Академический Документы

Профессиональный Документы

Культура Документы

Gemb 1

Загружено:

LUEИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Gemb 1

Загружено:

LUEАвторское право:

Доступные форматы

.", ;,.

~, '

" PRIVACYPOUCY It's YourCho!ce - Yoo haVe the rklhtlD ~wt ofourmanng ofinformallon wiIh

cst.an tliRI P<ries, as desaIbed"beIaN. To opt out pleaSe call us Ioft.free CReDlF~aexaAENT

:ion and at 1-877-28U389 or write to us at P.O. Bole 6160, RapId ~. SO 5T11l9

only to 6160. If you have previously Informed us of your prefenmce, you do 11 GENERAL This Agreement ('AQreement') governs your Select

Credit not need to do so again. Comfort credit card account rAccounrj. In this Agreement and your

bnling statement iStatement'), "we'. 'us', and 'our' means GE Money

Bank, 4246 South Riverboat Road, Suite 200, Salt Lake City. UT

~123-2551. "you' and "your" means all persons who we approve to

use the Account; and 'Card" means ypur Select Comfort Credit Card.

The effective data of Ibis ~reement WlU be the eai1ier of (0 Ihe date you

submit an Actount applicalion 1!Iat is approved by us. or 6i) Ihe IiIst date

lila! you or someone authorized by you uses 1I1e Account

2. USE OF ACCOUNT. You may use your Account to purchase gOOds

or services ("Purchases") or to obtai! cash advances by writing checks ,

\Checks; we may provide to you from lime to lime or by other means

as described~'Jfi ~ W!'l mey make available ("Casb Advances"), up to any credit limit we

f!IY'asdesaibedlnlhls mey estabUsh ("Credit ll!llir). We may Imlt your Cash Advances to a

a:.nllooe 10 share pprlion of your credit limit (your 'Cash Umlt') and If we do so, you

." transldons and agree not to lake Cash AdVances in e.xteSS oi your Cash Umlt We

Ily. may decline to authorize any Purchase or Cash Advance or change

If you have a joint a:x:ount, a request by one PCI1v I'Iil appy 10 aJ paifies on your Credit Limit at any time. You may use your Account only for

lheacooJlt . personal, family or household purposes.

i

• We will process your ~uesi promplly. However. it may take us several

;,' weeks iii eIlSUJe lhct III ieCooIs are ubdaIed wiIh you ~ In tle 3. PROMISE TO PAY. You promise to pay us for all crecfll that we

i!1lerim. you may coothIe to be induded in prograns as desailed above. eXtend on your Account for Purchases. Cash Advances. and all other

A!!!9. - ~ l!!IlIJest is ~, you [IlIi!Y sOO I!fI conlacled bv our amounts owed to us under the lerms of this Agreement

aIIiliates IriIIor orner c:anpliIlIes baseQ on 1II1lt O'M\ in!

:. ~ 4: PERIODIC FINANCE CHARGES.

• Even if)'OU OIlt rut. we IIIiII conti1ue to prcMde )'OU wiIh biling ilse!Is anti

mal notices Of spec::iaI oIfets and new benefils.

A. The !olaf pf!I1odlc Flnance Charge imposed in ablililg pl!rlod rcur

renl BiIIiI1g Period") is the total of Q) the dally pEllfodlc fk1ance Char

ges

Iluson

-,PUrchases

_..and _. GasIl."Advances

- in-,the Current Billing

Period,

'.:

Cash Advance balance aiId any balance of

Purcl1asi!s made-under any Special Payment Plan. in fuR on or be

fool Ihe Payment Due Oa!e for such billing period. In addition, there .

wi! be no period'1C finance Charges imposed in lIle Current BjUi~

Period on any new Purchases in Ihe Previous Bi(1I1!J Period if daily

Finance Charges were imposed al 1!Iose new Purchases In the

',' PrevIous BDling Period.

