Академический Документы

Профессиональный Документы

Культура Документы

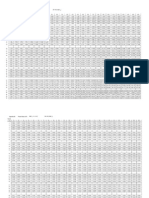

PV PMT (Pvifa) + FV (Pvif) : B M N o B M I

Загружено:

Arman Shah0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров1 страницаformula

Оригинальное название

Formula Test 2

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документformula

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров1 страницаPV PMT (Pvifa) + FV (Pvif) : B M N o B M I

Загружено:

Arman Shahformula

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

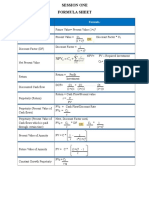

FORMULA

SECURITY VALUATION:

Valuing Bond : Vb =

PV = PMT (PVIFA k, n ) + FV (PVIF k, n )

M Bo

n

M Bo

2

I

Yield to Maturity =

Valuing Preferred Stock: Vps = D

kps

Valuing Common Stock:

Vs =

D0 (1+g)

ks g

D1

ks g

COST OF CAPITAL:

Cost of Common Equity

The CAPM Approach:

ks = D1 + g

P0

ks = krf + (km-krf)

After-tax cost of debt = kd(1-Tax rate).

Cost of New Common Equity ks =

D1

+g

P0 - flotation cost

Cost of Retained Earning, ks = (D1 /P0) + g

Weighted Average Cost of Capital (WACC)

k wacc wd k d (1 Tc ) w ps k ps wcs k cs wncs k ncs

CAPITAL BUDGETING:

Payback Period = BY

BY

UC

CF

UC

CF

= the year before full recovery

= the unrecovered cost at start of year

= the cash flow during the year

Net Present Value (NPV) = Annual Cash Flow - Initial Investment

(1+k)t

Profitability Index (PI) = Present value of Future Net Cash Inflows

Initial Outlays

Internal Rate of Return: IRR

Initial Investments - Annual Cash Flows = 0

(1+IRR)t

Вам также может понравиться

- Mathematical Formulas for Economics and Business: A Simple IntroductionОт EverandMathematical Formulas for Economics and Business: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (4)

- Formula SheetДокумент1 страницаFormula SheetMassih BehmardiОценок пока нет

- Economics-3 1Документ15 страницEconomics-3 1hannah mae tabanaoОценок пока нет

- Cost of CapitalДокумент5 страницCost of CapitalArie SwiftskandariansОценок пока нет

- Depreciation, Capital Recovery and Break Even AnalysisДокумент6 страницDepreciation, Capital Recovery and Break Even AnalysisMa. Angeline GlifoneaОценок пока нет

- Pln-Cmams - Cost of CapitalДокумент26 страницPln-Cmams - Cost of Capitaldwi suhartantoОценок пока нет

- Formula Sheets-GDBA505 – must be returned after exam < 40Документ3 страницыFormula Sheets-GDBA505 – must be returned after exam < 40FLOREAROMEOОценок пока нет

- Tax Shield PV For Amortizable AssetsДокумент1 страницаTax Shield PV For Amortizable AssetsDaniel Alejandro Rojas LieОценок пока нет

- 7 - Cost of CapitalДокумент20 страниц7 - Cost of CapitalYeano AndhikaОценок пока нет

- Cost of Debt Redeemable in Instalments:-: + I +P + I +P + + I +P (1+K) 1 (1+K) 2 (1+K) 3 (1+K) NДокумент4 страницыCost of Debt Redeemable in Instalments:-: + I +P + I +P + + I +P (1+K) 1 (1+K) 2 (1+K) 3 (1+K) Napi-19824242Оценок пока нет

- Corporate Finance Formula SheetДокумент5 страницCorporate Finance Formula SheetChan Jun LiangОценок пока нет

- Calculate WACC using CAPM and DCF methodsДокумент3 страницыCalculate WACC using CAPM and DCF methodsMostakОценок пока нет

