Академический Документы

Профессиональный Документы

Культура Документы

Revenue Ordinance 2017

Загружено:

The Daily LineАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Revenue Ordinance 2017

Загружено:

The Daily LineАвторское право:

Доступные форматы

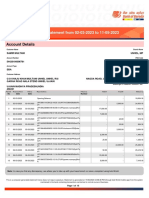

Summary

of Proposed Revenue Ordinance

Ordinance Article

House Number and Street/Alley Vacation Fees

Article I

Article III, Section 3

Proposed Rate

$50 House Number, $1025 Alley Vacation

$5 House Number, $50 Street/Alley Vacation Fees

Fees

Projected New Revenue

N/A

3-50 (new)

N/A

$.07 per bag with $.05 remitted to the

City and $.02 retained by the retailer

$9.2M (City portion)

3-4-100

3-4-120

N/A

N/A

N/A

The City's Uniform Revenue Procedures Code (URPO) contains rules for allocating tax payments and for limiting the periods that the Department of Finance can issue tax assessments. The proposed ordinance includes the

following amendments to URPO:

(1) Authorizes the allocation of any tax overpayments to the earliest period of underpayment starting with interest, then the tax and finally, any penalties. Current rules only provide for allocation of payments to current taxes,

allowing a taxpayer to avoid the carryback of the overpayment for which there are underpayments, thereby creating a refund for the taxpayer.

(2) Clarifies that the Department of Finance may extend the four year assessment or audit period for an additional two years for any taxpayer that paid less than 75 percent of taxes owed.

Amusement Tax -- Tour Boat Operator Tax

Article III, Section 2

Current Rate

Implements a 7 cent tax on disposable paper and plastic bags. The retailer will keep 2 cents and the remaining 5 cents will be remitted to the City. The proposed ordinance includes a number of exemptions including: bags

customers bring to a store, disposable bags provided by dine-in or take-out restaurants, paper and plastic bags used for package of loose bulk items, bags for prescriptions, dry cleaning bags, bags sold in packages containing

multiple bags intended for use as garbage bags, pet waste bags or yard waste, and other uses. The proposal also repeals the current plastic ban.

Clarification of Credits and Refunds and Statute of

Limitations for City Tax Procedures

Article III, Section 1

MCC

2-12--080

Amends the fee and clarifies requirements for obtaining a house, property, or address number from CDOT. Specifically, the proposed ordinance:

(1) Increases the fee for establishing a new official address number for property in Chicago from $5 to $50. The increase aligns the fee with CDOT's cost of processing the application. Additionally, the proposal clarifies that the

fee will be assessed on each main door entrance for a residence or property.

(2) Increases the fee for vacating the public way (streets and/alleys) from $50 to $1,025 and requires applicants to pay for any third party costs associated with vacating the public way incurred by CDOT, including survey work,

real estate appraisals, utility work, piping work and wiring work. Current practice and policy requires that applicants pay all third party costs, the proposal codifies this existing requirement.

(3) Requires the applicant to pay fair market value, which is current practice, for the vacated public way unless City Council adopts an ordinance which vacates the property at less than market value.

Chicago Checkout Bag Tax

Article II

2017 Budget Recommendation, City of Chicago

9%

3-92-010

No Change

N/A

Clarifies that the nine percent amusement tax applies to tour boat operators. Most operators currently remit the amusement tax on the sale of tickets or services provided by the tour boat operator. Code changes clarifies that

all tour boat operators are obligated to pay amusement tax.

Lease Tax -- Exemption for Annual Bike Share

3-32-020

Memberships

Provides a lease tax exemption for Divvy's annual bike share memberships.

9%

Page 1 of 4

0%

N/A

Draft-For Internal Review Only

Summary of Proposed Revenue Ordinance

Ground Transportation Tax -- Suburban Taxi, Limo and

Bus Companies

2017 Budget Recommendation, City of Chicago

$3.50 daily rate for vehicles with a capacity of 10

or fewer people, $6 daily rate for vehicles with a

capacity between 11 and 24 people, $9 for all

vehicles with a capacity over 25 people

3-46-040

Article III, Section 4

No Change

$1M

Requires suburban taxi, limo and bus companies picking up and dropping off at O'Hare and Midway Airports to pay the daily ground transportation tax rate at their first trip to the airport. This will be effective April 1, 2017.

