Академический Документы

Профессиональный Документы

Культура Документы

Fatca Definitions

Загружено:

amazing_pinoyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Fatca Definitions

Загружено:

amazing_pinoyАвторское право:

Доступные форматы

26 CFR 1.1471-1 - Scope of chapter 4 and definitions.

(a) Scope of chapter 4 of the Internal Revenue Code. Sections 1.1471-1 through

1.1474-7 provide rules for withholding when a withholding agent makes a payment to an

FFI or NFFE and prescribe the requirements for and definitions relevant to FFIs and NFFEs to

which withholding will not apply. Section 1.1471-1 provides definitions for terms used in

chapter 4 of the Internal Revenue Code (Code) and the regulations thereunder.

Section 1.1471-2 provides rules for withholding under section 1471(a) on payments to FFIs,

including the exception from withholding for payments made with respect to certain

grandfathered obligations. Section 1.1471-3 provides rules for determining the payee of a

payment and the documentation requirements to establish a payee's chapter 4 status.

Section1.1471-4 describes the requirements of an FFI agreement under section 1471(b)

and the application of sections 1471(b) and (c) to an expanded affiliated group of FFIs.

Section 1.1471-5 defines terms relevant to section 1471 and the FFI agreement and defines

categories of FFIs that will be deemed to have met the requirements of section 1471(b)

pursuant to section 1471(b)(2). Section 1.1471-6defines classes of beneficial owners of

payments that are exempt from withholding under chapter 4. Section 1.1472-1 provides

rules for withholding when a withholding agent makes a payment to an NFFE, and defines

categories of NFFEs that are not subject to withholding. Section 1.1473-1 provides

definitions of the statutory terms in section 1473. Section 1.1474-1 provides rules relating

to a withholding agent's liability for withheld tax, filing of income tax and information

returns, and depositing of tax withheld. Section 1.1474-2 provides rules relating to

adjustments for overwithholding and underwithholding of tax. Section 1.1474-3 provides the

circumstances in which a credit is allowed to a beneficial owner for a withheld tax.

Section 1.1474-4 provides that a chapter 4 withholding obligation need only be collected

once. Section 1.1474-5 contains rules relating to credits and refunds of tax withheld.

Section 1.1474-6 provides rules coordinating withholding under sections 1471 and 1472

with withholding provisions under other sections of the Code. Section 1.1474-7 provides the

confidentiality requirement for information obtained to comply with the requirements of

chapter 4. Any reference in the provisions of sections 1471 through 1474 to an amount that

is stated in U.S. dollars includes the foreign currency equivalent of that amount. Except as

otherwise provided, the provisions of sections 1471 through 1474 and the regulations

thereunder apply only for purposes of chapter 4. See 301.1474-1 of this chapter for the

requirements for reporting on magnetic media that apply to financial institutions making

payments or otherwise reporting accounts pursuant to chapter 4.

(b) Definitions. Except as otherwise provided in this paragraph (b) or under the terms of

an applicable Model 2 IGA, the following definitions apply for purposes of sections 1471

through 1474 and the regulations under those sections.

(1) Account. The term account means a financial account as defined in 1.1471-5(b).

(47) FFI. The term FFI or foreign financial institution has the meaning set forth in

1.1471-5(d).

(57) GIIN. The term GIIN or Global Intermediary Identification Number means the

identification number that is assigned to a participating FFI or registered deemed-compliant

FFI. The term GIIN orGlobal Intermediary Identification Number also includes the

identification number assigned to a reporting Model 1 FFI for purposes of identifying such

entity to withholding agents. All GIINs will appear on the IRS FFI list.

