Академический Документы

Профессиональный Документы

Культура Документы

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Загружено:

Shyam SunderОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

D.

DHANDARIA & COMPANY

CHARTERED ACCOLINTANTS

Thana Road, P.O. TINSTJKIA

\_*_____/

786125 (Assam)

Ph: 0374-2337681 lrax: 0374-23501 81

INDEPENPENT AUDITOB',S REVIEW REPORT ON REVTEW OF tNTER|M FtNANC|AL

RESULTS

TO THE BOARD OF DIRECTORS OF

HIMALAYA GRANITES LIMITED

We have reviewed the accompanying Statement of Standalone Unaudited Financial

Results of M/S. HIMALAYA GRANITES LIMITED ("the Company") for the Quarter ended

30th June, 2016 ("the Statement"), being submitted by the Company pursuant to the

requirement of Regulation 33 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015. This statement which is the responsibility of the

Company's Management and approved by the Board of Directors, has been prepared in

accordance with the recognition and measurement principles laid down in Accounting

Standard for Interim Financial Reporting (AS 25), prescribed under section 133 of the

Companies Act, 2013 read with relevant rules issued thereunder and other accounting

principles generally accepted in India. Our responsibility is to issue a report on these

financial statements based on our review.

We conducted our review of the Statement in accordance with the Standard on

Review Engagements (SRE) 2410, "Review of Interim Financial Information Performed by

the Independent Auditor of the Entity', issued by the Institute of Chartered Accountants of

India. This Standard requires that we plan and perform the review to obtain moderate

assurance as to whether the Statement is free of material misstatement. A review is

limited primarily to inquiries of Company personnel and analytical procedures applied to

financial data and thus provides less assurance than an audit. We have not performed any

audit and, accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our notice that

causes us to believe that the accompanying statement of unaudited financial results

prepared in accordance with the aforesaid Accounting Standards and other accounting

principles generally accepted in India, has not disclosed the information required to be

disclosed in terms of Regulation 33 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015, including the manner in which it is to be disclosed, or

that it contains any material misstatement.

For D. DFIANDARIA & COMPANY

Chartered Accountants

ICAI Firm Reg. No. 306142E

* i TtNSUKIA

Place: New Delhi

Dated: 11th August, 2016

RI"*

l*

"/\'a-"^

F^^l;-

(Naveen Kumar Dhandarla)

-,,'bf,

Partner

Membership No. 061127

e-Mails

Partners

Phones

CA D. Dhandaria, B.Com.(Hons.) F.C.A.

943 50-3 5007

d_dh andari a@red i ffm

CA P.K.Dhandaria, B.Com.(Hons.), F.C.A. DISA(lCAl)

CA N. K. Dhandaria, B.Com.(Hons.), F.C.A. DISA(ICAI)

99544-28208

pdhandaria@rediffmail.com

91351-35i160

91357-07803

naveen_dhandaria@yahoo.co. rn

CA (Mrs.) R. Dhandaria" B.Com. F.C.A.

ai l. co

HIMALAYA GRANITES LIMITED

Regd.office : Panchalam village, M6lpottai Post, Tindivanam, Tamilnadu - 604 307

CIN : L13206TN1987PLC01516!, Telefax: 044-266S3378, Websito; www.hgl.co'in, Email: investors@hgl co'in

st.

31

31.03.2016

No.

.03.?016

from Opqrations

isl

Net saleslincome kom operattons (Net 0f excise dury)

ibi Oiher Operatrng

Inc-.ome

rotal incomo trom operatlons (net)

rpdn6es

Cost of matBrials consurned

b) Purcnase of Sttck-in-irade

196

196

6.24

624

fa 01

3.71

3.73

(;aan0as tn invenlories ol finished gogds, warh-in'progfess and stook-:n-ttad

rl) Emsloyee benfr15 etpnse

15 Ca

761

17.56

p.ot,i riloss) Irom ope.alions before other Income. tinance costs and ercepfional ltemg

