Академический Документы

Профессиональный Документы

Культура Документы

Level III Ips

Загружено:

cpiercecfaИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Level III Ips

Загружено:

cpiercecfaАвторское право:

Доступные форматы

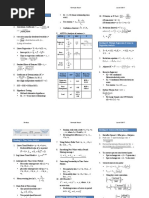

IPS Pension Funds (Def B) Foundations Endowments Life Insurance Property & Casulty Ins Banks

OBJECTIVES

Factors affecting risk tolerance: No defined liability stream => Above Factors affecting risk tolerance: -Conservative fiduciary principles limit risk - Face greater uncertainty than Life due to possibility - Risk measures:

(Factor change - Effect): average risk tolerance (Factor change - Effect) tolerance: of higher claims frequency => limited risk tolerance 1, Leverage-adjusted duration gap measures

1. Plan surplus (↑-↑) 1. Maintain an asset valuation reserve; - Not directly exposed to interest rate risk interest rate exposure:

2. Sponsor financial status - Short term affect: 2. Valuation concerns (losses during periods of - inlfation risk is a concern gap = D A - k*DL, where k = L/A

1. Strong recent returns and if smoothed spending rising interest rates) limit risk taking activities

D/A ratio (↓-↑)

rate < target rate => greater short-term risk 3. Control reinvestment risk - Premium income to Total surplus should be if gap=0 then balance sheet is immunized

profitability (↑-↑) tolerance 4. Credit risk (control by broad diversification) mainained between 2-to-1 and 3-to-1

3. Corr of sponsor's operations and 2. Managers are evaluated on short time frames => 5. Cash Flow volatility (uncertainty) if Int ↑

pension asset returns (↓-↑) reduced willingness to accept risk - Commond stock to surplus ratio (self imposed

and gap>0 => MV(A-L) ↓

4. Plan features (early retirement However, recently, competition has modified limitation) maintained at low levels when markets are

R-isk gap=0 => MV(A-L) does not change

lump-sum) - Long term affect: conservatism of life insurance companies, volatile

gap<0) => MV(A-L) ↑

availability (No-↑) 1. Endowment's role in operations (↑-↑) motivating them to accept and manage varying

degrees of risk to earn competitive investment 2. VAR

5. Workforce Characteristics 2. Institutions ability to adapt to drops in spending

returns 3. Credit measures

age (↓-↑) (↑-↑)

active/retired ratio (↑-↑) 3. Institution's debt (↓-↑) - Have a below average risk tolerance

- Risk relative to Liab is a primary concern (not

- Low investment risk is not the same as low risk absolute risk)

- RBC regulations further limit risk tolerance

of purchasing power impairment

Objectives: Normally: Objectives: 1. Earn a sufficient return to fund all liabilities Objectives: To earn a positive interest spread

1. Min return requirement is discount Minimum return objective = min 1. Maintain LT purchasing power (E(R) > Spending and match or exceed the expected returns 1. Offer competitive policy pricing

rate applied to compute pension liabilities spending rate + infl + investment mgnt Rate + infl + investment mgnt fees) 2. contribute to the growth of surplus through 2. Increase investment profitabilty (casualty premium

(achieve a total return sufficient to fund its exp; 2. Provide substancial resources to programs capital appreciation. rates are not sufficient to cover underwriting costs)

liabilities on an infl-adj basis.) OR 3. Growth of surplus

2. Minimize future contributions E(R) = (1+SpRate)*(1+infl)*(1+inv Smoothing rules of spending rates (SR): 4. Tax considerations

3. Generate pension income mgnt exp) - 1 1. Simple spending rule = SR* LastYr MV_end) 5. Total return management

R-eturn 2. Rolling 3-yr ave spending rule = SR*(sum of past

Greater risk tolerance => greater return 3 years MV_end)/3

objectives 3. Geometric smoothing rule (smoothing rate = w

(60-80%)

= w* (Last years spending*(1+infl) + (1-

w)*(SR*LastYr MV_beg)

