Академический Документы

Профессиональный Документы

Культура Документы

Industrial Infrastructure Sector Profile

Загружено:

Dhaval DadhaniaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Industrial Infrastructure Sector Profile

Загружено:

Dhaval DadhaniaАвторское право:

Доступные форматы

Industrial Infrastructure

SECTOR PROFILE

Table of Contents

Special Investment Regions (SIRs)

Special Economic Zones (SEZs)

Industrial Parks (PPP)

Opportunities

SPECIAL INVESTMENT REGIONS (SIRs)

01

SPECIAL INVESTMENT REGIONS (SIRs)

Gujarat is the 1st state in the

country to enact the SIR act in

2009

13 SIRs spread over ~ 3600 sq.km.

are underway

SANTALPUR

Out of the 13 SIRs, 7 SIRs have been

notified i.e.:

- Mandal-Becharaji

ANJAR

VIRAMGAM

- PCPIR

- Dholera

NAVLAKHI

- Halol Savli

- Santalpur

OKHA

HALOL SAVLI

CHANGODAR

DHOLERA

PCPIR

ALIYABET

- Navlakhi

PIPAVAV

- Aliyabet

Out of these, development of

Mandal - Becharaji, PCPIR, and

Dholera is on fast track

MANDAL-BECHARAJI

SIMAR

Indicative map of SIRs in Gujarat, not to scale

Notified SIRs

Other Proposed SIRs

02

REGULATORY AND POLICY FRAMEWORK

SIR Act 2009

It enables the State Government to establish, develop, operate and regulate SIRs

The Government is empowered to declare Investment Region or Industrial Area

SIR to have an area of more than 100 sq. km. and the Industrial Area will be more than 50 sq. km

A 4-tier administrative mechanism is set up for establishment, operation, regulation and management

The administrative mechanism comprises:

An Apex Authority (GIDB) highest policy making body. It acts as the single window system and the first

contact for setting up any economic activity or amenity in the SIR

Regional Development Authority (RDA) for each SIR to address ground level issues of development &

regulation. The RDA will make its own regulations for building, construction and development.

Project Development Agency the Government has already formed such a project development company

viz. Gujarat Industrial Corridor Company (GICC)

Project specific SPVs

It provides an effective framework for private sector participation in infrastructure

by drawing upon the Gujarat Infrastructure Development (GID) Act 1999

03

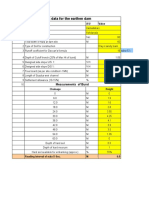

SUMMARY OF NOTIFIED SIRs

Region

04

Area (sq. km.)

Proposed industries

Dholera

879

Knowledge based industries (biotechnology, IT/ITES, education and

training), light manufacturing (textiles, electronics, leather, toys,

ceramic), engineering

Becharaji Mandal

509

Automobile industry, heavy engineering, light engineering (incl.

metal & alloy product), electronics, service & ancillary, agro & food

processing industry, ceramics & clay, non polluting industry (incl.

information technology), logistics, precision engineering, wind

power equipment manufacturing, solar power equipment

manufacturing, electronic systems design and manufacturing

(ESDM) and institutional & knowledge centre, tourism

PCPIR

453

Refinery downstream products, high performance chemicals,

pigments and coating products, nanotechnology, bio- refineries,

mineral resource based products

Halol-Savli

123

Engineering, automobile ancillaries, engineering plastics, electrical

and electronics

Santalpur

186

Agro based (spices and seed processing, vegetable and fruit

processing, dairy, cotton ginning), contract farming, solar power,

logistics

Navlakhi

182

Ceramic, engineering & automobiles, food processing and

electronics, textile, non polluting chemicals, ceramics and cement.

Aliyabet

169

Entertainment (eco zone, film city, amusement zone, golf course),

aquaculture and marine engineering

SUMMARY OF OTHER SIRs

Region

Proposed area (sq. km.)

