Академический Документы

Профессиональный Документы

Культура Документы

Responsible Investment in The Natural Resources Sector: An Analytical Profile of The Mining Sector in Zimbabwe

Загружено:

Lenin Tinashe ChisairaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Responsible Investment in The Natural Resources Sector: An Analytical Profile of The Mining Sector in Zimbabwe

Загружено:

Lenin Tinashe ChisairaАвторское право:

Доступные форматы

RESPONSIBLE INVESTMENT IN

THE NATURAL RESOURCES SECTOR

An Analytical profile of the Mining Sector in Zimbabwe

Published by:

Zimbabwe Environmental Law Association (ZELA)

Authors:

Rodney Ndamba & Lenin Tinashe Chisaira

Supported by:

Ford Foundation

Layout:

dorcas@suneaglespromotions.co.zw

Copyright:

2016, Zimbabwe Environmental Law Association (ZELA)

This publication may be reproduced in whole or in part and in any

form for educational or non-profit uses, without special permission

from the copyright holder, provided full acknowledgement of the source

is made. No use of this publication may be made for resale or other

commercial purposes without the prior written permission of ZELA.

Disclaimer:

The views expressed herein do not necessarily

represent those of the Ford Foundation but those

of the authors.

Year of Publication:

2016

Available from:

Zimbabwe Environmental Law Association (ZELA)

No. 26B, Seke Road, Hatfield, Harare.

Email: zela@mweb.co.zw,

Website: www.zela.org;

Twitter:@ZELA_Infor

CONTENTS

1.

2.

3.

4.

5.

6.

7.

7.1.

7.1.1.

7.1.2.

7.1.3.

7.1.4.

7.1.5.

7.1.6.

7.2.

7.2.1.

7.2.2.

8.

9.

10.

11.

4

INTRODUCTION

6

LITERATURE REVIEW

CONCEPT OF RESPONSIBLE INVESTMENT 8

CONTEXTUAL ANALYSIS OF RESPONSIBLE INVESTMENTS

10

IN ZIMBABWE

INVESTMENT IN THE NATURAL RESOURCES SECTOR 12

RESPONSIBLE INVESTMENT PRACTICES IN THE EXTRACTIVE

SECTOR IN ZIMBABWE 15

LEGAL, POLICY AND POLITICAL ASPECTS GUIDING

16

RESPONSIBLE INVESTMENTS IN ZIMBABWE

LEGAL FRAMEWORK 16

The Constitution of Zimbabwe 16

The Zimbabwe Investment Authority Act 20

Mines and Minerals Act 21

Environmental Management Act 25

Labour Act 26

Indigenisation and Economic Empowerment Act 28

POLICY FRAMEWORK 29

Zimbabwe Agenda for Sustainable Socio-Economic

Transformation (Zim Asset) 29

Political Environment 33

UN GUIDING PRINCIPLES ON BUSINESS AND HUMAN RIGHTS

RECOMMENDATIONS OR OPPORTUNITIES FOR RESPONSIBLE

INVESTMENTS IN THE EXTRACTIVE SECTOR 37

CONCLUSION 41

42

BIBILIOGRAPHY

35

ACRONYMS

CRISA

Code for Responsible Investing in South Africa

EMA

Environmental Management Agency

ESCAP

Economic and Social commission for Asia and the Pacific

ESG

Environmental, social and corporate governance

FDI

Foreign Direct Investment

INSAF

Institute for Sustainability Africa

SRI

Socially Responsible Investment Index

UNPRI

United Nations Principles for Responsible Investment

ZCDC

Zimbabwe Consolidated Diamond Company

ZELA

Zimbabwe Environmental Law Association

ZIA

Zimbabwe Investment Authority

ZIM ASSET

Zimbabwe Agenda for Sustainable Socio-Economic

Transformation

ZMDC

Zimbabwe Mining Development Corporation

Ii

Pg 4

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

1. INTRODUCTION

The call for responsible investments has been rising slowly in the past four

years in Zimbabwe. A number of initiatives have been placed and more

need to be placed in order to respond to rising corporate failures and poor

corporate governance practices by shareholders and investors especially

those in the natural resources sector. Some mining companies in

Zimbabwe have been accused of unsustainable business practices that

ignore community rights and environmental impacts. Above all, the

investment environment in Zimbabwe has largely been characterised by

lack of shareholder activism, unsustainable business values, poor corporate

governance and corruption. In an ideal setting, investors must use their

collective position to drive sustainable business values in the companies

they invest in. This paper explores the fundamental concept of responsible

investments, gives a contextual analysis of investment practices in the

natural resources sector while exploring opportunities for driving

sustainable and responsible investing in Zimbabwe. The natural resources

and extractive sector remains one of the major fiscal contributors, although

it is associated with high social, economic, political and environmental impacts. In

early 2016, the President of Zimbabwe, Robert Mugabe exposed that amounts

going up to US$15 billion have been externalized by diamond mining

companies operating in the Marange area. This is highly significant in a

country whose annual budget is a mere US$4 billion.

A nation that places people's needs as a priority above private profits

should particularly ensure that investments and business decisions are

done after thorough assessments of human rights and environmental justice.

However, political inconsistences and doubtful capacities on the part of the

Zimbabwean government agencies and authorities have characterised the

response to investment in the country. Zimbabwe's legal, policy and

political environment has been characterised by glaring inconsistences and

political whims. Much study is needed to constantly re-look at the impacts

of the legal, policy and political environment on investments in the country.

An Analytical profile of the Mining Sector in Zimbabwe

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 5

The existing laws contain some important provisions that should guide

responsible investments, however lack of capacity and sometimes lack of

political will has hindered progress towards responsible investment. To

determine whether responsible investment is effectively catered for and

enforced, the existing legal and policy framework on investment needs to

be reviewed. The review will further be aimed at ensuring that future

investment initiatives result in considerable gains and benefits for the

majority of the people surviving in the current set-up of an economy that

has been branded as an enclave economy.

An Analytical profile of the Mining Sector in Zimbabwe

Pg 6

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

2. LITERATURE REVIEW

Recent materials and researches on responsible investment in Zimbabwe

and the entire world have reached the conclusion that there is urgent need

for a change in outlook on the part of business and sometimes government

to depart from purely profit oriented irresponsible practices to people and

sustainability oriented procedures.

A research produced by the Zimbabwe Environmental Law Association on

the impact of chrome mining in the Great Dyke area of Zimbabwe points

out that whilst the ideal system is one of sustainability and responsibility on

the part of business leading to community development and happiness,

in reality, the socio-economic charm and benefits from mineral

wealth abundance has been privatised by corporates and few

corrupt, politically well-connected individuals. Host mining

communities find obscured the C in the Charm of mineral wealth

abundance but only see the Harm. The Great Dyke has been

tainted into The Great Threat. 1

The research report gives some key recommendations that should be taken

into consideration on the drive to attain responsible investment in

Zimbabwe. The report recommends that Open and unsecured mining pits

that are disused or in use must be rehabilitated or fenced by mining

2

companies to eliminate the risk posed to people and animals and goes

further to charge that, in the country, Issuance or renewal of mining license

should be merit based considering the performance on issues such as

environmental rehabilitation, corporate social investments and a social

3

license to operate.