CONSTRAINTS

Liq requirement = Benefit payments - Anticipated (required min spending Due to their perpetual nature, liquidity requirements Derivatives market enabled life ins companies High liquidity constraints due to uncertainty in CF Liquidiy requirements are determined by:

pension contributions rate) or Unanticipated liquidity are low. However, need to have some cash to manage interest rate risk and reduced 1. Net outflow of deposits

requirements reserves for distribution (in case large capital companies' need to hold reserves. 2. demand for loans

Factors affecting liq req: project is planned)

1. Active lives (↓-↑) Minimum spending requirement Consider:

(payout rate) includes salaries of 1. Disintermediation (switching to higher

2. Workforce age (↑-↑)

L-iquidity program officers and exec; but does interest paying investments => forced to sell

3. Plan features are available (Yes-↑) not include investment mgnt fees assets at loss to meet liquidity needs)

2. Asset marketability risk (liquid v. illiquid

To avoid large fluctuations, use investments)

smoothing rules

UMIFA, Prudence Rule UMIFA, Prudence Rule Highly regulated (primarily at the State level) 1. - Asset valuation reserve (AVR) is not required, but ris- Highly regulated. RBC regulations (depending on

Eligible investments (which classes and of what base capital (RBC) requirements are established. the risk on the balance sheet, capital requirements

quality) - Assets equal to 50% of "unearned premium are determined by this regulation)

L-egal 2. Prudent investor rule + loss reserves" be maintained in "eligible bonds and

1. ERISA 3. Valuation methods administered by NAIC mortgages." The rest can be invested in a relatively

2. Plan's trustee has a fiduciary duty broad array of assets

3. Prudence Rule

Factors affecting time horizon: Majority of foundations exist into Because of the objective to maintain purchasing Different portfolio segments have different time Time-horizon is a function of two factors (usually 15-30 Generally 3-7 years (intermediate term)

1. Open to new entrants (Yes-↑) perpetuity => long time horizon power, time horize is extremely long-term. horizons (duration) years):

1. duration of casulaty liab (short-term)

2. Workforce age (↓-↑)

T-ime However, if there are large projects to be 2. underwriting cycle

3. Active/retired ratio (↑-↑) implemented soon, these cash flows will dictate

short-term time horizon

Time horizons can be multi-stage (active

lives until retirement and after)

1. Tax-paying Tax-paying

As long as minimum spending rate is

2. Very important: can defer taxes on

Pension income and capital gain are tax maintained, excise tax is 2% (but can

T-axes Tax-exempt (unrelated income is taxed) accumulated cash within a life insurance "The complexities and implications of the taxation of Fully taxable

exempt be reduced to 1%) on "Net Investment

contract tax-exempt bond income for casualty companies are

Income"

beyond the scope of this reading"-p.425 Vol2)

1. Self-imposed constraint against 1. Restriction by the donor to diversify 1. Investment managers are not always available to 1. company size Same as LIFE Historical banking relationships, community needs

investing in certain "unethical" industries 2. Prohibited investments perform due diligence if alternative investments 2. sufficiancy of surplus

U-nique 2. Plan managers are sometimes not are being considered

Circum available in small firms 2. Ethical investment policies

Вам также может понравиться

- LIIIДокумент6 страницLIIIcpiercecfaОценок пока нет

- IPS Statements, CFA IIIДокумент7 страницIPS Statements, CFA IIImeabelnОценок пока нет

- Quantitative Methods: Reading Number Reading Title Study SessionДокумент40 страницQuantitative Methods: Reading Number Reading Title Study SessionNGOC NHIОценок пока нет

- FinQuiz - Curriculum Note, Study Session 4, Reading 10Документ16 страницFinQuiz - Curriculum Note, Study Session 4, Reading 10Jacek KowalskiОценок пока нет

- FinQuiz - Smart Summary - Study Session 14 - Reading 49Документ6 страницFinQuiz - Smart Summary - Study Session 14 - Reading 49Rafael100% (1)

- BEC 1 Outline - 2015 Becker CPA ReviewДокумент4 страницыBEC 1 Outline - 2015 Becker CPA ReviewGabriel100% (1)

- CFA Level III Outline-Notes (2010)Документ114 страницCFA Level III Outline-Notes (2010)Mark Oblad100% (2)

