Академический Документы

Профессиональный Документы

Культура Документы

Meh

Загружено:

pokeball001Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Meh

Загружено:

pokeball001Авторское право:

Доступные форматы

1

Tax I Syllabus SY 2016 2017

Lyceum College of Law

PART I

CHAPTER I:

Atty. Jon Ligon

TAXATION IN GENERAL

GENERAL PRINCIPLES OF TAXATION

i. TAXATION

A.

B.

C.

Definition

71 Am Jur 2nd 342

Readings: Are Taxes Evil? By Anthony Aguilar

Get to know about Boston Tea Party

Nature of Internal Revenue Law Hilado v CIR 100 Phil 288

Scope and Nature of Taxation

1. Scope

71 Am Jur 2nd 394-395

Sison v Ancheta 130 SCRA 654

citing C.J. John Marshall (McCulloch v Maryland)

and J. Holmes (Panhandle Oil Co. v Mississippi)

Reyes v. Almanzor 196 SCRA 322

2. Nature

71 Am Jur 2nd 397-398

S28 AVI, 1987Constitution

3. Cases

CIR v Pineda 21 SCRA 105

Phil. Guaranty v CIR 13 SCRA 775

Collector v Yuseco 3 SCRA 313

CIR v Algue, Inc. L-28896 Feb 17, 1988

D. Aspects of Taxation

71 Am Jur 2nd 342

E. Underlying theory and basis 71 Am Jur 2nd 346-347

F.

Principles of a sound tax system Chavez v Ongpin 186 SCRA 331

InternetReadings:

a.) Obama Tax Fainess Plan

http://obama.3cdn.net/b7be3b7cd08e587dca_v852mv8ja.pdf

b.) Tax Fairness, Goodluck w/ that

http://money.cnn.com/2009/04/20/pf/taxes/obama_tax_fairness/index.htm

c.) Transgender Tax Collectors

http://edition.cnn.com/2011/WORLD/asiapcf/04/14/pakistan.tax.collectors/index.html

?hpt=C1

d.) Tax Collectors Lifestyle in Ukraine

http://money.cnn.com/video/news/2014/04/30/n-ukraine-tax-office-secretluxury.cnnmoney/

G.

Comparison with Police Power and Eminent Domain

1. Similarities

2. Distinctions 71 Am Jur 2nd 395-397

3. Cases

Phil Match Co. v. Cebu 81 SCRA 99

Matalin v Mun. Council of Malabang 143 SCRA 404

Lutz v Araneta 98 Phil 48

NTC v CA 311 SCRA 508

ii. TAXES

A.

B.

C.

Definition

71 Am Jur 2nd 343-346

Essential Characteristics of Taxes

Taxes distinguished from:

1. Debts

71 Am Jur 2nd 345-346

Caltex v COA 208 SCRA 726

Francia v IAC 162 SCRA 753

RP v Ericta and Sampaguita Pictures 172 SCRA 653

Tax I Syllabus SY 2016 2017

Lyceum College of Law

2.

3.

4.

5.

6.

Atty. Jon Ligon

Domingo v Carlitos 8 SCRA 443

License Fees.

71 Am Jur 2nd 352-353

Progressive Dev. Corp. v QC 172 SCRA 629

PAL v Edu 164 SCRA 320

ESSO v CIR 175 SCRA 149

Special Assessments (now special levies under the 1991 Local

Government Code)

Apostolic Prefect v Treasurer of Baguio 71 Phil. 547

Tolls

71 Am Jur 351

Penalties NDC v CIR 151 SCRA 472

Custom duties

iii. CLASSIFICATION OF TAXES

A.

B.

C.

D.

E.

F.

As to subject matter

71 Am Jur 2nd 357-361

As to incidence 71 Am Jur 2nd 354

As to determination of amount 71 Am Jur 2nd 355

As to purposes

As to scope

As to graduation or rate

CHAPTER II:

I.

LIMITATION UPON THE POWER OF TAXATION

INHERENT LIMITATIONS

A.

B.

C.

D.

E.

