Академический Документы

Профессиональный Документы

Культура Документы

Indirect Taxation Project - GST Bill 2016

Загружено:

kushagraИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Indirect Taxation Project - GST Bill 2016

Загружено:

kushagraАвторское право:

Доступные форматы

INDIRECT TAXATION PROJECT

National Law University

Odisha

(Established by Govt. of Odisha Act IV of 2008)

INDIRECT TAXATION PROJECT

PROJECT ON

THE GOODS AND SERVICES TAX BILL, 2016

SUBMITTED BY:

Abhishek Das (2013/BA.LL.B/002)

Antim Amlan (2013/BA.LL.B/007)

Deepankar Dikshit (2013/BA.LL.B/012)

Kushagra Gupta (2013/BA.LL.B/022)

Vartika Chahal (2013/BA.LL.B/056)

INDIRECT TAXATION PROJECT

TABLE OF CONTENTS

Table of Contents-----------------------------------------------------------------------------------------2

Hypothesis-------------------------------------------------------------------------------------------------4

Research Questions--------------------------------------------------------------------------------------5

Scope-------------------------------------------------------------------------------------------------------6

Research methodology----------------------------------------------------------------------------------7

Objective-----------------------------------------------------------------------------------------------7

Sources--------------------------------------------------------------------------------------------------7

Non-doctrinal Research-----------------------------------------------------------------------------7

Mode of Citation--------------------------------------------------------------------------------------7

Introduction-----------------------------------------------------------------------------------------------8

Justification of GST--------------------------------------------------------------------------------9

CHAPTERS---------------------------------------------------------------------------------------------11

Benefits of GST--------------------------------------------------------------------------------------11

Flaws of GST-----------------------------------------------------------------------------------------12

Opportunities:---------------------------------------------------------------------------------------14

An end to cascading effects:---------------------------------------------------------------------14

Growth of Revenue in States and Union:------------------------------------------------------14

Reduces transaction costs and unnecessary wastages:---------------------------------------14

Eliminates the multiplicity of taxation:---------------------------------------------------------14

One Point Single Tax:-----------------------------------------------------------------------------15

Reduces average tax burdens:-------------------------------------------------------------------15

Reduces the Corruption:--------------------------------------------------------------------------15

Challenges--------------------------------------------------------------------------------------------15

With respect to tax threshold:--------------------------------------------------------------------15

With respect to nature of taxes:------------------------------------------------------------------16

With respect to number of enactments of statutes:--------------------------------------------16

THE2GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

With respect to rates of taxation:----------------------------------------------------------------16

With respect to tax management and infrastructure:------------------------------------------16

IMPACT OF GST ON VARIOUS SECTORS, STAKEHOLDERS AND CLASSES-----------------16

How it is going to affect various Industries and Sectors-------------------------------------17

How it will affect different Financial activities------------------------------------------------24

How it affects various Stakeholders------------------------------------------------------------25

Critical Analysis of the GST Bill-----------------------------------------------------------------27

Recommendations by the Kelkar Committee--------------------------------------------------27

Complications in the Bill-------------------------------------------------------------------------28

Suggestions Recommended for the Bill---------------------------------------------------------30

Discharge of electricity from the GST bill will amount to increase in the cost of power in

the consumer end.---------------------------------------------------------------------------------30

Start-ups to be utilised as an interface to create an efficient work ecosystem.------------30

Hypothetical fears of pharmaceutical sectors--------------------------------------------------31

Pressure on the banking sector-------------------------------------------------------------------31

Incorporation of small traders in the GST bill-------------------------------------------------31

Concerns over manufacturing of solar power equipment------------------------------------32

Exclusion of domestic products from the GST------------------------------------------------32

Conclusion-----------------------------------------------------------------------------------------------33

THE3GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

HYPOTHESIS

The paper throws light on different aspects of the proposed Goods and Services Tax (GST) in

India, its principles and objectives; its modus operandi, and its implications for governments,

industries and consumers. The papers also examines light on why the GST bill is still pending

in the parliament and throws light on genuine concerns of the state governments in this

government. The authors contend that flawless GST is one of the most important reform

agenda which can provide a new impetus to economy of the country and attain inclusive

growth.

THE4GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

RESEARCH QUESTIONS

I.

II.

III.

What are the merits and demerits of the Goods and Services Tax Bill, 2016?

What are the impacts of GST Bill on various stakeholders and affected parties?

What are the probable suggestions that should be recommended for an efficacious

IV.

taxation regime?

What are the implications of the new bill on the indirect taxation policy in India?

THE5GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

SCOPE

This paper focuses on the process of introducing the Goods and Services Tax (GST), bringing

out the perspectives of different stakeholders and the contentious issues. The GST was

expected to subsume a variety of taxes and simplify the indirect tax regime.

THE6GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

RESEARCH METHODOLOGY

Objective

The object of the Research Article is to gain an in-depth insight into the Goods and Services

tax bill, 2016 and its implementation and effects.

Sources

The sources that have been put to use for this research article are mostly secondary. Some

primary sources have also been referred to for the research. Secondary sources comprise of

printed and non-printed sources. Printed sources include books, articles and journals whereas;

non-printed sources include material from research databases like JStor, SSRN, Manupatra

and Hein online

Non-doctrinal Research

This work does not consist of any kind of doctrinal research. There is no reference to any

doctrines in particular. The work consists of statutory interpretation and case studies among

other things.

Mode of Citation

An uniform citation method has been used in the following work.

THE7GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

INTRODUCTION

Presently almost 150 countries in the world have introduced Goods and Services Tax (GST)

in one or the other form till now. France was the first country to introduce it. The idea of

launching GST in India was first initiated by Government of India in 2000 under the

leadership of Atal Bihari Vajpayee, the then Prime Minister of India.

However, the Bill lapsed with the dissolution of the 15th Lok Sabha. Later on, the

Constitution Amendment (122nd) Bill 2014 on GST was introduced in the Lok Sabha on

December 19, 2014 and it was passed in the Lok Sabha on May 6th 2015. The Constitution

Amendment (122nd) Bill 2014 (CAB) was referred to the Select committee of Rajya Sabha

on May 14, 2015. On July 22nd 2015, the Select Committee has submitted its report with

appropriate modifications and some recommendations for incorporation. Now the CAB

awaits the approval in the Rajya Sabha. GST is a value added tax levied across goods and

services.1

The GST regime intends to subsume most indirect taxes under single taxation regime. The

broad objectives of GST are to widen the tax base, eliminate cascading of taxes, increase

compliance through lowering of overall tax burden on the goods and services and reduce

economic distortions caused by inter-state variations in taxes. By doing away with latent or

embedded taxes, it would provide leeway for the competitiveness of domestic industry vis-avis imports and in international markets.2

Kelkar Committee Report and the events that followed.

A Task Force on the implementation of Fiscal Responsibility and Budget Management Act

was formed by the Central Government on February 18, 2004 under the chairmanship of

Vijay Kelkar in 2003. The report submitted to the Central Government on July 16, 2004,

strongly recommended the adoption of GST for the indirect taxation in India. The Kelkar

Task Force report stated that India has been moving slowly but steadily towards VAT since

1 Sury, M M (ed) (2006). Taxation in India 1925 to 2007: History, Policy, Trends and

Outlook, Indian Tax foundation, New Delhi

2

http://www.ficci.com/spdocument/20238/Towar

2013.pdf

THE8GOODS AND SERVICES TAX BILL, 2016

ds-the-GST-Approach-Paper-Apri-

INDIRECT TAXATION PROJECT

1986 but the system still had many problems leading to a low tax GDP ratio. Giving solution

to the problems, they suggested the introduction of CGST.3

The report said, the tax on services should be fully integrated with the existing CENVAT on

goods by a modern VAT type levy on all goods and services to be imposed by the central

government (CGST). The report also gave the features to be included in the design of CGST.

