Академический Документы

Профессиональный Документы

Культура Документы

Tutorial Chap 1

Загружено:

AwnieAzizanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tutorial Chap 1

Загружено:

AwnieAzizanАвторское право:

Доступные форматы

SEM II 2014/2015

BWFF2043

TUTORIAL TOPIC 1: TIME VALUE OF MONEY

Q.1

A companys 2005 sales were RM100 million. If sales grow at 8% per year,

how large will they be 10 years later (in 2015), in millions?

Q.2

Joanne places RM800 in a savings account paying 6% interest compounded

annually. She wants to know how much money will be in the account at the

end of 5 years.

Q.3

Rahman has an opportunity to receive RM300 one year from now. If he can

earn 6% on his investments in the normal course of events, what is the most

he should pay now for this opportunity?

Q.4

Pamela wishes to find the present value of RM1700 that will be received 8

years from now. The opportunity cost is 8%.

Q.5

The ABC Corp. offers to sell you a bond for RM613.81. No payments will be

made until the bond matures 10 years from now, at which time it will be

redeemed for RM1,000. What interest rate would you earn if you bought this

bond at the offer price?

Q.6

Tescom Corp's 2005 earnings per share were RM2, and its growth rate

during the prior 5 years was 11.0% per year. If that growth rate were

maintained, how long would it take for Tescoms EPS to double?

Q.7

Abby wishes to determine the number of years it will take for her initial

RM1000 deposit, earning 8% annual interest, to grow to equal RM2500.

Q.8

You have a chance to buy an annuity that pays RM1,000 at the end of each

year for 5 years. You could earn 6% on your money in other investments with

equal risk. What is the most you should pay for the annuity?

Q.9

Suppose you inherited RM200,000 and invested it at 6% per year. How much

could you withdraw at the end of each of the next 15 years?

SEM II 2014/2015

BWFF2043

Q.10

Deen Company, a small producer of plastic toys, wants to determine the

most it should pay to purchase a particular ordinary annuity. The annuity

consists of cash flows of RM700 at the end of each year for 5 years. The

company requires the annuity to provide a minimum return of 8%.

Q.11

Whats the present value of a perpetuity that pays RM100 per year if the

appropriate interest rate is 6%?

Q.12

Whats the rate of return you would earn if you paid RM1,500 for a perpetuity

that pays RM105 per year?

Q.13

At a rate of 8%, what is the present value of the following cash flow stream?

RM0 at Time 0; RM100 at the end of Year 1; RM300 at the end of Year 2; RM0

at the end of Year 3; and RM500 at the end of Year 4?

Q.14

You plan to invest RM2000 a year in one of the Malaysian unit trusts for the

next 20 years. You would like to know the effect of investing this money at

the beginning of each year rather than waiting until the end of each year.

Calculate the difference in the future value of your investment at the end of

20 years as an ordinary annuity versus an annuity due, assuming a 10

percent interest rate.

Q.15

Joe borrowed RM15,000 at 14 percent annual rate of interest to be repaid

over three years. The loan is amortized into three equal annual end-of-year

payments.

a.

b.

c.

Calculate the annual end-of-year loan payment.

Prepare a loan amortization schedule, showing the interest and

principal breakdown of each of the three loan payments.

Explain why the interest portion of each payment declines with the

passage of time.

Вам также может понравиться

- Essay - Lim Qian Ting SM3B2: Ways To Solve The Problem of LitteringДокумент2 страницыEssay - Lim Qian Ting SM3B2: Ways To Solve The Problem of Littering陈贤敬Tan Xian JingОценок пока нет

- 950 Math M (PPU) Semester 2 Topics-SyllabusДокумент4 страницы950 Math M (PPU) Semester 2 Topics-SyllabusJosh, LRTОценок пока нет

- Tutorial 11 Preparation of Financial Statements (Q)Документ6 страницTutorial 11 Preparation of Financial Statements (Q)lious liiОценок пока нет

- MUET Past Year Question (2010-2012)Документ5 страницMUET Past Year Question (2010-2012)honghong_LCHОценок пока нет

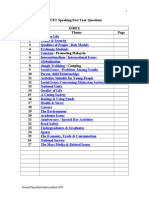

- MUET SpeakingДокумент4 страницыMUET SpeakingJewelle QiОценок пока нет

- Muet SpeakingДокумент9 страницMuet SpeakingNg Kim FaiОценок пока нет

- Study in LocalДокумент1 страницаStudy in LocalNur Amalia100% (1)