Public Purposes

1. Meaning of public purpose

2. Cases:

Lutz v Araneta 98 Phil. 48

Pascual v Sec. Of Public Works 110 Phil. 331

Taxing power may not be delegated

1. In general Delegata potestas non potest delegari

2. Exceptions

3. Cases:

Phil Comm. Satellite Corp. v. Alcuaz 180 SCRA 218

Meralco v. Prov. Of Laguna 306 SCRA 750

Pepsi-Cola Co. v City of Butuan 24 SCRA 789

Smith Bell & Co. v CIR, L-28271 July 25, 1975

Exemption of government agencies

1. Reason for the exemption

2. Exception

a. S27(C) as amended by RA 9337

b. S30(I) NIRC

c. S32(B)(7)(b)

3. Exemptions on GOCCs

a. Philippine Ports Authority vs. City of Iloilo GR No.

109791, July 14, 2003

b. MIAA vs. CA GR 155650 July 20, 2006

c. Philippine Fisheries Development Authority vs. CA GR

169836 July 31, 2007

International Comity

- in par parem, non habet imperium

Territoriality or Situs of Taxation

1. Meaning and scope of limitation

2. Situs of Taxation

a. Meaning

b. Determination of Situs

c. Situs of subjects of taxation

Tax I Syllabus SY 2016 2017

Lyceum College of Law

Atty. Jon Ligon

Persons

S157-158, 1991 LGC

ii. Lex Situs or Lex Rei Sitae - Real Property

iii.

Mobilia Sequuntur Personam - Personal Property

iv. Income

v. Business, Occupation, Transaction

vi. Transfer of property by death or gift

d. Multiple situs of taxation

Cases

Manila Gas v. Collector 62 Phil 895

Vegetable Oil Corp. v Trinidad 45 Phil. 822

Wells Fargo Bank v Col 70 Phil. 325

i.

3.

II.

CONSTITUTIONAL LIMITATIONS

A.

B.

C.

D.

E.

F.

G.

H.

I.

Due process Clause

S1(1) AIII, 1987 Constitution

Com. of Customs v CTA & Campos Rueda Co. 152 SCRA 641

Phil Bank of Comm v. CIR 302 SCRA 241

Sison v Ancheta 130 SCRA 654

Equal Protection Clause

S1 AIII, 1987 Constitution

Ormoc Sugar Co. v. Treasurer of Ormoc City 22 SCRA 603

Villegas v. Hsui Chiong Tsai Pao 86 SCRA 270

Shell Co. v Vano 94 Phil. 388

Tiu v. CA 301 SCRA 279

Rule of Taxation shall be Uniform and Equitable

S28(1) AVI, 1987 Constitution

Pepsi Cola v Butuan City 24 SCRA 789

Manila Race Horse v dela Fuente, 88 Phil. 60

Sison v. Ancheta 130 SCRA 654

Tolentino v. Sec of Fiance 249 SCRA 628

Non-Impairment of Contracts

S10 AIII & S11, AXII, 1987 Constitution

CIR v Lingayen Gulf Electric Co. 164 SCRA 67

Misamis Oriental v CEPALCO, 181 SCRA 38

Meralco v. Prov. Of Laguna 306 SCRA 750

Non-imprisonment for non payment of poll tax

S20 AIII, 1987 Constitution.

Prohibition against taxation of religious, charitable entities

S28(3) AVI, 1987 Constitution

Dealing with the Pajeros Joaquin Bernas

http://opinion.inquirer.net/7518/dealing-with-the%e2%80%98pajeros%e2%80%99

Lladoc v CIR 14 SCRA 292

Province of Abra v Hernando 107 SCRA 1021

Lung Center v QC et. al. GR No. 144104, June 29, 2004

Prohibition against taxation of non-stock non-profit educational

institutions

S4(3) AXIV, 1987 Constitution

S30(H), NIRC

BIR Revenue Memorandum Circular (RMC) No. 45-95

CIR v. CA & YMCA 298 SCRA 83

Freedom of religious professional and worship

S5 AIII, 1987 Constitution

American Bible Society v Manila, 101 Phil. 386.

Passage of tax bills / Granting of tax exemption

S24 AVI, 1987 Constitution

S28(4) AVI, 1987 Constitution

Tax I Syllabus SY 2016 2017

Lyceum College of Law

J.

K.

III.

Tolentino v Secretary of Finance 249 SCRA 628

Veto power of the President S27(2) AVI, 1987 Constitution

Non-impairment of SC Jurisdiction S5(2)(b) AVIII, 1987 Consti.

