Академический Документы

Профессиональный Документы

Культура Документы

At Quizzer 14 - Reporting Issues

Загружено:

Rachel LeachonОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

At Quizzer 14 - Reporting Issues

Загружено:

Rachel LeachonАвторское право:

Доступные форматы

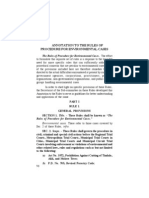

DE LA SALLE UNIVERSITY MANILA

RVR COB DEPARTMENT OF ACCOUNTANCY

REVDEVT 1st Term AY 14-15

Auditing Theory

Prof. Francis H. Villamin

AT Quizzer 14

==============================================================================

FORMING AN OPINION AND REPORTING ON F/S

1. To distinguish it from reports that might be issued by others, such as by officers of the entity, the

board of directors, or from the reports of other auditors who may not have to abide by the same

ethical requirements as the independent auditor, the auditors report should have an appropriate

a. Addressee

b. Title

c. Signature

d. Opinion

2. The auditors report should be addressed

a. Only to the shareholders of the entity whose financial statements are being audited.

b. Only to the board of directors of the entity whose financial statements are being audited.

c. Either to the shareholders or the board of directors of the entity whose financial statements are

being audited.

d. Either to the shareholders or the board of directors, or both, of the entity whose financial

statements are being audited.

3. Which of the following is included in the introductory or opening paragraph of the auditors report?

a. Identification of the financial statements audited, including the date of and period covered by

the financial statements.

b. A statement that the financial statements are the responsibility of the entitys management.

c. A statement that the audit was conducted in accordance with Philippine Standards on Auditing.

d. A statement that the responsibility of the auditor is to express an opinion on the financial

statements based on the audit.

4. An entitys management is responsible for the preparation and fair presentation of the financial

statements. Its responsibility includes the following, except

a. Designing, implementing, and maintaining internal control relevant to the preparation and

presentation of financial statements.

b. Making accounting estimates that are reasonable in the circumstances.

c. Selecting and applying appropriate accounting policies.

d. Assessing the risks of material misstatement of the financial statements.

5. The opinion paragraph of the auditors report

I. Identifies the applicable financial reporting framework on which the financial statements are

based.

II. Expresses an opinion on the financial statements.

a. I only

b. II only

c. Both I and II

d. Neither I nor II

6. The following statements relate to the date of the auditors report. Which is false?

a. The auditor should date the report as of the completion date of the audit.

b. The date of the auditors report should not be earlier than the date on which the financial

statements are signed or approved by management.

c. The date of the auditors report should not be later than the date on which the financial

statements are signed or approved by management.

d. The date of the auditors report should always be later than the date of the financial statements

(i.e. the balance sheet date).

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 2

7. Which of the following statements best expresses the objective of the traditional audit of financial

statements?

a. To express an opinion on the fairness with which the statements present financial position,

financial performance and cash flows in accordance with Philippine Financial Reporting

Standards.

b. To express an opinion on the accuracy with which the statements present financial position,

financial performance, and cash flows in accordance with Philippine Financial Reporting

Standards.

c. To make suggestions as to the form or content of the financial statements or to draft them in

whole or in part.

d. To assure adoption of sound accounting policies and the establishment and maintenance of

internal control.

8. Which of the following best describes why an independent auditor is asked to express an opinion

on the fair presentation of financial statements?

a. It is a customary courtesy that all shareholders receive an independent report on

managements stewardship in managing the affairs of the business.

b. The opinion of an independent party is needed because a company may not be objective with

respect to its own financial statements.

c. It is difficult to prepare financial statements that fairly present a companys financial position,

financial performance, and cash flows without the expertise of an independent auditor.

d. It is managements responsibility to seek available independent aid in the appraisal of the

financial information shown in its financial statements.

9. How are managements responsibility and the auditors responsibility represented in the auditors

report?

Managements

Auditors

Responsibility

Responsibility

a.

Implicitly

Implicitly

b.

Implicitly

Explicitly

c.

Explicitly

Implicitly

d.

Explicitly

Explicitly

10. In which of the following circumstances would an auditor most likely add an emphasis of matter

paragraph to the auditors report while expressing an unqualified opinion?

a. There is a substantial doubt about the entitys ability to continue as a going concern.

b. Managements estimates of the effects of future events are unreasonable.

c. No depreciation has been provided in the financial statements.

d. Certain transactions cannot be tested because of managements records retention policy.

11. An emphasis of matter paragraph of an auditors report describes an uncertainty as follows:

Without qualifying our opinion, we draw attention to Note X to the financial statements.

The Company is the defendant in a lawsuit alleging infringement of certain patent rights

and claiming royalties and punitive damages. The Company has filed a counter action

and preliminary hearings and discovery proceedings on both actions are in progress. The

ultimate outcome of the matter cannot presently be determined, and no provision for any

liability that may result has been made in the financial statements.

What type of opinion should the auditor express under these circumstances?

a. Unqualified

b. Except for qualified

c. Subject to qualified

d. Disclaimer

12. An auditors responsibility to express an opinion on the financial statements is

a. Implicitly represented in the auditors report.

b. Explicitly represented in the Auditors Responsibility paragraph of the auditors report.

c. Explicitly represented in the Managements Responsibility paragraph of the auditors report.

d. Explicitly represented in the opinion paragraph of the auditors report.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 3

13. The existence of audit risk is recognized by the statement in the auditors report that the auditor

a. Is responsible for expressing an opinion on the financial statements, which are the

responsibility of management.

b. Realizes some matters, either individually or in the aggregate, are important while other

matters are not important.

c. Obtains reasonable assurance about whether the financial statements are free of material

misstatement.

d. Assesses the accounting principles used and also evaluates the overall financial statements

presentation.

14. Which of the following statements is a basic element of the auditors report?

a. The auditor is responsible for the preparation and fair presentation of the financial statements.

b. The financial statements are consistent with those of the prior period.

c. An audit involves performing procedures to obtain audit evidence about the amounts and

disclosures in the financial statements.

d. The disclosures provide reasonable assurance that the financial statements are free of

material misstatement.

15. Which paragraphs of an auditors report on financial statements should refer to Philippine

Financial Reporting Standards?

a. Introductory and Opinion

b. Auditors Responsibility and Managements Responsibility

c. Introductory and Auditors Responsibility

d. Managements Responsibility and Opinion

16. An independent auditor discovers that a payroll supervisor of the company being audited has

misappropriated P50,000. The companys total assets and income before tax are P70 million and

P15 million, respectively. Assuming no other issues affect the report, the auditors report will most

likely contain a/an

a. Unqualified opinion

b. Disclaimer of opinion

c. Adverse opinion

d. Scope qualification

17. A client makes test counts on the basis of a statistical plan. The auditor observes such counts as

are deemed necessary and is able to become satisfied as to the reliability of the clients

procedures. In reporting on the results of the audit, the auditor

a. Must qualify the opinion if the inventories were material.

b. Can express an unqualified opinion.

c. Must comment in an emphasis of matter paragraph as to the inability to observe year-end

inventories.

d. Is required to disclaim an opinion if the inventories were material.

18. A note to the financial statements of the Prudent Bank indicates that all of the records relating to

the banks business operations are stored on magnetic disks, and that no emergency backup

systems or duplicate disks are stored because the bank and its auditors consider the occurrence

of a catastrophe to be remote. Based upon this note, the auditors report should express

a. A qualified opinion

b. An unqualified opinion

c. An adverse opinion

d. A subject to opinion

19. An auditor who uses the work of an expert may refer to and identify the expert in the auditors

report if the

a. Expert is employed by the entity.

b. Experts work provides the auditor greater assurance of reliability.

c. Auditor expresses a qualified opinion or an adverse opinion related to the work of the expert.

d. Auditor indicates a division of responsibility related to the work of the expert.