B. The periodlc Finance Charge Im(:losed in Ihe CtlTent Bilftng Period

on Purchases or Cash AIMlnces for the Curreill Billng Period Is de

mined by mullipl)'ing the Periodic Rate for 1I1e CUrren! Billing Per

iod times Ilia Daily Balances of Purchases or Cash Advances in the

Current BiIUng Period to determine the daily!leliodic Finance C/lages,

and adding loge1i1er those dally periodic F1nance ChaJges for each

day in the Current E "" - - - .

posed In the Currenl

ous Billing Period Is dateriiilned by multiplying the Periodic Rate for

the Current Bi111n9 Period times the Dally Balances of new Pur

chases in 1I1e Pr8VlOUS Billing Period to de!ennine the daily period'lC

Finance Charges. and addklg toge1her those daily peIiodiC Flnance

Charges for each dlrf in Ihe Previous Billing "Period. However,

there Is a minimum penodic FINANCE CHARGE of $1 for a billing

period in which a periodic Finance Charge is assessed

C. The periodic Rla1oe=es

Inllmld under Brrf

Wll be deIemiIed sepa!lIIliIy for chlilges

Payment Plan in aoco:danoe With Ihe fIlIms

esl!tliished for such • Payment Plan. \fJu tmdersland end (!J)o

6101/05 kncINIedge that this Account prr1Ifdes for the dailyoompoundi"J of per

6101/05 M-75474 iod/r: FInance Charges.

(11) (12) (1)

, ;;:;:::'~' .. '

5. PERIODIC RATES. E. We reseMl!he ~ht III obIaIn paymmt eIeI:toricaly for t!S'fI cited! «

dher instrumeIlt flat SEnd III us I7J lnitiatir1! I.Il ACH (eIedrofiC)

A. TIle Periodic Rate for your Dally Bliance of Purchases is _lIle Pur debit In the amoont ~r check IX" insl1unenIIll)'Wl" aa:.oont. Yotr

chase Standard Rate, unless the Delinquency Rate applies as de dIeck IX" iIem v.t nctbe reIumed III you by us ri yru bank.

SCfIled below. The Purchase standard Rate for a billing oeriod is

the greater of Iil!he Prime Rate plus 15.90%. times 11365, or (i)

O\'l .06011% (ANNOAL PERCENTAGE RATE 21.90%). TIle Pun::hase

Standard Rate shml not exceed .0678% (ANNUAL PERCENTAGE

RATE 24.75%~ The 'Prime Rate" for a liJIielthe I\i9hest

9. FEES. You agree lr.l pay IlIt foIlowIlg fees.

A. AI..aIa Payment Fee, if we have not received your MnilIlIIl Pay

bank prine ban rate as publl\lhed in Jhe w~

Money Rates section on lila fillll buSIIless

i:le In i1s

9 e fin;t

ment by llie Payment Due cae sIlrNm on your Statement The a

mount Of !he I.ale PaymeIi Fee wi be based on yaK New Bliln:e

attheendcfthebJingpaiod EiIldi"G derlhe PaymertDue Date. The

day (If the blUIng period. As of June 1 2005 the Pun::hasi! standard be treated as zero. Pur

' late ~ Fee Wlrbe $15 fir a New Bam:e under $99.99; $29

Rlite was .0600% (ANNUAl PERC~TAGE RATE 21.1IQ%). in the DailY Balance of

for a NeN BaIEme d $100.00 III $999.99; all $35 for a BImle of

, at our option, as of lila

B. The Periodic Rate for your Daily Balance of Gash Advances is the un!. $1000.00 or more.

Gash Standard Rate, unless !he DelinQuency Rate applies as de B. A ReIumed CIlec:k Fee of $00 if!l1Y check IX" oilier ins1ument sent Ib

scribed beklw. The Cash standard Rate for a bUIina pe!Ic.Jd 1$ the us, or !I1Y eIecIronic: payment au1horization you provide us In ~

~

of ~l the Pl1me Rate Dlus 15.90%. times 1/365; or rril .0600% men! on yoor Aa:ount, IS not honored upon fi"sl presenment, even if

NUAL PERCENTAGE RATE 21.90%). The Cash standard !he dieck, irnIlnIment « eledronic authoIil:etion Is IiiII!ir honored.

