Академический Документы

Профессиональный Документы

Культура Документы

15 Interviews 2016

Загружено:

ppateАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

15 Interviews 2016

Загружено:

ppateАвторское право:

Доступные форматы

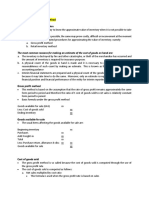

Fortnightly Thoughts

July 28, 2016

Special Issue

15 interviews to read this summer

We have dug around in our archives again to bring you fifteen of the best interviews we have

conducted in our 108 issues. They cover a huge breadth of topics from artificial intelligence

and income inequality to abundance and scarcity, and from consumer behaviour and

demographics to productivity and the role of GDP. Our interviewees are both eminent and

prominent in their fields, which is why we recommend tucking this special issue under your

arm or slipping it into your suitcase.

WORDS OF WISDOM FROM

Investing in the new, new world

Michael Porter, of Harvard, on competitive advantages in a smart, connected world

Aswath Damodaran, of NYU, on valuing disruption

Edward Chancellor, author of Devil Take the Hindmost, on capital investment cycles

2

7

12

The evolution of innovation

Erik Brynjolfsson, of MIT, on automation and the future of jobs

Rodney Brooks, Founder of Rethink Robotics, on artificial intelligence and collaborative robots

Peter Diamandis, Co-author of Abundance: The Future Is Better Than You Think

Vic Abate, CTO of General Electric, on the necessary conditions for innovation

17

30

14

27

The changing shape of economics

Greg Mankiw, of Harvard, on globalisation and income inequality

Branko Milanovi, author of Global Inequality: A New Approach for the Age of Globalization

Diane Coyle, author of GDP: A Brief but Affectionate History on the role, importance and future of GDP

Sir Partha Dasgupta, of Cambridge University, on falling fertility rates

Understanding the behavioural revolution

Dan Ariely, of Duke University, on irrational and rational consumer decision making

Robert Cialdini, author of Influence: The Psychology of Persuasion, on how consumers spend

Benedict Evans, Partner at Andreessen Horowitz, on the power of convenience

Rory Sutherland, of Ogilvy Group, on selling to young consumers

Hugo Scott-Gall

hugo.scott-gall@gs.com

+1 (212) 902 0159

Goldman, Sachs & Co.

10

24

39

37

5

20

22

33

Sumana Manohar, CFA

sumana.manohar@gs.com

+44 (20) 7051 9677

Goldman Sachs International

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be

aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this

report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see

the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not

registered/qualified as research analysts with FINRA in the U.S.

The Goldman Sachs Group, Inc.

Goldman Sachs Global Investment Research

Fortnightly Thoughts

Special Issue

Interview withMichael Porter

About Michael Porter

Michael Porter is the Bishop William Lawrence University Professor at The Insititute for Strategy and Competitiveness, Harvard Business

School. He has brought economic theory and strategy concepts to bear on many of the most challenging problems facing corporations,

economies and societies, including market competition and company strategy, economic development, the environment, and health care.

His extensive research is widely recognized in governments, corporations, NGOs, and academic circles around the globe. He is the most

cited scholar today in economics and business.

How is IT changing the nature of products as they become smart and connected?

What were witnessing is a very broad-based transformation of what we mean by a product; how its composed

and clearly what it can do. Over the long run, this IT wave should affect a great majority of products in the

economy and the impact is already evident in some areas. Complex equipment and machines like jet engines,

airplanes, generators etc. are changing in the B2B space, while IT has also penetrated the consumer domain

where everything from thermostats to tennis racquets are increasingly smart and connected. The shift in the

nature of products is also changing the nature of competition in industries that utilize those products.

Of course, we are still in the very early innings of this shift and even for companies that are very advanced in

this domain, only 10%-20% of product lines are currently connected; 80% of products are still the old kind and

it will take a lot of effort and a long time to build the new skills and organizational models required for the shift.

Will this mean that industry boundaries will change and be reshaped too...

Absolutely. The definition of the industry that a product serves is expanding. And this is because when we add

smartness and connectivity to conventional, previously non-connected products, we often find that the coordination and interaction of smart machines can actually boost the collective performance in totality. Take

farm tractors for example, which used to be a well-defined industry. Now, making the farm tractor smart in itself

requires a lot of disruption inside firms, in terms of how they make, design, market and service tractors. But it

is when we make the tractor both smart and connected, that suddenly other farm equipment and farm inputs

can be coordinated and integrated in a variety of ways. And this is when the products industry definition gets

blurred, and it moves from being part of the farm tractor industry to the smart farm industry. Tractor companies

thus face a tug of war between producing just one product (a conventional farm tractor) and risking losing out,

or broadening their scope and making the product interconnected to the wider system. Every player in the

industry would have to ask themselves if they can compete just as a farm tractor company anymore or if it is

imperative that they get into the irrigation, planter or tiller businesses.

Questions like these are becoming pertinent to companies across industries, be it an environmental system,

mobility system or home security and energy system; companies across domains need to think about

becoming part of integrated systems and the role that they can play in them.

This will create plenty of opportunities for product specialists going forward and we will see a war between old

and new players for setting the standard and gaining control of connected systems. This is what is happening

in the home energy space where utility companies, incumbents and new entrants such as Nest are vying for

dominance.

How is the current IT revolution different from previous IT-led improvements?

The previous generations of IT revolutions were primarily concerned with driving improvements in internal

efficiency and productivity. For example, via automating product design with CAD tools and improving supply

chains efficiencies through IT tools for supply chain/ customer relations management. But in the ongoing wave,

IT is becoming a more engrained part of the product itself and the impact of this is much more profound, not

just on the product but also on competition and industry definitions. And so, companies today continually need

to ask themselves what the boundaries of their industries are going to be and how will they compete in a world

where related products are interconnected?

What type of companies will enjoy genuine competitive advantages in the smart-connected world?

The sources of competitive advantages look very different in a purely digital world and a smart-connected one.

Let me explain with an example.

Because Google gathers a lot of information, its search is more profound and powerful versus competitors and

that contributes to a positive feedback loop, allowing the company to gather even more information and attract

even more people to search on its platform. And there are a lot of network externalities and natural monopoly

effects like this in a purely digital world. The smart-connected product world on the other hand is not just a

digital world, but an interplay of digital and mechanical worlds; a combination of physical products, software

and technology. And to be dominant in this world, a company will need to set the standard for the broader

system it operates in.

Creating well designed, world-class products which incorporate software and connectivity should matter more

than having a proprietary platform or information edge. And so, while Google has a natural monopoly on

information and search, and the company is increasingly getting stronger in mobile too, having a great

Goldman Sachs Global Investment Research

Fortnightly Thoughts

Special Issue

smartphone platform that people use as an interface for dealing with smart-connected products isnt

necessarily a strong source of competitive advantage for Google. The company is deeply entrenched in the

smart device ecosystem via its products, but what it provides is essentially basic infrastructure. And providing

connectivity and infrastructure to support products in this manner is a commodity type offering.

