Академический Документы

Профессиональный Документы

Культура Документы

Annuity Problems and Solutions

Загружено:

Francez Anne Guanzon0%(2)0% нашли этот документ полезным (2 голоса)

1K просмотров1 страницаThe document contains fill-in-the-blank questions about annuity terms and mathematical problems involving calculating present and future values of annuities. It asks the reader to identify the correct term for a sequence of periods made at equal time periods, the type of annuity where payments are made at the end of each period, and the name for an annuity where payments begin and end at definite times. It also presents 5 problems to solve involving calculating values of ordinary annuities with different interest rates, payment schedules, and time periods.

Исходное описание:

mathematics

Оригинальное название

Quiz Gen Math- Annuities

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe document contains fill-in-the-blank questions about annuity terms and mathematical problems involving calculating present and future values of annuities. It asks the reader to identify the correct term for a sequence of periods made at equal time periods, the type of annuity where payments are made at the end of each period, and the name for an annuity where payments begin and end at definite times. It also presents 5 problems to solve involving calculating values of ordinary annuities with different interest rates, payment schedules, and time periods.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0%(2)0% нашли этот документ полезным (2 голоса)

1K просмотров1 страницаAnnuity Problems and Solutions

Загружено:

Francez Anne GuanzonThe document contains fill-in-the-blank questions about annuity terms and mathematical problems involving calculating present and future values of annuities. It asks the reader to identify the correct term for a sequence of periods made at equal time periods, the type of annuity where payments are made at the end of each period, and the name for an annuity where payments begin and end at definite times. It also presents 5 problems to solve involving calculating values of ordinary annuities with different interest rates, payment schedules, and time periods.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

I.

1.

2.

3.

4.

5.

II.

1.

2.

3.

4.

5.

I.

1.

2.

3.

4.

5.

II.

1.

2.

3.

4.

5.

I.

1.

2.

3.

4.

5.

II.

1.

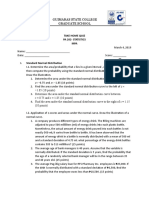

Fill in the blanks with the correct answer.

A sequence of periods made at equal time periods is a/an _____________.

A simple annuity in which payments are made at the end of each period is ___________.

An annuity where payment interval is not the same as interest period is _________.

An annuity where payment interval is not the same as interest period is _________.

An annuity in which payments begin and end in definite times is a/an ____________.

Solve the following problems completely!

Find the present value and future value of ordinary annuity of 5,000 payable semi-annually for 10 years if money is worth 6%

compounded semi-annually.

To pay for his debt at 12% compounded quarterly, Mildred Caban committed for 8 quarterly payments of 28,491.28 each. How much did

she borrow?

Juvie Mae, a high school student would like to save 50,000 for his graduation. How much should she deposit in savings account every

month for 5.5 years if interest is at 0.25% compounded monthly?

Engineer Martinez bought a car and pays 169,000 cash and 12,000 every month for 5 years. If money is 10% compounded monthly, how

much is the cash price of the car?

A TV set is for sale at 13,499 in cash or on installment terms, 2,500 each month for the next 6 months at 9% compounded monthly. If you

were the buyer, what would you prefer, cash or installment?

Fill in the blanks with the correct answer.

A sequence of periods made at equal time periods is a/an _____________.

A simple annuity in which payments are made at the end of each period is ___________.

An annuity where payment interval is not the same as interest period is _________.

An annuity where payment interval is not the same as interest period is _________.

An annuity in which payments begin and end in definite times is a/an ____________.

Solve the following problems completely!

Find the present value and future value of ordinary annuity of 5,000 payable semi-annually for 10 years if money is worth 6%

compounded semi-annually.

To pay for his debt at 12% compounded quarterly, Mildred Caban committed for 8 quarterly payments of 28,491.28 each. How much did

she borrow?

Juvie Mae, a high school student would like to save 50,000 for his graduation. How much should she deposit in savings account every

month for 5.5 years if interest is at 0.25% compounded monthly?

