Академический Документы

Профессиональный Документы

Культура Документы

PART B (Annexure) Details of Salary Paid and Any Other Income and Tax Deducted INR Inr Inr

Загружено:

Ashraf KhanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

PART B (Annexure) Details of Salary Paid and Any Other Income and Tax Deducted INR Inr Inr

Загружено:

Ashraf KhanАвторское право:

Доступные форматы

00393451/ASWPK9181E

Sana Khan

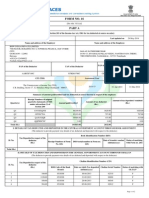

PART B (Annexure)

Details of Salary paid and any other income and tax deducted

INR

1. Gross Salary

(a) Salary as per provisions contained in sec.17(1)

(b) Value of perquisites u/s 17(2)

(as per Form No.12BA, wherever applicable)

(c) Profits in lieu of salary under section 17(3)

(as per Form No.12BA, wherever applicable)

INR

INR

461108.00

0.00

0.00

(d) Total

461108.00

2. Less: Allowance to the extent exempt u/s 10

Conveyance Exemption

9600.00

9600.00

3. Balance(1-2)

451508.00

4. Deductions :

(a) Entertainment allowance

0.00

(b) Tax on employment

2500.00

5. Aggregate of 4(a) and (b)

2500.00

6. Income chargeable under the head 'salaries' (3-5)

449008.00

7. Add: Any other income reported by the employee

0.00

8. Gross total income (6+7)

449008.00

9. Deductions under chapter VI-A

Gross amount

Deductible amount

(A) sections 80C, 80CCC and 80CCD

(a) section 80C

i) Employee Provident Fund

(b) section 80CCC

(c) section 80CCD

Note: 1. Aggregate amount deductible under sections 80C, 80CCC and

80CCD(1) shall not exceed one lakh rupees.

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

(a) 80D(01)

Gross amount

3596.00

12120.00

0.00

0.00

12120.00

0.00

0.00

Qualifying amount

3596.00

Deductible amount

3596.00

10. Aggregate of deductible amount under Chapter VIA

15716.00

11. Total Income (8-10)

433293.00

12. Tax on total income

16329.30

13. Education cess @ 3 % ( on tax computed at S.No.12 )

489.88

14. Tax Payable (12+13)

16820.00

15. Less: Relief under section 89 (attach details)

0.00

16. Tax payable (14-15)

16820.00

Verification

I, BHIKHOO J. KATRAK, son/daughter of JEHANGIRJI working in the capacity of SENIOR GENERAL MANAGER (designation) do

hereby certify that the information given above is true, complete and correct and is based on the books of account, documents, TDS

statements, and other available records.

Place

MUMBAI

Date

20.05.2015

Designation: SENIOR GENERAL MANAGER

(Signature of person responsible for deduction of tax)

Full Name: BHIKHOO J. KATRAK

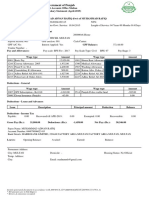

Annexure to Form No.16

Name: Sana Khan

Emp No.: 00393451

Particulars

Amount(Rs.)

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Emoluments paid

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Basic Salary

Conveyance Allowance

House Rent Allowance

Leave Travel Allowance

Medical Allowance

Other Allowances

BoB Kitty Allowance

Overtime

Personal Allowance

Variable Allowance

City Allowance

100968.00

9600.00

64320.00

7152.00

4800.00

639.00

59880.00

6840.00

130200.00

63510.00

13200.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Perks

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- ---------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Gross emoluments

461108.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Income from other sources

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- ---------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Total income from other sources

0.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Exemptions u/s 10

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Conveyance Exemption

9600.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Total Exemption

9600.00

Digitally Signed By BHIKHOO J KATRAK

(TATA CONSULTANCY SERVICES LIMITED)

Date : 21-May-2015

Date: 20.05.2015

Place: MUMBAI

Full Name: BHIKHOO J. KATRAK

Designation: SENIOR GENERAL MANAGER

00393451/ASWPK9181E

Sana Khan

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisites, other fringe

benefits or amenities and profits in lieu of salary with value thereof

1) Name and address of employer :