Genuine competitive advantage doesnt stem from simple algorithms that coordinate between connected

products either. The advantage lies not with the data around the usage pattern of a product, but in the

analytics that determines for instance that a water meter is likely to fail over the next three months based on

the data pattern emerging from the water meters sensors. Or to go back to the farm tractor example, the real

value add lies in using data to dramatically improve the functionality of tractors and making engines more fuel

efficient etc.

The ability to design products that can get the best out of hardware and software and integrate those two in a

powerful way is a source of genuine competitive advantage. And this is because transforming the functionality

of products by using technology optimizes product usage and improves the companys services offering. What

companies like Google and Amazon have are great platforms, efficient infrastructure and product clouds. And

while this should help them gain market share in the near term, the actual applications, analytics and physical

products will remain more critical in the digital connected world over a longer period.

Finally, not all connected systems are similar in complexity. While there are many parts that need to be

connected in a smart city, most of the connections dont require material changes in the design of individual

products that are part of the system. And so, the value add primarily comes through the information flows and

data sharing between components like traffic lights and vehicles, which help in the identification of traffic flows

and congestion hot-spots. On the other hand, a lot of co-design is needed to make manufacturing smart and

connected and to ensure that the entire factory is optimized.

Theres really no one size fits all solution and it is thus unlikely that any one company will dominate the smartconnected product world.

Will connected systems lead to a utilization and productivity revolution?

They should and its much needed given how weak productivity improvements have been in the slow growth

mode weve been stuck in for the last 10-15 years. What we are witnessing now has more profound

implications than the previous IT revolutions, which really only changed internal processes in companies. The

third wave of IT is much bigger. Companies should not only get a productivity boost via internal efficiency

improvements in manufacturing processes, but the product itself should become better. Machines for example

can be more energy efficient, come with better up-time and utilization, require less operator time, can be

remotely controlled and have multiple features that make it easier for people to use them. In short, in the third

IT revolution we get a productivity boost in the value chain, in the products innate productivity and in the

productivity of the users of smart-connected products. And all of this should impact revenues by allowing

companies to provide better services. In a smart-connected airplane for example, a maintenance issue can be

identified as soon as it occurs and be fixed rapidly. And this can translate into substantial fuel, time and

monetary saving and have a positive impact on the efficiency of the entire airline operation.

How hard will it be for companies to move towards smart products?

For an established company, the fixed cost and barriers of moving towards smart-connected-products are

generally quite high. It requires a lot of heavy lifting and can be a huge challenge for incumbent manufacturing

firms. They have to deal with software companies, carry out analytics and establish databases. They also need

to rethink their entire service operation as remote servicing reduces the need for spare parts, a traditionally big

revenue stream for manufacturing companies. The barriers to entry in the smart, connected product domain

are also much higher than the barriers to entry in conventional product businesses. To compete meaningfully,

companies not only need to have a great functional product thats well designed, well-made and reliable, but

they also need to incorporate software, sensors, algorithms, and effective connectivity in the product. Plus,

they need to manage a product cloud that is state of the art, secure and reliable. Having said that, for a new,

fresh company that comes in with a clean sheet of paper and no legacy asset base, the barriers to entry are

often much lower.

Do you think that increasing consolidation across industries has reduced the incentives for

companies to spend on R&D? And is this part of the reason why corporate profits are high?

Absolutely. A number of things are keeping profits high. A lot of EPS improvement has come via share buybacks as investors demanded greater shareholder returns. Globalization also boosted profitability as leading

MNCs were able to grow in under-penetrated emerging markets and capitalise on oversees growth. And of

course, theres been a lot of M&A and consolidation. The extent of consolidation is actually quite worrying as

gigantic companies in top five positions globally are now merging with each other. This is a very important

moment and a lot of industries are becoming too concentrated.

Goldman Sachs Global Investment Research

Fortnightly Thoughts

Special Issue

But there is hope for an investment revival. In order to transition to a smart and connected world, existing

manufacturers will have to invest significantly in cloud and IT infrastructure and in re-engineering their product

base. This is a very capital-intensive process and should boost capex and R&D. It can also fuel innovation and

entrepreneurship by creating enough discontinuity for new competitors to enter industries that were previously

deemed unassailable. Nest is a great example in this context. Until recently, it was hard to imagine a new

company competing with a dominant global leader like Honeywell, but suddenly, with a new way of thinking

about the product and its capabilities, a meaningful competitor has emerged in the form of Nest. Were starting

to see new entrants in other industries too which will hopefully put pressure on established players to speed up

their digital transformation which should create an up-tick in investment and drive innovation in the economy.

Which companies are investing in this opportunity?

GE is a great example. It has multi-billion-dollars of service backlog, and technology is allowing the company

to perform service much more efficiently across product lines, be it medical devices, locomotives, aircraft

engines or generators. It has invested c.US$1 bn in software and created a big operation in the Silicon Valley.

The pace of progress in a manufacturing company is of course not the same as the clock speed of a software

company, but, progress is being made. Companies like Caterpillar, Robert Bosch and Schneider Electric are

also heavily invested in this area while other manufacturing companies still lag in their understanding of the

shift towards digital-connected products.

Originally featured in issue 99 on thematic investing (Fortnightly Thoughts: What we think about when we think about themes, December

17, 2015)

Goldman Sachs Global Investment Research

Fortnightly Thoughts

Special Issue

Interview withDan Ariely

About Dan Ariely

Dan Ariely, the James B. Duke Professor of Psychology & Behavioral Economics at Duke University, is dedicated to answering these

questions and others in order to help people live more sensible if not rational lives. He is a founding member of the Center for

Advanced Hindsight, co-creator of the film documentary (Dis)Honesty: The Truth About Lies, and a three-time New York Times bestselling

author. His books include Predictably Irrational, The Upside of Irrationality, The Honest Truth About Dishonesty, and Irrationally Yours.

You argue that people are systematically irrational in the choices they make. Can you give a few

examples of business models that thrive on these inefficiencies?

Sadly, there are many. The biggest one is the gambling industry which is based on this interesting idea of

random reinforcements. The famous psychologist B.F. Skinner showed many years ago that if we give a rat a

fixed reward once every 100 times it presses a lever, the rat finds the exercise very interesting. But if we give it

a reward more randomly, with the frequency ranging from 1 to 200 lever presses, then, all of a sudden, the rat

is much more excited and persists in the activity for much longer. Of course, most of us know that the

expected value of gambling is negative i.e. players are expected to lose, but nevertheless, people continue to

be drawn to it, because of this concept of random reinforcement. So gambling is one example of a business

model built around behavioral inefficiencies.

Another example would be businesses supplying addictive substances; not just hard drugs, but also the likes

of nicotine, where people dont necessarily understand that they are getting addicted, leading them to exhibit

inefficient buying decisions. These are all examples on the extreme side of irrational behavior. There are also

some other interesting but less straightforward examples.