DOUBLE TAXATION

A.

B.

C.

Definition and Nature. 71 Am Jur 2nd 362-365

Cases:

Procter & Gamble Co. v Mun of Jagna 94 SCRA 894

Sanchez v CIR 97 Phil. 687

Punzalan v Mun Board of Manila 95 Phil. 46

Methods of avoiding the occurrence of double taxation

CIR v. SC Johnson & Sons, Inc. 309 SCRA 87

CHAPTER III:

I.

Atty. Jon Ligon

EXEMPTIONS FROM TAXATION

IN GENERAL

A.

Definition

B.

Kinds of Exemption

C.

Rationale of giving tax exemption

D.

Nature of power to grant tax exemption

E.

Grounds for tax exemption

F.

Examples of Exemption

1.

Constitutional Exemption

2.

Legislative grant of exemption

3.

Exemption created by Treaty

G. Cases:

CIR v Botelho

Shipping Corp. 20 SCRA 487

CIR v CTA, GCL Retirement Plan, 207 SCRA 487

CIR v Guerrero, 21 SCRA 180

Phil. Acetylene v CIR, 20 SCRA 1056

Maceda v Macaraig, Jr 197 SCRA 771

Sea-Land Service v. CA 357 SCRA 441

H. Tax Exemption vs. Tax Amnesty

1. Definition

2. People v Cataneda GR No. L-46881, Sept 15, 1988

3. Phil. Banking vs.CIR; GR No. 170574, Jan. 30, 2009

4. CIR v Marubeni; GR No. 137377 Dec 18, 2001

5. Sample Amnesty Program: RA No. 9480

I. Tax Exemption vs. Tax Avoidance vs. Tax Evasion

1. Definitions

2. CIR v. The Estate of Benigno P. Toda GR 147188, Sept 14, 2004

3. CIR vs. Arieta; GR. No. 164152 Jan. 21, 2010

II.

CONSTRUCTION OF STATUTORY EXEMPTIONS

A.

B.

C.

D.

General rule

Applicability to Claims for Refund

When exemption statutes are liberally construed

Cases: E. Rodriguez, Inc. v Collector 28 SCRA 119

Republic Flour Mills v CIR, 31 SCRA 148

Wonder Mechanical Engineering v CTA 64 SCRA 555

Luzon Stevedoring Corp. v CTA 163 SCRA 647

Floro Cement v Hen. Gorospe 200 SCRA 480

CIR v Ledesma 31 SCRA 95

Resins, Inc. v Auditor Gen. 25, SCRA 754

Tax I Syllabus SY 2016 2017

Lyceum College of Law

Atty. Jon Ligon

CIR v. CA & YMCA 298 SCRA 83

CHAPTER IV:

I.

SOURCES AND CONSTRUCTION OF TAX LAWS

SOURCES OF TAX LAW

A. Statutes

B. Revenue Regulations

C. Revenue Memorandum Circulars/Orders

- BIR Revenue Administrative Order (RAO) No. 2-2001

D. BIR Rulings

- BIR Revenue Administrative Order (RAO) No. 2-2001

- Revenue Regulation 5-2012

E. Opinions of the Secretary of Justice

F. Legislative Materials

G. Court Decision

II.

THE STATUTE

A.

III.

REVENUE REGULATIONS

A.

IV.

BIR-RR

1. Authority to promulgate. S244

2. Specific provisions to be contained in RR. S245

3. What is the force and effect of RR?

Art. 7, Civil Code

Asturias Sugar Central v Comm., 29 SCRA 617

BIR RULINGS

A.

B.

V.

Existing Tax Law

1. National

a. National Internal revenue Code of 1997

b. Tariff and Customs Code

2. Local

a. Book II, 1991 Local Government Code

Power of CIR to Interpret Tax Laws. S4

Non-Retroactivity of Rulings

S246

CIR v Burroughs Ltd., G.R. 66653. June 19, 1986

CIR v Mega Gen. Merchandising 166 SCRA 166

1. Exceptions

PBCOM vs. CIR 302 SCRA 241

CONSTRUCTION OF TAX LAW

A.

B.

C.