Proposed industries

Changodar

319

Agro based, steel & metal, plastic, pharmaceutical, biomedical,

and oil & gas

Anjar

237

Port and port based industries, wood based, mineral & agro

based, marine & salt industry and engineering

Okha

206

General manufacturing, pharmaceutical, CRO, biotechnology and

bio-pharma, auto and auto - ancillaries, mineral based, tourism,

education: marine biological studies, petrochemical studies

Pipavav

145

Logistics based industries, pre-cast structure, textile (only

spinning), thermal power plant, ship building, and iron & steel

Simar

84

Auto and auto components, heavy engineering, electronics,

engineering plastics, agri, pharma & biotechnology, non polluting

chemicals, cement and food processing

Viramgam

Under review, GoG

05

DEVELOPMENT OF SIRs STATUS

Stage of

Development

PCPIR Dholera*

HalolMandal Santalpur Aliyabet

Navlakhi Changodar Pipavav Viramgam

Savli

Becharaji

Okha

Selection of

Consultants

Preparation of

Feasibility

Report and

Concept Plan

Notification

RDAs

Notification

Detailed

Development

Plan

EIA Study

Operationalised

Completed

Sent to

Government

In Process

* Other Studies as mentioned below have also been conducted at Dholera

1. Seismic Micro - Zonation Study

2. Water Vulnerability

& Flood Protection Study

-

06

Under

Progress

Simar Anjar

SPECIAL ECONOMIC ZONES (SEZs)

07

SPECIAL ECONOMIC ZONES (SEZs): AN OVERVIEW

Status of SEZs in Gujarat

Gujarat has 16 SEZs (3 functional and

13 notified and operational), covering

an area of 17,295 hectares.

These SEZs comprise of industries in

several sectors such as Apparels,

Functional SEZ before

enactment

20%

Notified and operational*

22%

5%

24%

29%

Notified SEZ

Formally approved SEZ

In-principle approved SEZ

Pharma & Biotechnology, Engineering,

IT, Power, Handicraft/Artisan, Gems &

Jewellery etc.

* LOA issued by GoI to the units in SEZs is considered

as Notified and operational

~ 50% of land under SEZs in India is in

Gujarat i.e. ~ 30,000 hectares

Gujarat's SEZs contributed ~47% to

Sectoral spread of SEZs in Gujarat

India's SEZ exports (during 2010-11)

world's top 50 'free zones' in a survey

Multi-product/

Multi services

of 600 free zones across the world

Textile & Apparel

conducted by the prestigious FDI

Electronics/IT/ITES

Dahej SEZ Ltd. stood 26th among the

Magazine. (2012)

Pharma/Chemicals

Engineering

Others

08

18%

7%

33%

11%

9%

22%

SPECIAL ECONOMIC ZONES (SEZs): AN OVERVIEW

There are 16 operational SEZs (3

functional and 13 notified and

operational):

- 6 Multiproduct SEZs

Operational SEZs

- 3 Engineering SEZs

- 2 Apparel SEZs and

- 1 each in Electronics, Gems &

Jewellery, IT & ITeS, Pharma and Non

Conventional energy

Kandla SEZ (1000 acres) is promoted by

Central Government and has 175

operational units

Mundra Port & SEZ is the largest SEZ

spread over 6,178 hectares followed by

Reliance Jamnagar Infrastructure Ltd.

spread over 1,764 hectares

Apparel

Engineering

6%

Electronics

Gems & Jewellery

6%

13%

19%

6%

38%

IT/ITES

6%

6%

Multi-product

Pharma

Non Conventional Energy including

solar Energy eqpts/cells

09

SEZ INSTITUTIONAL FRAMEWORK

Development Commissioner

Grant all local and state level clearances etc.

delegated by the Central/ State Government.

Monitor such approvals, licenses, registrations etc.

Make town planning regulations

Approval Committee

Approve imports of goods and

services into the SEZ

Approve proposals for establishment

of SEZ units

Allow foreign collaborations/ FDI

proposals duly cleared by the Board of

Approval

Monitor compliance by SEZ

Developer, units

Township Authority

May be appointed by the

State Government, with

powers and functions as

may be prescribed

10

Board of Approval

Approval of proposals to set up SEZs

Approval of authorized operations in an SEZ

FDI approvals to Developers, Units

Approvals for infrastructure provision (through

co-developers , etc.)

Special Economic

Zone

Developer

Planned development of SEZ

Prepare development plan

Demarcate and develop sites

Allocate and transfer plots, buildings

Regulate the erection of buildings in

accordance with the plan

Develop, operate, maintain infra

Demarcate Zone Boundary

SEZ Authority

Responsible for

promotion, development

and functioning of the

zones in the state

Appropriate Authority

Customs

administration

Co-developer

Provider of

infrastructure facilities

SEZ ACT 2005

SEZ Incentives

Tax Incentives State & Central

Corporate tax holiday on export profit 100% for initial 5 years and 50% for the next 5 years thereafter and

50% of the ploughed back export profit for next 5 years

External commercial borrowing by SEZ units up to US D 500 million in a year without any maturity restriction

through recognized banking channels

Indirect Tax Incentives (Exemptions)

Customs duty

Excise duty

Central sales tax

Service tax

Single window clearance for Central and State level approvals

Exemption from State VAT and other levies as extended by the respective State Governments

For Developers of SEZs

100% tax holiday for a period of any 10 consecutive years out of 15 years beginning from the year in which the

SEZ is notified

Exempt from dividend distribution tax

Full freedom in allocation of developed plots to approved SEZ units on purely commercial basis

11

INDUSTRIAL PARKS

12

INDUSTRIAL PARKS : OVERVIEW

Sector wise Parks

Gujarat Industrial Policy 2003 identified

infrastructure development as a priority

and hence for the first time Industrial Parks

were developed on PPP.