20. When would the auditor refer to the work of an appraiser in the auditors report?

a. An adverse opinion is expressed based on a difference of opinion between the client and the

outside appraiser as to the value of certain assets.

b. A disclaimer of opinion is expressed because of a scope limitation imposed on the auditor by

the appraiser.

c. A qualified opinion is expressed because of a matter unrelated to the work of an appraiser.

d. An unqualified opinion is expressed and an emphasis of matter paragraph is added to disclose

the use of the appraisers work.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 4

21. When two or more auditing firms participate in an audit, one firm should be the principal auditor. If

the principal auditor makes reference to another auditor in an audit that would otherwise result in

an unqualified opinion, the type of audit report issued should be

a. A disclaimer of opinion

b. A qualified opinion

c. An unqualified opinion

d. An adverse opinion

22. Mr. X is auditing the consolidated financial statements of ABC Corp., a publicly held corporation.

Mr. Z is the auditor who has audited and reported on the financial statements of a wholly owned

subsidiary of ABC Corp. Mr. Xs first concern with respect to the ABCs financial statements is to

decide whether he

a. May serve as the principal auditor and report as such on the consolidated financial statements

of ABC Corp.

b. Should resign from the engagement because an unqualified opinion cannot be expressed on

the consolidated financial statements.

c. May refer to the work of Mr. Z in her report on the consolidated financial statements.

d. Should review the working papers of Mr. Z with respect to the audit of the subsidiarys financial

statements.

23. An auditors report contains the following: We did not audit the financial statements of LMN

Company, a wholly owned subsidiary, which statements reflect total assets and revenues

constituting 17% and 19%, respectively, of the related consolidated totals. Those statements were

audited by other auditors whose report has been furnished to us, and our opinion, insofar as it

relates to the amounts included for LMN Company, is based solely on the report of the other

auditors. These sentences

a. Disclaim an opinion

b. Divide responsibility

c. Are an improper form of reporting

d. Qualify the opinion

24. When audited financial statements are presented in a document (e.g. annual report) containing

other information, the auditor

a. Should read the other information to consider it is inconsistent with the audited financial

statements.

b. Has no responsibility for the other information because it is not part of the basic financial

statements.

c. Has an obligation to perform auditing procedures to corroborate the other information.

d. Is required to express a qualified opinion if the other information has a material misstatement

of fact.

25. An auditor concludes that there is a material inconsistency in the other information in an annual

report to shareholders containing audited financial statements. If the auditor concludes that the

financial statements do not require revision, but the client refuses to revise or eliminate the

material inconsistency, the auditor may

a. Disclaim an opinion on the financial statements after explaining the material inconsistency in

an emphasis of matter paragraph.

b. Revise the auditors report to include an emphasis of matter paragraph describing the material

inconsistency.

c. Express a qualified opinion after discussing the matter with the clients directors.

d. Consider the matter closed because the other information is not in the audited statements.

26. PSA 720 states, If, on reading the other information, the auditor identifies a material

inconsistency, the auditor should determine whether the audited financial statements or the other

information needs to be amended. What type of opinion should be expressed if the client refuses

to make the necessary amendment in the financial statements?

a. Disclaimer of opinion

b. Qualified opinion or disclaimer of opinion

c. Unqualified opinion with an emphasis of matter paragraph describing the material

inconsistency.

d. Qualified or adverse opinion.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 5

27. An auditor may express a qualified opinion under which of the following circumstances?

Lack of Sufficient

Restriction on the

Appropriate Evidence

Scope of the Audit

a.

No

No

b.

No

Yes

c.

Yes

No

d.

Yes

Yes

28. Which of the following should be included in the opinion paragraph when an auditor expresses a

qualified opinion?

When Read In

With the Foregoing

Conjunction with Note X

Explanation

a.

Yes

No

b.

No

Yes

c.

No

No

d.

Yes

Yes

29. In which of the following circumstances would an auditor usually choose between expressing a

qualified opinion or disclaiming an opinion?

a. Departure from generally accepted accounting principles.

b. Unreasonable justification for a change in accounting principle.

c. Inability to obtain sufficient appropriate audit evidence.

d. Inadequate disclosure of accounting policies.

30. An auditor decides to express a qualified opinion on an entitys financial statements because a

major inadequacy in its computerized accounting records prevents the auditor from applying

necessary procedures. The opinion paragraph of the auditors report should state that the

qualification pertains to

a. A client-imposed scope limitation.

b. A departure from generally accepted auditing standards.

c. Inadequate disclosure of necessary information.

d. The possible effects on the financial statements.

31. Mark, CPA, was engaged to audit the financial statements of Apollo Corp. after its fiscal year had

ended. The timing of Marks appointment as auditor and the start of field work made confirmation

of accounts receivable by direct communication with the debtors ineffective. However, Mark

applied other procedures and was satisfied as to the reasonableness of the account balances.

Marks auditors report most likely contained a/an

a. Qualified opinion because of a scope limitation.

b. Qualified opinion because of a departure from GAAS.

c. Unqualified opinion.

d. Unqualified opinion with an emphasis of matter paragraph.

32. In which of the following situations would an auditor ordinarily choose between expressing a

qualified opinion or an adverse opinion?

a. The auditor wishes to emphasize an unusually important subsequent event.

b. The financial statements fail to disclose information that is required by Philippine Financial

Reporting Standards.

c. Events disclosed in the financial statements cause the auditor to have substantial doubt about

the entitys ability to continue as a going concern.

d. The auditor did not observe the entitys physical inventory and is unable to become satisfied

as to its balance by other auditing procedures.

33. Under which of the following circumstances would a disclaimer of opinion not be appropriate?

a. The financial statements fail to contain adequate disclosure concerning related party

transactions.

b. The auditor is engaged after fiscal year-end and is unable to observe the physical inventories

or apply alternative procedures to verify their balances.

c. The auditor is unable to determine the amounts associated with fraud committed by the clients

management.

d. The client refuses to permit its attorney to furnish information requested in a letter of audit

inquiry.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 6

34. When a publicly held company refuses to include in its audited financial statements any of the

segment information that the auditor believes is required, the auditor should express a/an

a. Disclaimer of opinion because of the significant scope limitation.

b. Adverse opinion because of a significant uncertainty.

c. Unqualified opinion with an emphasis of matter paragraph emphasizing the matter.

d. Qualified opinion because of inadequate disclosure.

RPCA Examination

1. An auditors report on financial statements prepared in accordance with another comprehensive

basis of accounting should include all of the following except

a. An opinion as to whether the basis of accounting used is appropriate under the circumstances.

b. An opinion as to whether the financial statements are presented fairly in conformity with the

other comprehensive basis of accounting.

c. Reference to the note to financial statements that describe the basis of presentation.

d. A statement that the basis of presentation is a comprehensive basis of accounting other than

generally accepted accounting principles.

2. When reporting on financial statements prepared on the same basis of accounting used for in

come tax purposes, the auditor should include in the report a paragraph that

a.

Emphasizes that the financial statements are not intended to have been examined in

accordance with generally accepted auditing standards.

b. Refers to the authoritative pronouncements that explain the income tax basis of accounting

being used.

c. States that the income tax basis of accounting is a comprehensive basis of accounting being

used.

d. Justifies the use of the income tax basis of accounting.