- Cong Thuc Tinh Chi Phi Von Binh Quan WACCДокумент3 страницыCong Thuc Tinh Chi Phi Von Binh Quan WACCHủ Tiếu GõОценок пока нет

- Chapter 4 Cost of CapitalДокумент19 страницChapter 4 Cost of CapitalmedrekОценок пока нет

- FIN 401 - Cheat SheetДокумент2 страницыFIN 401 - Cheat SheetStephanie NaamaniОценок пока нет

- Equations for Cost of Capital, Valuation and Capital BudgetingДокумент2 страницыEquations for Cost of Capital, Valuation and Capital BudgetingTappei LoveОценок пока нет

- Return On EquityДокумент1 страницаReturn On EquityAva DasОценок пока нет

- Chapter 6 Cost of CapitalДокумент18 страницChapter 6 Cost of CapitalmedrekОценок пока нет

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For RiskДокумент22 страницыThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For RiskKaziRafiОценок пока нет

- FormulasДокумент6 страницFormulasapi-3765845Оценок пока нет

- Class Work (Copmutation of Cost of Capital) (19.03.09) (C)Документ3 страницыClass Work (Copmutation of Cost of Capital) (19.03.09) (C)api-19824242Оценок пока нет

- Finance Formula SheetДокумент8 страницFinance Formula SheetMatchagirlieОценок пока нет

- Final Exam FormulasДокумент2 страницыFinal Exam FormulasAbood AlfawazОценок пока нет

- Valor Del Dinero en El Tiempo y WACCДокумент23 страницыValor Del Dinero en El Tiempo y WACCYesenia HernandezОценок пока нет

- Cost of Capital and Capital Structure DecisionsДокумент21 страницаCost of Capital and Capital Structure DecisionsGregory MakaliОценок пока нет

- Cost of Retained Earnings: D + G or D + G N.P M.PДокумент5 страницCost of Retained Earnings: D + G or D + G N.P M.Papi-19824242Оценок пока нет

- Formula Fin420 TestДокумент2 страницыFormula Fin420 TestAmirul AmriОценок пока нет

- Ibf PPT Lecture # 15 (09012024) (Wacc)Документ57 страницIbf PPT Lecture # 15 (09012024) (Wacc)Ala AminОценок пока нет

- Cost of Capital FMДокумент45 страницCost of Capital FMVinay VinnuОценок пока нет

- FM FormulasДокумент9 страницFM FormulasrafishogunОценок пока нет

- FINA2222 Formula SheetДокумент6 страницFINA2222 Formula SheetDaksh ParasharОценок пока нет

- FMV Cheat SheetДокумент1 страницаFMV Cheat SheetAyushi SharmaОценок пока нет

- Cost of Capital: Formulae Used For Calculation of Specific Costs: Cost of DebenturesДокумент3 страницыCost of Capital: Formulae Used For Calculation of Specific Costs: Cost of DebenturesParas SinghОценок пока нет

- ECN 190/TTP 215 Lecture 16: Transportation Economics: Highway CongestionДокумент30 страницECN 190/TTP 215 Lecture 16: Transportation Economics: Highway CongestionAbu Abdul FattahОценок пока нет

- WACCДокумент5 страницWACCTulus ArifinОценок пока нет

- CHAPTER 9 - FORMULAДокумент2 страницыCHAPTER 9 - FORMULA2023607226Оценок пока нет

- 4 - Cost of CapitalДокумент10 страниц4 - Cost of Capitalramit_madan7372Оценок пока нет

- D C F M Dpu E 2 - 1 D N - 0 4 - 0 3 5 - 4 2: Iscounted ASH LOW Odel Xhibit Ocket OДокумент3 страницыD C F M Dpu E 2 - 1 D N - 0 4 - 0 3 5 - 4 2: Iscounted ASH LOW Odel Xhibit Ocket ODanielle BirbalОценок пока нет

