Академический Документы

Профессиональный Документы

Культура Документы

Maher, Stickney and Weil: Fundamental Concepts

Загружено:

Rachel NicoleОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Maher, Stickney and Weil: Fundamental Concepts

Загружено:

Rachel NicoleАвторское право:

Доступные форматы

Managerial Accounting:

An Introduction To Concepts, Methods,

And Uses

Chapter 1

Fundamental Concepts

Maher, Stickney and Weil

Learning Objectives

Deals with activities inside an

organization

Unregulated

May use projections about the

future

Implementing Strategies

Distinguish between managerial and

financial accounting.

Managerial accounting system should

help managers implement

organizations strategy

Understand how managers can use

accounting information to implement

strategies.

System must be adapted to

each organizations objectives,

strategy and environment

Identify the key financial players in the

organization.

Understand managerial accountants

professional environment and ethical

responsibilities.

Master the concept of cost.

Information required for decision

making, planning, and other

managerial activities often is not

provided by the financial accounting

system

Key Financial Players

P a r t ia l O r g a n iz a t io n C h a rt

Compare and contrast income

statements prepared for managerial

use and those prepared for external

reporting.

Understand the concepts useful for

managing costs.

P r e s id e n t a n d

C h i e f O p e r a t i n g O ffi c e r

In d u s tr ia l

D e p a r tm e n ts

Describe how managerial accounting

supports modern production

environments.

Understand the importance of

effective communication between

accountants and users of managerial

accounting information.

Understand the ethical standards that

comprise the Institute of Management

Accountants Code of Ethics.

Comparison of Financial

and Managerial Accounting

Financial Accounting

Deals with reporting to parties

outside the organization

Highly regulated

Primarily uses historical data

Managerial Accounting

S t a ff a n d

A d m in is tr a t iv e D e p a r t m e n t s

F in a n c e

V ic e - P r e s id e n t

T re a s u re r

C ost

A c c o u n tin g

C o n tr o lle r

F in a n c ia l

R e p o r tin g

O th e r

V ic e - P r e s id e n ts

I n c lu d in g E n g in e e r in g ,

L e g a l, E m p lo y e e R e la t io n s

In t e r n a l A u d it

Tax

Professional Environment

Institute of Management Accountants

(IMA)

Sponsors Certified Management

Accountant and Certified in

Financial Management

programs

Publishes a journal, policy

statements and research

studies on accounting issues

Certified Public Accountant

Cost Accounting Standards Board

Fixed costs do not change in

total when the activity level

changes

Sets accounting standards for

contracts between the U.S.

government and defense

contractors

Income Statement For External

Reporting

Sales Revenue

$400,000

Ethical issues, while always

important, have taken on added

significance due to recent

accounting failures

Less Cost of Goods Sold

210,000

Gross Margin

$190,000

The IMA has developed a Code

of Conduct mandating that

management accountants have

a responsibility to maintain the

highest levels of ethical conduct

Net Income Before Taxes $110,000

Basis Cost Concepts

A cost is a sacrifice of resources

You must know the context in

which the word cost is used to

know its meaning

Opportunity cost is the foregone

income from using an asset in its best

alternative

A cost is distinguished from an

expense

An outlay of cash may lead to

another resource taking its

place

The term expense is reserved

for external reporting under

GAAP and for income tax

reporting

A cost object is any item for which the

manager wishes to measure cost

Costs directly related to the cost

object are called direct costs

Other costs are called indirect

costs

The distinction between fixed and

variable costs is important since it

affects strategic decision making

Variable costs change in total as

the activity level changes

Less Mktg. and Admin Exp.

