Академический Документы

Профессиональный Документы

Культура Документы

User Manual For FSCM

Загружено:

Durga Tripathy DptОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

User Manual For FSCM

Загружено:

Durga Tripathy DptАвторское право:

Доступные форматы

User Manual for FSCM

Document Control

DOCUMENT INFORMATION

Title

FSCM Final User manual

Author

Santosh Pandit

File Name

FSCM User manual

Path

Release Date

Reviewed by

Number of pages

Document Number

REVISION DETAILS

Version

No.

Issue Date

TARGET READERSHIP

Table of Contents

Change

Details

Approved by

Released by

User Manual for FSCM

1.

Introduction................................................................................................. 3

2.

Master data................................................................................................. 3

2.1. Business Partner....................................................................................................... 3

2.1.1.

Creation of Business Partner...............................................................................3

2.1.2.

Extension of Business Partner to Role Counterparty...........................................5

2.1.3.

Extension of Business Partner to Depository Bank / Issuer.................................8

3.

4.

5.

2.2.

Securities Account.................................................................................................... 9

2.3.

Class ID................................................................................................................... 11

Investments in Mutual Funds......................................................................14

3.1.

Purchase of Securities............................................................................................. 14

3.2.

Financial posting of a Securities transaction...........................................................18

3.3.

Posting a Dividend reinvestment............................................................................24

3.4.

Posting a Dividend receipt......................................................................................28

3.5.

Sale of Securities..................................................................................................... 33

3.6.

Reversal of a posted transaction.............................................................................37

3.7.

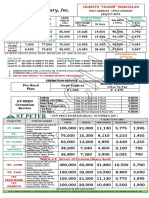

BDC for Purchase/Sale of Securities........................................................................43

3.8.

BDC for posting Dividends.......................................................................................44

Investments in Fixed Deposits....................................................................45

4.1.

Investing in a Fixed Deposit....................................................................................45

4.2.

Posting an FD transaction into FI.............................................................................53

4.3.

Posting of Interest related entries...........................................................................54

4.4.

Roll-over of an FD.................................................................................................... 55

Investments in Bonds/Debentures...............................................................57

5.1.

Creation of a Class ID for Bonds..............................................................................57

5.2.

Investing in a Bond................................................................................................. 61

5.3.

Calculating/Posting Accrued interest on the Bonds.................................................66

5.4.

Posting of periodic interest on the Bonds................................................................69

5.5.

Sale of Bonds.......................................................................................................... 71

User Manual for FSCM

1.Introduction

2.Master data

2.1.

Business Partner

The business partner is a natural or legal person with whom business relationships

are maintained. Typical business partners are banks, a brokerage house or a central

treasury department with which financial transactions are concluded or a customer

who has several accounts at the bank. BP has many roles such as counterparty,

issuer (for Securities), depository participant (for Securities) etc.

Use

In Treasury, each contract is entered as a transaction with one specific business

partner, which is why the business partner data must exist before the transaction

can be entered. The options available for creating a business partner depend on the

Customizing settings you make here.

2.1.1.

Creation of Business Partner

A Business partner can be a Person, Organisation or a Group. Accordingly, the

relevant icon needs to be selected during the creation of master data.

Specify the grouping under which the number of the Business partner needs to get

generated.

User Manual for FSCM

Enter the relevant details like name, address etc.

Specify the Bank account details and save the entry.

User Manual for FSCM

2.1.2.

Extension of Business Partner to Role

Counterparty

Extending the Business partner in a Counter-party role is essential when a

financial posting needs to be generated for any transaction with them. The BP role

gets selected through the field Change in BP role as shown below:

User Manual for FSCM

Note that once a Counter-party role is selected, the tab for Company code gets

enabled.

Specify the House bank and Account ID through which a payment would normally be

made to the Business partner. This will appear as a default at the transaction level

where it can as well be changed.

User Manual for FSCM

Select on the line item and goto Assignment as shown below:

Assign the bank to the broader category of transactions like Money market,

Securities.

User Manual for FSCM

Specify the Reconciliation account in the tab for Customer account management

User Manual for FSCM

Save the transaction

2.1.3.