Engineer Martinez bought a car and pays 169,000 cash and 12,000 every month for 5 years. If money is 10% compounded monthly, how

much is the cash price of the car?

A TV set is for sale at 13,499 in cash or on installment terms, 2,500 each month for the next 6 months at 9% compounded monthly. If you

were the buyer, what would you prefer, cash or installment?

Fill in the blanks with the correct answer.

A sequence of periods made at equal time periods is a/an _____________.

A simple annuity in which payments are made at the end of each period is ___________.

An annuity where payment interval is not the same as interest period is _________.

An annuity where payment interval is not the same as interest period is _________.

An annuity in which payments begin and end in definite times is a/an ____________.

Solve the following problems completely!

Find the present value and future value of ordinary annuity of 5,000 payable semi-annually for 10 years if money is worth 6%

compounded semi-annually.

2. To pay for his debt at 12% compounded quarterly, Mildred Caban committed for 8 quarterly payments of 28,491.28 each. How much did

she borrow?

3. Juvie Mae, a high school student would like to save 50,000 for his graduation. How much should she deposit in savings account every

month for 5.5 years if interest is at 0.25% compounded monthly?

4. Engineer Martinez bought a car and pays 169,000 cash and 12,000 every month for 5 years. If money is 10% compounded monthly, how

much is the cash price of the car?

5. A TV set is for sale at 13,499 in cash or on installment terms, 2,500 each month for the next 6 months at 9% compounded monthly. If you

were the buyer, what would you prefer, cash or installment?

I.

Fill in the blanks with the correct answer.

1. A sequence of periods made at equal time periods is a/an _____________.

2. A simple annuity in which payments are made at the end of each period is ___________.

3. An annuity where payment interval is not the same as interest period is _________.

4. An annuity where payment interval is not the same as interest period is _________.

5. An annuity in which payments begin and end in definite times is a/an ____________.

II.

Solve the following problems completely!

1. Find the present value and future value of ordinary annuity of 5,000 payable semi-annually for 10 years if money is worth 6%

compounded semi-annually.

2. To pay for his debt at 12% compounded quarterly, Mildred Caban committed for 8 quarterly payments of 28,491.28 each. How much did

she borrow?

3. Juvie Mae, a high school student would like to save 50,000 for his graduation. How much should she deposit in savings account every

month for 5.5 years if interest is at 0.25% compounded monthly?

4. Engineer Martinez bought a car and pays 169,000 cash and 12,000 every month for 5 years. If money is 10% compounded monthly, how

much is the cash price of the car?

5. A TV set is for sale at 13,499 in cash or on installment terms, 2,500 each month for the next 6 months at 9% compounded monthly. If you

were the buyer, what would you prefer, cash or installment?

Вам также может понравиться

- Chi-Square Test of IndependenceДокумент6 страницChi-Square Test of IndependenceJhoanie Marie CauanОценок пока нет

- Performance Task 4Th Quarter Scaffold No. 1Документ5 страницPerformance Task 4Th Quarter Scaffold No. 1MayaОценок пока нет

- Module 24 Steps in Hypothesis TestingДокумент4 страницыModule 24 Steps in Hypothesis TestingAlayka Mae Bandales LorzanoОценок пока нет

- Addressing Climate Refugees Through International CooperationДокумент2 страницыAddressing Climate Refugees Through International CooperationMarie Sheryl Fernandez100% (1)

- Module Overview: Mathematics As The Study of Patterns)Документ15 страницModule Overview: Mathematics As The Study of Patterns)hi ilyОценок пока нет

- Atomic StructureДокумент28 страницAtomic StructureParth Thakkar50% (2)

- Business Math - Quiz 2Документ2 страницыBusiness Math - Quiz 2serena van der wesenОценок пока нет

- Stat ReviewerДокумент2 страницыStat ReviewerDanilo CumpioОценок пока нет

- Political StructureДокумент37 страницPolitical StructureGeline Joy D. SamillanoОценок пока нет

- Letter To The Editor About Animal Cruelty Prevention MonthДокумент1 страницаLetter To The Editor About Animal Cruelty Prevention MonthKayla EllsworthОценок пока нет

