Академический Документы

Профессиональный Документы

Культура Документы

Aug.24 II - Vatzero Relatedtransactions Vatrefunds

Загружено:

Angelo CastilloИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Aug.24 II - Vatzero Relatedtransactions Vatrefunds

Загружено:

Angelo CastilloАвторское право:

Доступные форматы

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

VAT ZERO-RELATED TRANSACTIONS

1. AMERICAN EXPRESS v. CIR - Cristobal

FORMAT:

DOCTRINE:

FACTS:

ISSUE:

HELD:

2. CIR v. PLACER DOME TECH - Castillo

CIR VS. PLACER DOME TECHNICAL SERVICES (PHILS.), INC.,

G.R. No. 164365

DOCTRINE:

The law neither makes a qualification nor adds a condition in

determining the tax situs of a zero-rated service. Under this

criterion, the place where the service is rendered determines

the jurisdiction to impose the VAT.

FACTS:

Sometime in 1996, at the San Antonio Mines in Marinduque owned

by Marcopper Mining Corporation (Marcopper), mine tailings

from the Taipan Pit started to escape through the Makulapnit

Tunnel and Boac Rivers, causing the cessation of mining and

milling operations, and causing potential environmental damage

to the rivers and the immediate area. To contain the damage

and prevent the further spread of the tailing leak, Placer

Dome, Inc. (PDI), the owner of 39.9% of Marcopper, undertook

to perform the clean-up and rehabilitation of the Makalupnit

and Boac Rivers, through a subsidiary. To accomplish this, PDI

engaged Placer Dome Technical Services Limited (PDTSL), a nonresident foreign corporation with office in Canada, to carry

out the project. In turn, PDTSL engaged the services of Placer

Dome Technical Services (Philippines), Inc. (respondent), a

domestic corporation and registered Value-Added Tax (VAT)

entity, to implement the project in the Philippines.

PDTSL and respondent entered into an Implementation Agreement.

The Agreement further stipulated that PDTSL was to pay

respondent an amount of money, in U.S. funds, equal to all

Costs incurred for Implementation Services performed under the

Agreement,[5] as well as a fee agreed to one percent (1%) of

such Costs.

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

Later, respondent amended its quarterly VAT returns. In the

amended returns, respondent declared a total input VAT payment

of P43,015,461.98 for the said quarters, and P42,837,933.60 as

its total excess input VAT for the same period. Then

respondent filed an administrative claim for the refund of its

reported total input VAT payments in relation to the project

it had contracted from PDTSL, amounting to P43,015,461.98. In

support of this claim for refund, respondent argued that the

revenues it derived from services rendered to PDTSL, pursuant

to the Agreement, qualified as zero-rated sales under Section

102(b)(2) of the then Tax Code, since it was paid in foreign

currency inwardly remitted to the Philippines.

CIR did not act on this claim. Thus, respondent filed a

Petition for Review with the Court of Tax Appeals (CTA),

praying for the refund of its total reported excess input VAT

totaling P42,837,933.60.

ISSUE:

Whether respondent Placer is entitled to the refund as

the revenues qualified as zero rated sales.

HELD: YES.

Section 102(b) Transactions Subject to Zero Percent (0%) RateThe following services performed in the Philippines by VATregistered persons shall be subject to zero percent (0%) rate:

(1) Processing, manufacturing or repacking goods for other

persons doing business outside the Philippines which goods are

subsequently exported, where the services are paid for in

acceptable foreign currency and accounted for in accordance

with the rules and regulations of the Bangko Sentral ng

Pilipinas (BSP);(2) Services other than those mentioned in the

preceding subparagraph, the consideration for which is paid

for in acceptable foreign currency and accounted for in

accordance with the rules and regulations of the [BSP].

It is Section 102(b)(2) which finds special relevance to this

case. The VAT is a TAX on consumption expressed as a

percentage of the value added to goods or services purchased

by the producer or taxpayer. As an indirect tax on services,

its main object is the transaction itself or, more concretely,

the performance of all kinds of services conducted in the

course of trade or business in the Philippines. These services

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

must be regularly conducted in this country; undertaken in

pursuit of a commercial or an economic activity; for a

valuable consideration; and not exempt under the Tax Code,

other special laws, or any international agreement. Yet even

as services may be subject to VAT, our tax laws extend the

benefit of zero-rating the VAT due on certain services. Under

the last paragraph of Scetion 102 (b), services performed by

VAT-registered persons in the Philippines, when paid in

acceptable foreign currency and accounted for in accordance

with the rules and regulations of the BSP, are ZERO-RATED.

Petitioner invokes the destination principle, citing that

respondents

while

rendered

to

a

non-resident

foreign

corporation, are not destined to be consumed abroad. Hence,

the onus of taxation of the revenue arising therefrom, for VAT

purposes, is also within the Philippines. The Court in

American Express debunked this argument. As a general rule,

the VAT system uses the destination principle as a basis for

the jurisdictional reach of the tax. Goods and services are

taxed only in the country where they are consumed. Thus,

exports are zero-rated, while imports are taxed. Thus, exports

are zero-rated while imports are taxed.

Confusion in zero rating arises because petitioner equates the

performance of a particular type of service with the

consumption of its output abroad. In the present case, the

facilitation of the collection of receivables is different

from the utilization or consumption of the outcome of such

service. While the facilitation is done in the Philippines,

the consumption is not. Respondent renders assistance to its

foreign clients the ROCs outside the country by receiving the

bills of service establishments located here in the country

and forwarding them to the ROCs abroad. The consumption

contemplated by law, contrary to petitioner's administrative

interpretation, does not imply that the service be done abroad

in order to be zero-rated.

Consumption is "the use of a thing in a way that thereby

exhausts it." Applied to services, the term means the

performance or "successful completion of a contractual duty,

usually resulting in the performer's release from any past or

future liability x x x" The services rendered by respondent

are performed or successfully completed upon its sending to

its foreign client the drafts and bills it has gathered from

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

service establishments here. Its services, having been

performed in the Philippines, are therefore also consumed in

the Philippines.

Unlike goods, services cannot be physically used in or bound

for a specific place when their destination is determined.

Instead, there can only be a "predetermined end of a course"

when determining the service "location or position x x x for

legal purposes." Respondent's facilitation service has no

physical existence, yet takes place upon rendition, and

therefore upon consumption, in the Philippines. Under the

destination principle, as petitioner asserts, such service is

subject to VAT at the rate of 10 percent.

However, the law clearly provides for an exception to the

destination principle; that is, for a zero percent VAT rate

for services that are performed in the Philippines, "paid for

in acceptable foreign currency and accounted for in accordance

with the rules and regulations of the [BSP]." Thus, for the

supply of service to be zero-rated as an exception, the law

merely requires that first, the service be performed in the

Philippines; second, the service fall under any of the

categories in Section 102(b) of the Tax Code; and, third, it

be paid in acceptable foreign currency accounted for in

accordance with BSP rules and regulations.

The law neither makes a qualification nor adds a condition in

determining the tax situs of a zero-rated service. Under this

criterion, the place where the service is rendered determines

the jurisdiction to impose the VAT. Performed in the

Philippines, such service is necessarily subject to its

jurisdiction, for the State necessarily has to have "a

substantial connection" to it, in order to enforce a zero

rate. The place of payment is immaterial; much less is the

place where the output of the service will be further or

ultimately used.

3. CIR v. BURMEISTER - Arid

4. ACCENTURE INC v. CIR - Alba

DOCTRINE: FOR VAT ZERO-RATING OF SERVICES RENDERED TO NON-RESIDENT

FOREIGN CORPORATION UNDER SEC. 108 (B)(2) OF THE NIRC, IT IS NOT ENOUGH

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

THAT THE RECIPIENT OF SERVICES BE PROVEN TO BE A FOREIGN CORPORATION,

IT MUST BE PROVEN TO BE A NON-RESIDENT FOREIGN CORPORATION.