Take Kickstarter for instance. I am a big fan of the platform, but if you think about the people who contribute to

Kickstarter, you will find that some of them may be the same people who are willing to download a movie

illegally for free. So why are they willing to spend money in order to support something like a movie project on

Kickstarter, which, if it existed already, they might have watched for free? The reason is that in the Kickstarter

model, people feel that they are participating in the creation of something. So, if a movie hasnt been created

already, they are willing to spend money to participate in it, as they feel that it would make the competition of

that project more likely. Whereas if the movie has already been released, they assume that the fixed cost has

already been taken care of, and hence they dont need to contribute economically.

Another example is the name your own price model. A lot of businesses now have the mechanism wherein

consumers experience the product or the service, and are then asked how much they want to pay. There is no

real incentive for the customers to pay up, but they are often willing to pay some amount, even if it isnt as

much as the retail price the manufacturer would have wanted. Finally, think about businesses based around

reviews. Rationally, why would anybody ever leave reviews when it is clear that they are certainly going to

spend time writing one, and not get any tangible benefit out of it? But nevertheless, people do it, and that is

because they feel obligated and connected to the community and feel like they are helping other people. All of

the above examples show irrationality of human behavior; sometimes good and sometimes bad.

Do you see behavioral inefficiencies reducing in the future? What could help people make better

buying decisions e.g. AI powered Avatars or concierges?

First of all, I want to clarify that while we are talking about behavioral irrationalities here, not all irrationalities

are negative. I think we can reduce irrationalities to some extent using such tools, but it wont be easy. It is

hard to suppress a lot of these inefficiencies because often they come at a time of big decisions when we

decide to buy a home, for example. It is very hard to make those important decisions well and technological

tools are not really helping people in those areas. So there is definitely potential in those types of cases - for

example in helping people decide which house they should buy and why - but I dont see a lot of activity in

those areas yet.

What is it within peoples minds that draws them so powerfully to brands? Is it getting more or less

difficult for brands to develop in the digital world? Are brands becoming more or less powerful?

Brands embody multiple things. There are some things about brands which we use as a shortcut for

information. So, for example, when I say Sony or Apple or Porsche, you already know something about those

companies, what their product is, what they stand for etc. And from that perspective, given that we dont have

access to all the aspects of the product in the online world, brands can actually become more important.

Brands are also tools for signaling to yourself and other people. So if I wear a fancy undergarment, I feel

different about myself because of it. This signaling effect works to the extent that brands are often important to

determine both what I think of myself and what people think of me.

And so, the brands that will get eroded in the digital world are those that convey information that you can get

elsewhere. For example, if there was a brand for big and small hard drives, it is likely to become less important

as you can easily describe the product in other ways. But for brands of products that we cant experience

online or those that are used for signaling are unlikely to go away; such brands might get even more powerful.

Goldman Sachs Global Investment Research

Fortnightly Thoughts

Special Issue

We often pay too much when we pay nothing. Can you talk more about this, particularly in the context

that a lot of digital services, be it Google search, Facebook, or Wikipedia are seemingly free.

We love free

so much that we are

willing to pay instead

with our time and

attention, and in the

process we can

effectively end up

paying a high cost.

Wikipedia I think is an exception here, but firms like Google and Facebook grab a lot of our time and attention

with advertisements. Consider how much Google and Facebook are making from each of us in ad revenues

and if they are really free products? If Google and Facebook said that for $x a year, they wont show any ads,

such a proposition might actually be valuable for many users. Thats because while some ads are really great,

others can at times be distracting, misleading and confusing, appearing like real posts, when they are not. The

fact that we want things for free is creating this situation; we love free so much that we are willing to pay

instead with our time and attention, and in the process we can effectively end up paying a high cost.

Has information and the data explosion made it easier for us to make more rational decisions or has it

added to the complexity of decision making?

It has certainly added to the complexity. When we have more options to choose from and consider, the

difficulty of decision making increases. Think of the number of healthcare insurance choices we have and how

it has made the process more complex; or of the options we have for investing in the markets. When there are

so many options to choose from, people just resort to very simplified strategies, in the process often making

decisions which may not necessarily have the best economic outcome for them.

Take financial decision making for instance. People seek financial advisory services for say a 1% fee, which is

an incredibly high cost to pay in order to not deal with the complexity of making investment related decisions.

In the domain of housing too, people pay a lot of money to the brokers who help them view houses and make

the purchase decision. People definitely need help in figuring out how to make the right decisions. We cant

deal with all the complexities involved in decisions and so we ask for help and pay a lot in the process.

Do you think crowdsourcing of ideas, or relying on tools like peer reviews for decision making

diminishes or amplifies human irrationalities?

It could do both depending on the situation. So lets say there is a ball and you want to find the right weight of

that ball. If you seek the wisdom of the crowd for such a situation and everybody guesses the weight, the

average guess is likely to be quite good. So when people have information which is distributed randomly and

average guesses are likely to be correct, getting more information from people is useful.

But this doesnt work in cases where you require expertise. If you wanted to figure out how to take diabetes

medication and only some people are experts in that area, you can find the right answer by talking to them. But

in those cases, when the expertise is not with the crowd, asking a lot of people will obviously be a mistake.

Sadly, there are many cases when we ask people for feedback on things they have no expertise on. And so,

the wisdom of the crowds is not always correct when the crowd does not have much idea on the subject or if

they have some biases.

How important are cultural norms in shaping consumer behavior?

Cultural norms are extremely important and can have a big effect in shaping behavior. How we view different

actions can change a lot for example based on the cultural norms that influence us. And so, what a brand

symbolizes in one country can be very different from what it may in another. As we become more

interconnected, things are certainly changing, but they are changing slower than you think. Take Europe for

example. We have had the European Union for a while now but the culture in France, Italy, Greece, Spain and

the UK are still very, very distinct and they dont seem to be moving together very quickly.

Why do you think irrationalities arent always bad?

Presumably, it is rational that people should just do things that benefit them. But nevertheless we see lots of

altruistic behavior. If you think about it, human kindness is irrational. Even in the digital world, open source is a

great example of people getting motivated by reputation and community and so the entire open source

revolution is an incredible idea in that sense. Wikipedia is another example of something that is irrational as

people are ultimately helping others with no benefit for themselves, but people still engage in the platform.

How likely do you believe it is that future political/democratic processes will be influenced by social

media, search engine optimization, or the so-called "digital gerrymandering."

Very much so. As we get more and more information, it is increasingly harder to be experts on everything. And

so, we rely more on what we think is right rather than something that we have the time to figure out for sure.

And so, the role of social media is getting bigger and therefore the kind of media we get exposed to will

influence what we think dramatically.

Originally featured in issue 104 on consumer behavior (Fortnightly Thoughts: Understanding the behavioral revolution?, April 12, 2016)

Goldman Sachs Global Investment Research

Fortnightly Thoughts

Special Issue

Interview withAswath Damodaran

About Aswath Damodaran

Aswath Damodaran is Professor of Finance at the Stern School of Business at NYU. His research interests lie in valuation, portfolio

management and applied corporate finance.

How do you think about making an investment decision?