3. The existence of audit risk is recognized by the statement in the auditors standard report that the

auditor

a. Obtains reasonable assurance about whether the financial statements are free of material

misstatement.

b. Assesses the accounting principles used and also evaluates the overall financial statement

presentation.

c. Realizes some matters, either individually or in the aggregate, are important while other

matters are not important.

d. Is responsible for expressing an opinion on the financial statements that are the responsibility

of management.

4. An auditor may reasonably issue a qualified opinion for

Scope

Unjustified

Limitation

accounting change

a.

Yes

No

b.

No

Yes

c.

Yes

Yes

d.

No

No

5. Soyuz Co., a nonprofit entity prepared its financial statements on an accounting basis prescribed

by a regulatory agency solely for filing with that agency. Ronald audited the financial statements

in accordance with generally accepted auditing standards and concluded that the financial

statements were fairly presented on the prescribed basis. Ronald should issue a

a. Qualified opinion

b. Standard three paragraph report with reference to footnote disclosure.

c. Disclaimer of opinion.

d. Special report.

6. The following explanatory paragraph was included in an auditors report to indicate a lack of

consistency.

As discussed in Note 5 to the financial statements, the company changed its method of computing

depreciation in 20x4.

How should the auditor report on this matter if the auditor concurred with the change.

Type of

Location of

Opinion

Opinion

a.

b.

Unqualified

Unqualified

Before opinion paragraph

After opinion paragraph

Reports on Audited FS & Special Reporting Issues

AT Quizzer 14

c.

d.

Qualified

Qualified

Page 7

Before opinion paragraph

After opinion paragraph

7. After issuing a report, an auditor has no obligation to make continuing inquiries or perform other

procedures concerning the auditors financial statements unless

a. Information, which existed at the report date and may affect the report, comes to the auditors

attention.

b. Management of the entity requests the auditor to reissue the auditors report.

c. Information about an event that occurred after the end of fieldwork comes to the auditors

attention.

d. Final determinations or resolutions are made of contingencies that had been disclosed to the

financial statements.

8. An auditor was unable to obtain sufficient competent evidential matter concerning certain

transactions due to an inadequacy in the entitys accounting records. The auditor would choose

between issuing a(n)

a. Qualified opinion and an unqualified opinion with an explanatory paragraph.

b. Unqualified opinion with an explanatory paragraph and an adverse opinion.

c. Adverse opinion and a disclaimer of opinion.

d. Disclaimer of opinion and a qualified opinion.

9. For an entitys financial statements to be presented fairly in conformity with generally accepted

accounting principles, the principles selected should

a. Be applied on a basis consistent with those followed in the prior year.

b. Be approved by the Auditing and Assurance Standards Council or the appropriate industry

subcommittee.

c. Reflect transactions in a manner that presents the financial statements within a range of

acceptable limits.

d. Match the principles used by most other entities within the entitys particular industry.

10. In which of the following situations would a principal auditor least likely make reference to another

auditor who audited a subsidiary of the entity?

a. The other auditor was retained by the principal as auditor and the work was performed under

the principal auditors guidance and control.

b. The principal auditor finds it impracticable to review the other auditors work or otherwise be

satisfied as to the other auditors work.

c. The financial statements audited by the other auditor were material to the consolidated

financial statements covered by the principal auditors opinion.

d. The principal auditor is unable to be satisfied as to the independence and professional

reputation of the other auditor.

11. An auditor issued an audit report that was dual-dated for a subsequent event occurring after the

completion of field work but before issuance of the auditors report. The auditors responsibility for

events occurring subsequent to the completion of field work was

a. Extended to subsequent events occurring through the date of issuance of the auditors report.

b. Extended to include all events occurring since the completion of field work.

c. Limited to the specific event referenced.

d. Limited to include only events occurring up to the date of the last subsequent events

reference.

12. Which of the following phrases should be included in the opinion paragraph when an auditor

expresses a qualified opinion?

When read in

With the

Conjunction with

foregoing

Note X

explanation

a.

b.

c.

d.

Yes

No

Yes

No

No

Yes

Yes

No

13. When an auditor expresses an adverse opinion, the opinion paragraph should include

a. The principal effects of the departure from generally accepted accounting principles.

b. A direct reference to a separate paragraph disclosing the basis for the opinion.

c. The substantive reasons for the financial statements being misleading.

d. A description of the uncertainty or scope limitation that prevents an unqualified opinion.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 8

14. Richard, CPA, concludes that there is substantial doubt about Titan Companys ability to continue

as a going concern. If Janes financial statements adequately disclose its financial difficulties,

Richards auditors report should

Include an explanatory

Specifically use

Specifically use

Paragraph following

the words

the words

The opinion paragraph

going concern

substantial doubt

a.

Yes

Yes

Yes

b.

Yes

Yes

No

c.

Yes

No

Yes

d.

No

Yes

Yes

15. An auditor concludes that there is a substantial doubt about an entitys ability to continue as going

concern for a reasonable period of time. If the entitys disclosures concerning that matter are

adequate, the audit report may include a(n)

Disclaimer

Qualified

of opinion

opinion

a.

Yes

Yes

b.

No

No

c.

No

Yes

d.

Yes

No

16. In which of the following circumstances would an auditor most likely add an explanatory paragraph

to the standard report while not affecting the auditors unqualified opinion?

a. The auditor is asked to report on the balance sheet date, but not on the other basic financial

statements.

b. There is substantial doubt about the entitys ability to continue as a going concern.

c. Managements estimates of the effects of future events are unreasonable.

d. Certain transactions cannot be tested because of managements records retention policy.

17. Henry, CPA, was engaged to audit the financial statements of Rechelen Co. after its fiscal year

had ended. The timing of Henrys appointment as auditor and the start of field work made

confirmation of accounts receivable by direct communication with the debtors ineffective. However,

Henry applied other procedures and was satisfied as to the reasonableness of the account

balances. Henrys auditors report most likely contained a(n)

a. Unqualified opinion.

b. Unqualified opinion with an explanatory paragraph.

c. Qualified opinion due to scope limitation.

d. Qualified opinion due to a departure from generally accepted accounting principles.

18. Joy, CPA, believes there is a substantial doubt about the ability of Luna Co. to continue as a going

concern for a reasonable period of time. In evaluating Lunas plans for dealing with the adverse

effects of future conditions and events, Joy most likely would consider, as a mitigating factor,

Lunas plans to

a. Accelerate research and development projects related to future products.

b. Accumulate treasury stock at prices favorable to Lunas historic price range.

c. Purchase equipment and production facilities currently being leased.

d. Negotiate reductions in required dividends being paid on preference shares..

19. A limitation on the scope of an audit sufficient to preclude an unqualified opinion will usually result

when management

a. Is unable to obtain audited financial statements supporting the entitys investment in a foreign

subsidiary.

b. Refuses to disclose in the notes to the financial statements related-party transactions

authorized by the board of directors.

c. Does not sign an engagement letter specifying the responsibilities of both the entity and the

auditor.

d. Fails to correct a reportable condition communicated to the audit committee after the prior

years audit.

20. XYZ Life Insurance Co. prepares its financial statements on an accounting basis insurance

companies use pursuant to the rules of the governments insurance commission. If Myrna, CPA,

XYZs auditor, discovers that the statements are not suitably titled, Myrna should

a. Disclose any reservations in an explanatory paragraph and qualify the opinion.

b. Apply to the Insurance Commissioner for an advisory opinion.

c. Issue a special statutory basis report that clearly disclaims any opinion.

d. Explain in the notes to the financial statements the terminology used.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 9

21. When disclaiming an opinion due to a client-imposed scope limitation, an auditor should indicate

in a separate paragraph why the audit did not comply with generally accepted auditing standards.

