Академический Документы

Профессиональный Документы

Культура Документы

Flexi Plus Option 1 PDF

Загружено:

Prashant RajputОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Flexi Plus Option 1 PDF

Загружено:

Prashant RajputАвторское право:

Доступные форматы

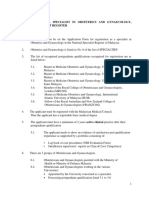

S. No.

Benefits

Aggregate Limit

Under the terms and conditions of the plan,

we will pay necessary, customary and

reasonable expenses up to an overall

maximum, per insured member per year.

Area of Cover

Eligibility

Network

5

6

Age Limit

Deductible for Out-Patient Services

Flexi Plus Platinum

Flexi Plus Diamond

AED 1,500,000/=

AED 750,000/=

UAE, GCC, ME, SEA

including Indian Subcontinent

All UAE residents

All UAE residents

(UAE Nationals &

(UAE Nationals &

Expatriates having a Valid Expatriates having a Valid

Residence Visa)

Residence Visa)

Worldwide excluding USA

& Canada

Flexi Plus - Gold Flexi Plus - Silver

AED 250,000/=

AED 150,000/=

UAE, GCC, ME, SEA

including Indian Subcontinent

All UAE residents

(UAE Nationals &

Expatriates having a

Valid Residence Visa)

UAE, GCC, ME, SEA

including Indian Subcontinent

All UAE residents

(UAE Nationals &

Expatriates having a

Valid Residence Visa)

GN + AH

GN

RN

RN2

0 to 70 Years

0 to 70 Years

0 to 70 Years

0 to 70 Years

AED 50/=

AED 50/=

AED 50/=

AED 50/=

20% Co-insurance subject

to UCR Network Charges

Treatment out-side the

Network is not allowed

and will not be

reimbursed.

Treatment out-side the

Network is not allowed

and will not be

reimbursed.

Within the Network

on Direct Billing Basis

Within the Network

on Direct Billing Basis

Treatment Outside the Network

If treatment is taken outside the network for

eligible medical condition covered under the

policy, reimbursement would be allowed subject 20% Co-insurance subject

to 20% Co-insurance based on Usual, Customary to UCR Network Charges

and Reasonable ( UCR ) Network Charges.

( UCR charges are as per the discretion of the

insurer )

Claims Settlement Basis

8

( as per Usual, Customary and Reasonable

Charges of the Network in UAE ).

Within the Network

on Direct Billing Basis

Within the Network

on Direct Billing Basis

Outside the Network on

Reimbursement Basis

Outside the Network on

Reimbursement Basis

Outside the Network on Outside the Network on

Reimbursement Basis

Reimbursement Basis

( if eligible )

( if eligible )

In-Patient Treatment

a

Accidents and emergencies, intensive care

and theatre costs

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Hospital Accommodation ( Room Charges )

Private Room

Covered

Private Room

Covered

Private Room

Covered up to

AED 750/= per day

Semi - Private Room

Covered up to

AED 450/= per day

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered in Full

c

d

e

f

g

h

i

Nursing Fees, medical expenses and

ancillary charges

Surgeons', consultants, anaesthetist',

specialists' , General Practitioners' fees

Prescribed Medicine and drugs

Reconstructive surgery following an

accident or following surgery for an eligible

medical condition

Prostheses: artificial body parts surgically

implated to form permanent parts of an

insured member's body

MRI, PET, CT Scans

X-Rays, Pathology, diagnostic tests and

procedures

Oncology tests, drugs and consultants' fees

including cover for chemotherapy and

radiotheraphy

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Physiotherapy recommended / referred by

a General Practitioner or a Specialist,

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered up to

AED 200/= per day

Covered up to

AED 200/= per day

Covered up to

AED 200/= per day

Covered up to

AED 200/= per day

Covered in Full

Covered in Full

Covered in Full

Covered in Full

Covered up to

AED 300/= per day

Covered up to

AED 300/= per day

Covered up to

AED 200/= per day

Covered up to

AED 200/= per day

NIL

NIL

NIL

NIL

Parent accommodation

l

Hospital accomodation cost in respect of a

parent or legal guardian staying with an Insured

member who is under 18 years of age and is

admitted to a Hospital as an In-Patient.

Accidental Damage to Teeth

m

Treatment recevied in an Emergency room in a

Hospital within 48 hours of incurring Accidental

damage caused to sound, natural teeth as a

result of an Accident.