Вам также может понравиться

- Excreccion de GuadañaДокумент18 страницExcreccion de Guadañacaspertone2003Оценок пока нет

- ACCOUNTING PERIODS AND TAX ACCOUNTING METHODS 2020 Printed Edition (iBOOK Version)Документ31 страницаACCOUNTING PERIODS AND TAX ACCOUNTING METHODS 2020 Printed Edition (iBOOK Version)Quinciano MorilloОценок пока нет

- Irb14 02Документ146 страницIrb14 02henrydpsinagaОценок пока нет

- US Internal Revenue Service: p7003Документ3 страницыUS Internal Revenue Service: p7003IRSОценок пока нет

- Employee Benefit Plans 8Документ8 страницEmployee Benefit Plans 8pdizypdizyОценок пока нет

- 61B-40.007 Financial Reporting RequirementsДокумент2 страницы61B-40.007 Financial Reporting RequirementsdikpalakОценок пока нет

- 2008 Treasury Regulations On PILOTsДокумент21 страница2008 Treasury Regulations On PILOTsNorman OderОценок пока нет

- Operating Circular 4Документ75 страницOperating Circular 4Troy StrawnОценок пока нет

- Audit Under Fiscal Laws - NotesДокумент17 страницAudit Under Fiscal Laws - NotesabhiОценок пока нет

- IFRIC 2 Shares in Cooperative EntitiesДокумент12 страницIFRIC 2 Shares in Cooperative EntitiesTopy DajayОценок пока нет

- FRS107Документ34 страницыFRS107Tack Wei HoОценок пока нет

- Tf-180-Related Party-Disclosures1121 PDFДокумент13 страницTf-180-Related Party-Disclosures1121 PDFBusch LearningОценок пока нет

- 09 - Audit Under Fiscal LawsДокумент33 страницы09 - Audit Under Fiscal LawsRavi RothiОценок пока нет

- Instructions For Form W-8BEN: (Rev. October 2021)Документ9 страницInstructions For Form W-8BEN: (Rev. October 2021)Mario SierraОценок пока нет

- Iw 8Документ19 страницIw 8nsakeniaОценок пока нет

- RR 017-2011Документ16 страницRR 017-2011RB BalanayОценок пока нет

- W8 Instructions PDFДокумент15 страницW8 Instructions PDFKrisdenОценок пока нет

- 01 DTMFZA - Employment Regulations - Issued On 29 Mar 2004Документ8 страниц01 DTMFZA - Employment Regulations - Issued On 29 Mar 2004lahirupathiranageОценок пока нет

- IFRS 2 Share-Based PaymentДокумент136 страницIFRS 2 Share-Based PaymentSheikh Aabid RehmatОценок пока нет

- Ifrs 4 - 2005Документ89 страницIfrs 4 - 2005jon_cpaОценок пока нет

- Model IU AgreementДокумент13 страницModel IU AgreementShashi Ranjan KumarОценок пока нет

- IRDA Regulations, 2000Документ35 страницIRDA Regulations, 2000VidhishaJainОценок пока нет

- CRS-related Frequently Asked Questions: Automatic Exchange PortalДокумент24 страницыCRS-related Frequently Asked Questions: Automatic Exchange PortalmigueОценок пока нет

- US Internal Revenue Service: n-04-34Документ6 страницUS Internal Revenue Service: n-04-34IRSОценок пока нет

- Life After CPO Registration Select CFTC and NFA Compliance Obligations That Lie Ahead - 11 Mar 13Документ12 страницLife After CPO Registration Select CFTC and NFA Compliance Obligations That Lie Ahead - 11 Mar 13m3nycpeterОценок пока нет

- 3.4 Presentation of Financial Statements: Adaptation For The Public Sector ContextДокумент133 страницы3.4 Presentation of Financial Statements: Adaptation For The Public Sector ContextTung NguyenОценок пока нет

- Form W-8BEN-E InstructionsДокумент15 страницForm W-8BEN-E InstructionsSteve ThompsonОценок пока нет

- Circular No 984-08-2014 - 16-09-2014-Appeal-Stay-predeposit PDFДокумент4 страницыCircular No 984-08-2014 - 16-09-2014-Appeal-Stay-predeposit PDFHimanshu SawОценок пока нет

- Community Legal Aid Service (CLAS)Документ1 страницаCommunity Legal Aid Service (CLAS)Dats FernandezОценок пока нет

- Penalty On EPF Delay PaymentДокумент8 страницPenalty On EPF Delay PaymentAnand ChaudharyОценок пока нет

- Solved by Verified Expert: Answer & ExplanationДокумент9 страницSolved by Verified Expert: Answer & ExplanationDegoОценок пока нет

- CRS-related Frequently Asked Questions: Automatic Exchange PortalДокумент22 страницыCRS-related Frequently Asked Questions: Automatic Exchange PortalsudemanОценок пока нет

