Академический Документы

Профессиональный Документы

Культура Документы

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Загружено:

Shyam SunderОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

Date: September 9, 2016

To,

National Stock Exchange of India Limited,

Listing Department,

Exchange Plaza,

Bandra (E), Mumbai 400 051

Ref Symbol: VASCONEQ

To,

BSE Limited,

The Department of Corporate Services

Department of Corporate Services

Mumbai 400 001

Ref: Scrip Code: 533156

Subject: Financial Results for the quarter ended June 30, 2016

Dear Sir/ Madam,

The Board of Directors of Vascon Engineers Limited, in their meeting held on September 9,

2016 have discussed and approved Financial Results for the quarter and year ended June

30, 2016.

Please find enclosed the financial results of the Company.

Request you to take the same on record.

Thanking you,

Yours faithfully,

For Vascon Engineers Limited,

MUTHUSWAMY

KRISHNAMURTHI

Digitally signed by MUTHUSWAMY KRISHNAMURTHI

DN: c=IN, o=Personal , CID - 4422262,

2.5.4.20=3d73fbc0362b7e511daa9f8f0bf706ea3067c89f0ff76

daf98f82452debc1648, postalCode=411014, st=Maharashtra,

serialNumber=6d8963e34b786f3f6f548ff260c8665f0dc59c80

d802c84993387b2efcc85aed, cn=MUTHUSWAMY

KRISHNAMURTHI

Date: 2016.09.09 15:01:40 +05'30'

M. Krishnamurthi

Company Secretary & Compliance Officer

Enclosures: As above

Date: September 9, 2016

To,

National Stock Exchange of India Limited,

Listing Department,

Exchange Plaza,

Bandra (E), Mumbai 400 051

Ref Symbol: VASCONEQ

To,

BSE Limited,

The Department of Corporate Services

Department of Corporate Services

Mumbai 400 001

Ref: Scrip Code: 533156

Subject: Financial Results for the quarter and year ended March 31, 2016

Dear Sir/ Madam,

The Board of Directors of Vascon Engineers Limited, in their meeting commenced at 11.00

a .m and concluded at 2.45 p.m on September 9, 2016 have discussed and approved the

following:

1. Approved and taken on record Unaudited Standalone Financial Results (reviewed) of

the Company for the quarter ended June 30, 2016, as per the format prescribed under

Regulation 33 SEBI (Listing Obligations and Disclosure Requirements) Regulations,

2015 (LODR) along with limited review report from Auditors. (As enclosed).

This is for your information and records.

Thanking you,

Yours faithfully,

For Vascon Engineers Limited,

MUTHUSWAMY

KRISHNAMURTHI

Digitally signed by MUTHUSWAMY KRISHNAMURTHI

DN: c=IN, o=Personal , CID - 4422262,

2.5.4.20=3d73fbc0362b7e511daa9f8f0bf706ea3067c89f0ff76d

af98f82452debc1648, postalCode=411014, st=Maharashtra,

serialNumber=6d8963e34b786f3f6f548ff260c8665f0dc59c80d

802c84993387b2efcc85aed, cn=MUTHUSWAMY

KRISHNAMURTHI

Date: 2016.09.09 15:01:24 +05'30'

M. Krishnamurthi

Company Secretary & Compliance Officer

Enclosures: As above

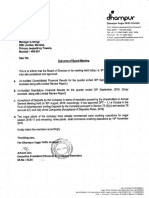

Vascon Engineers Limited

CIN: 170100MH1986P1C038511

Registered Office: 15/16, Hazari Baug, LBS marg , vikhroli (west), Mumbai - 400083

STATEMENT OF UNAUDITED STANDAI.ONE FINANCIAL RESULTS FOR THE QUATER ENOED 30 TH JUNE , 2015

(Rs.ln takhs)

STANDATONE

Quarter Ended

Sr. No

PARTICUTARS

lune 30,2015

June 30,2016

{Refer Note 7)

(Unaudited)

(Unaudired)

1

lncome from operations

a) Net Sale5/ lncomefrom operations

b) Other Operating lncome

Total lncome from operations (net)