TATA CONSULTANCY SERVICES LTD. , 8th Flr, Nirmal Bldg, Nariman Point Mumbai - 400021 , Maharashtra

2) TAN: MUMT11446B

3) TDS Assesment Range of the employer :

,,,,

4) Name, designation and PAN of employee :

Mr/Ms: Sana Khan , Desig.: Business Process Lead , Emp #: 00393451 , PAN: ASWPK9181E

5) Is the employee a director or a person with substantial interest in

the company (where the employer is a company):

6) Income under the head "Salaries" of the employee :

449008.00

(other than from perquisites)

7) Financial year :

2014-2015

8) Valuation of Perquisites

S.No

(1)

Nature of perquisite

(see rule 3)

(2)

Value of perquisite

as per rules ( INR )

(3)

Amount, if any, recovered

from the employee (INR)

(4)

Amount of perquisite

chargeable to tax( INR)

Col(3)-Col(4) (5)

Accommodation

0.00

0.00

0.00

Cars/Other automotive

0.00

0.00

0.00

Sweeper, gardener, watchman or

personal attendant

0.00

0.00

0.00

Gas, electricity, water

0.00

0.00

0.00

Interest free or concessional loans

0.00

0.00

0.00

Holiday expenses

0.00

0.00

0.00

Free or concessional travel

0.00

0.00

0.00

Free meals

0.00

0.00

0.00

Free Education

0.00

0.00

0.00

10

Gifts, vouchers, etc.

0.00

0.00

0.00

11

Credit card expenses

0.00

0.00

0.00

12

Club expenses

0.00

0.00

0.00

13

Use of movable assets by employees

0.00

0.00

0.00

14

Transfer of assets to employees

0.00

0.00

0.00

15

Value of any other benefit

/amenity/service/privilege

0.00

0.00

0.00

16

Stock options ( non-qualified options )

0.00

0.00

0.00

17

Other benefits or amenities

0.00

0.00

0.00

18

Total value of perquisites

0.00

0.00

0.00

19

Total value of profits in lieu of salary

as per section 17 (3)

0.00

0.00

0.00

9. Details of tax, (a) Tax deducted from salary of the employee under section 192(1)

(b) Tax paid by employer on behalf of the employee under section192(1A)

(c) Total tax paid

(d) Date of payment into Government treasury

16820.00

0.00

16820.00

DECLARATION BY EMPLOYER

I, BHIKHOO J. KATRAK son/daughter of JEHANGIRJI working as SENIOR GENERAL MANAGER (designation ) do hereby declare on

behalf of TATA CONSULTANCY SERVICES LTD. ( name of the employer ) that the information given above is based on the books of

account, documents and other relevant records or information available with us and the details of value of each such perquisite are in

accordance with section 17 and rules framed thereunder and that such information is true and correct.

Place: MUMBAI

Date : 20.05.2015

Signature of the person responsible

for deduction of tax

Full Name : BHIKHOO J. KATRAK

Designation : SENIOR GENERAL MANAGER

Вам также может понравиться

- Form16Документ5 страницForm16er_ved06Оценок пока нет

- Aaecc2134l 2023 PDFДокумент4 страницыAaecc2134l 2023 PDFVineet KhuranaОценок пока нет

- CSG 10Q Sep 10Документ226 страницCSG 10Q Sep 10Shubham BhatiaОценок пока нет

- Form16 Till 14 Dec 2019Документ11 страницForm16 Till 14 Dec 2019Aviral SankhyadharОценок пока нет

- Form 16 651746Документ4 страницыForm 16 651746Arslan1112Оценок пока нет

- Payslip FormДокумент2 страницыPayslip Formhisoca88Оценок пока нет

- PAYSLIPДокумент11 страницPAYSLIPSaran ManiОценок пока нет

- Form 16Документ3 страницыForm 16Alla VijayОценок пока нет

- 019 Tender Notice For Erp Upgrades For Cbs 1701776853753146Документ10 страниц019 Tender Notice For Erp Upgrades For Cbs 1701776853753146Bilal MughalОценок пока нет