- Ias 1 & As 1 Disclosure of Accounting PoliciesДокумент10 страницIas 1 & As 1 Disclosure of Accounting PoliciesHarpreet Singh GillОценок пока нет

- GFXHGJGKGKLДокумент2 страницыGFXHGJGKGKLJornel MandiaОценок пока нет

- IFRS 9 Prepayment FeatureДокумент20 страницIFRS 9 Prepayment Featureankit dubeyОценок пока нет

- Advance 202104Документ14 страницAdvance 202104Nino NinosОценок пока нет

- Wtax (A) 721 2015Документ13 страницWtax (A) 721 2015Neena BatlaОценок пока нет

- Federal Register / Vol. 76, No. 201 / Tuesday, October 18, 2011 / Proposed RulesДокумент20 страницFederal Register / Vol. 76, No. 201 / Tuesday, October 18, 2011 / Proposed RulesMarketsWikiОценок пока нет

- Federal Register / Vol. 78, No. 163 / Thursday, August 22, 2013 / Rules and RegulationsДокумент28 страницFederal Register / Vol. 78, No. 163 / Thursday, August 22, 2013 / Rules and RegulationsMarketsWikiОценок пока нет

- KJK Investments Limited (Gloans LTD) - Corporate and Professional Pensions Limited - Optimum Solutions Limited (AEGON Pension Transfer)Документ10 страницKJK Investments Limited (Gloans LTD) - Corporate and Professional Pensions Limited - Optimum Solutions Limited (AEGON Pension Transfer)hyenadogОценок пока нет

- Rbi PDFДокумент9 страницRbi PDFybbvvprasada raoОценок пока нет

- 2015 Village Ordinance - PoliceДокумент4 страницы2015 Village Ordinance - Policeal_crespoОценок пока нет

- RR 17-2011Документ13 страницRR 17-2011lazylawstudentОценок пока нет

- The CBDT has clarified that all the consequences provided under the Income-tax Act for not furnishing, intimating or quoting PAN shall come into effect from 01-04-2023 if PAN becomes inoperative due to non-linking of itДокумент2 страницыThe CBDT has clarified that all the consequences provided under the Income-tax Act for not furnishing, intimating or quoting PAN shall come into effect from 01-04-2023 if PAN becomes inoperative due to non-linking of itGovardhan VaranasiОценок пока нет

- To Be Published in The Gazette of India Extraordinary Part III Section 4Документ41 страницаTo Be Published in The Gazette of India Extraordinary Part III Section 4nagpalanishОценок пока нет

- Wtax (A) 1086 2022Документ74 страницыWtax (A) 1086 2022Neena BatlaОценок пока нет

- Chapter 4 CAM Precheck and Post Check in PAO.Документ9 страницChapter 4 CAM Precheck and Post Check in PAO.Sumant ChilkotiОценок пока нет

- IRDAI Master Circular Unclaimed Amounts of Policyholders Full Text CIRMisc282 Dated 18-11-2020Документ12 страницIRDAI Master Circular Unclaimed Amounts of Policyholders Full Text CIRMisc282 Dated 18-11-2020Puran Singh LabanaОценок пока нет

- HTML File ProcessДокумент10 страницHTML File ProcessSuresh SharmaОценок пока нет

- New York State Bar Association Tax SectionДокумент18 страницNew York State Bar Association Tax SectionduckyduckyОценок пока нет

- Pdic LawДокумент5 страницPdic LawDiaz, Bryan ChristopherОценок пока нет

- Statement of FinancialДокумент30 страницStatement of FinancialPrashant GuptaОценок пока нет

- ECB Gudelines 1.1.16Документ40 страницECB Gudelines 1.1.16Saloni DewanОценок пока нет

- Accounting NCEA Level 3 and Scholarship AppendixДокумент28 страницAccounting NCEA Level 3 and Scholarship AppendixRaaid TahaОценок пока нет

- Law Insider Service-Level-Agreement Filed 11-06-2010 ContractДокумент12 страницLaw Insider Service-Level-Agreement Filed 11-06-2010 ContractZazuan DaudОценок пока нет

- (As Amended March 2007 and Edited Dec.Документ46 страниц(As Amended March 2007 and Edited Dec.TINALEETNT723Оценок пока нет

