Академический Документы

Профессиональный Документы

Культура Документы

Managing Working Capital

Загружено:

yathsih24885Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Managing Working Capital

Загружено:

yathsih24885Авторское право:

Доступные форматы

STUDY ON WORKING CAPITAL MANAGEMENT

INTRODUCTION

General Introduction

This report is prepared on the base of working capital

management which comes under financial management.

Whether, big, medium or small each business needs finance for

its establishment and to carry out its routine operations. Today

finance is the life blood of an organization. Financial management

or corporation finance deals with the financial planning,

acquisition of funds, use and allocation of funds and financial

control. No business can run successfully and to achieve its

objectives without an adequate finance.

Working capital is the nerve center of the

business. Just as circulation of blood is essential in the human

body for maintaining life, working capital is very essential to

maintain the smooth running of the business. The main objective

of this study includes the existing system of working capital of the

company to evaluate the changes in working capital and to

suggest a better way of managing working capital. This study is

conducted in DISA INDIA PVT. LTD

Working capital management shows credit worthiness and

financial efficiency of an enterprise. The main idea of selecting

working capital management is that, it is significant in financial

management due to the fact that it plays a pivotal role in keeping

the wheels of business enterprise running. It is concerned with the

short term financial decisions.

SMU MBA 2016

Page 1

STUDY ON WORKING CAPITAL MANAGEMENT

CONCEPTUAL BACKGROUND OF

WORKING CAPITAL

WORKING CAPITAL- AN OVERVIEW

Every business needs funds for two purposes for its

establishment and to carry out its day-to-day operations. One is

fixed capital and the other one is working capital. Investments in

assets represent that part of firms capital which is blocked on a

permanent or fixed basis is called fixed capital. Working capital

means excess of current assets over current liabilities.

Working capital means funds required for routine

operations of the company. The interaction between current

assets and current liabilities is the main theme of working capital

management. The term current asset refers to those assets,

which are converted into cash with in the span of one year or

short period. The term current liabilities refer to those liabilities,

which are to be paid in the ordinary course of business.

Current asset management is one of the very

important financial decision to be taken by financial Manager. The

management of working capital is a challenging task and it is

considered as an integral part of the overall corporate

management. The firm should maintain sufficient level of working

capital to produce up to given capacity and maximize the return

on investment in fixed assets.

SMU MBA 2016

Page 2

STUDY ON WORKING CAPITAL MANAGEMENT

Shortage of working capital leads to capacity

utilization, lower turnover and hence lower profits. Working

capital, in excess of the amount required producing to full

capacity; it is idle and consequently leads to decline in profits. So

every business concern should have adequate working capital to

run its business operations. Working capital is also known as

revolving or circulating or short term capita

DEFINITION OF WORKING CAPITAL

According to Genestenberg working capital means

current assets of a company that are changed in the ordinary

course of business from one to another, as for example, from cash

to inventories, inventories to receivables, receivables into cash.

According to shubin working capital is the amount

of funds necessary to cover the cost of operating the enterprise.

CONCEPTS OF WORKING

CAPITAL

There are two concepts of working capital :

a) Balance sheet concept

b) Operating cycle or circular flow concept

BALANCE SHEET CONCEPT

There are two interpretations of working capital under balance

sheet concept

SMU MBA 2016

Page 3

STUDY ON WORKING CAPITAL MANAGEMENT

Gross working capital refers to firms investment in

current assets, like cash, bank balance, inventory and receivables.

It represents the commitment of funds to different items of

current assets and their relationship to turnover.

The gross working capital focus on two aspects.

a) Optimum investment in current asset, in order to avoid the

problem arising out of excessive and inadequate investment

in current assets.

b) The second aspect on which the gross working capital focus

is the need of arranging funds to finance current assets and

the need may arise due to changes in the level of business

activity.

Net working capital

Net working capital refers to the difference between the

current assets is more than the current liabilities the working

capital is positive. The negative working capital arises when

current liabilities are more than the current assets. Net working

capital concept is qualitative in nature and gross working capital

is primarily quantitative or it says:

Net working capital = current asset current

liabilities

OPERATING CYCLE OR CIRCULAR FLOW CONCEPT

The duration of time required to complete the fallowing

cycle of events in case of a manufacturing firm is called the

operating cycle.

SMU MBA 2016

Page 4

STUDY ON WORKING CAPITAL MANAGEMENT

DEBTORS

(RCEIVABLES)

CASH

FINISHED GOODS

RAW MATERIALS

WORK IN PROCESS

In a manufacturing concern, the working capital

starts with the purchase of raw materials and ends with

realization of cash from the sale of finished products. This cycle

involves purchase of raw materials and stores, its conversion into

stocks of finished goods through work in progress with

progressive increment of labour and service costs, conversion of

finished stocks into sales, debtors and receivables and ultimately

realization of cash and this cycle continues again from cash to

purchase of raw materials and so on.

SMU MBA 2016

Page 5

STUDY ON WORKING CAPITAL MANAGEMENT

Operating cycle of a manufacturing company involves three

phases

1. Acquisition of resources such as raw materials, labour, power,

and fuel etc.

2. Manufacture of products which include conversion of raw

materials into work-in-process and into finished goods.

3. Sales of the products either for cash or credit. Credit creates

book debts for collection.

Acquisition of materials

Manufacture of the product

Sale of the product

Operating cycle indicates the length of time between

companys paying for materials, entering into stock and receiving

the cash from sales of finished goods.

IMPORTANCE OF WORKING CAPITAL

The need for working capital arises for day-to-day

operations of business. Management of working capital is

considered to be an integral part of overall finance management

because it has been realized that business failure will occur

mainly due to inadequate or mismanagement of working capital.

SMU MBA 2016

Page 6

STUDY ON WORKING CAPITAL MANAGEMENT

Adequate working capital helps a firm in fallowing

ways

1. Adequate working capital helps in maintaining

solvency of the business.

2. Sufficient working capital enables a firm to make

prompt payments and helps in creating and

maintaining goodwill.

3. Sufficient working capital ensures regular supply

of raw materials and continuous production.

4. Adequate working capital make regular of

salaries, wages and other day-to-day

commitments.

Excessive Working Capital May Lead To The

Fallowing Reasons

Excess of working capital may result in unnecessary

accumulation of inventories. This may result in terms of inventory

mishandling, waste and theft. Due to excessive working capital

may adopt liberal credit policy and slacken the collection of

receivables, which has an adverse effect on profits. In order to

avoid the above mentioned problems it is important to have

efficient working capital.

CLASSIFICATION OF WORKING CAPITAL

Working capital may be classified in two ways:

on the basis of concept

SMU MBA 2016

Page 7

STUDY ON WORKING CAPITAL MANAGEMENT

On the basis of concept, working capital is classified

as gross working capital and net working capital as I gave a brief

explanation earlier. This classification is important from the point

of financial manager.

permanent or fixed working capital

temporary or variable working

KINDS OF WORKING CAPITAL

ON THE BASE OF CONCEPT

BASE OF TIME

GROSS WORKING

TEMPORARY

CAPITAL

CAPITAL

NET WORKING

CAPITAL

WORKINGCAPITAL

REGULAR WORKING

SPECIAL

SMU MBA 2016

ON THE

RESERVE

Page 8

PERMANENT

WORKING

SEASONAL

STUDY ON WORKING CAPITAL MANAGEMENT

CAPITAL

CAPITAL

WORKING CAPITAL

WORKING CAPITAL

WORKING

A. Temporary Working Capital Requirements

Temporary working capital requirement refers to the

extra working capital needed to support to change in production

and sales activities. It is also called as fluctuation or variable

working capital.

Depending upon the changes in production and

sales the need for working capital over and above permanent

working capital will fluctuate. For example, extra inventory of

finished goods will have to be maintained to support the peak

periods of the sale and investment in receivables may also

increase during such periods. On the other hand, investment in

raw material, work-in-process, finished goods will fall if the market

is slack.