FACTS:

Accenture filed with the Department of FInance an administrative claim for the refund or the

issuance of a Tax Credit Certificate (TCC). The Dept. of Finance did not act on the claim of

accenture. Thus, Accenture filed a Petition for Review with the CTA praying for the issuance

of a TCC in its favor in the amount of P35,178,844.21. Accenture presented as evidence

Official Receipts, Intercompany Payment Requests,Billing Statements, Memo InvoicesReceivable, Memo-Invoices Payable, and Bank Statements. The CIR denied the Petition of

Accenture for failing to prove that the latters sale of services to the alleged foreign clients

qualified for zero percent VAT.

ISSUE: Is Accenture entitled to a refund or an issuance of a TCC in the amount of

P35,178,844.21?

HELD:

NO. The Court ruled that to come within the purview of Section 108(B)(2), it is not enough

that the recipient of the service be proved to be a foreign corporation; rather, it must be

specifically proven to be a non-resident foreign corporation. The documents presented by

Accenture merely substantiated the existence of sales, receipt of foreign currency payments,

and inward remittance of the proceeds of such sales duly accounted for in accordance with

BSP rules. All of these were devoid of any evidence that the clients were doing business

outside the Philippines.

5. CIR v. SEKISUI - Bustamante

6.

7. CIR v. SEAGATE - jaramillo

8. CIR v. TOSHIBA - torres

Doctrine: The present rule is that an ECOZONE enterprise is a VAT-exempt entity. Sales of goods, properties and services by

persons to Customs Territory to ECOZONE enterprise shall be subject to VAT at zero percent (0%).

FACTS:

Respondent Toshiba was organized and established as a domestic corporation, duly-registered with SEC with the primary

purpose of engaging in the business of manufacturing and exporting of electrical and mechanical machinery and equipment.

Toshiba also registered with PEZA as an ECOZONE Export Enterprise and with the BIR as a VAT taxpayer and a withholding

agent. It filed its VAT returns reporting input VAT for a total of 18M, alleging it is from purchases of capital goods and services

remaining unutilized since it has not yet engaged in any business or transaction for which it may be liable for output VAT. It filed

with

the

Department

of

Finance

applications

for

tax

credit/refund

of

its

unutilized

input

VAT.

ISSUE: whether Toshiba is entitled to the tax credit/refund of its input VAT on its purchases of capital goods and services.

RULING:

Yes.

Petitioner CIR argues: Although respondent Toshiba may be a VAT-registered taxpayer, it is not engaged in a VAT-taxable

business. According to CIR, Toshiba is actually VAT-exempt, invoking the following provision of the Tax Code of 1977, as

amended

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

SEC.

103.

Exempt

transactions.

The

following

shall

be

exempt

from

value-added

tax.

(q) Transactions which are exempt under special laws, except those granted under Presidential Decree No. 66, 529, 972, 1491,

and 1590, and non-electric cooperatives under Republic Act No. 6938, or international agreements to which the Philippines is a

signatory.

By virtue of RA No. 7916, otherwise known as The Special Economic Zone Act of 1995, Toshiba is VAT exempt since it is only

paying

the

5%

preferential

tax

rate,

in

lieu

of

all

taxes.

The Court disagreed with this contention because Sec 103 (q) does not apply to Toshiba. THe very same section provides that

those

falling

under

PD

66

are

not

VAT exempt.

PD

66

is

the

precursor

of

RA 7916.

But Toshiba is still VAT exempt under Sec 8 of RA 7916, (not Sec 24 which imposes 5% preferential tax rate) which established

the

fiction

that

ECOZONES

are

foreign

territory.

It is important to note herein that Toshiba is located within an ECOZONE. An ECOZONE or a Special Economic Zone has been

described

as

. . . [S]elected areas with highly developed or which have the potential to be developed into agro-industrial, industrial, tourist,

recreational, commercial, banking, investment and financial centers whose metes and bounds are fixed or delimited by

Presidential Proclamations. An ECOZONE may contain any or all of the following: industrial estates (IEs), export processing

zones

(EPZs),

free

trade

zones

and

tourist/recreational

centers.

The national territory of the Philippines outside of the proclaimed borders of the ECOZONE shall be referred to as the Customs

Territory. Section 8 of Rep. Act No. 7916 mandates that the PEZA shall manage and operate the ECOZONES as a separate

customs territory;

thus, creating the fiction that the ECOZONE is a foreign territory. As a result,

sales made by a supplier in the Customs Territory to a purchaser in the ECOZONE are treated as an exportation from the

Customs

Territory.

sales made by a supplier from the ECOZONE to a purchaser in the Customs Territory are treated as an importation into the

Customs

Territory.

The Philippine VAT system adheres to the Cross Border Doctrine (which means no VAT shall be imposed to form part of the

cost of goods destined for consumption outside of the territorial border of the taxing authority). Hence:

export

of

goods

and

services

free

of

VAT;

import

of

goods

and

services

subject

to

10%

VAT

(now

12%)

Applying

the

Cross

Border

Doctrine,

BIR

issued

RMC

No.

74-99,

on

15

October

1999.

SECTION 3. Tax Treatment Of Sales Made By a VAT Registered Supplier from The Customs Territory, To a PEZA Registered

Enterprise.

If the Buyer is a PEZA registered enterprise which is subject to the 5% special tax regime, in lieu of all taxes, except real

property

tax,

pursuant

to

R.A.

No.

7916,

as

amended:

Sale of goods (i.e., merchandise). This shall be treated as indirect export hence, considered subject to zero percent (0%) VAT

Sale of service. This shall be treated subject to zero percent (0%) VAT under the cross border doctrine of the VAT System

If Buyer is a PEZA registered enterprise which is not embraced by the 5% special tax regime, hence, subject to taxes under the

NIRC, e.g., Service Establishments which are subject to taxes under the NIRC rather than the 5% special tax regime:

Sale of goods (i.e., merchandise). This shall be treated as indirect export hence, considered subject to zero percent (0%) VAT,

pursuant to Sec. 106(A)(2)(a)(5), NIRC and Sec. 23 of R.A. No. 7916 in relation to ART. 77(2) of the Omnibus Investments

Code.

Sale of Service. This shall be treated subject to zero percent (0%) VAT under the cross border doctrine of the VAT System,

pursuant

to

VAT

Ruling

No.

032-98

dated

Nov.

5,

1998.

In the final analysis, any sale of goods, property or services made by a VAT registered supplier from the Customs Territory to

any registered enterprise operating in the ecozone, regardless of the class or type of the latters PEZA registration, is actually

qualified and thus legally entitled to the zero percent (0%) VAT. Accordingly, all sales of goods or property to such enterprise

made by a VAT registered supplier from the Customs Territory shall be treated subject to 0% VAT, pursuant to Sec. 106(A)(2)(a)

(5), NIRC, in relation to ART. 77(2) of the Omnibus Investments Code, while all sales of services to the said enterprises, made

by VAT registered suppliers from the Customs Territory, shall be treated effectively subject to the 0% VAT, pursuant to Section

108(B)(3), NIRC, in relation to the provisions of R.A. No. 7916 and the Cross Border Doctrine of the VAT system.

Sales of goods, properties and services by a VAT-registered supplier from the Customs Territory to an ECOZONE enterprise

shall be treated as export sales. If such sales are made by a VAT-registered supplier, they shall be subject to VAT at zero

percent (0%). In zero-rated transactions, the VAT-registered supplier shall not pass on any output VAT to the ECOZONE

enterprise, and at the same time, shall be entitled to claim tax credit/refund of its input VAT attributable to such sales. Zero-

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

rating of export sales primarily intends to benefit the exporter (i.e., the supplier from the Customs Territory), who is directly and

legally liable for the VAT, making it internationally competitive by allowing it to credit/refund the input VAT attributable to its

export

sales.

But even if Toshiba is a VAT exempt entity that could not have engaged in VAT-taxable business, the Court still believes that it is

entitled

to

credit/refund

of

its

input

VAT.

CIR validly raised the question of whether any output VAT was actually passed on to respondent Toshiba which it could claim as

input VAT subject to credit/refund. If the VAT-registered supplier from the Customs Territory did not charge any output VAT to

respondent Toshiba believing that it is exempt from VAT or it is subject to zero-rated VAT, then respondent Toshiba did not pay

any input VAT on its purchase of capital goods and it could not claim any tax credit/refund thereof.