shall not exceed .0678% (ANNUAl PERCENTAGE RATE

24.15%~ As of June 1, 2005,1he Cash standard Rate was .0&00% C. AA Over !.knit Fee cf $30 lOr each billing period II ~ your New

(ANNUAL PERCENTAGE RATE 21.9O%J. Balance as ~ on your SIaIimEI1t exceeds yoor Credi umt. We

may assess an Over [/d Fee even If we autIiaizs Ihe Ir.:1nSactions

on yoor Aa:olI1t 1hit caused you 10 exceed your ereat UTi IX" if you

exceed your Credit UIIIt as a reSlft of unpaid FIoaooe Chages. !he

IliIing of de!en"ed accrued Finar1C8 Clages or other E.

D. ATlllnsadioo Fee for each Cash Mtance Il1at posts to your AD

pay at least the f.tnimum Pavrnent on your Statement CWlI. This fee wi! be a FINANCE CHARGE IlQualIo 4% of the

rlt Due Date shown on the'Statement: You may pay amount oflhe Cash Advance, will a rrininlrn d $5 and a maxmum

:.: of $50.

Your Mlnlmuni PaY

New BIiance minus

It Plan that Involves E. A Returned Loan CIleck Fee d $20, on your kcourt In the event

next highest dollar! any Check on}'Ol,ll" A.ccoont Is not honOrl!d by us because (i) the

Minimum Paymen! DOrtion of your Qid Umit avaiabIe fir CIledIs is ilsuIideIt 10 a:Nf!J"

5. You must 1he amourt d Ihe Check, (i) yqu have ~ a De1iIIcn in baIlkIupll..y. (Ii)

:::

Payment Ihe Check has expired, IX" (flI) your Accruil has been c:Iosed.

Fee ofU) ifwe sfqI ~on!l1Y CIIeck at your

,cIla!ge yoor AQ:rut a fee d $20. SIlbjEd III

mayreguest Silatwe sloP. pay!I)eIlt on_ao~6'I~

=

<r by caI&l!I

i:'r:=~~~~~

dlil buIeen (14) days of the cal or

6. BALANCE SUBJECT TO PERIODIC FINANCE CHARGES. qJIre. The vmten srop I)aYIl1eOt on:Ier

must Ildude the CIlec:k Rlllliler, payee. amount and dale of the

'*

Check on wli:h payment Is 10 be st6pJled. A Ni1Ien step payment

onIer will expire (6) months after we receive it unless !lie S\q)

payment (X"der Is renewed in writing.

a purchase money security

Interest in each Hem of merchmse purchased on your Account to

isecure ils unpaid pun::hase price urIiU such merchandise Is paid in fiJll.

•SoiaIr for the purpose of dellmninlng llie extent of our purchase money

secuiily interest in each sud! item Of men::hendlse, your paymenls wil

,be allocated irs! to Finance Chlllges on !he Account. ana then to pay

off each Pun::hase on the Account in the ortler in which tile Purchase

I.' was made Pf more than one item was purchased on the same ~

your payments wUl be allocated to pay off lIle lowest priced Item firs .

Ifyou made aPun::hase pursuant 10 a credit promo!lon, !he balalce • .

respect to liIe promotional Purchase may be shown on Slatemenls

dunng the promotional period and may reftect a different payment

aIIocalion method. In no event wii we assert a security interest In !he

promotional Pun::hase for an amount greater IhI.Il the loweSt balance

Shown on a Statement for !hat promolional Purchase. We agree lIlat no

security interest Is or win be retained « acquired under this·Agreement

in any real property which Is used or is expected 10 be used as your

dwelling. (4)

(3)

11. SPECIAL PAYMENT PLANS.

"1

, owe.~~

we reTerand/or

empl~ee.

CVi) take

your Aci:ount

'if'

coIlecIiOn cos

20.' CHANGE OF ADDRESS. You \'/iIi notify us promptly if you chalTge

your address. We may send Slatemenls and other notices to your

adllless in our records unb1 we halle a reasonable opportunity 10 upilate

our. records willl any new address for you.

