. Jordan J. Frassinetti, Trustee in Bankruptcy of The Estate of James Harold Coble, Trading and Doing Business As Harold's (Restaurant), Bankrupt, 278 F.2d 301, 4th Cir. (1960)Документ7 страницMickel-Hopkins, Inc. v. Jordan J. Frassinetti, Trustee in Bankruptcy of The Estate of James Harold Coble, Trading and Doing Business As Harold's (Restaurant), Bankrupt, 278 F.2d 301, 4th Cir. (1960)Scribd Government DocsОценок пока нет

- United States v. G. E. Hall and Christine B. Hall, G. E. Hall and Christine B. Hall, Cross-Appellants v. United States of America, Cross-Appellee, 307 F.2d 238, 10th Cir. (1962)Документ7 страницUnited States v. G. E. Hall and Christine B. Hall, G. E. Hall and Christine B. Hall, Cross-Appellants v. United States of America, Cross-Appellee, 307 F.2d 238, 10th Cir. (1962)Scribd Government DocsОценок пока нет

- United States v. Kayne, 90 F.3d 7, 1st Cir. (1996)Документ10 страницUnited States v. Kayne, 90 F.3d 7, 1st Cir. (1996)Scribd Government DocsОценок пока нет

- Bank of Pittsburgh v. Neal, 63 U.S. 96 (1860)Документ14 страницBank of Pittsburgh v. Neal, 63 U.S. 96 (1860)Scribd Government DocsОценок пока нет

- United States v. Bank of America National Trust and Savings Association, United States of America v. Security-First National Bank, 274 F.2d 366, 1st Cir. (1959)Документ5 страницUnited States v. Bank of America National Trust and Savings Association, United States of America v. Security-First National Bank, 274 F.2d 366, 1st Cir. (1959)Scribd Government DocsОценок пока нет

- W. E. Daniel and E. A. Dillard v. The First National Bank of Birmingham, 227 F.2d 353, 1st Cir. (1956)Документ7 страницW. E. Daniel and E. A. Dillard v. The First National Bank of Birmingham, 227 F.2d 353, 1st Cir. (1956)Scribd Government DocsОценок пока нет

- Smith v. United States, 30 U.S. 292 (1831)Документ9 страницSmith v. United States, 30 U.S. 292 (1831)Scribd Government DocsОценок пока нет

- Coiron v. Millaudon, 60 U.S. 113 (1857)Документ3 страницыCoiron v. Millaudon, 60 U.S. 113 (1857)Scribd Government DocsОценок пока нет

- United States v. McNicol, 1st Cir. (2016)Документ13 страницUnited States v. McNicol, 1st Cir. (2016)Scribd Government DocsОценок пока нет

- Codell Blease Thomas and Elizabeth F. Thomas v. Delta Enterprises, Inc., 813 F.2d 403, 4th Cir. (1986)Документ6 страницCodell Blease Thomas and Elizabeth F. Thomas v. Delta Enterprises, Inc., 813 F.2d 403, 4th Cir. (1986)Scribd Government DocsОценок пока нет

- Williams v. United States, 42 U.S. 290 (1843)Документ10 страницWilliams v. United States, 42 U.S. 290 (1843)Scribd Government DocsОценок пока нет

- Norene R. O'Dell v. Jack Ruhter, Trustee in Bankruptcy, and Internal Revenue Service, United States of America, 339 F.2d 577, 10th Cir. (1964)Документ2 страницыNorene R. O'Dell v. Jack Ruhter, Trustee in Bankruptcy, and Internal Revenue Service, United States of America, 339 F.2d 577, 10th Cir. (1964)Scribd Government DocsОценок пока нет

- In The Matter of Albert M. BARBATO, Bankrupt, Royal Indemnity Company, A Corporation of The State of New York, A Creditor, AppellantДокумент9 страницIn The Matter of Albert M. BARBATO, Bankrupt, Royal Indemnity Company, A Corporation of The State of New York, A Creditor, AppellantScribd Government DocsОценок пока нет