A.

Permanent Working Capital

Requirements

Permanent or fixed working capital is the minimum

amount which is required to ensure effective utilization of fixed

facilities and for maintaining the circulation of current assets. For

example, every firm has to maintain a minimum level of raw

materials, work-in-process, finished goods and cash balance.

This minimum level of current assets is called permanent capital.

SMU MBA 2016

Page 9

STUDY ON WORKING CAPITAL MANAGEMENT

As the business grows, the requirements of permanent working

capital also increase due to the increase in current assets.

FACTORS AFFECTING THE WORKING CAPITAL

The various factors that affect the working capital requirements of

a concern are:

1. Nature of the business

2. Size of the business

3. Growth of the business

4. Manufacturing cycle

5. Length of the operating cycle

6. Production policies

7. Rapidity of turnover

8. Price level changes

9. Business fluctuations and seasonal fluctuations

10.

Supply conditions

11.

Operating efficiency

12.

Firms credit policy

13.

Credit facilities enjoyed from the creditors

14.

Taxes

15.

Profit margin and appropriation

16.

Market condition/competitiveness

17.

Government restrictions

18.

Development of transport and communications

IMPORTANCE:

Every firm should have a balance working capital

position. Both excessive as well as inadequate working capital

position are dangerous from the firms point of view. Excessive

working capital means idle funds which earns no profits for the

firm. Paucity of working capital not only weakens firms

SMU MBA 2016

Page 10

STUDY ON WORKING CAPITAL MANAGEMENT

profitability but also results in production interruptions and

inefficiencies.

The Dangers of Excessive Working Capital are as

fallows:

1. Unnecessary accumulation of inventories chances of

inventories mishandling waste theft and losses will increase.

2. It is an indication of defective credit policy and slack collection

period. Consequently, higher incidence of bad debts results,

which adversely affects profits.

3. Leads to managerial inefficiency.

4. Will create a tendency of accumulate inventories and

speculative profits. This may tend to make dividend policy liberal

and difficult to cope with in future the firm is unable to make

speculative profits.

Inadequate Working Capital Is Also Bad With

Fallowing Reasons:

1. It stagnates growth. It becomes difficult for the firm to

undertake profitable projects for non-availability of working

capital.

SMU MBA 2016

Page 11

STUDY ON WORKING CAPITAL MANAGEMENT

2. It becomes difficult to implement operating plans and achieve

the firms profit target.

3. The firm has found difficult to make the day-to-day

commitments.

4. Fixed assets are not efficiently utilized and there by affect the

profitability.

5. The firm cannot avail attractive credit opportunities.

6. The firm loses its reputation when it is not in a position to honor

its short-term obligations. As a result, the firm faces tight credit

terms. Therefore an enlightened management should maintain

the right amount of working capital on a continuous basis. Then

only a proper functioning of business operations will ensure.

WORKING CAPITAL POLICY

An important working capital policy is concerned

with the level of investments in current assets how the working

capital requirement is financed. The alternative policies regarding

the total amount of current assets carried to support given level

of sales, hence in the turnover of those assets. Three policies are

namely, relaxed policy, moderate policy and restricted policy.

In relaxed policy current asset investment policy

relatively large amount of stimulated by the use of credit policy

that provides a liberal financing to customers and corresponding

high level of receivable. Conversely with the restricted the holding

of cash, securities, inventories and receivables are minimized,

under the restricted policy. Current assets are turned over more

frequently, so each dollar of current assets is forced to work

SMU MBA 2016

Page 12

STUDY ON WORKING CAPITAL MANAGEMENT

harder. The moderate current asset investment policy lies in

between two extremes.

RATIO OF SHORT - TERM FINANCING TO LONG

- TERM FINANCING

Current assets of a firm are supported by

spontaneous short term bank financing and long term sources of

finance (debentures and equity in the main); the level of

spontaneous current liabilities is determined by extraneous in

current asset financing is what should be the relative proportions

of short term bank financing.

Choosing the working capital policy

The overall working capital policy adopted by the

firm may broadly be conservative, moderate or aggressive. A

conservative overall working capital policy means that the firm

chooses a conservative current asset policy. A moderate overall

working capital policy reflects a combination of a conservative

current asset policy and a conservative current asset financing

policy. An aggressive overall working capital policy consists of an

aggressive current asset policy and an aggressive current asset

financing policy.

SMU MBA 2016

Page 13

STUDY ON WORKING CAPITAL MANAGEMENT

Moderate Overall Working

Aggressive Overall Working

Capital Policy

Capital Policy

conservative overall working

moderate Overall Working

Capital policy

Capital policy

Usually the various ways of combining individual policies with

respect to current assets and current assets financing into an

overall working capital policy. An overall conservative working

capital policy reduces risk and offers low return. An overall

moderate working capital policy offers moderate return

accomplished with moderate risk an overall aggressive working

capital policy would depend on the risk disposition of

management.

There are several strategies available to firm for

financing its capital requirements. They are as fallows

Strategy 1

Long term financing ensures the fixed assets

requirements as well as working capital requirements. Then

SMU MBA 2016

Page 14

STUDY ON WORKING CAPITAL MANAGEMENT

working capital requirement is less than peak level. The surplus is

invested liquid assets.

Strategy 2

Long-term finance is to meet fixed assets

requirements, permanent working capital requirement and a

portion of fluctuated working capital requirements. During

seasonal offspring, short term financing is used. During seasonal

down spring surplus is invested in liquid asset.

Strategy 3

Long term financing is used to make fixed assets

requirement and permanent working capital requirement. Short

financing is used to make fluctuating working capital

requirements.

CASH MANAGEMENT

Introduction

Cash is the important asset for the business. Cash is the

basic input need to keep the business running on a continuous

basis, it is also the ultimate output expected to be realized by

SMU MBA 2016

Page 15

STUDY ON WORKING CAPITAL MANAGEMENT

selling, service, and product manufactured by the firm should

keep sufficient cash neither more nor less. Cash shortage will

disrupt the firms manufacturing operations. While excessive cash

will remain idle without contributing anything towards the firms

profitability. Thus a major function of a financial manager is to

maintain a sound cash position.

Cash is the money that the firm can disburse

immediately without further conversion. The term `cash includes

coins, currency, and

cheques held by the firm and balance in its bank accounts. Some

times near- cash items such as marketable securities are also

included in cash. The basic

Characteristic of near-cash assets is that they can readily be

converted into cash. Generally, when this firm has excess cash, if

invested in marketable securities, this kind of investment

contributions some profits to the firm.

Management of cash is concerned with the managing of

Cash flows into and out of the firm

Cash inflows within the firm

Cash balances held by the firm at a point of time

Management of cash assumes more important than

other current assets because cash is the most significant and the

least productive asset that a firm holds.

SMU MBA 2016

Page 16

STUDY ON WORKING CAPITAL MANAGEMENT

It is significant because it is used to pay the firm

obligations. However, cash is unproductive like fixed assets or

inventories, it does not produce goods for sale. Therefore, the aim

of the cash management should be to maintain adequate cash

position to keep the firm sufficiently liquid and to use excess cash

income profitable way.

MOTIVES FOR HOLDING CASH

The firm is need to hold cash may be attributed to the

fallowing 3 motives:

1. Transaction motives

2. Precautionary motives

3. Speculative motives

Transaction motive

The transaction motive requires a firm to hold cash

primarily to make payments for purchases, wages, other

operating expenses, taxes, dividends etc. The need to hold

carriers simply because there is no synchronization of cash

inflows into cash outflows. Transaction motive mainly refers to

holding cash to anticipated payments whose timings is not

perfectly matched with cash receipts.