Please read this arbitration pro

provides lI1al, upon !he election of

een the parties WlI be resolved by

laces any exlslina arbitration

"We • 'Us • 'Our" arid simSer

its rispedive partIIlts. wholly

lreoecessors, successors,

(collectively. lIle 'Bank').

:... ·Claim" means any dlsllUte between YQU and Us

rerates ~ Y9U~ credit ~ account,,Ihe ielationsilips

accoun~ this ,

Including !he

pules based

tra~, torts,

B.

~dmln~ means the National Arbitration Forum P.O. Box 50191,

nneePii;}AN 55405, www.arb-forum.com (800) 474-2371; or

American Amillation Association, 335 Madison Avenue, New York, NY

1. DefiIm1d In!erestIWdfl Payments 10017, www.adr.org, (800) 778-7879.

Important Notice and limitations: If you or We elect to arbItrMe

a Claim, neither you nor We will have the right: (1) to have a

court or a jury decide the Claim; (2) to engage In dfsCovery (I.e.,

the right to obtaIn Information from the other PlIrM to the same

""""""1irIanI.::& chaI!Ies wi! lie assessed 00 !he'""",,",1m'" extent that you or We could In court; (3) to participate In a class

r' MiJliJJxJliP'.r:lt

::ha;)baIance from !he dale of urchasa

be require(! on yo.u: ~ ~ balance during ax! aIler

action In court or In arbitration, either as a class representative

or'a class member; (41 to act as a private attorney general ill court

the p«molionaI peliOd. or',ln arbitration; or {5) to join or consolidate your Clalms(sl with

CI~lms of any other person. The right to appeal Is more Irmlled

2. Deferred InIeres!IDeIayed Paymenls in .arbltration than In court. Other rights tllat you would have If

you went to court may also not be available In arbitration. Only

a court may determIne the validity and effect of the language In

thlll paragraph. If a court should hold this language to be

Invalrd, then the entire Provision shall be null and void.

:; .. I

S. In OOdltion. you ~ree \0 the -use of RIght to

information 'about You and your Account desClibed in the Privacy Policy. In Which

The Privacy Policy is a part of this Agreement and Is enclosed or

attached hei"eto.

( 17. TELEPHONE MONrroRlNG. To ensure that you receive accurate

t,'

12. TeRMINATION/CHANGE IN TERMS. You may terminate your and courteous customer service. on occasion, your caU may be moni

Account at !lIlY time by: pmvidlng us written notice. We maY,. at any: tored by our employees or agents and you agree to aIfj suCh monitor

time and subiect to aDDficable laW. ch\lfl99/ add or delele pll!VlSions of Ing.

? or tennUlate y"our AccoUnt Unless

may IIP.PIy 18. JOINT ACCOUNTS. If this Is a joint account. each of you will be

:.. ,

jointly and IndMdual1y ~ble for your obligations under ll1is Agree

ment notice to one of you wiR be consldered iii be nolice to bo1h of you;

and we can rely on iestructions from one of you, even if we receive

',". inconsistent instructions from the 01her person.

'.'

19. WAIVER. We mi;lY, In our sole discretion, choose to not exercise

anyoulitofll!lY

right under .!!lls Agreement,

-- - Including

.. -- the

....right to Impose

. the full

>,. OOV8fS aX Claims, except that We will not elect

us must be al Claim brought In small claims oourt or its

Claim is lransffirred. removed. or appealed 10 a

':r lion: To start an albiI.raH~~1 you or We must give

election to arbitrate. You mlJSl send 1his notice to GE

,." lance Looal Operalions, 1600 Summer Street. AM AIlOr,

. 06905. NoHce can be given after a lawsuit has been filed,

in I'ffiich case ft can be made in papers in !he lawsuiL If a notice electing

(S) (7)

:<.'

.....