Another important addition to the literature on responsible investments in

the natural resources sector, comes from the authoritative United Nations'

Economic and Social Commission for Asia and the Pacific (ESCAP) which

released a report titled Responsible Business and Sustainable Investment

1

Sibanda, M, From the Great Dyke to the Great Threat, page 3

As above, page 10

3

As above, page 10

2

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 7

in the Natural Resources Sector in Asia and the Pacific. The report breaks

down challenges and problems in the natural resources sector into

sustainable development challenges which include environmental and

social challenges (land acquisition, involuntary resettlement, and lack of

respect for human and labour rights) and governance challenges which

include corruption and transparency issues. Furthermore, the reports outline

policy challenges which include investment and mining law issues as well as

investment agreements and contracts issues. The report recommends

that investors should participate in responsible investment initiatives such

as the Equator Principles and Principles for Responsible Investment (PRI).

Governments are also recommended to strengthen revenue management

and increase public participation into all stages of the natural resource

extraction project cycle as well as in the review of extractive laws and contracts.4

The last but not least piece of literature on sustainable development

viewed for this paper comes from Jantzi-Sustainalytics.5 The paper titled

Sustainability and Materiality in the Natural Resources Sectors highlights

that:

Without proper engagement with local communities and aboriginal

groups, there is a strong potential that opposition may impede a

miner's ability to maintain business operations. Miners operating in

conflict zones or countries with poor human rights records are

particularly exposed. 6

The encouragement here is that there should be a meeting of the minds

between a serious investor in the natural resources sector and the local

communities. This is an aspect which most of the investors in Zimbabwe

seem to have thrown out of the window, in the end there is everlasting

tension with most of the communities that have been forcibly dislocated

from their ancestral lands as well as those whose crops keep being mowed

ESCAP, Responsible Business and Sustainable Investment in the natural resources sector in Asia

and the pacific, Page 116

5

described as an international and independent sustainability research and services provider

6

Jantzi-Sustainalytics, Sustainability and Materiality in the Natural Resources Sectors, page 7

Pg 8

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

down in areas like Chisumbanje. Responsible investment encourages

private sector and community discussions as well as keeping track of the

needs of such communities and generally, the needs of all persons.

3.

CONCEPT OF RESPONSIBLE INVESTMENT

Responsible investment is differentiated from conventional investment by

its emphasis on the integration of environmental, social and corporate

governance (ESG) in investment options and decisions. Over the past years,

responsible investment has evolved from just consideration of ESG to a

value system that differentiate responsible investors from mainstream

businesses. The concept of Responsible investment has been largely

defined by the United Nations Principles on Responsible Investment

(UNPRI) as 'an approach to investment that explicitly acknowledges the

relevance to the investor of environmental, social and governance factors,

and of the long term health and stability of the market as whole'.7 Investors

tend to use the term 'sustainable investing' which takes into account EGS

factors that may impacts the performance of an investment portfolio.8 The

concept of responsible investing can be views from the perspective of

guiding the investment process and the framework of making an

investment decision.

The UNPRI approach to responsible investing is formulated through a set of

value statements and beliefs which guide the approach and behavior of

investors. This approach has been replicated in many parts of the World. In

South Africa, the UNPRI principles have been influential in developing the

Code for Responsible Investing in South Africa (CRISA) and Johannesburg

9

Stock Exchange's Socially Responsible Investment Index (SRI). The UNPRI

http://www.unpri.org/introducing-responsible-investment/

Ceres (2013) The 21st Century Investor: Ceres Blueprint for sustainable investing

9

Code on Responsible Investing in South Africa (2011)

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 9

provides Six (6) Statements of Commitment to Responsible investment

which require investors to demonstrate their commitment by signing up to

the value statement (Figure 1):

The UNPRI principles are mainly focused on institutional investors and

thrive on commitment and ability to uphold the values. The principles

have guided the management of Trillions of dollars in investment funds

around the world. As of 2015, there were no institutional investors under

Zimbabwe who were signatories to the UNPRI Principles.

Figure 1: UNPRI: The Six Principles

Principle 1: We will incorporate ESG issues into investment analysis and decision-making

processes.

Principle 2:

We will be active owners and incorporate ESG issues into our ownership policies

and practices.

Principle 3:

We will seek appropriate disclosure on ESG issues by the entities in which we invest.

Principle 4: We will promote acceptance and implementation of the Principles within the

investment industry.

Principle 5:

We will work together to enhance our effectiveness in implementing the Principles.

Principle 6: We will each report on our activities and progress towards implementing the

Principles.

Source: UNPRI (2015)

An Analytical profile of the Mining Sector in Zimbabwe

Pg 10

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

4. CONTEXTUAL ANALYSIS OF RESPONSIBLE

INVESTMENTS IN ZIMBABWE

The subject of responsible investing is still finding its way in Zimbabwe's

investment world. Over the past four years, great efforts have been made

by the Institute for Sustainability Africa (INSAF) to influence responsible

investment through their project titled 'Shareholders and Investors Forum

on Sustainable and Responsible Investing in Zimbabwe' which is meant to

lead to the development of a Code on Responsible Investing in Zimbabwe

10

(CRIZ). Zimbabwe does not have an existing national framework on

responsible investing. Investment activities in Zimbabwe have been mainly

through institutional investors like pension fund, banks, nominees,

companies and limited individuals. As for the mining sector in Zimbabwe,

11

major investors have been large conglomerate mining companies and

pension funds.

Investments practices in Zimbabwe tend to focus on financial returns, as

compared to an integrated approach of incorporating social and

environments issues. An evaluation of the state of responsible investing in

South Africa (De Jongh et al, 2007) provides a contrast to practices in

12

Zimbabwe. The Investment community in South Africa has strong

consideration of environmental, social and governance issues, which could

be attributed to formal responsible investing and socially responsible

investments systems (De Jongh et al, 2007). The state of responsible

investing in Zimbabwe is largely attributed to the absence of a national

code of corporate governance, lack of shareholder/investor activism and

10

2015 Annual Shareholders and Investors Forum on Sustainable and Responsible Investing

11

KPMG (2013), Investing in the Mining Sector in Zimbabwe: A closer look at the investment

environment

12

The State of Responsible Investing in South Africa (2007)

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 11

weak demand for ESG disclosure practices by the investment community.

As such, environmental, social and governance issues have gone unnoticed

even within the natural resources extractive sector where those who take

them into account, do so on a voluntary basis. A research by Ndamba

(2009) showed that only 3% of Zimbabwe Stock Exchange listed companies

disclose information on their environmental impacts in Annual Reports.

In the past 3 years, there has been growing drive in pushing for responsible

investing in Zimbabwe through the Institute for Sustainability Africa

working with partners such as the Securities and Exchange Commission of

Zimbabwe, The Zimbabwe Stock Exchange and the Institute of Directors

Zimbabwe. In 2015, the Zimbabwe Association of Pension Funds (ZAPF)

was admitted by the UNPRI as Network Supporter in driving the

implementation of the Principles on Responsible Investment among

members.13 This development is expected to mark coordinated efforts

towards driving responsible investing in Zimbabwe through pension funds

that hold portfolio sectors such mining sector. However, significant steps

will be required in the banking and finance services sector to drive

responsible investing practices. Existing regulations in the banking sector in

Zimbabwe require improvement to explicitly integrate environmental,

social and governance issues in credit rating and lending processes.