Extension of Business Partner to Depository

Bank / Issuer

Depending on the nature of transactions with a business partner, he can also take

the following roles:

Issuer Representing an entity that issues securities

User Manual for FSCM

Depository Bank Bank where a investment is maintained e.g. Depository

participant

The extension is made in the similar way as has been explained above

2.2.

Securities Account

As the name suggests, it is the account in which security positions are held. Each

account needs to be identified with Sec Account type, e.g. AKT (DEMAT account),

PHY (physical).

Positions in one class ID can be held across multiple securities accounts. Similarly,

one security account will have positions with respect to multiple class IDs.

Positions in one class ID can be transferred from one security account to other if

necessary.

User Manual for FSCM

Specify the company code and the ID for the Securities account

Enter the Business partner who has been created in the role of a Depository bank.

The Bank account to which the DEMAT is linked can also be maintained herein.

User Manual for FSCM

The field Sec Account Type can be used to indicate whether the holding is in

dematerialized of physical form.

Any investment made, has to have a reference of the Securities account under

which the securities will be held or managed.

2.3.

Class ID

A Class ID represents the Securities in which investments are made. These could

hence take the form of a Mutual Fund, Shares in companies and Bonds/Debentures.

In Securities, we need to define each script in which we trade as a class ID. They

can be associated with only one asset class (product type) such as equity, mutual

funds, bonds etc. Each Class ID is to be assigned a security classification (e.g.

equity quoted Indian companies, unquoted Indian companies etc).

It is also possible to specify which stock exchange the security is listed on currently.

User Manual for FSCM

The following Product types would be typically used at KNPL:

02A Investment in Mutual Funds (Securities)

51A Investment in Fixed Deposits (Money Market)

04I Investments in Bonds/Debentures (Securities)

Specify the appropriate Security Class that categorizes the investment being made.

User Manual for FSCM

A Business partner in the role of an Issuer needs to be specified as follows

In the Conditions tab, the date when a Dividend is expected to be received needs

to be specified. This information can also be entered later-on whenever the dates

are known.

User Manual for FSCM

Save the entry

3.Investments in Mutual Funds

3.1.

Purchase of Securities

Purchase of Securities is entered with a combination of Class ID and Securities

Account.

User Manual for FSCM

Enter the company code and the Business partner from whom the securities are

being acquired.

Under the Structure tab, the Securities account, valuation class and date of

payment need to be entered.

Further, the Number of Units and the price per unit needs to be specified.

User Manual for FSCM

By default, the House bank and account ID gets copied from the business partner

master data as follows:

User Manual for FSCM

Next, goto, Security transaction Settle contract and Save the entry.

User Manual for FSCM

A transaction number gets generated that initially has a status as Contract which

needs to be changed to Settlement. Note that only a Settled transaction

number can be posted into financial accounting.

Specify the transaction number and save the entry. The status accordingly changes

as shown below:

User Manual for FSCM

3.2.

Financial posting of a Securities transaction

On Settlement of a transaction, no accounting entries are posted. In order to

generate the accounting effect, a separate transaction code needs to be executed

as follows:

Specify the Transaction number, the due date and execute the same.

User Manual for FSCM

The accounting entries that would get posted are displayed in the next screen

User Manual for FSCM

If the same is found correct, the Test run indicator

the final posting done.

An accounting document now gets generated.

can be unchecked and

User Manual for FSCM

The following report can be used to ascertain the total entries made for the

combination of a class ID and Securities account within a company code.

User Manual for FSCM

The average rate as of the report date gets displayed as follows:

User Manual for FSCM

Double click on the line item and the total transactions made until the report date

gets displayed as follows:

3.3.

Posting a Dividend reinvestment

Based on the terms of the MF scheme/offer, a Dividend can be either Reinvested

in the scheme or it can be distributed by the Mutual funds as Income.

In either case, the date when the dividend is expected to be received is indicated in

the class ID as follows:

The Amount indicated above represents the dividend amount declared per unit of

the holding in the fund.