Вам также может понравиться

- Treasury Direct Account TDAДокумент10 страницTreasury Direct Account TDAVincent J. Cataldi91% (81)

- Bagayao HandoutДокумент42 страницыBagayao HandoutChris Jackson100% (1)

- Capital One Arbitration Agreement 2008Документ2 страницыCapital One Arbitration Agreement 2008xltshirtcarlton0% (1)

- Capital One Arbitration Agreement 2008Документ2 страницыCapital One Arbitration Agreement 2008xltshirtcarlton0% (1)

- Capital One Arbitration Agreement 2008Документ2 страницыCapital One Arbitration Agreement 2008xltshirtcarlton0% (1)

- Capital One Arbitration Agreement 2008Документ2 страницыCapital One Arbitration Agreement 2008xltshirtcarlton0% (1)

- Manual Download 100 B - ArthurДокумент13 страницManual Download 100 B - ArthurSlamet S89% (9)

- Floating Charge Essay IIДокумент21 страницаFloating Charge Essay IIDavide D'UrsoОценок пока нет

- House Designs, QHC, 1950Документ50 страницHouse Designs, QHC, 1950House Histories100% (8)

- Cap 1 Cardagreement ArbДокумент8 страницCap 1 Cardagreement ArbLUEОценок пока нет

- Income TAX: Prof. Jeanefer Reyes CPA, MPAДокумент37 страницIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- SecuritizationДокумент102 страницыSecuritizationag maniac100% (14)

- Dopplick SettlementДокумент8 страницDopplick SettlementNicole MillerОценок пока нет

- LC Op FormДокумент3 страницыLC Op FormmsuterrorОценок пока нет

- (20-22398 17) Ex. A Credit Agreement Law DE 109Документ5 страниц(20-22398 17) Ex. A Credit Agreement Law DE 109larry-612445Оценок пока нет

- GM-10 - CCA Newsletter Fall 2006Документ24 страницыGM-10 - CCA Newsletter Fall 2006Albany Times UnionОценок пока нет

- Bank Reconciliation: DepositsДокумент42 страницыBank Reconciliation: DepositsMomoyОценок пока нет

- AEON I-Cash Personal Financing Facility Terms & ConditionsДокумент1 страницаAEON I-Cash Personal Financing Facility Terms & ConditionsSHAFIKОценок пока нет

- Scan 3 Mar 2020Документ1 страницаScan 3 Mar 2020Sandeep ChoudharyОценок пока нет

- Money Matters: - What Are The People in The Pho (OS Dolng? or Numbers in English? What Did You Do?Документ9 страницMoney Matters: - What Are The People in The Pho (OS Dolng? or Numbers in English? What Did You Do?Wika FitriaОценок пока нет

- SMCH 18 BeamsДокумент19 страницSMCH 18 BeamsAtika DaretyОценок пока нет

- Winding Up of A CompanyДокумент126 страницWinding Up of A CompanyYogesh Mehta0% (1)

- Audit Unit 4Документ12 страницAudit Unit 4nsabareesh83Оценок пока нет

- System @: K (IiefcisДокумент3 страницыSystem @: K (IiefcisFahomeda Rahman SumoniОценок пока нет

- Tybaf Sem5 Fa-V Nov19Документ8 страницTybaf Sem5 Fa-V Nov19katejagruti3Оценок пока нет

- G.R. No. L-19190 November 29, 1922 The People of The Philippine Islands, Plaintiff-Appellee, vs. Venancio Concepcion, Defendant-AppellantДокумент3 страницыG.R. No. L-19190 November 29, 1922 The People of The Philippine Islands, Plaintiff-Appellee, vs. Venancio Concepcion, Defendant-Appellantsally deeОценок пока нет

- Ffix039,: .Tli$,il"i"iii""'toh'Документ33 страницыFfix039,: .Tli$,il"i"iii""'toh'Peeyush JainОценок пока нет

- July, Z) LGL: in Extraordinary, Part-I, TheДокумент12 страницJuly, Z) LGL: in Extraordinary, Part-I, TheManzoor Shahzad DhudhiОценок пока нет

- Laws and EthicsДокумент38 страницLaws and EthicsKamika MarianoОценок пока нет

- Government Accounting ProblemsДокумент4 страницыGovernment Accounting ProblemsApril ManjaresОценок пока нет

- Bankruptcy Literature ReviewДокумент5 страницBankruptcy Literature Reviewafmzuiffugjdff100% (1)