13

UNPRI members 2015

Pg 12

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

5. INVESTMENT IN THE NATURAL RESOURCES SECTOR

The natural resources and extractive sector in Zimbabwe has been a

significant contributor to Foreign Direct Investment (FDI), especially

through investments in mining sector. The mining sector is mainly governed

through the Mines and Minerals Act (Chapter 21:05) while investment is

processed through the Zimbabwe Investment Authority (ZIA). Investment

processing is managed through a One-Stop Shop (OSS) investment centre

which also houses the Investment Facilitation and Aftercare, Registrar of

Companies, Immigration Control Department, Reserve Bank of

Zimbabwe, Ministry of Mines and Mining, Environmental Management,

and Ministry of Youth Development, Indigenisation and Economic

Empowerment (KPMG, 2013). This structure is meant to accelerate

investment processes across the economy including the mining sector. The

mining sector in Zimbabwe provides opportunities through minerals such

as gold, coal, platinum, chrome, nickel, copper, Iron ore, pegmatite,

dimension stones and diamonds. The marketing of the minerals is

exclusively regulated and monitored through the Minerals Marketing

Corporation of Zimbabwe (KPMG, 2013).

While there has been major investment in the mining sector in Zimbabwe,

the majority of investors have been institutional investors, Multinational

Mining Corporations and government. Major mining companies are

largely owned by multinational foreign owned mining companies who

tend to apply international standards and practices. In contrast, some of

the standards applied by local companies in Zimbabwe are still a bit low. To

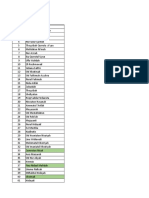

profile investment in the sector in Zimbabwe, Table 1provides the account

based on major minerals. Table 1 show that local investment or ownership

has been largely in diamond and coal mining through joint ventures.

An Analytical profile of the Mining Sector in Zimbabwe

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 13

The investment structure in the mining sector in Zimbabwe is largely

influenced by the type of mineral and the scale of investment required to

mine it. Highly sophisticated minerals like Gold, Platinum, Nickel and

Chrome tend to be largely dominated by foreign shareholder investments

while other less sophisticated mining process minerals like alluvial

diamonds have been dominated by state owned companies as joint

venture companies with foreigners. Observations from table 1 below

show that major foreign investors for the mining sector in Zimbabwe are

from Canada, South Africa, Australia, United Kingdom and China. It is also

noticeable that high value minerals like Platinum are predominantly

mined through investment from South Africa and Australia while alluvial

diamonds have been predominantly mined through partnerships

between governmentled companies through joint venture companies

with investors from China, South Africa, Lebanon and Mauritius. Table 1

provided as detailed profile major minerals, mining companies and their

ownership:

An Analytical profile of the Mining Sector in Zimbabwe

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 15

6.

RESPONSIBLE INVESTMENT PRACTICES IN THE

EXTRACTIVE SECTOR IN ZIMBABWE

Fundamental to responsible investment is the investor drive for

accountability and transparency in the companies they invest in.

Sustainability Reporting has been one of those instruments investors tend

to use to demonstrate their responsibility by demanding information from

companies prior to investing. Sustainability reporting using the Global

Reporting Initiatives (GRI) - Sustainability Reporting Guidelines provides

for disclosure of economic, environmental and social impacts of

14

companies. Social issues covered under the guidelines relate to issues of

labour, communities, gender, human rights, compliance and products

15

responsibility. However, these guidelines are gradually being adopted in

Zimbabwe. To date, the guidelines are contained in instruments such as

the National Code on Corporate Governance in Zimbabwe (ZIMCODE,

16

2015) and the Zimbabwe Stock Exchange Listing Rules.

A review of the mining companies in Table 1 show foreign owned platinum

and gold mining companies leading the disclosure of ESG information

which in turn can be a demonstration of the responsible investors behind

the companies. However, major concerns have been noted in some of

mining companies mainly in diamond and chrome mining. Concerns have

been associated with poor working conditions, health and safety of

workers, community rights (relocations) and environmental (rehabilitation

or mining closure procedures). These areas provide potential opportunity

for responsible investing consideration and improvements.

14

The Global Reporting Initiatives (GRI)

The Global Reporting Initiative GRI G4 Guidelines (2014)

16 The National Code on Corporate Governance in Zimbabwe (Zimcode)

15

Pg 16

7.

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

LEGAL, POLICY AND POLITICAL ASPECTS GUIDING

RESPONSIBLE INVESTMENTS IN ZIMBABWE

7.1. LEGAL FRAMEWORK

The legal framework governing responsible investment in the natural

resources sector in Zimbabwe consists of various pieces of legislation with

17

the main ones being the Zimbabwe Investment Authority Act, Mines and

18

20

19

Minerals Act, Environmental Management Act, Labour Act and the

21

Constitution of Zimbabwe among others. The Constitution of Zimbabwe

buttresses all existing legislation by providing for social and economic

rights that can be claimed by every person that are directly or indirectly

affected by business operations.

International law also influences responsible investment. This branch of law

usually refers to conventions, treaties, agreements and other sources of

international law as outlined in Article 38 of the Statute of the International

Court of Justice. Soft law instruments, (those international declarations that

may not have the force of law but usually have persuasive effects) are also a

necessity and encourage the inclusion of sustainable development models

and the protection of human and environmental rights as well as the

sovereign right of nations in their interactions with usually powerful investor

interests. To the soft-law category belongs the key UN Human Rights

Council document entitled 'Guiding Principles on Business and Human

Rights: Implementing the United Nations Protect, Respect and Remedy

Framework.'

7.1.1. The Constitution of Zimbabwe

The Zimbabwean Constitution is one of the newest in the world, and has

some very progressive clauses, on top of being the supreme law of the nation.22

17 [Chapter 14:30]

18 [Chapter 21:05]

19

[Chapter 20:27]

20

[Chapter 28:01]

21

Amendment (No 20) Act,2013

22

Sec 2 (1) of the Constitution

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 17

The Constitution for the first time provides for the right of every person to

an environment that is not harmful to health and that takes into

considerations ecologically sustainable development and use of natural

23

resources while promoting economic and social development. If utilised

well this would be the backbone of responsible investment in the natural

resources sector in Zimbabwe since natural resources would be utilised in a

considerate manner that advances the people's social and economic

livelihoods.

The objectives of the 2013 constitution present immense possibilities for a

clear responsible investment. The Constitution state that Zimbabwe is

24

founded on values and principles that include the following:

Fundamental human rights and freedoms;

Recognition of the inherent dignity and worth of each human being;

Recognition of the equality of all human beings;

Gender equality;

These values and principles are backed up by progressive provisions in

the National Objectives and in the Declaration of Rights. The national

Objectives are meant to guide the State and all institutions and agencies of

government at every level in formulating and implementing laws and

policy decisions that will lead to the establishment, enhancement and

promotion of a sustainable, just, free and democratic society in which

25

people enjoy prosperous, happy and fulfilling lives.