General Rules of Construction of Tax Laws

Stevedoring v Trinidad, 43 Phil. 803

Mandatory vs. Directory Provisions

Serafica v Treasurer of Ormoc City 27 SCRA 110

Application of Tax Laws

Tax I Syllabus SY 2016 2017

Lyceum College of Law

MANDATORY REFERENCE

National Internal Revenue Code of 1997

Republic Act 8424

Amendments to Title II of NIRC of 1997

Republic Act No. 9294

Republic Act No. 9337

Republic Act No. 9257

Republic Act No. 9504

Other SUGGESTED REFERENCES:

Fundamentals of Taxation by De Leon

Philippine Income Tax by Mamalateo

Taxation and Jurisprudence by Justice Vitug

Income Tax, Law & Accounting by Virgilio Reyes

Other Tax Books/Reviewers

Note:

RR BIR Revenue Regulations

RMC BIR Revenue Memorandum Circulars

Atty. Jon Ligon

Вам также может понравиться

- Taxation Law 1Документ21 страницаTaxation Law 1Bill DanaoОценок пока нет

- Taxation SyllabusДокумент7 страницTaxation Syllabusthirdy demaisipОценок пока нет

- Rem - CrimProCaseDigest - Rule 116 To 127 - 1st 2nd Batch PDFДокумент66 страницRem - CrimProCaseDigest - Rule 116 To 127 - 1st 2nd Batch PDFKayОценок пока нет

- Mechanics For ComplaintsДокумент4 страницыMechanics For ComplaintsMark Anthony AlvarioОценок пока нет

- Digested Cases Art15-20 by KieferДокумент8 страницDigested Cases Art15-20 by KieferkiefersagaОценок пока нет

- Atty Ligon Tx2Документ92 страницыAtty Ligon Tx2karlОценок пока нет

- Revenue Memorandum Circular No 48-90Документ2 страницыRevenue Memorandum Circular No 48-90UGHNESSОценок пока нет

- National Privacy Commission: Republic of The PhilippinesДокумент10 страницNational Privacy Commission: Republic of The PhilippinesLibertas KennelОценок пока нет

- 19 Surviving Heirs v. LindoДокумент6 страниц19 Surviving Heirs v. LindoAleine Leilanie OroОценок пока нет

- CIR Vs LednickyДокумент1 страницаCIR Vs Lednickyscartoneros_1Оценок пока нет

- Case1 Wassmer Vs Velez 12 SCRA 649Документ2 страницыCase1 Wassmer Vs Velez 12 SCRA 649Karyl Mae Bustamante OtazaОценок пока нет

- Central Vs CTAДокумент2 страницыCentral Vs CTATon Ton CananeaОценок пока нет

- Garchitorena v. PanganibanДокумент1 страницаGarchitorena v. PanganibanAnonymous MmbSn3Оценок пока нет

- Cta CaseДокумент10 страницCta Caselucial_68Оценок пока нет

- 1987 480us321 Arizona Vs HicksДокумент5 страниц1987 480us321 Arizona Vs HicksnikkaremullaОценок пока нет

- Wills and Succession Course Outline and Cases (New)Документ11 страницWills and Succession Course Outline and Cases (New)Pauline Mae AranetaОценок пока нет

- Ateneo Central Bar Operations 2007 Remedial Law Summer ReviewerДокумент74 страницыAteneo Central Bar Operations 2007 Remedial Law Summer Reviewertere_aquinoluna828Оценок пока нет

- Atty BagaresДокумент188 страницAtty Bagaresamun dinОценок пока нет

- Punsalan Vs Municipal Board of ManilaДокумент3 страницыPunsalan Vs Municipal Board of ManilaGayFleur Cabatit RamosОценок пока нет

- Lecture Notes On Civil ProcedureДокумент152 страницыLecture Notes On Civil Procedurekathygvas100% (1)

- Adelfa Properties V CAДокумент3 страницыAdelfa Properties V CAairlockОценок пока нет

- Gaite V FonacierДокумент3 страницыGaite V FonacierKat Manongsong-AntalanОценок пока нет

- Atty. Legarda - Outline in Persons 2018Документ58 страницAtty. Legarda - Outline in Persons 2018Mikhel BeltranОценок пока нет