User Manual for FSCM

This will get multiplied with the number of units held as on the due date so as to

arrive at the Dividend amount.

Specify the Class ID and Securities account in transaction code FWZE as follows:

The dividend entries would get reflected as per the respective dates as follows:

Double clicking on the line item will lead to the following screen:

User Manual for FSCM

Since the Dividend is to be Reinvested, select the icon for Capitalize as shown

above.

In the above pop-up, enter the Amount and the number of units that would get

capitalized.

User Manual for FSCM

Save the entry.

The accounting entries get posted as shown herein below:

3.4.

Posting a Dividend receipt

The other scenario for Dividend comprises of its actual receipt as against being

reinvested. In this case as well, the dividend date needs to be entered in the Class

ID.

User Manual for FSCM

Click on the icon of Insert Row to add a new Dividend condition. A pop-up will be

given as follows:

User Manual for FSCM

Specify the dividend date and its rate per unit as shown above.

Next goto, FWZE and enter the Class ID and securities account against which a

dividend is to be received.

User Manual for FSCM

The following screen comes up.

Double click on the same.

User Manual for FSCM

Choose the icon for Payment Details and enter the House bank and account ID in

which the same would be received.

Saving the entry will generate the corresponding accounting document as follows:

User Manual for FSCM

3.5.

Sale of Securities

A sale of securities is also entered through the transaction code TS01 but the

Transaction type to be used would be 200.

User Manual for FSCM

Specify the number of units and price of the same.

User Manual for FSCM

Settle the contract

User Manual for FSCM

A transaction number would be generated which then will be processed through

TBB1 for generating the accounting entries.

User Manual for FSCM

3.6.

Reversal of a posted transaction

A transaction that has been posted earlier can be reversed as follows:

Goto TS02 and specify the transaction number that needs to be reversed.

User Manual for FSCM

Select Reverse from the menu option.

User Manual for FSCM

Specify a reversal reason for the transaction.

The reversal of the financial entries happens through transaction code TPM10 as

follows:

User Manual for FSCM

Enter the transaction number that needs to be reversed.

User Manual for FSCM

Select the line item that is to be reversed and click on Execute

User Manual for FSCM

We would be reversing the Purchase transaction that was passed earlier.

Remove the indicator for Test run and re-execute the transaction.

3.7.

BDC for Purchase/Sale of Securities

At KNPL, a BDC has been developed for uploading the transactions relating to

Purchase/Sale of securities so as to automate the process.

The transaction code to be executed is ZFSCM01.

User Manual for FSCM

Selecting the icon for Purchase/Sale leads to the following screen wherein the file

path needs to be specified. Note that the program can be executed in the

background as well.

3.8.

BDC for posting Dividends

A BDC has also been developed for posting dividends through the same transaction

code.

User Manual for FSCM

Select the option of Dividend and specify the file path for upload.

Note that FWZZ relates to uploading the Dividend dates for the respective class

IDs, whereas FWZE pertains to posting of these dividends on the respective dates.

User Manual for FSCM

The excel formats for the above are as per the attached worksheets

Purchase of

Securities.xls

FWZZ.xls

FWZE upload.xls

4.Investments in Fixed Deposits

4.1.

Investing in a Fixed Deposit

A Fixed deposit is represented by Product type 51A in the system and the

transaction code to be used in this case is TM01

User Manual for FSCM

Specify the transaction type as 100 viz. placing of a FD and enter the relevant

business partner.

User Manual for FSCM

Specify the principal amount, start and maturity date, FD interest percentage and

the frequency of interest payments as shown above.

The respective Tabs in the transactions are accordingly populated as shown below

User Manual for FSCM

User Manual for FSCM

Based on the interest rates and frequency of receipts, the Cash Flow tab gets

automatically updated.

If the frequency is changed to Monthly instead of End of term, the cash flow

figures change as shown below:

User Manual for FSCM

Double click on any interest line item to ascertain the manner in which the amount

gets calculated.

User Manual for FSCM

Settle the contract

A transaction number gets generated as follows:

User Manual for FSCM

Save the transaction

User Manual for FSCM

4.2.

