Академический Документы

Профессиональный Документы

Культура Документы

A Question of Interest PDF

Загружено:

Kennith Ng0 оценок0% нашли этот документ полезным (0 голосов)

25 просмотров3 страницыОригинальное название

A Question of Interest.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

25 просмотров3 страницыA Question of Interest PDF

Загружено:

Kennith NgАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

A Question of Interest

By John B Molloy, LLB (Hons), BSc (Hons), FHKIS, FRICS, ACIArb, Managing Director, James R Knowles

(Hong Kong) Limited

Therefore in the Government contracts

if the Employer fails to pay to the

Contractor a sum certified within 21

days, the Contractor can claim interest

for the late payment.

The question as to when a contractor is

entitled to claim interest is one, which arises

regularly, and is one, which traditionally

causes confusion.

The position at common law is settled, if

somewhat surprising in the current

commercial world, and is that a debt which

is paid late does not give an entitlement to

interest. This position derives from the

famous case in 1893 of London, Chatham

and Dover Railway v South Eastern

Railway, and was more recently affirmed by

the House of Lords in the President of India

v. La Pintada Cia Navegacion (1984).

It is interesting to compare this with the

ICE Form of Contract that contains

similar but importantly different

wording in that it provides In the event

of failure by the Engineer to certify or

the Employer to make payment. The

Employer shall pay to the Contractor

interest .

The ICE conditions thus enable the

Contractor to seek interest on sums that

he considers he was due but which the

Engineer has failed to certify in an

interim certificate. This is significantly

wider than he Government Conditions

that only permit interest on sums, which

have already been certified but paid late.

Therefore if a contract provides that the

employer shall pay to the contractor any

sums certified within 14 days of the date of

certification, if he fails to make payment

until say 60 days later, the debt is

discharged and the contractor can not bring

an action for interest arising from the late

payment.

With regard to other contracts in use in

Hong Kong the KCRC Conditions

follow the same line as the Government

Conditions, but the RICS/HKIA Private

Form of Contract which is used in

almost every private development

contain no provisions entitling the

Contractor to interest for late payment

and so the Contractor has no entitlement

to claim interest for an Employers late

payment under these conditions.

However, there are exceptions to this

general rule, and there are four situations

where a contractor can claim interest. These

are as follows:

Where there is an express term in the

contract providing for interest in

specific circumstances.

A good example of this is the

Government of Hong Kong SAR

General Conditions of Contract Clause

79(4)(a) that provides "In the event of

the failure by the Employer to make

payment to the Contractor in

compliance with the provisions of this

Clause (Interim and Final Payments)

the Employer shall pay to the

Contractor interest at the judgement

debt rate...".

Where the interest forms

constituent part of the claim itself.

Interest or finance charges can be

validly claimed where such charges

have been incurred by reason of matters

giving a contractor entitlement to claim

either loss and expense (under the

RICS/HKIA Private Form) or Costs

(under the Government forms) because

However if the employer decides to pay

the $100,000 in June 1999 then (because

of the common law rule) the debt is

discharged, and it is not possible for the

contractor to serve notice of arbitration

solely to get the interest to which he

considers himself entitled.

the interest or finance charge are part of

the loss or expense or the Costs incurred.

This is an important area and a topic that

I will address in detail next month.

Where statute provides

payment of interest

for

the

There are a number of situations where

statute provides that interest may be paid

on settlement of a debt.

For example, and with most relevance to

the construction industry, if a dispute

between a contractor and an employer is

taken to court or arbitration, then the

provisions of the High Court Ordinance

(Cap 4), or the Arbitration Ordinance

(Cap 341) empowers the court or an

arbitrator to award interest on sums

awarded.

The interest will normally be awarded

from the date on which the payment

should have been made, unless, for

example there has been unreasonable

delay on the part of the contractor in

pursuing his claim.

It is important to note, however, that the

contractor can only claim interest at the

court or arbitrators discretion on a sum

that is being claimed as due, and a claim

for interest alone can not be made. For

example, consider a dispute where the

contractor is claiming entitlement to

$100,000 for some additional dredging

carried out in January 1998. The

Engineer refuses to certify payment and

the contractor serves notice of

arbitration in July 1999. The contractors

statement of claim for the arbitration

will be for $100,000 plus interest at the

discretion of the arbitrator. If the matters

proceeds to arbitration and the arbitrator

finds for the contractor he will normally

award $100,000 plus interest running

from January 1998, i.e. the date when

the payment should have been made.

Where interest is claimed as a special

damage.

The final exception to the general rule

that a person cannot claim interest

merely because money has been paid

late is where interest is claimed as a

special damage. The developments in

this area are the most interesting

challenges to the old common law rule,

and ones which may be of great

significance to the construction industry.

In accordance with the landmark case of

Hadley v Baxendale (1854) a wronged

party is entitled to those damages that

naturally arose from the breach of

contract (the first limb of the decision

known as general damages) and those

damages that may reasonably be

supposed to have been in the

contemplation of both parties at the time

the contract was made as a probable

result of the breach (the second limb of

the decision known as special damages).