- SSC Pay SlipДокумент1 страницаSSC Pay SlipMaheswaraReddyОценок пока нет

- Form 16 FY 19-20Документ6 страницForm 16 FY 19-20Anurag SharmaОценок пока нет

- AUGUST10 (1) PayslipNikhilДокумент1 страницаAUGUST10 (1) PayslipNikhilNasir HussianОценок пока нет

- Philippine Multimodal Transportation and Logistics Industry Roadmap - Key Recommendations - 2016.04.14Документ89 страницPhilippine Multimodal Transportation and Logistics Industry Roadmap - Key Recommendations - 2016.04.14PortCalls50% (4)

- Form No. 16: Part AДокумент6 страницForm No. 16: Part Asamir royОценок пока нет

- QUA05891 SepSalarySlipwithTaxDetailsДокумент1 страницаQUA05891 SepSalarySlipwithTaxDetailssrajput66Оценок пока нет

- Guest AccountingДокумент8 страницGuest Accountingjhen01gongonОценок пока нет

- Wipro 1Документ399 страницWipro 1GAMES ARENAОценок пока нет

- 255 PartA PDFДокумент2 страницы255 PartA PDFRamyaMeenakshiОценок пока нет

- People/Occupancy Rules of Thumb: Bell - Ch10.indd 93 8/17/07 10:39:31 AMДокумент8 страницPeople/Occupancy Rules of Thumb: Bell - Ch10.indd 93 8/17/07 10:39:31 AMPola OsamaОценок пока нет

- QUA05242 Form16Документ5 страницQUA05242 Form16saurabhОценок пока нет

- Form 16 - TCSДокумент3 страницыForm 16 - TCSBALAОценок пока нет

- QUA05123 SalarySlip-July15Документ1 страницаQUA05123 SalarySlip-July15RajdipmahantaОценок пока нет

- Form 16-Part B - 2020-2021Документ3 страницыForm 16-Part B - 2020-2021Ravi S. SharmaОценок пока нет

- Network Protection Automation Guide Areva 1 PDFДокумент500 страницNetwork Protection Automation Guide Areva 1 PDFEmeka N Obikwelu75% (4)

- Quatrro Global Services Private LimitedДокумент1 страницаQuatrro Global Services Private LimitedZubairsaeedОценок пока нет

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceДокумент2 страницыForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9Оценок пока нет

- Too Much Time in Social Media and Its Effects On The 2nd Year BSIT Students of USTPДокумент48 страницToo Much Time in Social Media and Its Effects On The 2nd Year BSIT Students of USTPLiam FabelaОценок пока нет

- Salary Slip (31692031 April, 2019) PDFДокумент1 страницаSalary Slip (31692031 April, 2019) PDFMuhammad AdnanОценок пока нет

- OCT 2023 UnlockedДокумент2 страницыOCT 2023 UnlockedSWADHIN KUMAR SAHOOОценок пока нет

- DX225LCA DX340LCA Sales MaterialДокумент46 страницDX225LCA DX340LCA Sales MaterialAntonio Carrion100% (9)

- Fine Fragrances After Shave, Eau de Parfum, Eau de Cologne, Eau de Toilette, Parfume Products (9-08)Документ6 страницFine Fragrances After Shave, Eau de Parfum, Eau de Cologne, Eau de Toilette, Parfume Products (9-08)Mustafa BanafaОценок пока нет

- June TCSДокумент1 страницаJune TCSBandari GoverdhanОценок пока нет

- Layer 3 Managed 8 10G Port Switch Controller: RTL9303-CGДокумент55 страницLayer 3 Managed 8 10G Port Switch Controller: RTL9303-CG박윤지100% (1)

