Академический Документы

Профессиональный Документы

Культура Документы

Currency Daily: April 20, 2016

Загружено:

umaganИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Currency Daily: April 20, 2016

Загружено:

umaganАвторское право:

Доступные форматы

April 20, 2016

Currency Daily

RUPEE GAIN 10 PAISE AGAINST US DOLLAR TO CLOSE AT

66.55

Currency Spot

Spot

Close

USDINR

66.553

Dollar Index

Prev.

% Chg.

Close

66.645

-0.14%

94.04

94.628

-0.62%

EURUSD

1.1364

1.1305

0.52%

GBPUSD

1.439

1.418

1.48%

109.05

108.27

0.72%

66.33

66.653

-0.48%

USDJPY

DGCX USDINR

* Updated at 8:00 am (Source: Bloomberg)

Prev.

Close

Close

Chg.

% Chg

Asian Markets*

SGX Nifty

7977

7924

53

0.67%

Nifty

7915

7850

64

0.82%

Sensex

25816

25627

190

0.74%

HangSeng

21300

21435

Nikkei

16971

16876

3042

3043

S&P Index

2101

2095

0.29%

Dow Jones

18054

18005

49

0.27%

4940

4960

Shanghai

-135 -0.63%

95

0.56%

-1 -0.02%

US Market

Nasdaq

-20 -0.40%

European Markets

FTSE

6405

6353

52

0.82%

CAC

4566

4506

60

1.33%

DAX

10350

10121

229

2.26%

* Asian Market as at 8:00 am (Source: Bloomberg)

FII Activity (Provisional Rs. in Cr.)

Equity

Debt

Indias 10-year bond yield closed at 7.417% as compared

with its Wednesdays close of 7.435%.

On the domestic front, India's wholesale prices fell for the

17th straight month in March, though the decline was

marginal. The Wholesale Price Index (WPI)-based inflation

declined to -0.85% as compared to -2.33% from a year ago

and -0.91% recorded in February.

Indias trade deficit at a record low of $5 billion in

March

Global Indices

Indices

On Monday, the rupee rose ten paise against the US dollar to

close at 66.55 on weakness in the greenback in overseas

markets and expectation of fresh foreign fund flow on

stronger domestic equity market. The rupee traded in the

range of 66.52 to 66.71 throughout the day before ending at

66.55, a gain of 0.14%.

13-Apr-16

12-Apr-16

428.27

155.68

-537.98

300.46

(Source: CDSL)

Indias merchandise exports contracted for the 16th straight

month by 5.47%, merchandise imports shrank 21.56%,

leading to a trade deficit of $5 billion in March. Indias exports

fell 15.9% to $261.1 billion in 2015-16 while imports

contracted by 15.3% to $379.6 billion. The trade deficit for

the year was $118.5 billion.

Dollar Fell Against

Economic Data

Major

Currencies

on

Weaker

The dollar lost ground against its major European rivals

Tuesday, but was nearly unchanged in comparison to the

Japanese Yen. The weakness in the U.S. currency was caused

by a particularly strong read on German economic sentiment.

Meanwhile, U.S. housing starts and building permits both

came in weaker than anticipated.

German economic confidence strengthened for the second

straight month to a four-month high in April on easing

concerns over China. The Indicator of Economic Sentiment

rose by a more-than-expected 6.9 points to 11.2 in April. This

was the highest score seen so far this year.

The report said U.S. housing starts tumbled by 8.8% to an

annual rate of 1.089 million in March after jumping by 6.9%

to a revised 1.194 million in February. Building permits, an

indicator of future housing demand, also dove by 7.7% to a

rate of 1.086 million in March from a revised 1.177 million in

February. The decrease surprised traders and economist, who

had expected building permits to climb 2.8% to a rate of

1.200 million from the 1.167 originally reported for the

previous month.

The Euro continuing to recover from a low of $1.1234 set last

week to $1.1358. It may trade volatile ahead of the European

Central Bank (ECB) policy meeting on Thursday.

The pound gained for a third day as a rally in global stocks

brought some relief for this years worst- performing major

currency. Currency touched its strongest level this month

versus both the euro and the greenback even as Bank of

England Governor Mark Carney said Tuesday that the impact

on the U.K. economy of Britain leaving the European Union

after a referendum in June would be unhelpful.