Posting an FD transaction into FI

The transaction number as generated above then needs to be processed through

TBB1 for generating the accounting entries.

User Manual for FSCM

4.3.

Posting of Interest related entries

On the respective interest receipt dates, TBB1 again has to be executed for

generating the accounting entries.

User Manual for FSCM

4.4.

Roll-over of an FD

Incase if a FD is renewed at the end of its term, the same can be done as follows:

Goto change mode for the FD transaction number

Goto Fixed term deposit Roll over as shown below:

User Manual for FSCM

Specify the revised maturity date in the field End as shown below:

User Manual for FSCM

5.Investments in Bonds/Debentures

5.1.

Creation of a Class ID for Bonds

Bonds/Debentures are tracked in FSCM within Securities module and the Product

type to be used while creating a class ID is 04I

User Manual for FSCM

User Manual for FSCM

User Manual for FSCM

The start and end of term for the bonds are specified in the respective fields as

shown above

User Manual for FSCM

In the conditions tab, the date and Interest rate are specified as shown above. The

Calculation date and Due date are to be input the same dates which normally would

be the end date of the Bond.

5.2.

Investing in a Bond

Specify the class ID, transaction type and business partner.

User Manual for FSCM

Specify the Payment amount as shown above as this is the amount of investment

that would get posted to in accounting.

User Manual for FSCM

Settle the contract

User Manual for FSCM

The transaction number generated would then be posted through TBB1

User Manual for FSCM

User Manual for FSCM

5.3.

Calculating/Posting Accrued interest on the

Bonds

Normally the interest on bonds would be received at the maturity date, however,

the interest accrued needs to be accounted for on a monthly basis.

Accrued interest can be calculated on the bonds through transaction code TPM44 as

follows

User Manual for FSCM

User Manual for FSCM

Specify the ID number as above and execute.

User Manual for FSCM

On un-checking the Test run, the actual accounting entries would get generated.

5.4.

Posting of periodic interest on the Bonds

The final interest receipt against a Bond can be posted through the transaction code

FWZE as follows

User Manual for FSCM

Select the interest line item and double click on the same.

User Manual for FSCM

Fill-in the bank details and post

5.5.

Sale of Bonds

Sale of bonds will be executed through transaction code TS01 with the Transaction

type as 200.

User Manual for FSCM

Settle the contract as follows

User Manual for FSCM

Ensure that the Payment amount is filled-in for the amount of bond matured.

User Manual for FSCM

Posting the transaction will generate the accounting entry.

Вам также может понравиться

- Dispute MGMT Config GuideДокумент65 страницDispute MGMT Config GuiderockyrrОценок пока нет

- Credit Management - Configuration Step by StepДокумент6 страницCredit Management - Configuration Step by Stepvickss1122Оценок пока нет

- FF7A Cash PositionДокумент9 страницFF7A Cash PositionloanltkОценок пока нет

- How To Use SAP TPM18Документ2 страницыHow To Use SAP TPM18raju0% (1)

- SAP FSCM Credit Management Config StepsДокумент3 страницыSAP FSCM Credit Management Config StepsDamodar Naidu PaladuguОценок пока нет

- SAP FSCM Interview QuestionsДокумент3 страницыSAP FSCM Interview QuestionsusasidharОценок пока нет

- F-04 GL Account ClearingДокумент8 страницF-04 GL Account ClearingMillionn Gizaw0% (1)

- Fin FSCM CCD 3Документ4 страницыFin FSCM CCD 3car_pierreОценок пока нет

- FF63 Create Memo RecordДокумент3 страницыFF63 Create Memo RecordloanltkОценок пока нет

- FF7B Liquidity ForecastДокумент11 страницFF7B Liquidity ForecastloanltkОценок пока нет

- Contents-SAP FSCM Configuration and User GuideДокумент3 страницыContents-SAP FSCM Configuration and User Guidesapfico2k8Оценок пока нет

- FSCM - Credit Management (Light Implementation Solution) Manage and Collect CreditsДокумент55 страницFSCM - Credit Management (Light Implementation Solution) Manage and Collect CreditsRajuОценок пока нет