The specific National Objectives26 which have a bearing on responsible

investment include the objectives of fostering of fundamental rights and

freedoms which in essence promotes the realisation of the rights outlined

in the Declaration of Rights and which will be discussed later. The objectives

also include the attainment of national development; empowerment and

employment creation; culture; gender balance; the best interests of

children in matters relating to children; affirmative action programmes for

23

Sec 73 of the Constitution

Sec 3 of the Constitution

25

Sec 8 of the Constitution

26

See generally, Chapter 2 of the Constitution

24

Pg 18

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

youths; the respect, support and protection for elderly persons ;

recognition of the rights of person with physical or mental disabilities; work

and labour relations; provisions of shelter, health services and social

welfare; the preservation of traditional knowledge including knowledge of

the medicinal and other properties of animal and plant life possessed

by local communities and people (this is a very important objective,

since at times most multinational companies, especially those in the

pharmaceutical industry seek to patent medicinal knowledge at the

expense of traditional communities); Finally the last - but not least - national

objective is on the need for the Sate to ensure that all international

conventions, treaties and agreements to which Zimbabwe is a party are

incorporated into domestic law.

The state being the entity empowered with the enforcement of responsible

investment principles, and being also the overseer of the activities of

multinational investors indeed needs to ensure that all such engagements,

contracts and overseeing of the activities of investors in the extractive

sector are conducted within the ambit of the mentioned constitutional

values, principles and objectives.

The Constitution contains a very comprehensive Declaration of Rights that

27

protects the rights of every person such as labour rights, access to

29

28

30

information, administrative justice, environmental rights, and freedom

32

33

from arbitrary eviction,31 health care as well food and water. These rights

can easily be overrun by business operations in an environment where

investors are not socially responsible. This has already been observed in

areas such as Marange (diamond extraction), Chisumbanje (ethanol

production), Shurugwi (gold and chrome mining), Mutoko (granite

mining) and Zvishavane (platinum and other minerals).

27

Sec 65 of the Constitution

Sec 62 of the Constitution

29

Sec 68 of the Constitution

30

Sec 73 of the Constitution

31

Sec 74 of the Constitution

32

Sec 75 of the Constitution

33

Sec 77 of the Constitution

28

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 19

However, it is important to note that the existence of these rights in the

Constitutions, gives a duty to every person, natural or juristic, to uphold

these rights. Juristic refers to corporates and this has implications on

corporate investors who are also expected to uphold Constitutional rights.

In terms of the Constitution, the obligations imposed in the document are

binding on every person, natural and juristic, including the State and all

executive, legislative and judicial institutions and agencies of government

34

at every level, and must be fulfilled by them.

The Constitution also contains other founding values, national objectives

and principles of good governance that can be used to promote

responsible investments by state entities as well as even private entities

35

including the need for transparency and accountability, personal integrity,

financial probity, and adoption of measures to expose, combat and

eradicate all forms of corruption and abuse of power by those holding

public office. In particular, Section 195 of the Constitution has a great

bearing on investments since it states that companies and other

commercial entities owned by the state must abide by generally accepted

standards of good corporate governance. They are also required to

establish transparent, open and competitive procurement systems. Further,

in terms of public administration in cases where state entities are involved in

investments, the officials may be bound by the principles of public

administration and leadership in Section 194 of the Constitution. In

particular, all public officials are bound by the following principles; timeous

response to people's needs, promote public participation in policy making,

accountable to the people and parliament, providing the public with

accessible and adequate information, ensuring that employment especially

within state entities and agencies should be based on merit and equality

between men and women.

34

35

Sec 2 (2) of the Constitution.

Section 3(2)(g)

Pg 20

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

7.1.2. The Zimbabwe Investment Authority Act

36

The Zimbabwe Investment Authority Act is one of the key legal instrument

in discussing responsible investment in Zimbabwe. The Act was passed in

2007. The Act established the Zimbabwe Investment Authority (ZIA), a

statutory body whose main objective is the promotion and co-ordination

of investment in the country. It repeals the Zimbabwe Investment Centre

37

38

Act and the Export Processing Zones Act.

In terms of the Act, all persons intending to invest in Zimbabwe have to 40

39

make an investment application to an Investment Committee established

in terms of the Act. When considering an application for an investment

licence, the ZIA is obliged to take into account various aspects. Key

considerations taken into account include the extent to which skills and

technology will be transferred for the benefit of Zimbabwe and its people;

the extent to which the proposed investment will lead to the creation of

employment opportunities and the development of human resources; the

likely impact the proposed investment is to have on the environment and

the measures proposed to deal with those adverse environmental

consequences. The Investment committee is also responsible for making

recommendations to the ZIA Board to approve or refuse to approve any

investment applications submitted to the Authority by any prospective

domestic or foreign investors. The Board therefore has the powers to reject

or accept the application.

These provisions point to the availability of legislation that can provide for

responsible investment in Zimbabwe. Investors need to be oriented

towards developing the local populace and transferring skills rather than

merely focusing on profit-making. In this regards the Act is one part of the

investment legal framework that can be utilised to provide for responsible

investment in the natural resources sector.

36

[Chapter 14:30]

[Chapter 24:16]

38

[Chapter 14:07].

37

39

40

Sec 13 of the Zimbabwe Investment Authority Act

As above, Sec 6 (1)

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 21

7.1.3. Mines and Minerals Act

41

The Mines and Minerals Act is an old piece of legislation, whose main

objective was to protect mining interests and investments, although it also

contains provisions that can go a long way in ensuring that responsible

investment caters for the rights of both miners and the mining communities

including their land, water, social, health and environmental rights. There

are many provisions related to the issuance of mining licences and

actual mining operations that can be viewed as promoting responsible

investments. The Act identifies about six principal titles for mining and

exploration and these are; Exclusive Prospecting Orders (EPO) and Special

Grants for exploration in reserved areas. The mining licences have different

requirements to be satisfied by applicants that can be viewed as

requirements for all mining investors for both local and foreign depending

on the licence category. In terms of the Mines and Minerals Act, the Mining

Affairs Board has a duty to ensure that all applicants for mining licences

meet the application requirements. For example, foreign investors who

apply for Special Mining Leases in terms of Section 159 of the Mines and

Minerals Act are required to develop a Mining Development Plan that takes

proper account of environmental and safety factors, ensure that the

programme for mining operations will ensure the efficient, timely and

beneficial use of the mineral resources concerned. An applicant for a

Special Mining Lease miner is supposed to present proposals for the

prevention or treatment of pollution, the treatment and disposal of waste

and the protection of rivers and other sources of water, the reclamation and

rehabilitation of land disturbed by mining operation as well as on

monitoring the general effect of mining operations on the environment.42

The applicant for a special mining lease is also supposed to include

proposals for the procurement and use of local goods and services and the

43

employment of Zimbabwean citizens. This requirement enhances the

sharing of benefits from the extractive sector between foreign investor and

the local populace. Other conditions may be imposed as recommendations

44

by the Mining Affairs Board and these may be used to promote

responsible investments in the mining sector.

41

[Chapter 21:05]

Sec 159 (3)(e) (vii) of the Mines and Minerals Act.