- Fundamental Accounting Principles 22nd Edition Wild Solutions ManualДокумент35 страницFundamental Accounting Principles 22nd Edition Wild Solutions Manualloanmaiyu28p7100% (20)

- Acc UralsДокумент1 страницаAcc UralsSwapnaKarma BhaktiОценок пока нет

- Bill of Exchange and Collection ArrangementsДокумент12 страницBill of Exchange and Collection ArrangementsRishabh KumarОценок пока нет

- 7 11 05 Offer of Employment To Coughlin by Hale LaneДокумент5 страниц7 11 05 Offer of Employment To Coughlin by Hale LaneDoTheMacaRenoОценок пока нет

- Income For Life - Walter Updegrave July 2002Документ7 страницIncome For Life - Walter Updegrave July 20024cinvestorОценок пока нет

- Jimenez vs. Bucoy: Pay To The Equitable Banking Corporation Order of A/C of Casville Enterprises, IncДокумент3 страницыJimenez vs. Bucoy: Pay To The Equitable Banking Corporation Order of A/C of Casville Enterprises, IncrockaholicnepsОценок пока нет

- BK 2 (43-48) SDE-2 Ex .A) FAB Complaint Credit AgreementДокумент6 страницBK 2 (43-48) SDE-2 Ex .A) FAB Complaint Credit Agreementlarry-612445Оценок пока нет

- 3 The Accounting EquationДокумент35 страниц3 The Accounting EquationAndruey EspirituОценок пока нет

- Standard and Conditions Governing Accounts: TermsДокумент26 страницStandard and Conditions Governing Accounts: TermsroymondusОценок пока нет

- Adobe Scan 24 Aug 2021Документ12 страницAdobe Scan 24 Aug 2021Felix FelixОценок пока нет

- CTC SIGNED - RA 9510 OfficialДокумент8 страницCTC SIGNED - RA 9510 OfficialJoy Ann MedijaОценок пока нет

- 5 Basic AccountingДокумент31 страница5 Basic Accounting2205611Оценок пока нет

- Robosigner Proof WellsДокумент17 страницRobosigner Proof WellsMark AnayaОценок пока нет

- Board Paper-2022-XIДокумент8 страницBoard Paper-2022-XIRn GuptaОценок пока нет

- RR No. 11-2021Документ17 страницRR No. 11-2021eric yuulОценок пока нет

- Op Cred Ban U8Документ12 страницOp Cred Ban U8Fer RamirezОценок пока нет

- Pamantasan NG Lungsod NG Pasig: Test I - True or FalseДокумент4 страницыPamantasan NG Lungsod NG Pasig: Test I - True or FalseJOHN PAUL DOROINОценок пока нет

- Metrobank V ChiokДокумент3 страницыMetrobank V Chiokyannie11100% (2)

- 1.cash Flow Material - T S Grewal 01.12.2018Документ78 страниц1.cash Flow Material - T S Grewal 01.12.2018Upendra bhati100% (1)

- (15-00293 258-7) - Ex. D Promissory Note Gary MillerДокумент9 страниц(15-00293 258-7) - Ex. D Promissory Note Gary Millerlarry-612445Оценок пока нет

- Credit A2015 Finals ReviewerДокумент136 страницCredit A2015 Finals ReviewerLeyCodes LeyCodesОценок пока нет

- Citi Sears AgreementДокумент11 страницCiti Sears AgreementLUEОценок пока нет

- The Use of BondsДокумент4 страницыThe Use of BondsBeLikeMike100% (2)

- Negotiable Instruments Case Digests: Metropolitan Bank and Trust Company v. Court of AppealsДокумент6 страницNegotiable Instruments Case Digests: Metropolitan Bank and Trust Company v. Court of AppealsRem SerranoОценок пока нет

- Credit & CollectionsДокумент4 страницыCredit & CollectionsMercury2012Оценок пока нет

- 3 Francis Beaufort PalmeretaДокумент10 страниц3 Francis Beaufort Palmeretamohit.jainОценок пока нет