- IFT Summary Level 3Документ17 страницIFT Summary Level 3jigneshОценок пока нет

- CPA BEC - BudgetingДокумент15 страницCPA BEC - Budgetingpambia2000Оценок пока нет

- R29 CFA Level 3Документ12 страницR29 CFA Level 3Ashna0188Оценок пока нет

- CFA Level III in 2 Months - KonvexityДокумент6 страницCFA Level III in 2 Months - Konvexityvishh8580Оценок пока нет

- FinQuiz - Smart Summary - Study Session 18 - Reading 60Документ14 страницFinQuiz - Smart Summary - Study Session 18 - Reading 60Rafael0% (1)

- Course Timetable November 2019: Tuition Only / Tuition Plus / Classroom EnhancedДокумент1 страницаCourse Timetable November 2019: Tuition Only / Tuition Plus / Classroom EnhancedBeastОценок пока нет

- CFA Level 3 FormulaДокумент6 страницCFA Level 3 FormulaRishabh SardaОценок пока нет

- Cfa Level I - Us Gaap Vs IfrsДокумент4 страницыCfa Level I - Us Gaap Vs IfrsSanjay RathiОценок пока нет

- FinQuiz - Smart Summary - Study Session 8 - Reading 25Документ6 страницFinQuiz - Smart Summary - Study Session 8 - Reading 25RafaelОценок пока нет

- CFA Level 2, June, 2017 - Formula SheetДокумент34 страницыCFA Level 2, June, 2017 - Formula Sheetpuneetgupta316230891% (11)

- 10 Must-Know Topics To Prepare For A Financial Analyst InterviewДокумент3 страницы10 Must-Know Topics To Prepare For A Financial Analyst InterviewAdilОценок пока нет

- CFA Level 2 Fixed Income 2017Документ52 страницыCFA Level 2 Fixed Income 2017EdmundSiauОценок пока нет

- CFA Level III Essay Questions 2014Документ37 страницCFA Level III Essay Questions 2014twinkle_shahОценок пока нет

- 기출 기관IPS 2015Документ11 страниц기출 기관IPS 2015soej1004Оценок пока нет

- Module 2Документ12 страницModule 2zoyaОценок пока нет

- 7 - Derivatives - Formula Sheet Mini Test Level IIДокумент5 страниц7 - Derivatives - Formula Sheet Mini Test Level IIcpacfa100% (1)

- FinQuiz ScheduleДокумент1 страницаFinQuiz SchedulePriyesh ThakkerОценок пока нет

- Finance Cheat Sheet - Formulas and Concepts - RM NISPEROSДокумент27 страницFinance Cheat Sheet - Formulas and Concepts - RM NISPEROSCHANDAN C KAMATHОценок пока нет

- 2014 CFA Level 3 Mock Exam Afternoon - AnsДокумент48 страниц2014 CFA Level 3 Mock Exam Afternoon - AnsElsiiieОценок пока нет

- Level II Alt Summary SlidesДокумент25 страницLevel II Alt Summary SlidesRaabiyaal IshaqОценок пока нет

- FinQuiz - Smart Summary - Study Session 5 - Reading 17Документ4 страницыFinQuiz - Smart Summary - Study Session 5 - Reading 17RafaelОценок пока нет

- CPA Exam REG Area 04 - Individual TaxationДокумент3 страницыCPA Exam REG Area 04 - Individual TaxationManny MarroquinОценок пока нет

- Cfa Level 1 High Level Cash Flow Statements Mind MapДокумент1 страницаCfa Level 1 High Level Cash Flow Statements Mind MapShania SainiОценок пока нет

- CFA Level III Mock Exam 5 June, 2017 Revision 1Документ35 страницCFA Level III Mock Exam 5 June, 2017 Revision 1menabavi2Оценок пока нет

- Money, Forex and Bond MarketsДокумент26 страницMoney, Forex and Bond MarketsSHITANSHUОценок пока нет

- BEC Study Guide 4-19-2013Документ220 страницBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- CFA Level III Mock Exam 4 June, 2018 Revision 1Документ47 страницCFA Level III Mock Exam 4 June, 2018 Revision 1Munkhbaatar SanjaasurenОценок пока нет

