Академический Документы

Профессиональный Документы

Культура Документы

Balance Sheet: (Except For Per Share Items)

Загружено:

Monica ReyesИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Balance Sheet: (Except For Per Share Items)

Загружено:

Monica ReyesАвторское право:

Доступные форматы

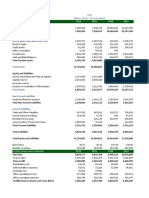

CEBU AIR, INC.

FS

BALANCE SHEET

In millions of PHP (except for per share items)

Fiscal data as of Dec 31 2014

2014

2013

2012

2011

2010

Cash And Short Term Investments

3,964

6,056

10,728

12,202

13,643

Total Receivables, Net

1,863

1,818

989

837

862

Total Inventory

1,531

1,693

1,121

453

420

Prepaid expenses

323

280

175

202

175

Other current assets, total

846

186

107

38

39

8,526

10,033

13,120

13,732

15,139

65,227

56,412

47,561

39,863

33,986

567

--

--

--

--

--

--

--

--

--

591

579

512

520

484

--

28

57

--

1,151

391

193

334

328

76,062

67,527

61,414

54,506

49,937

Accounts payable

3,984

4,314

2,479

2,640

1,996

Accrued expenses

4,565

3,540

3,750

3,313

2,756

4,712

3,755

2,769

2,467

2,056

Other current liabilities, total

10,799

6,730

7,567

6,109

5,488

Total current liabilities

24,061

18,338

16,565

14,529

12,296

Total long term debt

29,137

25,651

20,155

18,404

16,377

Total debt

33,850

29,406

22,924

20,872

18,433

129

450

222

153

--

--

--

--

--

1,196

2,456

2,207

2,186

3,204

54,523

46,446

39,376

35,341

32,030

ASSETS

Total current assets

Property, plant & equipment, net

Goodwill, net

Intangibles, net

Long term investments

Note receivable - long term

Other long term assets

Total assets

LIABILITIES

Notes payable/short-term debt

Current portion long-term debt/capital leases

Deferred income tax

Minority interest

Other liabilities, total

Total liabilities

Fiscal data as of Dec 31 2014

2014

2013

2012

2011

2010

613

613

613

613

613

8,406

8,406

8,406

8,406

8,406

13,181

12,934

13,634

10,682

8,891

(529)

(529)

(529)

(529)

--

--

--

--

(5.63)

(2.71)

(132)

(342)

(86)

--

--

Total equity

21,539

21,082

22,037

19,166

17,907

Total liabilities & shareholders' equity

76,062

67,527

61,414

54,506

49,937

Total common shares outstanding

606

606

606

606

613

Treasury shares - common primary issue

7.28

7.28

7.28

7.28

--

SHAREHOLDERS EQUITY

Common stock

Additional paid-in capital

Retained earnings (accumulated deficit)

Treasury stock - common

Unrealized gain (loss)

Other equity, total

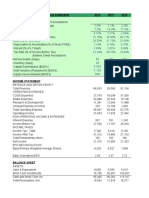

INCOME STATEMENT

In millions of PHP (except for per share items)

Fiscal data as of Dec 31 2014

2014

2013

2012

2011

2010

52,000

41,004

37,904

33,935

29,089

40,110

32,371

29,771

25,844

12,057

Selling, general and admin. expenses, total

3,451

2,774

2,702

2,301

8,387

Depreciation/amortization

4,282

3,455

2,768

2,315

2,101

Unusual expense(income)

--

--

--

--

--

Other operating expenses, total

--

--

--

139

93

47,843

38,600

35,241

30,599

22,639

4,157

2,404

2,663

3,336

6,450

--

--

--

--

108

REVENUE AND GROSS PROFIT

Total revenue

OPERATING EXPENSES

Cost of revenue total

Total operating expense

Operating income

Other, net

INCOME TAXES, MINORITY INTEREST AND EXTRA ITEMS

Net income before taxes

879

105

3,870

3,747

6,940

Provision for income taxes

25

(407)