- Reaction Paper Aguilar, Maria JeinalynДокумент2 страницыReaction Paper Aguilar, Maria JeinalynJeinalyn AguilarОценок пока нет

- Value of Life EssayДокумент6 страницValue of Life EssaynguyenpeteranОценок пока нет

- Lived Experience of Tokhang FamiliesДокумент26 страницLived Experience of Tokhang FamiliesAngelica SolomonОценок пока нет

- Computing Probabilities of Events and Conditional ProbabilitiesДокумент25 страницComputing Probabilities of Events and Conditional ProbabilitiesAlexis Nicole Joy ManatadОценок пока нет

- Probability Statistics Chapter2 Lesson5Документ20 страницProbability Statistics Chapter2 Lesson5Shanly Coleen OrendainОценок пока нет

- The Effect of Eggshell Powder On The Growth of EggДокумент8 страницThe Effect of Eggshell Powder On The Growth of EggAngge CarranzaОценок пока нет

- Lesson 25 Compound InterestДокумент22 страницыLesson 25 Compound InterestCarbon Copy100% (1)

- Travel Motivators Barriers Article QuestionsДокумент2 страницыTravel Motivators Barriers Article QuestionsAliОценок пока нет

- 4th Grading Remedial I (PS-G8)Документ4 страницы4th Grading Remedial I (PS-G8)GAD AM ITОценок пока нет

- Gen Math Quiz Simple and CompoundДокумент1 страницаGen Math Quiz Simple and CompoundLugabalugaОценок пока нет

- Definition of Terms: What Comes in Your Mind When You See A Bank?Документ11 страницDefinition of Terms: What Comes in Your Mind When You See A Bank?Cindy BononoОценок пока нет

- Variables 190105125456Документ36 страницVariables 190105125456Richard Torzar100% (1)

- Module On Standard Scores and The Normal CurveДокумент27 страницModule On Standard Scores and The Normal CurveUniversal CollabОценок пока нет

- Speech Before The Joint Session of The US Congress: Content and Contextual Analysis ofДокумент15 страницSpeech Before The Joint Session of The US Congress: Content and Contextual Analysis ofCyrus De LeonОценок пока нет

- Reflection Paper UniquenessДокумент3 страницыReflection Paper UniquenessNikka Therese PalladoОценок пока нет

- 4.2 CompoundДокумент18 страниц4.2 CompoundSzchel Eariel VillarinОценок пока нет

- 1-2 Mathematical Language - EditedДокумент12 страниц1-2 Mathematical Language - EditedAngelica Rey TulodОценок пока нет

- Step 1:: Understand The ProblemДокумент3 страницыStep 1:: Understand The ProblemYowdead is the name nameОценок пока нет

- Simple Interest: Course 3 Course 3Документ17 страницSimple Interest: Course 3 Course 3Opalyn Desiree LimОценок пока нет

- Compound InterestДокумент40 страницCompound InterestSharmaine BeranОценок пока нет

- Lesson 4 Measures of Position 2017 Final BlankДокумент27 страницLesson 4 Measures of Position 2017 Final BlankequiniganОценок пока нет

- (Chapter 1 and 2) : Anaphy Quiz Reviewer (Chapters 1-3)Документ20 страниц(Chapter 1 and 2) : Anaphy Quiz Reviewer (Chapters 1-3)Mariam GamosОценок пока нет

- Voting Habit: Understanding The Factors Affecting The Voters in Vote-SellingДокумент15 страницVoting Habit: Understanding The Factors Affecting The Voters in Vote-SellingjanhelОценок пока нет

- Genmath e PortfolioДокумент17 страницGenmath e Portfoliosalazar sagaОценок пока нет

- Business MathematicsДокумент80 страницBusiness Mathematicszyanna roshio adolfoОценок пока нет

- Discrete and Continuous Random VariablesДокумент12 страницDiscrete and Continuous Random Variablesgemma marcitoОценок пока нет