- FinQuiz - Smart Summary - Study Session 17 - Reading 57Документ4 страницыFinQuiz - Smart Summary - Study Session 17 - Reading 57RafaelОценок пока нет

- SBM Chapter 1 ModelДокумент43 страницыSBM Chapter 1 ModelArunjit SutradharОценок пока нет

- FinQuiz - Smart Summary - Study Session 4 - Reading 14Документ5 страницFinQuiz - Smart Summary - Study Session 4 - Reading 14RafaelОценок пока нет

- CFA Level II Formula Sheet CFA Level II Formula Sheet: Finance (Harvard University) Finance (Harvard University)Документ5 страницCFA Level II Formula Sheet CFA Level II Formula Sheet: Finance (Harvard University) Finance (Harvard University)smith100% (1)

- Key Financial Ratios (VIP)Документ10 страницKey Financial Ratios (VIP)Ahmed HeshamОценок пока нет

- Key Financial Ratios (M.N) FinialДокумент10 страницKey Financial Ratios (M.N) FinialYousab KaldasОценок пока нет

- Ch. 4-WebCampus Risk and ReturnДокумент6 страницCh. 4-WebCampus Risk and ReturnEng Stephen ArendeОценок пока нет

- QS 01 Cva Dva Fva 1709841617Документ5 страницQS 01 Cva Dva Fva 1709841617walid.ncirОценок пока нет

- Internship Proj About VaRДокумент10 страницInternship Proj About VaRYoussef IbrahimОценок пока нет

- Assignment Example May 2019 SubmissionДокумент26 страницAssignment Example May 2019 Submissionmuhammad abdullah janОценок пока нет

- Financial Risk ManagementДокумент90 страницFinancial Risk Managementmorrisonkaniu8283Оценок пока нет

- US CMA Gleim Part 2Документ258 страницUS CMA Gleim Part 2Joy Krishna Das100% (1)

- Understanding Financial Statements: Creditors' Point of ViewДокумент2 страницыUnderstanding Financial Statements: Creditors' Point of ViewJoey WassigОценок пока нет

- Financial Management: Summary of Ratios Objective of Analysis Ratios To Be Computed Basic ComponentsДокумент4 страницыFinancial Management: Summary of Ratios Objective of Analysis Ratios To Be Computed Basic ComponentsM AmmuОценок пока нет

- Breaking Down Risk Modeling Cheat Sheet: by ViaДокумент4 страницыBreaking Down Risk Modeling Cheat Sheet: by ViaHiro ArmstrongОценок пока нет

- 2022 Li PMДокумент130 страниц2022 Li PMayush4shekharОценок пока нет

- Solvency IIДокумент28 страницSolvency IIamingwaniОценок пока нет

- Functions of Bank CapitalДокумент4 страницыFunctions of Bank CapitalG117100% (1)

- L7 - Financial Stability Risks From Climate ChangeДокумент54 страницыL7 - Financial Stability Risks From Climate ChangeMbongeni ShongweОценок пока нет

- ALM HartfordДокумент16 страницALM HartfordIbnu NugrohoОценок пока нет

- BSBSTR801 Risk Register v1.0Документ6 страницBSBSTR801 Risk Register v1.0Cristine CunananОценок пока нет

- Part 2 Financial AnalysisДокумент32 страницыPart 2 Financial AnalysisMilad KarimyОценок пока нет

- Liquidity Only.: Ex Payable AmountДокумент12 страницLiquidity Only.: Ex Payable AmountPranshu SahasrabuddheОценок пока нет

- 2022 LI QuantMethodsДокумент109 страниц2022 LI QuantMethodssharma02decОценок пока нет

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Q1 2023 RICS UK Commercial Propety MonitorДокумент14 страницQ1 2023 RICS UK Commercial Propety Monitor344clothingОценок пока нет

- Dornbusch 6e Chapter12Документ19 страницDornbusch 6e Chapter12kushalОценок пока нет

- Financial Analysis For Boa CoffeeДокумент2 страницыFinancial Analysis For Boa CoffeeRunaway ShujiОценок пока нет

