Академический Документы

Профессиональный Документы

Культура Документы

Francia V IAC

Загружено:

Chino SisonОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Francia V IAC

Загружено:

Chino SisonАвторское право:

Доступные форматы

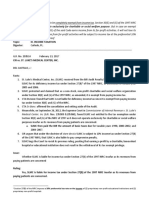

Republic of the Philippines

SUPREME COURT

1977. Hence, his tax obligation had been set-off by operation of law as of

October 15, 1977.

HELD

Manila

THIRD DIVISION

There is no legal basis for the contention.

RATIO

G.R. No. L-67649 June 28, 1988

ENGRACIO FRANCIA, petitioner,

vs.

INTERMEDIATE APPELLATE COURT and HO FERNANDEZ,

respondents.

FACTS

Engracio Francia is the registered owner of a residential lot and a

two-story house

The lot, with an area of about 328 square meters

a 125 square meter portion of Francia's property was expropriated by

the Republic of the Philippines for the sum of P4,116.00 representing

the estimated amount equivalent to the assessed value of the

aforesaid portion.

Since 1963 up to 1977 inclusive, Francia failed to pay his real estate

taxes.

his property was sold at public auction by the City Treasurer of

Pasay City pursuant to Section 73 of Presidential Decree No. 464

known as the Real Property Tax Code in order to satisfy a tax

delinquency of P2,400.00.

On March 20, 1979, Francia filed a complaint to annul the auction

sale.

ISSUE

Francia contends that his tax delinquency of P2,400.00 has been

extinguished by legal compensation. He claims that the government owed

him P4,116.00 when a portion of his land was expropriated on October 15,

By legal compensation, obligations of persons, who in their own right

are reciprocally debtors and creditors of each other, are extinguished

(Art. 1278, Civil Code). The circumstances of the case do not satisfy

the requirements provided by Article 1279, to wit:

(1) that each one of the obligors be bound principally and that

he be at the same time a principal creditor of the other;

xxx xxx xxx

(3) that the two debts be due.

xxx xxx xxx

We have consistently ruled that there can be no off-setting of taxes

against the claims that the taxpayer may have against the

government. A person cannot refuse to pay a tax on the ground

that the government owes him an amount equal to or greater

than the tax being collected. The collection of a tax cannot await

the results of a lawsuit against the government.

Republic v. Mambulao Lumber Co. (4 SCRA 622),

A claim for taxes is not such a debt, demand, contract or

judgment as is allowed to be set-off under the statutes of setoff, which are construed uniformly, in the light of public policy,

to exclude the remedy in an action or any indebtedness of the

state or municipality to one who is liable to the state or

municipality for taxes. Neither are they a proper subject of

recoupment since they do not arise out of the contract or

transaction sued on. ... (80 C.J.S., 7374). "The general rule

based on grounds of public policy is well-settled that no set-off

admissible against demands for taxes levied for general or

local governmental purposes. The reason on which the

general rule is based, is that taxes are not in the nature of

contracts between the party and party but grow out of

duty to, and are the positive acts of the government to the

making and enforcing of which, the personal consent of

individual taxpayers is not required. ..."

This rule was reiterated in the case of Corders v. Gonda (18 SCRA

331) where we stated that: "... internal revenue taxes cannot be the

subject of compensation: Reason: government and taxpayer are

not mutually creditors and debtors of each other' under Article

1278 of the Civil Code and a "claim for taxes is not such a debt,

demand, contract or judgment as is allowed to be set-off."

There are other factors which compel us to rule against the petitioner.

The tax was due to the city government while the expropriation

was effected by the national government.

Moreover, the amount of P4,116.00 paid by the national government

for the 125 square meter portion of his lot was deposited with the

Philippine National Bank long before the sale at public auction of his

remaining property. Notice of the deposit dated September 28, 1977

was received by the petitioner on September 30, 1977. The petitioner

admitted in his testimony that he knew about the P4,116.00 deposited

with the bank but he did not withdraw it. It would have been an easy

matter to withdraw P2,400.00 from the deposit so that he could pay

the tax obligation thus aborting the sale at public auction.

Petitioner had one year within which to redeem his property although,

as well be shown later, he claimed that he pocketed the notice of the

auction sale without reading it.