Hospital Cash Benefit

When treatment received as an In-Patient for an

eligible Medical Condition in a Government

Hospital, where the no costs were incurred for

accommodation and/or for treatment, then this

benefit pays for a daily cash benefit for In-Patient

stay more than 3 day.

This benefit is not applicable for Accident &

Emergency admissions.

Deductible for ( In-Patient Services )

o

( Applicable if treatment is taken in a facility

in-side/outside the Network of providers )

Out-Patient & Day-care

Treatment

Deductible for ( Out-Patient Services )

p

r

s

u

v

w

x

( Applicable if treatment is taken in a facility

inside/outside the Network of providers )

Primary Consultation and treatment to

include General Practitioners' fees,

prescribed medicines, drugs and dressings

X-ray, pathology, diagnostic tests and

procedures

Specialist or Consultant fees for consultation

with prescribed medicines, drugs and

dressings

Physiotherapy recommended / referred by

a General Practitioner or a Specialist,

Oncology tests, drugs and consultants' fees

including cover for chemotherapy and

radiotheraphy

MRI, PET, CT Scans

Out-Patient Surgical Operations

Post - Hospitalization Treatment

AED 50/= Per Visit

AED 50/= Per Visit

AED 50/= Per Visit

AED 50/= Per Visit

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Covered

Up to AED 25,000

Up to AED 15,000

Up to AED 10,000

Up to AED 5,000

In patient : upto annual

limit .

Out patient : upto Limit

AED 15,000

In patient : upto annual

limit .

Out patient : upto Limit

AED 10,000

In patient : upto annual

limit .

Out patient : upto Limit

AED 5,000

In patient : upto annual

limit .

Out patient : upto Limit

AED 3,000

Chronic Medical Conditions

y

Covered if not Pre-existing and sub -limited

Pre-existing Conditions

z

Covered after 2 years of continuous cover

with ASNIC

Emergency Local Ambulance

aa

Cost of road ambulance transport required

due to an emergency or medical necessity to

the nearest available and appropriate local

hospital.

Limited to AED 1,000/=

Limited to AED 750/=

Limited to AED 500/=

Limited to AED 250/=

Covered upto a limit of

AED 15,000/=

Covered upto a limit of

AED 10,000/=

Covered upto a limit of

AED 7,500/=

Covered upto a limit of

AED 5,000/=

Covered up to a limit of

AED 25,000/=

Covered up to a limit of

AED 15,000/=

Covered up to a limit of

AED 10,000/=

Not Covered

Covered upto a limit of

AED 5,000/=

Covered upto a limit of

AED 4,000/=

Covered upto a limit of

AED 2,500/=

Covered upto a limit of

AED 1,000/=

Repatriation of Mortal Remains

ab

In the event of death, the cost of

preparation and air transportation of the

body, mortal remains or the ashes of an

insured person, from the place of death to

the home country or the preparation and

local burial or cremation of the mortal

remains of the insured person, who dies

outside the home country.

Maternity Benefit

ac

(with 12 months waiting period )

Nursing at Home

ad

Immediately following Hospital discharge

on the recommendation of a specialist and

must be provided by a qualified nurse. All

treatments under this benefit must be preauthorized by us.

for a period not exceed 30 for a period not exceed 30

days in aggregate.

days in aggregate.

for a period not exceed for a period not exceed 30

30 days in aggregate.

days in aggregate.

Reconstructive Surgery

ae

Reconstructive surgery following an

Accident or following surgery for an eligible

medical conditions, which is not pre-existing

and the incident has not occurred prior to

commencing this cover under the policy.

Renal Disorder

( Kidney Transplant Only )

af

(Cost of organ not Covered)

Hospital Expense for person donating an

Organ for Transplant ( Kidney )

Dental Cover

ag

Below dental procedures excluding any

surgeries.

Root Canal, Fillings, Extractions, Antibiotics

for Infection of Gums Consultation and Xray.

Optical Cover

ah

Cover for a pair of lenses only.

Optical Cover Extension

ai

Surgery for Cataract

Eligibility : only after a continuous cover

with ASNIC for 2 years

Covered in Full

Covered in Full

Hospital Expenses

Covered.

Hospital Expenses Covered.

Dialysis ( pre & post )

operative covered.

Dialysis ( pre & post )

operative covered.