- 029-Magbanua, Et Al. v. Uy G.R. No. 161003 May 6, 2005Документ6 страниц029-Magbanua, Et Al. v. Uy G.R. No. 161003 May 6, 2005Jopan SJОценок пока нет

- Crim Rev DigestsДокумент188 страницCrim Rev DigestsSheena TОценок пока нет

- 06 CIR Vs Marubeni CorpДокумент22 страницы06 CIR Vs Marubeni CorpEMОценок пока нет

- Human Rights Assignement 3Документ9 страницHuman Rights Assignement 3ADОценок пока нет

- Case of Part of Res GestaeДокумент8 страницCase of Part of Res GestaeNasheya InereОценок пока нет

- Atty Vera Cruz Class NotesДокумент2 страницыAtty Vera Cruz Class Notesmlmagz123Оценок пока нет

- Digest CIR Vs Club FilipinoДокумент5 страницDigest CIR Vs Club FilipinoKenneth Ray AgustinОценок пока нет

- De La Salle University vs. de La Salle University Employees Association (Dlsuea-Nafteu) G.R. No. 169254 August 23, 2012 Leonardo-De Castro, J.: FactsДокумент22 страницыDe La Salle University vs. de La Salle University Employees Association (Dlsuea-Nafteu) G.R. No. 169254 August 23, 2012 Leonardo-De Castro, J.: FactsBenjie PangosfianОценок пока нет

- Dael vs. Intermediate Appellate CourtДокумент17 страницDael vs. Intermediate Appellate CourtPrincess MadaniОценок пока нет

- Persons Reviewer PDFДокумент25 страницPersons Reviewer PDFFroilan Richard RamosОценок пока нет

- Hernandez v. OcampoДокумент14 страницHernandez v. Ocampomccm92Оценок пока нет

- CrimRev Notes - Book IДокумент34 страницыCrimRev Notes - Book IAgnes Bianca MendozaОценок пока нет

- Fortuitous Event DoctrinesДокумент4 страницыFortuitous Event DoctrinesJustin YañezОценок пока нет

- Nikko Hotel Manila Garden Vs Roberto ReyesДокумент20 страницNikko Hotel Manila Garden Vs Roberto ReyesJes MinОценок пока нет

- Digest Garchitorena Vs PanganibanДокумент2 страницыDigest Garchitorena Vs PanganibanDiana BoadoОценок пока нет

- Capitol Wireless, Inc. vs. Confesor, 264 SCRA 68 (1996Документ14 страницCapitol Wireless, Inc. vs. Confesor, 264 SCRA 68 (1996Mei SuyatОценок пока нет

- Agulto V CAДокумент1 страницаAgulto V CAjuan aldabaОценок пока нет

- Summary For The Exam ObliconДокумент6 страницSummary For The Exam Obliconjinxz_mayetОценок пока нет

- Reparations Commission V Universal Deep-SeaДокумент2 страницыReparations Commission V Universal Deep-SeaSocОценок пока нет

- Gan Tion V CAДокумент3 страницыGan Tion V CAslashОценок пока нет

- First Division: Development Bank OF THE Philippines, Petitioner, vs. Court of Appeals and Lydia CUBA, RespondentsДокумент23 страницыFirst Division: Development Bank OF THE Philippines, Petitioner, vs. Court of Appeals and Lydia CUBA, RespondentsEMОценок пока нет

- TAX 1 ExamДокумент3 страницыTAX 1 ExamOnat PОценок пока нет

- Tax Remedies DigestsДокумент19 страницTax Remedies DigestsHiedi SugamotoОценок пока нет

- 14 Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 September 26 2012Документ28 страниц14 Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 September 26 2012DannethGianLatОценок пока нет

- Poli by Judge GitoДокумент37 страницPoli by Judge GitoKing KuntaОценок пока нет

- SuccessionДокумент5 страницSuccessionAlexis ArejolaОценок пока нет

- Martinez Vs Martinez PDFДокумент2 страницыMartinez Vs Martinez PDFMichael VariacionОценок пока нет

- Kabankalan Sugar Co. vs. Pachero: de Lim vs. Sun Life Assurance Co. 41 Phil. 263Документ11 страницKabankalan Sugar Co. vs. Pachero: de Lim vs. Sun Life Assurance Co. 41 Phil. 263gabbieseguiranОценок пока нет