80,000

Contribution Margin Format Income

Statement

Sales Revenue

$400,000

Less Variable Costs:

Variable Cost of Sales

Variable Mktg & Admin

168,000

$160,000

8,000

Contribution Margin

$232,000

Less Fixed Costs:

Fixed Cost of Sales $50,000

Fixed Mktg & Admin

122,000

72,000

Net Income Before Taxes

$110,000

Managing Costs

Effective cost control requires

managers to understand how

producing a product involves activities

and how those activities generate

costs

Activity-based Management studies

the need for activities and whether

they are operating efficiently

Value-Added Activities

Value-added activities increase the

products service to customers

Managers try to eliminate nonvalue-added activities to reduce

costs without reducing the

products service potential to

customers

The value chain describes the linked

set of activities that add value to the

products or services of the

organization

Managerial Accounting in Modern

Production Environments

Key developments that reshaped

Managerial Accounting include:

understand how accountants adapt

costing systems to them.

Know how to compute end-of-period

inventory book value using equivalent

units of production.

Integrated information systems

Web hosting

Just-in-time and lean production

Total Quality Management

Theory of constraints

Benchmarking and continuous

improvement

Chapter 2

Measuring Product Costs

Learning Objectives

Understand the nature of

manufacturing costs.

Explain the need for recording costs by

department and assigning costs to

products.

Understand how the Work-in-Process

account both describes the

transformation of inputs into outputs

in a company and accounts for the

costs incurred in the process.

Compare and contrast normal costing

and actual costing.

Know various production methods and

the different accounting systems each

requires.

Manufacturing Costs

Include three major categories:

Direct materials

Easily traced to a product

Direct labor

Labor of workers who

transform materials into a

finished product

Manufacturing Overhead

All other costs of

transforming materials

into a finished product

Relation Between Departmental Costing

and Product Costing

Manufacturing costs are first assigned

to departments or responsibility

centers

A responsibility center is any

organizational unit with its own

manager

e.g., divisions, territories, plants

Aids in planning and performance

evaluation

Compare and contrast job costing and

process costing systems.

Compare and contrast product costing

in service organizations to that in

manufacturing companies.

Understand the concepts of customer

costing and profitability analysis.

Identify ethical issues in job costing.

Recognize components of just-in-time

(JIT) production methods and

Actual manufacturing costs recorded

in departments can be compared to

standard or budgeted amounts

Differences, called variances,

can be investigated further

Actual overhead may vary for

reasons unrelated to production

activity resulting in product cost

fluctuations unrelated to

production activity

Costs are then assigned to products

Useful in managerial decision

making such as evaluating

Normal costing tends to smooth

out these fluctuations

Applying Overhead Costs

Normal costing works as follows:

1. Select a cost driver

2. Estimate overhead and the level of activity

for the accounting period

3. Compute the predetermined

manufacturing overhead rate

4. Apply overhead to production by

multiplying the predetermined overhead rate

times the actual activity

product profitability

Basis Cost Flow Equation

Beginning Balance + Transfers In= Transfers

Out + Ending Balance

Transfer In to Work-In-Process include:

Overhead Rate Computation

Predetermined manufacturing

overhead rate is calculated as follows:

Estimated Manufacturing Overhead

Normal (or Estimated) Activity Level

Predetermined Overhead

Materials

Rate

Labor

Example-Overhead

Rate Computation

Overhead

Equation is useful in determining

reasonableness of inventories

Cost Measures

Normal Costing--commonly used to

assign costs to products

Assigns actual direct materials

and direct labor plus normal

manufacturing overhead

Overhead is applied to

units produced using an

application rate

estimated before the

accounting period begins

Actual Costing--assigns actual

overhead to products

Plantimum Builders estimates that

next year variable overhead will be

$100,000 and direct labor will be

50,000 hours

The predetermined overhead

rate for next year will be:

$100,000

= $2.00 Per Direct Labor Hour

50,000 DLHs

Cost Systems

Effective cost systems must have the

following characteristics:

Decision focus

Provide different cost

information for different

purposes

Pass the cost-benefit test

Typically used when production

involves a standardized method

of making a product that is

performed repeatedly

Products may share

common production

methods but differ in

details

Examples: Clothing,

computers, furniture

Service Organizations

Production Methods and Accounting

Systems

Flow of costs is similar to that of a

manufacturing company

Providing a service requires

labor, overhead, and sometimes

materials (called supplies)