- SFRS (I) 02 (2022)Документ35 страницSFRS (I) 02 (2022)Celine LowОценок пока нет

- Amendment To PFRS 17 Comparative Information PrefaceДокумент12 страницAmendment To PFRS 17 Comparative Information PrefaceJaime LaronaОценок пока нет

- Law of War Part 4Документ6 страницLaw of War Part 4amazing_pinoyОценок пока нет

- Law of War Part 1Документ3 страницыLaw of War Part 1amazing_pinoyОценок пока нет

- Law of War Part 2Документ5 страницLaw of War Part 2amazing_pinoyОценок пока нет

- Law of War Part 3Документ3 страницыLaw of War Part 3amazing_pinoyОценок пока нет

- Law of War Part 5Документ3 страницыLaw of War Part 5amazing_pinoyОценок пока нет

- Anti-Terrorism Act Part 2Документ4 страницыAnti-Terrorism Act Part 2amazing_pinoyОценок пока нет

- Anti-Terrorism Act Part 4Документ4 страницыAnti-Terrorism Act Part 4amazing_pinoyОценок пока нет

- JR 2 RRDДокумент3 страницыJR 2 RRDamazing_pinoyОценок пока нет

- Anti-Terrorism Act Part 3Документ4 страницыAnti-Terrorism Act Part 3amazing_pinoyОценок пока нет

- Anti-Terrorism Act Part 5Документ4 страницыAnti-Terrorism Act Part 5amazing_pinoyОценок пока нет

- Military Justice System Part 3Документ6 страницMilitary Justice System Part 3amazing_pinoyОценок пока нет

- Military Justice System Part 2Документ7 страницMilitary Justice System Part 2amazing_pinoyОценок пока нет

- Military Justice System Part 4Документ5 страницMilitary Justice System Part 4amazing_pinoyОценок пока нет

- Language RoutineДокумент1 страницаLanguage Routineamazing_pinoyОценок пока нет

- Planner Cover PageДокумент1 страницаPlanner Cover Pageamazing_pinoyОценок пока нет

- 2022 Philippine Government Directory of Agencies and OfficialsДокумент293 страницы2022 Philippine Government Directory of Agencies and Officialsamazing_pinoyОценок пока нет

- Ra 7055Документ2 страницыRa 7055zrewtОценок пока нет

- INTERVIEW QUESTIONS (INCIDENT+IQ) - Ebanking Channels - FT, Bills Payment, Cardless WithdrawalДокумент2 страницыINTERVIEW QUESTIONS (INCIDENT+IQ) - Ebanking Channels - FT, Bills Payment, Cardless Withdrawalamazing_pinoyОценок пока нет

- Blue Sands AttireДокумент1 страницаBlue Sands Attireamazing_pinoyОценок пока нет

- Annex B - AffidavitДокумент1 страницаAnnex B - Affidavitamazing_pinoyОценок пока нет

- Fully Booked Reading ChallengeДокумент1 страницаFully Booked Reading Challengeamazing_pinoyОценок пока нет

- Approved Revised Transaction Dispute Form 062618 PDFДокумент2 страницыApproved Revised Transaction Dispute Form 062618 PDFGersonCallejaОценок пока нет

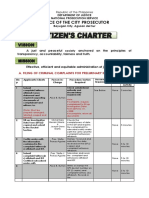

- OCP Bayugan CityДокумент7 страницOCP Bayugan Cityamazing_pinoyОценок пока нет

- Philippines Map ChartДокумент1 страницаPhilippines Map Chartamazing_pinoyОценок пока нет

- Every Good Boy Does FineДокумент1 страницаEvery Good Boy Does Fineamazing_pinoyОценок пока нет

- NLRC Notice On PICOPДокумент11 страницNLRC Notice On PICOPamazing_pinoyОценок пока нет

- Ra 10121Документ23 страницыRa 10121amazing_pinoyОценок пока нет

- EstafaДокумент241 страницаEstafaamazing_pinoyОценок пока нет

- Motion To Release Firearm SampleДокумент2 страницыMotion To Release Firearm Sampleamazing_pinoyОценок пока нет