- SAP Cash Journal ConfigurationДокумент16 страницSAP Cash Journal ConfigurationDaniloRullanОценок пока нет

- Configuring SAP BCM and SAP CRM Interaction CenterДокумент25 страницConfiguring SAP BCM and SAP CRM Interaction CenterSanjay RaghuОценок пока нет

- FEBANДокумент1 страницаFEBANsivasivasapОценок пока нет

- DMEE Detailed Configuration2Документ28 страницDMEE Detailed Configuration2Nayamath SyedОценок пока нет

- SAP New GL #9 Customise Cross Company Code Postings For Document SplittingДокумент11 страницSAP New GL #9 Customise Cross Company Code Postings For Document SplittingAlan Cheng100% (2)

- How To Create and Configure DME FileДокумент3 страницыHow To Create and Configure DME FilesairamsapОценок пока нет

- SAP FSCM Online TrainingДокумент9 страницSAP FSCM Online TrainingcosmosonlinetrainingОценок пока нет

- Sap CMLДокумент5 страницSap CMLabir_finance16Оценок пока нет

- FI - Auto Email Notification For Closing Cockpit PDFДокумент9 страницFI - Auto Email Notification For Closing Cockpit PDFHoang Quoc DatОценок пока нет

- Head Office and Branch Concept Demostrated For Both Vendors CustomersДокумент13 страницHead Office and Branch Concept Demostrated For Both Vendors CustomersAvinash Malladhi0% (1)

- FSCM User Manual: Disputes & Collections ManagementДокумент30 страницFSCM User Manual: Disputes & Collections ManagementkamranahmedaslamОценок пока нет

- A) Introduction: Quick KDS InformationДокумент11 страницA) Introduction: Quick KDS InformationDillip Kumar mallickОценок пока нет

- Configuration and Design Document Funds: Management Page 1 of 146Документ146 страницConfiguration and Design Document Funds: Management Page 1 of 146Reddaveni Nagaraju100% (1)

- Basic Credit ManagementДокумент18 страницBasic Credit ManagementPedro J PoncelaОценок пока нет

- Chapter 24 - Asset Management ConfigurationДокумент23 страницыChapter 24 - Asset Management ConfigurationShine KaippillyОценок пока нет

- Cookbook Deprecation of Commodity ID PDFДокумент35 страницCookbook Deprecation of Commodity ID PDFBülent Değirmencioğlu100% (1)

- SAP Funds Management - Commitment ItemДокумент21 страницаSAP Funds Management - Commitment ItemKathiresan Nagarajan100% (1)

- SAP Asset Tax DepreciationДокумент2 страницыSAP Asset Tax DepreciationThatra K ChariОценок пока нет

- 8 Methods To Process A CO Production OrderДокумент13 страниц8 Methods To Process A CO Production Orderrajesh reddyОценок пока нет

- Note 859998 - Installing SAP Credit Management 6.0: SymptomДокумент4 страницыNote 859998 - Installing SAP Credit Management 6.0: SymptomNidhi Rathi MantriОценок пока нет

- PRFI - Create Posting RunДокумент6 страницPRFI - Create Posting RunSenij Khan100% (1)

- Cash Manaagement ConceptДокумент4 страницыCash Manaagement ConceptRoberto De FlumeriОценок пока нет

- Report PainterДокумент43 страницыReport PainterPranshu Rastogi100% (1)

- 3 Planning Layout Planner ProfileДокумент17 страниц3 Planning Layout Planner ProfileNarayan Adapa100% (2)

- SAP Liquid PlannerДокумент3 страницыSAP Liquid PlannermrobalinhoОценок пока нет

- BRS Confg in Sap PDFДокумент25 страницBRS Confg in Sap PDFSANTOSH VAISHYAОценок пока нет

- DMEE Configuration - Step by Step Part 1 - Sap 4 AllДокумент14 страницDMEE Configuration - Step by Step Part 1 - Sap 4 AllМаксим БуяновОценок пока нет

- Results AnalysisДокумент7 страницResults AnalysisMarolop HutabaratОценок пока нет