4%

Gujarat has 27 private parks developed

under Industrial Policy 2003

Pharmaceuticals

Textile

37%

52%

IT/ITeS

7%

14 parks are Multiproduct Industrial Parks

and 10 are Textile Parks

Industrial Park

Majority of these parks are in Ahmedabad

district (7 parks) and Surat district (6 parks)

Realizing the growing importance and

increasing need for such infrastructure,

'Scheme for financial assistance to Industrial

Parks on PPP' was introduced as part of

Industrial Policy 2009.

Government has amended the Financial

assistance scheme for Industrial Park

development by Private Institution. They

have introduced suppor t for Link

Infrastructure in the scheme. There are

20 proposals for development of parks

under this scheme.

District wise No. of Parks

Ahmedabad

Gandhinagar

4% 4%

Surat

26%

18%

4%

4%

Kheda

3%

22%

11%

4%

Valsad

Junagadh

Anand

Vadodara

Mehsana

Bharuch

13

INDUSTRIAL POLICY 2009

SCHEME FOR ASSISTANCE TO PRIVATE INDUSTRIAL PARKS

Objective of Scheme

To identify the need to promote and encourage Industrial Parks by Private Institutions which aim at upgrading

and improve the state of the Park

Quantum of Assistance

Industrial Park/ Estate will be provided an amount up to Rs. 10 crore for link infrastructure

Developer of the park will be eligible for exemption from payment of stamp duty on purchase of land

for the park.* Whereas the units in the industrial park will be eligible for 50% exemption of stamp duty

Definition of Link Infrastructure

The park will be required to have minimum internal infrastructure facilities; the support will be only for Link

infrastructure which includes:

Road (incl. toll-road), bridges, runways and other air port facilities

Transmission or Distribution of power by laying a network of new transmission or distribution lines of

electricity

Telephone lines, telecommunications network

Pipelines for water, crude oil, slurry, waterways, port facilities, waste water/ solid waste pipelines

Railway tracks, signaling systems

Gas Pipeline

Conditions

The Industrial Park should be suitable for setting up min. 30 industrial units in at least 100 acres

Expansion or modification/ modernization of existing parks shall not be eligible

* Subject to approval of State Level Approval Committee

14

OPPORTUNITIES

15

SECTOR SPECIFIC OPPORTUNITIES

Engineering

Setting up industry in Greenfield precision engineering clusters being planned by GIDC at 5 locations i.e.

Jamnagar, Halol, Sanand, Lodhika, and Mandal

Centres of Excellence will be also be developed in each of these clusters

Technical Textile

Textile market in Gujarat is estimated to become ~USD 25 billion by 2017 and the growth is envisaged to be

driven by Technical Textiles

2 new Technical Textile zones will be developed in Ahmedabad and Surat district to drive this.

Government will also set up 2 new Composite Centres for the development of Technical Textiles in Ahmedabad

(existing centre in Ahmedabad to strengthened) and Surat district.

Auto

Auto clusters will be promoted in Rajkot, Halol, Sanand and Mandal

Specialty Chemicals

Chemical industry in Gujarat has the potential to reach ~USD 70 billion by 2017 and contribution of Specialty

and Fine Chemicals will be doubled by then.

Government plans to develop 3 speciality chemical zones in Jambusar, Padra and Dahej

Centres of Excellence will also be developed in each of these clusters

Gems & Jewellery

Upcoming gems & jewellery clusters on PPP mode at Bhavnagar & Sanand

16

KEY CONTACTS

Mr. Maheshwar Sahu, IAS

Principal Secretary (Industries & Mines)