- Corporate Finance Formula SheetДокумент4 страницыCorporate Finance Formula Sheetogsunny100% (3)

- Cost of CapitalДокумент26 страницCost of CapitalRajesh ShresthaОценок пока нет

- Financial Management Equations Korea UniversityДокумент2 страницыFinancial Management Equations Korea UniversityTom DОценок пока нет

- Financial Statement Analysis RatiosДокумент4 страницыFinancial Statement Analysis RatiosSumeet DekateОценок пока нет

- Depreciation: Definition of TermsДокумент6 страницDepreciation: Definition of TermsGlyzel DizonОценок пока нет

- Session One FormulasДокумент1 страницаSession One FormulasSalarAliMemonОценок пока нет

- Finalexam - Financial Management FicheДокумент6 страницFinalexam - Financial Management FicheLouis BarbierОценок пока нет

- Long Term Fin v3Документ56 страницLong Term Fin v3Mark christianОценок пока нет

- MK - ch12 - Cost of CapitalДокумент13 страницMK - ch12 - Cost of CapitalDwi Slamet RiyadiОценок пока нет

- Computation of Cost of CapitalДокумент11 страницComputation of Cost of CapitalusamaОценок пока нет

- Presented By:-Ankita Sneha AgarwalДокумент15 страницPresented By:-Ankita Sneha AgarwalSneha AgarwalОценок пока нет

- PAK CFE Supplemental Formula Sheet (Spring 2023)Документ49 страницPAK CFE Supplemental Formula Sheet (Spring 2023)CalvinОценок пока нет

- 11 - MK - ch14 - Cost of CapitalДокумент14 страниц11 - MK - ch14 - Cost of CapitalSafrizal PriambadaОценок пока нет

- Present Value and Future Value: Finance: Time Value of MoneyДокумент11 страницPresent Value and Future Value: Finance: Time Value of MoneyTes DudteОценок пока нет

- Manajemen Keuangan RangkumanДокумент6 страницManajemen Keuangan RangkumanDanty Christina SitalaksmiОценок пока нет

- FINA623 Advanced Capital Budeting Lecture Twelve Stakeholder Impacts OF ProjectsДокумент29 страницFINA623 Advanced Capital Budeting Lecture Twelve Stakeholder Impacts OF ProjectsAdepeju OluokunОценок пока нет

- 24 Top Financial FormulasДокумент1 страница24 Top Financial FormulasNgọc Linh NguyễnОценок пока нет

- Corporate Finance - FormulasДокумент3 страницыCorporate Finance - FormulasAbhijit Pandit100% (1)

- TOBIN'S Q THEORYДокумент38 страницTOBIN'S Q THEORYas111320034667Оценок пока нет

- 395 Midterm 1 Cheat SheetДокумент2 страницы395 Midterm 1 Cheat Sheetchrisjames20036Оценок пока нет

- Unit-II-Cost of CapitalДокумент80 страницUnit-II-Cost of CapitalRU ShenoyОценок пока нет

- Exercise Final SECTION B 2019Документ5 страницExercise Final SECTION B 2019Arman ShahОценок пока нет

- Al Quiz June 2017 Oct 2017 QsДокумент3 страницыAl Quiz June 2017 Oct 2017 QsArman ShahОценок пока нет

- Interest RateДокумент2 страницыInterest RateArman ShahОценок пока нет

- Cost of Capital UTMДокумент3 страницыCost of Capital UTMArman ShahОценок пока нет

- 4ePresentValueAnnuityDueof1 Table6Документ1 страница4ePresentValueAnnuityDueof1 Table6Andry OnixОценок пока нет

- Return and Risk: Calculating Expected Returns and Standard DeviationsДокумент1 страницаReturn and Risk: Calculating Expected Returns and Standard DeviationsArman ShahОценок пока нет

- 4ePresentValueAnnuityDueof1 Table6Документ1 страница4ePresentValueAnnuityDueof1 Table6Andry OnixОценок пока нет