Precautionary motives

The precautionary motive is the need to hold cash to

meet any contingencies in future. It provides better to withstand

SMU MBA 2016

Page 17

STUDY ON WORKING CAPITAL MANAGEMENT

some unexpected emergency. The precautionary amount of cash

depends upon the predictability of cash flows. If cash flows are

regular in nature then less cash will be maintained for emergency.

Speculative motive

The speculative motive relates to the holding of cash

for investing in profits making opportunities as and when they

arise. The firm can purchase the securities when the interest rate

can be expected to full. The firm will subsequently benefit by the

subsequent rise in the price of the securities, because these types

of speculations are too risky for the firms.

CASH PLANNING

Cash inflows and outflows are inseparable parts of

the business operations for the firm. This firm needs cash to

invest in inventories, receivables and fixed assets and to make

payments for operating expenses.

In order to maintain growth in sales and earnings it

is possible that this firm may be able in making adequate profits.

But may suffer from the shortage of cash as its position growing

needs may be consuming cash very last. The cash poor position

of the firm can be corrected if its cash needs are planned in

advance. Then the cash planning can help anticipate future cash

floes and needs of the firm and reduces the profitability and cash

defects. This can cause the firm failure.

Cash planning is a technique to plan for and central

the use of cash.

It may be done on daily working or monthly basis.

SMU MBA 2016

Page 18

STUDY ON WORKING CAPITAL MANAGEMENT

INVENTORY MANAGEMENT

Efficient management of inventories is very

necessary to minimize the operating cash of the firm and at the

same time of ensure sufficient inventories of satisfy production

and sales demand the term inventory refers to the stock piece of

the product of a firm which is offered afford for a sale and the

components that make up the product the inventories include

Raw materials

Work-in-progress

Finished goods

Raw materials: are those units, which have been

purchase and started for future productions and those are the

basic inputs that are converted into finished products.

Work-in-progress: are semi-manufactured products

they represent products that need more work before they become

finished products for sale.

Finished goods: finished goods are those completely

manufactured products, which are ready for sake. Therefore,

inventory management means an optimum investment in

inventories. It should neither be too low to affect the production

nor too high to block the funds unnecessary investment in

inventories should not be profitable for the business.

Meaning:

Inventory management is apart of industrial

management which is concerned with the activities involved in

SMU MBA 2016

Page 19

STUDY ON WORKING CAPITAL MANAGEMENT

the acquisition and use of all in materials employed in production

inventory in every industry has a ritual role to play and forms

significant factor in the total cost of production expenditure on

inventories may constitutes 20 to 90% of cost of production in an

industry.

Objectives of inventory management:

The main objectives of the inventory management

are as fallows:

To maintain a sufficient size of inventory for efficient and

smooth production and sales operation.

To maintain a minimum involvement in inventories to

maximize profitability.

Essentials of good inventory control system:

The following are the essentials of good inventory control

system:

1. Classification and identification of inventory by allowing

proper code number to each item.

2. Standardization and simplification of inventories in order to

maintain quality and reduce the number of item.

3. Adequate storage facilities to reduce waste.

4. Setting minimum, maximum and re-ordering limits for each

part of inventory.

5. Fixing economic ordering quantity.

6. Maintaining adequate inventory records, reports and

statements.

7. Intelligent and experienced persons for handling inventories

properly.

SMU MBA 2016

Page 20

STUDY ON WORKING CAPITAL MANAGEMENT

Benefits of holding inventory

The benefits of holding inventory are as fallows

Benefit in purchasing: Through a larger amount of purchase

at a time the firm can avail the discounts that are available on

bulk purchases more over the ordering costs will also be low. Firm

can purchase the inventory before anticipated price increase. This

will lead to decline in cost of production.

Benefit in production: finished goods inventory serves to

increase the production and sales. This enables production at a

different rate from a sale. In production it can carried on at a

higher rate or lower than the sales. This would be a special

advantage to the firms of seasonal character. In their cost, the

sales rate will be higher than the production rate during peak

season and lower during off-season. The level of production is

more economical and as it owes to the firm to reduce.

Benefit in sales: The maintenance of inventory also helps firm

to enhance its sales. If there is no inventory of finished goods, the

level of sales will depend upon the level of current production. A

firm will not be able to meet the demand immediately. If the firm

has inventory, actual sales will have to depend on lengthy

manufacturing process. This inventory serves as a bridge between

current production and actual sales.

Inventory control: inventory control means regulating the

availability of right materials of right quantities with a view to

maintain the economic and uninterrupted flow of production

maintenance of activities.

SMU MBA 2016

Page 21

STUDY ON WORKING CAPITAL MANAGEMENT

Cost of holding inventory:

The costs associated with handling inventories are as follows:

1. Ordering cost

2. Carrying cost

Ordering cost: the term ordering cost is used in case of rawmaterials. They include the costs incurred during the activities of

requisitions, purchase, ordering, transporting, receiving,

inspecting, and storing.

Ordering costs increase with the member of orders

more frequently the inventory is acquired the higher will be the

firms ordering cost on the other hand, if the firm maintains large

inventory level, the ordering cost will be less.

Economic ordering quantity: in that inventory level which

minimizes the total of ordering costs and carrying costs.

At this level of ordering the firm acquires the raw materials with

minimum ordering cost and also further carrying costs are also

minimized.

This can be mathematically calculated by applying the following

formula

EOQ=2AO/C

Where A= Annual requirements

SMU MBA 2016

Page 22

STUDY ON WORKING CAPITAL MANAGEMENT

O=ordering cost/order

C=Carrying cost/ unit

Reordering level: It is a point where orders for supplies of

materials have to be placed. The point is fixed somewhere

between the maximum and minimum point in such a way that

quartile available between minimum level and this point is

Adequate to meet the requirements of production until the fresh

supply are received.

acquiring

Reordering level = Minimum + (time in

* rate of

Level

materials

consumptions)

ABC Analysis system: Under this system all items are grouped

into three categories ABC. A being the most important and C

being the least important. The classification is made on value

wage rate and critically of items. After classification as AB&C

they are ranked by their values. With the help of this firm finds as

to what percentage of items should be held and for what

percentage of value.

RATIO ANALYSIS

Ratio analysis is one of the most powerful tools of financial

analysis. it is the process of establishing and interpreting various

ratios for helping in making certain decisions. The ratios may be

SMU MBA 2016

Page 23

STUDY ON WORKING CAPITAL MANAGEMENT

used as a symptom like blood pressure, the pulse rate or the body

temperature and their interpretation depends upon the caliber

and competence of the analyst.

The ratios are classified into five types namely:

Liquid ratio, current movement ratio, long term financial position,

profitability ratio, and capital structure ratio. As for as study of

working capital management is concerned, only the liquid ratio

and current asset movement ratio needs to be employed.

Meaning of Ratio

The relationship between two figures expressed

mathematically is called ratio. It is a numerical relationship

between two numbers which are related in some manner..

Definition of Ratio

According to accountants Handbook by wixon, kell,

and Bedford, a ratio is an expression of the quantitative

relationship of between two numbers .

According to James.c, van harne, ratio is a

yardstick used to evaluate the financial condition and

performance of a firm, relating to two pieces of financial data to

each other.

Importance of ratio analysis:

It is an important technique of financial analysis. It is

a way by which financial stability and wealth of a concern can be

SMU MBA 2016

Page 24

STUDY ON WORKING CAPITAL MANAGEMENT

judged. The following are the main points of importance of ratio

analysis:

Useful in financial position analysis.

Useful in simplifying accounting figures.

Useful in assessing the operational efficiency.

Useful in forecasting purpose.

Useful in locating the weak spots of the business.

Useful in comparison of performance.

Limitations of Ratio analysis:

Ratio analysis is one of the most power tools of financial

management. Though ratios are simple to calculate and easy to

understand, they suffer from serious limitations.