PRIVATE CLIENT GROUP [PCG]

April 20, 2016

Currency Daily

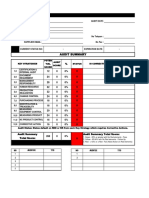

SHORT TERM USDINR OUTLOOK

Pair

Expected Range

SPOT USDINR

66.97 65.90

USDINR : RESISTANCE AT 20 SDMA (66.77)

SPOT USDINR : DAILY CHART

Technical Observations

USDINR (SPOT) continues downward momentum with the pair loses

66.55.

Lower top and Lower bottom formation remained intact on the daily chart with recent lower

top formed at 66.97.

Short-term moving averages are trading below medium term moving averages, indicating

bearish scenario for USDINR.

However, Daily RSI has been forming higher bottoms when USDINR forms lower bottoms.

This development is called positive divergence, which indicates that strength of the bears is

reducing compared to previous period. But for getting confirmation of trend reversal bullish

price breakout is must, which is not the case as of yet.

The pair has got strong support at 66.07, which happened to the double bottom on the daily

chart. Resistance for the same is placed at 66.97.

Looking at the above technical evidences, the outlook for the pair remains range bound to

bearish till the sequence of lower top-bottom changes to higher top-bottom. Bulls will take

charge only above 66.97.

PRIVATE CLIENT GROUP [PCG]

10 paise to close at

April 20, 2016

Currency Daily

CURRENCY PRICE MOVEMENT

APR.16

OPEN

HIGH

LOW

CLOSE

% CHG

OI

OI CHG

VOL

VOL CHG

USDINR

66.67

66.80

66.60

66.64

-0.12

1058738

-391802

EURINR

75.35

75.52

75.26

75.40

-0.07

62901

141

37319

-32172

GBPINR

94.82

94.82

94.36

94.52

-0.59

21657

2624

56825

-9990

JPYINR

61.65

61.85

61.37

61.51

0.75

22994

1613

24057

-2521

1984338 -100538

1 WEEK

HIGH

1 WEEK

LOW

1 MONTH

HIGH

1 MONTH

LOW

52 WEEK

HIGH

52 WEEK

LOW

USDINR

66.67

66.32

67.51

66.07

68.79

62.49

EURINR

76.23

75.24

76.23

73.46

77.49

66.97

GBPINR

95.37

93.70

96.48

93.34

105.28

93.30

JPYINR

61.67

60.74

61.79

58.43

61.79

50.84

SPOT

CURRENCY SUPPORT & RESISTANCE

APR.16

CLOSE

PIVOT

S3

S2

S1

R1

R2

R3

USDINR FUT.

66.64

66.68

66.37

66.48

66.56

66.76

66.64

66.68

EURINR FUT.

75.40

75.39

75.02

75.14

75.27

75.53

75.40

75.39

GBPINR FUT.

94.52

94.56

93.84

94.10

94.31

94.77

94.52

94.56

JPYINR FUT.

61.51

61.58

60.83

61.10

61.31

61.78

61.51

61.58

MAJOR MOVING AVERAGES

SPOT

LAST

5 DMA

20 DMA

50 DMA

100 DMA

200 DMA

USDINR

66.55

66.50

66.62

67.42

67.09

65.99

EURINR

75.27

75.59

75.12

75.08

73.66

72.97

GBPINR

94.36

94.63

94.53

95.65

97.03

98.84

JPYINR

61.38

61.19

60.06

59.96

57.95

55.82

PRIVATE CLIENT GROUP [PCG]