When making an investment decision, an investor needs to understand what other people are pricing into the

stock. A charitable view of markets is that investors are pricing in optionality, where the success of a company

in one market allows them to enter another. Apple is a classic example of a company that gained from

optionality, where the iTunes store was used to launch the iPod, the iPod then led to the iPhone and the

iPhone to the iPad. Yet, nobody, not even Steve Jobs, could have forecast that opening the iTunes store

would lead to these different growth opportunities later; and thats what makes valuation difficult. Its almost

impossible to value options on an expectations basis because, by definition, an option is an unexpected event.

We have a tendency to use metrics like the price to earnings ratio, but these are measures that are designed

to value mature businesses and they fail to capture dynamic concepts like optionality. This is particularly true

for the tech space.

And how would you go about bringing that optionality into the investment process?

That depends on the type of company. If Im investing in a mature company like Coca-Cola I normally want the

value to be higher than the current price. Im not a rigid value investor but in mature companies, I want my

valuation to be 15% or 20% higher than the price before I buy in.

In the case of a younger company like Twitter, which I value at around US$26 per share, I employ a slightly

different approach. While my valuation is US$26, I place a buy limit at US$27 is that inconsistent with my

principle of buying companies where my valuation is greater than the price? It isnt, because, unlike CocaCola, where the upside is constrained due to its maturity, Twitter has a far longer tail of upside scenarios from

optionality and I show that using a Monte Carlo simulation. But as I mentioned its very difficult to quantify the

value of those exact options because the parameters are fuzzy; you dont even know what the potential market

is. In the case of Twitter, they could enter the retail market, the news market or the data market, for example.

By noting that these various options exist, I would be more willing to invest in a company like Twitter, even if it

is fairly valued. And thats how I conceptualize option value; it shows up more in the timing of my investment

decision than as an explicit add on to my valuation.

Which companies are best at creating optionality?

The competitive advantage that creates optionality and movement into new markets, in my mind, is exclusivity.

I find that all too often people talk of opportunity based on size alone; for example an investment might be

justified by potential growth in the Chinese market. Thats necessary for optionality, but it is not sufficient; for

me to invest in a company I need to know that there is a big market but crucially that the company has

exclusivity to it. For social media companies, that exclusivity comes from a big and involved user base. We live

in an era where there are many companies all competing for our attention, and despite that competitive

landscape a disproportionately large amount of our time is spent on a few sites (Facebook, for instance). My

view is that the stronger the claim to exclusivity, the greater your optionality. Another interesting example is the

rise of big data, a trend which is often seen as bringing about greater optionality. For instance Google and

Amazon have collected large amounts of customer data and investors see scope for monetizing it. The issue is

that as more companies build up more data about their users, the value and exclusivity of that data falls. So in

a sense the value of big data comes from the fact that so few people have it, and when more people have it

the competitive advantage is eroded.

There is of course an element of optionality that is management driven. For Apple it came from the fact that

they controlled the operating system; Steve Jobs decision to buy back the operating system, which Apple had

licensed out in the 1990s, may have been the most important decision he made. Owning the operating system

gave Apple the exclusivity to build multiple versions, and create multiple levels of disruption.

How does competitive advantage evolve over time and across companies?

The more mysterious a competitive advantage is, the longer it lasts. Brand name is a good example because it

has been one of the most sustainable competitive advantages, but no-one really knows what creates a wellrespected and admired brand name. A company like Coca-Cola can leverage its brand name for decades and

consistently earn excess returns. But now I see the nature of competitive advantage changing with the ubiquity

of technology. The life expectancy of competitive advantage is declining, and thats because technology

means that it is much easier, both in terms of time and cost, to replicate business models and processes. Just

look at how Google caught up with and surpassed Yahoos search engine; competitive advantage is becoming

far more transient. This has implications for the entire life cycle of companies. Historically, companies would

start off small and low value, over time becoming larger and higher value. It took time to build infrastructure

and it took time to build new markets. New technology companies on the other hand seem to jump right

through this; they can go from nothing to valuations of billions of dollars in a short period of time.

Goldman Sachs Global Investment Research

Fortnightly Thoughts

Special Issue

If company life cycles are becoming shorter, how will that affect valuation methods?

We can no longer assume that competitive advantage will last a century as it used to for the old and mature

companies. Instead competitive advantage for tech companies comes with a life span that continues to

shorten. What this means is that youll climb faster as a company but fall faster too - Blackberry being a classic

example. Conventional stock analysis fails to capture these more compressed life cycles; we assume that

competitive advantages last forever. Using conventional techniques we might argue that a tech company is

undervalued on a P/E basis when actually it deserves to be lowly rated given there is a greater risk that a new

player enters and extracts market share.

How can investors ensure that their portfolios wont be disrupted by new competitors?

Diversification

shouldnt just be

across sectors, it

should also be

across corporate life

cycles.

They cant. But they can still diversify portfolios. Diversification shouldnt just be across sectors, it should also

be across corporate life cycles. So, if youre buying mature stocks with price to earnings ratios less than 10x,

because they look cheap relative to new players like Netflix, your portfolio is not diversified because youre

ignoring younger, higher priced disruptive companies. In fact by focusing on cheap mature companies your

portfolio is more susceptible to disruption and that should make any value investor uncomfortable. And for

growth investors it means investing in companies that are viewed as being in bad businesses that may

disappear with time. So, disruption proofing requires you to invest in some companies that youre not

comfortable with. When I teach my valuation class, I start the class by saying go where its darkest meaning

go with the uncertain, for example try to value a Greek shipping company or a Ukrainian mining company. It

will make you much more aware of how much uncertainty you dont control, and how you cant capture it all on

a spreadsheet.

Which industries are harder to disrupt?

Its tougher to disrupt service businesses. For example, I cant get my hair cut digitally. Healthcare is another

example because there are so many layers of human interaction that are difficult to control. Additionally, brand

names are also hard to disrupt even if individual segments of their businesses get disrupted. Portfolio

management is often seen as an industry ripe for disruption. While I agree with that thinking, I think disruption

will be slower than what the tech startups expect. Although these startups offer wealth management at a

considerably lower cost than traditional management, they struggle to replicate the psychological component

of what wealth advisors do. When your portfolio falls by 5% in one day, you want your wealth advisor to give

you their reassurance and empathy; Im not sure whether an app can do that.

Can companies self-disrupt to protect themselves from external disruptive forces?

They can, but it comes with its own challenges. Lets take the example of education, my own field, which I

think presents a compelling case for disruptors to move in and take market share. Many universities are now

offering online courses to both exploit the opportunity of online education and protect themselves from online

competitors. Even Harvard Business School now offers online courses including accounting and finance

modules. The problem is that traditional university education costs are around US$50,000 pa; but a shift online

may offer the same number of classes for around US$3,000. Students are going to start wondering what they

gain from the extra US$47,000. Therein lies the problem for incumbents; by unbundling to self-disrupt they

show what individual components are worth and expose their underlying business model.