1.

2.

3.

4.

5.

limited use of single ratios

Lack of inadequate standards

Price level changes

Limitation of accounting records

Differences in def

RECEIVABLES MANAGEMENT

Accounts receivables occupy an important position in the

structure of current assets of a firm. The term receivables defined

SMU MBA 2016

Page 25

STUDY ON WORKING CAPITAL MANAGEMENT

as, dept owned to the firm by customers arising from sale of

goods/services in ordinary course of business.

Accounts receivable management means making decisions

relating to the investment in these current assets as an integral

part of operating process, the objective being maximization of

return on investment in receivables.

According to Joseph, The purpose of any commercial

enterprise is the earning of profits. Credit in itself is utilized to

increase sales, but sales must return a profit.

Receivables management is the process of making

decisions relating to investment in trade debtors. The objectives

of receivables management is to promote sales and profits until

that point is reached, where return on investment in further

funding of receivables is less

Characteristics of receivables :

Risk involvement : receivable invoves risk, since payment

takes in future, and future is uncertain . so they should carefully

analysed.

1) Based on economic value : accounts receivables based on

economic value. The economic value in goods or services

passes to the buyer currently in return thr seller expects an

SMU MBA 2016

Page 26

STUDY ON WORKING CAPITAL MANAGEMENT

equivalent value from the buyer latter than the cost of funds

raised to finance that additional credit.

2)Objectives of Receivables management:

The

following

are

the

main

objectives

of

accounts

receivables management:

Maximizing the value of the firm:

The basic objective of debtors management is to maximize

the value of the firm by achieving a tradeoff between liquidity and

return.

The main purpose of receivables management is to minimize

the risk of bad debts and not maximization of order.

3.Optimum investment in sundry debtors:

Credit sales expand, but they involves block of funds, that

have an opportunity cost, which can be reduced by optimum

investment in receivables. Providing liberal credit increases sales

consequently profit will increase, but increasing investment in

receivables results in increased costs.

4. Control and Cost of trade credit:

When there are no credit sales, there will not be any trade

credit cost. But credit sales increases profits. It is possible

only when the firm is able to keep the costs at minimum.

SMU MBA 2016

Page 27

STUDY ON WORKING CAPITAL MANAGEMENT

Benefits of receivables mangement:

Increased sales: providind goods or services on credit

expands sles, by retaining old customers and attraction of

prospective customers .

1) Market share increase : when the firm is able to retain old

customers and attract new customer automatically market

share will be increased to the extent of new sales .

2) Increase in profits : increase sales leads to increase in

profits, because it need to produce more products with a

give sales fixed costs and sales of products with a given

sales network, in both cost per unit comes down and the

profit will be increased .

Establishing

optimum

credit

policy

or

influencing the size of accounts receivables:

A firms accounts receivables depends on

1. Volume of credit sales.

2. The collection policy/credit policy.

SMU MBA 2016

Page 28

Factors

STUDY ON WORKING CAPITAL MANAGEMENT

The volume of credit sales is the first factors which

increases or decreases the size of receivables. The higher the part

of credit sales out of total sales, figures of receivables will also be

more or vice versa.

A firm with conservative credit policy will have a low size of

receivables while with a liberal credit policy will be increasing this

figure.

Establishing of credit policy involves determination of the

level of credit sales, credit standards and credit terms.

Establishing of collection policy means the

determination of policies and procedures to be followed for the

collection.

Control of accounts receivables is maintenance at the

minimum possible level. Tools for control or management of

accounts receivables are many.

Effectiveness

of

accounts

receivables

can

be

ensured through certain techniques or tools:

1. Formation of suitable credit and collection prices.

2. Computation of debtors turnover ratio and average

collection period.

SMU MBA 2016

Page 29

STUDY ON WORKING CAPITAL MANAGEMENT

3.

Preparation of using schedules and accounts

receivables.

Formulating suitable credit and collection policies ensure

effective control over accounts receivables.

By computing the debtor turnover ratio and average

collection period of the current year and comparing them with

previous year for making enquiry into the under increase if any

accounts receivables can be controlled. They are calculated as:

Credit

sales/sales

Debtor

turnover

ratio

=-----------------------------------Average accounts

receivables

365 days

Average collection period =

-------------

Ageing

DTR

schedule

break down the receivable at a point of time into different age

SMU MBA 2016

Page 30

STUDY ON WORKING CAPITAL MANAGEMENT

groups account to the length of time for which they are

outstanding. It helps to spot out the slow paying debtors.

INDUSTRY PROFILE

Birth of the automobile industry

The history of the automobile industry actually

began about 4000 years ago when the first wheel was used for

transportation in India. Several Italians record design for winddriven vehicles. The first was guido da Vigevano in 1335. It was

also never built. Later Leonardo da Vinci designed clockwork

driven tricycle with tiller steering and a differential mechanism

between the rear wheels.

The origin of the machine tools industry can be traced to

the human civilization. In the stonage, Man first learnt to make

round whole s in stones us in hands to rotate wooden sticks while

pressing sand against the surface being worked upon. Later on

man learnt to use the ropes and the bow string to rotate the tools

much faster rate.

The history of the bow-drives turning lathes, for making

wooden ornaments, has been traced to a far back as much as

SMU MBA 2016

Page 31

STUDY ON WORKING CAPITAL MANAGEMENT

5000 B.C. Relatively those sophisticated foot,

driven tuning

lathes has been found depicted in 14th century miniature by a

French scholar. By the year 1568, a lath using a pedal and wood

spring and a tool rest was in use for making articles like eating

plates, flasks, wind instruments, vessels and furniture parts etc a

separate drive in for of a pulley also appeared around that time.

Specialized turning shops producing only wooden dishware

were since from the 17th century. The 18th century saw the use

of water power and horse power for driving laths and its use in

the production of highly complicated articles such as vehicles,

tables, ornaments and snuff boxes etc, made of wood and bone

also precision parts for use i

watch manufacture. around 1800

A.D the first shaping machine with a crank-connecting rod

mechanism was put in to use until the advent of the first

revolution that is till about 1750, skilled craftsman and each

machine tool made machines along time but the requirement of

mass production resulting from the industrial revolution made it

necessary to create machine tools in order to produce other

machines. Consequently the development

become much faster.

SMU MBA 2016

Page 32

in the tool technology

STUDY ON WORKING CAPITAL MANAGEMENT

The most rapid growth of machine tools industry and

technology has occurred in the 20th century.

DEVELOPMENT OF FORGING COMPANY

Notable achievement of the past century is new tool such as

carbides and oxides, special purpose machines for flow line

production machining heads, transfer machines numerically

controlled machine tool development of robots, automate guided

vehicles (AGVs) and flexible manufacturing system.

The first numerically controlled machine was developed in

1951 and in these modes: data was fed by punched tape. This

was now developed into computer-controlled machine tool. Each

machine has a separate computer attached to machine and it can

be programmed, thus eliminating punched tape. These are called

computer numerical control or CNC machine. More powerful

computers are used to operate more than one machine. These

machines are called direct numerical (DNC) machines.

A new

type of machine called machining center has an array of the tools

for the purpose. The machine can choose and pick the desired

tool and put it on the machine. With the above mentioned,

SMU MBA 2016

Page 33

STUDY ON WORKING CAPITAL MANAGEMENT

development experts are now thinking of having a completely

automatic factory. In such a factory there would be no work

experts for maintenance purpose. It would be completely

managed by computer with the help robots and AGVs.

The architecture of such a factory would quite different from

the present day factory. It has no windows, no lighting, no

canteens

and

other

facilities

required

by

the

workers.

completely automatic factory has got to come; ever-complete

automation in section has been successfully achieved.