Amusement Tax -- Ticket Resale

4-156-020, 4-156-030

Article III, Section 5

5% or 9% depending on amusement type applied

only to ticket mark-up value

3.5% applied to full value of the ticket

N/A

Changes the application of the amusement tax for ticket resales from applying the 5 percent and 9 percent tax only on the mark-up to 3.5 percent applied to the full value of the ticket.

Garage Parking Tax -- Eliminate Minimum Charge

Exemption

Article III, Section 6

4-236-020

N/A

22% weekdays, 20% weekends

$800,000

Eliminates the minimum threshold exemption for the Garage Parking Tax, applying the tax rate to all garage and lot charges, regardless of amount. Currently, garage fees at or below $2 for 24 hours or less, $10 for weekly, and

$40 for monthly are exempt from the Garage Parking Tax. The proposed ordinance maintains an exemption for government entities, including CTA parking lots, Park District lots, and the Juvenile Court House.

Commercial User Paid Loading Zones

9-64-165, 9-64-166, 9-64-190, 9-64-200, 964-205, 9-64-206, 9-100-020

$500 for first 20 feet in Central Business District

and $110 for 20 feet outside CBD; $50 for each

additional foot

$14 per hour

$13.8M

Article IV

Authorizes a pilot program to convert current business-paid loading zones to user-paid loading zones. The user-paid loading zone rate will be $14 per hour. The proposed ordinance does not impact loading zones or standing

zones adjacent to medical centers, private residences, day care centers, government buildings, churches, hotels, and schools. The ordinance increases fines for parking violations only within the pilot commercial loading zones

to $140.

Special Event Congestion Parking Rates

Article V, Section 1

9-64-205

$2 per hour

$4 per hour during special events, $2 per

hour all other times

$2.4M

Implement special event pricing of $4 per hour at approximately 820 parking meters around the area of Wrigley Field and approximately 670 parking meters around Soldier Field. The special event pricing would begin two

hours prior to the start of a scheduled special event (football and baseball games, concerts, etc.) and extend for seven hours. The regular meter rate of $2 per hour will continue to apply during all non-special event times.

(1) The meters impacted in the Wrigley Field area are bounded on the north side by West Irving Park Road, the west side by Ashland Avenue, the south side by Belmont Avenue, and the east side by North Broadway.

(2) The meters impact in the Soldier Field area are bounded on the north side by Roosevelt Road, on the west side by State Street, on the south side by Cermak Road, and on the east side by Lake Shore Drive.

Page 2 of 4

Draft-For Internal Review Only

Вам также может понравиться

- COVID-19 Telework PolicyДокумент3 страницыCOVID-19 Telework PolicyThe Daily LineОценок пока нет

- Divvy Case DismissalДокумент20 страницDivvy Case DismissalThe Daily LineОценок пока нет

- Health - Opening Statement-2020 Budget - FinalДокумент3 страницыHealth - Opening Statement-2020 Budget - FinalThe Daily LineОценок пока нет

- COFA Analysis of Chicago's 2020 Expenditure PrioritiesДокумент24 страницыCOFA Analysis of Chicago's 2020 Expenditure PrioritiesThe Daily Line100% (2)

- CCHR Opening StatementДокумент4 страницыCCHR Opening StatementThe Daily LineОценок пока нет

- Woodlawn Housing Preservation Ordinance DRAFTДокумент26 страницWoodlawn Housing Preservation Ordinance DRAFTThe Daily LineОценок пока нет

- Emergency City EO2020-1Документ6 страницEmergency City EO2020-1The Daily LineОценок пока нет

- CPD Opening Statement FinalДокумент5 страницCPD Opening Statement FinalThe Daily LineОценок пока нет