In the case of Holbeach Plant Hire Ltd v

Anglican Water Authority (1988) the

court accepted that a contractor may be

entitled to claim interest on sums that

the Engineer should have certified as

special damages, if it could be proven

that the fact that the contractor would

incur finance charges in the event that a

late payment was made was in the

contemplation of both parties at the time

the contract was made.

This must be at least arguable in every

construction contract in Hong Kong

where contractors traditionally operate

in an overdraft situation.

Whilst the common law position has

remained unchanged for over one

hundred years that a payee cannot claim

damages by way of interest merely

because money has been paid late, the

situations above indicate the exceptions

to the rule, and the final exception, the

area of special damages has the potential

to make significant inroads into the

traditional rule.

(Adopted from the HKIS Newsletter 8(8) August

1999)

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Watchtower: Preparing For A Child Custody Case With Religious Issues - 2008Документ72 страницыWatchtower: Preparing For A Child Custody Case With Religious Issues - 2008sirjsslut100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Arbitration Clause Determines Proper Forum for Mining Dispute ResolutionДокумент6 страницArbitration Clause Determines Proper Forum for Mining Dispute ResolutionAnsfav PontigaОценок пока нет

- DocumentДокумент15 страницDocumentElijah Aziz'ElОценок пока нет

- Fidic White BookДокумент28 страницFidic White Bookmustafaayman675% (8)

- Alternate Dispute Resolution ADR Renaissance Law College NotesДокумент70 страницAlternate Dispute Resolution ADR Renaissance Law College NotesAaera Singh100% (1)

- 1999 Award HCE v. IndonesiaДокумент85 страниц1999 Award HCE v. IndonesiaAmr Arafa100% (2)

- Assignment and NovationДокумент3 страницыAssignment and NovationKennith NgОценок пока нет

- Important Letters From Railway BoardДокумент4 страницыImportant Letters From Railway BoardRamesh RkОценок пока нет

- Dispute Resolution GuideДокумент24 страницыDispute Resolution GuideMrinalBhatnagarОценок пока нет

- Guidelines on Construction Project ManagementДокумент538 страницGuidelines on Construction Project ManagementVivek KumarОценок пока нет

- Liability For Materials Specified in Bills of Quantities PDFДокумент2 страницыLiability For Materials Specified in Bills of Quantities PDFKennith NgОценок пока нет

- Claim - Should Overheads in All Variations Be Deducted From Loss & Expense PDFДокумент2 страницыClaim - Should Overheads in All Variations Be Deducted From Loss & Expense PDFKennith NgОценок пока нет

- Frequently Asked Questions Relating To Comfort Letters and Comfort Letter PracticeДокумент12 страницFrequently Asked Questions Relating To Comfort Letters and Comfort Letter PracticeKennith NgОценок пока нет

- Who Bears The Cost of Investigating For DefectsДокумент2 страницыWho Bears The Cost of Investigating For DefectsMdms PayoeОценок пока нет

- Disputes - The Difficulties of Being An Expert Witness PDFДокумент2 страницыDisputes - The Difficulties of Being An Expert Witness PDFKennith NgОценок пока нет

- Know Your Expert Witness - But Don't Know Him Too Well PDFДокумент2 страницыKnow Your Expert Witness - But Don't Know Him Too Well PDFKennith NgОценок пока нет

- Conlaw26 0Документ3 страницыConlaw26 0Krish DoodnauthОценок пока нет

- Henry Boot Construction LTD Alstom Combined Cycles LTD PDFДокумент2 страницыHenry Boot Construction LTD Alstom Combined Cycles LTD PDFKennith NgОценок пока нет

- Contingency Fee Agreements - Valid in Arbitrations PDFДокумент2 страницыContingency Fee Agreements - Valid in Arbitrations PDFKennith NgОценок пока нет

- Extending The Time For Completion PDFДокумент3 страницыExtending The Time For Completion PDFKennith NgОценок пока нет

- Destroying The Purpose of Bills of Quantities PDFДокумент3 страницыDestroying The Purpose of Bills of Quantities PDFKennith NgОценок пока нет

- How Final Is The Final Certificate PDFДокумент2 страницыHow Final Is The Final Certificate PDFKennith NgОценок пока нет

- Is The Cost of Preparing A Claim Recoverable PDFДокумент2 страницыIs The Cost of Preparing A Claim Recoverable PDFKennith NgОценок пока нет

- Conclusiveness of The Final Certificate PDFДокумент3 страницыConclusiveness of The Final Certificate PDFKennith NgОценок пока нет

- Fair Valuations Must Include Overheads and ProfitДокумент3 страницыFair Valuations Must Include Overheads and ProfitgimasaviОценок пока нет

- A1998 HKIS - LnE - Financing ChargesДокумент2 страницыA1998 HKIS - LnE - Financing ChargesPameswaraОценок пока нет