- Cash and Cash EquivalentДокумент50 страницCash and Cash EquivalentAurcus JumskieОценок пока нет

- Trust Receipts Law (Ampil)Документ9 страницTrust Receipts Law (Ampil)yassercarlomanОценок пока нет

- June 2012 JurisprudenceДокумент4 страницыJune 2012 JurisprudenceJohn AlbertОценок пока нет

- Contingent LiabilitiesДокумент5 страницContingent LiabilitiesKayelaine RollonОценок пока нет

- Cash and Cash EquivalentsДокумент18 страницCash and Cash EquivalentsNoella Marie BaronОценок пока нет

- Gross Income Definition - Case Law PrinciplesДокумент7 страницGross Income Definition - Case Law PrinciplesHitekani ConsolationОценок пока нет

- Don't Try This at HomeДокумент19 страницDon't Try This at Homeruss willisОценок пока нет

- Equitable Bank Vs Special SteelДокумент2 страницыEquitable Bank Vs Special SteelJustin EnriquezОценок пока нет

- CDA MC-2022-32 Voluntary Arbitrators in The CDAДокумент6 страницCDA MC-2022-32 Voluntary Arbitrators in The CDAVincent BautistaОценок пока нет

- A Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsОт EverandA Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsРейтинг: 3 из 5 звезд3/5 (1)

- A Stiptick for a Bleeding Nation: Or, a safe and speedy way to restore publick credit, and pay the national debtsОт EverandA Stiptick for a Bleeding Nation: Or, a safe and speedy way to restore publick credit, and pay the national debtsОценок пока нет

- Discover Cardmember Agreement Arb FullДокумент13 страницDiscover Cardmember Agreement Arb FullLUE100% (1)

- Wamu Arbitration AgreementДокумент12 страницWamu Arbitration AgreementLUEОценок пока нет

- 2009 - 11 Fifth Third Bank Credit Card AgreementДокумент8 страниц2009 - 11 Fifth Third Bank Credit Card Agreementwps013Оценок пока нет

- Hooters AgreementДокумент2 страницыHooters AgreementLUEОценок пока нет

- FDCPA CaselawAnnotatedДокумент58 страницFDCPA CaselawAnnotatedLUEОценок пока нет

- Jams Fee WaiverДокумент1 страницаJams Fee WaiverLUEОценок пока нет

- Wisconsin AT&TДокумент13 страницWisconsin AT&TLUEОценок пока нет

- Gemb 2Документ2 страницыGemb 2LUEОценок пока нет

- FNB OmahaДокумент13 страницFNB OmahaLUEОценок пока нет

- Wells Fargo Business Card AgreementДокумент2 страницыWells Fargo Business Card AgreementLUE0% (1)

- Pay Pal Plus Master CardДокумент6 страницPay Pal Plus Master CardLUEОценок пока нет

- Washington Mutual Providian CCard TermsДокумент7 страницWashington Mutual Providian CCard TermsLUEОценок пока нет

- Citi Sears AgreementДокумент11 страницCiti Sears AgreementLUEОценок пока нет

- Wells Fargo Business Card AgreementДокумент2 страницыWells Fargo Business Card AgreementLUE0% (1)

- HSBC Card Member Agreement No JAMSДокумент6 страницHSBC Card Member Agreement No JAMSLUEОценок пока нет

- Wells Fargo Business Card AgreementДокумент2 страницыWells Fargo Business Card AgreementLUE0% (1)

- HSBC AgreementДокумент8 страницHSBC AgreementLUEОценок пока нет

- Discover Cardmember Agreement Arb FullДокумент13 страницDiscover Cardmember Agreement Arb FullLUE100% (1)

- Discover Arb AgreementДокумент1 страницаDiscover Arb AgreementLUEОценок пока нет

- IAS 1 Presentation of Financial StatementsДокумент12 страницIAS 1 Presentation of Financial StatementsIFRS is easyОценок пока нет

- Monex Presentation EnglishДокумент21 страницаMonex Presentation EnglishBanco MonexОценок пока нет

- Tourism Cluster in South KoreaДокумент49 страницTourism Cluster in South KoreaShreyas SATHEОценок пока нет