Costs are collected by the job or

client

Provides info for cost control,

performance evaluation, and

future pricing decisions

Job Costing

Collect costs for each unit produced

Typically used by companies

producing customized products

or jobs

Examples: print shops,

customized construction

companies, defense contractors

Process Costing

Company accumulates costs in a

department or production process

Those costs are spread evenly

over units produced

Essentially, computes an

average cost per unit

Examples: manufacture of soft

drinks, paint, chemicals

Operation Costing

A hybrid of job and process costing

Ethical Issues in Job Costing

Improprieties in job costing generally

arise from:

Misstating stage of completion

Charging costs to the wrong job

May be an attempt to

avoid the appearance of

cost overruns

Misrepresenting the costs of

jobs

Causes problems when

job is billed on a costplus-fee basis

Just-In-Time (JIT) Methods

Attempt to obtain materials or provide

finished goods just in time

Reduces or eliminates

inventories and related carrying

costs

May allow production costs to

be recorded directly to Cost of

Goods Sold (COGS)

May involve use of

Backflush Costing

Used to transfer

costs back to

inventories when

production costs

are initially

recorded as COGS

Chapter 3

Activity-Based Management

Learning Objectives

Identify strategic and operational uses

of activity-based management.

Differentiate between traditional cost

allocation methods and activity-based

costing.

Understand the concept of activitybased costing.

Identify the steps in activity-based

costing.

Identify strategic and operational uses

of activity-based management.

Differentiate between traditional cost

allocation methods and activity-based

costing.

Spoilage and

Quality of Production

Normal waste is typically included in

the cost of work performed

If waste is not normal it may

be included in an expense

account called Abnormal

Spoilage

Companies concerned about

quality production may not treat

any waste or spoilage as normal

Prevents these costs from

being buried in

production costs

Computing Costs of

Equivalent Production

Five steps required to compute costs

of products, ending inventory, and

finished goods

1. Summarize flow of physical units

2. Compute equivalent units

3. Summarize costs to be accounted for

Understand the concept of activitybased costing.

Identify the steps in activity-based

costing.

Apply activity-based management and

costing to marketing.

Use the cost hierarchy to organize cost

information for decision making.

Distinguish between resources used

and resources supplied, and measure

unused resource capacity.

Explain the difficulties of implementing

advanced cost-management systems.

Activity-based Costing and

Management (ABCM)

ABCM rests on this premise:

Products require activities

Activities consume resources

To understand a products costs, one

must:

4. Compute unit costs

Identify activities required to

make the product

5. Compute cost of goods completed and

transferred out and cost of ending inventory

of WIP

Identify resources used to

provide for those activities

Figure the cost of those

resources

To be competitive, managers must

know both:

Activities involved in making the

goods or providing the services,

and

The cost of those activities

ABCM has 2 parts:

The costing part known as

Activity-based Costing (ABC)

The management part known as

Activity-Based management

(ABM)

ABC treats mostly indirect costs

including:

Overhead costs related to the

manufacture of a product or

providing a service

Indirect costs of marketing a

product

Indirect costs of managing a

company

Strategic Use of ABCM

Managers use activity-based

information in 2 ways:

To shift the mix of activities and

products away from less

profitable to more profitable

operations

To help them become a low-cost

producer or seller

Activity Analysis

Involves 4 steps:

activities or replace them with

more efficient activities

Cost Pools

Cost pools are groups of costs

Three major types of cost pools:

Plant (traditional)

Department (traditional)

Activity center (activity-based

costing)

Traditional Allocation Methods

Plantwide allocation

Uses the entire plant as a cost

pool

Simple organizations with only a

few departments and little

variety in activities might use

this method

Department allocation

Uses separate cost pools with

different overhead allocation

rates for each department

Activity-Based Costing

Activity-based costing (ABC)

Assigns costs first to activities

Then to products based on each

products use of activities

Activity-Based

Costing Methods

Requires the following steps:

1. Identify activities that consume resources

and assign costs to those activities

Chart activities used to

complete the product or service

2. Identify cost drivers associated with each

activity

Classify activities as valueadded or non-value-added

A cost driver is a factor that causes or

drives an activitys costs

Eliminate non-value-added

activities

3. Compute a cost rate for each cost driver

Continuously improve &

reevaluate efficiency of

4. Assign costs to products

Cost Rates per

Cost Driver Unit

Calculate predetermined cost rate for

each cost driver as follows:

Predetermined = Estimated indirect cost

cost rate

Est.volume of allocation base

Multiply predetermined cost

driver rate times volume of cost

drivers consumed

Cost Hierarchies

Resources Used Vs.

Resources Supplied

ABC estimates cost of resources used

by an activity as:

Cost driver rate X cost driver volume

Cost of Resources supplied = amount

spent on the activity

Difference between resources used

and supplied is unused capacity

Вам также может понравиться

- Managerial Accounting:: An Introduction To Concepts, Methods, and UsesДокумент22 страницыManagerial Accounting:: An Introduction To Concepts, Methods, and UsesamitbaggausОценок пока нет

- Financial Statement Analysis: Business Strategy & Competitive AdvantageОт EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageРейтинг: 5 из 5 звезд5/5 (1)

- Principles of Cost Accounting 13E: Edward J. VanderbeckДокумент29 страницPrinciples of Cost Accounting 13E: Edward J. VanderbeckTubagus Donny SyafardanОценок пока нет

- The Balanced Scorecard: Turn your data into a roadmap to successОт EverandThe Balanced Scorecard: Turn your data into a roadmap to successРейтинг: 3.5 из 5 звезд3.5/5 (4)

- Role of Cost AccountingДокумент5 страницRole of Cost AccountingIshan_Bhowmik100% (1)

- Activity Based Managament Very UsefulДокумент24 страницыActivity Based Managament Very UsefulDamascene SwordОценок пока нет

- What Is Cost AccountingДокумент3 страницыWhat Is Cost AccountingJappy QuilasОценок пока нет

- Cost AccountingДокумент29 страницCost Accountingsskumar82Оценок пока нет

- Cost AccountingДокумент25 страницCost AccountingkapilmmsaОценок пока нет

- Cost Accounting OverviewДокумент10 страницCost Accounting OverviewMiki WorkuОценок пока нет

- Chapter 1 - StudentsДокумент8 страницChapter 1 - StudentsLynn NguyenОценок пока нет

- Managerial Accounting:: Fundamental ConceptsДокумент19 страницManagerial Accounting:: Fundamental ConceptsRed GaonОценок пока нет

- ManagementAccounting - ALL CHAPTERSДокумент27 страницManagementAccounting - ALL CHAPTERSHAOYU LEEОценок пока нет

- 2400-Bcom-18 Cost AccountingДокумент36 страниц2400-Bcom-18 Cost Accountingliza shahОценок пока нет

- What Is Cost Accounting and DiferencesДокумент6 страницWhat Is Cost Accounting and Diferenceskasuntop99838Оценок пока нет

- Internal Routine Reporting and Decisions Internal Non-Routine Reporting and Decisions External ReportingДокумент22 страницыInternal Routine Reporting and Decisions Internal Non-Routine Reporting and Decisions External ReportingBarbie GarzaОценок пока нет

- Cost and Management Accounting 11Документ84 страницыCost and Management Accounting 11Pratik BhambriОценок пока нет

- What Is Cost Accounting?: Volume 0%Документ6 страницWhat Is Cost Accounting?: Volume 0%Sheila Mae AramanОценок пока нет

- Managerial Accounting - Class 1Документ19 страницManagerial Accounting - Class 1AshiqОценок пока нет

- Cost Accounting and Cost Control - Discussion TranscriptДокумент10 страницCost Accounting and Cost Control - Discussion Transcriptkakimog738Оценок пока нет