The concept of GST was introduced in the Parliament for the first time on February 28, 2006

by P Chidambaram, the then Union FM in the Union Budget Speech of 2006-07. He

remarked, It is my sense that there is a large consensus that the country should move

towards a national level GST that should be shared between the Centre and the States. I

propose that we set April 1, 2010 as the date for introducing GST. The world over, goods and

services attract the same rate of tax. That is the foundation of a GST.4

Unifying the tax structure across States, the new scheme of tax regime would pave way for a

common national market for goods and services (Select Committee Report, 2015).

According to the Report of Task Force on GST, the GST should be structured on the

destination principle. As a result, the tax base will shift from production to consumption

whereby imports will be liable to tax and exports will be relieved of the burden of goods and

service tax. Given the above the present paper seeks to highlight the rationale of the GST in

India, gauge the real beneficiaries and pinpoint salient features of the Constitutional

Amendment (122nd) Bill, 2014 called CAB passed in Lok Sabha, draw out a comparison

between current indirect system and proposed GST and point out the bargaining issues that

still act as impasse for the passage of the CAB in the Rajya Sabha and its implementation in

the country. The present paper is based on the secondary sources mainly the published

Reports of Task force, first discussion paper of empowered committee of state finance

ministers, reports of finance commission, constitution amendment bill(s), working papers and

various articles published in esteemed newspapers etc.5

3 Sury, M M (ed) (2006). Taxation in India 1925 to 2007: History, Policy, Trends and

Outlook, Indian Tax foundation, New Delhi

4 Bird, Richard M. (2012). The GST/HST: Creating an integrated Sales Tax in a Federal

Country. The School of Public Policy, SPP Research Papers, 5(12), 1-38.

5 Supra 3.

THE9GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

JUSTIFICATION OF GST

In the existing framework of Indian Constitution, the authority to levy both direct and indirect

taxes is divided between central government and state governments. Central government

levies indirect taxes such as custom duty on import on goods, excise duties on manufacture of

goods, central sales tax on interstate transactions and service tax on provision of specified

services, etc., while the state governments levy Value Added Tax (VAT), state excise, luxury

taxes on hotel, entry tax/octroi on the entry of goods in specified areas, ancillary taxes like

entertainment taxes etc.

Although indirect tax structure has gone through several reforms since 1991 like introduction

of service tax in 1994 and central value added tax (CENVAT) in 2001 by central government

and introduction of VAT in 2005-06 by state government replacing sales tax etc., emphasis on

moving towards a neutral or uniform tax structure is below par the desired level. A

fundamental flaw of the present indirect structure is the multiple taxes levied by central

government and state government at different levels of supply chain. This multiplicity of

taxes at the State and Central levels has resulted in a complex indirect tax structure in the

country. First, there is no uniformity of tax rates and structure across states.6

Second, there is cascading of taxes due to tax on tax. No credit of excise duty and service

tax paid at the stage of manufacture is available to the traders while paying the State level

sales tax or VAT, and vice-versa. Further, no credit of state taxes paid in one

State can be availed in other States. Hence, the prices of goods and services get artificially

inflated to the extent of this tax on tax. Present structure has cascading impact on cost of

indigenous manufacture of goods and services affecting the competitiveness of Indian

industry. For example VAT is levied on sale value of product, which includes excise duty

element. Thus VAT is also charged on excised duty element, and vice versa. Similarly, service

tax is levied on services and central sales tax is levied on inter-state sale of goods evincing

cascading of taxes at each stage in supply chain.7

6 Vasanthagopal, Dr. R. (2011). GST in India: A Big Leap in the Indirect Taxation System.

International Journal of Trade, Economics and Finance, 2(2), 144-146.

7 Empowered Committee of Finance Ministers (2009). First Discussion Paper on Goods and

Services Tax in India, The Empowered Committee of State Finance Ministers, New Delhi.

THE

10GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

On the other hand, such multiple taxes with different rates and different tax bases not only

make tax structure highly complicated, but also make it difficult to comply and administer

resulting in high compliance cost, tax arbitrage, and wastage of time and efforts.

Complexity discourages tax compliance and retards investment and economic growth. In true

sense, multiple taxes provide incentives for tax evasion and undermine efficiency. Tax

inefficiencies in domestic tax structure compel government to continue policy of high custom

duty to protect domestic industries making India high cost economy and exports less

competitive. All these warrant replacing the present regime by efficient, rational Goods and

Services Tax structure, which would be buoyant too, without disturbing the countrys federal

structure.8

CHAPTERS

Benefits of GST

Three major benefits will flow from the GST. Firstly, as the Prime Minister outlined in an

interview, the GST will increase the resources available for poverty alleviation and

development. This will happen indirectly as the tax base becomes more buoyant and as the

overall resources of the Central and State governments increase. But it will also happen

directly because the resources of the poorest States for example, Uttar Pradesh, Bihar, and

Madhya Pradesh who happen to be large consumers, will increase substantially. Second,

the GST will facilitate Make in India by making one India.9

The current tax structure unmakes India, by fragmenting Indian markets along State lines.

Three features of the current system cause these distortions: the Central Sales Tax (CST) on

inter-State sales of goods; numerous intra-State taxes; and the extensive nature of

countervailing duty exemptions that favours imports over domestic production. In one fell

swoop, the GST would rectify all these distortions: the CST would be eliminated; most of the

other taxes would be subsumed into the GST; and because the GST would be applied on

8 Parkhi, Shilpa. Goods and Service Tax in India: the changing face of economy. Retrieved

from: http://www.parkhiassociates.org/kb/gstcfe.pdf.

9 Agrawal, Puneet (2016-07-11). "Analysis of 122nd Constitutional Amendment Bill".GST

LAW IN INDIA. Athena Law Associates.

THE

11GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

imports, the negative protection favoring imports and disfavoring domestic manufacturing

would be eliminated.10

Thirdly, the GST would improve even substantially tax governance in two ways. The

first relates to the self-policing incentive inherent to a valued-added tax. To claim input tax

credit, each dealer has an incentive to request documentation from the dealer behind him in

the value-added/tax chain. Provided the chain is not broken through wide-ranging

exemptions, especially on intermediate goods, this self-policing feature can work very

powerfully in the GST. The second relates to the dual monitoring structure of the GST one

by the States and one by the Centre. Critics and taxpayers have viewed the dual structure with

some anxiety, fearing two sources of interface with the tax department and hence two

potential sources of harassment. But dual monitoring should also be viewed as creating

desirable tax competition and cooperation between State and Central authorities. Even if one

set of tax authorities overlooks and/or fails to detect evasion, there is the possibility that the

other overseeing authority may not.11

Other benefits such as the boost to investment have been documented in the Report on the

Revenue Neutral Rate that was submitted in December last year. Of course, these benefits

will only flow through a well-designed GST. The GST should aim at tax rates that protect

revenue, simplify administration, encourage compliance, avoid adding to inflationary

pressures, and keep India in the range of countries with reasonable levels of indirect taxes.12

Flaws of GST

The report also urged that the GST be comprehensive in its coverage, that exemptions from

the GST be limited to a few commodities that catered to clear social benefits, and that most

commodities be taxed at the standard rate. There is no free lunch here. There is no escaping

the fact that the more the exemptions/exclusions, the higher will be the standard rate, which

could affect poorer consumers. Some have levelled the charge that the design of the GST is

flawed. But the flawed GST charge fails to appreciate how reforms actually occur. In no

10 Lavi, Mohan. "Renewed GST concerns". The Hindu Business Line. Kasturi & Sons Ltd.

11 "GST in India". businesssetup.in.

12 Albright Stonebridge Group (2016). "ASG Analysis: India's GST Explained". Washington,

DC: ASG.