43

As above, Sec 160 (2) (e)

44

As above, Sec 159 (3) (g)

42

Pg 22

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

The Mines and Minerals Act also outlines that no claim holder of a

registered mining location should be entitled to peg or acquire any site on

any town lands unless and until he has obtained the consent in writing of

the local authority concerned or, failing the consent of such local authority,

45

the consent of the President.

Furthermore, the Act also places limitations on miners' rights by prohibiting

holders of prospecting licences or of mining locations situated on town

lands from cutting indigenous wood or timber upon such lands without the

consent of a mining commissioner. The mining commissioner

himself/herself should only give his consent when such wood or timber

interferes with prospecting or mining operations or the erection of

buildings required for such operations.46

The Act also seeks to promote establishment of a responsible mining

industry in terms of the disposal of subterranean water. It provides that:47

(1) The holder of any mining location situated on town lands

shall lead into the nearest natural water channel any water

issuing from or brought to the surface of the ground from

the subterraneous working of such location and not being

used by such holder.

(2) The holder, while complying with subsection (1), shall not

pollute any water in such channel

In the Zimbabwean extractive sector, especially in the platinum rich areas

of Shurugwi and Zvishavane, there has been severe problems caused by

the effects of abandoned and uncovered mine pits. Rural and

neighbouring communities living in these areas have always complained,

especially after engagements with the Zimbabwe Environmental Law

Association, about how human life, livestock and children continue to

perish due to the uncovered and unfenced abandoned pits in the areas.48

45

As above, Sec 310

As above, Sec 311

47

As above, Sec 312

48

Page 5,6 of Community Voices on Mining Impacts, ZELA Publication, Harare,2015

46

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 23

Despite the presence of such human hazards, the Mines and Minerals Act

49

provides for ways and means of dealing with mine pits therefore signalling

that the problems with responsible investment in Zimbabwe's mining sector

is not necessarily the absence of proper laws but failure by the mining

investors to comply or failure by government to monitor and inspect

compliance with mining laws. The act provides for the protection and filling

up of open workings by prospectors by requiring that:50

(1) Every person digging a prospecting trench shall throw

out the earth in such manner as to form as far as possible

regular ridges on either side of such trench.

(2) Every person acting under and by virtue of any

prospecting licence, exclusive prospecting order or special

grant shall fence or enclose the mouths of all his shafts and

other open surface workings and excavations sufficiently to

ensure the safety of persons and stock, and he shall

maintain such fencing or other works in good and effective

repair while carrying on his work and before abandoning

any prospecting area, he shall fill in such shafts, workings

and excavations or shall so fence or deal with them as

permanently to ensure the safety of persons and stock, and

shall restore any work previously erected or constructed for

the protection of mine workings which he may have

removed or interfered with, and shall notify the occupier, if

any, of the land that he has completed the protection work

required under the provisions of this subsection:

Provided that if any such shaft, working or excavation is

within twenty metres of a public road or thoroughfare he

shall not fence it, but shall fill it in.

The provisions of the Mines and Minerals Act highlight that, despite the outdatedness and the history of the Act as a product of a colonial system that

was bent on ruthless exploitation of natural resources, there indeed exists

provisions in the same legislation that can make life more bearable for

communities living around mining locations. The solution is in the

49

50

Sec 370 of the Mines and Mineral Act

As above

Pg 24

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

capacitation of both business and government agencies that are

responsible for environmental rehabilitation.

From a human rights perspective however the Act seems to have loopholes

especially as regards the eviction of people living in the vicinity of a mining

location. Such people are referred to as squatters. The Act provides that if it

appears to the mining commissioner that a registered mining location

occupied by any person in reliance on mining title is being occupied

otherwise than for bona fide mining purposes in accordance with the rights

conferred on the miner thereof by section one hundred and seventy-eight,

he may serve an order upon the occupier to vacate the mining location.51

The problem with this provision is that if used against a community member,

it is usually very difficult for the person to effectively challenge the eviction

as there is supposed to be a certain sum of money to be paid on appealing

against the order. 52 This is unfair on community members who may have the

order issued against them without their knowledge, hence violating their

right to freedom from forced eviction.

It is however important to note that since 2015, Parliament and the

Executive are working on a Mines and Minerals (Amendment) Bill.53 If the Bill

pulls through, the amended act will add a whole new Part XVA focusing on

Environmental Protection. A significant development in environmental

protection will be the establishment of a Safety, Health and Rehabilitation

Fund into which every miner shall make an annual contribution. The Fund

shall be used for the rehabilitation of the environment with regard to

environmental degradation caused by, among others, the following mining

54

activities:

Mine fires and explosions;

Entrapments and inundations;

Ground subsidence;

51

As above, Sec 381 (1)

As above, Sec 381 (3).

53

An analysis of the Mines and Minerals Amendment Bill, 2015 is in the process of being

compiled by ZELA and the Publish What You Pay-Zimbabwe (PWYP-ZIM) coalition.

54

Proposed Sec 257E of the amended Mines and Minerals Act

52

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 25

Tailing and waste dump breaches and contamination;

Chemical spillage or acid mine drainage; and

Closed mine risks (chemical leaks, water contamination and collapse).

The amended Act will also require miners to fence off their mining

locations adjacent to pasture lands.55 Land owners and occupiers who have

been injuriously affected by mining operations will be entitled to recover

compensation from the mines through agreements or failing that, through

56

the determination of the Administrative Court. These provisions will go a

long way in addressing farmer-miner conflict.

7.1.4. Environmental Management Act

57

The Environmental Management Act outlines the environmental rights of

every person as well as some components of environmental governance.

In essence the Act guarantees every person the right to live in a clean

environment that does not cause harm to health. The Act also provides

that it is the right of every person to protect the environment for the

benefit of present and future generations. This means even corporates as

legal persons are also included. It is the further duty of every person, in

terms of the legislation, to participate in the implementation of reasonable

legislative policy and measures that prevent pollution and environmental

degradation, as well as measures that secure ecologically sustainable

management and use of natural resources while promoting justifiable

economic and social development.58

One of the major issues of concern to many investors has been the

requirement for carrying out and preparation of Environmental Impact

Assessment Reports by any project proponent whose proposed project is

59

listed in the Act as requiring an EIA. For example, before commencement

of any operations the following projects are required to be undertaken

55

As above, Proposed Sec 85A

As above, Proposed Sec 85B

57

[Chapter 20:27]

58

Sec 4 (1) (c) of the Environmental Management Act

59

Section 97

56

Pg 26

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

after an EIA has been carried out and an EIA Certificate obtained from the

Environmental Management Agency; mining water supply, irrigation,

agriculture, waste treatment, power-generation, oil and gas exploration,

various industries, infrastructure development, forestry, dams and

60

housing projects among others. EIAs are an important tool that can be

used to identify the potential environmental, social and economic impacts

of a particular project on the community or the nation as a whole. Once

the risks or potential impacts are identified, measures to address them

must also be identified. If followed properly EIA's are a sure way of

promoting responsible investments in the country. However, what has

been problematic in practice is that once the investors or project

proponents get the EIA certificate they fail to comply with their EIA

commitments and measures to address the negative impacts of their

operations on communities such as water pollution, land degradation,

displacement of communities and other commitments. Nevertheless,

while monitoring of compliance with EIA requirements has also been

affected by lack of financial and human resources at EMA, many investors

and mining companies in Zimbabwe have been complaining that EIA

requirements and other environmental obligations imposed by EMA are

stifling or affecting investments. This has led to calls by different

stakeholders including the corporate sector for EMA to carry out a study

on the impacts of environmental legislation and requirements on

investments.