However, the rule on zero-based transactions, as imposed by RMC 74-99 only took effect on Oct. 15, 1999. Prior to the said

date, the old rule is that a PEZA-registered enterprise has the option to choose between two sets of fiscal incentives:

5% preferential tax rate on its gross income under RA 7916, as amended (the 5% tax on its gross income is in lieu of all taxes)

Income tax holiday provided under EO 226 (Omnibus Investment Code of 1987) income tax holiday in 6 or 4 year periods but

not

exempt

from

other

taxes,

such

as

VAT

In the case of Toshiba, the sale of capital goods by suppliers to Toshiba took place before the effectivity of RMC 74-99, when

the old rule was implemented by the BIR. Toshiba availed the income tax holiday and was deemed subject to 10% VAT. It was

very likely therefore that suppliers from the Custom territory had passed on output VAT to Toshiba, and the latter incurred input

VAT.

9. CIR v. CONTEX CORP - salto

INPUT VAT

10. ABAKADA GURO v. ERMITA (Sept. 1, 2005) - Samson

11. ABAKADA GURO v. ERMITA (Oct. 18, 2005) - Rosario

For resolution are different motions for reconsideration of the Courts Decision dated September 1, 2005 upholding the

constitutionality of Republic Act No. 9337 or the VAT Reform Act:

Grounds:

1.

Petitioners Escudero, et al., insist that the bicameral conference committee should not even have acted on the no

pass-on provisions since there is no disagreement between House Bill Nos. 3705 and 3555 on the one hand, and

Senate Bill No. 1950 on the other

SC: Such argument is flawed. Note that the rules of both houses of Congress provide that a conference committee shall settle

the "differences" in the respective bills of each house. Verily, the fact that a no pass-on provision is present in one version but

absent in the other, and one version intends two industries, i.e., power generation companies and petroleum sellers, to bear the

burden of the tax, while the other version intended only the industry of power generation, transmission and distribution to be

saddled with such burden, clearly shows that there are indeed differences between the bills coming from each house, which

differences should be acted upon by the bicameral conference committee as mandated by the rules of both houses of

Congress.

Moreover, the deletion of the no pass-on provision made the present VAT law more in consonance with the very nature of VAT

which, as stated in the Decision promulgated on September 1, 2005, is a tax on spending or consumption, thus, the burden

thereof is ultimately borne by the end-consumer.

2.

Escudero, et al., then claim that the Rules of the House of Representatives changed since the time of Tolentino vs.

Secretary of Finance to the effect that the House panel must report back to the House if there are substantial

differences in the House and Senate bills.

SC: Mere failure to conform to parliamentary usage will not invalidate the action (taken by a deliberative body) when the

requisite number of members have agreed to a particular measure.

3. Escudero, et. al., also contend that RA 9337 violates the constitutional imperative on exclusive origination of revenue

bills under Section 24 of Article VI of the Constitution when the Senate introduced amendments not connected with

VAT.

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

SC: The Court is not persuaded. Section 24 speaks of origination of certain bills from the House of Representatives which has

been interpreted in the Tolentino case as follows:

To begin with, it is not the law but the revenue bill which is required by the Constitution to "originate exclusively" in the

House of Representatives. To insist that a revenue statute must substantially be the same as the House bill would be to deny

the Senate's power not only to "concur with amendments" but also to " propose amendments." Indeed, what the Constitution

simply means is that the initiative for filing revenue, tariff, or tax bills, bills authorizing an increase of the public debt, private bills

and bills of local application must come from the House of Representatives on the theory that, elected as they are from the

districts, the members of the House can be expected to be more sensitive to the local needs and problems. On the other hand,

the senators, who are elected at large, are expected to approach the same problems from the national perspective.

4.

Escudero, et al., also reiterate that R.A. No. 9337s stand- by authority to the Executive to increase the VAT rate,

especially on account of the recommendatory power granted to the Secretary of Finance, constitutes undue

delegation of legislative power. as policy making.

SC: There is no merit in this contention. The Court reiterates that in making his recommendation to the President on the

existence of either of the two conditions, the Secretary of Finance is not acting as the alter ego of the President or even her

subordinate. He is acting as the agent of the legislative department, to determine and declare the event upon which its

expressed will is to take effect. Congress granted the Secretary of Finance the authority to ascertain the existence of a fact,

namely, whether by December 31, 2005, the value-added tax collection as a percentage of GDP of the previous year exceeds

two and four-fifth percent (2 4/5%) or the national government deficit as a percentage of GDP of the previous year exceeds one

and one-half percent (1%). Congress does not abdicate its functions or unduly delegate power when it describes what job

must be done, who must do it, and what is the scope of his authority.

5.

Petitioners Association of Pilipinas Shell Dealers, Inc. reiterated their arguments that even if the right to credit the

input VAT is merely a statutory privilege, it has already evolved into a vested right that the State cannot remove.

SC: As the Court stated in its Decision, the right to credit the input tax is a mere creation of law. Prior to the enactment of multistage sales taxation, the sales taxes paid at every level of distribution are not recoverable from the taxes payable. With the

advent of Executive Order No. 273 imposing a 10% multi-stage tax on all sales, it was only then that the crediting of the input

tax paid on purchase or importation of goods and services by VAT-registered persons against the output tax was established.

This continued with the Expanded VAT Law (R.A. No. 7716), and The Tax Reform Act of 1997 (R.A. No. 8424). The right to

credit input tax as against the output tax is clearly a privilege created by law, a privilege that also the law can limit. It should be

stressed that a person has no vested right in statutory privileges.

Rights are considered vested when the right to enjoyment is a present interest, absolute, unconditional, and perfect or fixed and

irrefutable. As adeptly stated by Associate Justice Minita V. Chico-Nazario in her Concurring Opinion

It should be remembered that prior to RA 9337, the petroleum dealers input VAT credits were inexistent they were

unrecognized and disallowed by law. The petroleum dealers had no such property called input VAT credits. It is only rational,

therefore, that they cannot acquire vested rights to the use of such input VAT credits when they were never entitled to such

credits in the first place, at least, not until RA 9337. Petroleum dealers right to use their input VAT as credit against their output

VAT unlimitedly has not vested, being a mere expectancy of a future benefit and being contingent on the continuance of Section

110 of the National Internal Revenue Code of 1997, prior to its amendment by Rep. Act No. 9337.

DENIED WITH FINALITY. The temporary restraining order issued by the Court is LIFTED.

12. CIR v. ACESITE - Radovan

Facts: (Super Short Case lang)

Acesite is the owner and operator of the Holiday Inn Manila Pavilion Hotel along United Nations Avenue in

Manila. It leases 6,768.53 square meters of the hotels premises to the Philippine Amusement and Gaming

Corporation [hereafter, PAGCOR] for casino operations. It also caters food and beverages to PAGCORs casino

patrons through the hotels restaurant outlets. Acesite incurred VAT amounting to P30,152,892.02 from its

rental income and sale of food and beverages to PAGCOR during said period. Acesite tried to shift the said

taxes to PAGCOR by incorporating it in the amount assessed to PAGCOR but the latter refused to pay the taxes

on account of its tax exempt status. Acesite paid the VAT. However, Acesite belatedly arrived at the conclusion

that its transaction with PAGCOR was subject to zero rate as it was rendered to a tax-exempt entity. Acesite

now files claim for refund

CTA ruling:

Acesite is subject to zero percent tax pursuant to Section 102 (b)(3) [now 106(A)(C)] insofar as its

gross income from rentals and sales to PAGCOR, a tax exempt entity by virtue of a special law.

Accordingly, the amounts of P21,413,026.78 and P8,739,865.24, representing the 10% EVAT on its

sales of food and services and gross rentals, respectively from PAGCOR shall, as a matter of course,

be refunded to the petitioner for having been inadvertently remitted to the respondent.

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

ISSUES:

Whether PAGCORs tax exemption privilege includes the indirect tax of VAT to entitle Acesite to zero percent

(0%) VAT rate; --- YES

Whether the zero percent (0%) VAT rate under then Section 102 (b)(3) of the Tax Code (now Section 108 (B)

(3) of the Tax Code of 1997) legally applies to Acesite. --- YES

Held:

Petition DENIED.

Decision of lower court AFFIRMED

Ratio:PAGCOR is exempt from payment of indirect taxes

It is undisputed that P.D. 1869, the charter creating PAGCOR, grants the latter an exemption from the payment

of taxes. Section 13 of P.D. 1869 pertinently provides:

Sec. 13. Exemptions.