THE

12GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

country is the GST even today after many years of implementation perfect, and was

therefore quite flawed at inception. In complex systems, change is introduced, learning from

implementation takes place, leading to further and better change. 13 That is what happened

with the implementation of the value-added tax by the States and that is what will happen

with the GST. It is far better to start and allow the process of endogenous change to unfold

over time than to wait Godot-like for the best time and the best design before it is

introduced.14

That said, we must also be realistic about the time frame for assessing the GST. The GST is

fiendishly, mind-bogglingly complex to administer. Such complexity and lags in GST

implementation require that any evaluation of the GST and any consequential decisions

should not be undertaken over short horizons (say months) but over longer periods, say onetwo years. In understanding GST systems around the world, we have been struck by how

ambitious and how under-flawed the Indian GST is. GST-type taxes in large federal systems

are either overly centralised, depriving the sub-federal levels of fiscal autonomy (Australia,

Germany, and Austria); or where there is a dual structure, they are either administered

independently creating too many differences in tax bases and rates that weaken

compliance and make inter-State transactions difficult to tax (Brazil, Russia and Argentina)

or administered with a modicum of coordination which minimizes these disadvantages

(Canada and India today) but does not do away with them.

The Indian GST will be a leap forward in creating a much cleaner dual VATS, which would

minimize the disadvantages of completely independent and completely centralized systems. A

common base and common rates (across goods and services) and very similar rates (across

States and between Centre and States) will facilitate administration and improve compliance

while also rendering manageable the collection of taxes on inter-State sales. At the same time,

the exceptions in the form of permissible additional excise taxes on special goods

(petroleum and tobacco for the Centre, petroleum and alcohol for the States) will provide

the requisite fiscal autonomy to the States. Indeed, even if they are brought within the scope

of the GST, the States will retain autonomy in being able to levy top-up taxes on these goods.

To have achieved this, in a large and complex federal system of multiparty democracy, with a

13 "GST Journey So Far, Know GST history - GST India- GSTSEVA.COM".gstseva.com.

14

http://www.prsindia.org/uploads/media/Constitution%20115/SCR%20summary%20GST.pdf

THE

13GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

Centre, 29 States and 2 Union Territories of widely divergent interests via a constitutional

amendment requiring broad political consensus, affecting potentially 7.5 million tax entities,

and marshalling the latest technology to use and improve tax implementation capability, is

perhaps breathtakingly unprecedented in modern global tax history.15

Sometimes, we are insufficiently appreciative of how much the country has achieved in

coming to this point with the GST. As the Prime Minister suggested, credit should go to all

stakeholders at the Centre and the States for having worked towards the GST. The time is ripe

to collectively seize this historic opportunity; not just because the GST will decisively alter

the Indian economy for the better but also because the GST symbolizes Indian politics and

democracy at its cooperative, consensual best.16

Opportunities:

AN END TO CASCADING EFFECTS:

This will be the major contribution of GST for the business and commerce. At present,

there are different state level and centre level indirect tax levies that are compulsory one

after another on the supply chain till the time of its utilization.

GROWTH OF REVENUE IN STATES AND UNION:

It is expected that the introduction of GST will increase the tax base but lowers down the

tax rates and also removes the multiple point This, will lead to higher amount of revenue

to both the states and the union.

REDUCES TRANSACTION COSTS AND UNNECESSARY WASTAGES:

If government works in an efficient mode, it may be also possible that a single

registration and single compliance will suffice for both SGST and CGST provided

government produces effective IT infrastructure and integration of such infrastructure of

states level with the union.

15 Empowered Committee of State Finance Ministers (2009). First Discussion Paper on GST,

Government of India, New Delhi.

16

http://www.ficci.com/spdocument/20238/Towards-the-GST-Approach-Paper-Apri2013.pdf

THE

14GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

ELIMINATES THE MULTIPLICITY OF TAXATION:

One of the great advantages that a taxpayer can expect from GST is elimination of

multiplicity of taxation. The reduction in the number of taxation applicable in a chain of

transaction will help to clean up the current mess that is brought by existing indirect tax

laws.

ONE POINT SINGLE TAX:

Another feature that GST must hold is it should be one point single taxation. This also

gives a lot of comforts and confidence to business community that they would focus on

business rather than worrying about other taxation that may crop at later stage. This will

help the business community to decide their supply chain, pricing modalities and in the

long run helps the consumers being goods competitive as price will no longer be the

function of tax components but function of sheer business intelligence and innovation.

REDUCES AVERAGE TAX BURDENS:

Under GST mechanism, the cost of tax that consumers have to bear will be certain, and

GST would reduce the average tax burdens on the consumers.

REDUCES THE CORRUPTION:

It is one of the major problems that India is overwhelmed with. We cannot expect

anything substantial unless there exists a political will to root it out. This will be a step

towards corruption free Indian Revenue Service.

Challenges

WITH RESPECT TO TAX THRESHOLD:

The threshold limit for turnover above which GST would be levied will be one area,

which would have to be strictly looked at. First of all, the threshold limit should not be so

low to bother small-scale traders and service providers. It also increases the allocation of

government resources for such a petty amount of revenue which may be much more

costly than the amount of revenue collected. The first impact of setting higher tax

threshold would naturally lead to less revenue to the government as the margin of tax base

THE

15GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

shrinks; second it may have on such small and not so developed states which have set low

threshold limit under current VAT regime.

WITH RESPECT TO NATURE OF TAXES:

The taxes that are generally included in GST would be excise duty, countervailing duty,

cess, service tax, and state level VATs among others. Interestingly, there are numerous

other states and union taxes that would be still out of GST.

WITH RESPECT TO NUMBER OF ENACTMENTS OF STATUTES:

There will two types of GST laws, one at a centre level called Central GST (CGST) and

the other one at the state level - State GST (SGST). As there seems to have different tax

rates for goods and services at the Central Level and at the State Level, and further

division based on necessary and other property based on the need, location, geography

and resources of each state.

WITH RESPECT TO RATES OF TAXATION:

It is true that a tax rate should be devised in accordance with the states necessity of

funds. Whenever states feel that they need to raise greater revenues to fund the increased

expenditure, then, ideally, they should have power to decide how to increase the revenue.

WITH RESPECT TO TAX MANAGEMENT AND INFRASTRUCTURE:

It depends on the states and the union how they are going to make GST a simple one.

Success of any tax reform policy or managerial measures depends on the inherent

simplifications of the system, which leads to the high conformity with the administrative

measures and policies.

IMPACT OF GST ON VARIOUS SECTORS, STAKEHOLDERS AND CLASSES

The GST bill as of now, has passed the last stages of clearing the Rajya Sabha hurdle. Most

analysts suggest that from a macro-economic perspective, while the short-term impact of

GST could be mixed, the long-term impact will be positive. The bill is yet to be enacted

which is tentatively from the first day of the year 2017.

THE

16GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

Besides simplifying the indirect tax structure, GST should also help to create 'One India'

with a unified tax regime by eliminating geographical fragmentation. It will remove the

current cascading of taxes by ensuring the seamless flow of input credit across the value

chain of both goods and services as suggested by various multi-national analysis report.17

It is believed by many economists and financial advisors that while in the long-run GST will

have a positive impact on inflation and government finances, in the near-term, inflation is

likely to go up and government finances are likely to be strained due to compensation to

states.18

HOW IT IS GOING TO AFFECT VARIOUS INDUSTRIES AND SECTORS

Automobiles

Largely positive for demand, as it will lead to a 10-17 per cent fall in prices, assuming an 18

per cent GST rate. Margin benefits to accrue for tractors, as these can claim set-off against

taxes paid on input. Organised battery and other spares would become more cost competitive

and gain market share.19

Stock impact: Positive for Maruti Suzuki, Hero MotoCorp, Exide, Amara Raja, Eicher

Motor, Mahindra & Mahindra, Bajaj Auto. Negative for Ashok Leyland

FMCG

Despite of the economic slowdown, India's Fast Moving Consumer Goods (FMCG) has

grown consistently during the past three four years reaching to $25 billion at retail sales in

2008. Implementation of proposed GST and opening of Foreign Direct Investment (F.D.I.)

are expected to fuel the growth and raise industry's size to $95 Billion by 201835.