As a second example, think of an airline starting its own budget airline with much lower fares than the existing

business say US$100 instead of US$200. Customers are going to begin to question whether the extra US$100

they pay is worth the additional legroom, small meal and other perks. Again the issue is that the underlying

business model is exposed; unbundling creates tensions if the subsidiary extracts demand from the parent. I

think its very difficult to self-disrupt and agree with Clayton Christensens thesis that disruption almost always

originates externally. Incumbents often think that by acquiring disruptors they can self-disrupt, but all too often

the disruptor gets integrated into the incumbents process and stops being effective at disruption. Thats

compounded by acquisitions coming at a premium, and even though the acquisition may help to protect the

incumbent, its impact on valuation can be limited due to the premium paid.

And how have barriers to entry changed?

I think there are two competing forces here; firstly the rise of tech has lowered barriers to entry but industry

wide consolidation has increased them. The rise of tech has undoubtedly made it easier to enter an industry,

and that brings both good news and bad news. The good news is that these new companies can earn much

higher returns on capital. The bad news links back to what I said earlier; your competitive advantage has

become far more transient and new companies can enter with ease. An opposing force comes in the form of

the major consolidation weve seen across industries in recent years. We now see fewer entertainment

companies, fewer transportation companies and fewer steel companies, for example. Consolidation will allow

incumbents to become more powerful and utilize economies of scale to make it harder for new entrants to

succeed. These two competing forces create an interesting dynamic. The greater the amount of consolidation,

the less likely it is that incumbents will try new things and innovate, and this increases the opportunity for

disruptors. Im not sure what the outcome will be, but these two forces are going to be key as to how markets

and businesses evolve.

Goldman Sachs Global Investment Research

Fortnightly Thoughts

Special Issue

How do you think about companies that have entered a number of different product markets?

I feel that industry classifications are outdated. Modern multinationals span several different industry

segments; for example, Amazon is as much an entertainment company as it is a retail company. We will begin

to see these multinationals compete with each other in new markets; take online advertising for example.

Googles pre-tax operating margins are 25% while Facebooks are around 32% in this particular business line.

At some point its inevitable that they will start competing with each other, so Id expect to see those margins

come down. As companies diversify across markets, analysts need to think of out-of-the-box valuation

methods. Take Sprouts Farmers Market, the specialty grocery stores, for example; it may be more appropriate

to compare them with a high-end retail business as opposed to a typical grocery business. Given the rise of

big data analytics, we should be able to find better comparable firms, which match more appropriately on risk,

return and growth characteristics. One method Im currently exploring is how to group companies based on

how sensitive their revenues are to the overall economy.

Has the rise of tech impacted aggregate capital expenditure?

My fundamental issue with capex numbers is that we think of capex from an accounting standpoint. Capex is

seen as a line item in the cash flow statement, but thats only really applicable for the old manufacturing firms

that are entirely product-based. Now were seeing traditionally product-based companies shifting towards

offering services, and I have a feeling that a lot of capex has slipped out of the grasp of accounting and

actually shows up in operating expenses. Take Amazon for example; when they offer Amazon Prime at a loss

thats their version of capex to gain customers over the long term. So just because capex indicators might be

pointing downwards, Im not convinced by the notion that companies are investing less now than they did

before. I think its just that different companies are making the investments, and the composition of capex has

also changed in a way that is not easily captured by standard accounting.

Originally featured in issue 99 on thematic investing (Fortnightly Thoughts: What we think about when we think about themes, December

17, 2015)

Goldman Sachs Global Investment Research

Fortnightly Thoughts

Special Issue

Interview withGreg Mankiw

About Greg Mankiw

Gregory Mankiw is the Robert M. Beren Professor of Economics and Chairman of the Economics department at Harvard University. From

2003 to 2005 he served as Chairman of the President's Council of Economic Advisers.

What has driven the rise in income inequality in the US?

There are multiple forces at work which have increased inequality. While some have been benign, others have

proven to be pernicious. A benign force has been the addition of more women into the labour force which has

increased household inequality. Men with relatively high incomes are more likely to be married to women with

high incomes and this can be seen in the correlation between husbands' and wives' incomes, which has risen

substantially over the last few decades. More women entering the labour force, despite having a side effect of

increasing inequality, is not something we would want to reverse to reduce inequality.

On the other hand, inequality, to an extent, has been a function of an educational system which has failed

parts of the population and this should be addressed. It is important to understand that inequality here is a

symptom of the problem, and improving educational attainment especially amongst those at the bottom of the

economic ladder is a key part of the solution. Previously in the US, each consecutive generation received more

education than their parents, but this trend has plateaued over the last 20-30 years; we certainly haven't seen

big generational advances in education since the GI Bill generation graduated in the 1950s.

Apart from education, technology has been the other big driver of inequality. Technological progress increases

the demand for skilled workers, and in turn the premium paid relative to unskilled workers. The impact of this

phenomenon has been studied by economists for a very long time and the policy response should be to

increase the supply of skilled workers entering the labour market, which takes us back to why education is

important.

Inequality, to an

extent, has been a

function of an

educational system

which has failed parts

of the population and

this should be

addressed. It is

important to

understand that

inequality here is a

symptom of the

problem.

Finally, there has been the rise of the 'superstar' economy; technology has allowed certain individuals to

leverage their skills and address very, very big markets. I like to use the example of the actor Robert Downey

Jr. who made US$50 mn for his role in the movie The Avengers. Each person who went to watch the movie,

say in the US, probably contributed only US$0.25 out of the cost of his or her cinema ticket to Robert Downey

Jr, but when a film can be shown to an audience all over the world, that amount to US$50 mn. Clearly, 200

years ago this would not have been possible for an actor; no matter how good he was in a theatre in New York

or London, he could not have performed in front of enough people to earn the equivalent of US$50 mn.

And you could apply the same to the increases in CEO pay as well. As large corporations have become larger,

there has been the commensurate rise in responsibilities. Critics argue that the boards of directors have not

performed their duties and have allowed compensation to reach levels over and above the CEO's value to the

company. However, if this was the case companies owned by private equity firms, who do not suffer from the

same principal-agent problem as publicly traded companies would not pay their CEOs just as handsomely.

But justifying such a disparity is hard...

Most people's perception of the very wealthy, including mine, is dependent on how it was earned. The actor

Robert Downey Jr. made a movie that everybody enjoyed watching and the public can see how he made his

money, and therefore they do not really mind if he made US$50 mn. He did not make anyone's life worse off

by virtue of becoming richer, but in fact made the viewer's life better and created value for society. On the

other hand, Bernie Madoff, which I acknowledge is perhaps the most extreme case, acquired his wealth by

illegitimate means. Therefore, people's natural response is that he does not deserve it and something should

be done about it - his money should be taken away and he should be put in jail.

How much of a factor is low social or economic mobility for persistent inequality?

The most recent studies that have looked at the changes in mobility over time have found that it has remained

remarkably stable in the US. Even though lower mobility is a feature of the US relative to some European

countries that are more equal, the figure has not changed significantly to what it was 20-30 years ago. The

glass can be half-empty and half-full depending on how much mobility you previously thought there was.