- Chapter 2 Alkanes and CycloalkanesДокумент62 страницыChapter 2 Alkanes and CycloalkanesJitherDoromalDelaCruzОценок пока нет

- Laboratory Exercise11: Topic Learning OutcomeДокумент2 страницыLaboratory Exercise11: Topic Learning OutcomeMyrah Gail BadangayonОценок пока нет

- 1 - Big Bang TheoryДокумент20 страниц1 - Big Bang TheoryIra Mae Santiago PunoОценок пока нет

- Kenken Puzzle Activity No 2Документ2 страницыKenken Puzzle Activity No 2Desiree50% (2)

- Lesson 4 Computing The Variance of A Discrete Probability DistributionДокумент13 страницLesson 4 Computing The Variance of A Discrete Probability DistributionAaronkim PalonОценок пока нет

- Grade 7 English Quarter IV-Week 4Документ9 страницGrade 7 English Quarter IV-Week 4MinelleОценок пока нет

- Module 2 - Part 4 - CaricatureДокумент17 страницModule 2 - Part 4 - CaricatureJudith AlindayoОценок пока нет

- Poverty in The PhilippinesДокумент10 страницPoverty in The PhilippinesJymaer GeromoОценок пока нет

- Chapter 2 Part 1Документ42 страницыChapter 2 Part 1Raphael RazonОценок пока нет

- Textual Presentation of DataДокумент7 страницTextual Presentation of DataForshia Antonette BañaciaОценок пока нет

- Logic: A. Logic Statements and QuantifiersДокумент6 страницLogic: A. Logic Statements and QuantifiersJhon dave SurbanoОценок пока нет

- Regular Payment of An AnnuityДокумент11 страницRegular Payment of An AnnuityKarla BangFerОценок пока нет

- Bardinas Portfolio Art AppctnДокумент10 страницBardinas Portfolio Art AppctnRaymon Villapando Bardinas100% (1)

- Lesson 11 - Simple Annuity PDFДокумент2 страницыLesson 11 - Simple Annuity PDFPeter EcleviaОценок пока нет

- Patfit Activity 2Документ3 страницыPatfit Activity 2Mary Grace Ferrer0% (1)

- The Wind Whispered To The Grass by Amelita LoДокумент4 страницыThe Wind Whispered To The Grass by Amelita LoTerry Gabriel SignoОценок пока нет

- Chapter 3.3 Problem-Solving StrategiesДокумент25 страницChapter 3.3 Problem-Solving StrategiesGray Panie AsisОценок пока нет

- Competition Simulation: Go To The at Biology SimulationsДокумент6 страницCompetition Simulation: Go To The at Biology Simulationsanurag singh100% (1)

- HI! I'm Teacher Maricel Welcome To Our Classroom!Документ23 страницыHI! I'm Teacher Maricel Welcome To Our Classroom!Leciram Santiago Masikip33% (3)

- Performance Task # 2 Accuracy and PrecisionДокумент3 страницыPerformance Task # 2 Accuracy and PrecisionJomar BacaniОценок пока нет

- Purc Finals PSA (Public Service Announcement) : What Makes A Psa Effective?Документ13 страницPurc Finals PSA (Public Service Announcement) : What Makes A Psa Effective?Dustin Delos SantosОценок пока нет

- GSC Graduate Statistics QuizДокумент3 страницыGSC Graduate Statistics QuizDebbie Martir-PuyaoanОценок пока нет

- Activity #6 SAMPLING DISTRIBUTIONSДокумент8 страницActivity #6 SAMPLING DISTRIBUTIONSleonessa jorban cortes0% (1)

- Quiz Gen Math AnnuitiesДокумент1 страницаQuiz Gen Math AnnuitiesAnalyn Briones100% (2)

- Components of a Business PlanДокумент17 страницComponents of a Business PlanFrancez Anne Guanzon100% (1)

- Topic 14 - Income and Business TaxationДокумент71 страницаTopic 14 - Income and Business TaxationFrancez Anne Guanzon100% (1)