298

123

18

853

512

3,572

3,624

6,922

--

--

--

--

--

853

512

3,572

3,624

6,922

--

--

--

--

--

Net income after taxes

Minority interest

Net income before extra. Items

Total extraordinary items

Fiscal data as of Dec 31 2014

2014

2013

2012

2011

2010

Net income

853

512

3,572

3,624

6,922

Inc.avail. to common excl. extra. Items

853

512

3,572

3,624

6,922

Inc.avail. to common incl. extra. Items

853

512

3,572

3,624

6,922

Basic/primary weighted average shares

606

606

606

611

588

Basic/primary eps excl. extra items

1.41

0.84

5.89

5.93

12

Basic/primary eps incl. extra items

1.41

0.84

5.89

5.93

12

--

--

--

--

Diluted weighted average shares

606

606

606

611

588

Diluted eps excl. extra items

1.41

0.84

5.89

5.93

12

Diluted eps incl. extra items

1.41

0.84

5.89

5.93

12

1.00

1.00

1.00

--

2.00

--

--

606

--

--

--

--

--

--

1,013

866

733

663

931

4,282

3,455

2,768

2,315

2,101

--

--

--

--

--

879

105

3,870

3,747

6,940

--

--

--

--

--

25

(407)

298

123

18

Normalized income after tax

853

512

3,572

3,624

6,922

Normalized income avail. to common

853

512

3,572

3,624

6,922

Basic normalized EPS

1.41

0.84

5.89

5.93

12

Diluted normalized EPS

1.41

0.84

5.89

5.93

12

EPS RECONCILIATION

Dilution adjustment

COMMON STOCK DIVIDENDS

DPS - common stock primary issue

Gross dividend - common stock

PRO FORMA INCOME

Pro forma net income

Interest expense, supplemental

SUPPLEMENTAL INCOME

Depreciation, supplemental

Total special items

NORMALIZED INCOME

Normalized income before taxes

Effect of special items on income taxes

Income tax excluding impact of special items

CASH FLOW

In millions of PHP (except for per share items)

Annual data

Interim data

Fiscal data as of Dec 31 2014

2014

2013

2012

2011

2010

879

105

3,870

3,747

6,940

Depreciation/depletion

4,282

3,455

2,768

2,315

2,101

Non-Cash items

3,819

2,729

(575)

118

(482)

45

35

--

--

1,005

772

730

679

803

(1,147)

(2,073)

97

1,816

1,464

7,832

4,216

6,161

7,995

10,024

(13,317)

(12,180)

(10,422)

(4,232)

(2,361)

(289)

(116)

3,493

(59)

(3,562)

(13,605)

(12,296)

(6,929)

(4,291)

(5,923)

--

--

--

(100)

(606)

(1,212)

(606)

(1,834)

--

--

--

--

(529)

3,833

Issuance (retirement) of debt, net

4,301

4,414

3,407

(2,141)

(1,832)

Total cash from financing

3,695

3,203

2,801

(4,504)

1,900

(14)

205

(262)

(5.90)

(78)

(2,092)

(4,672)

1,771

(806)

5,922

Net cash-begin balance/reserved for future use

6,056

10,728

8,958

9,763

3,841

Net cash-end balance/reserved for future use

3,964

6,056

10,728

--

9,763

Depreciation, supplemental

4,282

3,455

2,768

2,315

2,101

Cash interest paid, supplemental

1,005

772

730

679

803

45

35

--

--

OPERATIONS

Net income

Cash taxes paid, supplemental

Cash interest paid, supplemental

Changes in working capital

Total cash from operations

INVESTING

Capital expenditures

Other investing and cash flow items, total

Total cash from investing

FINANCING

Financing cash flow items

Total cash dividends paid

Issuance (retirement) of stock, net

NET CHANGE IN CASH

Foreign exchange effects

Net change in cash

SUPPLEMENTAL INCOME

Cash taxes paid, supplemental

Вам также может понравиться

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОт EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Tesla, Inc. (TSLA) : Cash FlowДокумент239 страницTesla, Inc. (TSLA) : Cash FlowAngelllaОценок пока нет

- Afm 2nd YrДокумент9 страницAfm 2nd YrrakeshОценок пока нет

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018От EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018Оценок пока нет

- Financial Analysis ToolДокумент50 страницFinancial Analysis ToolContessa PetriniОценок пока нет

- HCL Technologies: Balance Sheet - in Rs. Cr.Документ20 страницHCL Technologies: Balance Sheet - in Rs. Cr.Kuldeep SinghОценок пока нет