A statistic to illustrate this point is to look at a child's expected position on the income distribution based on his

parents' income. Let's imagine that his parents are in the 99th percentile. If there is perfect mobility in society,

you would expect the child's eventual income to be in the middle of the population's distribution, i.e. the 50th

percentile. The data shows that in fact the child's income on average has been 65th percentile; that is above

average, but far below the top 1%. From my perspective, that means that there remains a healthy level of

mobility in the US economy, even though it is quite often portrayed as a static society.

How do you see governments responding to high income inequality? Voters in democracies are likely

to more strongly demand actions from policy makers...

The trend towards increasing inequality in the US began in the 1970s, and a reversal, if there is ever going to

be one, will take a number of decades and require the public to have realistic expectations. My fear is that

inequality will cause a variety of backlashes, including inclination away from globalisation, which may push

policymakers in the wrong direction. There have been worrying signals of this already happening. Democratic

Goldman Sachs Global Investment Research

10

Fortnightly Thoughts

Special Issue

members of Congress have been balking at Obama's free trade policy agreements, and this does not bode

well for the US or the world economy. Contrary to popular belief, globalisation has not been a major factor that

has contributed to inequality in the same way as technology. If it had been so, then developing countries like

China, which experienced a large supply of unskilled workers entering the world market and thus wage

increases for the unskilled, should have seen falling levels of inequality. However, inequality has increased

there as well; this fact suggests that the advantages enabled by technology have been more significant as

drivers than globalisation.

Raising taxes is often cited as the most direct way to redistribute income. What in your view is the

optimal tax rate?

Even among professional economists, there are far-ranging views; some on the left believe the 75% top

marginal tax rate in France is a good thing, whereas others think the 40% tax rate in the US is already too

high. In the US, the top 1% pays relatively high taxes by historical standards and the middle relatively lower.

The effective tax rates on the top 1%, estimated by the Congressional Budget Office, are similar to 1979, just

before Ronald Reagan was elected on a platform of cutting taxes. Over this period, tax rates have been made

more progressive, although having said that, the increases in progressivity have been small compared to the

changes in inequality. Also, adjusting the tax rate has a very low impact on reducing inequality because the

before-tax income disparity is so high. To find a solution requires looking at the causes of before-tax income

inequality. Policies that similarly target an increase in the minimum wage are also not likely to help to solve the

underlying problem and serve only to have an adverse impact on the economy, which is why there should be

more of a focus on education. That takes time to influence inequality, more than a generation, but still, it's the

best way to go.

How should education be reformed?

Contrary to

popular belief,

globalisation has not

been a major factor

that has contributed

to inequality in the

same way as

technology. If it had

been so, then

developing countries

like China, which

experienced a large

supply of unskilled

workers entering the

world market and

thus wage increases

for the unskilled,

should have seen

falling levels of

inequality.

The difference in earnings between those who go to college versus those who graduate from high-school is as

high as it has ever been. In addition, the return on going to graduate school after college remains meaningful.

So, a step in the right direction is to increase the years of schooling.And it's not just about quantity; increasing

the quality of schooling is also necessary and requires educational reforms to take place. Unfortunately, I do

not believe a single administration in office for four or eight years can have a big enough impact, because it

requires a whole generation to undo some of the mistakes made over the past few decades. There needs to

be more emphasis on increasing students' attainment in the sciences and mathematics. English literature is a

great subject to study, but I would encourage spending more time teaching students a broader set of writing

skills. I do not believe, for example, that students are being asked as often to write non-fiction like Malcolm

Gladwell, in comparison to writing and analysing the fictional works of Jane Eyre. In areas such as

mathematics I believe there should be a focus on teaching students more statistics. Topics such as Euclidean

geometry, although a beautiful section of mathematics, are probably not as important in the modern world.

Nevertheless, I do not believe there exists a perfect standard to measure education systems against.

International standards only look at some aspects, and do not measure, for example, the level of creativity.

This raises the question as to whether Asian education systems can produce a creative workforce, given that

students tend to spend most of their very long hours learning the nuts and bolts of maths and science, but may

offer students fewer creative outlets.

How important is the role of technology in solving the problems in education?

In recent years, there have been a number of new developments and investments taking place in the

education and technology arena. A successful innovator has been the Khan Academy, a non-profit video

tutorial website that has provided over 300 million lessons to students around the globe. Harvard has also

made large investments in massive open online courses (MOOCs) which offer course materials for distance

learning. However, my sense so far has been that reality has undershot expectations. I am sceptical that

MOOCs will be able to replicate the relationship fostered by the face-to-face interaction of a teacher, and this

has partly been evidenced by the very high dropout rates in these courses. The truth remains that for an

individual who is dedicated, a lot can be learnt from just sitting in a library and picking up a textbook. However,

most people cannot do this and require qualified teachers who in many ways act like coaches in creating the

right social setting and motivating students. There is some promise in online education, but so far we are yet to

see significant progress.

Originally featured in issue 71 on income inequality (Fortnightly Thoughts: Unequal Income, unequal implications, March 27, 2014)

Goldman Sachs Global Investment Research

11

Fortnightly Thoughts

Special Issue

Interview withEdward Chancellor

About Edward Chancellor

Edward Chancellor is an award-winning financial journalist, who has written for the Financial Times, Wall Street Journal, and many other

publications. He is also a former member of the asset allocation team at GMO, a Boston-based investment firm. Mr. Chancellor has

authored several books including Devil Take the Hindmost: A History of Financial Speculation (FSG, 1999), a New York Times Notable

Book of the Year. He has also edited two publications for Marathon Asset Management: Capital Returns and Capital Account: A Fund

Manager Reports on a Turbulent Decade, 1993-2002.

What are the fundamental factors that drive a boom-bust cycle in an industry?

From the behavioural end, bubbles arise when people have overinflated expectations for a particular sector. A

bubble can also arise when interest rates are too low - what we get is a monetary bubble, and we can see that

speculative bubbles tend to occur around periods of easy money. Such analysis around the dynamics of

system fragility and the dangers of setting a low interest rate has been a big part of my work so far, and even

now, Im writing about the consequences of the ultra-low interest rates that we have been living in since the

financial crisis.

Can you talk about a few examples where we have seen overinvestments in the past and the common

thread across those cases?

Sure. Ill start with a few examples that Andrew Odlyzko of the University of Minnesota, Minneapolis has

written about. He has pointed out that in 2000, internet data traffic was actually growing at only half the

reported usage rate. But many companies were using the false traffic growth stats to justify huge amounts of

capital spending. It was this myth of astronomical traffic growth that directed huge capital flows into the sector

and inflated the tech bubble. Andrews work also shows the impact of overinvestment in the British railway

space. He charts the railway stocks prices during the 1830s to 1850s against the acts of Parliament

authorizing new miles of railway, you will see that they run pretty close together. The Canal Mania of the 1780s

is another historical example of overinvestment.

The key takeaway from all these examples is that market booms generate capital spending which then drives

mean reversions. Overinvestment, as we saw in both the British canals and railways, can permanently destroy

returns for a sector.