In todays market the demand for forged components is high

and it is increasing day by day. The requirement of these

components is very high in the automobile industry. Since, the

Automobile industry is not able to produce the components,

so that the forging industry is necessary.

In the todays market the automobile industry is growing

at a faster rate, along with this forging industry is also growing

faster.

SMU MBA 2016

Page 34

STUDY ON WORKING CAPITAL MANAGEMENT

COMPANY PROFILE

ESTABLISHMENT OF DISA & NATURE OF WORK

CARRIED ON

Established in the year 1987

SMU MBA 2016

Page 35

STUDY ON WORKING CAPITAL MANAGEMENT

Managing director: D.R.subramanya, B.Sc,

B.E.Mechanical

Located about 70kms(45miles) from Bangalore

ISO/TS 16949: 2002 certified company

TPM being practiced

Worked as an ancillary to M/s KSSIDC for about 3 years

to manufacture forged hand tools.

Company became independent in the year 1990

Since then, we have diversified into manufacture of small

precision forged components both horizontal and vertical forgings.

They specialize in the manufacture of arm valve rocker, gear shift

fork, connecting rods, control levers, pump barrels for diesel

engine application, Gear shafts, drive shafts, rotor forge and

various other precision forged components.

we are single source to:

1. M/s SEPL( for some components)

2. M/s MICO-BOSCH for their control levers

3. M/s Delphi TVS Diesel system for their vertical forgings

( import substitution)

4. M/s Stanadyne Amalgamation (100% EOU)for their pump

barrel forgings.

In October 2006 company became subsidiary of M/s

Sansera Engineering pvt. Ltd.

SMU MBA 2016

Page 36

STUDY ON WORKING CAPITAL MANAGEMENT

Scope

Manufacture, sales and supply of precision forged rocker

arms, connecting rods, Gear shifters, levers, shafts, flanges, for

automotive applications. without element 7.3 (product design)

Vision:

To achieve and maintain leadership in precision forging

industry is through customer satisfaction and improvement

methods.

Mission:

To give superior products and service to automobile

industries to maintain market leadership through quality, cost

efficiency and modern manufacturing technology.

Board of directors:

1 D.R Subramanya

Functional heads:

1) D.R Subramanya -Managing Director

SMU MBA 2016

Page 37

STUDY ON WORKING CAPITAL MANAGEMENT

2) D.N Nagakumar - Plant manager

3) D.S Ananth - Administration manager

Classification of employees:

In Disa Private Limited the employees are classified in to three

groups,

1 Administrative staffs (Members).

2 Union (Members).

3 Casuals (Members).

SMU MBA 2016

Page 38

STUDY ON WORKING CAPITAL MANAGEMENT

ORGANISATION CHART

SMU MBA 2016

Page 39

STUDY ON WORKING CAPITAL MANAGEMENT

Managing Director

Admin

Manager

Customer

Asst. Accounts Mgmt

Office. Asst. cum typist

Representative

Personnel OfficerRepresentative

In chargeIn charge

In chargeIn charge

In charge

In charge

In charge Stores/material

In charge

In chargeIn charge

ProductionProcess

Purchase Quality

Design

Dies and tools

Development

Maintenance(mechanical)

Maintenance(electrical)

Forge Assistant

shop incharge(shift

Assistant

(shift

Inward

wise)

Assistant

(shift

wise)

inspection

wise)

Production

(shift3 wise)

quality

Final

3 quality

inspection

inspection

inspection

6 1&2

quality

Assistant

1,2

shift

inspection&2

&3 shifts

Assistant

(shift wise)

shifts

Assistant

(shift wise)

(shift wise)

Hammer wise line inspector

SMU MBA 2016

Page 40

Plant

Manager

STUDY ON WORKING CAPITAL MANAGEMENT

Quality policy

To achieve and maintain leadership in precision forging

industry by customer satisfaction and continuous improvement

methods.

Quality objectives

Zero customer complaints

Maintain 100% delivery performance

Maintain in-house rejection within 2%

Suppliers:

The

Disa is getting raw material from,

Sansera engineering private limited

Mukund private limited.

Sun flag private limited

In

char

ge of

CN

C

Assis

tant

(shif

t

wise

Area of operation-Global/National/Regional:

The companys products are sold In the Inland India. The major

customers are:

Bosch

Delphi TVS Limited

Sansera Engineering Private Limited.

BUSHARUS

SMU MBA 2016

Page 41

STUDY ON WORKING CAPITAL MANAGEMENT

Ownership pattern:

Disa India is a private limited company. Managing director

Mr. M.S.Subramanya holding 60% of the shares of the company

and Sansera Engineering Private Limited holding 40% of the

shares of the company.

LAND & BUILDING

Total Area

: 150,000 sq ft

Built up Area

: 70,000 sq ft. (46%)

Open Land

: 80, 000 sq ft ( 54%)

Facilitated and buildings:

Infrastructure:

58,000sq.ft. of built up area housing forge shop, heat

treatment, die shop, is fishing section and administration.

67,000sq.ft. area of open grounds for storing, movement of raw

material and finished products leaving sufficient space for

expansion of the unit covers of total area 125,000sq.ft.

SMU MBA 2016

Page 42

STUDY ON WORKING CAPITAL MANAGEMENT

Plant and machinery:

1)Hammer/vertical forging

Power press

Trimming press

Induction heater

2)Press/horizontal forging

Power press

Trimming press

Material gathering machine.

3)CNC (computer numerical control)

PRODUCTS IN DISA

SMU MBA 2016

Page 43

STUDY ON WORKING CAPITAL MANAGEMENT

SMU MBA 2016

Page 44

STUDY ON WORKING CAPITAL MANAGEMENT

SMU MBA 2016

Page 45

STUDY ON WORKING CAPITAL MANAGEMENT

SMU MBA 2016

Page 46

STUDY ON WORKING CAPITAL MANAGEMENT

Achievements and Awards:

zero PPM award from BOSCH

partnership for leadership wander award from YAMAHA.

efficient productivity from BOSCH

company achieved ISO/TS16949-2002

TECHNITIUM-2009 from Siddaganga Institution

Best supplier Award-2009 from BOSCH

Best supplier award-2009 from DELPHI TVS For consistent

Award Quality Rating

COMPETITORS INFORMATION

Disa is facing stiff companies after liberalization. Some of the

major competitors are:

SMU MBA 2016

Page 47

STUDY ON WORKING CAPITAL MANAGEMENT

Bharath precision and forging private limited

Kalyani forge private limited

Bill forges private limited

Lakshmi forge private limited

Diagram forging private limited

Blue Stamping Forging private limited

WORK FLOW MODEL:

Send back

to suppliers

Raw Material Inspection

Rejected

Accepted

Shearing

Rejected

Scrap

Accepted

Forging

Non confirming product

Trimming

Rejected

Scrap

Accepted

Normalizing

SMU MBA 2016

Page 48

STUDY ON WORKING CAPITAL MANAGEMENT

Rejected

Scrap

Shot Blasting

RW

Final inspection

Rejected

Scrap

Dispatch

RW

Manufacturing Facility:

FORGE SHOP

Drop hammers:

i.

1250 Kgs: 1 no.,

ii.

1000 Kgs: 2 no.,

iii.

750 Kgs: 1 no.,

iv.

500 Kgs: 2 no.

(All are equipped with induction heating facility; trimming presses

and conveyors for movement of material from hammers to

trimming press).

Hydraulic Drop Hammer(imported):

1. 500 Kgs: 1 no.

Forging press:

SMU MBA 2016

Page 49

STUDY ON WORKING CAPITAL MANAGEMENT

1. 1No. 560 Ton(imported) with 200 kw Induction

Heater and End heating facility.

2. 2Nos. 350 Ton (Tos make)with 50kw gathering

machines for manufacturing vertical upset

Forging-9Nos.

3. 1No.300 Ton(Tos make) with 100 kw Induction

heater.