Covered in Full

Covered in Full

Hospital Expenses

Covered upto AED

20,000/= only

Hospital Expenses

Covered upto AED

15,000/= Only

Dialysis not covered

Dialysis not covered

Covered Up to AED

15,000/=

Covered Up to AED

10,000/=

Not Covered

Not Covered

Covered up to a limit of

AED 2,000/= with AED

100/= as deductible

Not Covered

Not Covered

Not Covered

Covered up to a limit of

AED 200/= for a pair of

lenses

Not Covered

Not Covered

Not Covered

Covered up to a limit of

AED 10,000/= after 2

years of Continuous cover

with ASNIC

Covered up to a limit of

AED 6,000/= after 2 years

of Continuous cover with

ASNIC

Not Covered

Not Covered

aj

ak

al

Available from 3rd Year of Available from 3rd Year of

insurance cover for female insurance cover for female

Annual Breast Screening

members above the age of members above the age of

35 years and within our

35 years and within our

Network

Network

Available from 3rd Year of Available from 3rd Year of

insurance cover for Male

insurance cover for Male

Annual Prostate Screening

members above the age of members above the age of

45 years and within our

45 years and within our

Network

Network

AED 2,000/=

AED 2,000/=

Return Air Fare to Patient for Surgery in

Plus

Plus

Home Country

AED 2,000/= for

None

( if treatment is not available in the country of

accompanying Family

for Accompanying Family

residence or the treatment expense is up to 50%

of the cost in UAE ).

Member

Member

Not Covered

Not Covered

Not Covered

Not Covered

Not Covered

Not Covered

Exclusions

Standard Individual Policy Exclusions would apply.

LIMITED PERIOD EXCLUSIONS

Limited Period Exclusions

applicable for first 2 years of being covered

with ASNIC

Applicable to all

categories

Applicable to all categories

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Not Covered for first 2 Years

Years

Not Covered for first 2

Not Covered for first 2 Years

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Applicable to all categories Applicable to all categories

x

( Health services of the following conditions

/ illness / ailments ) are not covered for the

first 2 years of commencing the policy for

all insured members

a.1

Cataracts

a.2

Prostatic Hypertrophy Tumors/Benign

a.3

Hysterectomy for Menorrhagia or

Fibromyoma

a.4

Hernia and Hydrocele

a.5

Varicose Viens and Varicocele

a.6

Piles, Fistula in anus, Fissure

Surgeries for : Sinusitis and related

Disorders

Arthritis, Gout, Rheumatism and Spinal Disc

a.8

Disorders.

Joint Replacement, unless arising out of

a.9

accidents

a.7

a.10

Stone in urinary and biliary systems

a.11

Dilatations & Currettage

a.12

Skin and all internal tumors / cysts/

nodules / polyps of any kind, including

breast lumps, adenoids and hemorrhoids

a.13

dialysis required for chronic renal failure

a.14

surgery on Tonsils, adenoids and sinuses

a.15

Gastric and deodenal ulcers

a.16

Circumcision, unless necessary for the

treatment of a disease not othersise

excluded or required as a result of

accidental bodily injury

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2 Years

Not Covered for first 2

Years

Not Covered for first 2 Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2

Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Not Covered for first 2 Years

Вам также может понравиться

- Sachin Tendulkar and India Lost The MatchДокумент7 страницSachin Tendulkar and India Lost The MatchPrashant RajputОценок пока нет

- Special Terms and Conditions - Diamond PDFДокумент11 страницSpecial Terms and Conditions - Diamond PDFPrashant RajputОценок пока нет

- Gluco Chek PDFДокумент2 страницыGluco Chek PDFPrashant RajputОценок пока нет

- Indian Classics StoriesДокумент7 страницIndian Classics StoriesPrashant RajputОценок пока нет

- Basics of Distribution Substations For Electrical Engineers (Beginners)Документ14 страницBasics of Distribution Substations For Electrical Engineers (Beginners)Prashant RajputОценок пока нет

- Panama CanalДокумент2 страницыPanama CanalPrashant RajputОценок пока нет

- ReadmeДокумент1 страницаReadmePrashant RajputОценок пока нет

- HTTP WWW - BookgangaДокумент2 страницыHTTP WWW - BookgangaPrashant RajputОценок пока нет

- Tech Paper Lighting Concepts A Short Guide: Lumen (Luminous Flux) Lux (Illumance)Документ1 страницаTech Paper Lighting Concepts A Short Guide: Lumen (Luminous Flux) Lux (Illumance)Prashant RajputОценок пока нет