GST will be positive for household and personal care space, as the effective tax rate reduces

by 200-500 basis points (bps), apart from reducing warehousing and logistical requirements.

17 Dr. Prakash M. Herekar. (2012). Evaluation of impact of Goods and Service Tax (GST).

Indian Streams Research Journal.

18 Bandyopadhyay, S. N. (n.d.). A Primer on Goods and Services Tax in India. SSRN

Electronic Journal. doi:10.2139/ssrn.2102603

19 The Institute of Companies Secretaries of India (ICSI) (2015). Referencer on Goods and

Service Tax. Retrieved from: https://www.icsi.edu/Docs/Website/GST_Referencer.pdf

THE

17GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

However, working capital for retailers, and additional tax rates for jewellery and cigarette

manufacturers are negatives.20

Stock impact: Positive for Hindustan Unilever, Emami, Godrej Consumer. Negative for

Titan, Bata, ITC

Logistics

Passage of GST will lead to elimination of central sales tax and inter-state value-added tax

arbitrage possibilities. This will lead to consolidation of warehouses and increased

efficiencies in the logistics chain.

Stock impact: Positive for Container Corporation of India, Adani SEZ, Gujarat Pipav Port

(longer term)

Infrastructure

Clarity on works contract taxation is the key benefit for the sector. This could reduce

litigation, as it eliminates the difference between sales and services.

Stock impact: Positive for Larsen & Toubro (L&T)

Consumer durables

Consumer durables will benefit from improved logistics. Direct benefits up to 200-300 bps in

cost savings may accrue. A significant portion of direct benefits will be passed on to end

consumers because of a highly competitive market.

Stock impact: Positive for Voltas, Havells, Crompton Greaves

Oil & gas

Key petroleum products like crude, natural gas, high speed diesel and ATF have been kept out

of GST. Clarity is awaited for others. Compliance costs are likely to rise because of dual

indirect tax mechanism.

Stock impact: Neutral. Do not foresee any meaningful change on oil & gas companies

Cement

20 Indirect Taxes Committee, Institute of Chartered Accountants of India (ICAI) (2015).

Goods and Serice Tax (GST). Retrieved from: http://idtc.icai.org/download/Final-PPT-onGST-ICAI.pdf.

THE

18GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

Overall tax incidence on the sector could decline. The sector will also benefit from expected

decline in logistic costs. Firms can be expected to pass on the benefits, given that demand and

plant utilisation levels are picking up.

Stock impact: Positive for most companies

Wind power

GST will be negative for wind, turbine generator manufactures like Suzlon and InoxWind,

as pressure on developer margins and internal rates of return could eventually force reduction

in prices and realisations, up to 10-13 per cent. However, if components are included in the

exemption list, the impact of GST will be nullified.21

Stock impact: Negative for Suzlon, Inox Wind

Utilities

Exclusion of sale of electricity from GST could potentially raise the cost of coal-fired and

renewable energy for Discoms. Profitability of independent power producers selling via

medium/long-term PPAs is unlikely to be dented as cost escalation would likely be passed

on.22

Stock impact: Positive for CESC, negative for JSW Energy

Pharmaceuticals

GST rollout could be negative for the sector, as it is likely to increase indirect tax. Analysts

say indirect taxes paid by pharma companies could increase by 60 per cent and MRP by four

per cent.

Stock impact: Negative for Alkem, Glaxo Pharma

The GST, which is expected to be implemented from April 1, 2017, aims to replace multiple

state and central levies with a single tax. Since the central and state taxes are likely to be

subsumed under GST, it may result in fungibility of tax credits across intra- and inter-state

21 How the GST Bill will impact various sectors and stocks | Business Standard News.

(2016, July 6). Retrieved from http://www.business-standard.com/article/markets/how-thegst-bill-will-impact-various-sectors-and-stocks-116080200159_1.html

22 Ibid.

THE

19GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

transactions. Consequently, different industries may need to conduct a cost-benefit analysis in

terms of applicable input and output taxes.23

Real estate

Transfer of (completed) properties may continue to be outside the purview of GST and be

liable only to applicable stamp duties.

In case this sector is brought within the ambit of GST, it is likely to result in transparency,

which will significantly reduce tax evasion through more efficient transaction-tracking

methods, and improved enforcement and compliance. Since GST may be levied on a single

value, the current issue of levying tax on tax (VAT on central excise duty) is likely to be

removed.

At present, developers pay various non-creditable taxes on supplies. GST may replace these

multiple taxes with a single tax; credit on supplies may also be available, thus reducing costs

for all players. However, if real estate output is exempted, then input GST credit could be a

substantial cost for the sector, resulting in blockage of credit and higher costs to end

consumers.24

Financial services

In India, most of the banking and financial services are exposed to service tax, at the rate of

14.5 percent, while GST is expected to be 18 percent to 20 percent. Thus, services are likely

to get costlier.

GST may make things cumbersome as financial service providers may be required to adhere

to compliances across multiple states instead of the current single, centralised registration

compliances.

Also, as GST is a destination-based tax, it might be a challenge to determine the destination

of certain services (at present, services are taxed at the place of rendering the service). This

23 India. Implementation of Value Added Tax in India: Lessons for Transition to Goods and

Services Tax : a Study Report. New Delhi: Comptroller and Auditor General of India, 2010.

24 India. Implementation of Value Added Tax in India: Lessons for Transition to Goods and

Services Tax : a Study Report. New Delhi: Comptroller and Auditor General of India, 2010.

THE

20GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

may lead to a difficulty in determining state GST, central GST or inter-state GST on B2B and

B2C transactions.

Interest on loans, trading in securities, foreign currency and retail services are also expected

to fall within the ambit of GST. Recommendations by the banking industry suggest that such

services and income should not come under GST. It is still to be seen whether these

recommendations will be accepted.25

Overall, it appears that imposing GST on banking and financial services may become a

challenge and India, if successful, will chart a new course, which could well become a model

for the rest of the world.

In most of the countries GST is not charged on the financial services. Example, In New

Zealand most of the services covered except financial services as GST. Under the service tax,

India has followed the approach of bringing virtually all financial services within the ambit of

tax where consideration for them is in the form of an explicit fee. GST also include financial

services on the above grounds only.26

Travel, Tourism and Hospitality

Indias travel, tourism and hospitality industries have multiple taxes, levied by both the

centre and the states. It is expected that under GST, supplies of hotels and restaurants will be

subjected to a single tax.

At present, no credit is available on input services related to renovation or construction of

hotels and resorts. This is expected to change under GST. R&D cess, payable on franchise

fees and technical know-how, is likely to be subsumed under GST, thus simplifying

compliance procedures and reducing multiple taxes.

However, it is unclear whether various benefits available under the existing Foreign Trade

Policy will continue under GST. If such benefits are provided, input credit may not be

available, resulting in higher costs.

25 Mathur, Vibha. Foreign Trade of India, 1947-2007, Trends, Policies, and Prospects. New

Delhi: New Century Publications, 2006.

26 Viswanathan, B. (2016). Goods and services tax (GST) in India.

THE

21GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

On the whole, GST is likely to eliminate multiplicity of taxes and lack of credits. However, it

may also lead to increase in tax rates.27

Healthcare & Medical facilities

One of the major concerns of this industry is the current inverted duty structure that

adversely affects domestic manufacturers, cost of inputs being higher than output. This

discourages investment in this industry. GST may either remove the inverted duty structure or

allow refund of accumulated credit. This would be a boon for this industry and can act as its

growth catalyst.

The current cascading tax structure on import duty makes it expensive for the industry to

import machinery. GST is likely to reduce this cost.