Вам также может понравиться

- (I4) Bureau of Telecomunications V PSC 29 SCRA 751Документ2 страницы(I4) Bureau of Telecomunications V PSC 29 SCRA 751MhaliОценок пока нет

- Bertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAДокумент2 страницыBertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAStella BertilloОценок пока нет

- Pacific Banking Corp. vs. CAДокумент1 страницаPacific Banking Corp. vs. CAJohn Mark RevillaОценок пока нет

- Sambiaggo CaseДокумент1 страницаSambiaggo CaseMichelle Montenegro - AraujoОценок пока нет

- Tax Obligation Cannot Be Offset by Other ClaimsДокумент1 страницаTax Obligation Cannot Be Offset by Other ClaimsluigimanzanaresОценок пока нет

- CDCP V EstrellaДокумент2 страницыCDCP V Estrelladll123Оценок пока нет

- PAL v. Edu Facts: Motor Vehicle Registration Fees are TaxesДокумент2 страницыPAL v. Edu Facts: Motor Vehicle Registration Fees are TaxesJohn Ferick Tecson CasinabeОценок пока нет

- Report On Estoppel 1437 To 1439Документ2 страницыReport On Estoppel 1437 To 1439Maria LucesОценок пока нет

- Digest Villanueva vs. City of IloiloДокумент2 страницыDigest Villanueva vs. City of IloiloPrecious AnneОценок пока нет

- Pablo Lorenzo vs. Juan Posadas, Jr - Inheritance tax caseДокумент2 страницыPablo Lorenzo vs. Juan Posadas, Jr - Inheritance tax caseJoshua Erik MadriaОценок пока нет

- Today's Court Ruling on Insurance Claim DisputeДокумент20 страницToday's Court Ruling on Insurance Claim DisputewuplawschoolОценок пока нет

- Employing Casuals.: A Quick Guide For Australian EmployersДокумент19 страницEmploying Casuals.: A Quick Guide For Australian EmployersJoel JamesОценок пока нет

- Medicard PhilippinesДокумент2 страницыMedicard PhilippinesNFNLОценок пока нет

- Mayer Steel Pipe Corp. vs. CA Case Digest: Dole Philippines, Inc. V Maritime Company of The PhilippinesДокумент17 страницMayer Steel Pipe Corp. vs. CA Case Digest: Dole Philippines, Inc. V Maritime Company of The Philippinesmina villamorОценок пока нет

- 38 Florendo V PhilamДокумент2 страницы38 Florendo V PhilamRoger Pascual CuaresmaОценок пока нет

- GCL Retirement Plan Tax RefundДокумент6 страницGCL Retirement Plan Tax RefundLord AumarОценок пока нет

- Insurance Case Digests: Malayan Insurance vs. CAДокумент12 страницInsurance Case Digests: Malayan Insurance vs. CAJimcris Posadas HermosadoОценок пока нет

- De Castro v. Court of AppealsДокумент5 страницDe Castro v. Court of AppealswuplawschoolОценок пока нет

- Ma. Reina P. Cabilin 3 Year StudentДокумент3 страницыMa. Reina P. Cabilin 3 Year StudentReinОценок пока нет

- San Miguel Vs Sec. of LaborДокумент5 страницSan Miguel Vs Sec. of LaborMelissa Joy OhaoОценок пока нет

- 3.G.R. No. 103092Документ5 страниц3.G.R. No. 103092Lord AumarОценок пока нет

- Taxation of Life Insurance Proceeds Received by CorporationДокумент2 страницыTaxation of Life Insurance Proceeds Received by CorporationNatasha MilitarОценок пока нет

- 2.2 Mariano Vs Callejas and de Borja GR 16640 July 31, 2009Документ9 страниц2.2 Mariano Vs Callejas and de Borja GR 16640 July 31, 2009Arlyn MacaloodОценок пока нет

- Legal Ethics Case ReportДокумент32 страницыLegal Ethics Case ReportKarl Rigo AndrinoОценок пока нет

- Legprof Cases 1Документ31 страницаLegprof Cases 1kateОценок пока нет

- CIR v. Cebu Portland Cement CoДокумент4 страницыCIR v. Cebu Portland Cement CoPaddy PaulinОценок пока нет

- Baluyot Vs HolganzaДокумент3 страницыBaluyot Vs HolganzaJohn Allen De TorresОценок пока нет

- DOTr DO No. 2015-011 PDFДокумент6 страницDOTr DO No. 2015-011 PDFEarvin James AtienzaОценок пока нет

- GR 182729 Kukan Intl Corp Vs Amor ReyesДокумент10 страницGR 182729 Kukan Intl Corp Vs Amor ReyesNesrene Emy LlenoОценок пока нет