4. 250 Ton power press: 2Nos.

Continuous Electric Furnace for

Normalizing:

50 kw 2 No.,

100 kw

200 kw

(Total 400 Kgs per hour normalizing capacity with PLC control

and SKADA Software).

Trimming press: 50-150 Tons capacity(10No.s)

Bogie Hearth Batch Furnace: 50kw(2No.s)

Pit type Furnace: 27kw(2No.s)

Magnoflux Machine: 3No.s

Shot Blasting Machine : 1No.(Disa India Ltd)

SMU MBA 2016

Page 50

STUDY ON WORKING CAPITAL MANAGEMENT

Die Welding Facility: Technology got from Italy

CNC Turning Centre: 5No.s

LIST OF CUSTOMER V/S PRODUCT

Sl.

Customers

Products

No

Rocker Arms,

Gear Shift Forks,

M/S Sansera

1.

Engineering Pvt. Ltd.

Connecting Rods,

Crank Shafts.

Control levers,

Tension Levers,

Spanners,

M/S Motor Industries

2.

Co. Ltd. (BOSCH

Drive Shafts,

Group).

Pump Barrets etc.

Vertical Forgings

M/S Delphi TVS Diesel

3.

Links,

Systems Ltd., Chennai.

(Rotors, Drive

Shaft, Pump

Barrel)

for diesel

pumps.

SMU MBA 2016

Page 51

STUDY ON WORKING CAPITAL MANAGEMENT

M/S Stanadyne

4.

Barrel Forgings.

Amalgamations Pvt.

Ltd., Chennai.

5.

M/S MIVIN Engineering

Gear Shaft (Driver

Technologies Pvt. Ltd.,

and Driven) for

(REXROTH BOSCH

their gear

group)

pumps.

Cross Head for

6.

M/S Quest Machining

and Manufacturing Pvt.

Ltd.

SMU MBA 2016

Page 52

Engine Breaking

System

(Deemed Export).

STUDY ON WORKING CAPITAL MANAGEMENT

COMPANY GROWTH

CHART

Chart Title

3000

2500

2000

1500

1000

500

0

FY 09-10 FY 10-11 FY 11-12 FY 12-13 FY 13-14

FY 14-15 (Projected)

SMU MBA 2016

Page 53

STUDY ON WORKING CAPITAL MANAGEMENT

SPECIAL CERTIFICATES

EXPANSION AND FUTURE PLANS

The company is planning to expand and grow in

forging well as machining sectors.

2000 tons press is being planned.

1010 tons hot forging presses is being planned.

One more 1600 Tons hot forging press is being planned

Machine shop is being planned with CNC Turning centre, CNC

Milling and all other related machinery.

Cold forging facility is being planned.

Die milling facility is being planned

ISO 14001 systems and procedures.

Around 6 to 10 turning centers.

Cold forgings.

To be a machining leader in the precision forging and

machining industry by investing in the latest technology, develop

infrastructure to meet the increasing Quality and Quantity

SMU MBA 2016

Page 54

STUDY ON WORKING CAPITAL MANAGEMENT

requirements of the customers both inland and overseas and

create a good working environment for our work.

SWOT ANALYSIS

STRENGTHES:

I.

Major strength: Two and four wheeler automobile players are

its customers.

Good infrastructure for present and future requirements

Customers are satisfied with their quality standards

Good financial backup

They are paying good salary and it is above Tumkur cost of

living.

Emphasis on exports.

II.

III.

IV.

V.

VI.

WEAKNESSES

I.

II.

Yielding to customer pressures.

Company premises is far from customer places.

OPPORTUNITIES

Customer wants their products in machined conditions. So good

chance to the company for expansion and are diversification.

I.

II.

Few customers but high volume demand

They can improve good relationship with customers.

SMU MBA 2016

Page 55

STUDY ON WORKING CAPITAL MANAGEMENT

III.

To attract more customers there is need to invest money in

marketing for bringing new customers to the company.

THREATS

I.

II.

III.

IV.

V.

High competition

High price sensitive customers.

High quality expectation from customers.

Lower capacity of machine

Tax and regulatory structure

SMU MBA 2016

Page 56

STUDY ON WORKING CAPITAL MANAGEMENT

RESEARCH DESIGN

RESEARCH:

A systematic search for an answer to a question or

solution to a problem is called research.

According to Black and Champion, Scientific research

consists of obtaining information through empirical observation

that can be used for the systematic development of logically

related among variable.

RESEARCH DESIGN:

A research design is a logically and systematic plan

prepared from directing a research study. It specifies the

objectives of the study. Its the methodology and technology to be

adopted for achieving the objectives. It constitutes the blue print

for the collection, measurement and analysis of data.

Definition:

According to Clair Seltiz, a research design is a logical

and systematic plan prepared for directing a research study. It

specifies the objectives of the study, the methodology and

techniques to be adopted for achieving.

SMU MBA 2016

Page 57

STUDY ON WORKING CAPITAL MANAGEMENT

STEPS IN RESEARCH DESIGN:

Identification and Selection of research

problem

Prepare

list

of

information

Design

the

data

collection

Select

sample

Determine

the

Sample size

Organize

field

work

Analyze the data and report the

SMU MBA 2016

Page 58

STUDY ON WORKING CAPITAL MANAGEMENT

findings

Title of the study:

A study on Working Capital Management at Disa

Tools and Forgings Pvt . Ltd. Anthrasanahalli .

Place of the study

Fitwe l Tools and Forgings Pvt. Ltd.

No.5, K T Complex,

Anthrasanahalli,

Tumkur 572106,

Karnataka-India

Statement of the problem:

WORKING CAPITAL MANAGEMENT

To analyze and evaluate financial position of Disa India

Pvt. Ltd., with specific regards to working capital and related

ratios.

Objectives of the study

To know the existing system of working capital management

in Disa

SMU MBA 2016

Page 59

STUDY ON WORKING CAPITAL MANAGEMENT

To know the technique and objectives of cash management

To analyze the changes in working capital

To study the liquidity position of Disa

To study the management of inventory in Disa

To study above the future trend of working capital

management

Research methodology

The data for the study include both primary data and

Secondary data collection method.

Primary data

Primary data means the primary information collected

for a specific purpose and gives accurate data relevant

information and it is generated in an investigation according to

the needs of the problem.

Primary data collected from interviewing and

interacting with concerned official from various departments of

Disa India Pvt. Ltd.

Secondary data

Secondary data can be defined as data collected by

secondary source for purpose other than solving problem being

investigation and are previously mean for another purpose.

Secondary data is collected through company

journals , books, company website, and from the audited reports

of the company.

SMU MBA 2016

Page 60

STUDY ON WORKING CAPITAL MANAGEMENT

Tools :

Three years balance sheet and profit & loss

account stated in the annual reports were used

for analysis.

Working capital and concerned ratios were used

as a tool of analysis, based upon this

performance was evaluated and suggestions

were made.

Procedure for data collection

There are three processes for analyzing the data,

Collection of the information

Analyzing and interpretation

Findings and suggestions

Collection of the information

Primary data

Secondary data

Analyzing and interpretation

Ratios are the main tools and technique for analysis

and interpretation of working capital management.

Findings and suggestions

SMU MBA 2016

Page 61

STUDY ON WORKING CAPITAL MANAGEMENT

Findings and suggestions are drawn from the data

what I gathered from the survey.

Limitations of the study

The analysis of the study is based on the

available data only.

Due to time constraint the study is

restricted to 10 weeks only

As the executives were found to be

always busy in the work it was difficult

to get the data from them.

This study has analyzed with only few

ratios

Chapter scheme:

Chapter.1: introduction

The chapter deals with the introduction of the topic

and its background.

Chapter.2: industry profile

this chapter deals with the brief history of forging industry.