- Kann v. Commissioner of Internal Revenue. Kann's Estate v. Commissioner of Internal Revenue, 210 F.2d 247, 3rd Cir. (1954)Документ13 страницKann v. Commissioner of Internal Revenue. Kann's Estate v. Commissioner of Internal Revenue, 210 F.2d 247, 3rd Cir. (1954)Scribd Government DocsОценок пока нет

- United States Court of Appeals, Third CircuitДокумент9 страницUnited States Court of Appeals, Third CircuitScribd Government DocsОценок пока нет

- Wing On & Co. v. Syyap (64 OG 8311)Документ8 страницWing On & Co. v. Syyap (64 OG 8311)Anit EmersonОценок пока нет

- Falco v. Donner Foundation, Inc., 208 F.2d 600, 2d Cir. (1953)Документ6 страницFalco v. Donner Foundation, Inc., 208 F.2d 600, 2d Cir. (1953)Scribd Government DocsОценок пока нет

- R.G. Cope, JR., Inc., Alleged Transferee v. Commissioner of Internal Revenue, 781 F.2d 852, 11th Cir. (1986)Документ4 страницыR.G. Cope, JR., Inc., Alleged Transferee v. Commissioner of Internal Revenue, 781 F.2d 852, 11th Cir. (1986)Scribd Government DocsОценок пока нет

- Nannie v. Compton v. United States of America, 334 F.2d 212, 4th Cir. (1964)Документ11 страницNannie v. Compton v. United States of America, 334 F.2d 212, 4th Cir. (1964)Scribd Government DocsОценок пока нет

- Kenneth M. Henson and Sue B. Henson, Cross-Appellees v. Commissioner of Internal Revenue, Cross-Appellant, 835 F.2d 850, 11th Cir. (1988)Документ7 страницKenneth M. Henson and Sue B. Henson, Cross-Appellees v. Commissioner of Internal Revenue, Cross-Appellant, 835 F.2d 850, 11th Cir. (1988)Scribd Government DocsОценок пока нет

- First National Bank of Emlenton, Pennsylvania v. United States, 265 F.2d 297, 1st Cir. (1959)Документ4 страницыFirst National Bank of Emlenton, Pennsylvania v. United States, 265 F.2d 297, 1st Cir. (1959)Scribd Government DocsОценок пока нет

- Scudder v. Comptroller of NY, 175 U.S. 32 (1899)Документ4 страницыScudder v. Comptroller of NY, 175 U.S. 32 (1899)Scribd Government DocsОценок пока нет

- James L. Doyal and Colleen N. Doyal v. Commissioner of Internal Revenue, 616 F.2d 1191, 10th Cir. (1980)Документ3 страницыJames L. Doyal and Colleen N. Doyal v. Commissioner of Internal Revenue, 616 F.2d 1191, 10th Cir. (1980)Scribd Government DocsОценок пока нет

- Parker v. Delaney, 186 F.2d 455, 1st Cir. (1950)Документ6 страницParker v. Delaney, 186 F.2d 455, 1st Cir. (1950)Scribd Government DocsОценок пока нет

- United States Court of Appeals, Sixth CircuitДокумент14 страницUnited States Court of Appeals, Sixth CircuitScribd Government DocsОценок пока нет

- Nelson v. New York City, 352 U.S. 103 (1956)Документ6 страницNelson v. New York City, 352 U.S. 103 (1956)Scribd Government DocsОценок пока нет

- Charles I. Brown and Kathleen M. Brown v. Commissioner of Internal Revenue, 529 F.2d 609, 10th Cir. (1976)Документ7 страницCharles I. Brown and Kathleen M. Brown v. Commissioner of Internal Revenue, 529 F.2d 609, 10th Cir. (1976)Scribd Government DocsОценок пока нет

- United States v. Gardner S. Drape, 668 F.2d 22, 1st Cir. (1982)Документ6 страницUnited States v. Gardner S. Drape, 668 F.2d 22, 1st Cir. (1982)Scribd Government DocsОценок пока нет

- United States Court of Appeals Tenth CircuitДокумент8 страницUnited States Court of Appeals Tenth CircuitScribd Government DocsОценок пока нет

- United States v. William M. Tadio, 223 F.2d 759, 2d Cir. (1955)Документ3 страницыUnited States v. William M. Tadio, 223 F.2d 759, 2d Cir. (1955)Scribd Government DocsОценок пока нет