- Introduction To Cost and Management AccountingДокумент3 страницыIntroduction To Cost and Management AccountingTheaОценок пока нет

- Unit 1-4Документ104 страницыUnit 1-4ዝምታ ተሻለОценок пока нет

- 09435BBA305 - Notes (Module 1)Документ11 страниц09435BBA305 - Notes (Module 1)Divakar Pratap SinghОценок пока нет

- Fundamental of CostingДокумент24 страницыFundamental of CostingCharith LiyanageОценок пока нет

- Management Accounting Costing and BudgetingДокумент20 страницManagement Accounting Costing and BudgetingDigontaArifОценок пока нет

- Note of Cost Accounting IncomДокумент5 страницNote of Cost Accounting IncomAdam AbdullahiОценок пока нет

- CAC C1M1 Cost Concepts and Cost ClassificationsДокумент9 страницCAC C1M1 Cost Concepts and Cost ClassificationsKyla Mae AllamОценок пока нет

- Introduction To Management AccountingДокумент28 страницIntroduction To Management Accountingtj00007Оценок пока нет

- Introduction To Cost Accounting - Module 1Документ49 страницIntroduction To Cost Accounting - Module 1Sonali Jagath0% (1)

- BBA Management AccountingДокумент7 страницBBA Management AccountingMohamaad SihatthОценок пока нет

- Management Accounting ReviewerДокумент17 страницManagement Accounting ReviewerIvan LuzuriagaОценок пока нет

- Cost CH IДокумент5 страницCost CH IheysemОценок пока нет

- 1... FMA Assignment 2Документ7 страниц1... FMA Assignment 2kibur amahaОценок пока нет

- Responsibility AccountingДокумент7 страницResponsibility AccountingMarilou Olaguir SañoОценок пока нет

- Arbaminch University: Colege of Business and EconomicsДокумент13 страницArbaminch University: Colege of Business and EconomicsHope KnockОценок пока нет

- Cost and Management Accounting Learning ObjectivesДокумент22 страницыCost and Management Accounting Learning ObjectivesvyajivvОценок пока нет

- Financial, Management & Cost Accounting ExplainedДокумент20 страницFinancial, Management & Cost Accounting ExplainedTimothyОценок пока нет

- ADVANCED MANAGEMENT ACCOUNTINGДокумент276 страницADVANCED MANAGEMENT ACCOUNTINGTasleem Faraz MinhasОценок пока нет

- MANAGEMENT ACCOUNTING: KEY CONCEPTSДокумент6 страницMANAGEMENT ACCOUNTING: KEY CONCEPTSharoonОценок пока нет

- CMA FullДокумент22 страницыCMA FullHalar KhanОценок пока нет

- CMA FullДокумент22 страницыCMA FullHalar KhanОценок пока нет

- Cost Accounting OverviewДокумент7 страницCost Accounting OverviewMadonna KristinaОценок пока нет

- Accounts MBA (Sem-1) Accounts MBAДокумент4 страницыAccounts MBA (Sem-1) Accounts MBAmaddymithunОценок пока нет

- Advanced Management Accounting: Dr. Ronny Andesto, S.E., M.M Program Magister Akuntansi Universitas Mercu Buana 2018Документ30 страницAdvanced Management Accounting: Dr. Ronny Andesto, S.E., M.M Program Magister Akuntansi Universitas Mercu Buana 2018dhianОценок пока нет

- SEM II Cost-Accounting Unit 1Документ23 страницыSEM II Cost-Accounting Unit 1mahendrabpatelОценок пока нет

- Assignment DataДокумент284 страницыAssignment DataDerickMwansaОценок пока нет

- Universidad Tecnológica de Coahuila Production Cost Accounting ClassДокумент13 страницUniversidad Tecnológica de Coahuila Production Cost Accounting ClassEdgar IbarraОценок пока нет