- Batch PrimerДокумент23 страницыBatch PrimerAlexis Dominic San ValentinОценок пока нет

- People vs. VillamarДокумент5 страницPeople vs. VillamarNash LedesmaОценок пока нет

- Virata V Wee To DigestДокумент29 страницVirata V Wee To Digestanime loveОценок пока нет

- LCD Digest For Rem 1 Session 3 (Reformatted)Документ23 страницыLCD Digest For Rem 1 Session 3 (Reformatted)Argel CosmeОценок пока нет

- QuamtoДокумент4 страницыQuamtoClarissa dela Cruz0% (1)

- Partnership DigestДокумент31 страницаPartnership DigestFG FGОценок пока нет

- Tax1 Syllabus SY 2015-2016Документ19 страницTax1 Syllabus SY 2015-2016Dino Bernard LapitanОценок пока нет

- UP Tax I Syllabus SY 2018 Part 1Документ8 страницUP Tax I Syllabus SY 2018 Part 1rgtan3Оценок пока нет

- Tax1 Syllabus For LyceumДокумент6 страницTax1 Syllabus For Lyceumpokeball001Оценок пока нет

- Tax1 Syllabus For LyceumДокумент6 страницTax1 Syllabus For Lyceumpokeball001Оценок пока нет

- Platos Theory of JusticeДокумент17 страницPlatos Theory of Justicepokeball001100% (1)

- Tañada vs. Tuvera 136 SCRA 27 (April 24, 1985) 146 SCRA 446 (December 29, 1986)Документ4 страницыTañada vs. Tuvera 136 SCRA 27 (April 24, 1985) 146 SCRA 446 (December 29, 1986)pokeball001Оценок пока нет

- (Compiled) Torts Day EightДокумент23 страницы(Compiled) Torts Day Eightpokeball001Оценок пока нет

- Regional Trial Court: National Capital Region Branch 23 Naga CityДокумент4 страницыRegional Trial Court: National Capital Region Branch 23 Naga Citypokeball001Оценок пока нет

- The Republic by PlatoДокумент35 страницThe Republic by Platopokeball0010% (1)

- Branch Vs Subsidiary (TAX)Документ4 страницыBranch Vs Subsidiary (TAX)pokeball001Оценок пока нет

- Teach Fair Play and Good Sportsmanship. The Game Is Played To Win, But It Is Not PlayedДокумент2 страницыTeach Fair Play and Good Sportsmanship. The Game Is Played To Win, But It Is Not Playedpokeball001Оценок пока нет

- of Man's Last End: First Part of The Second Part (Qq. 1-114)Документ20 страницof Man's Last End: First Part of The Second Part (Qq. 1-114)pokeball001Оценок пока нет

- Taxonomy of The Passions: Basic Passion Species (Including Intellective Analogues) Causes EffectsДокумент5 страницTaxonomy of The Passions: Basic Passion Species (Including Intellective Analogues) Causes Effectspokeball001Оценок пока нет

- Are Taxes EvilДокумент5 страницAre Taxes Evilpokeball0010% (1)

- PIL DigestsДокумент4 страницыPIL Digestspokeball001Оценок пока нет

- AGRA Law Case Digest 3Документ4 страницыAGRA Law Case Digest 3pokeball001Оценок пока нет

- Simulasi Cat HitungДокумент2 страницыSimulasi Cat HitungSir cokieОценок пока нет

- Understanding Political Ideologies: Lesson 4Документ14 страницUnderstanding Political Ideologies: Lesson 4Victoria HosmilloОценок пока нет

- Rothbard's Wall Street Banks and American Foreign PolicyДокумент5 страницRothbard's Wall Street Banks and American Foreign PolicyGold Silver WorldsОценок пока нет

- Lecture 5 Political History of PakistanДокумент33 страницыLecture 5 Political History of PakistanAFZAL MUGHALОценок пока нет

- Prabhunath Singh - WikipediaДокумент3 страницыPrabhunath Singh - WikipediaVaibhav SharmaОценок пока нет

- Indo Pak History Papers 2006 - CSS Forums PDFДокумент7 страницIndo Pak History Papers 2006 - CSS Forums PDFMansoor Ali KhanОценок пока нет

- Final Appeal MemorandumДокумент21 страницаFinal Appeal MemorandumSHANMUKH BACHUОценок пока нет