- 2014-15 Form 16Документ4 страницы2014-15 Form 16om shanker soniОценок пока нет

- Sungf9tIqDhAO64RjsPj Form16 PartAДокумент2 страницыSungf9tIqDhAO64RjsPj Form16 PartARAJIV RANJAN PRIYADARSHIОценок пока нет

- SCLM ManualДокумент340 страницSCLM ManualpavanrajhrОценок пока нет

- Abend Solving (Mine)Документ63 страницыAbend Solving (Mine)Thrinadh B JОценок пока нет

- JCL Theory - E Book On JCLДокумент4 страницыJCL Theory - E Book On JCLDebanjan SahaОценок пока нет

- AEMДокумент10 страницAEMBHARATH MPОценок пока нет

- 1 1000 Form16Документ5 страниц1 1000 Form16Rakshit SharmaОценок пока нет

- Pay Slip March 2017Документ4 страницыPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Pay Slip ANUJДокумент1 страницаPay Slip ANUJNehal AhmedОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Adventure TimeОценок пока нет

- Income Tax Department: Computerized Payment Receipt (CPR - It)Документ1 страницаIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990Оценок пока нет

- Form 16: Wipro LimitedДокумент5 страницForm 16: Wipro LimitedRishabh PareekОценок пока нет

- Process and Guidelines For ID Card SubmissionДокумент2 страницыProcess and Guidelines For ID Card SubmissionSunil Yadav0% (1)

- Revenue LipcksДокумент1 страницаRevenue LipcksArPit GuptaОценок пока нет

- Plotno.14, Rajiv Gandhi Infotech Park, Hinjewadi, Phase-Iii, Midc-Sez, Village Man Taluka Mulshi, Pune, Maharashtra, 411057Документ3 страницыPlotno.14, Rajiv Gandhi Infotech Park, Hinjewadi, Phase-Iii, Midc-Sez, Village Man Taluka Mulshi, Pune, Maharashtra, 411057Ravi RanjanОценок пока нет

- DopfinacleprocessdocumentДокумент34 страницыDopfinacleprocessdocumentAjayan K Ajayan KОценок пока нет

- SlipДокумент1 страницаSlipDEPUTY DIRECTOR SOCIAL WELFAREОценок пока нет

- Jxunzk BX 9 UIy 0 QM RДокумент7 страницJxunzk BX 9 UIy 0 QM Rvishnu ksОценок пока нет

- PrintTax14 PDFДокумент2 страницыPrintTax14 PDFarnieanuОценок пока нет

- Employee Details Payment & Leave Details: Arrears Current AmountДокумент1 страницаEmployee Details Payment & Leave Details: Arrears Current AmountswapnilОценок пока нет

- Train TicketДокумент2 страницыTrain TicketSanjeev SinghОценок пока нет

- EEU - BILLING - Adjustment Reversal - UTM - Ver - 1.2Документ50 страницEEU - BILLING - Adjustment Reversal - UTM - Ver - 1.2metadelОценок пока нет

- Prices & Services Updates: DashboardДокумент1 страницаPrices & Services Updates: Dashboardzafira fatimaОценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariОценок пока нет

- Government of The People'S Republic of Bangladesh: National Board of Revenue Mushak-9.1 Value Added Tax Return FormДокумент11 страницGovernment of The People'S Republic of Bangladesh: National Board of Revenue Mushak-9.1 Value Added Tax Return FormMd. Abu NaserОценок пока нет

- 14374752Документ2 страницы14374752Anshul MehtaОценок пока нет

- Payslip Prakhar PRA745634 1635359400000Документ1 страницаPayslip Prakhar PRA745634 163535940000024hours service centerОценок пока нет

- Mini Statement 1Документ2 страницыMini Statement 1Aashish ChaudhariОценок пока нет

- 2 83 Bandaru Veedhi Bondapallivizian Agaram VIZIANAGARAM - 535260 Andhra Pradesh, IndiaДокумент1 страница2 83 Bandaru Veedhi Bondapallivizian Agaram VIZIANAGARAM - 535260 Andhra Pradesh, Indiaakshay varmaОценок пока нет