The auditor should also omit

Scope

Opinion

Paragraph

Paragraph

a.

No

Yes

b.

Yes

Yes

c.

No

No

d.

Yes

No

22. An auditor decides to issue a qualified opinion on an entitys financial statements because a major

inadequacy in its computerized accounting record prevents the auditor from applying necessary

procedures. The opinion paragraph of the auditors report should state that the qualification

pertains to

a. Client-imposed scope limitation

b. A departure from generally accepted auditing standards

c. The possible effects on the financial statements

d. Inadequate disclosure of the necessary information

23. Which of the following events occurring after the issuance of an auditors report most likely would

cause the auditor to make further inquiries about the previously issued financial statements?

a. A technological development that could affect the entitys future ability to continue as a going

concern.

b. The discovery of information regarding a contingency that existed before the financial

statements were issued.

c. The entitys sale of a subsidiary that accounts for 30% of the entitys consolidated sales.

d. The final resolution of a lawsuit explained in a separate paragraph of the auditors report.

24. A material departure from GAAP will result in auditor consideration of

a. Whether to issue an adverse opinion rather than a disclaimer of opinion.

b. Whether to issue a disclaimer of opinion rather than an except for opinion.

c. Whether to issue an adverse opinion rather than an except for opinion.

d. Nothing, because none of these opinions is applicable to this type of exception.

25. The auditors report should be dated as of the date the

a. Report is delivered to the client.

b. Field work is completed.

c. Fiscal period under audit ends.

d. Review of the working papers is completed.

26. In the report of the principal auditor, reference to the fact that a portion of the audit was made by

another is

a. Not to be construed as a qualification, but rather as a division of responsibility between two

CPA firms.

b. Not in accordance with GAAS.

c. A qualification that lessens the collective responsibility of both CPA firms.

d. An example of a dual opinion requiring the signatures of both auditors.

27. Assume that the opinion paragraph of an auditors report begin as follows: With the explanation

given in Note 6, the financial statements referred to above present fairly. This is:

a. An unqualified opinion.

b. A disclaimer of opinion.

c. An except for opinion.

d. An improper type of reporting.

28. The auditor who wishes to indicate that the entity has significant transactions with related parties

should disclose this fact in

a. An explanatory paragraph to the auditors report.

b. An explanatory note to the financial statements.

c. The body of the financial statements.

d. The summary of significant accounting policies section of the financial statements.

29. When restrictions that significantly limit the scope of the audit are imposed by the client, the

auditor should generally issue which of the following opinions

a. Qualified

b. Disclaimer

c. Adverse

d. Unqualified

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 10

30. A CPA found that the client has not capitalized a material amount of leases in the financial

statements. When considering the materiality of this departure from GAAP, the CPAs reporting

options are

a. Unqualified opinion or disclaimer of opinion

b. Unqualified opinion or qualified opinion

c. Emphasis paragraph with unqualified opinion or an adverse opinion

d. Qualified opinion or adverse opinion

31. An auditor has found that the client is suffering financial difficulty and the going-concern status is

seriously in doubt. Even though the client has placed good disclosures in the financial statements,

the CPA must choose between the following audit report alternatives:

a. Unqualified report with a going-concern explanatory paragraph or disclaimer of opinion.

b. Standard unqualified report or a disclaimer of opinion.

c. Qualified opinion or adverse opinion

d. Standard unqualified report or adverse opinion

32. Frank became the new auditor for Twin Commission succeeding Ronnie, who audited the financial

statements last year. Frank needs to report on Twins comparative financial statements and

should write in his report an explanation about another auditor having audited the prior year.

a. Only if Ronnies opinion last year was qualified.

b. Describing the prior audit and the opinion but not naming Ronnie as the predecessor auditor.

c. Describing the audit but not revealing the type of opinion Ronnie gave.

d. Describing the audit and the opinion and naming Ronnie as the predecessor auditor.

33. When other independent auditors are involved in the current audit of parts of the clients business,

the principal auditor can write an audit report that (two answers)

a. Mentions the other auditor, describes the extent of the other auditors work, and gives an

unqualified opinion.

b. Does not mention the other auditor and gives an unqualified opinion in a standard unqualified

report.

c. Places primary responsibility for the audit report on the other auditors.

d. Names the other auditors, describes their work, and presents only the principal auditors

report.

34. An emphasis of a matter paragraph inserted in a standard audit report causes the report to be

characterized as

a. Unqualified opinion report.

b. Divided responsibility.

c. Adverse opinion report.

d. Disclaimer of opinion.

35. Under which of the following conditions can a disclaimer of opinion never be given?

a. Going-concern problems are overwhelming the company.

b. The client does not let the auditor have access to evidence about important accounts.

c. The auditor owns stock in the client corporation.

d. The auditor has found that the client used the NIFO (next-in, first-out ) inventory costing

method.

36. An entity changed from the straight-line method to the declining balance method of depreciation

for all newly acquired assets. This change has no material effect on the current years financial

statements but is reasonably certain to have a substantial effect in later years. If the change is

disclosed in the notes to the financial statements, the auditor should issue a report with a(n)

a. Except for unqualified opinion

b. Explanatory paragraph

c. Unqualified opinion

d. Consistency modification

37. In which of the following situations would an auditor ordinarily choose between expressing an

except for qualified opinion and expressing an adverse opinion?

a. The auditor did not observe the entitys physical inventory and is unable to become satisfied

as to its balance by other auditing procedures.

b. The financial statements fail to disclose information that is required by generally accepted

accounting principles.

c. The auditor is asked to report only on the entitys balance sheet and not on the other basic

financial statements.

d. Events disclosed in the financial statements caused the auditor to have substantial doubt

about the entitys ability to continue as a going concern.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 11

38. Queen Companys financial statements contain a departure from generally accepted accounting

principles because, due to unusual circumstances, the statements would otherwise be misleading.

The auditor should express an opinion that is

a. Unqualified but not mention the departure in the auditors report.

b. Unqualified and describe the departure in a separate paragraph,

c. Qualified and describe the departure in a separate paragraph.

d. Qualified or adverse, depending on materiality, and describe the departure in a separate

paragraph.

39. An auditor would issue an adverse opinion if

a. The audit was begun by other independent auditors who withdrew from the engagement.

b. A qualified opinion cannot be given because the auditor lacks independence.

c. The restriction on the scope of the audit was significant.

d. The statements taken as a whole do not fairly present the financial condition and results of

operations of the company.

40. In which of the following circumstances would an auditor usually choose between issuing a

qualified opinion and issuing a disclaimer of opinion?

a. Departure from generally accepted accounting principles.

b. Inadequate disclosure of accounting policies.

c. Inability to obtain sufficient competent evidential matter.

d. Unreasonable justification for a change in accounting principle.

41. Valerie, CPA, was engaged to audit the financial statements of GALE Company after its fiscal year

had ended. Valerie neither observed the inventory count nor confirmed the receivables by direct

communications with debtors but was satisfied concerning both after applying alternative

procedures. Valeries auditors report most likely contained a(n)

a. Qualified opinion

b. Disclaimer of opinion.

c. Unqualified opinion.

d. Unqualified opinion with an explanatory paragraph.

42. In which of the following situations would an auditor ordinarily issue an unqualified audit opinion

without an explanatory paragraph?

a. The auditor wishes to emphasize that the entitys had significant related-party transactions.

b. The auditor decides to refer to the report of another auditor as a basis, in part, for the auditors

opinion.

c. The entity issues financial statements that present financial position and results of operations

but omits the statement of cash flows.

d. The auditor has substantial doubt about the entitys ability to continue as a going concern, but

the circumstances are fully disclosed in the financial statements.