- Basic of CostingДокумент15 страницBasic of CostingAmit JaiswatОценок пока нет

- Cost Prelim MCДокумент10 страницCost Prelim MCNhel AlvaroОценок пока нет

- Chap 001Документ38 страницChap 001Peta Simone Munroe-SanchezОценок пока нет

- Cost Accounting ExerciseДокумент4 страницыCost Accounting ExerciseAnanda RiskiОценок пока нет

- Cost Accounting AssignmentДокумент5 страницCost Accounting AssignmentMargie Therese SanchezОценок пока нет

- Cost Accounting FundamentalsДокумент25 страницCost Accounting Fundamentalssushantsaurav051060Оценок пока нет

- Management Accounting Chapter 1Документ4 страницыManagement Accounting Chapter 1Ieda ShaharОценок пока нет

- ADVANCED MANAGEMENT ACCOUNTING TECHNIQUESДокумент326 страницADVANCED MANAGEMENT ACCOUNTING TECHNIQUESZahid UsmanОценок пока нет

- Chapter 1Документ5 страницChapter 1HkОценок пока нет

- 1Документ21 страница1Na RaunaОценок пока нет

- ICPAP Advanced Management AccountingДокумент326 страницICPAP Advanced Management Accountingelite76100% (2)

- AIOU8408 Assignment 1 0000603169Документ18 страницAIOU8408 Assignment 1 0000603169Farhan ShakilОценок пока нет

- Finance Graduate Seeks Career StartДокумент4 страницыFinance Graduate Seeks Career StartRachel NicoleОценок пока нет

- Heal Me and I Shall Be HealedДокумент1 страницаHeal Me and I Shall Be HealedRachel NicoleОценок пока нет

- Everything I do is for you LORDДокумент1 страницаEverything I do is for you LORDRachel NicoleОценок пока нет

- My Beloved is Mine and I am HisДокумент2 страницыMy Beloved is Mine and I am HisRachel NicoleОценок пока нет

- We Preach Christ PDFДокумент7 страницWe Preach Christ PDFRachel NicoleОценок пока нет

- Sambong Subic Corporation Statement of Account As of February 7, 2019 Date Vessel Sales Invoice Gross SalesДокумент2 страницыSambong Subic Corporation Statement of Account As of February 7, 2019 Date Vessel Sales Invoice Gross SalesRachel NicoleОценок пока нет

- AvailableДокумент2 страницыAvailableRachel NicoleОценок пока нет

- SamsungДокумент15 страницSamsungRachel NicoleОценок пока нет

- Etirenity FS RevisedДокумент152 страницыEtirenity FS RevisedRachel NicoleОценок пока нет

- Ako Ang DaigdigДокумент4 страницыAko Ang DaigdigRachel NicoleОценок пока нет

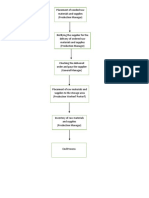

- Material Handling ProcessДокумент1 страницаMaterial Handling ProcessRachel NicoleОценок пока нет

- Limited PartnershipДокумент2 страницыLimited PartnershipRachel NicoleОценок пока нет

- Thermochemistry: A Vital Knowledge We Should Know: By: Richter L. RodriguezДокумент1 страницаThermochemistry: A Vital Knowledge We Should Know: By: Richter L. RodriguezRachel NicoleОценок пока нет

- Articles of PartnershipДокумент6 страницArticles of PartnershipRachel NicoleОценок пока нет

- Reflection PaperДокумент4 страницыReflection PaperRachel Nicole100% (1)

- A Letter For Borrowing A BookДокумент1 страницаA Letter For Borrowing A BookRachel NicoleОценок пока нет

- UST GN 2011 - Labor Law ProperДокумент191 страницаUST GN 2011 - Labor Law ProperGhost100% (8)

- Federalism Explained: Understanding the Differences Between National and Local GovernmentsДокумент1 страницаFederalism Explained: Understanding the Differences Between National and Local GovernmentsRachel NicoleОценок пока нет