Chapter.3: company profile

SMU MBA 2016

Page 62

STUDY ON WORKING CAPITAL MANAGEMENT

This chapter explains various significant information of

the DISA INDIA PVT. LTD.

Chapter.4: Research Design

This chapter explains title of the study, statement of

the problem, scope of the study, tools, objectives of the study and

its limitation, methodology adopted for analysis and chapter

scheme.

Chapter.5: analysis and interpretation

This chapter deals with analysis of data by using

various ratios drawn on interpretations relating to each ratio of

data.

Chapter.6: findings, suggestions, and conclusions

Under this important aspects have been drawn

based on analysis research for providing suitable suggestions.

Remaining parts will be containing Annexure and Bibliography.

SMU MBA 2016

Page 63

STUDY ON WORKING CAPITAL MANAGEMENT

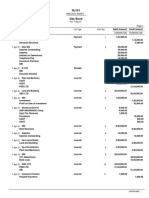

ANALYSIS AND INTERPRETATION OF

WORKING CAPITAL

Working capital is important to all type organization. Without

working capital no business organization can be carried any

activity with this reason we can say that working capital is hardly

required to carry effective and efficient activity of DISA.

Working capital is of two types:

Gross working capital

Net working capital

Gross working capital is nothing but all current assets

of the company. The gross working capital focuses on two aspects

of current asset management.

1 Optimum investment in current assets

2 Financing of current assets

SMU MBA 2016

Page 64

STUDY ON WORKING CAPITAL MANAGEMENT

Net working capital means the difference between the

current assets and current liabilities, alternative definition of

Networking is that part of the current assets, which are financed

with long term funds.

Gross Working Capital=Total current assets

Net Working Capital=Current asset-Current liabilities

Components of gross working capital

The main components of gross working capital are

1

2

3

4

Criteria

for

Inventories

Sundry debtors

Cash and Bank balance

Loans and Advances

judging

the

efficiency

of

working

capital management:

The efficiency of working capital management can be

judged through accounting ratio. The important accounting ratios

that could be used for judging the efficiency of working capital

management are:

I. Ratio Analysis

SMU MBA 2016

Page 65

STUDY ON WORKING CAPITAL MANAGEMENT

i. Current ratio.

ii. Quick ratio.

iii. Absolute liquidity ratio.

iv. Working capital turnover ratio.

v. Current asset turnover ratio.

vi. Fixed asset turnover ratio.

vii. Ratio of Current Assets to Fixed Assets.

viii. Book debts to Sales ratio.

ix. Net working capital.

II. Cash Management.

i.

Cash balance to Current Assets ratio.

ii.

Cash position

III. Receivables management.

i.

Debtors turnover ratio.

ii.

Debtor collection period.

IV. Inventory management.

SMU MBA 2016

Page 66

STUDY ON WORKING CAPITAL MANAGEMENT

i.

Inventory turnover ratio.

Current Ratio

This ratio measures the solvency of the company in

the short term. Current assets are those assets, which can be

converted into cash with in a year. Current liabilities and

provisions are those liabilities that are payable with in a year. A

current ratio of 2:1 indicates a highly solvent position. i.e., current

assets should be twice of the current liabilities. Banks consider a

current ratio of 1.33:1 as the minimum acceptable level for

providing working capital finance.

It is calculated dividing current assets by current

liabilities

Current assets

SMU MBA 2016

Page 67

STUDY ON WORKING CAPITAL MANAGEMENT

Current Ratio=-------------------------Current liabilities

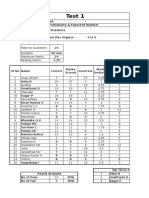

Year

2012-

Current

Current

Current

Assets

Liability

Ratio

54964152

20239088

2.72

72614053

22062187

3.29

90673361

25907525

3.50

13

201314

201415

Graph No.1

Graph showing the current

ratio

SMU MBA 2016

Page 68

STUDY ON WORKING CAPITAL MANAGEMENT

Current Ratio

140000000

120000000

100000000

Current RATIO

80000000

Current Liability

Current Assets

60000000

40000000

20000000

0

2012-13

2013-14

2014-15

Interpretation:

o

In the year 2012-13 it was 2.72. It was again increased to

3.29 in the year 2013-14. Lastly in the year 2014-15 it has

been 3.50

o From the above analysis, it is clear that the current ratio is

increasing year by year. It shows that the company

liquidity position is good.

Quick Ratio or Liquid Ratio

SMU MBA 2016

Page 69

STUDY ON WORKING CAPITAL MANAGEMENT

Quick Ratio=Quick assets/Quick liabilities

Quick assets=current assets- inventories

Quick liabilities=current liabilities-bank overdrafts

Quick ratio is used as measure of the companys

ability to meet its current obligations since bank overdrafts is

secured by the inventories, the other current assets must be

sufficient to meet other current liabilities. A quick ratio of 1:1

indicates highly solvent position. This ratio is also called as Acid

Test Ratio. This ratio serves as a supplement to the current ratio

in analyzing liquidity.

TABLE NO. 2:

SHOWING THE QUICK RATIO OF THE

COMPANY:

SMU MBA 2016

Page 70

STUDY ON WORKING CAPITAL MANAGEMENT

Year

Quick

Quick

assets

liabilities

Ratio

2012-13

38447227

23261951

1.6528

2013-14

43894152

20239088

2.1688

2014-15

56969053

22062187

2.582

GRAPH 2:

SHOWING THE QUICK RATIO OF THE COMPANY

Graph showing quick ratio

3

2.58

2.5

2.17

1.65

1.5

1

0.5

0

Graph showing quick ratio

2012-13

2013-14

Interpretation:

SMU MBA 2016

Page 71

2014-15

STUDY ON WORKING CAPITAL MANAGEMENT

The liquidity ratio of the company in the year 2012-13 was

1.65 which has increased to 2.16 and 2.58 in the year 2013-14 &

2014-15.From the above table it is clear that the concern has

favorable liquid ratio in the above 3 years.

The company

maintained to the standard i.e. 1:1. It shows the company has

repaid their liabilities immediately. The company can easily meet

all current claims, i.e. the firms short-term financial position is

satisfactory.

Absolute Liquidity ratio or Super Quick ratio:

Absolute liquid ratio is a ratio, which expresses the

relationship between absolute liquid assets and current liabilities.

Absolute liquid assets include cash in hand, cash at bank and

temporary investment. The desirable norm for this ratio is 1:2.

i.e., Re.1 worth of absolute liquid assets or sufficient for Rs.2

worth of current liabilities. Even though the ratio gives a more

meaningful measure of liquidity.

Absolute liquid

assets

Absolute Liquid Ratio =

-------------------------------

SMU MBA 2016

Page 72

STUDY ON WORKING CAPITAL MANAGEMENT

Current

liabilities

Table. NO: 3

SHOWING THE ABSOLUTE LIQUIDITY

RATIO

Year

Cash and

Current

bank

liabilities

Ratio

balance

2012-13

870395

20239088

0.04300

2013-14

956476

22062187

0.0433

2014-15

1330181

23261951

0.05718

Graph.3

Graph showing absolute liquid

ratio

SMU MBA 2016

Page 73

STUDY ON WORKING CAPITAL MANAGEMENT

Absolute Liquid Ratio

25000000

20000000

Ratio

15000000

0.04

0.04

current liabilities

0.06

cash and bank balance

10000000

5000000

0

2012-13

2007-08

2014-15

2013-14

2008-09

2009-10

Interpretation:

An Absolute ratio of 1:2 or 0.5:1 is considered as a

satisfactory financial condition the above table we can observe

that the concern has the absolute ratio above the satisfactory. It

shows the companys increasing efficiency in absolute assets and

it shows a favorable liquidity position of the company.

