Академический Документы

Профессиональный Документы

Культура Документы

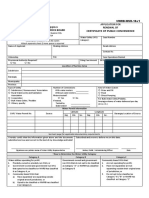

Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"

Загружено:

Kristine CabalteraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"

Загружено:

Kristine CabalteraАвторское право:

Доступные форматы

(To be filled up by the BIR)

DLN:

PSIC:

BIR Form No.

Monthly Percentage

Tax Return

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

2551M

September 2005 (ENCS)

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1

2

For the

Calendar

Year ended

(MM/YYYY)

1 2

Fiscal

2 0 1 6

Part I

6

3 For the month

0 7

(MM/YYYY)

Background

TIN

1 7 0

2 0 1 6

7 8 1

Yes

5 Number of sheets attached

No

Information

7 RDO Code

4 7 4

Amended Return

0 0 0

8 Line of Business/

MEDICAL SERVICE

Occupation

Taxpayer's Name (For Individual)Last Name, First Name, Middle Name/(For Non-individual) Registered Name

10

Telephone Number

CVG MATERNITY CLINIC

11 Registered Address

Zip Code

12

BLK-21 L-12 UC-3 BRGY CITRUS, CSJDM, BULACAN.

13 Are you availing of tax relief under Special Law

or International Tax Treaty?

Yes

Part II

No

If yes, specify

Computation of Tax

Taxable Transaction/

Industry Classification

14A

3 0 2

ATC

SERVICES

Taxable Amount

23520

Tax Rate

14D

3%

Tax Due

14B

14C

15A

15B

15C

15D

15E

16A

16B

16C

16D

16E

17A

17B

17C

17D

17E

18A

18B

18C

18D

18E

19 Total Tax Due

20

Less: Tax Credits/Payments

706.6

19

20A

Creditable Percentage Tax Withheld Per BIR Form No. 2307 (See Schedule 1)

20A

20B

Tax Paid in Return Previously Filed, if this is an Amended Return

20B

Total Tax Credits/Payments (Sum of Items 20A & 20B)

21

14E

22 Tax Payable (Overpayment) (Item 19 less Item 21)

Add: Penalties

Surcharge

23

23A

23B

21

22

Interest

Compromise

23C

23D

24 Total Amount Payable/(Overpayment) (Sum of Items 22 and 23D)

24

If overpayment, mark one box only:

To be Refunded

To be issued a Tax Credit Certificate

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

25

26

CONSOLACION V. GURAR

President/Vice President/Principal Officer/Accredited Tax Agent/

Authorized Representative/Taxpayer

(Signature Over Printed Name)

OWNER

Title/Position of Signatory

TIN of Signatory

Tax Agent Acc. No./Atty's Roll No.(if applicable)

Part III

Particulars

Treasurer/Assistant Treasurer

(Signature Over Printed Name)

Date of Issuance

Title/Position of Signatory

Date of Expiry

TIN of Signatory

Details of Payment

Drawee Bank/

Agency

Number

MM

Date

DD

YYYY

Amount

27B

27C

27D

28 Check 28A

28B

28C

28D

29 Tax Debit

29A

29B

29C

30B

30C

30D

27 Cash/Bank 27A

Debit Memo

Memo

30 Others 30A

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

Stamp of

Receiving Office/AAB

and Date of Receipt

(RO's Signature/

Bank Teller's Initial)

Вам также может понравиться

- 2551QДокумент2 страницы2551QCris David Moreno79% (14)

- 2551MДокумент3 страницы2551MButch Pogi100% (2)

- Bir Form Percentage TaxДокумент3 страницыBir Form Percentage TaxEc MendozaОценок пока нет

- BIR Form 2551MДокумент4 страницыBIR Form 2551MJun Casono100% (2)

- Bir 1905Документ2 страницыBir 1905Allan Paul Mariano100% (1)

- Schedule of Compromise Penalties RMO 19-2007Документ10 страницSchedule of Compromise Penalties RMO 19-2007Emmanuel A. RemolacioОценок пока нет

- Pbcom V CirДокумент9 страницPbcom V CirAbby ParwaniОценок пока нет

- S/I Under Philippines Law There Ar E Severe Penalties For Making False or Misleading Declarations, Including Fines And/Or IimprisonmentДокумент1 страницаS/I Under Philippines Law There Ar E Severe Penalties For Making False or Misleading Declarations, Including Fines And/Or IimprisonmentArrah Mae SawanoОценок пока нет

- BIR Form 1701QДокумент2 страницыBIR Form 1701QfileksОценок пока нет

- Draft MR - DAanimallabДокумент5 страницDraft MR - DAanimallabAlfred Joseph P. BiscaydaОценок пока нет

- Gas AffidavitДокумент2 страницыGas Affidavitdipak_shirbhate6847Оценок пока нет

- SALN2012form NewДокумент2 страницыSALN2012form NewAriel Jr Riñon MaganaОценок пока нет

- VALUE ADDED TAX Notes From BIRДокумент30 страницVALUE ADDED TAX Notes From BIREmil BautistaОценок пока нет

- 1906 January 2018 ENCS FinalДокумент1 страница1906 January 2018 ENCS FinalShane Shane100% (4)

- New Income Tax Return BIR Form 1702 - November 2011 RevisedДокумент6 страницNew Income Tax Return BIR Form 1702 - November 2011 RevisedBusinessTips.Ph100% (4)

- BIR REliefДокумент32 страницыBIR REliefJayRellvic Guy-ab67% (6)

- Efps Letter 009Документ1 страницаEfps Letter 009ElsieJhadeWandasAmandoОценок пока нет