April 20, 2016

Currency Daily

ECONOMIC DATA RELEASED

Date Time

Country

Event

Period

Survey

Actual

Prior

04/19/2016 13:30

EC

ECB Current Account SA

Feb

--

19.0b

04/19/2016 13:30

EC

Current Account NSA

Feb

--

11.1b

8.3b

04/19/2016 14:30

EC

ZEW Survey Expectations

Apr

--

21.5

10.6

04/19/2016 18:00

US

Housing Starts

Mar

1170k

1089k

1194k

04/19/2016 18:00

US

Building Permits

Mar

1200k

1086k

1177k

27.5b

ECONOMIC DATA TODAY

Date Time

Country

Event

04/20/2016 05:20

JN

Trade Balance

Mar

835b

755b

243b

04/20/2016 14:00

UK

Claimant Count Rate

Mar

2.10%

--

2.10%

04/20/2016 14:00

UK

Jobless Claims Change

Mar

-10.0k

--

-18.0k

04/20/2016 14:00

UK

ILO Unemployment Rate 3Mths

Feb

5.10%

--

5.10%

04/20/2016 16:30

US

MBA Mortgage Applications

--

--

10.00%

04/20/2016 19:30

US

Existing Home Sales

5.26m

--

5.08m

PRIVATE CLIENT GROUP [PCG]

Period

15-Apr

Mar

Survey

Actual

Prior

Currency Daily

April 20, 2016

Disclosure:

I/We, Dilip Parmar and Vinay Rajani, MBA, hereby certify that all of the views expressed in

this research report accurately reflect my views about the subject issuer (s) or securities. I also certify

that no part of our compensation was, is, or will be directly or indirectly related to the specific

recommendation(s) or view(s) in his report.

Research Analyst or his/her relative does not have any financial interest in the subject company. Also

HDFC Securities Ltd. or its Associate may have beneficial ownership of 1% or more in the subject

instrument at the end of the month immediately preceding the date of publication of the Research

Report.

Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any

material conflict of interest.

Any position in Instruments NO

Disclaimer

This report has been prepared by HDFC securities Ltd and is meant for sole use by the recipient and not

for circulation. The information and opinions contained herein have been compiled or arrived at, based

upon information obtained in good faith from sources believed to be reliable. Such information has not

been independently verified and no guaranty, representation of warranty, express or implied, is made as

to its accuracy, completeness or correctness. All such information and opinions are subject to change

without notice. This document is for information purposes only. Descriptions of any company or

companies or their securities mentioned herein are not intended to be complete and this document is

not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or

other financial instruments. HDFC securities Ltd may from time to time solicit from, or perform broking,

or other services for, any company mentioned in this mail and/or its attachments. HDFC securities Ltd,

its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses

or the damages sustained due to the investments made or any action taken on basis of this report,

including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency

rates, diminution in the NAVs, reduction in the dividend or income, etc. Neither HDFC securities nor any

of its employees shall be liable for any direct, indirect, special, incidental, consequential, punitive or

exemplary damages, including lost profits arising in any way from the information contained in this

material. This report is intended for retail and private client group and not for any other category of

clients, including, but not limited to, Institutional clients. For detailed disclaimer refer our website

www.hdfcsec.com.

Chart

This is by way of intimation of the availability of the HDFC securities Limited service and does not

constitute on offer to buy or sell or a solicitation in this regard made to any person. This service is not

available to foreign residents including Non-Resident Indians (NRIs) in United States. It is available only

to NRIs residing in jurisdictions permitting Investment in and Trading of Indian Securities on Indian

Stock Exchanges. This service is not available to any person or entity who is a citizen or resident of or

located in any locality, state, country or other jurisdiction, where availing of such services would be

contrary to any applicable law or regulation or which would subject HDFC Bank Limited, HDFC securities

Limited and any of their respective affiliates or group companies to any registration or licensing

requirement within such jurisdiction. Availability of this service to NRIs is subject to compliance with

procedural formalities as prescribed by HDFC securities Limited from time to time.

HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475

PRIVATE CLIENT GROUP [PCG]

Вам также может понравиться

- HSL PCG "Currency Insight"-Weekly: 19 September, 2016Документ16 страницHSL PCG "Currency Insight"-Weekly: 19 September, 2016shobhaОценок пока нет

- HSL PCG "Currency Daily": June 02, 2016Документ6 страницHSL PCG "Currency Daily": June 02, 2016umaganОценок пока нет

- Somewhat Better Sentiment: Morning ReportДокумент3 страницыSomewhat Better Sentiment: Morning Reportnaudaslietas_lvОценок пока нет

- 6 - 6th October 2016 - tcm12-12785Документ2 страницы6 - 6th October 2016 - tcm12-12785sharktale2828Оценок пока нет