Current asset turnover ratio:

Assets are used to generate sales therefore a firm should

manage its assets efficiency to maximize sales. The relationship

between sales and assets is called assets turnover. The current

asset turnover ratio is the ratio between sales and current assets.

SMU MBA 2016

Page 74

STUDY ON WORKING CAPITAL MANAGEMENT

This ratio indicates how many net sales have made for every Re

of investment in current assets.

Net sales

Current Asset Turnover Ratio =

-----------------------

Current Assets

Table No. 4

Table showing the current asset turnover

ratio

Year

Net Sales

Current

Current

Assets

Asset

Turnover

Ratio

2012-

140300529

54964152

2013

SMU MBA 2016

Page 75

2.55

STUDY ON WORKING CAPITAL MANAGEMENT

2013-

162020062

72614053

2.23

209825912

90673361

2.31

2014

20142015

Graph No. 4

Graph showing the current asset turnover ratio

Current asset turnover ratio

350000000

2.31

300000000

250000000

200000000

ratio

2.23

current assets

2.55

netsales

150000000

100000000

50000000

0

2012-13

2007-08

2013-14

2008-09

2014-15

2009-10

Interpretation:

Though there is no standard ideal current assets turnover ratio,

the higher the current indication of a better utilization current

asset. From the above table it is clear that current asset

turnover ratio is In the year 2012-2013 the ratio was 2.55 and

SMU MBA 2016

Page 76

STUDY ON WORKING CAPITAL MANAGEMENT

the ratio was gradual decrease to 2.23 in the 2013-2014.

Finally in the year 2014-2015 it was 2.31.It shows that the

concern is utilizing its current assets to the better extent.

Fixed Assets Turnover Ratio:

Fixed asset turnover ratio is the ratio between fixed assets

and turnover. Fixed assets means Net fixed assets i.e., fixed

assets less depreciation. Turnover means net sales. i.e., total

sales less sales turnover.

This ratio indicates as to what extent the fixed assets of a

concern have contributed to sales. In other words it indicates the

extent of fixed assets utilized. This ratio is usually expressed as a

proportion .i.e.,

Table

Net Sales

No. 5

Fixed assets turnover Ratio =

-------------------

Table

Fixed Assets

showing Fixed Assets Turnover Ratio

SMU MBA 2016

Page 77

STUDY ON WORKING CAPITAL MANAGEMENT

Year

Net sales

Fixed

Fixed assets

assets

turnover

ratio

2012-

140300529

66891487

2.10

162020062

62324776

2.60

209825912

74672294

2.81

2013

20132014

20142015

Graph No. 5

Graph showing Fixed assets Turnover ratio

SMU MBA 2016

Page 78

STUDY ON WORKING CAPITAL MANAGEMENT

Fixed asset turnover ratio

27%

41%

32%

Interpretation:

By seeing the above table and graph we can understand that

there is are slight differences in every year from the past

three years. There were 2.10 by the year 2012-2013, then it

is increased to 2.60 in the year 2013-14 and then also have

been increased to 2.81 for the year 2014-2015. So it shows

that the fixed assets are well maintained in the company.

SMU MBA 2016

Page 79

STUDY ON WORKING CAPITAL MANAGEMENT

Ratio of Current assets to fixed assets:

This ratio will differ from industry to industry. A decrease in a

ratio may mean that trading is slack or more mechanization has

been put through. An increase in the ratio may reveal that

inventories and debtors have unduly increased or fixed assets

have been intensively used. A increase in the ratio accompanied

by increase in profit, indicates the business is expanding.

Current assets

Ratio of Current assets to Fixed assets =

---------------------Fixed assets

Table No.6

Table showing the current asset to fixed asset ratio

Year

SMU MBA 2016

Current

Fixed assets

Page 80

C.A to F.A

STUDY ON WORKING CAPITAL MANAGEMENT

assets

2012-

Ratio

54964152

66891487

0.82

72614053

62324776

1.17

90673361

74672294

1.21

2013

20132014

20142015

Graph No. 6

Graph showing current asset to fixed asset ratio.

SMU MBA 2016

Page 81

STUDY ON WORKING CAPITAL MANAGEMENT

current asset to fixed asset ratio

300000000

2.81

250000000

2.6

2.1

200000000 2012-13

2013-14

2014F.A. TURNOVER RATIO

Fixed assets

15

Net sales

150000000

100000000

50000000

0

Interpretation:

The table and graph showing the sligth differences from the

intial year to the assessment year. It is most ranging from .6

to 1.2 of fixed assets turnover ratio.

SMU MBA 2016

Page 82

STUDY ON WORKING CAPITAL MANAGEMENT

Here in this table and chart it was 0.82 in the year 20122013 and then increased to 1.17 in the year 2013-14 and

again slight increase to 1.21 in the final year i.e., 2014-15.

Book debts to sales Ratio:

This is the ratio which shows the relationship between book

debts and sales (here book debts includes both good and bad

debts).

Book

debts

Book debts to sales Ratio =

----------------- x 100

Sales

Table No. 7

SMU MBA 2016

Page 83

STUDY ON WORKING CAPITAL MANAGEMENT

Table showing the percentage of

debts to sales

Year

Book debts

Sales

Percentage

2012-

18826176

140300529

13.42

21056135

16202062

13

22956004

209825912

10.94

2013

20132014

20142015

Graph No. 7

Graph showing the percentage of debts to sales

SMU MBA 2016

Page 84

STUDY ON WORKING CAPITAL MANAGEMENT

percentage of debt to sales

Bookdebts

Sales

Percentage

250000000

10.94

200000000

150000000

13.42

100000000

50000000

0

13

2012-13

2007-08

15

2013-14

2008-09

20142009-10

Interpretation:

Decrease in the ratio shows the efficient management of

debts in the company.

The ratio of debts to sales was 13.42 during 201213.Finally in the year 2014-15 it has decrease to the

ratio of 10.94.

WORKING CAPITAL TURNOVER RATIO

Net working capital turnover ratio, is the turnover divided by

the cost of goods sold and net working capital of the company.

SMU MBA 2016

Page 85

STUDY ON WORKING CAPITAL MANAGEMENT

Working capital turnover ratio =

net sales

Net working capital

TABLE No 8

SHOWING THE WORKING CAPITAL TURN

OVER RATIO

Year

Net credit

Net

Ratio

Sales (Rs.) working

capital

(Rs)

2012-13

2013-14

2014-15

SMU MBA 2016

113229663

23417386

140300529

34725064

152020062

50551866

Graph No. 8

Page 86

4.8353

4.0403

3.0072

STUDY ON WORKING CAPITAL MANAGEMENT

Graph showing working capital turnover ratio

Working capital turnover ratio

28%

37%

35%

Analysis and interpretation:

The working capital turnover ratio of the company was 4.83

in the year 2012-13 which has decreased to 4.04 in the year

2013-14 and which decreased to 3.0072 in the year 2014-15.

Analysis of Cash management:

Cash balance to current assets ratio:

As cash in hand and at bank is the most liquid form of all the

current assets. The ratio of cash to current assets will indicate the

SMU MBA 2016

Page 87

STUDY ON WORKING CAPITAL MANAGEMENT

liquidity position of a company much better than the earlier

ratios. While a high ratio is indicative of better liquidity the

opportunity loss sustained by the company by keeping a large

amount of idle cash should be taken note of.

Cash balance

Cash balance to current assets ratio =

---------------------

Current assets

Table 9

Table showing balance to current asset ratio

Years

Cash

Current

balances

assets

2012-2013

870395

54964152

0.015

2013-2014

2956476

72614053

0.040

2014-2015

5987723

90673361

0.066

SMU MBA 2016

Page 88

Percentage

STUDY ON WORKING CAPITAL MANAGEMENT

GRAPH 9

Graph showing balance to current assets ratio

Balance to current asset ratio

2012-13

2013-14