- GSK Financial FiguresДокумент35 страницGSK Financial FiguresKalenga CyrilleОценок пока нет

- Consolidated AccountДокумент44 страницыConsolidated Accountnaveed153331Оценок пока нет

- Business & Finance Homework HelpДокумент9 страницBusiness & Finance Homework HelpAustine OtienoОценок пока нет

- Airline AnalysisДокумент20 страницAirline Analysisapi-314693711Оценок пока нет

- 2go FSДокумент45 страниц2go FSHafsah Amod DisomangcopОценок пока нет

- Premier CementДокумент13 страницPremier CementWasif KhanОценок пока нет

- LBP NO. 3A (Consolidated Programmed Appropriation and Obligation by Object of Expenditure) (2013)Документ6 страницLBP NO. 3A (Consolidated Programmed Appropriation and Obligation by Object of Expenditure) (2013)Bar2012Оценок пока нет

- Tesla Inc ModelДокумент57 страницTesla Inc ModelRachel GreeneОценок пока нет

- Pro Forma Financial Statements 2014 2015 2016 Income StatementДокумент4 страницыPro Forma Financial Statements 2014 2015 2016 Income Statementpriyanka khobragadeОценок пока нет

- FINM 7044 Group Assignment 终Документ4 страницыFINM 7044 Group Assignment 终jimmmmОценок пока нет

- BUS 635 Project On BD LampsДокумент24 страницыBUS 635 Project On BD LampsNazmus Sakib PlabonОценок пока нет

- Tesla Inc Unsolved Model 330PMДокумент61 страницаTesla Inc Unsolved Model 330PMAYUSH SHARMAОценок пока нет

- Onsolidated Balance Sheet of Jet Airways - in Rs. Cr.Документ11 страницOnsolidated Balance Sheet of Jet Airways - in Rs. Cr.Anuj SharmaОценок пока нет

- Metodos Flujos de Caja, Ejemplo AltriaДокумент5 страницMetodos Flujos de Caja, Ejemplo AltriaEsteban BustamanteОценок пока нет

- Financial Statement Analysis: Kapuso O KapamilyaДокумент51 страницаFinancial Statement Analysis: Kapuso O KapamilyaMark Angelo BustosОценок пока нет

- VineetAg FAДокумент10 страницVineetAg FAVineet AgarwalОценок пока нет

- Valuation Report SonyДокумент38 страницValuation Report SonyankurОценок пока нет

- Quice Foods Industries LTDДокумент4 страницыQuice Foods Industries LTDOsama RiazОценок пока нет

- Comparative Financial StatementsДокумент6 страницComparative Financial StatementsPratikBhowmickОценок пока нет

- TeslaДокумент5 страницTeslaRajib ChatterjeeОценок пока нет

- Profit & Loss Statement: O' Lites GymДокумент8 страницProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- Example of Financial TemplateДокумент2 страницыExample of Financial Templatezeus33Оценок пока нет

- For The Year Ended 30 June 2018: Chapter No. 4 Financial AnalysisДокумент37 страницFor The Year Ended 30 June 2018: Chapter No. 4 Financial AnalysisAbdul MajeedОценок пока нет

- FSAP Wal-Mart Data and TemplateДокумент44 страницыFSAP Wal-Mart Data and TemplateJose ArmazaОценок пока нет

- Financial Statement Analysis UnsolvedДокумент3 страницыFinancial Statement Analysis Unsolvedavani singhОценок пока нет

- 16 FIN 065 FinalДокумент28 страниц16 FIN 065 Finalযুবরাজ মহিউদ্দিনОценок пока нет

- Analisis Fundamental (Kbri)Документ125 страницAnalisis Fundamental (Kbri)triaОценок пока нет

- Enterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToДокумент35 страницEnterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToMD.Thariqul Islam 1411347630Оценок пока нет

- Infosys Excel FinalДокумент44 страницыInfosys Excel FinalAnanthkrishnanОценок пока нет

- Financial Statements Analysis: Arsalan FarooqueДокумент31 страницаFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioОценок пока нет