- Sap FSCM SampleДокумент13 страницSap FSCM Samplephilkphilk100% (1)

- DMEE ConfigurationДокумент27 страницDMEE ConfigurationMahesh Kamsali100% (2)

- SAP Travel and ExpenseДокумент33 страницыSAP Travel and ExpensePrateekОценок пока нет

- Sap FM 001Документ35 страницSap FM 001RakeshОценок пока нет

- Customizing For Liquidity Management 20170508Документ77 страницCustomizing For Liquidity Management 20170508Jops DiPaОценок пока нет

- Fund Management Table of ContentДокумент134 страницыFund Management Table of ContentSridharquestОценок пока нет

- Single Euro Payments Area in SAPДокумент12 страницSingle Euro Payments Area in SAPRicky Das100% (1)

- BAdIs For The Process Integration - SAP Dispute Management Configuration Guide For FI-AR - SAP LibraryДокумент3 страницыBAdIs For The Process Integration - SAP Dispute Management Configuration Guide For FI-AR - SAP LibraryRajuОценок пока нет

- SAP in House CashДокумент3 страницыSAP in House Cashpaiashok0% (1)

- Business Partner ConfigurationДокумент2 страницыBusiness Partner ConfigurationM AshokОценок пока нет

- SAP FI - Automatic Payment Program (Configuration and Run)Документ26 страницSAP FI - Automatic Payment Program (Configuration and Run)ravi sahОценок пока нет

- SAP FSCM BasicsДокумент5 страницSAP FSCM BasicspaiashokОценок пока нет

- DMEE Configuration - Step by Step Part 1 - SAP Blogs2Документ50 страницDMEE Configuration - Step by Step Part 1 - SAP Blogs2Максим Буянов100% (1)

- Cash Journal - Concept, Config, ManualДокумент24 страницыCash Journal - Concept, Config, ManualKamonchai KОценок пока нет

- S4 HANA FI-GL User ManualДокумент27 страницS4 HANA FI-GL User Manualcv babuОценок пока нет

- Config Guide FSC M PrototypДокумент99 страницConfig Guide FSC M PrototypArindam GhoshОценок пока нет

- Cross-Company - Inter-Company Transactions - SAP BlogsДокумент26 страницCross-Company - Inter-Company Transactions - SAP Blogspuditime100% (1)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОт EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОценок пока нет

- S4 O Data and ABAPДокумент1 страницаS4 O Data and ABAPDurga Tripathy DptОценок пока нет

- Ledger Approach in New Asset AccountingДокумент3 страницыLedger Approach in New Asset AccountingDurga Tripathy DptОценок пока нет

- ML Q&aДокумент7 страницML Q&aDurga Tripathy Dpt100% (1)

- Co CC CycleДокумент3 страницыCo CC CycleDurga Tripathy DptОценок пока нет

- SD Config ImplementationДокумент3 страницыSD Config ImplementationDurga Tripathy DptОценок пока нет

- DMEE ConfigurationДокумент43 страницыDMEE ConfigurationDurga Tripathy DptОценок пока нет

- GFKL Co Sap - CoДокумент107 страницGFKL Co Sap - CoDurga Tripathy Dpt100% (1)

- Script BSE: 1 WaitДокумент9 страницScript BSE: 1 WaitDurga Tripathy DptОценок пока нет

- TradeДокумент8 страницTradeDurga Tripathy DptОценок пока нет

- SAP Question and AnswerДокумент13 страницSAP Question and AnswerDurga Tripathy DptОценок пока нет

- Astrology Can Be Divided in Two SectionsДокумент10 страницAstrology Can Be Divided in Two SectionsDurga Tripathy DptОценок пока нет

- Yogesh Kumar - Fps Id 2177Документ29 страницYogesh Kumar - Fps Id 2177Shaminder SinghОценок пока нет

- Monetary Policy and CB Module-7Документ18 страницMonetary Policy and CB Module-7Eleine Taroma AlvarezОценок пока нет

- What Is Electronic Funds Transfer (EFT) ?Документ2 страницыWhat Is Electronic Funds Transfer (EFT) ?Philemon Wishikoti SawonoОценок пока нет