17 09

Oihtr rncorne

Prorit i{Lossi trom ordinary actryilies befcr6 flnanc ccsls anc excett'onal rtems

,)

{17 56)

(0

5.18

14 73

34 41

23.5r

i:,i

9e?8

17 74

4/)

4.51

ii:1

39',,r

315

,4

1? 55

t t<

4.64

1?.56

Finance costs

Pfcttttlossl troff ordinary activi{ies efter rinane costs but before xcepllonai riems

(0 47i

Sxceplonal ilgms

9

ProtitJ {Loss} lrom ordlndry actlvltios bsfo.e

10

Iilx

(0.c21

tax

Expenses

for Cunenl

16r

Celgned

lcf MAT Crodrt

4

(0.4?)

1l

,1: Ai

12 58

?t

rr t<il

115

$2.sA1:

231.08

ai4

15 91)

4.64

300 50

331 e8

473 ?g

15

{0,02}'

1S

0.14',

I

I

I

I

I

I

0.431

0.43

{0.02)'

0.14'

(0.02]'

(0.54r

(0.1:)i

10,?fl-:.

{0 r2t,

ii) Oiluted

'

Not annualisod

Notas:

of the Company al thett

. The above results have been reviewed by the Audit Cornmitlee and approved by the Board of Drrectors

abovP results'

fespective meetings held on 11th A-ugust, 20t6. The Auditors have earried out "Limited Roview" of the

? The previous periods figures have been regrouped and reclassified wherever necessary'

rnforrnattcn as pef AS 17

3. A.s there is neither more lhan one busrness segment nor more than one geographical segmeit segmen:

.l

rs not aoPlicable

Place : New 0elhi

Dntod : 'l'lth August, 2016

By 0rder of the Board

For HIMALAYA GRANITES LIMITED

iri*sux'ai;

i"'

ii'

' t.l ".

'

Ramesh Ktth, ar Haritwal

llltanaging Director & CEO

DIN:01486666

Вам также может понравиться

- Mutual Fund Holdings in DHFLДокумент7 страницMutual Fund Holdings in DHFLShyam SunderОценок пока нет

- JUSTDIAL Mutual Fund HoldingsДокумент2 страницыJUSTDIAL Mutual Fund HoldingsShyam SunderОценок пока нет

- HINDUNILVR: Hindustan Unilever LimitedДокумент1 страницаHINDUNILVR: Hindustan Unilever LimitedShyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results For June 30, 2014 (Audited) (Result)Документ3 страницыFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderОценок пока нет

- Order of Hon'ble Supreme Court in The Matter of The SaharasДокумент6 страницOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderОценок пока нет

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Документ1 страницаPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedДокумент2 страницыSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderОценок пока нет

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliДокумент5 страницExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderОценок пока нет

- Settlement Order in Respect of R.R. Corporate Securities LimitedДокумент2 страницыSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For Dec 31, 2013 (Result)Документ4 страницыFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For Mar 31, 2014 (Result)Документ2 страницыFinancial Results For Mar 31, 2014 (Result)Shyam SunderОценок пока нет

- Financial Results For September 30, 2013 (Result)Документ2 страницыFinancial Results For September 30, 2013 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For June 30, 2016 (Result)Документ2 страницыStandalone Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For June 30, 2013 (Audited) (Result)Документ2 страницыFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

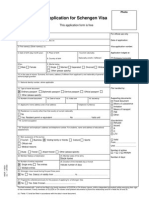

- Application For Schengen Visa: This Application Form Is FreeДокумент2 страницыApplication For Schengen Visa: This Application Form Is FreeMonirul IslamОценок пока нет

- ManualДокумент108 страницManualSaid Abu khaulaОценок пока нет

- History Assignment 4 Interview of Napoleon BonaparteДокумент2 страницыHistory Assignment 4 Interview of Napoleon BonaparteRyan BurwellОценок пока нет