43. Which of the following best describes the auditors responsibility for other information included in

the annual report to stockholders that contain financial statements and the auditors report?

a. The auditor has no obligation to read the other information.

b. The auditor has no obligation to corroborate the other information but should read the other

information to determine whether it is materially inconsistent with the financial statements.

c. The auditor should extend the examination to the extent necessary to verify the other

information.

d. The auditor must modify the auditors report to state that the other information is audited or

is not covered by the auditors report.

44. Comparative financial statements include the prior years financial statements that were audited by

a predecessor auditor whose report is not presented. If the predecessors report was unqualified,

the successor should

a. Express an opinion on the current years statements alone and make no reference to the prior

years statements.

b. Indicate in the auditors report that the predecessor auditor expressed an unqualified opinion.

c. Obtain a letter of representations from the predecessor concerning any matters that might

affect the successors opinion.

d. Request the predecessor auditor to reissue the prior years report.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 12

45. An auditor decides to issue a qualified opinion on an entitys financial statements because a major

inadequacy in the entitys computerized accounting records prevents the auditor from applying

necessary procedures. The opinion paragraph of the auditors report should state that the

qualification pertains to

a. A client-imposed scope limitation.

b. A departure from generally accepted auditing standards.

c. The possible effects on the financial statements.

d. Inadequate disclosure of necessary information.

46. For the report containing a disclaimer for lack of independence, the disclaimer is in the

a. third or opinion paragraph

b. second or scope paragraph

c. first and only paragraph

d. fourth or explanatory paragraph

47. When reporting on comparative financial statements, which of the following circumstances should

ordinarily cause the auditor to change the previously issued opinion on the prior years financial

statements?

a. The prior years financial statements are restated following a pooling of interest in the current

year.

b. A departure from generally accepted accounting principles caused an adverse opinion on the

prior years financial statements, and those statements have been properly restated.

c. A change in accounting principle causes the auditor to make a consistency modification in the

current years audit report.

d. A scope limitation caused a qualified opinion on the prior years financial statements, but the

current years opinion is properly unqualified.

48. An auditor has previously expressed a qualified opinion on the financial statements of a prior

period because of a departure from generally accepted accounting principles. The prior-period

financial statements are restated in the current period to conform to accounting principles

generally accepted in the Philippines. The auditors updated report on the prior-period financial

statements should

a. Express an unqualified opinion concerning the restated financial statements.

b. Be accompanied by the original auditors report on the prior period.

c. Bear the same date as the original auditors report on the prior period.

d. Qualify the opinion concerning the restated financial statements because of a change in

accounting principle.

49. When there is a significant change in accounting principle, an auditors report should refer to the

lack of consistency in

a. The scope paragraph.

b. An explanatory paragraph between the scope paragraph and the opinion paragraph.

c. An explanatory paragraph following the opinion paragraph.

d. The opinion paragraph.

50. Which of the following audit procedures is most likely to assist an auditor in identifying conditions

and events that may indicate a substantial doubt an entitys ability to continue as a going concern?

a. Review compliance with the terms of debt agreements.

b. Confirm accounts receivable from principal customers.

c. Reconcile interest expense with outstanding debt.

d. Confirm bank balances.

51. Which of the following is appropriate when material inconsistency exists in the other information

and the entity refuses to make amendment?

a. Issue a qualification opinion due to inconsistent data.

b. Issue a qualified opinion because material inconsistency may raise doubt about the audit

conclusion drawn from audit evidence.

c. Include an emphasis of matter paragraph describing the material inconsistency.

d. Attach a separate statement that reconciles the inconsistency.

52. When, after the financial statements have been issued, the auditor becomes aware of a fact that

existed at the date of the auditors report, the auditor should do the following, except:

a. Consider whether the financial statements need revisions.

b. Discuss the matter with management.

c. Take the action appropriately in the circumstance.

d. Inform those users who are currently relying on the financial statements.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 13

53. When a fact, that existed before the date of the report is discovered and the management revises

previously issued audited financial statements, the following are appropriate except:

a. A new auditors report should include an emphasis of a matter paragraph that refers to a note

to the financial statements that discusses the reason for the revision of the financial

statements and to the earlier report issued by the auditor.

b. The new auditors report should contain the original date.

c. The performance of the procedures that are designed to obtain sufficient evidence as to

subsequent events would ordinarily be extended to the date the revised financial statements

are approved by the entitys management.

d. The auditor is permitted to restrict the audit procedures regarding the financial statements to

the effects of the subsequent event that necessitated the revision.

54. When a fact is discovered after the date of the report but before the financial statements are

issued and the client amends the financial statements, would the following procedures or actions

be necessary?

A.

B.

C.

D.

I. Procedures to obtain evidence with

Yes

Yes

No

No

respect to subsequent events are extended.

II. An emphasis of a matter paragraph is required.

Yes

No

No

Yes

55. When the comparatives in which the prior audit report is unmodified, the auditor should use an

audit report in which:

a. The comparatives are specifically identified in the opening paragraph but not referred to in the

opinion paragraph of the auditors report.

b. The comparatives are specifically identified in the opening paragraph and are referred to in the

opinion paragraph.

c. The comparatives are not specifically identified in the audit report.

d. The comparatives are described in the emphasis-of-matter paragraph of the auditors report.

56. When the auditors report on the prior period, as previously issued, included a modified opinion

and the matter which gave rise to the modification is unresolved, and results in a modification of

the auditors report regarding the current period figures:

a. The auditors report should be unmodified regarding the corresponding figures.

b. The auditors report should also be modified regarding the corresponding figures.

c. The auditors report should not refer to the previous modification.

d. The auditor should omit the comparatives as corresponding figures.

57. In relation to comparatives as corresponding figures, which of the following is incorrect?

a. When the prior period financial statements are not audited, the incoming auditor should state

in the auditors report that the corresponding figures are unaudited.

b. The incoming auditor must refer to the predecessor auditors report on the corresponding

figures in the incoming auditors report for the current period.

c. When the financial statements of the prior period where audited by another auditor, the

incoming auditors report should state that the prior period was audited by another auditor.

d. In situations were the incoming auditor identified that the corresponding figures are materially

misstated, the auditor should request management refuses to do so, appropriately modify the

report.

RPCPA BOARD EXAMINATIONS

MULTIPLE CHOICE QUESTIONS

1. An auditors report may be addressed to the company whose financial statements have been

examined or to that companys:

a. President

b. Board of Directors

c. Controller

d. Chief Accountant

2. Which is known as the third statement in accounting reports?

a. The balance sheet

b. The income statement

c. The statement of retained earnings

d. The cash flows statement

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 14

3. A government agency requires an external auditor to include accounting and financial data

pertaining to his client in prescribed forms which the auditor believes does not conform to

accepted auditing practice. The auditor should:

a. Withdraw from the engagement

b. Reword the forms and attach a separate report

c. Submit a short-form report with comments

d. Submit the forms with no date on questioned items

4. The adequacy of disclosures in the financial statements and footnotes is the primary responsibility

of the:

a. Client

b. Auditor in charge of field work

c. Partner assigned to engagement

d. Staff member who drafted the statements

5. Which of the following must accompany unaudited financial statements which are prepared by a

CPA?

a. Qualified opinion

b. Adverse opinion

c. Piecemeal opinion

d. Disclaimer opinion

6. Which of the following material events occurring subsequent to the balance sheet date would

require an adjustment to the financial statements before they are issued?

a. Sale of shares of capital stock

b. Loss of a building due to a fire

c. Settlement of litigation in excess of recorded liability

d. Major purchase of business which is expected to double sales volume

7. Which of the following changes would not affect the consistency standard/principle?

a. Change from cash to accrual basis of accounting

b. Change in principal officers of the company

c. Change in method of computing depreciation

d. Change in basis of pricing inventories

8. Mr. X has been retained as auditor of Vanguard Company. The function of his opinion on financial

statements of Vanguard Company is to:

a. Improve financial decisions of company management.

b. Lend credibility to a managements representations.

c. Detect fraud and abuse in management operations.

d. Serve requirements of BIR, SEC, or Bangko Sentral nags Pilipinas.