- SHS E-Class Record - STEM - AQUAMARINEДокумент17 страницSHS E-Class Record - STEM - AQUAMARINEFrancez Anne GuanzonОценок пока нет

- Red Christmas InvitationДокумент2 страницыRed Christmas InvitationFrancez Anne GuanzonОценок пока нет

- Debut RecipeДокумент10 страницDebut RecipeFrancez Anne GuanzonОценок пока нет

- Sample SwotДокумент2 страницыSample SwotFrancez Anne GuanzonОценок пока нет

- Week 1 Entrepreneurship Daily Lesson Log TemplateДокумент5 страницWeek 1 Entrepreneurship Daily Lesson Log TemplateMichelleAdanteMorong75% (8)

- Quiz in Business PlanДокумент1 страницаQuiz in Business PlanFrancez Anne GuanzonОценок пока нет

- Week 1 Entrepreneurship Daily Lesson Log TemplateДокумент3 страницыWeek 1 Entrepreneurship Daily Lesson Log TemplateFrancez Anne GuanzonОценок пока нет

- Bus ModelsДокумент5 страницBus ModelsFrancez Anne GuanzonОценок пока нет

- Opportunity AnalysisДокумент4 страницыOpportunity AnalysisFrancez Anne GuanzonОценок пока нет

- Hand Outs - Statement of Cash FlowsДокумент2 страницыHand Outs - Statement of Cash FlowsFrancez Anne GuanzonОценок пока нет

- Intro To EntrepДокумент7 страницIntro To EntrepFrancez Anne GuanzonОценок пока нет

- Activity - Production PlanДокумент1 страницаActivity - Production PlanFrancez Anne GuanzonОценок пока нет

- Market ResearchДокумент7 страницMarket ResearchFrancez Anne GuanzonОценок пока нет

- Business Plan - ActivityДокумент2 страницыBusiness Plan - ActivityFrancez Anne GuanzonОценок пока нет

- Quiz 1 - Statement of Financial PositionДокумент1 страницаQuiz 1 - Statement of Financial PositionFrancez Anne GuanzonОценок пока нет

- Romero, Francis Anne GuanzonДокумент3 страницыRomero, Francis Anne GuanzonFrancez Anne GuanzonОценок пока нет

- Comprehensive Problem 2 - SciДокумент1 страницаComprehensive Problem 2 - SciFrancez Anne GuanzonОценок пока нет

- Cagayan National High School Financial Position StatementДокумент1 страницаCagayan National High School Financial Position StatementFrancez Anne GuanzonОценок пока нет

- Quiz 2 - Statement of Comprehensive IncomeДокумент1 страницаQuiz 2 - Statement of Comprehensive IncomeFrancez Anne GuanzonОценок пока нет

- CNHS Quiz 4 cash flow statementДокумент2 страницыCNHS Quiz 4 cash flow statementFrancez Anne Guanzon33% (3)

- Fundamentals of ABM 2 Special QuizДокумент3 страницыFundamentals of ABM 2 Special QuizFrancez Anne GuanzonОценок пока нет

- Completed Competency - Fabm 2Документ3 страницыCompleted Competency - Fabm 2Francez Anne GuanzonОценок пока нет

- DLL Mathematics 3 q1 w6Документ3 страницыDLL Mathematics 3 q1 w6Francez Anne Guanzon100% (1)

- Applied Econ Answer SheetДокумент1 страницаApplied Econ Answer SheetFrancez Anne GuanzonОценок пока нет

- Introduction to Statistics for NursesДокумент39 страницIntroduction to Statistics for NursesFrancez Anne GuanzonОценок пока нет

- Francis Anne S. GuanzonДокумент2 страницыFrancis Anne S. GuanzonFrancez Anne GuanzonОценок пока нет

- Find Marketing Words & Define MarketingДокумент1 страницаFind Marketing Words & Define MarketingFrancez Anne GuanzonОценок пока нет

- Marketing Goals DefinitionДокумент30 страницMarketing Goals DefinitionFrancez Anne GuanzonОценок пока нет