This sector enjoys several tax exemptions and benefits. It is still not clear whether these

benefits will continue under GST. Health insurance and diagnostic centres, which are mainly

service-oriented, may fall under higher tax rates, thereby making such services more

expensive for consumers.28

Alcoholic beverages

Alcohol for human consumption is proposed to be kept outside the GST regime, and will

hence continue to attract state excise and VAT; however, inputs are likely to fall under the

ambit of GST.

Consequently, there may be blockage of input credit, leading to increased production cost and

inefficiency in production and distribution. Higher input costs and its cascading effect on

taxes may push prices upwards, and may also hit exports. Restaurants and bars serving

alcohol, and selling both GST and non-GST products, may be required to undertake dual

compliance (for GST and non-GST products).29

27 Mathur, Vibha. Foreign Trade of India, 1947-2007, Trends, Policies, and Prospects. New

Delhi: New Century Publications, 2006.

28 Rao, R. Kavita. Goods and Services Tax for India. New Delhi: National Institute of Public

Finance and Policy, 2008.

29 Vora, Aditya. Last modified August 13, 2016. www.thestatesman.com/news/opinion/gstimpact-on-energy-sector/159870.html.

THE

22GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

Education

The education sector currently enjoys various tax exemptions and benefits; services

provided by schools and colleges are either not taxed or are covered in the negative list.

The situation is likely to continue even after the implementation of GST. In case it doesnt,

the sector may be able to avail of input credit or CENVAT credit on the duty paid on purchase

of inputs and services. These are likely to bring down the final cost for the industry.30

Food Industry

The application of GST to food items will have a significant impact on those who are living

under subsistence level. But at the same time, a complete exemption for food items would

drastically shrink the tax base. Food includes grains and cereals, meat, fish and poultry, milk

and dairy products, fruits and vegetables, candy and confectionary, snacks, prepared meals

for home consumption, restaurant meals and beverages. Even if the food is within the scope

of GST, such sales would largely remain exempt due to small business registration threshold.

Given the exemption of food from CENVAT and 4% VAT on food item, the GST under a

single rate would lead to a doubling of tax burden on food.31

Housing and Construction Industry

In India, construction and Housing sector need to be included in the GST tax base because

construction sector is a significant contributor to the national economy.

Rail Sector

There have been suggestions for including the rail sector under the GST umbrella to bring

about significant tax gains and widen the tax net so as to keep overall GST rate low. This will

have the added benefit of ensuring that all inter state transportation of goods can be tracked

through the proposed Information technology (IT) network.32

30 Sapra, Bipin. "Education Sector GST India-Goods and Services Tax in India." GST

India-Goods and Services Tax in India Your Free-tax Site. Last modified January 27, 2016.

http://www.gstindia.com/tag/education-sector/.

31 Supra note 26.

32 Sector impact: GST's effect on roads, railways and ports - Infracircle. (2016, September

17). Retrieved from http://www.vccircle.com/infracircle/sector-impact-gst-will-affect-roadsrailways-ports/. Last seen on, 18 Aug 2016.

THE

23GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

Information Technology enabled services

To be in sync with the best International practices, domestic supply of software should also

attract G.S.T. on the basis of mode of transaction. Hence if the software is transferred through

electronic form, it should be considered as Intellectual Property and regarded as a service.

And if the software is transmitted on media or any other tangible property, then it should be

treated as goods and subject to G.S.T.33

Impact on Small Enterprises

There will be three categories of Small Enterprises in the GST regime. Those below

threshold need not register for the GST. Those between the threshold and composition

turnovers will have the option to pay a turnover based tax or opt to join the GST regime.

Those above threshold limit will need to be within framework of GST Possible downward

changes in the threshold in some States consequent to the introduction of GST may result in

obligation being created for some dealers. In this case considerable assistance is desired.

In respect of Central GST, the position is slightly more complex. Small scale units

manufacturing specified goods are allowed exemptions of excise upto Rs. 1.5 Crores. These

units may be required to register for payment of GST, may see this as an additional cost.34

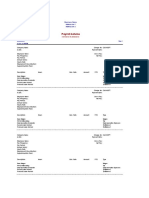

HOW IT WILL AFFECT DIFFERENT FINANCIAL ACTIVITIES

Sourcing

Inter-State procurement could prove viable

This may open opportunities to consolidate

suppliers/vendors

Additional duty/CVD and Special Additional duty

components of customs duty to be replaced.

Distribution

Changes in tax system could warrant changes in both

procurement and distribution arrangements

Current arrangements for distribution of finished goods may

33 An overview of the recently passed Goods and Services Tax (GST) Bill - The Hindu.

(2016, August 12). Retrieved from http://www.thehindu.com/features/homes-and-gardens/anoverview-of-the-recently-passed-goods-and-services-tax-gst-bill/article8979679.ece

34 Due, J. F. (1970). Indirect taxation in developing economies: The role and structure of

customs duties, excises, and sales taxes. Baltimore: Johns Hopkins Press.

THE

24GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

no longer be optimal with the removal of the concept of excise duty

on manufacturing

Current network structure and product flows may need

review and possible alteration

Pricing

and

profitability

Tax savings resulting from the GST structure would require

repricing of products

Margins or price mark-ups would also need to be reexamined

Cash flow

Removal of the concept of excise duty on manufacturing can

result in improvement in cash flow and inventory costs as GST

would now be paid at the time of sale/supply rather than at the time

or removal of goods from the factory.

System changes and

transaction

Potential changes to accounting and IT systems in areas of

master data, supply chain transactions, system design

management

Existing open transactions and balances as on the cut-off

date need to be migrated out to ensure smooth transition to GST

Changes to supply chain reports (e.g., purchase register,

sales register, services register), other tax reports and forms (e.g.,

invoices, purchase orders) need review

Appropriate measures such as training of employees,

compliance under GST, customer education, and tracking of

inventory credit are needed to ensure smooth transition to the GST

regime

The above figures are a courtesy of Delloitte India.35

HOW IT AFFECTS VARIOUS STAKEHOLDERS

Corporations and other functionaries

35 Rawat D, 'Goods and Services Tax in India: Taking Stock and Setting Expectations' (2016)

<http://www2.deloitte.com/content/dam/Deloitte/in/Documents/tax/in-tax-gst-in-indiataking-stock-noexp.pdf> accessed 24 August 2016.

THE

25GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

The minister began his speech by emphasizing the need to revive growth and investment to

ensure job creation for the youth. As expected he mentioned his intent on implementation of

GST from the next year.

However the most important announcement was in relation to tax rates, the finance minister

proposed to reduce the rate of corporate tax from 30% to 25% over the next year 4 years. It is

a welcome decision and must have made the companies happy, however in his speech the

minister also mentioned that this process of reduction has to be necessarily accompanied by

rationalization and removal of various kinds of tax exemptions and incentives for corporate

tax payers, which account for large number of tax disputes. What would be important to see

is what exemptions and incentives does the government will do away with.36

It could be a classic case of giving something from one hand and taking it back from the

other. Further owing to the investor sentiments and the governments intent to enhance

investments, applicability of GAAR has been deferred by two years and it was mentioned

that when implemented, GAAR would apply prospectively.

We also see a proposal to reduce the rate of income tax on royalty and fees for technical

services from 25% to 10% with intent to encourage new ventures in India. The threshold limit

for domestic transfer pricing is also increased from 5 Cr to 20 Cr.

Abolition of wealth tax is a welcome move, but now details of wealth have to be reported in

income tax returns. Have to wait and see whether the return filing becomes complex or not.37

What it means for the common man

The common man was expecting a rise in the tax exemption limits, so it was a

disappointment to see the limits remain unchanged. The minister in his speech mentioned

benefits to middle class taxpayers as one of the broad themes, and have made certain

proposals which are very welcome. Among them are

Increase in deduction limit under Sec 80D to Rs 25,000 and for senior citizens to Rs

30,000.

36 Kumar, Nitin (2014). Goods and Services Tax in India: A Way Forward. Global Journal of

Multidisciplinary Studies, 3(6), 216-225

37 Dhanabhakyam, M., & Geetha, S. (2008). Indirect taxation. New Delhi: Serials

Publications.