- The Pricing of Crude Oil: Stephanie Dunn and James HollowayДокумент10 страницThe Pricing of Crude Oil: Stephanie Dunn and James HollowayAnand aashishОценок пока нет

- RFBT QuizzerДокумент8 страницRFBT QuizzerMara Shaira SiegaОценок пока нет

- Taxation: Md. Kamrul Hasan ShovonДокумент15 страницTaxation: Md. Kamrul Hasan ShovonMaruf KhanОценок пока нет

- MAIN PPT Business Ethics, Corporate Governance & CSRДокумент24 страницыMAIN PPT Business Ethics, Corporate Governance & CSRrajithaОценок пока нет

- Emerald Emerging Markets Case Studies: Article InformationДокумент22 страницыEmerald Emerging Markets Case Studies: Article InformationAliza FatimaОценок пока нет

- Ratio of Sasbadi Holdings Berhad For Group 2016 1. Liquidity RatioДокумент7 страницRatio of Sasbadi Holdings Berhad For Group 2016 1. Liquidity RatioizzhnsrОценок пока нет

- ACCELERATING Entrepreneurship in Africa: Understanding Africa's Challenges To Creating Opportunity Driven Entrepreneurship - Omidyar Network in Partnership With Monitor GroupДокумент48 страницACCELERATING Entrepreneurship in Africa: Understanding Africa's Challenges To Creating Opportunity Driven Entrepreneurship - Omidyar Network in Partnership With Monitor GroupCraft AfrikaОценок пока нет

- International Financial Management 9Документ38 страницInternational Financial Management 9胡依然100% (3)

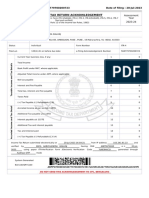

- Itr Fy 22-23Документ6 страницItr Fy 22-23Omkar kaleОценок пока нет

- Final Answer KeyДокумент13 страницFinal Answer Keysiva prasadОценок пока нет

- What Is A Zero-Coupon Treasury Bond: Guarantees The SecurityДокумент7 страницWhat Is A Zero-Coupon Treasury Bond: Guarantees The Security88arjОценок пока нет

- Proforma Invoice: Armforce Rubber Co.,LtdДокумент2 страницыProforma Invoice: Armforce Rubber Co.,LtdrogerОценок пока нет

- Abm 3 Exam ReviewerДокумент7 страницAbm 3 Exam Reviewerjoshua korylle mahinayОценок пока нет

- Money Back Guarantee Terms and ConditionsДокумент2 страницыMoney Back Guarantee Terms and ConditionsSidharth KaliaОценок пока нет

- PT Aldenio: Memorial Journal (ADJUSTMENT)Документ7 страницPT Aldenio: Memorial Journal (ADJUSTMENT)Laela LitaОценок пока нет

- Surveillance in Stock Exchanges ModuleДокумент13 страницSurveillance in Stock Exchanges ModulebharatОценок пока нет

- PWC Insights Examples Reporting Impact of Covid 19 On Going Concern and Subsequent EventsДокумент10 страницPWC Insights Examples Reporting Impact of Covid 19 On Going Concern and Subsequent EventsSuman UroojОценок пока нет

- 54 IBA MBA Intake QSN (Math)Документ4 страницы54 IBA MBA Intake QSN (Math)Raihan RahmanОценок пока нет

- Bond Solvency Form 2018-19Документ4 страницыBond Solvency Form 2018-19Mohit PatelОценок пока нет

- All FormulaДокумент7 страницAll FormulaLeeshОценок пока нет

- Introduction To Agricultural AccountingДокумент54 страницыIntroduction To Agricultural AccountingManal ElkhoshkhanyОценок пока нет

- Chapter 15Документ27 страницChapter 15Busiswa MsiphanyanaОценок пока нет

- Fund Acc - Ringkasan Chapter 1Документ3 страницыFund Acc - Ringkasan Chapter 1Andini OleyОценок пока нет

- Prepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADДокумент29 страницPrepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADBino JosephОценок пока нет