- Villanueva Vs City of IloiloДокумент7 страницVillanueva Vs City of IloilocharmssatellОценок пока нет

- Philippine Phoenix Surety Insurance Inc. Vs WoodworksДокумент3 страницыPhilippine Phoenix Surety Insurance Inc. Vs WoodworksKadzNituraОценок пока нет

- NSB Vs PNB Case DigestДокумент3 страницыNSB Vs PNB Case DigestLily M.Оценок пока нет

- 21 Kapalaran Bus Line V CoronadoДокумент2 страницы21 Kapalaran Bus Line V CoronadoJoyceMendozaОценок пока нет

- Taxation 1 Case Analysis No. 1Документ5 страницTaxation 1 Case Analysis No. 1PJ OrtizОценок пока нет

- Conflict of Laws Case DigestsДокумент12 страницConflict of Laws Case DigestsJane CuizonОценок пока нет

- H. Taxation Other Inherent To Escape From Taxation CasesДокумент36 страницH. Taxation Other Inherent To Escape From Taxation CasesErwin April MidsapakОценок пока нет

- Transpo finaLS CasesДокумент93 страницыTranspo finaLS CasesNikki SiaОценок пока нет

- Transpo Public ServiceДокумент3 страницыTranspo Public ServiceJImlan Sahipa IsmaelОценок пока нет

- Tio v. Videogram Regulatory Board, G.R. No. L-75697, June 18, 1987Документ2 страницыTio v. Videogram Regulatory Board, G.R. No. L-75697, June 18, 1987Ree EneОценок пока нет

- CIR vs. St. Luke's Medical Center (2017)Документ17 страницCIR vs. St. Luke's Medical Center (2017)Phulagyn CañedoОценок пока нет

- Ang v. American Steamship Agencies, Inc.Документ1 страницаAng v. American Steamship Agencies, Inc.Krizzia GojarОценок пока нет

- 48 Philippine American Life Insurance Co. v. PinedaДокумент3 страницы48 Philippine American Life Insurance Co. v. PinedaKaryl Eric BardelasОценок пока нет

- First Malayan Leasing V CA (TRANSPO)Документ4 страницыFirst Malayan Leasing V CA (TRANSPO)Nenzo CruzОценок пока нет

- Insurance 2 - Ong - RCBC V CAДокумент2 страницыInsurance 2 - Ong - RCBC V CADaniel OngОценок пока нет

- Tolentino Vs Secretary of Finance PDFДокумент82 страницыTolentino Vs Secretary of Finance PDFCJ CasedaОценок пока нет

- RA 8291 GSIS ActДокумент19 страницRA 8291 GSIS ActAicing Namingit-VelascoОценок пока нет

- Surety liability without written contractДокумент2 страницыSurety liability without written contractRoger Pascual CuaresmaОценок пока нет

- 11 Lorenzo v. Posadas G.R. No. 43082 (1937)Документ5 страниц11 Lorenzo v. Posadas G.R. No. 43082 (1937)Angelie ManingasОценок пока нет

- Tax 1 CasesДокумент625 страницTax 1 CasesDence Cris RondonОценок пока нет

- Cases in Insurance Law (Part I)Документ71 страницаCases in Insurance Law (Part I)kingofhearts006Оценок пока нет

- Perkins Vs RoxasДокумент2 страницыPerkins Vs RoxasRealKD30Оценок пока нет

- 3 Kapalaran Bus Line Vs CoronadoДокумент9 страниц3 Kapalaran Bus Line Vs CoronadoGillian Alexis ColegadoОценок пока нет

- Roman Catholic Bishop v. De la PeñaДокумент2 страницыRoman Catholic Bishop v. De la PeñaChin MartinzОценок пока нет

- Management Prerogative Transfer Not Illegal TerminationДокумент2 страницыManagement Prerogative Transfer Not Illegal TerminationRuss Tuazon100% (1)

- Case 01 - Escano, Et Al vs. Ortigas JR., GR No. 151953, June 29, 2007Документ5 страницCase 01 - Escano, Et Al vs. Ortigas JR., GR No. 151953, June 29, 2007bernadeth ranolaОценок пока нет

- Air France V Court of AppealsДокумент3 страницыAir France V Court of AppealsShanicaОценок пока нет

- G.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestДокумент1 страницаG.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestKTОценок пока нет

- 06 Francia V IACДокумент2 страницы06 Francia V IACHappy Dreams PhilippinesОценок пока нет