- Exercise Chapter 6Документ3 страницыExercise Chapter 6Siti AishahОценок пока нет

- Muet Speaking QuestionsДокумент2 страницыMuet Speaking QuestionsKevin LimОценок пока нет

- Ace Ahead (MUET) Info Ekstra Writing Q2Документ4 страницыAce Ahead (MUET) Info Ekstra Writing Q2Esther WongОценок пока нет

- Compilation of MUET Speaking QuestionsДокумент35 страницCompilation of MUET Speaking QuestionsVasantha MallarОценок пока нет

- Elc151 (Speaking Practice - Gift To Brother)Документ4 страницыElc151 (Speaking Practice - Gift To Brother)Lisyaa AhmadОценок пока нет

- Muet Question BankДокумент2 страницыMuet Question BankVanila Ais100% (1)

- As We Head Towards The Year 2020, Many Malaysians Feel That Much Remains To Be Done in Order To Improve The Quality of Our Life.Документ2 страницыAs We Head Towards The Year 2020, Many Malaysians Feel That Much Remains To Be Done in Order To Improve The Quality of Our Life.AnswerHub83% (6)

- Tutorial 7 PC & MONOPOLYДокумент3 страницыTutorial 7 PC & MONOPOLYCHZE CHZI CHUAHОценок пока нет

- Consumer BehaviourДокумент7 страницConsumer Behaviourmophat SabareОценок пока нет

- Muet Soalan SpeakingДокумент1 страницаMuet Soalan Speakingizan2824Оценок пока нет

- Meeting Someone For The First Time Through TheДокумент6 страницMeeting Someone For The First Time Through TheYong JinОценок пока нет

- Form 1 ACS 2019ver5Документ7 страницForm 1 ACS 2019ver5phreak90210Оценок пока нет

- Detectives - We've Seen Some Great Projects Where Schools Have Collected All of Their Waste andДокумент6 страницDetectives - We've Seen Some Great Projects Where Schools Have Collected All of Their Waste andShirley LinОценок пока нет

- Paper 2 Section CДокумент11 страницPaper 2 Section CAnonymous MuCuTGd1aoОценок пока нет

- Ans For International Youth DayДокумент3 страницыAns For International Youth DayMUHAMMAD AKBAR KUGHAN BIN MUHAMMAD DANIAL PHILIP MoeОценок пока нет

- Q2 March 2014 Imbalance of Male and FemaleДокумент3 страницыQ2 March 2014 Imbalance of Male and FemaleTunku Hilman Al-nordin50% (4)

- MUET WRITING Question EssayДокумент3 страницыMUET WRITING Question Essay和 和了自己Оценок пока нет

- MUET Writing MillionaireДокумент3 страницыMUET Writing MillionaireLuculus LeeОценок пока нет

- Task 1 (Email)Документ2 страницыTask 1 (Email)diviya viyaaОценок пока нет

- Tutorial Questions (Chapter 3)Документ2 страницыTutorial Questions (Chapter 3)Nabilah Razak0% (1)

- Formula Makro STPM 944Документ8 страницFormula Makro STPM 944Salwa Syed AhmadОценок пока нет

- EnglishДокумент2 страницыEnglishHmk Penang50% (4)

- The Elc231 Evaluative Commentary - Outline Template TITLE: Are Young People's Social Skills Declining?Документ3 страницыThe Elc231 Evaluative Commentary - Outline Template TITLE: Are Young People's Social Skills Declining?NUR AMNI NABILAH MOHD ZAMRIОценок пока нет

- Annual Report PROTONДокумент228 страницAnnual Report PROTONMuhammad Adzan Ad-din YusriОценок пока нет

- Causes of Road Accidents in Malaysia EssayДокумент3 страницыCauses of Road Accidents in Malaysia Essayashraf95100% (1)

- IMC 402 - Chapter 3Документ67 страницIMC 402 - Chapter 3Suzaini SupingatОценок пока нет

- EmailДокумент1 страницаEmailRadin Siti AishahОценок пока нет

- Muet Speaking TipsДокумент8 страницMuet Speaking TipsKeman MjОценок пока нет

- STPM (Math M)Документ54 страницыSTPM (Math M)norhidayumohdzaini100% (1)