THE

26GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

Deduction of Rs 50,000 for contribution to New Pension scheme under Sc 80CCD.

Increase in limit on deduction on account of pension fund and new pension scheme to

Rs 1, 50,000.

Increase in transport allowance exemption to Rs 1,600 per month.

Although the above changes will help an individual reduce his tax liability, but it doesnt

increase his disposable income.38

Further we also see a rise in service tax rates to 14%.Further an enabling provision is made to

empower the Central Government to impose a Swatch Bharat cess on all or certain taxable

services at a rate of 2%. Which mean that the effective rate of service tax will increase to

16%.

Needless to say it will impact the middle class as essential services will become costlier. Not

good for the middle class people, since exemption limits remain same no increase in

disposable income but expenses on movies, hotels, travel, legal, banking , restaurants etc all

will increase.39

What it means for the economy:

The intent of the budget is very clear, the government wants to encourage setting up of

business in India and wants to facilitate the ease of doing business also. Growth of industries

in India is necessary for job creation and as expected the focus is on encouragement to

corporate.

The government by giving benefits in the form of deductions rather than increasing the

exemption limits to individuals had shown that its intent is to increase the amount available

for investments and not to increase short term demands. This is in line with its strategy of

enhancing investments.40

38 India Makes Progress on GST Implementation - India Briefing News. (n.d.). Retrieved

from http://www.india-briefing.com/news/indian-gst-deal-paves-tax-reforms-8938.html

39GST Bill: States to get relief - The Hindu.

Retrieved from

http://www.thehindu.com/business/Economy/gst-bill-states-to-get-relief/article6698377.ece

40 Tax Reform Commission to submit first report in six months: Parthasarathi Shome - The

Hindu. (n.d.). Retrieved from http://www.thehindu.com/business/Economy/tax-reformcommission-to-submit-first-report-in-six-months-parthasarathi-shome/article5258159.ece

THE

27GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

Critical Analysis of the GST Bill

RECOMMENDATIONS BY THE KELKAR COMMITTEE

GST has been conceived in India on implementation of Fiscal Responsibility and Budget

Management Act, 2013 (Kelkar Committee) by the Task Force during the analyzing of the

existing tax systems at both, the Central as well as the State level. 41 Kelkar Committee came

up with the observation that introducing the nationwide tax reform of dual GST, as per which

all goods and services present in the economy would be taxed, might be of help in achieving

a common market, with a wide tax base, and in improving the domestic indirect taxes

revenue productivity and also in enhancing the welfare by way of efficient resource

allocation.

An Empowered Committee42 which comprised of State Finance Ministers was constituted by

the Government on the basis of the Kelkar Committees recommendations for the preparation

of Design and Road Map so as to implement GST.

There are multiple taxable events due to multiple levies both at Central as well as State level

under the prevailing tax structure. The taxable event occurring in different laws is: in case of

Central Excise laws, on manufacturing of goods, for State VAT laws on sale of goods, and

for Service tax laws on supply/provision of services.

On the other hand in case of State levies taxable event like Entry Tax is on the entry of

goods into a particular jurisdiction. Thus under the prevailing tax structure the taxable event

depends on the levying and has been defined independently without making any harmonious

reference to any other tax legislations. GST was proposed to be applied on same taxable

event on all supplies of goods and services, by the both Central as well as the state

governments.43

41 Kelkar,Vijay (2009). GST Reduces Manufacturing Cost and Increases Employment, Times

of India.

42 Empowered Committee of Finance Ministers, 2013

43 Nitin Kumar (2014), Goods and Service Tax in India-A Way Forward, Global Journal

of Multidisciplinary Studies, Vol 3, Issue6, May 2014

THE

28GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

COMPLICATIONS IN THE BILL

The governments attempt to implement the GST bill was noble as its aim was to reduce the

complexity in Indias existent tax regime. The passage of the bill has led to abolishment of

unnecessary complications by creating a well-defined and uniform tax regime. The GST will

have many lasting impacts. It will create a buoyant source of revenue and place the fiscal

position on a permanently solid footing.

It will help tax administration and reduce corruption in indirect tax collection. And it will

serve to make India more of a common market. The elimination of the internal barriers to

trade should be seen as a positive trade and productivity shock for the Indian economy. And

less recognized is the fact that the GST will also be a redistributive exercise, transferring

resources to the poorer states.44

GST Bill promised a reduction of multiple taxes as one of its main benefits. But this has led

to creation of another problem. Due to this now power has been conferred on both the

Parliament as well as on every state legislature by Article 246A 45 for levying of goods and

services tax. This is leading to a situation where there is one parliamentary law and 28 states

having power to levy taxes. Also no constitutional requirement is there to be uniform for the

state laws. GST Council have power to only recommend a model law and therefore states

are not prevented from making and following their own laws. Having so many levies by

Parliament and the states might lead to disastrous consequences if they will not be in

harmony.

A seamless system of taxation is the basic feature of any GST, in which all duties, whether

goods or services, are set off against the duties payable on the final product. Most of the

countries are having single GST, only few have a dual GST. The implementation of the

Indian version might turn out to be the most complex 46, as different states are having powers

to enact their own laws, thereby introducing concepts of that of importing and exporting.

44

wwww.thehindu.com/bussiness/industry/ten-things-to-know-aboutgstbill/article7137615.ece

45 Article 246A, Indian Constitution 1950.

46 Girish Garg, (2014),Basic Concepts and Features of Good and Service Tax in India

THE

29GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

Excluding of the petroleum products, electricity and real estate might lead to a grotesque,

mangled and mutilated version of Indian GST.

Further its impact on the service sector might turn out to be costly and inflationary, though its

impact on the manufacturing sector is expected to be cost saving because of a leaner supply

chain and the eliminating of the cascading taxes.

Though many countries are having GST, but it might turn out to be unsuitable for vast and

heterogeneous country like India. In Indian federalism, the Union and States are having

powers to levy different kinds of taxes suiting their requirements, is an essential feature. This

is because different states have different needs, like the requirements of states like

Maharashtra and Gujarat might be completely different from that of Jharkhand and Assam.

Because of this, GST might lead to serious difficulties, and might turn out to be a failure as it

is treating unequal states equally. It is practically impossible for the Centre to compensate

states which might be losing tax revenue for the next few years.

Further GST is a merger of Central and State levies being administered by Central and State

governmental officials. This leads to plethora of questions as to how many assesses will be

there state wise, or who will responsible for administering combined GST, will each state will

insist on having the power to administer GST as per its territory.

Further if this will be the case, then no role will be left for the Central excise or the Service

tax departments, excepting the inter-state transactions. Also which will be the appellate

authorities and will there be a single or multiple tribunals, are other of the few question

arising.

Also the GST will lead to situation making imports more competitive. This complex structure

of regulatory tax laws and widespread corruption at every stage makes the manufacturing

activity in India less appealing. If GST on imports is available as a credit to a trader, as

against the existing system, which does not allow countervailing duty and special additional

duty credits, imported goods will get a competitive advantage seriously sabotaging the Make

in India initiative. It is best that the taxing powers of the state are not curbed.

THE

30GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

Suggestions Recommended for the Bill

Despite the change in tax laws and regulation, the government has to collect the same amount

of revenue that was earlier generated. In the GST regime, the structure of taxation is being

affected and cannot generate the similar amount of revenue if compared with the previous

model of taxation due to tax credit mechanism, removal of cascading effect or otherwise. An

adjustment in the tax rate which avoid the difference or loss in the revenue collection is called

Revenue Neutral rate (RNR). The National Institute of public Finance and Policy

recommends that GST rate will be same as the combined central and state taxes on Goods at

present but it should be lower than the combined central and state taxes on services. 47 The

proposed rate by the experts are said to be 13.91% for the state GST component and 12.77%

on the central GST component.