- DOF Opening StatementДокумент3 страницыDOF Opening StatementThe Daily LineОценок пока нет

- Consultant's 3rd Report On ISRsДокумент139 страницConsultant's 3rd Report On ISRsThe Daily LineОценок пока нет

- Legal Memo in Support of D4 Complaint SignedДокумент6 страницLegal Memo in Support of D4 Complaint SignedThe Daily LineОценок пока нет

- CFO Opening StatementДокумент3 страницыCFO Opening StatementThe Daily LineОценок пока нет

- OBM Opening StatementДокумент3 страницыOBM Opening StatementThe Daily LineОценок пока нет

- 2019 09 23 Working Toward A Healed City FINALДокумент16 страниц2019 09 23 Working Toward A Healed City FINALThe Daily LineОценок пока нет

- June 20, 2019 Cook County Democrats Pre-Slating ScheduleДокумент2 страницыJune 20, 2019 Cook County Democrats Pre-Slating ScheduleThe Daily LineОценок пока нет

- Dkt. 23 Second Amended ComplaintДокумент22 страницыDkt. 23 Second Amended ComplaintThe Daily LineОценок пока нет

- 2019-08-02 Uber V Chicago ComplaintДокумент16 страниц2019-08-02 Uber V Chicago ComplaintThe Daily LineОценок пока нет

- FWW 072219Документ12 страницFWW 072219The Daily LineОценок пока нет

- Advancing Equity 2019 - FINALBOOKДокумент26 страницAdvancing Equity 2019 - FINALBOOKThe Daily LineОценок пока нет

- Mlel Sixtyday RPRT FinalДокумент46 страницMlel Sixtyday RPRT FinalThe Daily LineОценок пока нет

- Cfwo Draft - 07172019Документ10 страницCfwo Draft - 07172019The Daily LineОценок пока нет

- June 21, 2019 Cook County Democrats Pre-Slating ScheduleДокумент2 страницыJune 21, 2019 Cook County Democrats Pre-Slating ScheduleThe Daily LineОценок пока нет

- Cook County 2020 Preliminary Budget PresentationДокумент23 страницыCook County 2020 Preliminary Budget PresentationThe Daily LineОценок пока нет

- Grant Thornton Audit AppendicesДокумент51 страницаGrant Thornton Audit AppendicesThe Daily LineОценок пока нет

- Assessor Listening Tour SlidesДокумент22 страницыAssessor Listening Tour SlidesThe Daily LineОценок пока нет

- Stakeholder Letter On SB 1379 IIДокумент3 страницыStakeholder Letter On SB 1379 IIThe Daily LineОценок пока нет

- MAY 30 Final Proposal Memo Press ReleaseДокумент21 страницаMAY 30 Final Proposal Memo Press ReleaseThe Daily LineОценок пока нет

- Chicago Consent Decree Year One Monitoring PlanДокумент78 страницChicago Consent Decree Year One Monitoring PlanThe Daily LineОценок пока нет

- Enhancing Our Culture Anti-Harassment Working Group Report 5-30-19Документ32 страницыEnhancing Our Culture Anti-Harassment Working Group Report 5-30-19The Daily LineОценок пока нет

- 5.28.19 - City Club Speech - FINALДокумент16 страниц5.28.19 - City Club Speech - FINALThe Daily LineОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Week 4: Sto. Tomas College of Agriculture, Sciences and TechnologyДокумент12 страницWeek 4: Sto. Tomas College of Agriculture, Sciences and TechnologyHannah Jean Lapenid LemorenasОценок пока нет

- Comparative Study of Investment Vs RISK SYNДокумент12 страницComparative Study of Investment Vs RISK SYNAnonymous F6fyRYGOqGОценок пока нет

- UTS Bahasa Inggris Nanda Pratama Nor R 202210100087Документ4 страницыUTS Bahasa Inggris Nanda Pratama Nor R 202210100087Nanda Pratama Nor RochimОценок пока нет