- HSL PCG "Currency Insight"-Weekly: 13 June, 2016Документ17 страницHSL PCG "Currency Insight"-Weekly: 13 June, 2016Dinesh ChoudharyОценок пока нет

- HSL PCG "Currency Daily": June 08, 2016Документ6 страницHSL PCG "Currency Daily": June 08, 2016Dinesh ChoudharyОценок пока нет

- HSL PCG "Currency Insight"-Weekly: 3 September, 2016Документ16 страницHSL PCG "Currency Insight"-Weekly: 3 September, 2016shobhaОценок пока нет

- Weekly Report 10-14 JuneДокумент2 страницыWeekly Report 10-14 JuneFEPFinanceClubОценок пока нет

- HSL PCG "Currency Insight"-Weekly: 12 September, 2016Документ17 страницHSL PCG "Currency Insight"-Weekly: 12 September, 2016shobhaОценок пока нет

- Daily FX Update: Europe Provides Offset To Worrisome China PmiДокумент3 страницыDaily FX Update: Europe Provides Offset To Worrisome China PmiMohd Sofian YusoffОценок пока нет

- MCB Market Update - 16th December 2016 - tcm12-13133Документ2 страницыMCB Market Update - 16th December 2016 - tcm12-13133sharktale2828Оценок пока нет

- Ranges (Up Till 11.50am HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470Оценок пока нет

- Ranges (Up Till 11.35am HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 11.35am HKT) : Currency Currencyapi-290371470Оценок пока нет

- HSL PCG "Currency Daily": June 22, 2016Документ6 страницHSL PCG "Currency Daily": June 22, 2016GauriGanОценок пока нет

- Morning Call June 14 2010Документ4 страницыMorning Call June 14 2010chibondking100% (1)

- UT Daily Market Update 280911Документ5 страницUT Daily Market Update 280911jemliang_85Оценок пока нет

- 4 - 4th October 2016 - tcm12-12779Документ2 страницы4 - 4th October 2016 - tcm12-12779sharktale2828Оценок пока нет

- Currency Market Weekly ReportДокумент5 страницCurrency Market Weekly ReportRahul SolankiОценок пока нет

- Weekly Commentary 4-23-12Документ2 страницыWeekly Commentary 4-23-12Stephen GierlОценок пока нет

- Equity Analysis Equity Analysis - Weekl WeeklyДокумент8 страницEquity Analysis Equity Analysis - Weekl Weeklyapi-160037995Оценок пока нет

- HSL PCG "Currency Daily": Private Client Group (PCG)Документ6 страницHSL PCG "Currency Daily": Private Client Group (PCG)umaganОценок пока нет

- Slower Growth in China: Morning ReportДокумент3 страницыSlower Growth in China: Morning Reportnaudaslietas_lvОценок пока нет

- HSL PCG "Currency Daily": Private Client Group (PCG)Документ6 страницHSL PCG "Currency Daily": Private Client Group (PCG)umaganОценок пока нет

- Currency Daily Report, July 22 2013Документ4 страницыCurrency Daily Report, July 22 2013Angel BrokingОценок пока нет

- US Trading Note August 09 2016Документ3 страницыUS Trading Note August 09 2016robertoklОценок пока нет

- Currency Daily Report August 27Документ4 страницыCurrency Daily Report August 27Angel BrokingОценок пока нет

- Towards Stabilization in China: Morning ReportДокумент3 страницыTowards Stabilization in China: Morning Reportnaudaslietas_lvОценок пока нет

- Citi 14061Документ1 страницаCiti 14061roshanr009Оценок пока нет

- Currency Research: 25th January 2013Документ2 страницыCurrency Research: 25th January 2013abhaykatОценок пока нет

- Barclays FX Weekly Brief 20100902Документ18 страницBarclays FX Weekly Brief 20100902aaronandmosesllcОценок пока нет

- HSL PCG "Currency Daily": 26 August, 2016Документ6 страницHSL PCG "Currency Daily": 26 August, 2016shobhaОценок пока нет

- Ficc Times HTML HTML: The Key Events of Last WeekДокумент6 страницFicc Times HTML HTML: The Key Events of Last WeekMelissa MillerОценок пока нет

- Ficc Times HTML HTML: The Key Events of Last WeekДокумент6 страницFicc Times HTML HTML: The Key Events of Last WeekMelissa MillerОценок пока нет