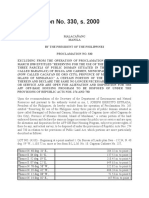

- PP 330Документ2 страницыPP 330amazing_pinoyОценок пока нет

- Total Number of Rooms 50.63Документ4 страницыTotal Number of Rooms 50.63hanuman2467% (3)

- Electric Power Assisted Steering Market by Type (EPHS, HPS, C-EPAS, P-EPAS, R-EPAS Etc.) - Forecast (2015-2020)Документ8 страницElectric Power Assisted Steering Market by Type (EPHS, HPS, C-EPAS, P-EPAS, R-EPAS Etc.) - Forecast (2015-2020)ThirupathiОценок пока нет

- What Is Life Insurance ?Документ15 страницWhat Is Life Insurance ?Jagdish SutharОценок пока нет

- 1Q21 Net Income Above Expectation: Semirara Mining CorporationДокумент8 страниц1Q21 Net Income Above Expectation: Semirara Mining CorporationJajahinaОценок пока нет

- Chapter 3 - Cash Flow Analysis - SVДокумент26 страницChapter 3 - Cash Flow Analysis - SVNguyen LienОценок пока нет

- Finsight 1april2012Документ10 страницFinsight 1april2012Archish GuptaОценок пока нет

- PGPACM ProspectusДокумент19 страницPGPACM Prospectusviratarun100% (1)

- ACJC Prelim H2 (Essays)Документ26 страницACJC Prelim H2 (Essays)lammofjvl0% (1)

- Malaysian TextileДокумент28 страницMalaysian TextileDato NJОценок пока нет

- f3 Prelim Exam Answer KeyДокумент4 страницыf3 Prelim Exam Answer KeyKriz-leen TiuОценок пока нет

- Key Tax Issues at Year End For Re Investors 2019 20 PDFДокумент202 страницыKey Tax Issues at Year End For Re Investors 2019 20 PDFAJ QuimОценок пока нет

- Capital Structure DecisionsДокумент32 страницыCapital Structure Decisionsrimoniba33% (3)

- Introduction To Finance Zeeshan Notes Cost of CapitalДокумент12 страницIntroduction To Finance Zeeshan Notes Cost of CapitalZeeshan SardarОценок пока нет

- The Seeker 1983 - Master Time FactorДокумент169 страницThe Seeker 1983 - Master Time FactorNarendra Kamma93% (15)

- Internship Final SlideДокумент21 страницаInternship Final SlideIqbalОценок пока нет

- PartnershipДокумент28 страницPartnershipAdi Murthy100% (2)

- Mahindra & Mahindra VS Tata MotorsДокумент20 страницMahindra & Mahindra VS Tata MotorsPratik Kalekar100% (1)

- ACF - Boston BeerДокумент42 страницыACF - Boston BeerpermafrostXx89% (9)

- Incorporators.: 2. That The Purpose or Purposes of The Corporation AreДокумент7 страницIncorporators.: 2. That The Purpose or Purposes of The Corporation AreLaw StudentОценок пока нет

- First Support Sources:: Positive Developments in Relation To Corruption and InvestmentДокумент4 страницыFirst Support Sources:: Positive Developments in Relation To Corruption and InvestmentrlslinaresОценок пока нет

- Portfolio RevisionДокумент14 страницPortfolio RevisionchitkarashellyОценок пока нет

- Income Tax On CorporationДокумент21 страницаIncome Tax On Corporationelainerodriguez0101Оценок пока нет

- KBWДокумент5 страницKBWEliot Brown / New York ObserverОценок пока нет

- Part5 PracticeTest1Документ4 страницыPart5 PracticeTest1Oanh NguyễnОценок пока нет

- Assignment 1 Business Mathematics (MAT 402)Документ4 страницыAssignment 1 Business Mathematics (MAT 402)biokimia 2018100% (1)

- LiveДокумент31 страницаLivebkaaljdaelvОценок пока нет

- No Fail ForexДокумент39 страницNo Fail ForexVincent Sampieri100% (5)

- The Stamford Land Conspiracy MatterДокумент3 страницыThe Stamford Land Conspiracy Matteropenid_OtVX6n9h100% (1)

- Financial Engineering & Risk ManagementДокумент10 страницFinancial Engineering & Risk ManagementRobin NeemaОценок пока нет