(2) Income and other taxes. (a) Franchise Holder: No tax of any kind or form, income or otherwise, as

well as fees, charges or levies of whatever nature, whether National or Local, shall be assessed and

collected under this Franchise from the Corporation; nor shall any form of tax or charge attach in

any way to the earnings of the Corporation, except a Franchise Tax of five (5%) percent of the gross

revenue or earnings derived by the Corporation from its operation under this Franchise. Such tax shall be due

and payable quarterly to the National Government and shall be in lieu of all kinds of taxes, levies, fees or

assessments of any kind, nature or description, levied, established or collected by any municipal, provincial, or

national government authority.

(b) Others: The exemptions herein granted for earnings derived from the operations conducted

under the franchise specifically from the payment of any tax, income or otherwise, as well as any

form of charges, fees or levies, shall inure to the benefit of and extend to corporation(s),

association(s), agency(ies), or individual(s) with whom the Corporation or operator has any

contractual relationship in connection with the operations of the casino(s) authorized to be

conducted under this Franchise and to those receiving compensation or other remuneration from the

Corporation or operator as a result of essential facilities furnished and/or technical services rendered to the

Corporation or operator.

A close scrutiny of the above provisos clearly gives PAGCOR a blanket exemption to taxes with no distinction on

whether the taxes are direct or indirect. We are one with the CA ruling that PAGCOR is also exempt from

indirect taxes, like VAT,

The manner of charging VAT does not make PAGCOR liable to said tax

It is true that VAT can either be incorporated in the value of the goods, properties, or services sold or leased, in

which case it is computed as 1/11 of such value, or charged as an additional 10% to the value. Verily, the

seller or lesser has the option to follow either way in charging its client and customer. In the instant case,

Acesite followed the latter method, that is, charging an additional 10% of the gross sales and rentals. Be that

as it may, the use of either method, does not denigrate the fact that PAGCOR is exempt from indirect tax, like

VAT.

VAT EXEMPTION EXTENDS TO ACESITE

Thus, while it was proper for PAGCOR not to pay the 10% VAT charged by Acesite, the latter is not liable for

the payment of it as it is exempt in this particular transaction by operation of law to pay the indirect tax. Such

exemption falls within the former Section 102 (b) (3) of the 1977 Tax Code, as amended (now, Sec. 108[b] [3]

of R.A. 8424), which provides:

Section 102. Value-added tax on sale of services (a) Rate and base of tax There shall be levied, assessed

and collected, a value-added tax equivalent to 10% of gross receipts derived by any person engaged in the

sale of services x x x; Provided, that the following services performed in the Philippines by VAT-registered

persons shall be subject to 0%.

3) Services rendered to persons or entities whose exemption under special laws or international

agreements to which the Philippines is a signatory effectively subjects the supply of such services to zero

(0%) rate.

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

The rationale for the exemption from indirect taxes provided for in P.D. 1869 and the extension of such

exemption to entities or individuals dealing with PAGCOR in casino operations are best elucidated from the

1987 case of Commissioner of Internal Revenue v. John Gotamco & Sons, Inc., where the absolute tax

exemption of the World Health Organization (WHO) upon an international agreement was upheld. We held in

said case that the exemption of contractee WHO should be implemented to mean that the entity or person

exempt is the contractor itself who constructed the building owned by contractee WHO, and such does not

violate the rule that tax exemptions are personal because the manifest intention of the agreement is to

exempt the contractor so that no contractors tax may be shifted to the contractee WHO. Thus, the

proviso in P.D. 1869, extending the exemption to entities or individuals dealing with PAGCOR in casino

operations, is clearly to proscribe any indirect tax, like VAT, that may be shifted to PAGCOR.

13. CIR v. SONY - Pangilinan

Doctrine

Thus, there must be a sale, barter or exchange of goods or properties before any VAT may be levied.

Facts

The CIR issued Letter of Authority No. 000019734 authorizing certain revenue officers to examine Sony's books

of accounts and other accounting records regarding revenue taxes for "the period 1997 and unverified prior

years."

A preliminary assessment for 1997 deficiency taxes and penalties was issued by the CIR which Sony protested.

Sony filed a petition for review before the CTA. The CTA-First Division disallowed the deficiency VAT assessment

because the subsidized advertising expense paid by Sony which was duly covered by a VAT invoice resulted in

an input VAT credit.

The CIR filed before the Supreme Court a petition for review alleging that Sony should be liable for deficiency

VAT.

The CIR alleges that Sony's advertising expense could not be considered as an input VAT credit because the

same was eventually reimbursed by Sony International Singapore (SIS).

The CIR further argues that Sony itself admitted that the reimbursement from SIS was income and, thus, taxable.

In support of this, the CIR cited a portion of Sony's protest filed before it:

The fact that due to adverse economic conditions, Sony-Singapore Has granted to our client a

subsidy equivalent to the latter's advertising expenses will not affect the validity of the input taxes

from such expenses. Thus, at the most, this is an additional income of our client subject to

income tax. We submit further that our client is not subject to VAT on the subsidy income as this

was not derived from the sale of goods or services.

Issue

WON Sony should be liable for deficiency Value Added Tax.

Held

No. Insofar as the abovementioned subsidy may be considered as income and, therefore, subject to income tax,

the Court agrees. However, the Court does not agree that the same subsidy should be subject to the 10% VAT.

To begin with, the said subsidy termed by the CIR as reimbursement was not even exclusively earmarked for

Sony's advertising expense for it was but an assistance or aid in view of Sony's dire or adverse economic

conditions, and was only "equivalent to the latter's (Sony's) advertising expenses."

Section 106 of the Tax Code explains when VAT may be imposed or exacted. Thus:

SEC. 106. Value-added Tax on Sale of Goods or Properties.

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

(A) Rate and Base of Tax. There shall be levied, assessed and collected on every sale, barter or

exchange of goods or properties, value-added tax equivalent to ten percent (10%) of the gross

selling price or gross value in money of the goods or properties sold, bartered or exchanged,

such tax to be paid by the seller or transferor.

Thus, there must be a sale, barter or exchange of goods or properties before any VAT may be levied. Certainly,

there was no such sale, barter or exchange in the subsidy given by SIS to Sony. It was but a dole out by SIS and

not in payment for goods or properties sold, bartered or exchanged by Sony.

The Court held that services rendered for a fee even on reimbursement-on-cost basis only and without realizing

profit are subject to VAT, which is inapplicable to this case. Sony did not render any service to SIS at all. The

services rendered by the advertising companies, paid for by Sony using SIS dole-out, were for Sony and not SIS.

SIS just gave assistance to Sony in the amount equivalent to the latter's advertising expense but never received

any goods, properties or service from Sony.

WITHHOLDING, PRESUMPTIVE, TRANSITIONAL INPUT VAT

14. FORT BONIFACIO v. CIR - Morales

15. LVM v. SANCHEZ - Marasigan

VAT REFUNDS

16. CIR v. MIRANT PAGBILAO - Gaite

Doctrines:

1. Failure to secure an approved application for zero-rating makes sales to

tax-exempt entities subject to 12% VAT.

2. When a zero-rated VAT taxpayer pays its input VAT a year after the pertinent

transaction, said taxpayer only has a year to file a claim for refund or tax credit of

the unutilized creditable input VAT. The reckoning frame would always be the

end of the quarter when the pertinent sales or transaction was made, regardless

when the input VAT was paid.

Facts:

CIR filed a Petition for Review on Certiorari under Rule 45 assailing and

seeking to set aside the Decision dated December 22, 2005 of the CA

(Thus the present case)

MPC, formerly Southern Energy Quezon, Inc., and also formerly known as Hopewell (Phil.) Corporation, is a

domestic firm engaged in the generation of power which it sells to the National Power Corporation (NPC). Input VAT

Refund stems from amount paid for the construction of the electrical and mechanical equipment portion of its

Pagbilao, Quezon plant, which appears to have been undertaken from 1993 to 1996, MPC secured the services of

Mitsubishi Corporation (Mitsubishi) of Japan.