- Digest Gonzales vs. Pennisi 614 SCRA 292 (2010) G.R. No. 169958Документ4 страницыDigest Gonzales vs. Pennisi 614 SCRA 292 (2010) G.R. No. 169958KRDP ABCDОценок пока нет

- Urban Transition in Bangladesh Issues and Challenges: Urban Knowledge Platform Country TeamДокумент16 страницUrban Transition in Bangladesh Issues and Challenges: Urban Knowledge Platform Country TeamUrbanKnowledgeОценок пока нет

- Consumer Court Complaint - DraftДокумент6 страницConsumer Court Complaint - DraftBrandi HopperОценок пока нет

- Susi vs. RazonДокумент2 страницыSusi vs. RazonCaitlin Kintanar100% (1)

- Rural Bank of Salinas V CAДокумент2 страницыRural Bank of Salinas V CAmitsudayo_100% (2)

- EssayДокумент10 страницEssayalessia_riposiОценок пока нет

- Judicial Precedent As A Source of LawДокумент8 страницJudicial Precedent As A Source of LawBilawal MughalОценок пока нет

- The Failure of The War On DrugsДокумент46 страницThe Failure of The War On DrugsAvinash Tharoor100% (5)

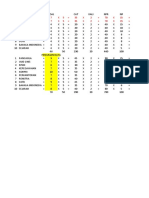

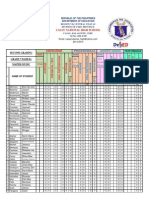

- Casay NHS K12 Grading TemplateДокумент4 страницыCasay NHS K12 Grading TemplatePrince Yahwe RodriguezОценок пока нет

- Notice: Highway Planning and Construction Licenses, Permits, Approvals, Etc.: Waukesha County, WIДокумент2 страницыNotice: Highway Planning and Construction Licenses, Permits, Approvals, Etc.: Waukesha County, WIJustia.comОценок пока нет

- Orientation of WCPD New Policewomen Without TrainingsДокумент23 страницыOrientation of WCPD New Policewomen Without TrainingsCarol Jacinto67% (3)

- Lederman V Giuliani RulingДокумент14 страницLederman V Giuliani RulingRobert LedermanОценок пока нет

- Maritime LiensДокумент3 страницыMaritime LiensJohn Ox100% (1)

- Legal Research Writing Syllabus FinalДокумент5 страницLegal Research Writing Syllabus Finalremil badolesОценок пока нет

- Liaison Office PDFДокумент3 страницыLiaison Office PDFawellОценок пока нет

- Pip (Program Implementation Plan)Документ2 страницыPip (Program Implementation Plan)sureesicОценок пока нет

- Daniel Holtzclaw: Brief of Appellee - Filed 2018-10-01 - Oklahoma vs. Daniel Holtzclaw - F-16-62Документ57 страницDaniel Holtzclaw: Brief of Appellee - Filed 2018-10-01 - Oklahoma vs. Daniel Holtzclaw - F-16-62Brian BatesОценок пока нет

- Notes by NishДокумент10 страницNotes by NisharonyuОценок пока нет

- Locked Up But Not ForgottenДокумент52 страницыLocked Up But Not ForgottenThe Jersey City IndependentОценок пока нет

- DBQ ProgressivismДокумент3 страницыDBQ Progressivismapi-286303526Оценок пока нет

- Thayer Vietnam - Vo Van Thuong Under The MicroscopeДокумент3 страницыThayer Vietnam - Vo Van Thuong Under The MicroscopeCarlyle Alan ThayerОценок пока нет

- Union and The States Art. 308 To 323Документ9 страницUnion and The States Art. 308 To 323Prachi TripathiОценок пока нет

- Jeanette Runyon - Respod of The Office of The Prosecutor General of Ukraine PDFДокумент2 страницыJeanette Runyon - Respod of The Office of The Prosecutor General of Ukraine PDFMyRed BootsОценок пока нет

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeОт EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeРейтинг: 2 из 5 звезд2/5 (1)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldОт EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldРейтинг: 4.5 из 5 звезд4.5/5 (1145)

- 1177 B.C.: The Year Civilization Collapsed: Revised and UpdatedОт Everand1177 B.C.: The Year Civilization Collapsed: Revised and UpdatedРейтинг: 4.5 из 5 звезд4.5/5 (111)