4,872

755

s,627

8,964

9,447

4,711

6,351

483

2 Expenses

alConstruction Expenses

Cost of materials consumed

b) Purchase of stock- in- trade

c) Changes of inventories of finlshed goods, work in progress and stock ln trade

d) Employees benefits expenses

e) Depreciation and amortisation expenses

f) other expenses

TotalExpenses

Profit from Operations before Other lnaome, finance costs and Etaeptional ltems l1-

is0s)

119

848

985

184

199

485

960

5,t26

9,2L4

233

501

2l

4 Other lncorne

5

Profit trom ordinary activities before Finance costs and Exceptional ltems {3+4)

6 Finance costs

7 Profit from ordinary activities alter Finance costs but before [xceptional ltems (5-5)

429

970

930

1,203

113

1,O19

157

\24

r57

124

L57

424

8 Exceptionalitems

9 Prolit from Ordinary Activities before tax (7+8)

10 Tax Expenses

11 Net Protit

from Ordinary Activities afte. tax (9-10)

24

18

181

L42

16,134

9,048

0.11

0.14

0.11

o-14

12 Other Comprehensive lncome (OCl)

1l

Total comprehensive income {11+12)

14 Paid up Equity Share Capital (Face Value

15 tarnings Per Share (EPS)

a) Basic EPS (in Rs.) {Not Annualised)

Rs.

10/- per share)

b) Diluted EPS(in Rs.) (Not Annualised)

Segment wise Revenue, Results, Assets and Liabilities fot the quarter ended 30th lune, 2016

Quarter Ended

Partiaulars

June 30,2015

June 30,2015

lJnaudited

{Unaudited)

1. Segment Revenue

EPC (Engineering,

+,eor

Procurement and Constr!ction)

7,627

1,820

955

Real Estate Development

Total

Quarter Ended

.rune 30,2016

Particulars

June 30,2015

Unaudited

ment Results

EPC {Engineering, Procurement and Construction)

Real Estate Development

Subtotal

less: lnterest

Other Unallocable ex enditure net off Unallocable income

Total Profit / (l-oss before Tax

(unaudited)

2.

327

1,530

1,538

@t

l'773],

151

IN

491

1,O41

1,857

{1,079)

124

Quarter Ended

Particulars

3

June 30,2016

ment Assets and tiabilities

June 30,2015

(Unaudited)

(Unaudited)

23,4a1

23,7AO

49,102

40,910

113,499

37,262

Se ments Assets

EPC 1E

ineering, Procurement and Constru ction)

nt

Real Estate Devel

Linallocable

Total

ts Liabilities

EPC Ingineerin

Procurement and Construction )

Real Estate Develo pment

Unallocable

Total

50,3L7

111,359

13,185

\4,256

14,083

L6,691

86,231

80,405

111,499

111,359

The above financial results have been reviewed by the Audit

committee and approved by the Board of Directors of the company at

its

meeting held on 8th September, 2016 and 9th September, 2016

respectively.

2.The financial results of the Company have been prepared

in accordance with lndian Accounting Standards (tnd AS) notified under

th

Companies (lndian Accounting Standard) Rules, 2015 as

amended by the Companies (lndian Accounting Standards)

Rules

201G

{Amendment)

The Company adopted lnd AS from 1st Aprjl 2016, and accordingly,

these fjnancial statements (including for all the periods presented jn

accordance with lnd AS 101 - Fjrst time Adoption of lndian AccountinB

Standards) have been prepared in accordance with the recognition

and

measurement principles in lnd AS 34,lnterim Financial Reporti

ng, prescribed !nder Section 133 of the Companies Act, 2013 read

with

the

relevant rules issued thereunder and the other accounting prini ples generally

accepted in lndia

3'The format for unaudited quarterly results as prescribed in

sEEl's circutar clR/c FD/cMo/7s/2c,15 dated 3oth November

2015 has been

modified to comply with requirements of sEBl's circular dated 5th

July 201G, tnd As and schedule lll to the companies Act, 2013.