Under its charter, NPC is exempt from all taxes both direct and indirect as ruled in Maceda v. Macaraig.

MPCs CONTENTION:

MPC, believes that its sale of power generation services to NPC is, pursuant to Sec. 108(B)(3) of the Tax Code, zerorated for VAT purposes. It therefore filed on December 1, 1997 with Revenue District Office (RDO) No. 60 in Lucena

City an Application for Effective Zero Rating. The application covered the construction and operation of its Pagbilao

power station under a Build, Operate, and Transfer scheme.

WHAT MADE THE ISSUE:

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

Consistent with its belief to be zero-rated, MPC opted not to pay the VAT component of the progress billings from

Mitsubishi for the period covering April 1993 to September 1996for the E & M Equipment Erection Portion of MPCs

contract with Mitsubishi. This prompted Mitsubishi to advance the VAT component as this serves as its output VAT

which is essential for the determination of its VAT payment. Apparently, it was only on April 14, 1998 that MPC paid

Mitsubishi the VAT component for the progress billings from April 1993 to September 1996, and for which Mitsubishi

issued Official Receipt (OR) No. 0189 in the aggregate amount of PhP 135,993,570.

MPC, while awaiting approval of its application, MPC filed its quarterly VAT return for the second quarter of 1998

where it reflected an input VAT of PhP 148,003,047.62, which included PhP 135,993,570 supported by OR No. 0189.

Pursuant to the procedure prescribed in Revenue Regulations No. 7-95, MPC filed on December 20, 1999 an

administrative claim for refund of unutilized input VAT in the amount of PhP 148,003,047.62.

WHAT HAPPENED NEXT:

BIR failed to act on MPCs claim for refund and the case was elevated to CTA

CTA partially granted input VAT Refund for MPC disallowing items

not substantiated with receipts.

CTA commissioned SGV in verifying and analyzing documents and figures and entries to determine whether MPC

has unapplied or unutilized creditable input VAT for the 2nd quarter of 1998 attributable to zero-rated sales to NPC, if

creditable input VAT of MPC for said period is substantiated and if unutilized creditable input VAT for said quarter, if

any, was applied against any of the VAT output tax of MPC in the subsequent quarter.

CA rendered its assailed decision modifying that of the CTA decision by granting most of MPCs claims for tax

refund or credit. CA ordered to refund or issue a tax credit certificate in favor of petitioner Mirant Pagbilao Corporation

its unutilized input VAT payments directly attributable to its effectively zero-rated sales for the second quarter of 1998

in the total amount of P146,760,509.48.

CA agreed on:

(1) a zero-rating for VAT purposes for its sales and services to tax-exempt NPC; and

(2) a refund or tax credit for its unutilized input VAT for the second quarter of 1998, with only a disagreement on

evidentiary value of OR No. 0189.

Issue:

1. WON MPC is entitled to the refund of its input VAT payments made from 1993 to 1996 amounting to [PhP]

146,760,509.48?

Held:

PARTLY. THERE ARE ITEMS WHICH HAVE BEEN PRESCRIBED.

Verily, a claim for tax refund may be based on a statute granting tax exemption, or, as Commissioner of Internal

Revenue v. Fortune Tobacco Corporation would have it, the result of legislative grace. In such case, the claim is to be

construed strictissimi juris against the taxpayer, meaning that the claim cannot be made to rest on vague inference.

Where the rule of strict interpretation against the taxpayer is applicable as the claim for refund partakes of the nature

of an exemption, the claimant must show that he clearly falls under the exempting statute. On the other hand, a tax

refund may be, as usually it is, predicated on tax refund provisions allowing a refund of erroneous or excess payment

of tax. The return of what was erroneously paid is founded on the principle of solutio indebiti, a basic postulate that

no one should unjustly enrich himself at the expense of another. The caveat against unjust enrichment covers the

government. And as decisional law teaches, a claim for tax refund proper, as here, necessitates only the

preponderance-of-evidence threshold like in any ordinary civil case.

SC notes that the BIR Commissioner, while making reference to the figure PhP 146,760,509.48, joins the CA and

the CTA on their disposition on the propriety of the refund of or the issuance of a TCC for the amount of PhP

10,766,939.48. In fine, the BIR Commissioner trains his sight and focuses his arguments on the core issue of

whether or not MPC is entitled to a refund for PhP 135,993,570 (PhP 146,760,509.48 - PhP 10,766,939.48 = PhP

135,993,570) it allegedly paid as creditable input VAT for services and goods purchased from Mitsubishi during the

1993 to 1996 stretch.

Belated payment by MPC of its obligation for creditable input VAT it is no less found by the CTA, citing the SGVs

report, the payments covered by OR No. 0189 were for goods and service purchases made by MPC through the

progress billings from Mitsubishi for the period covering April 1993 to September 1996for the E & M Equipment

Erection Portion of MPCs contract with Mitsubishi. In net effect, MPC did not, for the VATable MPC-Mitsubishi 1993

to 1996 transactions adverted to, immediately pay the corresponding input VAT. OR No. 0189 issued on April 14,

1998 clearly reflects the belated payment of input VAT corresponding to the payment of the progress billings from

Mitsubishi for the period covering April 7, 1993 to September 6, 1996. SGV found that OR No. 0189 in the amount of

PhP 135,993,570 (USD 5,190,000) was duly supported by bank statement evidencing payment to Mitsubishi (Japan).

Undoubtedly, OR No. 0189 proves payment by MPC of its creditable input VAT relative to its purchases from

Mitsubishi.

OR No. 0189 by itself sufficiently proves payment of VAT (however it has prescribed its status for refund)

Section 110. Tax Credits.

A. Creditable Input Tax.

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

(1) Any input tax evidenced by a VAT invoice or official receipt issued in accordance with Section 113 hereof on the

following transactions shall be creditable against the output tax:

(a) Purchase or importation of goods:

xxx

(b) Purchase of services on which a value-added tax has been actually

paid.

xxx

The law considers a duly-executed VAT invoice or OR referred to in the above provision as sufficient evidence to

support a claim for input tax credit. And any doubt as to what OR No. 0189 was for or tended to prove should

reasonably be put to rest by the SGV report on which the CTA notably placed much reliance. The SGV report stated

that [OR] No. 0189 dated April 14, 1998 is for the payment of the VAT on the progress billings from Mitsubishi Japan

for the period April 7, 1993 to September 6, 1996 for the E & M Equipment Erection Portion of the

Companys contract with Mitsubishi Corporation (Japan).

Therefore, VAT is presumably paid on April 14, 1998 for OR 0189 when MPC paid to Mitsubishi

The claim for refund or tax credit for the creditable input VAT payment made by MPC embodied in

OR No. 0189 was filed beyond the period provided by law for such claim. Sec. 112(A) of the NIRC

pertinently reads:

(A) Zero-rated or Effectively Zero-rated Sales. Any VAT registered person, whose sales are zerorated or effectively zero-rated may, within two (2) years after the close of the taxable quarter when

the sales were made, apply for the issuance of a tax credit certificate or refund of creditable input tax

due or paid attributable to such sales, except transitional input tax, to the extent that such input tax

has not been applied against output tax: x x x.

Thus, when a zero-rated VAT taxpayer pays its input VAT a year after the pertinent transaction, said

taxpayer only has a year to file a claim for refund or tax credit of the unutilized creditable input VAT.

The reckoning frame would always be the end of the quarter when the pertinent sales or transaction

was made, regardless when the input VAT was paid. Be that as it may, and given that the last

creditable input VAT due for the period covering the progress billing of September 6, 1996 is the third

quarter of 1996 ending on September 30, 1996, any claim for unutilized creditable input VAT refund or

tax credit for said quarter prescribed two years after September 30, 1996 or, to be precise, on

September 30, 1998. Consequently, MPCs claim for refund or tax credit filed on December 10, 1999

had already prescribed. (See Sec. 204(C) and 229 which SC decided will not apply for MPC for

prescription issue)

MPCs creditable input VAT not erroneously paid. MPCs sale of electricity to NPC is not zero-rated for

its failure to secure an approved application for zero-rating.