- CH 05 Ok DataResourceManagementДокумент15 страницCH 05 Ok DataResourceManagementRachel NicoleОценок пока нет

- Postwar Problems and The RepublicДокумент1 страницаPostwar Problems and The RepublicRachel NicoleОценок пока нет

- Postwar Philippines economic challenges and government reorganizationДокумент2 страницыPostwar Philippines economic challenges and government reorganizationRachel Nicole100% (1)

- Postwar Problems and the Restoration of the Philippine GovernmentДокумент2 страницыPostwar Problems and the Restoration of the Philippine GovernmentRachel NicoleОценок пока нет

- Data Resource ManagementДокумент11 страницData Resource ManagementRachel NicoleОценок пока нет

- CSRДокумент4 страницыCSRRachel NicoleОценок пока нет

- Formulas 1Документ3 страницыFormulas 1Rachel NicoleОценок пока нет

- What It The Time Value of MoneyДокумент17 страницWhat It The Time Value of MoneyRachel NicoleОценок пока нет

- 6-Types of Cost-23-08-2021 (23-Aug-2021) Material - I - 23-Aug-2021 - MEE1014 - Elements - of - Cost - NewДокумент67 страниц6-Types of Cost-23-08-2021 (23-Aug-2021) Material - I - 23-Aug-2021 - MEE1014 - Elements - of - Cost - NewSahil KumarОценок пока нет

- AkhilArora PC5Документ2 страницыAkhilArora PC5rui zhangОценок пока нет

- Study Guide Variable Versus Absorption CostingДокумент9 страницStudy Guide Variable Versus Absorption CostingFlorie May HizoОценок пока нет

- Chapter 7Документ10 страницChapter 7Eki OmallaoОценок пока нет

- Business Plan TemplateДокумент19 страницBusiness Plan Templateloganathan89Оценок пока нет

- Problem 5-29: Analyzing the effects of increased variable costs and automation on break-even point, sales volume needed, and contribution margin ratioДокумент6 страницProblem 5-29: Analyzing the effects of increased variable costs and automation on break-even point, sales volume needed, and contribution margin ratioFitzmore PetersОценок пока нет

- Receivables Management: © Tata Mcgraw-Hill Publishing Company Limited, Financial ManagementДокумент46 страницReceivables Management: © Tata Mcgraw-Hill Publishing Company Limited, Financial Managementarchana_anuragi100% (1)

- MODULE 1.0 - Break Even & Marginal AnalysisДокумент6 страницMODULE 1.0 - Break Even & Marginal AnalysisTyron TayloОценок пока нет

- Cost Accounting Assignment 2Документ4 страницыCost Accounting Assignment 2leeroy mekiОценок пока нет

- Solution To Assignment 6Документ3 страницыSolution To Assignment 6Khyla DivinagraciaОценок пока нет

- Strategic Cost Management and CVP AnalysisДокумент39 страницStrategic Cost Management and CVP AnalysisShiela RengelОценок пока нет

- Decision Making: Relevant Costs and Benefits: Answers To Review QuestionsДокумент57 страницDecision Making: Relevant Costs and Benefits: Answers To Review Questionszoomblue200Оценок пока нет

- CMA611S-2016-CMA311S - Notes (2010) - Unit 1Документ27 страницCMA611S-2016-CMA311S - Notes (2010) - Unit 1Albert MuzitiОценок пока нет

- Cost Volume Profit AnalysisДокумент23 страницыCost Volume Profit AnalysisRoxan Jane Valle EspirituОценок пока нет

- Managerial Accounting 5th Edition Jiambalvo Solutions ManualДокумент25 страницManagerial Accounting 5th Edition Jiambalvo Solutions Manualnhattranel7k1100% (26)

- Marketing Metrics As of 090219Документ32 страницыMarketing Metrics As of 090219joyceabellaОценок пока нет

- University of Technology School of Business Administration: Cost - Volume - Profit Tutorial SheetДокумент7 страницUniversity of Technology School of Business Administration: Cost - Volume - Profit Tutorial SheetMichelle LindsayОценок пока нет