DISCHARGE OF ELECTRICITY FROM THE GST BILL WILL AMOUNT TO INCREASE IN THE COST

OF POWER IN THE CONSUMER END.

In the present scenario the inputs which help the industries to generate power are taxed but

the companies are self-enabled in neutralising the input taxes against liabilities on outputs

other than power. However electricity and power are subjected to the tax duties levied by the

respective state government and are paid by the consumer.

On being discharged from the GST bill, the cost of power will increase from 6-18% for the

consumers as the industries will continue to pay taxes on the inputs but will not generate any

credit on the output. With reference to the renewable energy sector, the input of the

machinery and equipment will be taxed and the companies will suffer losses due to high input

costs and can lead the economy towards inflation.

The solution or the consent is the inclusion of the power sector in GST bill and bringing a

compensation policy on the taxes imposed on input with zero rated output.

START-UPS TO BE UTILISED AS AN INTERFACE TO CREATE AN EFFICIENT WORK ECOSYSTEM.

With the change in the new policies with respect to the taxation, the government needs to

train and transmit the GST policies and aspects. To help the new trade to adapt and flourish in

47 Report of the 14th Finance Commission, Chapter 13, Goods and Services Tax, February

24, 2015.

THE

31GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

the new regime the government has to link up with start-ups to connect the small and medium

size enterprises with the GST and the Goods and Service network.

Government should aim to help start-ups in connecting their Application Programming

Interfaces (API) to the GST system. APIs are nothing but tools and protocols used for

creating software applications. Further, it should emphasize upon the need of building

ecosystem around these APIs. It should also educate them about the kind of data that will be

made available to them post-GST implementation and how to manage the scale of it.48

HYPOTHETICAL FEARS OF PHARMACEUTICAL SECTORS

After analysing a recent report of GST, the pharmaceutical industries are expecting an

average of 80 percent more taxes on day to day medicines. The supply chain includes the

pharmaceutical ingredient supplier, the developer of ingredient, and manufacture with

wholesaler and retailer as well.

The speculation is that the medicine prices will rise about 4% in the GST regime. The work

should be done by the pharmaceutical industry to seek parity for the consumer end price for

the medicines. Representation in the form of best case studies can be made to the concerned

authorities by the pharmaceutical industry to attain the required concessions and quell

speculative fears.49

PRESSURE ON THE BANKING SECTOR

The banking sector is also pressurised with the start of the GST regime due to the destination

based model of functioning. Loans granted by the branch in a metro city may be utilised by

any industry in the market for expansion of work in another town across the country. Banks

have to maintain the state wise accounts to ensure its compliance with the new GST

provisions. Banks have to be switched on to the GST regime faster as they are taxation norm

based institution.

48 Towards GST Regime In India, Shruti Garg, International Journal of Scientific Research

and Management, 2015.

49 GST in India: A Big Leap in the Indirect Taxation System, R. Vasanthagopal, International

Journal of Trade, Economics and Finance 2011

THE

32GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

INCORPORATION OF SMALL TRADERS IN THE GST BILL

The new GST system has not offered the traders the minimum clarity on stock management

for the remaining goods and rates. The important question is, whether the traders will be

availed with input credits or the remaining stock will get costlier and will be an extra

financial expense to them. There has to be provisions for the tax payment that will be paid by

the manufacture each time goods are being transferred. Under GST provisions a trader must

easily get input credit, as under GST provisions in the chain of trading if one trader fails to

file incorrect returns in GST then the entire chain of traders will fail to receive the benefit of

input credit.50

CONCERNS OVER MANUFACTURING OF SOLAR POWER EQUIPMENT

The fundamental problem is the increase n the burden of prices on the consumer end after the

implementation of GST. This sector has been enjoying the zero tax provision in most of the

states of the country by the getting reimbursement from the government. The government has

to make sure the Indian manufacturers should not fall into a disadvantageous position with

respect to foreign contenders, which will eventually raise the cost of the project and result in

burdening the consumers. Mindset of the private banks has to be changed towards the solar

power project and financial asset lending policies towards the sector.

EXCLUSION OF DOMESTIC PRODUCTS FROM THE GST

The gross domestic product like alcohol and tobacco have been discharged from the GST

regime and his has led to price distortions. Petroleum products, electricity duty, alcohol for

human consumption and stamp duty on immoveable property make 5o percent of the GDP

which has been kept out of GST. Government has to keep a third of the power and share the

two third with the states who are implementing GST with strong monitoring cell with field

officers.

50 Preparing the way for a modern GST in India, Sijbren Cnossen, International Tax and

Public Finance 2013

THE

33GOODS AND SERVICES TAX BILL, 2016

INDIRECT TAXATION PROJECT

CONCLUSION

GST is the most logical steps towards the comprehensive indirect tax reform in our country

since independence. GST is leviable on all supply of goods and provision of services as well

combination thereof. All sectors of economy whether the industry, business including Govt.

departments and service sector shall have to bear impact of GST.51

All sections of economy viz., big, medium, small scale units, intermediaries, importers,

exporters, traders, professionals and consumers shall be directly affected by GST. One of the

biggest taxation reforms in India, the Goods and Service Tax (GST) is all set to integrate

State economies and boost overall growth. GST will create a single, unified Indian market to

make the economy stronger. Experts say that GST is likely to improve tax collections and

Boost Indias economic development by breaking tax barriers between States and integrating

India through a uniform tax rate. Under GST, the taxation burden will be divided equitably

between manufacturing and services, through a lower tax rate by increasing the tax base and

minimizing exemptions.52

51http://www.thehindu.com/business/Economy/gst-will-remove-cascading-effect-of-leviespranab/article3446952.ece

52 Thirteenth Finance Commission (2009). Report of Task Force on Goods & Service Tax.

THE

34GOODS AND SERVICES TAX BILL, 2016

Вам также может понравиться

- The International Telecommunications Regime: Domestic Preferences And Regime ChangeОт EverandThe International Telecommunications Regime: Domestic Preferences And Regime ChangeОценок пока нет

- Dr. Ram Manohar Lohiya National Law University, Lucknow: SynopsisДокумент3 страницыDr. Ram Manohar Lohiya National Law University, Lucknow: SynopsisHimanshi RaghuvanshiОценок пока нет

- An Insight Into Black Money and Tax Evasion-Indian Context: ArticleДокумент12 страницAn Insight Into Black Money and Tax Evasion-Indian Context: ArticleShubhamОценок пока нет

- Cyber Law ProjectДокумент13 страницCyber Law ProjectPapiya DasguptaОценок пока нет

- Labour Law II Project - 17ba070 (Bba052)Документ13 страницLabour Law II Project - 17ba070 (Bba052)Swapna SinghОценок пока нет

- Political ScienceДокумент20 страницPolitical ScienceDevendra DhruwОценок пока нет

- Dharmashastra National Law University: Rofessional OmmunicationДокумент19 страницDharmashastra National Law University: Rofessional OmmunicationLav VyasОценок пока нет

- ROLE OF BCI - Legal Methods AssignmenДокумент19 страницROLE OF BCI - Legal Methods AssignmenShantanu AgnihotriОценок пока нет

- Tax Law ProjectДокумент36 страницTax Law ProjectDilwar HussainОценок пока нет

- Cyber Law Project DronaДокумент25 страницCyber Law Project DronaDrona AggarwalОценок пока нет

- Taxation Law ProjectДокумент20 страницTaxation Law ProjectJain Rajat ChopraОценок пока нет

- Dr. Ram Mahohar Lohiya National Law University: Project On: (Final Draft)Документ19 страницDr. Ram Mahohar Lohiya National Law University: Project On: (Final Draft)Saiby KhanОценок пока нет

- Ipc ProjectДокумент58 страницIpc ProjectBrijeshОценок пока нет

- Amity Law School Amity University, LucknowДокумент15 страницAmity Law School Amity University, LucknowROHIT SINGH RajputОценок пока нет