- Why We Die: The New Science of Aging and the Quest for ImmortalityОт EverandWhy We Die: The New Science of Aging and the Quest for ImmortalityРейтинг: 4 из 5 звезд4/5 (5)

- Briefly Perfectly Human: Making an Authentic Life by Getting Real About the EndОт EverandBriefly Perfectly Human: Making an Authentic Life by Getting Real About the EndОценок пока нет

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessОт EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessРейтинг: 4.5 из 5 звезд4.5/5 (328)

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansОт EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansРейтинг: 4 из 5 звезд4/5 (19)

- The War after the War: A New History of ReconstructionОт EverandThe War after the War: A New History of ReconstructionРейтинг: 5 из 5 звезд5/5 (2)

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.От EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Рейтинг: 5 из 5 звезд5/5 (45)

- Dark Psychology & Manipulation: Discover How To Analyze People and Master Human Behaviour Using Emotional Influence Techniques, Body Language Secrets, Covert NLP, Speed Reading, and Hypnosis.От EverandDark Psychology & Manipulation: Discover How To Analyze People and Master Human Behaviour Using Emotional Influence Techniques, Body Language Secrets, Covert NLP, Speed Reading, and Hypnosis.Рейтинг: 4.5 из 5 звезд4.5/5 (110)

- Troubled: The Failed Promise of America’s Behavioral Treatment ProgramsОт EverandTroubled: The Failed Promise of America’s Behavioral Treatment ProgramsРейтинг: 5 из 5 звезд5/5 (2)

- The Story of Philosophy: The Lives and Opinions of the Greater PhilosophersОт EverandThe Story of Philosophy: The Lives and Opinions of the Greater PhilosophersОценок пока нет

- Our Little Secret: The True Story of a Teenage Killer and the Silence of a Small New England TownОт EverandOur Little Secret: The True Story of a Teenage Killer and the Silence of a Small New England TownРейтинг: 4.5 из 5 звезд4.5/5 (86)

- His Needs, Her Needs: Building a Marriage That LastsОт EverandHis Needs, Her Needs: Building a Marriage That LastsРейтинг: 4.5 из 5 звезд4.5/5 (100)

- Cult, A Love Story: Ten Years Inside a Canadian Cult and the Subsequent Long Road of RecoveryОт EverandCult, A Love Story: Ten Years Inside a Canadian Cult and the Subsequent Long Road of RecoveryРейтинг: 4 из 5 звезд4/5 (46)

- The Other Significant Others: Reimagining Life with Friendship at the CenterОт EverandThe Other Significant Others: Reimagining Life with Friendship at the CenterРейтинг: 4 из 5 звезд4/5 (1)

- The Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenОт EverandThe Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenРейтинг: 3.5 из 5 звезд3.5/5 (37)

- Troubled: A Memoir of Foster Care, Family, and Social ClassОт EverandTroubled: A Memoir of Foster Care, Family, and Social ClassРейтинг: 4.5 из 5 звезд4.5/5 (27)

- A Special Place In Hell: The World's Most Depraved Serial KillersОт EverandA Special Place In Hell: The World's Most Depraved Serial KillersРейтинг: 4 из 5 звезд4/5 (55)

- Hearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIОт EverandHearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIРейтинг: 4 из 5 звезд4/5 (20)

- American Jezebel: The Uncommon Life of Anne Hutchinson, the Woman Who Defied the PuritansОт EverandAmerican Jezebel: The Uncommon Life of Anne Hutchinson, the Woman Who Defied the PuritansРейтинг: 3.5 из 5 звезд3.5/5 (66)

- If You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodОт EverandIf You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodРейтинг: 4.5 из 5 звезд4.5/5 (1804)

- The Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchОт EverandThe Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchРейтинг: 4.5 из 5 звезд4.5/5 (13)

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfОт EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfРейтинг: 5 из 5 звезд5/5 (36)

- This Will Be My Undoing: Living at the Intersection of Black, Female, and Feminist in (White) AmericaОт EverandThis Will Be My Undoing: Living at the Intersection of Black, Female, and Feminist in (White) AmericaРейтинг: 4 из 5 звезд4/5 (78)