- Power BI Case StudyДокумент107 страницPower BI Case StudyaronoislamОценок пока нет

- Cheat Sheet V3Документ1 страницаCheat Sheet V3DokajanОценок пока нет

- Analyzing Management Services and Cost-Volume-Profit AnalysisДокумент16 страницAnalyzing Management Services and Cost-Volume-Profit AnalysisChristian Clyde Zacal ChingОценок пока нет

- LitterДокумент4 страницыLitterDarwin Dionisio ClementeОценок пока нет

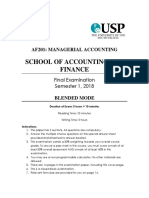

- Final Exam, s1, 2018-FINAL PDFДокумент14 страницFinal Exam, s1, 2018-FINAL PDFShivneel NaiduОценок пока нет

- Chapter 4Документ27 страницChapter 4Manish SadhuОценок пока нет

- Cost Acctg Exams 09.25.2019 QUIZДокумент5 страницCost Acctg Exams 09.25.2019 QUIZRenalyn ParasОценок пока нет

- Salem Telephone Company Case StudyДокумент4 страницыSalem Telephone Company Case StudyTôn Thiện Đức100% (4)

- Chapter 3 CVPДокумент37 страницChapter 3 CVPfekadeОценок пока нет

- Ma PHD01003 Harshad Savant Term2 EndtermДокумент8 страницMa PHD01003 Harshad Savant Term2 EndtermHarshad SavantОценок пока нет

- Space InfonauticsДокумент2 страницыSpace InfonauticsElliot RichardОценок пока нет

- Problem 8-35 Hansen Mowen Cornerstone of Managerial AccountingДокумент4 страницыProblem 8-35 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiОценок пока нет

- Risk ManagementДокумент22 страницыRisk ManagementPaw AdanОценок пока нет

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantОт EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantРейтинг: 4.5 из 5 звезд4.5/5 (146)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- Profit First for Therapists: A Simple Framework for Financial FreedomОт EverandProfit First for Therapists: A Simple Framework for Financial FreedomОценок пока нет

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (12)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- The Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryОт EverandThe Machine That Changed the World: The Story of Lean Production-- Toyota's Secret Weapon in the Global Car Wars That Is Now Revolutionizing World IndustryРейтинг: 4.5 из 5 звезд4.5/5 (40)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- The Goal: A Process of Ongoing Improvement - 30th Aniversary EditionОт EverandThe Goal: A Process of Ongoing Improvement - 30th Aniversary EditionРейтинг: 4 из 5 звезд4/5 (684)

- Process!: How Discipline and Consistency Will Set You and Your Business FreeОт EverandProcess!: How Discipline and Consistency Will Set You and Your Business FreeРейтинг: 4.5 из 5 звезд4.5/5 (5)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОт EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesОт EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesРейтинг: 4.5 из 5 звезд4.5/5 (30)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 5 из 5 звезд5/5 (13)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyОт EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyРейтинг: 5 из 5 звезд5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanОт EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanРейтинг: 4.5 из 5 звезд4.5/5 (79)

- Self-Discipline: The Ultimate Guide To Beat Procrastination, Achieve Your Goals, and Get What You Want In Your LifeОт EverandSelf-Discipline: The Ultimate Guide To Beat Procrastination, Achieve Your Goals, and Get What You Want In Your LifeРейтинг: 4.5 из 5 звезд4.5/5 (662)

- PMP Exam Prep: How to pass the PMP Exam on your First Attempt – Learn Faster, Retain More and Pass the PMP ExamОт EverandPMP Exam Prep: How to pass the PMP Exam on your First Attempt – Learn Faster, Retain More and Pass the PMP ExamРейтинг: 4.5 из 5 звезд4.5/5 (3)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Project Control Methods and Best Practices: Achieving Project SuccessОт EverandProject Control Methods and Best Practices: Achieving Project SuccessОценок пока нет