Under Sec. 105 of the NIRC, creditable input VAT is an indirect tax which can be shifted or passed on

to the buyer, transferee, or lessee of the goods, properties, or services of the taxpayer. The fact that

the subsequent sale or transaction involves a wholly-tax exempt client, resulting in a zero-rated or

effectively zero-rated transaction, does not, standing alone, deprive the taxpayer of its right to a

refund for any unutilized creditable input VAT, albeit the erroneous, illegal, or wrongful payment angle

does not enter the equation.

In Commissioner of Internal Revenue v. Seagate Technology (Philippines), the Court explained the

nature of the VAT and the entitlement to tax refund or credit of a zero-rated taxpayer:

Viewed broadly, the VAT is a uniform tax x x x levied on every importation of goods, whether or not in

the course of trade or business, or imposed on each sale, barter, exchange or lease of goods or

properties or on each rendition of services in the course of trade or business as they pass along the

production and distribution chain, the tax being limited only to the value added to such goods,

properties or services by the seller, transferor or lessor. It is an indirect tax that may be shifted or

passed on to the buyer, transferee or lessee of the goods, properties or services. As such, it should be

understood not in the context of the person or entity that is primarily, directly and legally liable for its

payment, but in terms of its nature as a tax on consumption. In either case, though, the same

conclusion is arrived at.

The Court wishes to remind the BIR and other tax agencies of their duty to treat claims for refunds

and tax credits with proper attention and urgency. Had RDO No. 60 and, later, the BIR proper acted,

instead of sitting, on MPCs underlying application for effective zero rating, the matter of addressing

MPCs right, or lack of it, to tax credit or refund could have plausibly been addressed at their level and

perchance freed the taxpayer and the government from the rigors of a tedious litigation. The all too

familiar complaint is that the government acts with dispatch when it comes to tax collection, but pays

little, if any, attention to tax claims for refund or exemption. It is high time our tax collectors prove

the cynics wrong.

WHEREFORE, the petition is PARTLY GRANTED. The Decision dated December 22, 2005 and the

Resolution dated March 31, 2006 of the CA in CA-G.R. SP No. 78280 are AFFIRMED with the

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

MODIFICATION that the claim of respondent MPC for tax refund or credit to the extent of PhP

135,993,570, representing its input VAT payments for service purchases from Mitsubishi Corporation

of Japan for the construction of a portion of its Pagbilao, Quezon power station, is DENIED on the

ground that the claim had prescribed. Accordingly, petitioner Commissioner of Internal Revenue is

ordered to refund or, in the alternative, issue a tax credit certificate in favor of MPC, its unutilized

input VAT payments directly attributable to its effectively zero-rated sales for the second quarter in

the total amount of PhP 10,766,939.48.

17. CIR v. AICHI - Espiritu

DOCTRINE: In case of full or partial denial of the claim for tax refund or tax credit, or the failure on the part of the

Commissioner to act on the application within the period prescribed above, the taxpayer affected may, within

thirty (30) days from the receipt of the decision denying the claim or after the expiration of the one hundred

twenty day-period, appeal the decision or the unacted claim with the Court of Tax Appeals.

Facts: Respondent Aichi Forging Company of Asia, Inc, is engaged in the manufacturing, producing, and

processing of steel and its by-products. It is registered with the Bureau of Internal Revenue (BIR) as a ValueAdded Tax (VAT) entity and its products, "close impression die steel forgings" and "tool and dies," are registered

with the Board of Investments (BOI) as a pioneer status.

Respondent filed a claim for refund/credit of input VAT for the period July 1, 2002 to September 30, 2002 in the

total 2 with the CIR, through the Department of Finance (DOF) One-Stop Shop Inter-Agency Tax Credit and Duty

Drawback Center.

Petitioner, maintains that respondents administrative and judicial claims for tax refund/credit were filed in

violation of Sections 112(A) and 229 of the NIRC. He posits that pursuant to Article 13 of the Civil Code, since the

year 2004 was a leap year, the filing of the claim for tax refund/credit on September 30, 2004 was beyond the

two-year period, which expired on September 29, 2004. Respondent claims that it is entitled to a refund/credit of

its unutilized input VAT for the period July 1, 2002 to September 30, 2002 as a matter of right because it has

substantially complied with all the requirements provided by law

ISSUE: Whether respondents judicial and administrative claims for tax refund/credit were filed within the twoyear prescriptive period provided in Sections 112(A) and 229 of the NIRC.

HELD:

1. Administrative claim was TIMELY filed.

Section 31, Chapter VIII, Book I of the Administrative Code of 1987, being the more recent law, governs

the computation of legal periods, the two-year prescriptive period (reckoned from the time respondent filed its

final adjusted return on April 14, 1998) consisted of 24 calendar months. Respondent's petition (filed on April 14,

2000) was filed on the last day of the 24th calendar month from the day respondent filed its final adjusted return.

Hence, it was filed within the reglementary period.

Applying this to the present case, the two-year period to file a claim for tax refund/credit for the period July 1,

2002 to September 30, 2002 expired on September 30, 2004. Hence, respondents administrative claim was

timely filed.

2. The filing of the judicial claim was PREMATURE

Section 112(D) of the NIRC clearly provides that the CIR has "120 days, from the date of the submission

of the complete documents in support of the application [for tax refund/credit]," within which to grant or deny the

claim. In case of full or partial denial by the CIR, the taxpayers recourse is to file an appeal before the CTA within

30 days from receipt of the decision of the CIR. However, if after the 120-day period the CIR fails to act on the

application for tax refund/credit, the remedy of the taxpayer is to appeal the inaction of the CIR to CTA within 30

days.

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

In this case, the administrative and the judicial claims were simultaneously filed on September 30, 2004.

Obviously, respondent did not wait for the decision of the CIR or the lapse of the 120-day period. For this reason,

we find the filing of the judicial claim with the CTA premature.

* In fine, the premature filing of respondents claim for refund/credit of input VAT before the CTA warrants a

dismissal inasmuch as no jurisdiction was acquired by the CTA.

18. WESTERN MINDANAO v. CIR - Erandio

Doctrine:

(1) In a claim for tax refund or tax credit, the applicant must not only prove entitlement under substantive law,

but it must also show satisfaction to the documentary and evidentiary requirements under the law.

(2) Under RR 7-95 the subsequent incorporation of RA 9337 actually confirmed the imprinting requirement on VAT

invoices or receipts on a case falling under the principle of legislative approval or administrative interpretation

by reenactment.

Facts

WMPC is a domestic corporation engaged in the production and sale of electricity, it is duly registered

with BIR as a VAT taxpayer, during the taxable years of 2000 to 2001, it alleges that it has only sold to the

National Power Corporation, hence it is exempt from paying all forms of taxes, duties, fees and imposts

pursuant to Section 108(B)(3) stating that their power generation service is Zero-Rated

On June 20, 2000 and June 13, 2001 WMPC filed for the tax credit certification and during the

following months, as the CIR had not acted upon its applications, they file a petition for review in order to

decide the case wherein they sought to refund 9.2m

The CIR filed a comment stating that they are not entitled pursuant to Section 4.108-1 or RR 7-95

which states:

Invoicing Requirements: xxx. For every sale or lease of goods or property and service, issue invoices

or receipts which must xxx 5. Show the Zero Rated Imrinted on the invoice covering Zero Rated

Sales

1.

2.

Contentions of the WMPC

That the invoicing requirements were merely compliance requirements and only substantial compliance was

enough;

Zero rated sale imprint requirement cannot be applied retroactively considering it only took effect on July 2005

(or 4 years after the application)

Issue

WON the CTA En Banc erred in dismissing the case on the ground that receipts did not contain Zero-Rated

Held

No, Tax exemption is strictly construed in favor of the authority and against the person claiming the exemption.

In a claim for tax refund or tax credit, the applicant must not onbly prove entitlement under substantive law, it

must also show satisfaction to the documentary and evidentiary requirements of the law.

Under the NIRC, a creditable input tax should be evidenced by a VAT invoice or official

receipt, which may only be considered as such when it complies with the requirements of RR

7-95, particularly Section 4.108-1. This section requires, among others, that (i)f the sale is

subject to zero percent (0%) value-added tax, the term zero-rated sale shall be written or

printed prominently on the invoice or receipt.