- HSL PCG "Currency Daily": Private Client Group (PCG)Документ6 страницHSL PCG "Currency Daily": Private Client Group (PCG)umaganОценок пока нет

- 2014 October 17 Weekly Report UpdateДокумент4 страницы2014 October 17 Weekly Report UpdateAnthony WrightОценок пока нет

- Morning Call July 7 2010Документ4 страницыMorning Call July 7 2010chibondkingОценок пока нет

- Weekly CommentaryДокумент4 страницыWeekly Commentaryapi-150779697Оценок пока нет

- HSL PCG "Currency Daily": June 07, 2016Документ6 страницHSL PCG "Currency Daily": June 07, 2016Dinesh ChoudharyОценок пока нет

- Weekly Report Dec 9th 14thДокумент2 страницыWeekly Report Dec 9th 14thFEPFinanceClubОценок пока нет

- Ismar Daily Forecast 19 June 2012Документ10 страницIsmar Daily Forecast 19 June 2012amin_idrees5563Оценок пока нет

- Morning Call - June 7 2010Документ7 страницMorning Call - June 7 2010chibondkingОценок пока нет

- HSL PCG "Currency Daily": June 09, 2016Документ6 страницHSL PCG "Currency Daily": June 09, 2016Dinesh ChoudharyОценок пока нет

- HSL PCG "Currency Daily": 12 August, 2016Документ6 страницHSL PCG "Currency Daily": 12 August, 2016umaganОценок пока нет

- Ranges (Up Till 12.12pm HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 12.12pm HKT) : Currency Currencyapi-290371470Оценок пока нет

- Urrency Forecast: $ Continued To Weaken Vs Other Major CurrenciesДокумент4 страницыUrrency Forecast: $ Continued To Weaken Vs Other Major CurrenciesprinceasatiОценок пока нет

- Daily US Opening News: Market Re-CapДокумент0 страницDaily US Opening News: Market Re-CapZerohedgeОценок пока нет

- Daily Currency Update: Market SummaryДокумент3 страницыDaily Currency Update: Market Summarysilviu_catrinaОценок пока нет

- HSL PCG "Currency Daily": June 21, 2016Документ6 страницHSL PCG "Currency Daily": June 21, 2016GauriGanОценок пока нет

- Citigold Citigold: Financial Market AnalysisДокумент5 страницCitigold Citigold: Financial Market AnalysisRam BehinОценок пока нет

- Weekly Markets UpdateДокумент31 страницаWeekly Markets Updateapi-25889552Оценок пока нет

- US Fixed Income Markets WeeklyДокумент96 страницUS Fixed Income Markets Weeklyckman10014100% (1)

- Morning Call June 17 2010Документ5 страницMorning Call June 17 2010chibondkingОценок пока нет

- Daily Equty Report by Epic Research - 27 June 2012Документ10 страницDaily Equty Report by Epic Research - 27 June 2012Ryan WalterОценок пока нет

- Equity Tips::market Analysis On 15 Oct 2012Документ8 страницEquity Tips::market Analysis On 15 Oct 2012Theequicom AdvisoryОценок пока нет

- Weekly Mutual Fund and Debt Report: Retail ResearchДокумент14 страницWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanОценок пока нет

- Ranges (Up Till 11.30am HKT) : Currency CurrencyДокумент3 страницыRanges (Up Till 11.30am HKT) : Currency Currencyapi-290371470Оценок пока нет

- Ficc Times HTML HTML: The Week Gone by and The Week AheadДокумент6 страницFicc Times HTML HTML: The Week Gone by and The Week Aheadr_squareОценок пока нет

- FX Daily Strategist: Europe: Foreign Exchange London: 8 February 2012 07:00 GMTДокумент2 страницыFX Daily Strategist: Europe: Foreign Exchange London: 8 February 2012 07:00 GMTzinxyОценок пока нет

- ReportДокумент5 страницReportumaganОценок пока нет

- HSL Crystal Ball: Retail ResearchДокумент6 страницHSL Crystal Ball: Retail ResearchumaganОценок пока нет