- Default of Nominated Sub-Contractors PDFДокумент2 страницыDefault of Nominated Sub-Contractors PDFKennith NgОценок пока нет

- Calculation of Head Office OverheadsДокумент2 страницыCalculation of Head Office OverheadsManoj LankaОценок пока нет

- Global Claims - The Current Position PDFДокумент2 страницыGlobal Claims - The Current Position PDFKennith NgОценок пока нет

- Civil Engineering Measurement Disputes Revisited PDFДокумент2 страницыCivil Engineering Measurement Disputes Revisited PDFKennith NgОценок пока нет

- Unrealistic Rates in BoQДокумент2 страницыUnrealistic Rates in BoQabj7Оценок пока нет

- Can A Contractor Claim For Loss of Profit On Omitted Works PDFДокумент2 страницыCan A Contractor Claim For Loss of Profit On Omitted Works PDFKennith NgОценок пока нет

- The Meaning of CompletionДокумент2 страницыThe Meaning of CompletionKennith NgОценок пока нет

- The Meaning of VariationДокумент2 страницыThe Meaning of VariationMdms PayoeОценок пока нет

- A Formula For Success PDFДокумент3 страницыA Formula For Success PDFRita HuiОценок пока нет

- Extra OverДокумент2 страницыExtra OverDonny MackinnonОценок пока нет

- The Final ChapterДокумент3 страницыThe Final ChapterMdms PayoeОценок пока нет

- Labor Law 2 - Art. 224Документ8 страницLabor Law 2 - Art. 224edrea_abonОценок пока нет

- Multi-tier Arbitration IssuesДокумент11 страницMulti-tier Arbitration IssuesutsavОценок пока нет

- FIITJEE Admission Tests '2013Документ4 страницыFIITJEE Admission Tests '2013FIITJEE Mumbai Centre100% (4)

- DATAR SWITCHGEARS VS TATA FINANCE ARBITRATION CASE STUDYДокумент15 страницDATAR SWITCHGEARS VS TATA FINANCE ARBITRATION CASE STUDYNimya RoyОценок пока нет

- ADR Ms Bativala and Karani v. K.I. Johny & AnrДокумент18 страницADR Ms Bativala and Karani v. K.I. Johny & AnrJashaswee MishraОценок пока нет

- Supreme Court rules arbitration clause survives contract terminationДокумент11 страницSupreme Court rules arbitration clause survives contract terminationAnshul YadavОценок пока нет

- AC Maintenance Tender for Guntur SSA 2016-17Документ16 страницAC Maintenance Tender for Guntur SSA 2016-17Karthik PalaniОценок пока нет

- Estimating Costing VДокумент4 страницыEstimating Costing Vशंकर थापाОценок пока нет

- Juris - Seaman Seafarer Death CompensabilityДокумент18 страницJuris - Seaman Seafarer Death CompensabilityDennis NinoОценок пока нет

- Compilation of Case DigestsДокумент22 страницыCompilation of Case DigestsMarietta Alquiza MagallonОценок пока нет

- Supreme Court of India Page 1 of 6Документ6 страницSupreme Court of India Page 1 of 6Vicky VermaОценок пока нет

- Guidelines Regarding Registration of Independent Floors' - Policy 9Документ26 страницGuidelines Regarding Registration of Independent Floors' - Policy 9Manish Prasad Sinha100% (1)

- Union of India Vs BescoДокумент11 страницUnion of India Vs BescoSidhant WadhawanОценок пока нет

- Adr CaseДокумент17 страницAdr Caseshilpasingh1297Оценок пока нет

- Commencement of Arbitral ProceedingsДокумент3 страницыCommencement of Arbitral ProceedingsMichael LagundiОценок пока нет

- NLRC Ruling on Venue in Labor Dispute UpheldДокумент5 страницNLRC Ruling on Venue in Labor Dispute UpheldSmoke PhoenixОценок пока нет

- Dgp76 02 03 - Paulsson Uncitral Model Law - CommentaryДокумент178 страницDgp76 02 03 - Paulsson Uncitral Model Law - CommentaryDaniela Henao HongОценок пока нет

- Luzon Development Bank v. EmployeesДокумент4 страницыLuzon Development Bank v. EmployeesGhatz CondaОценок пока нет

- Is Dispute Adjudication Under Fidic Contracts For Major Works Indeed A Precondition To ArbitrationДокумент13 страницIs Dispute Adjudication Under Fidic Contracts For Major Works Indeed A Precondition To ArbitrationMarc MarcoОценок пока нет

- ALTERNATIVE DISPUTE RESOLUTION END-TERM EXAMДокумент16 страницALTERNATIVE DISPUTE RESOLUTION END-TERM EXAMPranav SharmaОценок пока нет

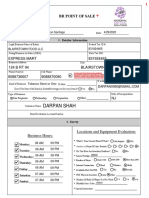

- Darpan Shah: BR Point of SaleДокумент10 страницDarpan Shah: BR Point of SaleGerson OsoriaОценок пока нет