The pattern of events is generally this - the first mover gets high returns on equity in a new technology. This

triggers a surge of investment in the sector. If assets have a long shelf life and dont disappear, such as canals

or railways, investors can get locked into permanently low returns. Monetary policy or speculative euphoria can

create a capital boom. What I find particularly interesting is how these seemingly obvious insights are rarely

acted upon. A similar story is now unfolding with respect to China. People have woken up to the

overinvestment in mining and the supply side developments in the energy sector only in the last couple of

years. Anyone with a capital cycle framework should have realized that measures like capex to depreciation

were becoming very high for the miners.

Why do people take so long to exit sectors where evidence of overinvestment is building up?

The markets short-term horizon, focus on EPS growth and other near-term performance measures is one key

reason. Also, even when some investors are aware of the developments on the supply side, the fantasy of

demand keeps them in the game. The other problem is that capital cycles differ for each industry. And, timing

the turn ex-ante is pretty much impossible. So, to avoid the aftermaths of things like the mining supercycle,

investors have to be long-termist and very obdurate in sticking to their positions.

Also, analysts spend too much time thinking about the P&L statement and traditional valuation measures for

their companies, but they dont spend enough time looking at the balance sheet and cash flows, which are

often negative when capital spending is booming. Take the classic case of homebuilders. Even in boom

periods, while they generate high profits, they tend to bid up the price of land, and so, their cash flow is

actually quite weak. Back in 2005-06, quite a few well known value investors thought that buying home

builders was a good idea as they were trading close to their trough levels on price to book. What they missed

was that the book itself had been increasing at around 25% a year for five years straight. This is what I call a

fundamental bubble; i.e., the valuations may look cheap, but the asset itself is a bubble. This was true in the

case of US housing and we are seeing a rerun of the same phenomenon for miners.

Where else do you see meaningful overinvestment?

China and emerging markets more broadly have been the boom sectors in terms of credit and capital flows

over the last eight to ten years. So there is massive capital concentration in China. Also, a lot of money has

been invested in building logistics for the resources sectors, and this is true in Brazil, for example.

The tech sector is similarly attracting a lot of capital right now. There has been a lot of excitement around

unicorns. In my opinion, when interest rates are low, speculative assets with no yield get bid up in the market

its no coincidence that Bitcoin bubbled and crashed at a time of zero rates. Abundance of capital is very much

at play here.

Goldman Sachs Global Investment Research

12

Fortnightly Thoughts

you could

argue that because

of low interest rates

London today is

overrun by Uber

taxis.

Special Issue

So, from a global perspective on one end we have China with massive capex, poor cash flows, and really

weak returns, and on the other, we have platform companies with low capex and in some ways artificially high

returns. That tends to exacerbate when the capital cycle stops working you could argue that because of low

interest rates London today is overrun by Uber taxis. The European and US auto industries clearly should

have gone through massive consolidation in 2008, but that didnt happen.

Do you think that increasingly consolidated industries will exhibit better capex discipline?

Whether consolidation leads to a more disciplined capital cycle or not depends on the industry and players, so

we will have to look at each industry on its own merits.

On one hand, airline companies have shown some capex discipline post consolidation. Three to four years

ago only a few smart investors were able to overcome the conventional bias against the airline sector they

made a lot of money. But on the other hand, we also have examples of some very concentrated industries that

show a lack of discipline. Mining is a good example here. It is an extremely concentrated industry with a

handful of big companies like Vale, Rio and BHP controlling supply. So theoretically, we should have expected

the big miners to show some capex discipline at the time of the disruptive entry of a fourth player, Fortescue.

But instead, what we saw was an increase in production last year. And the miners are spending similarly this

year too. BHP even said that the lowest-cost producer has the right to continue producing. The fine art auction

market provides another apt example; despite having a duopoly, Sothebys and Christies do not really

cooperate. The same can perhaps be said about Airbus and Boeing too.

I also dont think that measures like the Herfindahl-Hirschmann index which shows industry concentration can

provide a good indication of how supply discipline is evolving in a sector.

Industry conditions are constantly changing - investors need to look out for what Marathon calls the evolution

of cooperation among companies in a formerly highly competitive industry. This can lead to pricing discipline

and returns on capital may pick up faster than the market expects. There are no eternal truths here; things are

always changing and the drivers differ across industries. It is when the conventional wisdom of the market

adheres around a certain view and the underlying reality has changed a tiny bit, that a smart investor can gain

an edge. Let me use the fox-hedgehog analogy here. Investors need to be a bit of both. The capital cycle

approach requires being single-minded like a hedgehog, who know one thing namely, that returns on capital

are driven by changes on the supply side. The good capital cycle investor is also something of a fox, who likes

to sniff around different opportunities and applies his experience of the cycle in one industry to understand

developments in another. Drawing on previous experiences in this manner can be very useful for investors.

So what is the bigger concern for miners going forward the demand slowdown in China or lack of

supply discipline?

Ive been a severe China bear for a very long time, but abnormal demand from China was just one side of the

capital cycle story for the miners. Even if you ignore China, there are sufficient reasons to be fairly bearish

about miners going forward purely on a capital cycle argument. The BHPs, Rios and Vales of this world will

carry on digging because the supply cost curve has flattened. i.e. they can produce more at a lower cost. And

so, theyll carry on bringing more supply which will eventually bankrupt the industry. Its tempting to catch

falling knives, but you can be fairly bearish on the miners today even if you didnt account for the impact of

Chinas rebalancing. This is the trouble; as investment strategist Russell Napier commented analysts spend

90% of their time looking at demand, and 10% looking at supply. And, it should be the other way around.

Originally featured in issue 102 on investment cycles (Fortnightly Thoughts: The long, slow recovery for mining, February 18, 2016)

Goldman Sachs Global Investment Research

13

Fortnightly Thoughts

Special Issue

Interview withPeter Diamandis

About Peter Diamandis

Peter H. Diamandis is the founder and chairman of the XPRIZE Foundation, the co-founder and chairman of Singularity University and the

co-author of the book Abundance: The Future Is Better Than You Think. He is also the former CEO and co-founder of the Zero-Gravity

Corporation, the co-founder and vice chairman of Space Adventures Ltd., the founder and chairman of the Rocket Racing League, the cofounder of the International Space University and the co-founder of Planetary Resources.

Can you talk about the role of technology in driving the shift towards abundance?

In the traditional business model, we saw companies make money either by guarding a set of resources to

make them scarce, or to process scarce resources, whether its diamonds, other precious metals or

information, so that they could be sold to the world. But now, exponentially accelerating technologies are

helping us produce what used to be scarce in huge volumes, and making them near abundant. I would

suggest that there is nothing that is truly scarce anymore be it time, money, expertise, energy, food or health,

everything is becoming relatively more abundant than it used to. And this shift towards relative abundance is

being driven by technological developments in areas like sensors, networks, AI, robotics, 3-D printing,

synthetic biology, nano-materials and virtual worlds and access to near infinite computing power. Further, we

also have access to a cognitive surplus of a kind that is emerging as a result of more and more people with

expertise being connected to powerful technologies which allow them to solve more problems in less time.