- East Coast Equipment Company v. Commissioner of Internal Revenue, 222 F.2d 676, 3rd Cir. (1955)Документ4 страницыEast Coast Equipment Company v. Commissioner of Internal Revenue, 222 F.2d 676, 3rd Cir. (1955)Scribd Government DocsОценок пока нет

- George P. Shultz, Secretary of Labor, United States Department of Labor v. Roger Merriman, 425 F.2d 228, 1st Cir. (1970)Документ3 страницыGeorge P. Shultz, Secretary of Labor, United States Department of Labor v. Roger Merriman, 425 F.2d 228, 1st Cir. (1970)Scribd Government DocsОценок пока нет

- Commissioner of Internal Revenue v. Waldman's Estate, 196 F.2d 83, 2d Cir. (1952)Документ4 страницыCommissioner of Internal Revenue v. Waldman's Estate, 196 F.2d 83, 2d Cir. (1952)Scribd Government DocsОценок пока нет

- United States v. Bernard Feinberg, Administrator of The Estate of Joseph Saladoff, Deceased, 372 F.2d 352, 3rd Cir. (1967)Документ21 страницаUnited States v. Bernard Feinberg, Administrator of The Estate of Joseph Saladoff, Deceased, 372 F.2d 352, 3rd Cir. (1967)Scribd Government DocsОценок пока нет

- United States v. Bernard W. Coblentz, 453 F.2d 503, 2d Cir. (1972)Документ5 страницUnited States v. Bernard W. Coblentz, 453 F.2d 503, 2d Cir. (1972)Scribd Government DocsОценок пока нет

- United States v. Garcia-Damian, 10th Cir. (2017)Документ9 страницUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Kieffer, 10th Cir. (2017)Документ20 страницUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Документ22 страницыConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Apodaca v. Raemisch, 10th Cir. (2017)Документ15 страницApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Olden, 10th Cir. (2017)Документ4 страницыUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Документ100 страницHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Документ21 страницаCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Payn v. Kelley, 10th Cir. (2017)Документ8 страницPayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- Coyle v. Jackson, 10th Cir. (2017)Документ7 страницCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Greene v. Tennessee Board, 10th Cir. (2017)Документ2 страницыGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Wilson v. Dowling, 10th Cir. (2017)Документ5 страницWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Brown v. Shoe, 10th Cir. (2017)Документ6 страницBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент10 страницPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsОценок пока нет

- Pecha v. Lake, 10th Cir. (2017)Документ25 страницPecha v. Lake, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент14 страницPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- Publish United States Court of Appeals For The Tenth CircuitДокумент24 страницыPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsОценок пока нет

- United States v. Voog, 10th Cir. (2017)Документ5 страницUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Roberson, 10th Cir. (2017)Документ50 страницUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Kearn, 10th Cir. (2017)Документ25 страницUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Webb v. Allbaugh, 10th Cir. (2017)Документ18 страницWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Документ9 страницNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Windom, 10th Cir. (2017)Документ25 страницUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Kundo, 10th Cir. (2017)Документ7 страницUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Документ10 страницNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Henderson, 10th Cir. (2017)Документ2 страницыUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Pledger v. Russell, 10th Cir. (2017)Документ5 страницPledger v. Russell, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Muhtorov, 10th Cir. (2017)Документ15 страницUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- United States v. Magnan, 10th Cir. (2017)Документ27 страницUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- Publish United States Court of Appeals For The Tenth CircuitДокумент17 страницPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsОценок пока нет

- United States v. Magnan, 10th Cir. (2017)Документ4 страницыUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsОценок пока нет

- SNC 2p1 Course Overview 2015Документ2 страницыSNC 2p1 Course Overview 2015api-212901753Оценок пока нет

- IELTS Speaking Q&AДокумент17 страницIELTS Speaking Q&ABDApp Star100% (1)

- Basic Features of The Microcredit Regulatory Authority Act, 2006Документ10 страницBasic Features of The Microcredit Regulatory Authority Act, 2006Asif Hasan DhimanОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент2 страницыBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledCesar ValeraОценок пока нет