- Cases TaxДокумент59 страницCases TaxAyme SoОценок пока нет

- Francia Intermediate Appellate Court, G.R. No. 76749Документ5 страницFrancia Intermediate Appellate Court, G.R. No. 76749Mp CasОценок пока нет

- Third Division (G.R. No. 156966. May 7, 2004) PILIPINO TELEPHONE CORPORATION, Petitioner, vs. DELFINO TECSON, Respondent. Vitug, J.Документ2 страницыThird Division (G.R. No. 156966. May 7, 2004) PILIPINO TELEPHONE CORPORATION, Petitioner, vs. DELFINO TECSON, Respondent. Vitug, J.Chino SisonОценок пока нет

- Raymond Vs CAДокумент2 страницыRaymond Vs CAChino SisonОценок пока нет

- Esuerte v. CAДокумент2 страницыEsuerte v. CAChino SisonОценок пока нет

- REY v. ANSONДокумент2 страницыREY v. ANSONChino SisonОценок пока нет

- MACTAN ROCK INDUSTRIES, INC. v. GERMOДокумент2 страницыMACTAN ROCK INDUSTRIES, INC. v. GERMOChino SisonОценок пока нет

- DACOYCOY vs. IACДокумент2 страницыDACOYCOY vs. IACChino SisonОценок пока нет

- CAPATI V OcampoДокумент1 страницаCAPATI V OcampoChino SisonОценок пока нет

- FEDERAL EXPRESS CORPORATION VДокумент2 страницыFEDERAL EXPRESS CORPORATION VChino SisonОценок пока нет

- Decision: Petitioners Respondents "Invited"Документ44 страницыDecision: Petitioners Respondents "Invited"Maria Theresa AlarconОценок пока нет

- Mortgage Foreclosure PrescriptionДокумент3 страницыMortgage Foreclosure PrescriptionChino SisonОценок пока нет

- LAND BANK OF THE PHILIPPINES v. HEREDEROS DE CIRIACO CHUNACO DISTILERIA, INC.Документ2 страницыLAND BANK OF THE PHILIPPINES v. HEREDEROS DE CIRIACO CHUNACO DISTILERIA, INC.Chino Sison100% (2)

- Civpro CasesДокумент24 страницыCivpro CasesChino SisonОценок пока нет

- GAMBITO v. BACENAДокумент3 страницыGAMBITO v. BACENAChino SisonОценок пока нет

- AMERICAN POWER CONVERSION CORPORATION v. LIMДокумент3 страницыAMERICAN POWER CONVERSION CORPORATION v. LIMChino SisonОценок пока нет

- Cases in Evidence Rule 128 - 129Документ38 страницCases in Evidence Rule 128 - 129Chino SisonОценок пока нет

- Chavez v. PCGG, 299 Scra 744 (1998)Документ9 страницChavez v. PCGG, 299 Scra 744 (1998)Chino SisonОценок пока нет

- Civil LiabilityДокумент39 страницCivil LiabilityChino SisonОценок пока нет

- China Banking Corp. v. CTAДокумент9 страницChina Banking Corp. v. CTAChino SisonОценок пока нет

- Code of CommerceДокумент56 страницCode of Commerceviktor samuel fontanilla91% (11)

- Cases in Recruitment and PlacementДокумент22 страницыCases in Recruitment and PlacementChino SisonОценок пока нет

- Compiled Cases in BankingДокумент42 страницыCompiled Cases in BankingChino SisonОценок пока нет

- Cases in EvidenceДокумент47 страницCases in EvidenceChino SisonОценок пока нет

- Philippine inheritance dispute over will of American citizenДокумент125 страницPhilippine inheritance dispute over will of American citizenChino SisonОценок пока нет

- Cases For Recruitment of Local and Migrant WorkersДокумент4 страницыCases For Recruitment of Local and Migrant WorkersChino SisonОценок пока нет

- Canon 10-12Документ60 страницCanon 10-12Chino SisonОценок пока нет

- Enrile Bail CaseДокумент13 страницEnrile Bail CaseChino SisonОценок пока нет

- Cases VAT 1-5Документ141 страницаCases VAT 1-5Chino SisonОценок пока нет

- Supreme Court probes falsified resolution in Urban Bank caseДокумент69 страницSupreme Court probes falsified resolution in Urban Bank caseChino SisonОценок пока нет

- Ra 9243Документ3 страницыRa 9243Chino SisonОценок пока нет

- A.M. No. 10-10-4-SCДокумент24 страницыA.M. No. 10-10-4-SCChino SisonОценок пока нет