- There Is A Lack of Freedom Given To Teenagers Today. Do You Agree?Документ11 страницThere Is A Lack of Freedom Given To Teenagers Today. Do You Agree?Rishaleni RajanОценок пока нет

- Muet EssayДокумент7 страницMuet EssayyeemanОценок пока нет

- Example of Muet WritingДокумент6 страницExample of Muet WritingZulhelmie ZakiОценок пока нет

- Esei MuetДокумент2 страницыEsei MuetNinaLishesОценок пока нет

- A Person's Career Choice Should Be Determined by His or Her InterestДокумент1 страницаA Person's Career Choice Should Be Determined by His or Her Interestsapphire0112Оценок пока нет

- The Statement "Rich Children Are Generally Happier Than Those From Poorer" Is Not Really TrueДокумент1 страницаThe Statement "Rich Children Are Generally Happier Than Those From Poorer" Is Not Really Trueahmed5577Оценок пока нет

- C. Compilation of MUET Writting QuestionsДокумент4 страницыC. Compilation of MUET Writting Questionsmuhamad habilОценок пока нет

- MUET: Malaysia National ServiceДокумент3 страницыMUET: Malaysia National ServiceSyahirah SharumОценок пока нет

- MUETДокумент30 страницMUETAina Izany75% (4)

- Topic 10 - Lecturer 2Документ10 страницTopic 10 - Lecturer 2Nuradriana09Оценок пока нет

- MUET EssayДокумент3 страницыMUET EssayMicky TanОценок пока нет

- Assigment Account FullДокумент16 страницAssigment Account FullFaid AmmarОценок пока нет

- MuetДокумент28 страницMuetChan KarlokОценок пока нет

- Imc 414 IndДокумент16 страницImc 414 IndNurulnazatul03Оценок пока нет

- Acknowledgement: Bpme 2023creativity and InnovationДокумент15 страницAcknowledgement: Bpme 2023creativity and Innovationwong68040% (1)

- STPM Mathematics MДокумент63 страницыSTPM Mathematics MMuhammad Syawal50% (2)

- MUET Exercise 12 - Vocabulary W AnswerДокумент8 страницMUET Exercise 12 - Vocabulary W AnswerIli Farhana100% (1)

- Muet Reading July 2016Документ4 страницыMuet Reading July 2016chandrika100% (1)

- Prison Is Not A Cure For CrimeДокумент8 страницPrison Is Not A Cure For CrimeTiffany LeongОценок пока нет

- Visit To Book FairДокумент2 страницыVisit To Book Fairyogamalar_chandrasekaranОценок пока нет

- MUET English Speaking TestДокумент5 страницMUET English Speaking TestJIE YI CHENОценок пока нет

- A151 Tutorial Topic 5 - QuestionДокумент3 страницыA151 Tutorial Topic 5 - QuestionNadirah Mohamad Sarif100% (1)

- Gsm5400 (May2017) :time Value of Money ExerciseДокумент1 страницаGsm5400 (May2017) :time Value of Money ExerciseSivasakti MarimuthuОценок пока нет

- What Single Investment Made TodayДокумент5 страницWhat Single Investment Made TodaynorazimahОценок пока нет

- (Chapter 3) Quadratic FunctionДокумент17 страниц(Chapter 3) Quadratic Functiondenixng100% (3)

- Threats and Controls of The Expenditure CycleДокумент3 страницыThreats and Controls of The Expenditure CycleAwnieAzizanОценок пока нет

- Chapter 2 - ExampleДокумент2 страницыChapter 2 - ExampleAwnieAzizanОценок пока нет

- Marketing Chapter 8Документ92 страницыMarketing Chapter 8AwnieAzizan0% (1)

- Tutorial QuestionsДокумент11 страницTutorial QuestionsAwnieAzizanОценок пока нет

- SQQS1013 Ch5 A122Документ48 страницSQQS1013 Ch5 A122AwnieAzizanОценок пока нет

- SQQS1013 Ch6 A122Документ27 страницSQQS1013 Ch6 A122AwnieAzizanОценок пока нет

- BKAF1023 Syllabus A131-Sept 2013Документ6 страницBKAF1023 Syllabus A131-Sept 2013AwnieAzizanОценок пока нет

- SQQS1013 Ch4 A122Документ20 страницSQQS1013 Ch4 A122AwnieAzizanОценок пока нет

- SQQS1013 Ch3 A122Документ33 страницыSQQS1013 Ch3 A122AwnieAzizan0% (1)