The described provisions are main elements that make up the concept of

sustainable development. Such principles and measures of ensuring

sustainable development by the legislature are key factors in attaining

responsible investment in the exploitation and extraction of natural

resources.

61

7.1.5. Labour Act

There cannot be responsibility in investment if human capital in terms of

labour is not adequately catered for. Zimbabwe has a Labour Act whose

60

61

FIRST SCHEDULE (Section 2 and 97)

[Chapter 28:01]

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 27

main objective is the advancement of social justice and democracy in the

62

workplace. The legislation also supports the promotion of human rights

63

in the workplace through providing for non-discrimination on numerous

64

grounds including sex and race as well as fair labour practices and

employees' right to democracy in the workplace.65 This is an enactment

that will be essential in ensuring that labour, as a key human resource, is

cushioned from irresponsible investment. The protection of human rights

in the business environment must start with the labour rights of the

workforce.

The position at the moment is however disadvantageous for labour

following a High Court decision in July 2015 in the Don Nyamande and

66

Anor v Zuva Petroleum case. The judgement led to the loss of jobs at

unilateral three months' notices issued by employers. These developments

especially at a time when the government is busy courting investors by all

means, can easily throw efforts to attain real responsible investment down

the drain.

It is imperative however that labour rights be given priority and

considerations when it comes to investment deals and decision-making.

This is the sector which is directly involved in the production processes as

well as the one that would suffer the worst when it comes to labour rights

violations and irresponsible company shutdowns. Disregard for labour

rights in neighbouring countries like South Africa have in recent years led

to the death of miners after police confrontations in places like Marikana,

67

Rustenburg. At the moment in Zimbabwe, there are serious fights in the

natural resources sector in areas like Chisumbanje where Green Field

Ethanol Projects are being carried out, with serious conflicts68 between

62

Sec 2A (1) of the Labour Act.

As above, Sec 5.

64

As above, Sec 6.

65

As above, Sec 7.

66

SC 43/15

67

http://photoblog.nbcnews.com/_news/2012/08/16/13317646-south-africa-police-fire-onstriking-miners-killing-34

68

Newsday, accessed at

https://www.newsday.co.zw/2014/05/26/green-fuel-petitioned-boundary-clashes-villagers/

63

Pg 28

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

the community, the company, the underpaid workers and the police

continue to ring out. These problems are the natural result of serious

human rights, environmental and labour issues and point out to

irresponsible investment.

7.1.6. Indigenisation and Economic Empowerment Act 69

The Indigenisation and Economic Empowerment Act was a bold move by

the Zimbabwean government to ensure that business profits also

benefit a significant part of historically disadvantaged people. The Act has

influenced policies and statutory instruments that cater for, among others,

Community Share Ownership Trusts and Employee Share Ownership

Trusts.

The Minister of Youth, Indigenisation and Economic Empowerment

70

indicated the following as noteworthy provisions under the Act:

The key objective of the Act is to achieve at least 51% indigenous

shareholding in the majority of businesses in all sectors of the

economy.

The provisions that indigenous Zimbabweans must be suitably

represented in the governing bodies in all these businesses.

The provisions for the establishment of the National Indigenisation

and economic Empowerment Charter. The Charter will provide for

ethical business conduct for all businesses and outlines the

fundamental principles, which have to be observed and followed

by businesses as they undertake their day to day activities.

The provision for the National Indigenisation and Economic

Empowerment Fund. The Fund will provide financial assistance for

share acquisition, warehousing of shares under employee share

ownership schemes or trusts, management buy ins and buy outs,

business start-up, consolidation and expansion.

69

70

[Chapter 14:33]

Kasukuwere, S (Hon), Government Perspective on the Historical and Contextual background to

indigenisation and Empowerment Reforms in Kempton Makamure Labour Journal, Vol 3:2011

(Zimbabwe Labour Centre & KMLLS Board, University of Zimbabwe) ISSN 2223-5337

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 29

It must be mentioned that the Act has led to significant economic

participation and social service delivery in areas like Zvishavane,

Shurugwi, Tongogara and Runde due to the works of Community Share

Ownership Trusts. Furthermore, the Act has ensured that businesses do

not always hide under the voluntary nature of corporate social

responsibility but also empower communities to attain developmental

goals from the proceeds of natural resources found in their localities.

7.2.

POLICY FRAMEWORK

7.2.1. Zimbabwe Agenda for Sustainable Socio-Economic

Transformation (ZimAsset)

The Zimbabwean economic blueprint (2013-2018) is known as Zim Asset.

The blueprint offers some insight into the relevance of both the natural

resources' sector and the need for local empowerment in the sector in

order to enforce responsible investment. The drafters of Zim Asset state

that the blueprint was crafted to achieve sustainable development and

social equity anchored on indigenization, empowerment and

employment creation which will be largely propelled by the judicious

exploitation of the country's abundant human and natural resources.71

This is a clear indication that government policy is now greatly influenced

by the exploitation of the natural resources' sector, however coupled with

the creation of employment and empowerment of locals.

In terms of state policies on responsible investment in the natural

resources sector much needs to be said. Recent times saw the increased

role of Asian countries such as China, India and Japan investing in

Zimbabwe as a result of the pronounced Look East Policy. The involvement

of Asian countries has had adverse impact on the social, political and

economic set up of the nation, with incidences where responsible

71

Foreword to Zim Asset.

Pg 30

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

investment considerations have been thrown out of the window. These

incidences include the controversial allocation of a licence for the

construction of the Chinese Shopping Mall called Long Cheng Plaza on a

72

wetland in Harare. In addition, the use of diamond revenues from Anjin

Pvt to pay a loan for the construction of a military academy by

government instead of making the money available for social services and

other pressing social needs also raises concerns about responsible

investments by the Chinese and the Zimbabwean government.

Since 1980 government came up with various economic policies, which

were at times meant to respond to the global and national dynamics at

each stage of the country's developmental history. These included

structural adjustment programs at the fall of the Soviet Union and the

ending of the Cold War as well as economic recovery strategies after the

73

economy went into a free-fall in the 2000s.

The key economic policy at the moment is the Zimbabwe Agenda for

Sustainable Socio-Economic Transformation (ZIM ASSET) with the vision

outlined as Towards an Empowered Society and a Growing Economy

and the mission being To provide an enabling environment for

sustainable economic empowerment and social transformation to the

people of Zimbabwe. The policy will run from 2013 up to 2018 when the

current government term of office will end and the next general elections

will be held.

The objective of ZIM ASSET is to accelerate economic growth based on

indigenization, empowerment and exploitation of natural resources.