Under RR 7-95 the subsequent incorporation of RA 9337 actually confirmed the validity of the imprinting

requirement on vat invoices or Original Receipts on a case falling under the principle of legislative approval of

the administrative interpretation by reenactment.

VAT ZERO-RELATED TRANSACTIONS - VAT REFUNDS

CONTRIBUTORS: Alba,Arid,Bustamante,Castillo,Cristobal,De Castro,Boy George

Erandio,Espiritu,Gaite,Jaramillo,Marasigan,Morales,Pangilinan,Radovan,Rosario,Samson,

Salto,Torres

19. CIR v. SAN ROQUE - De Castro

20. NIPPON v. CIR - Cristobal

21. BONIFACIO WATER v. CIR - Castillo

22. CIR v. GST - Arid

23. CIR v. MINDANAO - Alba

Вам также может понравиться

- Cir vs. Amex, GR No. 152609Документ5 страницCir vs. Amex, GR No. 152609Jani MisterioОценок пока нет

- John Lear UFO Coverup RevelationsДокумент30 страницJohn Lear UFO Coverup RevelationscorneliusgummerichОценок пока нет

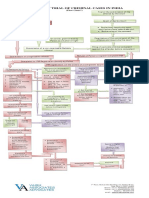

- Process of Trial of Criminal Cases in India (Flow Chart)Документ1 страницаProcess of Trial of Criminal Cases in India (Flow Chart)Arun Hiro100% (1)

- Tax Amnesty Doctrines in Taxation DigestДокумент9 страницTax Amnesty Doctrines in Taxation DigestJuralexОценок пока нет

- (TAX 1) Scope and Limitations - 05 JRRBДокумент3 страницы(TAX 1) Scope and Limitations - 05 JRRBJay-ar Rivera BadulisОценок пока нет

- VAT ReviewerДокумент18 страницVAT ReviewerNash Ortiz LuisОценок пока нет

- Tax DigestДокумент6 страницTax DigestjoyfandialanОценок пока нет

- VAT in General - CIR Vs CA &CMS, GR No. 125355Документ2 страницыVAT in General - CIR Vs CA &CMS, GR No. 125355Christine Gel MadrilejoОценок пока нет

- Tax Case Digests MidtermsДокумент47 страницTax Case Digests MidtermsJulo R. TaleonОценок пока нет

- Esso Standard V CIRДокумент2 страницыEsso Standard V CIRSui100% (1)

- Tax Vat Week4Документ73 страницыTax Vat Week4Neil FrangilimanОценок пока нет

- Taxation Q&AДокумент18 страницTaxation Q&AZsazsaОценок пока нет

- Financial Management Full Notes at Mba FinanceДокумент44 страницыFinancial Management Full Notes at Mba FinanceBabasab Patil (Karrisatte)86% (7)

- Api 4G PDFДокумент12 страницApi 4G PDFAluosh AluoshОценок пока нет

- Recent Jurisprudence TaxДокумент17 страницRecent Jurisprudence TaxGrenalyn AlcantaraОценок пока нет

- CIR v. AmEx (Digest)Документ3 страницыCIR v. AmEx (Digest)Tini GuanioОценок пока нет

- Tax Digests On Tax 2Документ25 страницTax Digests On Tax 2John Roel S. VillaruzОценок пока нет

- July 18 - SPIT NotesДокумент8 страницJuly 18 - SPIT NotesMiggy CardenasОценок пока нет

- 39 Storey Treehouse Activity Pack PDFДокумент11 страниц39 Storey Treehouse Activity Pack PDFNeptune Shell0% (3)

- Atlas Consolidated Mining V CIR (Case Digest)Документ2 страницыAtlas Consolidated Mining V CIR (Case Digest)Jeng Pion100% (1)

- CIR vs. Fisher (Case Digest)Документ2 страницыCIR vs. Fisher (Case Digest)Angelo Castillo90% (10)

- Ra 10023 FormsДокумент9 страницRa 10023 FormsFrederick Casenas Maglay100% (1)

- (Digest) - CIR vs. Burmeister and WAinДокумент5 страниц(Digest) - CIR vs. Burmeister and WAinGuiller C. MagsumbolОценок пока нет

- CIR vs. American ExpressДокумент2 страницыCIR vs. American ExpressJessa F. Austria-Calderon100% (1)

- Gestopa vs. CA (Case Digest)Документ2 страницыGestopa vs. CA (Case Digest)Angelo Castillo100% (1)

- CIR vs. Placer DomeДокумент4 страницыCIR vs. Placer DomeAngelo Castillo100% (1)

- CIR Vs American Express InternationalДокумент2 страницыCIR Vs American Express InternationalCheryl Churl100% (2)

- Lorenzo V Posadas (Case Digest)Документ3 страницыLorenzo V Posadas (Case Digest)Angelo CastilloОценок пока нет

- Secretary Vs Lazatin: FactsДокумент6 страницSecretary Vs Lazatin: FactsArah Mae BonillaОценок пока нет

- Cir V American Express InternationalДокумент3 страницыCir V American Express Internationalerikha_araneta100% (2)

- First Lepanto Taisho Insurance Corporation V CIRДокумент4 страницыFirst Lepanto Taisho Insurance Corporation V CIRmikmgonzalesОценок пока нет

- Deductions and Exemptions DigestsДокумент16 страницDeductions and Exemptions DigestsjmclacasОценок пока нет

- CIR V Placer DomeДокумент3 страницыCIR V Placer DomeAsia WyОценок пока нет

- 31 CIR Vs American ExpressДокумент4 страницы31 CIR Vs American ExpressSheilah Mae PadallaОценок пока нет

- Cir V American Express International, IncДокумент1 страницаCir V American Express International, IncDinahОценок пока нет

- Authorization Letter (Mendoza)Документ1 страницаAuthorization Letter (Mendoza)Angelo CastilloОценок пока нет

- Case Digest (Metro Pacific Corp. vs. CIRДокумент2 страницыCase Digest (Metro Pacific Corp. vs. CIRAngelo CastilloОценок пока нет

- T2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVAДокумент1 страницаT2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVACJVОценок пока нет

- Cir Vs Bank of Commerce DigestДокумент3 страницыCir Vs Bank of Commerce Digestwaws20Оценок пока нет

- Fort Bonifacio Development Corp v. CIR, G.R. No. 173425, 2013 Case DigestДокумент4 страницыFort Bonifacio Development Corp v. CIR, G.R. No. 173425, 2013 Case Digestbeingme2Оценок пока нет

- Tax 1 DeductionsДокумент30 страницTax 1 DeductionsAQAAОценок пока нет

- CIR vs. American ExpressДокумент2 страницыCIR vs. American ExpressCaroline A. LegaspinoОценок пока нет

- Toaz - Info Vat Reviewer PRДокумент18 страницToaz - Info Vat Reviewer PRDenise RoqueОценок пока нет

- J. Bersamin TaxДокумент14 страницJ. Bersamin TaxJessica JungОценок пока нет

- 2020 Taxation Cases FinalДокумент21 страница2020 Taxation Cases FinalRia Evita Cruz RevitaОценок пока нет

- Articles About VAT Zero-RatingДокумент8 страницArticles About VAT Zero-RatingkmoОценок пока нет

- BIR Ruling DA-143-06Документ4 страницыBIR Ruling DA-143-06joefieОценок пока нет

- BIR RulingДокумент3 страницыBIR RulingyakyakxxОценок пока нет

- Taxation Case Digest (Batch 2) Case #1Документ7 страницTaxation Case Digest (Batch 2) Case #1Na AbdurahimОценок пока нет

- Commissioner of Internal Revenue vs. American Express International, Inc. (Philippine Branch)Документ2 страницыCommissioner of Internal Revenue vs. American Express International, Inc. (Philippine Branch)Ae-cha Nae GukОценок пока нет

- TaxationДокумент5 страницTaxationWindylyn LalasОценок пока нет

- Cir Vs Amex Full TextДокумент2 страницыCir Vs Amex Full TextStella BertilloОценок пока нет

- Tax 1 DigestsДокумент17 страницTax 1 DigestsFrances Angelie NacepoОценок пока нет