- Bkam 2013Документ7 страницBkam 2013AwnieAzizanОценок пока нет

- Marketing Chapter 9Документ91 страницаMarketing Chapter 9AwnieAzizanОценок пока нет

- Syllabus - BKAA2013 - 1 - (1) A142Документ7 страницSyllabus - BKAA2013 - 1 - (1) A142AwnieAzizanОценок пока нет

- SFP Act 2021Документ4 страницыSFP Act 2021moreОценок пока нет

- Study of Deposit Schemes of Bank of IndiaДокумент69 страницStudy of Deposit Schemes of Bank of IndiaMegha JerathОценок пока нет

- 06 Gregory V HelveringДокумент3 страницы06 Gregory V HelveringYaz CarlomanОценок пока нет

- Capital Structure TheoriesДокумент13 страницCapital Structure Theoriesಮಂಜುನಾಥ್ ರಂಪುರೆ ಎಸ್Оценок пока нет

- Fin611 Solved Online QuizzesДокумент7 страницFin611 Solved Online QuizzesFarhan Bajwa100% (1)

- Productivity Analysis of Steel IndustryДокумент9 страницProductivity Analysis of Steel IndustryDr-Abhijit SinhaОценок пока нет

- Practical Oriented Questions and AnswersДокумент11 страницPractical Oriented Questions and AnswersAshok dore Ashok doreОценок пока нет

- Sibongile Mnana TAX2601 Assignment 3Документ7 страницSibongile Mnana TAX2601 Assignment 3sibongileОценок пока нет

- Course SyllabusДокумент11 страницCourse SyllabusLiwayОценок пока нет

- Exam Finals Manon-OgДокумент14 страницExam Finals Manon-OgJM RoxasОценок пока нет

- Luang Company Is Considering The Purchase of A New Machine PDFДокумент1 страницаLuang Company Is Considering The Purchase of A New Machine PDFDoreenОценок пока нет

- Quiz 2 Financial Accounting SolutionsДокумент5 страницQuiz 2 Financial Accounting SolutionsScribdTranslationsОценок пока нет

- Concierge Service Business PlanДокумент35 страницConcierge Service Business PlanTamer KhattabОценок пока нет

- Retirement Calculator & Planner DemoДокумент39 страницRetirement Calculator & Planner DemoSumit TodiОценок пока нет

- Yong Chan Kim v. People, GR 84719Документ2 страницыYong Chan Kim v. People, GR 84719Kaye Miranda Laurente100% (1)

- BBS - 1st - Financial Accounting and AnalysisДокумент46 страницBBS - 1st - Financial Accounting and AnalysisJALDIMAIОценок пока нет

- Unit 4 Expatriate CompensationДокумент36 страницUnit 4 Expatriate Compensationlizza samОценок пока нет

- H. Family IncomeДокумент29 страницH. Family IncomeFahad AkmadОценок пока нет

- Capital Budgeting, Cash Flows & Decision Making ProcessДокумент47 страницCapital Budgeting, Cash Flows & Decision Making ProcessAnifahchannie PacalnaОценок пока нет

- 2017 Bar Exams Questions in Mercantile LawДокумент29 страниц2017 Bar Exams Questions in Mercantile LawGeeAgayamPastorОценок пока нет

- Atomy Compensation PlanДокумент5 страницAtomy Compensation PlanDJ punye by LCОценок пока нет

- Practicalweek48 0809answersДокумент8 страницPracticalweek48 0809answersLaura BasalicОценок пока нет

- IC One Page Financial Plan Template 9036 PDFДокумент2 страницыIC One Page Financial Plan Template 9036 PDFrocky700inrОценок пока нет

- Cir v. Menguito DigestДокумент3 страницыCir v. Menguito Digestkathrynmaydeveza100% (1)

- Lyn Thomas-BookДокумент85 страницLyn Thomas-BookmustafahashimkhaskheОценок пока нет

- Preliminary Topic Five - Financial MarketsДокумент12 страницPreliminary Topic Five - Financial MarketsBaro LeeОценок пока нет

- Module 3 Part 1Документ19 страницModule 3 Part 1Prakhar KulshresthaОценок пока нет

- ACIB Past Questions PDFДокумент208 страницACIB Past Questions PDFdamola2real100% (1)

- AFM AssignmentДокумент3 страницыAFM AssignmentAin NsrОценок пока нет