Industries & Mines Department

Ph.: +91 79 2325 0703

secimd@gujarat.gov.in

www.imd-gujarat.gov.in

Mr. Kamal Dayani, IAS

Industries Commissioner

Industries Commissionerate

Phone: +91 79 23252683, Fax : 91(79)232 52683

comind@gujarat.gov.in

www.ic.gujarat.gov.in

Mr. B.B. Swain, IAS

Vice Chairman & Managing Director

Gujarat Industrial Development Corporation

Phone: +91 79 2325 0583, Fax: +91 79 2325 0587

vcmd@gidcgujarat.org

www.gidc.gov.in

Mr. A.K. Sharma, IAS

Chief Executive Officer

Gujarat Infrastructure Development Board

Phone: +91 79 23232701, Fax: +91 79 23222481

ceo@gidb.org

www.gidb.org

17

National Partner

Knowledge Partner

Relationship Partner

Exhibition Partner

Airline Partners

Head Office: Block No. 18, 2nd Floor, Udyog Bhavan, GH-4, Sector 11, Gandhinagar 382 010 Gujarat, INDIA

Phone: +91-79-23250492/93 Fax: +91-79-23250490

www.indextb.com, www.ic.gujarat.gov.in E-mail: indextb@indextb.com

Regional Office: A-6, State Emporia Building, Baba Kharak Singh Marg, New Delhi 110 001, INDIA

Telefax: 011-23747002, 23360049 E-mail: indextbnd@indextb.com

For more details and online registration, log on to www.vibrantgujarat.com

Вам также может понравиться

- 29-07-2016 (2 PDFДокумент1 страница29-07-2016 (2 PDFDhaval DadhaniaОценок пока нет

- Produced by An Autodesk Educational Product: Title: Pop Design (Hall)Документ1 страницаProduced by An Autodesk Educational Product: Title: Pop Design (Hall)Dhaval DadhaniaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- GATT DeclarationДокумент1 страницаGATT Declarationchirag_vaswaniОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Produced by An Autodesk Educational ProductДокумент1 страницаProduced by An Autodesk Educational ProductDhaval DadhaniaОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Autodesk Educational Product DocumentДокумент1 страницаAutodesk Educational Product DocumentDhaval DadhaniaОценок пока нет

- 29-07-2016 (2 PDFДокумент1 страница29-07-2016 (2 PDFDhaval DadhaniaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Produced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Документ1 страницаProduced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Dhaval DadhaniaОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- 29 07 2016 (3 PDFДокумент1 страница29 07 2016 (3 PDFDhaval DadhaniaОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Produced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Документ1 страницаProduced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Dhaval DadhaniaОценок пока нет

- Produced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Документ1 страницаProduced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Dhaval DadhaniaОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Produced by An Autodesk Educational Product: Title: Pop Design (Hall)Документ1 страницаProduced by An Autodesk Educational Product: Title: Pop Design (Hall)Dhaval DadhaniaОценок пока нет

- KYC Upload ProcessДокумент3 страницыKYC Upload ProcessDhaval DadhaniaОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Produced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Документ1 страницаProduced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Dhaval DadhaniaОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Produced by An Autodesk Educational ProductДокумент1 страницаProduced by An Autodesk Educational ProductDhaval DadhaniaОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Produced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Документ1 страницаProduced by An Autodesk Educational Product: Title: Pop Design (Master Bed Room)Dhaval DadhaniaОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Produced by An Autodesk Educational Product: Title: Pop Design (Hall)Документ1 страницаProduced by An Autodesk Educational Product: Title: Pop Design (Hall)Dhaval DadhaniaОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- List of Boiler ManufacturerДокумент28 страницList of Boiler ManufacturerGp MishraОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Ahmedabad office 2023 holiday list for MMP system confirmationДокумент1 страницаAhmedabad office 2023 holiday list for MMP system confirmationDhaval DadhaniaОценок пока нет

- Changodar PDFДокумент1 страницаChangodar PDFDhaval DadhaniaОценок пока нет

- GujaratДокумент1 490 страницGujaratDhaval DadhaniaОценок пока нет

- Produced by An Autodesk Educational Product: Title: Pop Design (Hall)Документ1 страницаProduced by An Autodesk Educational Product: Title: Pop Design (Hall)Dhaval DadhaniaОценок пока нет

- Zoho Entry ListДокумент29 страницZoho Entry ListDhaval DadhaniaОценок пока нет

- Ahmedabad PDFДокумент16 страницAhmedabad PDFDhaval DadhaniaОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Vap I Chemical ClusterДокумент2 страницыVap I Chemical ClusterDhaval DadhaniaОценок пока нет

- Data Company Name OnlyДокумент1 977 страницData Company Name OnlyDhaval DadhaniaОценок пока нет

- SHFDJДокумент1 страницаSHFDJDhaval DadhaniaОценок пока нет

- SHFDJДокумент1 страницаSHFDJDhaval DadhaniaОценок пока нет

- 2004 - Road Design StandardsДокумент44 страницы2004 - Road Design Standardsanik_kurpОценок пока нет