- ReportДокумент6 страницReportumaganОценок пока нет

- HSL Weekly Insight: Retail ResearchДокумент4 страницыHSL Weekly Insight: Retail ResearchumaganОценок пока нет

- Hindustan Petroleum Corporation: Strong FootholdДокумент9 страницHindustan Petroleum Corporation: Strong FootholdumaganОценок пока нет

- HSL Looking Glass: Retail ResearchДокумент4 страницыHSL Looking Glass: Retail ResearchumaganОценок пока нет

- SML Isuzu: PCG ResearchДокумент9 страницSML Isuzu: PCG ResearchumaganОценок пока нет

- Special Technical Report - Crude Oil: Retail ResearchДокумент3 страницыSpecial Technical Report - Crude Oil: Retail ResearchumaganОценок пока нет

- HSL Techno Edge: Retail ResearchДокумент3 страницыHSL Techno Edge: Retail ResearchumaganОценок пока нет

- HSL Weekly Insight: Retail ResearchДокумент5 страницHSL Weekly Insight: Retail ResearchumaganОценок пока нет

- Diwali Technical Stock Picks: Retail ResearchДокумент2 страницыDiwali Technical Stock Picks: Retail ResearchumaganОценок пока нет

- Corporate Event Tracker: Tracker of Forthcoming Corporate Action From February 02, 2017 To February 15, 2017Документ2 страницыCorporate Event Tracker: Tracker of Forthcoming Corporate Action From February 02, 2017 To February 15, 2017umaganОценок пока нет

- Trident LTD: Retail ResearchДокумент18 страницTrident LTD: Retail ResearchumaganОценок пока нет

- An Exciting Ride Set To Take Off: Wonderla Holidays LTDДокумент14 страницAn Exciting Ride Set To Take Off: Wonderla Holidays LTDumaganОценок пока нет

- The Indian Cements LTD: Retail ResearchДокумент22 страницыThe Indian Cements LTD: Retail ResearchumaganОценок пока нет

- HSL Weekly Insight: Retail ResearchДокумент4 страницыHSL Weekly Insight: Retail ResearchumaganОценок пока нет

- Technical Stock PickДокумент2 страницыTechnical Stock PickumaganОценок пока нет

- HSL PCG "Currency Daily": 25 October, 2016Документ6 страницHSL PCG "Currency Daily": 25 October, 2016umaganОценок пока нет

- Weekly Technical ReportДокумент5 страницWeekly Technical ReportumaganОценок пока нет

- HSL Techno Edge: Retail ResearchДокумент3 страницыHSL Techno Edge: Retail ResearchumaganОценок пока нет

- Quarterly/Monthly Report - Oct 2016: Retail ResearchДокумент17 страницQuarterly/Monthly Report - Oct 2016: Retail ResearchumaganОценок пока нет

- Diwali Technical Stock Pick: Private Client GroupДокумент2 страницыDiwali Technical Stock Pick: Private Client GroupumaganОценок пока нет

- Diwali Technical Stock Pick: Retail ResearchДокумент2 страницыDiwali Technical Stock Pick: Retail ResearchumaganОценок пока нет

- Possible Nifty Scenario Over 2 - 3 Days: FiverДокумент2 страницыPossible Nifty Scenario Over 2 - 3 Days: FiverumaganОценок пока нет

- Technical Stock Idea: Retail ResearchДокумент3 страницыTechnical Stock Idea: Retail ResearchumaganОценок пока нет

- HSL Looking Glass: Retail ResearchДокумент4 страницыHSL Looking Glass: Retail ResearchumaganОценок пока нет

- HSL Techno-Sector Buzzer: Retail ResearchДокумент6 страницHSL Techno-Sector Buzzer: Retail ResearchumaganОценок пока нет

- Texmaco Rail & Engineering: PCG ResearchДокумент13 страницTexmaco Rail & Engineering: PCG ResearchumaganОценок пока нет

- Medieval Societies The Central Islamic LДокумент2 страницыMedieval Societies The Central Islamic LSk sahidulОценок пока нет

- Prince Baruri Offer Letter-1Документ3 страницыPrince Baruri Offer Letter-1Sukharanjan RoyОценок пока нет

- GOUP GO of 8 May 2013 For EM SchoolsДокумент8 страницGOUP GO of 8 May 2013 For EM SchoolsDevendra DamleОценок пока нет