- Cost SheetДокумент29 страницCost Sheetnidhisanjeet0% (1)

- Extinguishment of Obligations: General ProvisionsДокумент72 страницыExtinguishment of Obligations: General ProvisionsSergio ConjugalОценок пока нет

- Draft Cost Accounting Standard-6 On Determination of Arm'S Length PriceДокумент12 страницDraft Cost Accounting Standard-6 On Determination of Arm'S Length PricessneeerajОценок пока нет

- Bar Exam Questions For PropertyДокумент20 страницBar Exam Questions For PropertyMoon Beams100% (7)

- Project Policy 2018Документ13 страницProject Policy 2018ibrahim khan100% (6)

- Nat Law 2 - CasesДокумент12 страницNat Law 2 - CasesLylo BesaresОценок пока нет

- DerivativesДокумент53 страницыDerivativesnikitsharmaОценок пока нет

- Claim Form II B Departmental ExecutionДокумент1 страницаClaim Form II B Departmental ExecutionChimakurthy NagarapanchayatОценок пока нет

- FXTM Refer A Friend TCs - Final VersionДокумент5 страницFXTM Refer A Friend TCs - Final VersionMuhaemin Umar PawaraОценок пока нет

- 12 International Hotel Corp. v. Joaquin, JR PDFДокумент16 страниц12 International Hotel Corp. v. Joaquin, JR PDFSarah C.Оценок пока нет

- Banco Filipino Savings and Mortgage Bank Vs CAДокумент2 страницыBanco Filipino Savings and Mortgage Bank Vs CAcmv mendozaОценок пока нет

- Far East Bank Vs Gold PalaceДокумент2 страницыFar East Bank Vs Gold PalaceBAROPS0% (1)

- Tamil Nadu Cultivating Tenants Arrears of Rent (Relief) Act, 1980Документ19 страницTamil Nadu Cultivating Tenants Arrears of Rent (Relief) Act, 1980Latest Laws TeamОценок пока нет

- My Labor Rev. Chapte 0ne of AzucenaДокумент15 страницMy Labor Rev. Chapte 0ne of Azucenafranz100% (2)

- 2 Grammar Test PDFДокумент18 страниц2 Grammar Test PDFHa Ni MaziahОценок пока нет

- India - Relocation Policy - 2014 PDFДокумент5 страницIndia - Relocation Policy - 2014 PDFmahakagrawal3100% (1)

- Standard Costing ProblemsДокумент2 страницыStandard Costing ProblemsDave ScottОценок пока нет

- Compensation Practices at NBPДокумент9 страницCompensation Practices at NBPBen TenisonОценок пока нет

- Zulueta V. Pan-Am (January 8, 1973) : Digest By: Jedd Hernandez D 2015 Persons and Family Relations Prof. K. LegardaДокумент2 страницыZulueta V. Pan-Am (January 8, 1973) : Digest By: Jedd Hernandez D 2015 Persons and Family Relations Prof. K. LegardalabellejolieОценок пока нет

- Development AgreementДокумент17 страницDevelopment AgreementSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್67% (3)

- DACION-EN-PAGO AGREEMENT ASSIGNMENTДокумент3 страницыDACION-EN-PAGO AGREEMENT ASSIGNMENTGlenda Abrenica100% (5)

- Land Sale Rescinded Due to Lack of DeliveryДокумент2 страницыLand Sale Rescinded Due to Lack of DeliveryJejomarie TatoyОценок пока нет

- Insurance Contract DisputeДокумент4 страницыInsurance Contract DisputeEzra Dan BelarminoОценок пока нет

- Professional Practice PPT - 23.02.20Документ14 страницProfessional Practice PPT - 23.02.20Harsha AlexОценок пока нет

- Employment Contract for Sri Lankan HousekeepersДокумент7 страницEmployment Contract for Sri Lankan Housekeepersnmee001Оценок пока нет

- 5 Hire - Purchase - System PDFДокумент17 страниц5 Hire - Purchase - System PDFnavin_raghu0% (1)

- M.E. Gray V Insular Lumber CompanyДокумент2 страницыM.E. Gray V Insular Lumber CompanyAllen Windel BernabeОценок пока нет

- CH 14Документ44 страницыCH 14heema222Оценок пока нет

- Lecture 9 - CIE 531Документ63 страницыLecture 9 - CIE 531Penelope MalilweОценок пока нет

- YyyДокумент29 страницYyyJed Riel Balatan0% (1)