- ETAP User Guide 7.1Документ8 страницETAP User Guide 7.1hesse21Оценок пока нет

- Siemens TransformerДокумент12 страницSiemens TransformerPrashant RajputОценок пока нет

- Drillmec DrawworksДокумент8 страницDrillmec DrawworksPrashant Rajput100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Byron J Good (1977) The Heart of Whats The MatterДокумент34 страницыByron J Good (1977) The Heart of Whats The MatterJavier Fernando GalindoОценок пока нет

- Legal MedicineДокумент36 страницLegal Medicinepyulovincent100% (1)

- Resume CV Military Trained Director or Perioperative Specialty Surgical Services BSN MA Texas Post Medical Resume Physician CVДокумент3 страницыResume CV Military Trained Director or Perioperative Specialty Surgical Services BSN MA Texas Post Medical Resume Physician CVRick WhitleyОценок пока нет

- Department of Health and Human Services: Payments ForДокумент32 страницыDepartment of Health and Human Services: Payments Formarkv93Оценок пока нет

- Australian Immigration Skilled Occupation ListДокумент7 страницAustralian Immigration Skilled Occupation ListKishore KumarОценок пока нет

- DM Critical Care Medicine PDFДокумент23 страницыDM Critical Care Medicine PDFArun Sahaya RajaОценок пока нет

- Hospital Guidebook IitbДокумент15 страницHospital Guidebook IitbAyandev Barman100% (1)

- Apply For Elective FormsДокумент7 страницApply For Elective FormsAnonymous pviAGxjvrTОценок пока нет

- Bozeman Deaconess Proposal For Big Sky HospitalДокумент48 страницBozeman Deaconess Proposal For Big Sky HospitalBozeman Daily ChronicleОценок пока нет

- C Obstetrics and GynaecologyДокумент12 страницC Obstetrics and GynaecologymahaletchemyОценок пока нет

- Thinking of Urgent Care?Документ3 страницыThinking of Urgent Care?gus_lionsОценок пока нет

- 2012-2013 RACP Training Positions GuideДокумент68 страниц2012-2013 RACP Training Positions Guideleh.mo9315Оценок пока нет

- Ivan Illich Talks Tough at CFPC Meeting in DublinДокумент4 страницыIvan Illich Talks Tough at CFPC Meeting in DublinGreenman52Оценок пока нет

- Dubai Healthcare Professional Licensing Guide - FinalДокумент141 страницаDubai Healthcare Professional Licensing Guide - FinalAlvin OccianoОценок пока нет

- DLL - MAPEH 6 - Q1 - W9 - HealthДокумент4 страницыDLL - MAPEH 6 - Q1 - W9 - HealthKaren Kichelle Navarro Evia100% (1)

- Physicians Directory PDFДокумент126 страницPhysicians Directory PDFThebestearldom0% (1)

- Ambulatory Care GuideДокумент139 страницAmbulatory Care Guideveera_chapo100% (1)

- IMA CGP ProspectusДокумент28 страницIMA CGP ProspectusGurmeet SinghОценок пока нет

- Residency Prog CanadaДокумент116 страницResidency Prog Canadahswami20037730Оценок пока нет

- Policies, Guidelines and Standards of Medical EducationДокумент5 страницPolicies, Guidelines and Standards of Medical EducationFatima ZaharaОценок пока нет

- Dgsurg PDFДокумент401 страницаDgsurg PDFAhmad Gamal Elden MAhanyОценок пока нет

- Asclepius ConsultingДокумент13 страницAsclepius ConsultingSujatha GnanasekherОценок пока нет

- Imm Pathology 2016Документ43 страницыImm Pathology 2016Aamir Hamaad100% (3)

- New Assessment Tool Level 2 Hospital PDFДокумент18 страницNew Assessment Tool Level 2 Hospital PDFMaridel JuenОценок пока нет

- MD Occupational Health ProtocolДокумент6 страницMD Occupational Health ProtocolGareth GrechОценок пока нет

- MOMS Application Information - New FormatДокумент33 страницыMOMS Application Information - New Formatbluberry00100% (3)

- Kerala Health PolicyДокумент31 страницаKerala Health PolicyanukeralaОценок пока нет

- Teresio Varetto: Vienna 06 October 2015Документ27 страницTeresio Varetto: Vienna 06 October 2015intnpsОценок пока нет

- Department of Labor: WDS1Документ6 страницDepartment of Labor: WDS1USA_DepartmentOfLaborОценок пока нет

- Legal MedicineДокумент36 страницLegal MedicineSerious Leo100% (1)