- B. LiabilitiesДокумент1 страницаB. LiabilitiesSamuel OnyumaОценок пока нет

- Income Statement: 2013-2014 (Year) 2014-2015 (Year) 2015-2016 (Year)Документ3 страницыIncome Statement: 2013-2014 (Year) 2014-2015 (Year) 2015-2016 (Year)Rifat Ibna LokmanОценок пока нет

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Документ19 страницNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaОценок пока нет

- BSNL Balance SheetДокумент15 страницBSNL Balance SheetAbhishek AgarwalОценок пока нет

- Spreadsheet-Company A - Quiz 2Документ6 страницSpreadsheet-Company A - Quiz 2BinsiboiОценок пока нет

- Balance Sheet of WiproДокумент3 страницыBalance Sheet of WiproRinni JainОценок пока нет

- Comman Size Analysis of Income StatementДокумент11 страницComman Size Analysis of Income Statement4 7Оценок пока нет

- Khulna Power Company Limited: Balnace Sheet StatementДокумент9 страницKhulna Power Company Limited: Balnace Sheet StatementTahmid ShovonОценок пока нет

- Standard-Ceramic-Limited NewДокумент10 страницStandard-Ceramic-Limited NewTahmid ShovonОценок пока нет

- NICOL Financial Statement For The Period Ended 30 Sept 2023Документ4 страницыNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkОценок пока нет

- اكسل شيت رائع في التحليل الماليДокумент144 страницыاكسل شيت رائع في التحليل الماليNabil SharafaldinОценок пока нет

- Zimplow FY 2012Документ2 страницыZimplow FY 2012Kristi DuranОценок пока нет

- Accounting Presentation (Beximco Pharma)Документ18 страницAccounting Presentation (Beximco Pharma)asifonikОценок пока нет

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Документ1 страницаSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCОценок пока нет

- PIOC Data For Corporate ValuationДокумент6 страницPIOC Data For Corporate ValuationMuhammad Ali SamarОценок пока нет

- Indian Bank: Profit and Loss StatementДокумент33 страницыIndian Bank: Profit and Loss StatementKaushaljm PatelОценок пока нет

- Financial StatementsДокумент14 страницFinancial Statementsthenal kulandaianОценок пока нет

- 02 04 EndДокумент6 страниц02 04 EndnehaОценок пока нет

- Profit & Loss Statement: O' Lites RestaurantДокумент7 страницProfit & Loss Statement: O' Lites RestaurantNoorulain AdnanОценок пока нет

- Business Valuation Cia 1 Component 1Документ7 страницBusiness Valuation Cia 1 Component 1Tanushree LamareОценок пока нет

- 11 MalabonCity2018 - Part4 AnnexesДокумент4 страницы11 MalabonCity2018 - Part4 AnnexesJuan Uriel CruzОценок пока нет

- New ExcelДокумент25 страницNew Excelred8blue8Оценок пока нет

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Документ32 страницы4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiОценок пока нет

- Mathematical Literacy P1 GR 12 Exemplar 2021 EngДокумент15 страницMathematical Literacy P1 GR 12 Exemplar 2021 EngJeketera Shadreck67% (21)

- QB 11,12,14,15Документ59 страницQB 11,12,14,15Giang Thái HươngОценок пока нет

- CASE #90 Securities and Exchange Commission (Sec) and Insurance Commission (Ic) vs. COLLEGE ASSURANCE PLAN PHILIPPINES, INC., G.R. No. 202052, March 7, 2018 FactsДокумент1 страницаCASE #90 Securities and Exchange Commission (Sec) and Insurance Commission (Ic) vs. COLLEGE ASSURANCE PLAN PHILIPPINES, INC., G.R. No. 202052, March 7, 2018 FactsHarleneОценок пока нет

- Code Report Code NameДокумент24 страницыCode Report Code NameLucy Marie RamirezОценок пока нет

- Meressa Paper 2021Документ24 страницыMeressa Paper 2021Mk FisihaОценок пока нет

- Basic Accounting NotesДокумент40 страницBasic Accounting NotesRae Slaughter100% (1)

- SYBCO AC FIN Financial Accounting Special Accounting Areas IIIДокумент249 страницSYBCO AC FIN Financial Accounting Special Accounting Areas IIIctfworkshop2020Оценок пока нет

- AFAR-non ProfitДокумент21 страницаAFAR-non ProfitJessica Pama EstandarteОценок пока нет