- BA BSC - HONS - ECONOMICS - Sem 3 - CC 6 0203Документ2 страницыBA BSC - HONS - ECONOMICS - Sem 3 - CC 6 0203Shruti HalderОценок пока нет

- Financial Management: Acca Revision Mock 3Документ13 страницFinancial Management: Acca Revision Mock 3krishna gopalОценок пока нет

- 9 StatementOfAccount-September2023Документ3 страницы9 StatementOfAccount-September2023cailinghoneygenОценок пока нет

- Lecture 5Документ1 страницаLecture 5JohnОценок пока нет

- KPMG Budget Analysis 2023 - ReportДокумент34 страницыKPMG Budget Analysis 2023 - Reportbanu kuhanОценок пока нет

- A Macroeconomic Analysis of IndiaДокумент21 страницаA Macroeconomic Analysis of IndiaJehangir KhambataОценок пока нет

- Full Download Test Bank For Management 10th Edition Ricky W Griffin PDF Full ChapterДокумент34 страницыFull Download Test Bank For Management 10th Edition Ricky W Griffin PDF Full Chaptercrincumose.at2d100% (19)

- Alhaj Textile Mills LTDДокумент22 страницыAlhaj Textile Mills LTDMohammad Sayad ArmanОценок пока нет

- Financial Management For Decision Makers Canadian 2nd Edition Atrill Test BankДокумент17 страницFinancial Management For Decision Makers Canadian 2nd Edition Atrill Test Bankodiledominicmyfmf100% (28)

- Unit 3 Money and Budgeting: Ebe 1 Adina Oana NicolaeДокумент15 страницUnit 3 Money and Budgeting: Ebe 1 Adina Oana NicolaedanielaОценок пока нет

- Chapter 8 Debentures and ChargesДокумент2 страницыChapter 8 Debentures and ChargesNahar Sabirah100% (1)

- FR Assignment 4Документ4 страницыFR Assignment 4shashalalaxiangОценок пока нет

- Mami LK TW Iii 2018Документ83 страницыMami LK TW Iii 2018ayyib12Оценок пока нет

- Mckinsey PDFДокумент36 страницMckinsey PDFMohammed Abdul HadyОценок пока нет

- Final Exammm 3Документ10 страницFinal Exammm 3Marianne Adalid MadrigalОценок пока нет

- Annuities - A Series of Equal Payments Occurring at Equal Periods of TimeДокумент5 страницAnnuities - A Series of Equal Payments Occurring at Equal Periods of TimeMarcial MilitanteОценок пока нет

- FRM Juice Notes 2019Документ202 страницыFRM Juice Notes 2019Dipesh Memani100% (8)

- Invitation To Bid: General GuidelinesДокумент6 страницInvitation To Bid: General GuidelinesMae Ann GonzalesОценок пока нет

- Quiz No 1 AuditingДокумент11 страницQuiz No 1 AuditingrylОценок пока нет

- Application Form - CashVantage (Version2 2 - Dec 2014) - V7Документ5 страницApplication Form - CashVantage (Version2 2 - Dec 2014) - V7Mfairuz HassanОценок пока нет

- Quiz 2 For StudentsДокумент4 страницыQuiz 2 For StudentsLorОценок пока нет

- WadiahДокумент11 страницWadiahareep94100% (1)

- Consolidated Fund of India: The Accounts of Government Are Kept in Three PartsДокумент1 страницаConsolidated Fund of India: The Accounts of Government Are Kept in Three PartsAshok KumarОценок пока нет

- Chapter 5. INTRODUCTION TO VALUATION THE TIME VALUE OF MONEYДокумент33 страницыChapter 5. INTRODUCTION TO VALUATION THE TIME VALUE OF MONEYChloe JtrОценок пока нет

- Chapter 5-The Statement of Cash Flows: Multiple ChoiceДокумент29 страницChapter 5-The Statement of Cash Flows: Multiple ChoiceJoebin Corporal LopezОценок пока нет

- Tugas Kelompok 1Документ6 страницTugas Kelompok 1Bought By UsОценок пока нет

- World Bank General Conditions For LoansДокумент32 страницыWorld Bank General Conditions For LoansMax AzulОценок пока нет