- RMC 124-2020Документ19 страницRMC 124-2020Glenn Sabanal GarciaОценок пока нет

- Republic of The Philippines Application For: National Water Resources Board Renewal ofДокумент2 страницыRepublic of The Philippines Application For: National Water Resources Board Renewal ofMark PesiganОценок пока нет

- Use of Representative: 1. Your Full NameДокумент2 страницыUse of Representative: 1. Your Full NameWORKBUDDY BOOKKEEPING SERVICES100% (1)

- Application For Provident Benefits (Apb) ClaimДокумент2 страницыApplication For Provident Benefits (Apb) ClaimLIERAОценок пока нет

- How To Enroll EfpsДокумент18 страницHow To Enroll EfpsAdyОценок пока нет

- 267731702final PDFДокумент5 страниц267731702final PDFelmarcomonal100% (1)

- RR 2-98 Section 2.57 (B) - CWTДокумент3 страницыRR 2-98 Section 2.57 (B) - CWTZenaida LatorreОценок пока нет

- Form 1594777111Документ1 страницаForm 1594777111Evcillove Mangubat100% (1)

- SSS R3 Contribution Collection List in Excel FormatДокумент2 страницыSSS R3 Contribution Collection List in Excel FormatChristopher Daniels0% (2)

- Letter Request (Bir)Документ1 страницаLetter Request (Bir)Arkim llovitОценок пока нет

- 1905 (Encs) 2000Документ4 страницы1905 (Encs) 2000Loss Pokla100% (1)

- 2018 - COA-Audited-Financial Statements PDFДокумент66 страниц2018 - COA-Audited-Financial Statements PDFAnna Marie AlferezОценок пока нет

- 1905 January 2018 ENCS - Corrected PDFДокумент3 страницы1905 January 2018 ENCS - Corrected PDFJoseph Jr TengayОценок пока нет

- Guidelines and Instruction For BIR Form No 1702 RTДокумент2 страницыGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- CAR 2D Expanded Engagement Ltr-Compilation (5-17)Документ8 страницCAR 2D Expanded Engagement Ltr-Compilation (5-17)Andy RossОценок пока нет

- 70534BIR Form 1921 - Annex B PDFДокумент1 страница70534BIR Form 1921 - Annex B PDFJunar MadaliОценок пока нет

- Nunez - Verification and Certification Against Forum ShoppingДокумент2 страницыNunez - Verification and Certification Against Forum ShoppingCzarlyn NunezОценок пока нет

- BIR Form 2316 UndertakingДокумент1 страницаBIR Form 2316 UndertakingJan Paolo CruzОценок пока нет

- Application For Closure of BusinessДокумент2 страницыApplication For Closure of BusinessallanОценок пока нет

- Bir Form No. 1914Документ1 страницаBir Form No. 1914Mark Lord Morales BumagatОценок пока нет

- Special Power of AttorneyДокумент1 страницаSpecial Power of AttorneygbvОценок пока нет

- Procedure For OccupancyДокумент1 страницаProcedure For Occupancypa3ckblancoОценок пока нет

- RMO No. 12-2012Документ11 страницRMO No. 12-2012PatOcampo100% (1)

- Optical Media BoardДокумент2 страницыOptical Media Boardted canadaОценок пока нет

- China Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0Документ48 страницChina Banking Corporation Bir E-Fps Payment Manual: May 2011 V 6.0KyonОценок пока нет

- Waiver of Banks LiabilityДокумент1 страницаWaiver of Banks LiabilityMaureen Encarnacion MalazarteОценок пока нет

- Statement of ManagementДокумент31 страницаStatement of ManagementSharmz SalazarОценок пока нет

- Statement of Management ResponsibilityДокумент1 страницаStatement of Management ResponsibilityLecel Llamedo100% (1)

- SEC Requirements For Accreditation of CPAs in Public PracticeДокумент2 страницыSEC Requirements For Accreditation of CPAs in Public PracticemelissaОценок пока нет

- TaxДокумент6 страницTaxChristian GonzalesОценок пока нет

- RMC No. 122-2022 S1905-RUSДокумент1 страницаRMC No. 122-2022 S1905-RUSDENVERОценок пока нет

- Spa Businessclosure WeisДокумент2 страницыSpa Businessclosure Weisleah piolenОценок пока нет

- 1601EДокумент7 страниц1601EEnrique Membrere SupsupОценок пока нет

- Authorisation LetterДокумент1 страницаAuthorisation LetterLalaine MarianoОценок пока нет

- Rmo No. 7-2015 Annex AДокумент12 страницRmo No. 7-2015 Annex Ablackcholo100% (1)

- Statement of Management'S ResponsibilityДокумент1 страницаStatement of Management'S ResponsibilityLizanne Gaurana100% (1)

- FTP FTP - Bir.gov - PH Webadmin Forms 2551mДокумент1 страницаFTP FTP - Bir.gov - PH Webadmin Forms 2551mPeter John M. LainezОценок пока нет

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Документ4 страницыMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Eric LeguardaОценок пока нет

- Monthly Remittance Return of Income Taxes Withheld On CompensationДокумент26 страницMonthly Remittance Return of Income Taxes Withheld On CompensationWinchelle Dimaapi ManalaysayОценок пока нет

- BIR Form 2551MДокумент6 страницBIR Form 2551MDeiv PaddyОценок пока нет

- Quarterly Remittance Return of Final Income Taxes Withheld: On Fringe Benefits Paid To Employees Other Than Rank and FileДокумент2 страницыQuarterly Remittance Return of Final Income Taxes Withheld: On Fringe Benefits Paid To Employees Other Than Rank and FilefatmaaleahОценок пока нет

- BIR FormДокумент4 страницыBIR FormfyeahОценок пока нет