9. On September 22, 2012, the auditor completed the required field work on a clients financial

statements for the fiscal year ended June 30, 2012, the date when the audit report was finally

drafted, the auditor learned from one of the officials that one of their factories including a stock of

finished goods was destroyed by fire. This loss was soon after confirmed in a written report dated

October 30, 2012. What date should the audit report bear?

a. September 22, 2012.

b. October 23, 2012.

c. October 30, 2012..

d. June 30, 2012.

10. An unqualified opinion may be submitted only:

a. If an audit has been conducted in accordance with generally accepted auditing standards.

b. If it has been possible to apply all procedures necessary in the circumstances.

c. If the auditor has no reservations concerning the fairness of the financial statements.

d. All of the above.

11. When the auditor believes that the financial statements are misleading or do not reflect the proper

application of generally accepted accounting principles, the report will contain:

a. Disclaimer of opinion

b. Qualified opinion

c. Unqualified opinion

d. Adverse opinion

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 15

12. Material weaknesses in internal controls prevent the auditors collection of sufficient, competent

evidential matter and will justify the issuance of:

a. Disclaimer of opinion

b. Qualified opinion

c. Unqualified opinion

d. Adverse opinion

13. LMN Company prepared an annual report with comparative financial statements of the prior year

which was unaudited. The company retained a CPA to provide recommendations regarding the

accounting methods and financial affairs in general of the company and to prepare income tax

returns based on records made available to him. The CPA was requested to submit an audit

report.

a. The auditor need not report to the company.

b. He must qualify an opinion to the effect that comparison with the prior year figures may not be

valid because they are unaudited.

c. The auditor should inform that if the company wants to include his report of this years financial

statements in the annual report, the company cannot include the comparative financial

statements because he has not audited them.

d. The auditor must add a disclaimer of opinion of the prior years financial statements to the

report.

14. The auditor, may, if inappropriate, express an opinion on specific items in the financial statement

with which he is satisfied referred to as:

a. Qualified opinion

b. Disclaimer opinion

c. Unqualified opinion

d. None of the above

15. The principal auditor may decide to make reference to the examination of the other auditor when

he expresses an opinion on the financial statements based on this suggestion:

a. The report need not disclose the magnitude of the portion of the financial statement examined

by the auditor inasmuch as the total assets, total revenues, and other appropriate criteria

included in the report reveals clearly the portion done by the auditor.

b. It is enough that the report discloses the peso amounts of the total assets or percentage of

total revenues to indicate portion of the financial statements examined by the other auditor.

c. The other auditor may be named but only after obtaining his permission in writing in which

case where is no need for the principal auditor to present the other report together with his.

d. Opinion based in part on the report of the other auditor may be presented as a qualification of

the principal auditors opinion.

16. An auditor, depending upon a given situation, may express an unqualified opinion, a qualified

opinion, an adverse opinion or a disclaimer. Accordingly, what is the most suitable opinion if a

CPA has made an examination in accordance with generally accepted auditing standards, and

financial statement presentation conforms with generally accepted accounting principles applied

on a consistent basis and includes all informative disclosures necessary to make the statements

not misleading?

a. Unqualified

b. Qualified

c. Adverse

d. Disclaimer

17. When a CPA who is deemed not independent is associated with financial statements, this

suggests a(n):

a. Unqualified opinion

b. Qualified opinion

c. Adverse opinion

d. Disclaimer

18. There is material exception as to the fairness of presentation in accordance with generally

accepted accounting principles, as to their consistent application, thus suggesting:

a. Unqualified opinion

b. Qualified opinion

c. Adverse opinion

d. Disclaimer

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 16

19. If a CPA has not obtained sufficient competent evidential matter to form an opinion on the fairness

of the presentation of the financial statement as a whole:

a. Unqualified opinion

b. Qualified opinion

c. Adverse opinion

d. Disclaimer

20. When the financial statements do not fairly present the financial position in conformity with

generally accepted accounting principles?

a. Unqualified opinion

b. Qualified opinion

c. Disclaimer of opinion

d. Adverse opinion

21. When is it not possible in a first audit to validate the year-opening balance of an account?

a. Unqualified opinion

b. Qualified opinion

c. Disclaimer of opinion

d. Adverse opinion

22. If the auditor has no reservations concerning the fairness of the financial statements he makes a

(n)

a. Unqualified opinion

b. Qualified opinion

c. Disclaimer of opinion

d. Adverse opinion

23. When does the auditor associated with the financial statements consider himself or herself not to

be independent with respect to the auditee or its agents and affiliates he makes a(n)

a. Unqualified opinion

b. Qualified opinion

c. Disclaimer of opinion

d. Adverse opinion

24. When material weaknesses in internal controls prevent the auditors accumulation of sufficient,

competent evidential matter, this is a(n)

a. Unqualified opinion

b. Qualified opinion

c. Disclaimer of opinion

d. Adverse opinion

25. When the auditors exceptions are of such significant materiality that the financial statements,

taken as a whole, would be misleading to the users, we have a(n)

a. Unqualified opinion

b. Qualified opinion

c. Disclaimer of opinion

d. Adverse opinion

26. When the company failed to apportion cost of factory overhead incurred to each of the

manufactured products, this is

a. Unqualified opinion

b. Qualified opinion

c. Disclaimer of opinion

d. Adverse opinion

27. If the auditor disapproves of a clients change in the application of an accounting principle, this is

a. Unqualified opinion

b. Qualified opinion

c. Disclaimer of opinion

d. Adverse opinion

28. When the financial position or operating results of the client cast doubt on the feasibility of

continuing operations in the future, this suggests

a. Modified unqualified opinion

b. Qualified opinion

c. Disclaimer of opinion

d. Adverse opinion

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 17

29. An auditors formal review of subsequent events normally should be extended through the date of

the:

a. Audit report.

b. Next formal interim financial statements.

c. Delivery of the audit report to the client.

d. Mailing of the financial statements to the stockholders.

30. After performing all necessary procedures a predecessor auditor reissues a prior-period report on

financial statements at the request of the client without revising the original wording. The

predecessor auditor should

a. Dual-date the report.

b. Use the reissue date.

c. Use the date of the previous report.

d. Delete the date of the report.

31. In his report, the auditor need not mention consistency if:

a. The client has acquired another company through a pooling of interest.

b. An adverse opinion is issued.

c. This is the first year the client has had an audit.

d. Comparative financial statements are issued.

32. An independent auditor, who has examined a companys financial statements for the preceding

year but is doing so in the current year, should, with respect to consistency:

a. Report on the financial statements of the current year without referring to consistency.

b. Consider the consistent application of principles within the year under examination but not

between the current and preceding year.

c. Adopt procedures that are practicable and reasonable in the circumstances to obtain

assurance that the principles employed are consistent between the current and preceding

year.

d. Rely on the report of the prior years auditors if such a report does not take exception as to

consistency.

33. The auditor, if he believes that required disclosures of a significant nature are omitted from the

financial statements under examination, should decide between issuing:

a. A qualified opinion or an adverse opinion.

b. A disclaimer of opinion or a qualified opinion.

c. An adverse opinion or a qualified opinion.

d. An unqualified opinion or a qualified opinion.