- Designing Risk Qualitative Assessment On Fiber Optic InstalationДокумент13 страницDesigning Risk Qualitative Assessment On Fiber Optic InstalationpradityaОценок пока нет

- Firms ExperienceДокумент58 страницFirms Experienceapi-291540104Оценок пока нет

- Brochure Mining Brochure May17Документ24 страницыBrochure Mining Brochure May17Jaime GutierrezОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Bhuda 171023141612Документ20 страницBhuda 171023141612Kshitij YamgarОценок пока нет

- Theory Test Questions Section 2 Categories Am, A1, A2, AДокумент53 страницыTheory Test Questions Section 2 Categories Am, A1, A2, Anikko baluyotОценок пока нет

- Clean Food Cold Chain Alternatives in the PhilippinesДокумент58 страницClean Food Cold Chain Alternatives in the PhilippinesJustine DakanayОценок пока нет

- East Kalimantan Industrial Area PDFДокумент81 страницаEast Kalimantan Industrial Area PDFJS Jalil100% (1)

- Subject - Instrumentation in The Railway Super Structure Across Railway Bridge Po11io Related To Construction of ROBsRUBs.Документ7 страницSubject - Instrumentation in The Railway Super Structure Across Railway Bridge Po11io Related To Construction of ROBsRUBs.PushОценок пока нет

- D Investment Incentive CodeДокумент9 страницD Investment Incentive CodeGleamy SoriaОценок пока нет

- Syeda Farza Khalid-07-IBF-SwedenДокумент25 страницSyeda Farza Khalid-07-IBF-SwedenSyeda Farza KhalidОценок пока нет

- Civil Calculation Sheet for KO Drum Foundation Pile DesignДокумент13 страницCivil Calculation Sheet for KO Drum Foundation Pile DesignDwiadi Cahyabudi100% (1)

- Estimate Earthen DamДокумент11 страницEstimate Earthen DamSakthi SabariОценок пока нет

- Civil Engineering Department Geotechnical Laboratory Consolidation Test and PermeabilityДокумент27 страницCivil Engineering Department Geotechnical Laboratory Consolidation Test and PermeabilityKwasi BempongОценок пока нет

- Introduction-ParadeepДокумент5 страницIntroduction-ParadeepVikram DalalОценок пока нет

- National Tourism Policy: Scheme For Product/Infrastructure and Destination DevelopmentДокумент4 страницыNational Tourism Policy: Scheme For Product/Infrastructure and Destination DevelopmentPardeep BanaОценок пока нет

- Essential Guide to Philippine Highway Maintenance ManagementДокумент60 страницEssential Guide to Philippine Highway Maintenance ManagementMichael DixonОценок пока нет

- SAIL JO Manual 2022 - Industry & Company AwarnessДокумент102 страницыSAIL JO Manual 2022 - Industry & Company AwarnessT V KANNANОценок пока нет

- Soil and Foundation Handbook Florida DOTДокумент163 страницыSoil and Foundation Handbook Florida DOTavishain1Оценок пока нет

- LECTURE - FoundationsДокумент6 страницLECTURE - FoundationsFazelah YakubОценок пока нет

- Kutch 2001Документ294 страницыKutch 2001mgmayurgaikwad8Оценок пока нет

- Construction Management (MS-310Документ25 страницConstruction Management (MS-310SyedОценок пока нет

- Highway Intersection and Its TypesДокумент13 страницHighway Intersection and Its Typessydney augustОценок пока нет

- Pile Foundation DesignДокумент143 страницыPile Foundation DesignVirendra Kumar Pareek100% (2)

- Reaffirmed Indian Standards for Water Resources DepartmentДокумент2 страницыReaffirmed Indian Standards for Water Resources Departmentjamjam75Оценок пока нет

- Asset Management Presentation1787Документ56 страницAsset Management Presentation1787cvijica635Оценок пока нет

- Port Master Plan 2040 For WebДокумент43 страницыPort Master Plan 2040 For WebVagner Jose100% (1)

- Classificação Dos SolosДокумент109 страницClassificação Dos SolosIlton SantosОценок пока нет

- Project Charter TemplateДокумент10 страницProject Charter TemplateJorizza JovitaОценок пока нет

- The Process of Erection or Assembly of Any or On A Site.: Building InfrastructureДокумент2 страницыThe Process of Erection or Assembly of Any or On A Site.: Building InfrastructureBienvenida Ycoy MontenegroОценок пока нет