- Prac Res Q2 Module 1Документ14 страницPrac Res Q2 Module 1oea aoueoОценок пока нет

- Navistar O & M ManualДокумент56 страницNavistar O & M ManualMushtaq Hasan95% (20)

- Kaydon Dry Gas SealДокумент12 страницKaydon Dry Gas Sealxsi666Оценок пока нет

- OS LabДокумент130 страницOS LabSourav BadhanОценок пока нет

- SolBridge Application 2012Документ14 страницSolBridge Application 2012Corissa WandmacherОценок пока нет

- Process Financial Transactions and Extract Interim Reports - 025735Документ37 страницProcess Financial Transactions and Extract Interim Reports - 025735l2557206Оценок пока нет

- Inborn Errors of Metabolism in Infancy: A Guide To DiagnosisДокумент11 страницInborn Errors of Metabolism in Infancy: A Guide To DiagnosisEdu Diaperlover São PauloОценок пока нет

- Uses and Soxhlet Extraction of Apigenin From Parsley Petroselinum CrispumДокумент6 страницUses and Soxhlet Extraction of Apigenin From Parsley Petroselinum CrispumEditor IJTSRDОценок пока нет

- Draft SemestralWorK Aircraft2Документ7 страницDraft SemestralWorK Aircraft2Filip SkultetyОценок пока нет

- October 2009 Centeral Aucland, Royal Forest and Bird Protecton Society NewsletterДокумент8 страницOctober 2009 Centeral Aucland, Royal Forest and Bird Protecton Society NewsletterRoyal Forest and Bird Protecton SocietyОценок пока нет

- PNBONE_mPassbook_134611_6-4-2024_13-4-2024_0053XXXXXXXX00 (1) (1)Документ3 страницыPNBONE_mPassbook_134611_6-4-2024_13-4-2024_0053XXXXXXXX00 (1) (1)imtiyaz726492Оценок пока нет

- Ielts Practice Tests: ListeningДокумент19 страницIelts Practice Tests: ListeningKadek Santiari DewiОценок пока нет

- Unr Ece R046Документ74 страницыUnr Ece R046rianteri1125Оценок пока нет

- IQ CommandДокумент6 страницIQ CommandkuoliusОценок пока нет

- Brochure en 2014 Web Canyon Bikes How ToДокумент36 страницBrochure en 2014 Web Canyon Bikes How ToRadivizija PortalОценок пока нет

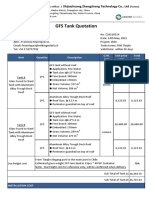

- GFS Tank Quotation C20210514Документ4 страницыGFS Tank Quotation C20210514Francisco ManriquezОценок пока нет

- 2020 Global Finance Business Management Analyst Program - IIMДокумент4 страницы2020 Global Finance Business Management Analyst Program - IIMrishabhaaaОценок пока нет

- Maxx 1657181198Документ4 страницыMaxx 1657181198Super UserОценок пока нет

- Endangered EcosystemДокумент11 страницEndangered EcosystemNur SyahirahОценок пока нет

- Corporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Документ18 страницCorporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Lia asnamОценок пока нет

- Reading and Writing Q1 - M13Документ13 страницReading and Writing Q1 - M13Joshua Lander Soquita Cadayona100% (1)

- Gabinete STS Activity1Документ2 страницыGabinete STS Activity1Anthony GabineteОценок пока нет

- Shopping Mall: Computer Application - IiiДокумент15 страницShopping Mall: Computer Application - IiiShadowdare VirkОценок пока нет

- TJUSAMO 2013-2014 Modular ArithmeticДокумент4 страницыTJUSAMO 2013-2014 Modular ArithmeticChanthana ChongchareonОценок пока нет

- Peran Dan Tugas Receptionist Pada Pt. Serim Indonesia: Disadur Oleh: Dra. Nani Nuraini Sarah MsiДокумент19 страницPeran Dan Tugas Receptionist Pada Pt. Serim Indonesia: Disadur Oleh: Dra. Nani Nuraini Sarah MsiCynthia HtbОценок пока нет

- Anti Jamming of CdmaДокумент10 страницAnti Jamming of CdmaVishnupriya_Ma_4804Оценок пока нет