For the purpose of Standalone Resuks, the Company has identified

ln ljne with lnd

reporting business segments as follows:

AS

108 "Operating Segments,,, into two prima

a) Engineering, Procurement and Construction

{EpC)

b) Real Estate Development

5. The reconciliation of net profit recorded in accordance with previous

lndian GAAP to total comprehensive income in accordance with lnd

AS is given below

Rs

Particulars

Net rolit as per

Recl as si fi cati

in lakhs

For the quarter ended

June 30,2015

us lndian GAAP

a ct ua

ga

5S

33

a ti

respe ct

5C hemes to oth

c p reh n ve

OC

Non amortisation of investrnent in artnership firm

Net impact of measuring financial assets and financial llabilities at amortized

cost

efit

(18)

74

44

lmpact of recognising the cost ofthe employee stock option scheme at

fair value

(e)

Net ProIit as per lnd AS

Other Com rehensive lncome

TotalCom rehensive lncome as

L24

18

lnd AS

142

6.Pul'uant to the approval of the Right rssue committee of the Board

of Directors dated 1st Alugust,2015, the Company approved the

allotment of 6,66,66,66G equity shares of face value of Re.10 each

at a price of Rs. 15 per equity share {including share premium of Rs. s

eq uity share) for an amount not exceeding Rs 1OOOO lakhs to the

existing equity shar eholders ofthe Company on rights basis in the ratio

14 equity shares for every 19 equity shares held by equity shareholders

under cha pter lV of the SEBI tCDR Regulations and provisions of all

other applicable laws and regulations

Rs

Particulars

Repayment/ pre-payment, in full or part, of certain identified loans availed

by our

Company

Iinance the construction of our Ongoing projects

Generalcorporate

and lssue Expenses

Total

The balance unutilized amount had been temporaril de

in fi

th bankt.

Amounts to be

utilised

in lakhs

Actualutilisation

till lune 30, 2016

6,200

6,200

2,800

2,250

1,000

1,000

10,000

9,450

The lnd

affairs.

AS compliant financial results, pertaining to the quarter ended 30th June 2015 have not

been subjected to limited review or audit

, the management has exercised necessary due diligence to ensure that the financial results provide a true and faar view of

8- The figures for the corresponding period have been regrouped and rearranSed wherever necessary

Place: Pune

September 09, 2016

to make them comparable

By Order

ott

ofD

R. Vasudevan

Managing

Di

Вам также может понравиться

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ8 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23От EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Оценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Документ17 страницStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Updates On Financial Results For June 30, 2016 (Result)Документ3 страницыUpdates On Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Документ5 страницAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderОценок пока нет

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Документ3 страницыAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Документ4 страницыAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ7 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ13 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ9 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ7 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ7 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ6 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ7 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ9 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Документ7 страницStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- 3.CFA财报分析 Financial Statement AnalysisДокумент408 страниц3.CFA财报分析 Financial Statement AnalysisliujinxinljxОценок пока нет

- Apollo HospitalsДокумент18 страницApollo HospitalsvishalОценок пока нет

- P U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Документ10 страницP U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Shaina AragonОценок пока нет

- Exercises (7-27-18)Документ2 страницыExercises (7-27-18)Justin ManaogОценок пока нет

- Accounting Top 50 QuestionsДокумент152 страницыAccounting Top 50 QuestionsDeep Mehta0% (1)

- Ratio Analysis of Ambuja cement-TUSARДокумент16 страницRatio Analysis of Ambuja cement-TUSARTusarkant BeheraОценок пока нет

- CAARTSДокумент290 страницCAARTSJonef Dulawan100% (1)

- A. Masay Company Statement of Cost of Goods Manufactured Year Ended XX 2020Документ6 страницA. Masay Company Statement of Cost of Goods Manufactured Year Ended XX 2020Jay Ann DomeОценок пока нет

- Exercise 17.1 Budgeted Cash Flow Statement - Top Hats: © Simmons & Hardy Cambridge University Press, 2019 1Документ46 страницExercise 17.1 Budgeted Cash Flow Statement - Top Hats: © Simmons & Hardy Cambridge University Press, 2019 1STATОценок пока нет

- BoardPaper 2019 SolutionsДокумент7 страницBoardPaper 2019 Solutionskartik 011Оценок пока нет

- FABM1-11 q3 Mod4 Typesofmajoraccounts v5Документ23 страницыFABM1-11 q3 Mod4 Typesofmajoraccounts v5Anna May Serador CamachoОценок пока нет