- June Pay SlipДокумент1 страницаJune Pay SlipAniket WakchaureОценок пока нет

- Salary Slip March 16Документ1 страницаSalary Slip March 16Anonymous ce49esgnveОценок пока нет

- Itr - TCSДокумент3 страницыItr - TCSsivaОценок пока нет

- A 40029127 Part-BДокумент3 страницыA 40029127 Part-Bdeepak_cool4556Оценок пока нет

- f4f0880 33401Документ3 страницыf4f0880 33401uschandraОценок пока нет

- Memorandum of AgreementДокумент6 страницMemorandum of AgreementJomar JaymeОценок пока нет

- Partes Oki - MPS5501B - RSPL - Rev - HДокумент12 страницPartes Oki - MPS5501B - RSPL - Rev - HJaiber Eduardo Gutierrez OrtizОценок пока нет

- Managerial Economics - 1Документ36 страницManagerial Economics - 1Deepi SinghОценок пока нет

- Pepsico IncДокумент26 страницPepsico IncYKJ VLOGSОценок пока нет

- Chap 14Документ31 страницаChap 14Dipti Bhavin DesaiОценок пока нет

- Peace Corps Guatemala Welcome Book - June 2009Документ42 страницыPeace Corps Guatemala Welcome Book - June 2009Accessible Journal Media: Peace Corps DocumentsОценок пока нет

- Data Loss PreventionДокумент20 страницData Loss Preventiondeepak4315Оценок пока нет

- KINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25Документ329 страницKINDRED HEALTHCARE, INC 10-K (Annual Reports) 2009-02-25http://secwatch.comОценок пока нет

- Understanding FreeRTOS SVCДокумент11 страницUnderstanding FreeRTOS SVCshafi hasmani0% (1)

- RVT Liquid DistributorДокумент5 страницRVT Liquid DistributorimeagorОценок пока нет

- Invoice 1281595768Документ3 страницыInvoice 1281595768vikas9849Оценок пока нет

- County Project Name Cycle Project Address Proj City Proj Zip Applicant/Owner Name HDGP $ Home $ FHTF $ Lihtc9 $ Help $ Oahtc $ Ghap $ HPF $ Lihtc4 $Документ60 страницCounty Project Name Cycle Project Address Proj City Proj Zip Applicant/Owner Name HDGP $ Home $ FHTF $ Lihtc9 $ Help $ Oahtc $ Ghap $ HPF $ Lihtc4 $Mamello PortiaОценок пока нет

- 2B. Glicerina - USP-NF-FCC Glycerin Nutritional Statement USP GlycerinДокумент1 страница2B. Glicerina - USP-NF-FCC Glycerin Nutritional Statement USP Glycerinchristian muñozОценок пока нет

- 3d Mug Tutorial in 3d MaxДокумент5 страниц3d Mug Tutorial in 3d MaxCalvin TejaОценок пока нет

- Fashion Designing Sample Question Paper1Документ3 страницыFashion Designing Sample Question Paper1Aditi VermaОценок пока нет

- Modeling Cover Letter No ExperienceДокумент7 страницModeling Cover Letter No Experienceimpalayhf100% (1)

- Lab ManualДокумент15 страницLab ManualsamyukthabaswaОценок пока нет

- Profile Romblon IslandДокумент10 страницProfile Romblon Islandderella starsОценок пока нет

- Sap On Cloud PlatformДокумент2 страницыSap On Cloud PlatformQueen ValleОценок пока нет

- 1 48 Volt Parallel Battery System PSS-SOC - Step-By-Step VolvoДокумент11 страниц1 48 Volt Parallel Battery System PSS-SOC - Step-By-Step VolvoEyosyas NathanОценок пока нет

- Hydraulic Breakers in Mining ApplicationДокумент28 страницHydraulic Breakers in Mining ApplicationdrmassterОценок пока нет

- 036 ColumnComparisonGuideДокумент16 страниц036 ColumnComparisonGuidefarkad rawiОценок пока нет