- Albanese Company Worksheet (Partial) For The Month Ended April 30, 2014Документ4 страницыAlbanese Company Worksheet (Partial) For The Month Ended April 30, 2014Feliks RudiОценок пока нет

- Financial Statements of HSYДокумент16 страницFinancial Statements of HSYAqsa Umer0% (2)

- Analysis in SunPlusДокумент17 страницAnalysis in SunPlusFernando José Fernandez NavasОценок пока нет

- Chapter 8Документ7 страницChapter 8jeanОценок пока нет

- Sample: Personal Health Insurance PolicyДокумент23 страницыSample: Personal Health Insurance PolicypreetiОценок пока нет

- Infosys Result UpdatedДокумент15 страницInfosys Result UpdatedAngel BrokingОценок пока нет

- ENTREP Q2 W4 ForecastingДокумент44 страницыENTREP Q2 W4 ForecastingSally BaranganОценок пока нет

- Clep Financial AccountingДокумент25 страницClep Financial Accountingsundevil2010usa4605Оценок пока нет

- NGO Audited Documents Balance Sheet and Profit and Loss A/cДокумент27 страницNGO Audited Documents Balance Sheet and Profit and Loss A/cMitesh Khatri100% (5)

- Seatwork No. 2 (Sanguine) AnswerДокумент1 страницаSeatwork No. 2 (Sanguine) AnswerJohn Paul Cristobal0% (1)

- Reinforcement Activity 2 Part BДокумент21 страницаReinforcement Activity 2 Part BmattbtaitОценок пока нет

- Form Special JournalДокумент17 страницForm Special JournalDimasОценок пока нет

- Managerial Accounting Wey Chapter 2Документ88 страницManagerial Accounting Wey Chapter 2Steven ShamОценок пока нет

- Acctg11 CN 3000 TQ Midterm Exam 1ST Sem 2021-2022Документ5 страницAcctg11 CN 3000 TQ Midterm Exam 1ST Sem 2021-2022Jaya RamirezОценок пока нет

- Definition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesДокумент8 страницDefinition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesKae Abegail GarciaОценок пока нет

- A Sample Film and Video Production Business Plan TemplateДокумент17 страницA Sample Film and Video Production Business Plan TemplateClement Thompson75% (8)

- Business Finance Test PracticeДокумент49 страницBusiness Finance Test PracticeLovan So0% (1)

- BalaJi Amines LTDДокумент7 страницBalaJi Amines LTDchittorasОценок пока нет

- CEL 1 PRAC 1 Answer KeyДокумент12 страницCEL 1 PRAC 1 Answer KeyRichel ArmayanОценок пока нет

- 會計科目中英對照表Документ4 страницы會計科目中英對照表yuxuan1228.yxwОценок пока нет

- Intro To Financial Accounting Horngen 11e Chapter2 SolutionsДокумент41 страницаIntro To Financial Accounting Horngen 11e Chapter2 SolutionsArena Arena100% (7)

- Examiners Report NSSCO 2023Документ687 страницExaminers Report NSSCO 2023jacobinaiipinge050% (2)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProОт EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProРейтинг: 4.5 из 5 звезд4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОт EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesОт EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesРейтинг: 4 из 5 звезд4/5 (9)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideОт EverandTax Savvy for Small Business: A Complete Tax Strategy GuideРейтинг: 5 из 5 звезд5/5 (1)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthОт EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthОценок пока нет

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyОт EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyРейтинг: 4 из 5 звезд4/5 (52)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessОт EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessРейтинг: 5 из 5 звезд5/5 (5)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОт EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОценок пока нет

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОт EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationОценок пока нет

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОт EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionОценок пока нет

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsОт EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsРейтинг: 3.5 из 5 звезд3.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingОт EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingРейтинг: 5 из 5 звезд5/5 (3)

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerОт EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerОценок пока нет

- The Payroll Book: A Guide for Small Businesses and StartupsОт EverandThe Payroll Book: A Guide for Small Businesses and StartupsРейтинг: 5 из 5 звезд5/5 (1)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОт EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipОценок пока нет

- S Corporation ESOP Traps for the UnwaryОт EverandS Corporation ESOP Traps for the UnwaryОценок пока нет

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesОт EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesОценок пока нет

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-2-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)