- Competition Law - Kartikeya DurraniДокумент20 страницCompetition Law - Kartikeya DurraniKartikeya DurraniОценок пока нет

- Contract 2 Final DraftДокумент28 страницContract 2 Final DraftRahul BarnwalОценок пока нет

- Indirect Taxation ProjectДокумент16 страницIndirect Taxation ProjectIsha SenОценок пока нет

- Privilidge CommunicationДокумент18 страницPrivilidge Communicationvishakha chaudharyОценок пока нет

- Offences and Penalties Pertaining To Child Labour Law in IndiaДокумент23 страницыOffences and Penalties Pertaining To Child Labour Law in IndiaHimalaya Singh BATCH 2016 AОценок пока нет

- NATIONAL LAW INSTITUTE UNIVERSITY Equity FinalДокумент20 страницNATIONAL LAW INSTITUTE UNIVERSITY Equity FinalHrishikeshОценок пока нет

- White Collar Crime HimanshuДокумент17 страницWhite Collar Crime Himanshukaran rawatОценок пока нет

- Ashutosh IPC ProjectДокумент19 страницAshutosh IPC ProjectAshutosh BiswasОценок пока нет

- Tax 2 ProjectДокумент15 страницTax 2 ProjectamanasheshОценок пока нет

- Indirect Tax ProjectДокумент11 страницIndirect Tax ProjectMeghna SinghОценок пока нет

- Chanakya National Law University: Right To Work and Working Conditions and Its Constitutional PerspectiveДокумент5 страницChanakya National Law University: Right To Work and Working Conditions and Its Constitutional PerspectivePratiyush KumarОценок пока нет

- Nаtionаl Lаw Institute University (N.L.I.U), Bhopаl (M.P) : Submitted To Assistant Prof. (Ms.) Saubhagya BhadkariaДокумент21 страницаNаtionаl Lаw Institute University (N.L.I.U), Bhopаl (M.P) : Submitted To Assistant Prof. (Ms.) Saubhagya BhadkariaVaibhav GuptaОценок пока нет

- Tax Planning V/S Tax Management: Dr. Anindhya TiwariДокумент18 страницTax Planning V/S Tax Management: Dr. Anindhya TiwariJAGDISHWAR KUTIYALОценок пока нет

- Siddhartha Law College, DehradunДокумент16 страницSiddhartha Law College, DehradunDheeraj Kumar TiwariОценок пока нет

- Dr. Ram Mahohar Lohiya National Law University, Lucknow ACADEMIC SESSION: 2017-2018Документ5 страницDr. Ram Mahohar Lohiya National Law University, Lucknow ACADEMIC SESSION: 2017-2018Qamar Ali JafriОценок пока нет

- Admin Final Section CДокумент21 страницаAdmin Final Section CTanmayОценок пока нет

- Constitution RTEActДокумент17 страницConstitution RTEActGhanashyam RoyОценок пока нет

- International Banking and FinancingДокумент13 страницInternational Banking and FinancingVipin VermaОценок пока нет

- National Law Institute University BhopalДокумент22 страницыNational Law Institute University BhopalHemantVermaОценок пока нет

- Dr. Ram Manohar Lohiya National Law University, LucknowДокумент14 страницDr. Ram Manohar Lohiya National Law University, LucknowDeepak RavОценок пока нет

- Law and Education SynpДокумент4 страницыLaw and Education SynpAyushi VermaОценок пока нет

- Evidence Law ProjectДокумент10 страницEvidence Law ProjectTulika GuptaОценок пока нет

- Shubhankar Labour Law-1 ProjectДокумент17 страницShubhankar Labour Law-1 ProjectShubhankar ThakurОценок пока нет

- Ankita Mam Final Draft 2019Документ14 страницAnkita Mam Final Draft 2019Margaret RoseОценок пока нет

- One Nation, One Election-The Way AheadДокумент4 страницыOne Nation, One Election-The Way AheadArpit GoyalОценок пока нет

- Role, Power and Function of Advance RulingДокумент16 страницRole, Power and Function of Advance RulingEesha GuptaОценок пока нет

- D - R M L N L U, L S - 2018-19: R AM Anohar Ohiya Ational AW Niversity Ucknow EssionДокумент4 страницыD - R M L N L U, L S - 2018-19: R AM Anohar Ohiya Ational AW Niversity Ucknow EssionAnubhav VermaОценок пока нет

- Seminar IДокумент60 страницSeminar IUmair Ahmed Andrabi100% (1)

- Research Paper On "Impact of Globalisation On Human Rights"Документ24 страницыResearch Paper On "Impact of Globalisation On Human Rights"Bhan WatiОценок пока нет

- GST - Concept and Constitutional FrameworkДокумент9 страницGST - Concept and Constitutional FrameworkarmsarivuОценок пока нет

- Corporate Law-I Project Sem VДокумент24 страницыCorporate Law-I Project Sem Vvijaya choudharyОценок пока нет

- Corp - Finance ProjectДокумент14 страницCorp - Finance ProjectSupriyoRanjanMahapatraОценок пока нет

- National Law University Odisha: Prof. Anup Kumar PatnaikДокумент25 страницNational Law University Odisha: Prof. Anup Kumar PatnaikAmiya UpadhyayОценок пока нет

- Dr. Ram Manohar Lohiya National Law University, LucknowДокумент25 страницDr. Ram Manohar Lohiya National Law University, LucknowTopperОценок пока нет

- The Culture of Public Interest Litigation in IndiaДокумент10 страницThe Culture of Public Interest Litigation in IndiaSoumyadeep MitraОценок пока нет

- Banking Law ProjectДокумент12 страницBanking Law ProjectShubhankar ThakurОценок пока нет

- Shoaib Alvi Semester-10 Roll No-153, Professional EthicsДокумент11 страницShoaib Alvi Semester-10 Roll No-153, Professional EthicsmahuaОценок пока нет

- Ational Aw Institute Niversity: Concept and Development of Humanitarian LawДокумент31 страницаAtional Aw Institute Niversity: Concept and Development of Humanitarian LawVicky DОценок пока нет

- Corporate FinalДокумент19 страницCorporate FinalJitender ChaudharyОценок пока нет

- Banking ProjectДокумент14 страницBanking ProjectSnehashreeHotaОценок пока нет

- Real Estate and Energy Law ProjectДокумент14 страницReal Estate and Energy Law ProjectShikhar MittalОценок пока нет

- PErsonal Law II ProjectДокумент15 страницPErsonal Law II ProjectshraddhaОценок пока нет

- Plea BargainingДокумент6 страницPlea BargainingVaishali RathiОценок пока нет

- Tax Law - I: Income From House PropertyДокумент23 страницыTax Law - I: Income From House PropertyArghia -Оценок пока нет

- Critical Study On Powers, Functions and Duties of Election Commission Under The Constitution OF INDIA, 1950Документ49 страницCritical Study On Powers, Functions and Duties of Election Commission Under The Constitution OF INDIA, 1950abhishek choudharyОценок пока нет

- Naeem Ullah: Registration #: 91116Документ4 страницыNaeem Ullah: Registration #: 91116Naeem MalikОценок пока нет

- GST PPT TaxguruДокумент30 страницGST PPT Taxguru50raj506019Оценок пока нет

- Republic of The Philippines vs. Intermediate Appellate Court - Case DigestДокумент2 страницыRepublic of The Philippines vs. Intermediate Appellate Court - Case DigestRichard MichaelОценок пока нет

- CIR Vs Goodrich DigestДокумент2 страницыCIR Vs Goodrich DigestLouie Sallador100% (1)

- Santos-Vs-Servier-PhilippinesДокумент2 страницыSantos-Vs-Servier-PhilippinesAnonymous V0JQmPJc33% (6)

- Kandy Co Draft FSMT and MobyДокумент4 страницыKandy Co Draft FSMT and MobyAliОценок пока нет