- Admission of Partner PDFДокумент6 страницAdmission of Partner PDFBHUMIKA JAINОценок пока нет

- Performance Task BUSINESS-and-ACCOUNTINGДокумент3 страницыPerformance Task BUSINESS-and-ACCOUNTINGSallyContiBolorОценок пока нет

- OutcomeofBoardMeeting10082023 10082023173019Документ5 страницOutcomeofBoardMeeting10082023 10082023173019PM LOgsОценок пока нет

- Kelompok 8 - Kelas o - Week 8Документ7 страницKelompok 8 - Kelas o - Week 8Yefinia OpianaОценок пока нет

- Mock Cpa Board Examination Ul Cpa Review CenterДокумент18 страницMock Cpa Board Examination Ul Cpa Review CenterasdfghjОценок пока нет

- Tire - City AnalysisДокумент17 страницTire - City AnalysisJustin HoОценок пока нет

- Branch AccountingДокумент50 страницBranch AccountingyuvrajbarariaОценок пока нет

- Tutorial 1 Q - MergedДокумент37 страницTutorial 1 Q - MergedWeiqin ChanОценок пока нет

- Act2 1Документ7 страницAct2 1MingОценок пока нет

- FABM Final ExaminationДокумент2 страницыFABM Final ExaminationWarren Nahial ValerioОценок пока нет

- SectionD Group15 Larsen&ToubroДокумент8 страницSectionD Group15 Larsen&ToubroSiddharthОценок пока нет

- AF210 Revision Package Test 2 - QuestionsДокумент2 страницыAF210 Revision Package Test 2 - QuestionsShweta ChandraОценок пока нет

- Statement of Comprehensive Income - ValixДокумент7 страницStatement of Comprehensive Income - ValixYstefani ValderamaОценок пока нет

- Akl P4.7Документ12 страницAkl P4.7ApriancaesarioОценок пока нет

- Final Account - 6-9-21Документ9 страницFinal Account - 6-9-21rohit bhoirОценок пока нет

- Ashirwad Stone CrusherДокумент26 страницAshirwad Stone Crusherkushal chopdaОценок пока нет

- Hire PurchaseДокумент16 страницHire PurchaseNaseer Sap0% (1)

- Chapter 5.SVДокумент73 страницыChapter 5.SVHương ViệtОценок пока нет

- Gaurav Enterprises: College Road KhesmiДокумент18 страницGaurav Enterprises: College Road KhesmiPawan KumarОценок пока нет

- PPL Exam Secrets Guide: Aviation Law & Operational ProceduresОт EverandPPL Exam Secrets Guide: Aviation Law & Operational ProceduresРейтинг: 4.5 из 5 звезд4.5/5 (3)

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsОт EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsРейтинг: 4.5 из 5 звезд4.5/5 (77)

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsОт EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsОценок пока нет

- CUNY Proficiency Examination (CPE): Passbooks Study GuideОт EverandCUNY Proficiency Examination (CPE): Passbooks Study GuideОценок пока нет

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideОт Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideРейтинг: 2.5 из 5 звезд2.5/5 (2)

- Preclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1От EverandPreclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Рейтинг: 5 из 5 звезд5/5 (1)

- 2024/2025 ASVAB For Dummies: Book + 7 Practice Tests + Flashcards + Videos OnlineОт Everand2024/2025 ASVAB For Dummies: Book + 7 Practice Tests + Flashcards + Videos OnlineОценок пока нет

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)От Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Оценок пока нет

- Textbook of Plastic and Reconstructive SurgeryОт EverandTextbook of Plastic and Reconstructive SurgeryDeepak K. Kalaskar B.Tech PhDРейтинг: 4 из 5 звезд4/5 (9)

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessОт EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessРейтинг: 4.5 из 5 звезд4.5/5 (17)

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsОт EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsОценок пока нет

- Note Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusОт EverandNote Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusРейтинг: 3.5 из 5 звезд3.5/5 (10)

- Pilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CОт EverandPilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CОценок пока нет

- Substation Maintenance Electrical Technician: Passbooks Study GuideОт EverandSubstation Maintenance Electrical Technician: Passbooks Study GuideОценок пока нет

- The Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)От EverandThe Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)Рейтинг: 4 из 5 звезд4/5 (1)