- 9 History NcertSolutions Chapter 1 PDFДокумент3 страницы9 History NcertSolutions Chapter 1 PDFRaj AnandОценок пока нет

- V32LN SpanishДокумент340 страницV32LN SpanishEDDIN1960100% (4)

- Armstrong BCE3 Install 507120-01Документ18 страницArmstrong BCE3 Install 507120-01manchuricoОценок пока нет

- I. True or FalseДокумент5 страницI. True or FalseDianne S. GarciaОценок пока нет

- KSA Salary Guide 2023: Emerging Sectors & Mega-Projects to Drive 3% Pay RiseДокумент29 страницKSA Salary Guide 2023: Emerging Sectors & Mega-Projects to Drive 3% Pay Riseدحوم ..100% (8)

- Barangay Hearing NoticeДокумент2 страницыBarangay Hearing NoticeSto Niño PagadianОценок пока нет

- Blaw 1000 ReviewerДокумент10 страницBlaw 1000 ReviewerKyla FacunlaОценок пока нет

- Kerala rules on dangerous and offensive trade licensesДокумент3 страницыKerala rules on dangerous and offensive trade licensesPranav Narayan GovindОценок пока нет

- Nationalism in India - L1 - SST - Class - 10 - by - Ujjvala - MamДокумент22 страницыNationalism in India - L1 - SST - Class - 10 - by - Ujjvala - Mampriyanshu sharmaОценок пока нет

- Tuanda vs. SandiganbayanДокумент2 страницыTuanda vs. SandiganbayanJelena SebastianОценок пока нет

- Tax RTP May 2020Документ35 страницTax RTP May 2020KarthikОценок пока нет

- TL01 Behold Terra LibraДокумент15 страницTL01 Behold Terra LibraKeyProphet100% (1)

- Grant Thornton - Co-Op 3Документ7 страницGrant Thornton - Co-Op 3ConnieLowОценок пока нет

- Code of Business Conduct For Suppliers To The Coca-Cola CompanyДокумент1 страницаCode of Business Conduct For Suppliers To The Coca-Cola CompanyMonicaОценок пока нет

- Docshare - Tips - Cash and Cash Equivalents PDFДокумент10 страницDocshare - Tips - Cash and Cash Equivalents PDFAMANDA0% (1)

- PDF 05 EuroMedJeunesse Etude LEBANON 090325Документ28 страницPDF 05 EuroMedJeunesse Etude LEBANON 090325ermetemОценок пока нет

- Skippers United Pacific, Inc. v. DozaДокумент2 страницыSkippers United Pacific, Inc. v. DozaAntonio BartolomeОценок пока нет

- SALAZAR WrittenДокумент3 страницыSALAZAR WrittenJustin SalazarОценок пока нет

- Pandan, AntiqueДокумент3 страницыPandan, AntiqueSunStar Philippine NewsОценок пока нет

- UKLSR Volume 2 Issue 1 Article 3 PDFДокумент34 страницыUKLSR Volume 2 Issue 1 Article 3 PDFIbrahim SalahudinОценок пока нет

- STM32F429 DiscoveryДокумент11 страницSTM32F429 Discoverymail87523Оценок пока нет

- Order Dated - 18-08-2020Документ5 страницOrder Dated - 18-08-2020Gaurav LavaniaОценок пока нет

- Upgrade Guide For Oracle Forms and ReportsДокумент46 страницUpgrade Guide For Oracle Forms and ReportsJibin samОценок пока нет

- 1982 SAMAHAN ConstitutionДокумент11 страниц1982 SAMAHAN ConstitutionSAMAHAN Central BoardОценок пока нет

- Business Practices of Cooperatives: Principles and Philosophies of CooperativismДокумент32 страницыBusiness Practices of Cooperatives: Principles and Philosophies of CooperativismJaneth TugadeОценок пока нет

- Dvash-Banks v. U.S. Dep't of StateДокумент2 страницыDvash-Banks v. U.S. Dep't of StateJohn Froy TabingoОценок пока нет