- Accounting Principles CH 03 + 04 ExamДокумент7 страницAccounting Principles CH 03 + 04 ExamJames MorganОценок пока нет

- Remote Deposit Capture ProjectДокумент9 страницRemote Deposit Capture ProjectRavi Chandra0% (1)

- BFM Project Report in FinanceДокумент52 страницыBFM Project Report in FinanceRaunak MotwaniОценок пока нет

- Banking and Finance Project TopicsДокумент4 страницыBanking and Finance Project Topicskelvin carterОценок пока нет

- TaxДокумент8 страницTaxiamnumberfourОценок пока нет

- Activity 7 Motivation-GomezДокумент12 страницActivity 7 Motivation-GomezANGELICA FRANSCINE GOMEZ100% (1)

- The Articles of Agreement of The IMF Vis-À-Vis Prohibition On Repatriation of Capital Investment by A Member State-The Gambit of The Articles To The Investors RightsДокумент2 страницыThe Articles of Agreement of The IMF Vis-À-Vis Prohibition On Repatriation of Capital Investment by A Member State-The Gambit of The Articles To The Investors RightsBirhanu Tadesse Daba100% (1)

- Bank Al HabibДокумент4 страницыBank Al HabibTahir HakroОценок пока нет

- IRP-1 Form First Time RegistrationДокумент2 страницыIRP-1 Form First Time Registrationbella FlorОценок пока нет

- Life Insurance Linked With InvestmentДокумент14 страницLife Insurance Linked With InvestmentWyatt HurleyОценок пока нет

- 18 - Villalva vs. RCBC Savings BankДокумент3 страницы18 - Villalva vs. RCBC Savings BankJade Viguilla100% (1)

- MT940Документ13 страницMT940NestorMoyanoQОценок пока нет

- Cash and Cash Equivalent LatestДокумент54 страницыCash and Cash Equivalent LatestNil Justeen GarciaОценок пока нет

- ICICI Net Banking & E StatementДокумент18 страницICICI Net Banking & E StatementgoanfidalgosОценок пока нет

- Hermenegildo Z. Narvaez Francisco Javier P. Bonoan Reginaldo Anthony B. CariasoДокумент19 страницHermenegildo Z. Narvaez Francisco Javier P. Bonoan Reginaldo Anthony B. CariasoCarlo NicolasОценок пока нет

- DBP V CA, G.R. No. 118342Документ15 страницDBP V CA, G.R. No. 118342Krister VallenteОценок пока нет

- Gmail - Attention To - Firaol Wondesen BulbulaДокумент2 страницыGmail - Attention To - Firaol Wondesen BulbulaFira tubeОценок пока нет

- How We Classify CountriesДокумент2 страницыHow We Classify Countriesyogeshdhuri22Оценок пока нет

- Redemption PeriodДокумент3 страницыRedemption PeriodKrisleen AbrenicaОценок пока нет

- PayMongo Memorandum of AgreementДокумент14 страницPayMongo Memorandum of AgreementMakuto MitsuharaОценок пока нет

- 42 Desdemar 11 Coliwa InglésДокумент198 страниц42 Desdemar 11 Coliwa InglésweliОценок пока нет

- 2017 Undas Pricelist NewДокумент1 страница2017 Undas Pricelist NewDanica UgayОценок пока нет

- Base24 zOSДокумент198 страницBase24 zOSaksmsaidОценок пока нет

- Commercial Bank Management Sem IIIДокумент11 страницCommercial Bank Management Sem IIIJanvi MhatreОценок пока нет

- MBBcurrent 564548147990 2022-04-30 PDFДокумент7 страницMBBcurrent 564548147990 2022-04-30 PDFAdeela fazlinОценок пока нет

- The Coming World Government - Tragedy & Hope - Adrian Salbuchi - May2011Документ106 страницThe Coming World Government - Tragedy & Hope - Adrian Salbuchi - May2011Fer EscotoОценок пока нет

- AmendmentДокумент2 страницыAmendmentvaishnaviОценок пока нет