- Section 5 QuizДокумент14 страницSection 5 QuizSailesh KattelОценок пока нет

- GlobalChallengesandtheRoleofCivilEngineering Bled2011 Springer PDFДокумент11 страницGlobalChallengesandtheRoleofCivilEngineering Bled2011 Springer PDFsaurav rajОценок пока нет

- 2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A RecessionДокумент1 страница2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A Recessionpan0Оценок пока нет

- A True Indicator of The Success of A BusinessДокумент4 страницыA True Indicator of The Success of A BusinessNguyen Ngoc Yen VyОценок пока нет

- Final TOR Medical Consultants-RD CellДокумент4 страницыFinal TOR Medical Consultants-RD Cellrohit gargОценок пока нет

- Management In: Verification NeededДокумент12 страницManagement In: Verification NeededLakshanmayaОценок пока нет

- Homabay County Draft Strategic PlanДокумент107 страницHomabay County Draft Strategic PlanCyprian Otieno Awiti86% (7)

- Principles of Operations Management 9th Edition Heizer Test BankДокумент34 страницыPrinciples of Operations Management 9th Edition Heizer Test Bankelmerthuy6ns76100% (25)

- Paper Tigers, Hidden Dragons - Chapter-1Документ35 страницPaper Tigers, Hidden Dragons - Chapter-1Daniel Chan Ka LokОценок пока нет

- Franchise AccountingДокумент17 страницFranchise AccountingCha EsguerraОценок пока нет

- Best Practices in Public-Sector Human Resources Wisconsin State Government 1Документ16 страницBest Practices in Public-Sector Human Resources Wisconsin State Government 1Mahmoud SabryОценок пока нет

- Congruence Model: Submitted By-SyndicateДокумент9 страницCongruence Model: Submitted By-SyndicateKrishnakant NeekhraОценок пока нет

- Preboard 1 Plumbing ArithmeticДокумент8 страницPreboard 1 Plumbing ArithmeticMarvin Kalngan100% (1)

- Case: Mired in Corruption - Kellogg Brown & Root in NigeriaДокумент9 страницCase: Mired in Corruption - Kellogg Brown & Root in NigeriakenkenОценок пока нет

- Piece Work - WikipediaДокумент5 страницPiece Work - WikipediaBrayan Anderson Chumpen CarranzaОценок пока нет

- Memorandum by Virgin Atlantic Airways: Executive SummaryДокумент5 страницMemorandum by Virgin Atlantic Airways: Executive Summaryroman181Оценок пока нет

- Accounting TermsДокумент5 страницAccounting TermsShanti GunaОценок пока нет

- Case Study - DaburДокумент1 страницаCase Study - DaburMonica PandeyОценок пока нет

- Primus - Abap FactoryДокумент2 страницыPrimus - Abap FactorySambhajiОценок пока нет

- XXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedДокумент16 страницXXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedRajendra SharmaОценок пока нет

- Maidens, Meal and Money Capitalism and The Domestic Community (Claude Meillassoux) PDFДокумент213 страницMaidens, Meal and Money Capitalism and The Domestic Community (Claude Meillassoux) PDFjacoОценок пока нет

- Impact of Dividend PolicyДокумент12 страницImpact of Dividend PolicyGarimaОценок пока нет

- The Gold Standard Journal 12Документ13 страницThe Gold Standard Journal 12ulfheidner9103Оценок пока нет

- ACCA F1 Night Before NotesДокумент20 страницACCA F1 Night Before NotesMarlyn RichardsОценок пока нет

- Annual Barangay Youth Investment Program Monitoring FormДокумент3 страницыAnnual Barangay Youth Investment Program Monitoring FormJaimeh AnnabelleОценок пока нет

- Consolidated Teaching Timetable For September - December 2023 SemesterДокумент76 страницConsolidated Teaching Timetable For September - December 2023 Semesterjudepettersson18Оценок пока нет

- D081 and C714V2 CASE STUDYДокумент2 страницыD081 and C714V2 CASE STUDYsteve mwasОценок пока нет