- Cases in Taxation 2Документ145 страницCases in Taxation 2MACОценок пока нет

- OtesvatДокумент18 страницOtesvatRichelle Joy Reyes BenitoОценок пока нет

- W4 I B05 CirvsAmericanExpressInternational GonzalgoДокумент2 страницыW4 I B05 CirvsAmericanExpressInternational GonzalgoRezie GonzalgoОценок пока нет

- Possibilities in Taxation For The 2017 Bar Examinations: (Project Phoenix)Документ54 страницыPossibilities in Taxation For The 2017 Bar Examinations: (Project Phoenix)Ihon BaldadoОценок пока нет

- Q. Deduction: in GeneralДокумент40 страницQ. Deduction: in GeneralJen MoloОценок пока нет

- Republic of Philippines Court of Appeals Quezon City: THE TAXДокумент9 страницRepublic of Philippines Court of Appeals Quezon City: THE TAXCaroline Claire BaricОценок пока нет

- Tax Alert - 2005 - OctДокумент11 страницTax Alert - 2005 - OctKarina PulidoОценок пока нет

- Tom Digest AcleoДокумент15 страницTom Digest AcleoGuilgamesh EmpireОценок пока нет

- Tax Case DigestДокумент11 страницTax Case DigestPrincess Caroline Nichole IbarraОценок пока нет

- Cta 3D CV 09015 D 2017nov17 RefДокумент23 страницыCta 3D CV 09015 D 2017nov17 Refmimaymi120987Оценок пока нет

- CIR v. Placer DomeДокумент9 страницCIR v. Placer DomeKristineSherikaChyОценок пока нет

- Ejusdem GenerisДокумент3 страницыEjusdem GenerisSonia PortugaleteОценок пока нет

- Bar Ops Pilipinas 2016: Taxation LAWДокумент31 страницаBar Ops Pilipinas 2016: Taxation LAWAna Flouressa Yap CabanillaОценок пока нет

- Taxation IIДокумент3 страницыTaxation IIAnonymous BNrz1arОценок пока нет

- Pamonag - Accenture Inc. vs. Commissioner of The Internal RevenueДокумент4 страницыPamonag - Accenture Inc. vs. Commissioner of The Internal RevenueNoel Christopher G. BellezaОценок пока нет

- McDonalds vs. MacJoy, G.R. No. 166115, February 2, 2007Документ12 страницMcDonalds vs. MacJoy, G.R. No. 166115, February 2, 2007Angelo CastilloОценок пока нет

- Law On Franchisng 1Документ6 страницLaw On Franchisng 1Angelo Castillo0% (1)

- Special Power of Attorney: Know All Men by These PresentsДокумент2 страницыSpecial Power of Attorney: Know All Men by These PresentsAngelo CastilloОценок пока нет

- Bonifacio Water vs. CIRДокумент13 страницBonifacio Water vs. CIRAngelo CastilloОценок пока нет

- Levi's Strauss vs. Tony Lim, G.R. No. 162311, December 4, 2008Документ9 страницLevi's Strauss vs. Tony Lim, G.R. No. 162311, December 4, 2008Angelo CastilloОценок пока нет

- Philip Morris vs. Fortune Tobacco, G.R. No. 158589, June 27, 2006Документ11 страницPhilip Morris vs. Fortune Tobacco, G.R. No. 158589, June 27, 2006Angelo CastilloОценок пока нет

- IN-N-OUT DigestДокумент3 страницыIN-N-OUT DigestAngelo CastilloОценок пока нет

- Microsoft vs. Maxicorp, G.R. No. 140946, Sept. 13, 2004Документ9 страницMicrosoft vs. Maxicorp, G.R. No. 140946, Sept. 13, 2004Angelo CastilloОценок пока нет

- Bonifacio Water Corp V CIR (Digest)Документ3 страницыBonifacio Water Corp V CIR (Digest)Angelo CastilloОценок пока нет

- Law On Franchisng 1Документ6 страницLaw On Franchisng 1Angelo Castillo0% (1)

- Sony Corp of AmericaДокумент56 страницSony Corp of AmericaAngelo CastilloОценок пока нет

- Membership Application Form (PFA)Документ3 страницыMembership Application Form (PFA)Angelo CastilloОценок пока нет

- Wildvalley Shipping Co., Ltd. Petitioner, vs. Court of Appeals and Philippine President Lines Inc., RespondentsДокумент11 страницWildvalley Shipping Co., Ltd. Petitioner, vs. Court of Appeals and Philippine President Lines Inc., RespondentsAngelo CastilloОценок пока нет

- Preparatory Surface Cleaning of Architectural Sandstone: Standard Practice ForДокумент2 страницыPreparatory Surface Cleaning of Architectural Sandstone: Standard Practice Fors.swamyОценок пока нет

- Case Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022Документ4 страницыCase Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022ShravanОценок пока нет

- FAN XR UP1 - E7Документ26 страницFAN XR UP1 - E7Mathieu MaesОценок пока нет

- Rhetorical Analysis EssayДокумент8 страницRhetorical Analysis Essayapi-308821140Оценок пока нет

- Russia 2Документ21 страницаRussia 2api-302784045Оценок пока нет

- DocuPrint C2255Документ2 страницыDocuPrint C2255sydengОценок пока нет

- Mindfulness of Breathing and The Four Elements MeditationДокумент98 страницMindfulness of Breathing and The Four Elements Meditationulrich_ehrenbergerОценок пока нет

- Biology Project Asad AliДокумент16 страницBiology Project Asad Alisikander.a.khanixd26Оценок пока нет

- Shadow World in Search of Vurkanan TyesДокумент10 страницShadow World in Search of Vurkanan Tyesbob100% (1)

- Pass The TOEIC TestДокумент2 страницыPass The TOEIC TesteispupilОценок пока нет

- TEMPLATE Keputusan Peperiksaan THP 1Документ49 страницTEMPLATE Keputusan Peperiksaan THP 1SABERI BIN BANDU KPM-GuruОценок пока нет

- Alternating Voltage and CurrentДокумент41 страницаAlternating Voltage and CurrentKARTHIK LОценок пока нет

- browningsong 안동Документ68 страницbrowningsong 안동yooОценок пока нет

- 19.2 - China Limits European ContactsДокумент17 страниц19.2 - China Limits European ContactsEftichia KatopodiОценок пока нет

- ORtHOGRAPHIC Plan FinalДокумент8 страницORtHOGRAPHIC Plan FinalKrizzie Jade CailingОценок пока нет

- Kenya's Top 10 Tourist SpotsДокумент23 страницыKenya's Top 10 Tourist SpotsAaron LopezОценок пока нет

- Igice Cya Kabiri: 2.0. Intambwe Zitandukanye Z'Imikorere Ya Mariyamu KinyamaruraДокумент7 страницIgice Cya Kabiri: 2.0. Intambwe Zitandukanye Z'Imikorere Ya Mariyamu KinyamaruraJacques Abimanikunda BarahirwaОценок пока нет

- Whether To Use Their GPS To Find Their Way To The New Cool Teen HangoutДокумент3 страницыWhether To Use Their GPS To Find Their Way To The New Cool Teen HangoutCarpovici Victor100% (1)

- Huawei Videoconferencing MCU VP9600 Series Data SheetДокумент2 страницыHuawei Videoconferencing MCU VP9600 Series Data SheetIsaac PiresОценок пока нет

- ECAT STD 2 Sample Question PaperДокумент7 страницECAT STD 2 Sample Question PaperVinay Jindal0% (1)

- Finals Lesson Ii Technology As A WAY of Revealing: Submitted By: Teejay M. AndrdaДокумент8 страницFinals Lesson Ii Technology As A WAY of Revealing: Submitted By: Teejay M. AndrdaTeejay AndradaОценок пока нет

- Fujiwheel CatalogДокумент16 страницFujiwheel CatalogKhaeri El BarbasyОценок пока нет

- Walsh January Arrest Sherrif Records Pgs 10601-10700Документ99 страницWalsh January Arrest Sherrif Records Pgs 10601-10700columbinefamilyrequest100% (1)

- PRE-TEST (World Religion)Документ3 страницыPRE-TEST (World Religion)Marc Sealtiel ZunigaОценок пока нет

- A Psychological Crusade by Fernando Sorrentino - Text 7Документ2 страницыA Psychological Crusade by Fernando Sorrentino - Text 7Donnie DominguezОценок пока нет