Sadly, Zim Asset woefully misses specific and concrete strategies on

fighting corruption, mismanagement of natural resource revenues,

human rights violations and transparency and accountability. The

programme has four strategic clusters that are identified as; Food Security

and Nutrition; Social Services and Poverty Eradication; Infrastructure and

72

73

http://nehandaradio.com/2013/12/18/chinese-mall-opens-despite-warnings-from-environmentalists/

B. Raftopoulos, 'The Labour Movement and the Emergence of Opposition Politics in Zimbabwe,'

in B. Raftopoulos and L. Sachikonye (eds), Striking Back: The Labour Movement and the PostColonial State in Zimbabwe, 19802000 (Harare: Weaver Press, 2001), pp. 124.

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 31

Utilities; and Value Addition and Beneficiation. On funding, the following,

interalia, have been identified as financing mechanisms for Zim Asset; tax

and non-tax revenue, leveraging resources, creation of a Sovereign

Wealth Fund, re-engagement with the international and multilateral

finance institutions and focusing on Brazil, Russia, India, China and South

Africa (BRICS).

From the above, there are a number of scenarios that may be important to

focus on from an investment perspective. Firstly, given the centrality and

potential of mining as an economic growth factor, there is need to focus on

contract and revenue transparency in the extractive sector. This is because

a lot of mining contracts will be signed with many investors as the country

is trying to re-engage other countries and international players. The most

notable countries are China, India, Brazil and South Africa (the BRICS

countries) as these are viewed as friendly by the new ZANU PF

government. The focus on BRICS is stated in the Zim Asset. It is likely that as

the country faces the economic squeeze due to ZANU PF's

uncreditworthness, in order to attract investors, it will give away many

mining contracts to investors from these countries. The mining investment

deals are likely to be without any stringent terms and conditions. These

companies may as well get a lot of tax exemptions and other incentives.

Further, Zimbabwe may also be an attractive destination for opportunists,

daring and get rich-quick mining outfits and investors that will be attracted

by the use of the United States dollars (US$) and tax incentives in the

country. This is because other countries are hesitant to invest in

Zimbabwe. The opportunists are likely to snap up, in many cases corruptly,

a lot of mining rights and start mining or resell the rights at a much higher

price. This situation would clearly necessitate adoption of measures by civil

society to promote contract and revenue transparency initiatives.

ZIM ASSET also recognises the governments' position on sanctions and

states that the country is experiencing worse conditions in the social and

economic sphere as a result of illegal economic sanctions imposed by

74

Western countries.

74

Executive Summary of the Zimbabwe Agenda for

Sustainable Socio-Economic Transformation (ZIM ASSET)

Pg 32

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

Further, other natural resources related issues pointed out in ZIM ASSET

include its acknowledgement that the country faces severe environmental

management challenges such as pollution, poor waste management,

deforestation and land degradation, veld fires, poaching and biodiversity

75

loss. The economic blueprint also acknowledges that the country is

susceptible to perennial floods and droughts caused by climatic changes

emanating from global warming. In the end all these factors affect the

natural resources sector and climatic issues have an adverse impact on the

country's agro-based economy.

The ZIM ASSET document looks at environmental management as one of

its key result areas under the Food and Nutrition Cluster. The outcome for

that area is to attain improved natural resources management. This will be

achieved by the strengthening and implementation of a climate and

disaster management policy, putting in place a comprehensive veld fire

management framework, capacitating Local authorities and EMA to

manage pollution and waste.

The strategies adopted by the ruling government in terms of ZIM ASSET

consists of continuous advocacy and awareness campaigns, the

enactment of legislation to effectively manage the environment and the

formulation of a national climatic change policy. In this vein, it is sufficient

to note that the Zimbabwe government has already put strides into

coming up with a national climate change policy document, the national

climate change response strategy.

However, it is interesting to note that the Zim-ASSET policy document has

been developed in a country that has witnessed ravages on human rights

violations yet, there is no single mention of the term human rights in the

entire ZIM ASSET document. Meanwhile the document continues to

blame sanctions for the lack of investment on the sanctions imposed on

the country.76 In a nutshell, the policy document does not effectively cater

75

Clause 2.23 of ZIM ASSET

As above, Clause 2.10.

76

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 33

for responsible investment that takes into account human rights principles

in Zimbabwe. The government should come up with an investment

strategy that takes into consideration the human rights aspect of business.

7.2.2. Political Environment

Political infighting both internal and external in the Zimbabwe's biggest

political parties and most importantly since the early 2000s, have led to a

situation where the country's investment environment has become highly

inhospitable. The controversies on the fast track land reform program and

elitist grabbing of businesses under the guise of Indigenisation and

Economic Empowerment also added up to the lack of predictability in

investments in the local economy.

The fighting that rocked Zanu Pf towards the party's congress in 2014

centred on allegation and counter-accusations of political elites who were

in the habit of demanding certain percentages of shares as paybacks for

facilitating investment deals as well as entering into illicit diamond deals

77

and embarking on extortion. The infighting led to the expulsion of the

country's Vice-President. 78

These political fights have contributed to the country itself being regarded

as a high risk destination in terms of foreign investment. Presenting the

2014 National Budget, the Minister of Finance and Economic

Development, Patrick Chinamasa admitted that amongst the key

economic challenges for the country was limited external inflows in the

form of foreign direct investment, lines of credit and grants linked to high

country risk premium resulting in low of confidence by investors.79

77

78

79

The Herald, accessed at http://www.herald.co.zw/vp-mujuru-on-the-ropes/

The Herald, accessed at http://www.herald.co.zw/vp-mujuru-8-ministers-fired/

The 2014 National Budget Statement, towards an Empowered Society and a Growing

Economy Presented to the Parliament of Zimbabwe on 19 December, 2013

Pg 34

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

The political environment in the country is one that has been marked by

human rights violations and glaring lack of policy initiatives by the

government. These violations have become the harbingers of almost

every election in the country. And have the danger of derailing investment

and also bringing down the morale of the labour force, which in many

cases in the violence-prone areas.

Surrounding communities in investment sites have borne the brunt of

political and state or private company-sponsored violence in the past five

years as well. A report released by Human Rights Watch noted that in 2011

even though there was some decrease in violence at the Marange

diamond fields, a research found that Zimbabwe police and private

security guards employed by mining companies in the Marange diamond

80

fields were implicated in abuses against local unlicensed miners.

It is imperative that the nation be committed to upholding democracy,

transparency and human rights if responsible investment strategies are to

work in Zimbabwe. This could involve the crafting of leadership codes for

public office holders in which they make commitment to the eradication of

corruption and lack of transparency in investment ventures in the natural

resources sectors. In this regard the National Code on Corporate

Governance needs to be made into legislation. Furthermore, there must

be rule of law so that no individual, however powerful abuses the state and

natural resources under the guise of political affiliation or supremacy.