So, 1,000 years ago, the best that even the kings and queens could do to solve problems on a national or

global scale was to deploy their troops. One hundred years ago, it was industrialists who could address some

constraints, by building railroads and steel mills etc. But today, the number of people able to take action has

exploded, because technologies that were only available to governments and corporations 20 years ago are

now readily accessible to all. Capital is similarly more easily accessible to people with expertise, thanks to the

development of angel and virtual networks, and crowd-funding platforms.

I believe technologies go through 6 Ds of exponential growth - as things digitise, they enter a period of

deceptive growth and then disruptive growth. Then, the technology becomes dematerialised, demonetised and

democratised. And this can happen because the marginal cost of replication and distribution is near zero in the

digital format. So ultimately, the once scarce physical good becomes available not just to the few people who

can pay a huge amount of money for it, but to the entire world instead.

Where are we likely to see the impact of this phenomenon next?

The force of these 6 Ds is disrupting industry after industry and I believe healthcare and education will go

through this cycle in the next ten years, along with industries such as insurance and finance. And as industries

such as education become demonetised, a billionaire in Manhattan and a teenager in an emerging economy

will have equal access to the best teachers that they can then learn from at effectively zero cost.

Dematerialisation should also disrupt middle men in many cases and give customers direct access to the

product in a cheaper, faster and more scalable manner. Real estate agents, for example, should become less

valuable as technology progresses and eventually allows people to have virtual tours of the property at a time

convenient to them, while some form of AI answers all their questions. Take it a step forward, and it might also

be possible to try different modes and changes in the house and find out how much they will cost, or have real

time bids on the financing of the place.

All this should drive a change in consumer behaviour as well...

Absolutely. With cost of accessing goods and services approaching zero in multiple industries - be it autos,

education or healthcare - were heading toward an interesting change in capitalism as we know it.

Instead of buying a fancy car which remains parked in the garage for 96% of the time for instance, we are

moving towards an era where people can fulfil their needs through autonomous cars without having to spend

any money owning the car. Even the energy cost can fall dramatically if the autonomous car runs on electricity

instead of traditional fuel.

Further, while only the wealthy have been able to afford a chauffeur in the past, autonomous cars and

platforms like Uber have now made chauffeur service one of the most cost-effective approaches for

transportation. So the thoughts around the utility of cars are surely changing, particularly in the younger

generations.

What is becoming abundant and what is still scarce?

Energy is already becoming abundant, as are most material resources. And while information is still valued

and there are certain forms of information that people want to hold onto and restrict, to some extent a lot of

information can also be duplicated, be it in the form of a scan of a design, or through the use of infinite

computing to model a million different variants to arrive at the right solution.

Also, scarcity is often a matter of view point. i.e., certain resources like strategic metals, platinum group metals

etc., while scarce on earth, no longer appear scarce if we extend our horizon. The company Planetary

Resources for example works towards retrieving strategic materials from approaching asteroids which

Goldman Sachs Global Investment Research

14

Fortnightly Thoughts

Special Issue

energetically are much closer to the Earth and the Moon and tend to be rich in fuels, platinum group metals,

construction materials etc.

In essence, technology is a dominant force that takes what used to be scarce and makes it abundant. It is

almost like a ladder that allows us to reach higher and move away from the scarcity that is created

momentarily when the low hanging fruits are exhausted in an industry. O&G used to be scarce when we were

only able to drill 1,000-5,000 meters below the oceans surface for instance, but oil became abundant once we

developed the technology for deep ocean drilling, which allowed us to unlock more energy in an economically

viable fashion. The same thing happened in food. And we are similarly moving towards abundance in other

sectors too, but this shift is likely to include some turbulent times on the economics front for businesses that

are being disrupted by new business models.

Theres massive risk in the world for people and physical assets then...

Yes, there is. Of course there are fundamental resources and infrastructure such as servers which still need to

exist and wont be dematerialised, but overall, we dont necessarily need to own a lot of the things that we

used to anymore. And while people may still buy cars or refrigerators if they enjoy driving or cooking for

instance, goods like these are no longer essential to maintain a standard of living. It is possible to economically

order out every day and have the food delivered at your doorsteps at a convenient time for example.

I would

suggest that there is

nothing that is truly

scarce anymore

be it time, money,

expertise, energy,

food or health,

everything is

becoming relatively

more abundant.

So what kind of companies will succeed in the world of abundance?

Theres only one Google, one Amazon, one eBay and what makes it hard to replicate these companies is not

just their IP but their broad reach and the fact that their search engine algorithms have become extremely

good, due to the number of searches that are done on them. And this network effect should help the winnertakes-all trend to persist in a large number of areas going forward. One of my companies Human Longevity

Inc. for example is focused on creating the most valuable database of biological information in the world and

building it so fast and so big that it becomes sensible for everybody to add their data to our system rather than

starting their own database from scratch. In short, companies that are globally dominant network effect players

hold tremendous value propositions for the world and will continue to succeed.

How do you respond to the relatively pessimistic counterarguments you hear around innovation?

People who hold a more pessimistic view about innovation often say that the rate of change in human life

expectancy has stagnated, or that jet planes are no longer becoming faster on a 30 year view. And while all

that may be true, what these arguments dont consider is the progress being made on new parameters. A high

fidelity virtual world for example can allow people to experience the same setting as some far-off place

instantaneously, and we already have early versions of telepresence from Cisco in this domain. There have

been other investments in this area including Google - Magic Leap, Microsoft - HoloLens, and Facebook Oculus Rift, and at some point, we may see developments in this area displace the need for point to point

travel.

Similarly, while the increase in rate of human longevity is slowing as a function of how it was growing until now,

we are finally progressing towards unlocking the understanding of the genome and fundamentally

understanding the code that makes people live to over 120, the changes in stem cells that make them unable

to repair and other mechanisms which once uncovered can extend the human life span significantly in one go.

Even in terms of experiences, while there is certainly a difference between seeing the actual Mona Lisa at the

Louvre and owning a replica or looking at a replica online, the difference isnt always sufficient to make the

alternative invaluable. And so, eventually, if people could go on a virtual adventure to some far-off place, and

have a compelling experience which feels so real that they gather 90% of the value of that experience,

experiences that are currently scarce and accessible to only 0.001% of the worlds population will also become

more broadly available.

Where do you see prices coming down as scarcity cedes to abundance?

Healthcare and education for sure, which is why I think they will soon be dematerialised. 3D printing should

similarly disintermediate some manufacturing and make things like apparel manufacturing more personalised,

allowing for perfectly tailored custom clothing. The current retail experience which involves a lot of time to

purchase clothes that may not even fit, should similarly get disrupted to an extent.

So are we moving to an 'everything as a service' economy where people will own a lot less of

everything as it becomes accessible as a service?

If the service that is available is better in terms of lower maintenance, lower overhead cost, lower time