34. The objectivity of the fourth reporting standard of auditing which requires that the auditors report

should contain an expression of opinion regarding the financial statements, taken as a whole or an

assertion to the effect that an opinion cannot be expressed is to prevent

a. The CPA from reporting on one basic financial statement and not to the others.

b. The CPA from expressing different opinions on each of the basic financial statements.

c. Misinterpretation regarding the degree of responsibility the auditor is assuming.

d. Management from reducing its final responsibility for the basic financial statements.

35. The opinion paragraph of an audit report expressing an adverse opinion should include a direct

reference to:

a. A footnote to the financial statements which discusses the basis for the opinion.

b. The scope paragraph which discusses the basis for the opinion rendered.

c. A separate paragraph which discusses the basis for the opinion rendered.

d. The consistency or lack of consistency in the application of generally accepted accounting

principles.

36. When an auditee refuses to make essential disclosures in the financial statements or in the

footnotes, the independent auditor should

a. Provide the necessary disclosures in the auditors report and appropriately modify the opinion

b. Explain to the client that an adverse opinion must be issued.

c. Issue an unqualified report and inform the stockholders of the improper disclosure in an

unaudited footnote.

d. Issue an opinion subject to the clients lack of disclosure of supplementary information as

explained in a middle paragraph of the report.

AT Quizzer 14

Reports on Audited FS & Special Reporting Issues

Page 18

37. The expression taken as a whole referred to in the fourth generally auditing standard of reporting

is best described by which of the following?

a. It applies equally to a competent set of financial statements and to each individual financial

statements.

b. It applies only to a complete set of financial statements.

c. It applies equally to each item in each financial statement.

d. It applies equally to each material item in each financial statement.

38. In a case where the auditor cannot determine the amounts associated with certain illegal acts

committed by the auditee, he would most likely:

a. Issue either a qualified opinion or a disclaimer of opinion.

b. Issue only an adverse opinion.

c. Issue either a qualified opinion or an adverse opinion.

d. Issue only a disclaimer of opinion.

39. The adequacy of disclosure in the financial statements and footnotes is the primary responsibility

of:

a. Partner assigned to the engagement.

b. Auditor in charge of field work.

c. Staff man who drafts the statement and footnotes.

d. Client.

40. When an auditor expresses an opinion on financial statements, his responsibilities extend to:

a. The underlying wisdom of his clients management decisions.

b. Whether the results of his clients operating decisions are fairly presented in the financial

statements.

c. Active participation in the implementation of the advice given to his client.

d. An ongoing responsibility for his clients solvency.

41. Chen, CPA, accepted the audit engagement of Renz Corporation. During the audit, Chen became

aware of the fact that he did not have the competence required for the engagement. What should

Chen do?

a. Disclaim an opinion.

b. Issue a subject to opinion.

c. Suggest that Renz Corp. engage another CPA to perform the audit.

d. Rely on the competence of client personnel.

*******************************************

Вам также может понравиться

- AT Quizzer 13 - Reporting Issues (2TAY1718) PDFДокумент10 страницAT Quizzer 13 - Reporting Issues (2TAY1718) PDFWihl Mathew Zalatar0% (1)

- At Reviewer Part II - (May 2015 Batch)Документ22 страницыAt Reviewer Part II - (May 2015 Batch)Jake BundokОценок пока нет

- BAC 318 Final Examination With AnswersДокумент10 страницBAC 318 Final Examination With Answersjanus lopez100% (1)

- Relevant Costing by A BobadillaДокумент99 страницRelevant Costing by A BobadillaShailene DavidОценок пока нет

- AT Quizzer 17 - Other Assurance and Non Assurance ServicesДокумент10 страницAT Quizzer 17 - Other Assurance and Non Assurance ServicesRachel LeachonОценок пока нет

- Government Accounting PDFДокумент33 страницыGovernment Accounting PDFKenneth RobledoОценок пока нет

- CH 13Документ19 страницCH 13pesoload100Оценок пока нет

- ACC 211 Review AssignmentДокумент5 страницACC 211 Review Assignmentglrosaaa cОценок пока нет

- Audit of LiabsДокумент2 страницыAudit of LiabsRommel Royce CadapanОценок пока нет

- CHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersДокумент2 страницыCHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichОценок пока нет

- AT-02 Q Assurance and Non-Assurance ServicesДокумент43 страницыAT-02 Q Assurance and Non-Assurance ServicesNicale JeenОценок пока нет

- AT Quizzer 4 (Audit Documentation)Документ5 страницAT Quizzer 4 (Audit Documentation)JimmyChaoОценок пока нет

- Items 1Документ7 страницItems 1RYANОценок пока нет

- Quiz BeeДокумент15 страницQuiz BeeRudolf Christian Oliveras UgmaОценок пока нет

- Auditing Theory - Key Concepts and Financial Statement AssertionsДокумент11 страницAuditing Theory - Key Concepts and Financial Statement AssertionsJeric TorionОценок пока нет

- Audit Control Risk AssessmentДокумент26 страницAudit Control Risk AssessmentMary GarciaОценок пока нет

- AFAR - Revenue Recognition, JointДокумент3 страницыAFAR - Revenue Recognition, JointJoanna Rose DeciarОценок пока нет

- DRILL 2: Board of Accountancy and CPA Licensure Exam ReviewДокумент9 страницDRILL 2: Board of Accountancy and CPA Licensure Exam ReviewjhouvanОценок пока нет

- CMPC312 QuizДокумент19 страницCMPC312 QuizNicole ViernesОценок пока нет

- Name: - Date: - Year &sec. - ScoreДокумент10 страницName: - Date: - Year &sec. - ScorePigging Etchuzera0% (1)

- Nfjpia Nmbe Far 2017 AnsДокумент9 страницNfjpia Nmbe Far 2017 AnsSamieeОценок пока нет

- Pre EngagementДокумент3 страницыPre EngagementJanica BerbaОценок пока нет

- Successor Auditor ResponsibilitiesДокумент5 страницSuccessor Auditor ResponsibilitiesVergel MartinezОценок пока нет

- Seatwork - Advacc1Документ2 страницыSeatwork - Advacc1David DavidОценок пока нет

- ACCT601 - Prelim Examination PDFДокумент10 страницACCT601 - Prelim Examination PDFSweet EmmeОценок пока нет

- Quizzer 5Документ6 страницQuizzer 5RarajОценок пока нет

- Auditing Multiple ChoiceДокумент18 страницAuditing Multiple ChoiceAken Lieram Ats AnaОценок пока нет

- Completion of Audit Quiz ANSWERДокумент9 страницCompletion of Audit Quiz ANSWERJenn DajaoОценок пока нет

- Right of Stoppage in TransitДокумент8 страницRight of Stoppage in TransitMara Shaira SiegaОценок пока нет

- Use The Fact Pattern Below For The Next Three Independent CasesДокумент5 страницUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- CERTS - Audit SamplingДокумент8 страницCERTS - Audit SamplingralphalonzoОценок пока нет

- Auditing Assignment Planning and Risk AssessmentДокумент32 страницыAuditing Assignment Planning and Risk AssessmentMarisolОценок пока нет

- Auditing Theory MULTIPLE CHOICE. Read Carefully The Questions Below and Choose The Best Statement Among The ChoicesДокумент12 страницAuditing Theory MULTIPLE CHOICE. Read Carefully The Questions Below and Choose The Best Statement Among The ChoiceschimchimcoliОценок пока нет

- Substantive Audit Testing CompДокумент36 страницSubstantive Audit Testing CompJoshua WacanganОценок пока нет