- CRR Dec 2016Документ35 страницCRR Dec 2016Arman ShahОценок пока нет

- Answer For Quiz 1 - Partnership AccountsДокумент1 страницаAnswer For Quiz 1 - Partnership AccountsArman ShahОценок пока нет

- TUTORIAL: Capital Budgeting: Cash Flow Principles: PurchaseДокумент2 страницыTUTORIAL: Capital Budgeting: Cash Flow Principles: PurchaseArman ShahОценок пока нет

- Portfolio BetaДокумент1 страницаPortfolio BetaArman ShahОценок пока нет

- Tutorial CashflowДокумент2 страницыTutorial CashflowArman ShahОценок пока нет

- Risk and ReturnДокумент30 страницRisk and ReturnArman ShahОценок пока нет

- Risk and ReturnДокумент30 страницRisk and ReturnArman ShahОценок пока нет

- Tutorial CashflowДокумент2 страницыTutorial CashflowArman ShahОценок пока нет

- Stock ValuationДокумент3 страницыStock ValuationArman ShahОценок пока нет

- Finance Tables NewДокумент4 страницыFinance Tables NewArman ShahОценок пока нет

- Topic 01Документ40 страницTopic 01Arman ShahОценок пока нет

- Finance Tables NewДокумент4 страницыFinance Tables NewArman ShahОценок пока нет

- Tutorial CashflowДокумент2 страницыTutorial CashflowArman ShahОценок пока нет

- Appendix B1 Future Value of $1: Fvif (1+i) FV PV (Fvif) Period NДокумент4 страницыAppendix B1 Future Value of $1: Fvif (1+i) FV PV (Fvif) Period NArman ShahОценок пока нет

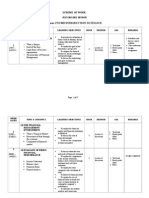

- FNC3033 Lesson PlanДокумент8 страницFNC3033 Lesson PlanArman ShahОценок пока нет

- Soalan 2Документ2 страницыSoalan 2Arman ShahОценок пока нет

- Future Value CalculatorДокумент4 страницыFuture Value CalculatorArman ShahОценок пока нет

- Soalan 3Документ1 страницаSoalan 3Arman ShahОценок пока нет

- R Giggs Income Statement and Balance Sheet for 2007Документ2 страницыR Giggs Income Statement and Balance Sheet for 2007Arman ShahОценок пока нет

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОт EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsОценок пока нет

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.От EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Рейтинг: 5 из 5 звезд5/5 (82)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantОт EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantРейтинг: 4 из 5 звезд4/5 (104)

- Rich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouОт EverandRich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouОценок пока нет

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesОт EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesРейтинг: 4.5 из 5 звезд4.5/5 (30)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouОт EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouРейтинг: 5 из 5 звезд5/5 (5)

- How To Budget And Manage Your Money In 7 Simple StepsОт EverandHow To Budget And Manage Your Money In 7 Simple StepsРейтинг: 5 из 5 звезд5/5 (4)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessОт EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeОт EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeРейтинг: 5 из 5 звезд5/5 (4)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonОт EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonРейтинг: 5 из 5 звезд5/5 (9)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherОт EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherРейтинг: 5 из 5 звезд5/5 (14)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyОт EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyРейтинг: 5 из 5 звезд5/5 (1)

- Retirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyОт EverandRetirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyОценок пока нет

- Lean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeОт EverandLean but Agile: Rethink Workforce Planning and Gain a True Competitive EdgeОценок пока нет

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayОт EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayРейтинг: 3.5 из 5 звезд3.5/5 (2)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningОт EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningРейтинг: 4.5 из 5 звезд4.5/5 (8)

- How to Save Money: 100 Ways to Live a Frugal LifeОт EverandHow to Save Money: 100 Ways to Live a Frugal LifeРейтинг: 5 из 5 звезд5/5 (1)