- Contemporary World Reflection PaperДокумент8 страницContemporary World Reflection PaperNyna Claire GangeОценок пока нет

- Jive Is A Lively, and Uninhibited Variation of The Jitterbug. Many of Its Basic Patterns AreДокумент2 страницыJive Is A Lively, and Uninhibited Variation of The Jitterbug. Many of Its Basic Patterns Aretic apОценок пока нет

- Dwnload Full Essentials of Testing and Assessment A Practical Guide For Counselors Social Workers and Psychologists 3rd Edition Neukrug Test Bank PDFДокумент36 страницDwnload Full Essentials of Testing and Assessment A Practical Guide For Counselors Social Workers and Psychologists 3rd Edition Neukrug Test Bank PDFbiolysis.roomthyzp2y100% (9)

- Shipping - Documents - Lpg01Документ30 страницShipping - Documents - Lpg01Romandon RomandonОценок пока нет

- Module Letter 1Документ2 страницыModule Letter 1eeroleОценок пока нет

- EnglishДокумент3 страницыEnglishYuyeen Farhanah100% (1)

- DepEd Red Cross 3 4 Seater Detached PoWs BoQsДокумент42 страницыDepEd Red Cross 3 4 Seater Detached PoWs BoQsRamil S. ArtatesОценок пока нет

- List of Departed Soul For Daily PrayerДокумент12 страницList of Departed Soul For Daily PrayermoreОценок пока нет

- Consolidation Physical Fitness Test FormДокумент5 страницConsolidation Physical Fitness Test Formvenus velonza100% (1)

- Daniel Salazar - PERSUASIVE ESSAYДокумент2 страницыDaniel Salazar - PERSUASIVE ESSAYDaniel SalazarОценок пока нет

- 05 Vision IAS CSP21 Test 5Q HIS AM ACДокумент17 страниц05 Vision IAS CSP21 Test 5Q HIS AM ACAvanishОценок пока нет

- History and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFДокумент1 124 страницыHistory and Culture of The Indian People, Volume 10, Bran Renaissance, Part 2 - R. C. Majumdar, General Editor PDFOmkar sinhaОценок пока нет

- Organizational Behavior: Chapter 6: Understanding Work TeamДокумент6 страницOrganizational Behavior: Chapter 6: Understanding Work TeamCatherineОценок пока нет

- (BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeДокумент5 страниц(BDMR) (DIY) (Building) (Green) (Eng) Munton - Straw Bale Family HomeMiklós GrécziОценок пока нет

- DocumentДокумент2 страницыDocumentHP- JK7Оценок пока нет

- Variable Costing Case Part A SolutionДокумент3 страницыVariable Costing Case Part A SolutionG, BОценок пока нет

- Fatawa Aleemia Part 1Документ222 страницыFatawa Aleemia Part 1Tariq Mehmood TariqОценок пока нет

- See 2013Документ38 страницSee 2013Ankur BarsainyaОценок пока нет

- Revision of Future TensesДокумент11 страницRevision of Future TensesStefan StefanovicОценок пока нет

- Tally Trading and Profit Loss Acc Balance SheetДокумент14 страницTally Trading and Profit Loss Acc Balance Sheetsuresh kumar10Оценок пока нет

- Kaalabhiravashtakam With English ExplainationДокумент2 страницыKaalabhiravashtakam With English ExplainationShashanka KshetrapalasharmaОценок пока нет

- Sop Draft Utas Final-2Документ4 страницыSop Draft Utas Final-2Himanshu Waster0% (1)

- Pineapples Export's To Copenhagen, DenmarkДокумент13 страницPineapples Export's To Copenhagen, DenmarkMuhammad SyafiqОценок пока нет

- Form Audit QAV 1&2 Supplier 2020 PDFДокумент1 страницаForm Audit QAV 1&2 Supplier 2020 PDFovanОценок пока нет

- CKA CKAD Candidate Handbook v1.10Документ28 страницCKA CKAD Candidate Handbook v1.10Chiran RavaniОценок пока нет

- CT 1 - QP - Icse - X - GSTДокумент2 страницыCT 1 - QP - Icse - X - GSTAnanya IyerОценок пока нет