- Quiz 2 - Corp Liqui and Installment SalesДокумент8 страницQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburОценок пока нет

- Quiz 1 ConsulДокумент4 страницыQuiz 1 ConsulJenelyn Pontiveros40% (5)

- Auditing TheoryДокумент11 страницAuditing Theoryfnyeko100% (1)

- Philippine School of Business Administration: Auditing (Theoretical Concepts)Документ5 страницPhilippine School of Business Administration: Auditing (Theoretical Concepts)John Ellard M. SaturnoОценок пока нет

- Audit Expenditure Cycle TestsДокумент28 страницAudit Expenditure Cycle TestsAid BolanioОценок пока нет

- CPA Review School Philippines Audit Final ExamДокумент17 страницCPA Review School Philippines Audit Final ExamJane DizonОценок пока нет

- Accounting For LTCCДокумент5 страницAccounting For LTCCRoland CatubigОценок пока нет

- PSA PPT by Sir JekellДокумент96 страницPSA PPT by Sir JekellNeizel Bicol-ArceОценок пока нет

- ACTIVITY 2 Cost Behavior Cost Function FДокумент2 страницыACTIVITY 2 Cost Behavior Cost Function FLovely Anne Dela CruzОценок пока нет

- AP.2906 InvestmentsДокумент6 страницAP.2906 InvestmentsmoОценок пока нет

- Afar 106 - Home Office and Branch Accounting PDFДокумент3 страницыAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesОценок пока нет

- Summit Professional Review Center: Auditing Problems Shareholders' EquityДокумент6 страницSummit Professional Review Center: Auditing Problems Shareholders' EquityKris Van HalenОценок пока нет

- Simulated Exam 1Документ28 страницSimulated Exam 1Erin CruzОценок пока нет

- Angelo - Chapter 10 Operating LeaseДокумент8 страницAngelo - Chapter 10 Operating LeaseAngelo Andro Suan100% (1)

- Auditing fraud risk factors and responsibilitiesДокумент2 страницыAuditing fraud risk factors and responsibilitiesnhbОценок пока нет

- Module 13 Other Professional ServicesДокумент18 страницModule 13 Other Professional ServicesYeobo DarlingОценок пока нет

- Session 3 AUDITING AND ASSURANCE PRINCIPLESДокумент29 страницSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100Оценок пока нет

- Reviewer For Auditing TheoryДокумент10 страницReviewer For Auditing TheoryMharNellBantasanОценок пока нет

- Auditing Theory QuizДокумент9 страницAuditing Theory QuizMilcah Deloso SantosОценок пока нет

- Pas 34Документ17 страницPas 34rena chavezОценок пока нет

- Chapter 16: Hybrid and Derivative SecuritiesДокумент70 страницChapter 16: Hybrid and Derivative SecuritiesJoreseОценок пока нет

- Chapter 3 Quiz KeyДокумент2 страницыChapter 3 Quiz KeyAmna MalikОценок пока нет

- MAS 2 Prelim Exam To PrintДокумент3 страницыMAS 2 Prelim Exam To PrintJuly LumantasОценок пока нет

- 6 ACCT 2A&B C. OperationДокумент10 страниц6 ACCT 2A&B C. OperationShannon Mojica100% (1)

- PSA 700, 705, 706, 710, 720 ExercisesДокумент11 страницPSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungОценок пока нет

- Auditing Theory Key Concepts ExplainedДокумент12 страницAuditing Theory Key Concepts ExplainedKevin Ryan EscobarОценок пока нет

- G.R. No. 119308 - People v. Espanola y PaquinganДокумент22 страницыG.R. No. 119308 - People v. Espanola y PaquinganRachel LeachonОценок пока нет

- G.R. No. L-27434 - Goñi v. Court of AppealsДокумент10 страницG.R. No. L-27434 - Goñi v. Court of AppealsRachel LeachonОценок пока нет

- EvidenceДокумент4 страницыEvidenceRachel LeachonОценок пока нет

- The Fourth Asian Roundtable On Corporate Governance: Moving Towards Transparency of Ownership and Control: A Case StudyДокумент15 страницThe Fourth Asian Roundtable On Corporate Governance: Moving Towards Transparency of Ownership and Control: A Case StudyRachel LeachonОценок пока нет

- Supreme Court Rules on Jurisdiction in Case Involving Custody of Dead BodyДокумент4 страницыSupreme Court Rules on Jurisdiction in Case Involving Custody of Dead BodyRachel LeachonОценок пока нет

- Intestate Estate of Delgado Ad Rustia PDFДокумент9 страницIntestate Estate of Delgado Ad Rustia PDFRachel LeachonОценок пока нет

- Environmental RationaleДокумент97 страницEnvironmental Rationalegoannamarie7814Оценок пока нет

- San Beda College of Law: Dividend in InsolvencyДокумент2 страницыSan Beda College of Law: Dividend in InsolvencyRachel LeachonОценок пока нет

- 6banking - Eto TalagaДокумент23 страницы6banking - Eto TalagaRachel LeachonОценок пока нет

- San Beda Civil Law Memory Aid 2005 Centralized Bar OperationsДокумент1 страницаSan Beda Civil Law Memory Aid 2005 Centralized Bar OperationsRachel LeachonОценок пока нет

- De Jesus Vs Estate of TizonДокумент5 страницDe Jesus Vs Estate of TizonmilkymimiОценок пока нет

- Hiyas Savings and Loan Bank v. Acuna PDFДокумент4 страницыHiyas Savings and Loan Bank v. Acuna PDFRachel LeachonОценок пока нет

- Back Page - CivilДокумент1 страницаBack Page - CivilRachel LeachonОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- MercialДокумент38 страницMercialRachel LeachonОценок пока нет

- 2d-3d LaborДокумент4 страницы2d-3d LaborRachel LeachonОценок пока нет

- Conjugal Partnership Liable for Husband's Suretyship ObligationДокумент121 страницаConjugal Partnership Liable for Husband's Suretyship ObligationRachel LeachonОценок пока нет

- Anaya v. PalaraonДокумент3 страницыAnaya v. PalaraonRachel LeachonОценок пока нет

- INTERPRET LAW TO UPHOLD RATHER THAN DESTROYДокумент5 страницINTERPRET LAW TO UPHOLD RATHER THAN DESTROYRachel LeachonОценок пока нет

- Local Government Powers and StructureДокумент2 страницыLocal Government Powers and StructureRachel LeachonОценок пока нет

- Supplement in Criminal Law: Entralized AR PerationsДокумент2 страницыSupplement in Criminal Law: Entralized AR PerationsRachel LeachonОценок пока нет

- Callanta Notes (Criminal Law1)Документ166 страницCallanta Notes (Criminal Law1)aer0211100% (2)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 1C StatCon Midterm Google DocsДокумент2 страницы1C StatCon Midterm Google DocsRachel LeachonОценок пока нет

- Maceda Vs VasquezДокумент3 страницыMaceda Vs Vasquezbingkydoodle1012Оценок пока нет

- Environmental AnnotationДокумент63 страницыEnvironmental AnnotationIvan Angelo ApostolОценок пока нет

- Judge Tamin v. CAДокумент8 страницJudge Tamin v. CARachel LeachonОценок пока нет

- 2table Jurisdiction RemДокумент7 страниц2table Jurisdiction RemRachel LeachonОценок пока нет

- Persons and Family Relations Case Digest on Psychological Incapacity and Effects of Nullity of MarriageДокумент25 страницPersons and Family Relations Case Digest on Psychological Incapacity and Effects of Nullity of MarriageRachel LeachonОценок пока нет