80

Human Rights Watch, World Report 2012, accessed at

https://www.hrw.org/world-report/2012/country-chapters/zimbabwe

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 39

8. UN GUIDING PRINCIPLES ON BUSINESS AND

HUMAN RIGHTS

In the extractive sector, principles of international economic and

environmental law are very persuasive in the attainment ad safeguarding

of responsible investment. It remains a matter of political will, however for

the governing powers to utilise such instruments in their homes states. In

this regard the UN Guiding Principles on Business and Human Rights is

very illustrative. However, this remains a soft-law instrument, i.e., it is not a

legally-binding document, as compared to Conventions for example. The

document contains a set of 31 standards, the majority of which are aimed

at the attainment of responsible investment and a sustainable human

rights centred relationship between business, government and the

people. The Principles basically state that whilst it is the responsibility of the

state to provide for the human rights of its citizens, business also have the

responsibility to respect such rights. Furthermore, people affected by the

actions or neglect of business or the state, have the right to efficient and

quick access to remedies.

The Guiding Principles on Business and Human Rights specifically

encourage the state to come up with policies that ensure that human

rights are bot violated by private business concerns. The Principle states

that:

States must protect against human rights abuse within their territory

and/or jurisdiction by third parties, including business enterprises. This

requires taking appropriate steps to prevent, investigate, punish and

redress such abuse through effective policies, legislation, regulations

and adjudication.

In that regard, it would be beneficial for the Zimbabwean government to

ensure that investors carry out their business in a responsible manner

through the formulation of laws and policies that protect the human

rights of all persons as well as providing for environmental protection

and sustainable development. The state should take into account that

An Analytical profile of the Mining Sector in Zimbabwe

Pg 40

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

though the Guiding Principles are not legally binding, their provisions

can be accommodated into domestic statutes and policies and have

the force of law.

The Guiding principles go on to encourage business enterprises to

highlight their commitment toward the respect of human rights. The

respect for human rights by business is a fundamental aspect of

responsible investment. The principles state that businesses should avoid

infringing on the human rights of others and should address adverse

81

human rights impacts with which they are involved. These rights are

outlined to involve at a minimum, those expressed in the International Bill

of Human Rights and the principles concerning fundamental rights set out

in the International labour Organization's Declaration on Fundamental

82

Principles and Rights at Work.

These specific sources have significant impact on worker-and communityrelations with businesses especially in the natural resources sector. In a

country like Zimbabwe, where relations have often times soured between

the two parties and companies, it is a matter of urgency for the state to

include the framework on business and human rights in the country's

investment and labour laws.

81

82

Principle 11 of the UN Guiding Principles on Business and Human Rights.

As above, Principle 12

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 35

9. RECOMMENDATIONS / OPPORTUNITIES FOR RESPONSIBLE

INVESTMENTS IN THE EXTRACTIVE SECTOR

While Responsible Investing in the extractives in Zimbabwe is still to be

fully developed and understood, the subject provides a number of

opportunities for active development and policy influence. There are also

a number of options that can be utilised in order to ensure the proper

promotion of human rights, environmental sustainability and social

responsibility. These include the involvement of impacted stakeholders in

investment decisions and operations, legislative reform and capacitating

institutions involved in responsible investment in Zimbabwe. Potential

options for ensuring overall responsible investments would be for:

The Government through ZIA - OSS to incorporate responsible

investing requirements at the stage of mining contract negotiation

and licensing. Further frameworks can be developed for

monitoring and evaluation progress.

Driving the implementation of the National Code on Corporate

Governance in Zimbabwe (ZIMCODE) which provides an

opportunity for investors to invest in companies that take into

account environmental and social impacts. This code has

requirements for sustainability reporting.

The Zimbabwe Stock Exchange listing rules can be used to speed

up implementation of sustainability reporting across companies

for investors to investing responsible companies.

The Zimbabwe Association of Pension Funds (ZAPF) should

encourage its members to consider environmental, social and

governance issues under the UNPRI when investing mining

companies to drive responsible investing.

The Zimbabwe Investment Authority which is a gateway to

investment in the mining sector to provide policy requirements for

An Analytical profile of the Mining Sector in Zimbabwe

Pg 36

83

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

investors to consider ESG issues when investing.

The amendments to Mines and Minerals Act (Chapter 24:05)should

provide additional provisions that require investors to explicitly

consider environmental and social impacts in their investments.

Mining sector associations such as the Chamber of Mines of

Zimbabwe should adopt a framework for extractive companies to

consider ESG issues like human and community rights as part of

responsible investing and company practice.

The Banking sector can play a role of ensuring that investors are

assessed on their consideration of ESG issues before receiving

financing for their investment options.

The Insurance sector should ensure that environmental and social

issues are covered as part of risk profiling and assessment before

mining investment insurance provision.

Active campaigns by civil society in bringing attention of investment

regulatory authorities, government and institutional investors on

the need for responsible investment in sectors like mining which has

high environmental and social impacts.

Clear consultation with the community and other sectors affected

by investments to ensure the realisation of the constitutional right

for every Zimbabwean to gain access to information, especially the

information required for public accountability on investors. 83

Investors as the most direct beneficiaries of investment projects

should start respecting human and environmental rights. As an

important step in that direction, Zimbabwe must adopt the United

Nations' Guiding Principles on Business and Human Rights. These

are international best practice guides that were endorsed in June

2011 by the Human Rights Council. The principles state clearly that

states are obliged to protect against human rights abuse within

their territory and/or jurisdiction by third parties, including business

Sec 62 (1) of the Constitution

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR Pg 37

84

enterprises. This requires taking appropriate steps to prevent,

investigate, punish and redress such abuse through effective

84

policies, legislation, regulations and adjudication.

Strengthening the capacity of human rights bodies and other

agencies working on environmental sustainability and social

responsibility to support responsible investments. Such bodies

that need strengthened institutional capacity include the

Environmental Management Agency (EMA), the Zimbabwe

Human Rights Commission and the Zimbabwe Investment

Authority. These bodies should be adequately trained on human

rights and business as well as on ways of correctly analysing

company operations. Furthermore, these bodies need to be

scrutinised with the aim of coming up with legal reforms that make

the institutions truly independent or at least, reasonably outside

the grasp of politicians and business.

EMA should closely look at how it can promote and contribute

meaningfully to responsible investments and economic growth. A

research of the impacts of its policies on investments and

community rights is vital.

The Zimbabwe Investment Authority to move from having a Board

almost entirely appointed by politicians (Ministers) and business. It

would be a reasonable that the Board responsible for foreign

investments should also have the representation of civil society,

community leaders as well as labour.

Alignment of legislation with the 2013 Constitution is vital. The

state must commit itself to pass laws that ensure that investors

respect human rights and environmental justice in their operations.

Alignment of legislation such as the Labour Act, Mines and Minerals

Act and the Zimbabwe Investment Authority Act is therefore a

necessity.

Art 1 of the UN Guiding Principles on Business and Human Rights.

Pg 38

RESPONSIBLE INVESTMENT IN THE NATURAL RESOURCES SECTOR

Clear and strong political will on the part of the government to

ensure responsible investment is also important. In this regard,

while government policies such as the Look East Policy are

commendable in light of the economic growth experienced by

countries in the East, these partnerships need to be viewed from a

human rights and environmental justice lens. Furthermore,

political leaders and representatives must take serious note of the

grievances raised by their communities at multi-stakeholder

engagements forums such as the Zimbabwe Alternative Mining

Indaba and during public consultations by Parliamentary Portfolio

Committees responsible for the natural resources sector.

Civil society should strengthen its capacities to claim and demand

for the respect of the rights of communities affected by natural