Академический Документы

Профессиональный Документы

Культура Документы

Trump - DJTF Contribution AJFA - Response 06292016

Загружено:

Janet Babin0 оценок0% нашли этот документ полезным (0 голосов)

32 просмотров2 страницыTrump Foundation mia culpa for $25K foundation to Florida-based And Justice For All. "The contribution was made in error," said Allen Weisselberg, treasurer for the Donald J. Trump Foundation.

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTrump Foundation mia culpa for $25K foundation to Florida-based And Justice For All. "The contribution was made in error," said Allen Weisselberg, treasurer for the Donald J. Trump Foundation.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

32 просмотров2 страницыTrump - DJTF Contribution AJFA - Response 06292016

Загружено:

Janet BabinTrump Foundation mia culpa for $25K foundation to Florida-based And Justice For All. "The contribution was made in error," said Allen Weisselberg, treasurer for the Donald J. Trump Foundation.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

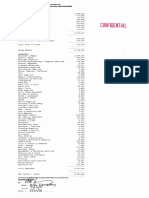

The Donald J. Trump Foundation

725 Fifth Avenue

New York, New York 10022

June 28, 2016

By Federal Express

Karin Kunstler Goldman, Esq.

Assistant Attorney General

New York State Department of Law Charities Bureau

120 Broadway - 3rd Floor

New York, NY 10271

Dear Ms. Kunstler Goldman:

I write in response to your June 9, 2016 letter requesting information concerning a $25,000

contribution made by The Donald J. Trump Foundation (the “Foundation”) to an organization

known as “And Justice for All” (the “Contribution”.

In short, the Contribution was made in error due to a case of mistaken identity involving

organizations with the same name. Both the Foundation and Mr. Trump first learned of this

mistake in March 2016 after sccing it reported in the media. Upon learning of this mistake, the

Foundation promptly filed IRS Form 4720, the relevant IRS Form used for this purpose, and Mr.

‘Trump paid the excise tax due under Section 4955 with a personal check. In addition, the

Foundation was reimbursed $25,000. The Foundation will not provide a donor acknowledgment

letter for this reimbursement, and no one will claim a charitable contribution deduction for such

reimbursement.

‘This was an isolated occurrence. From January 1, 2013 to the present, there have been no other

similar incidents. To prevent any mistakes in the future, the Foundation’s staff received training

on May 11, 2016, led by legal counsel specializing in tax-exempt organizations law, regarding the

federal tax rules and regulations applicable to private foundations. As part of this training,

Foundation staff were advised to collect additional information about proposed grantees using the

TRS Exempt Organizations Select Check tool to verify the tax status of potential grantees based on

their taxpayer identification numbers rather than relying solely on their names. This will eliminate

the possibility of confusion in the circumstance when two organizations share the same name. The

Foundation will also provide its accountants with the name, address, and taxpayer identification

number of its grantees in the future to ensure correct Form 990-PF reporting.

‘The Foundation regrets the mistake described above. It is committed to complying fully with the

federal tax laws governing private foundations. Please let me know if you have any further

questions.

Very truly yours,

ta i>

Allen Weisselberg

Treasurer

The Donald J. Trump Foundation

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Climate Group FS 2018Документ16 страницThe Climate Group FS 2018Janet BabinОценок пока нет

- Opening Core Brief - File-Stamped (M0119247xCECC6)Документ193 страницыOpening Core Brief - File-Stamped (M0119247xCECC6)Janet BabinОценок пока нет

- Memorandum of Law in Opposition To Respondents' Pre-Trial Motion and in Support of The NYAG's Cross-MotionДокумент43 страницыMemorandum of Law in Opposition To Respondents' Pre-Trial Motion and in Support of The NYAG's Cross-MotionJanet BabinОценок пока нет

- FP Income Expense CY15Документ1 страницаFP Income Expense CY15Janet BabinОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Housing New York, Housing PlanДокумент117 страницHousing New York, Housing PlanJanet BabinОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Donald Trump's Financial DisclosuresДокумент92 страницыDonald Trump's Financial DisclosuresCNBCDigital90% (20)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Trump DisclosuresДокумент92 страницыTrump DisclosuresJanet BabinОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- CPSunshine Task Force ReportДокумент33 страницыCPSunshine Task Force ReportLW25Оценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- FINAL 421-A Hearing PowerpointДокумент22 страницыFINAL 421-A Hearing PowerpointJanet BabinОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)