- Sectoral Snippets: India Industry InformationДокумент18 страницSectoral Snippets: India Industry Informationpg10shivi_gОценок пока нет

- Personal and Household Finance ExplainedДокумент5 страницPersonal and Household Finance ExplainedMuhammad SamhanОценок пока нет

- Merchant BankingДокумент29 страницMerchant BankingramrattangОценок пока нет

- Business Combination Quiz 1Документ5 страницBusiness Combination Quiz 1Ansherina AquinoОценок пока нет

- Introduction To Finacial Markets Final With Refence To CDSLДокумент40 страницIntroduction To Finacial Markets Final With Refence To CDSLShoumi Mahapatra100% (1)

- CH 12 Hull Fundamentals 8 The DДокумент25 страницCH 12 Hull Fundamentals 8 The DjlosamОценок пока нет

- Competency Mapping at Ujjivan Small Finance BankДокумент8 страницCompetency Mapping at Ujjivan Small Finance BankPRANUОценок пока нет

- Partnership PRE-MID PersonalДокумент12 страницPartnership PRE-MID PersonalAbigail LicayanОценок пока нет

- Economic Value AnalysisДокумент5 страницEconomic Value AnalysisVipin V Vijayan0% (1)

- Spec. Pro. ReportДокумент5 страницSpec. Pro. ReportCharshiiОценок пока нет

- 4li Lu's Second Lecture at ColumbiaДокумент5 страниц4li Lu's Second Lecture at ColumbianabsОценок пока нет

- Book 5Документ174 страницыBook 5Anonymous hsZanpCОценок пока нет

- 618V1 - Business FinanceДокумент24 страницы618V1 - Business FinanceZain MaggssiОценок пока нет

- Bee Bagley Amended ComplaintДокумент105 страницBee Bagley Amended ComplaintTony OrtegaОценок пока нет

- Mid MonthДокумент4 страницыMid Monthcipollini50% (2)

- Critical Analysis of PNB Scam: Impact and LoopholesДокумент11 страницCritical Analysis of PNB Scam: Impact and LoopholesSaahiel SharrmaОценок пока нет

- Bank Modeling Course Outline OfferДокумент21 страницаBank Modeling Course Outline OffercartigayanОценок пока нет

- Fairness Opinions: A Flawed RegimeДокумент71 страницаFairness Opinions: A Flawed RegimetimevalueОценок пока нет

- Operar Con IchimokuДокумент91 страницаOperar Con IchimokuJose Calachahuin100% (2)

- Elara Securities - Eicher MotorsДокумент10 страницElara Securities - Eicher MotorsMehul PanjuaniОценок пока нет

- Document Prezentare IEBA TRUST V15 IUL 2017Документ28 страницDocument Prezentare IEBA TRUST V15 IUL 2017Elena DidilaОценок пока нет

- Perdana Petroleum - NPA and RSF FormДокумент3 страницыPerdana Petroleum - NPA and RSF FormChen YishengОценок пока нет

- Blockchain to Transform Financial ServicesДокумент4 страницыBlockchain to Transform Financial ServicesUJJWALОценок пока нет

- Arbitrage Pricing Theory ExplainedДокумент41 страницаArbitrage Pricing Theory ExplainedPablo DiegoОценок пока нет

- Two Alternative Binomial Option Pricing Model Approaches To Derive Black-Scholes Option Pricing ModelДокумент27 страницTwo Alternative Binomial Option Pricing Model Approaches To Derive Black-Scholes Option Pricing ModelHyzcinth BorjaОценок пока нет

- EndorsementДокумент13 страницEndorsementsagarg94gmailcom100% (2)

- Intershi Report On Uttora Bank Ltd.Документ114 страницIntershi Report On Uttora Bank Ltd.Sirajul Islam Srabon100% (1)

- Abrera v. BarzaДокумент29 страницAbrera v. BarzaangelieqОценок пока нет

- Project Finance: Case Study: Gangavaram PortДокумент4 страницыProject Finance: Case Study: Gangavaram PortSwathi KiranОценок пока нет