Академический Документы

Профессиональный Документы

Культура Документы

Deferred Tax Problem

Загружено:

Koffee Farmer0 оценок0% нашли этот документ полезным (0 голосов)

12 просмотров1 страницаDEFTXA

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDEFTXA

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

12 просмотров1 страницаDeferred Tax Problem

Загружено:

Koffee FarmerDEFTXA

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

International accounting

Deferred taxes

15.4.2016

Solve the following tax reporting problem

A company operates for ten years and is then dissolved.

It pays annually 10 000 expert fees (that are tax deductible).

Local government gives it an penalty fee of 5 000 annually.

At the beginning of first year it buys a maching (purchase price 500 000), that it deducts fully during the ten years using a straigth line depreciation.

In tax returns it uses a 25% depreciation calulated from the remaining balance sheet value in the tax return (menojnnspoistoja). The company aims at

minimizing it taxes but does not report negative taxable results in its tax returns.

In last year it will make an additional tax deduction in its tax retun because by that time the machine has lost is value an ability to generate positive cash

flows.

Apply 20 % tax rate in all calculations.

IFRS Income statement

Year

Revenues

Expert expense

Penalty fee

Depreciation

EBIT

Tax

Profit for the period

1

2

3

100 000 100 000 100 000

10 000 10 000 10 000

5 000

5 000

5 000

50 000 50 000 50 000

35 000 35 000 35 000

8 000

8 000

8 000

27 000 27 000 27 000

4

100 000

10 000

5 000

50 000

35 000

8 000

27 000

5

6

7

8

9

10

100 000 100 000 100 000 100 000 100 000 100 000

10 000 10 000 10 000 10 000 10 000 10 000

5 000

5 000

5 000

5 000

5 000

5 000

50 000 50 000 50 000 50 000 50 000 50 000

35 000 35 000 35 000 35 000 35 000 35 000

8 000

8 000

8 000

8 000

8 000

8 000

27 000 27 000 27 000 27 000 27 000 27 000

Вам также может понравиться

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Understanding Business Accounting For DummiesОт EverandUnderstanding Business Accounting For DummiesРейтинг: 3.5 из 5 звезд3.5/5 (8)

- Tax AustraliaДокумент92 страницыTax AustraliaHtet Arkar SoeОценок пока нет

- Improperly Accumulated Earnings TaxДокумент4 страницыImproperly Accumulated Earnings TaxSophia OñateОценок пока нет

- Improperly Accumulated Earnings TaxДокумент7 страницImproperly Accumulated Earnings Taxmonica giduquioОценок пока нет

- New Performance Objectives DocumentДокумент9 страницNew Performance Objectives DocumentCef LeCefОценок пока нет

- New Performance Objectives DocumentДокумент9 страницNew Performance Objectives DocumentCef LeCefОценок пока нет

- Determine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overДокумент46 страницDetermine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overmicaella pasionОценок пока нет

- PWC Income Tax 2013 PDFДокумент668 страницPWC Income Tax 2013 PDFKoffee Farmer100% (1)

- 8 Capital Budgeting - Problems - With AnswersДокумент15 страниц8 Capital Budgeting - Problems - With AnswersIamnti domnateОценок пока нет

- Company Tax Calculation GuideДокумент21 страницаCompany Tax Calculation GuideHY DeenОценок пока нет

- Draft Copy of A Practical Guide To Developing A Commercial Wine VineyardДокумент178 страницDraft Copy of A Practical Guide To Developing A Commercial Wine Vineyardzaratustra21Оценок пока нет

- Corporation As A TaxpayerДокумент27 страницCorporation As A TaxpayerBSA-2C John Dominic Mia100% (1)

- Deferred TaxДокумент6 страницDeferred TaxJayson Manalo GañaОценок пока нет

- International TaxationДокумент8 страницInternational TaxationkinslinОценок пока нет

- Comprehensive Example of Interperiod TAX ALLOCATIONДокумент9 страницComprehensive Example of Interperiod TAX ALLOCATIONarsykeiwayОценок пока нет

- 5.09 Analysis of Income TaxesДокумент10 страниц5.09 Analysis of Income TaxesClaptrapjackОценок пока нет

- Current Tax Rates and Provisions NigeriaДокумент6 страницCurrent Tax Rates and Provisions NigeriaVikky MehtaОценок пока нет

- Minimum Corporate Income Tax (MCIT) Improperly Accumulated Earnings Tax (IAET) Gross Income Tax (GIT)Документ18 страницMinimum Corporate Income Tax (MCIT) Improperly Accumulated Earnings Tax (IAET) Gross Income Tax (GIT)Anne Mel Bariquit100% (1)

- Module 6 - Income Tax On Corporations - Part 2Документ5 страницModule 6 - Income Tax On Corporations - Part 2Never Letting GoОценок пока нет

- M4 - Income TaxationДокумент12 страницM4 - Income TaxationGraceCayabyabNiduazaОценок пока нет

- Peza ReportДокумент2 страницыPeza ReportDiana FernandezОценок пока нет

- Part B: Write An Essay That Explains The Self-Assessment System (SAS) Related To A Company's Income Tax Return and Tax EstimateДокумент3 страницыPart B: Write An Essay That Explains The Self-Assessment System (SAS) Related To A Company's Income Tax Return and Tax EstimateChai MargaretОценок пока нет

- F6 ZweДокумент6 страницF6 Zwepercy mapetereОценок пока нет

- Tax Calculation for CorporationsДокумент5 страницTax Calculation for CorporationsClaire BarbaОценок пока нет

- 3.2 Business Profit TaxДокумент53 страницы3.2 Business Profit TaxBizu AtnafuОценок пока нет

- Calculate Income Tax Expense and Deferred TaxДокумент10 страницCalculate Income Tax Expense and Deferred Taxlana del reyОценок пока нет

- CORPORATE TAX CALCULATORДокумент11 страницCORPORATE TAX CALCULATORmohanraokp2279Оценок пока нет

- BuwisДокумент23 страницыBuwisshineneigh00Оценок пока нет

- Exercise CorporationДокумент3 страницыExercise CorporationJefferson MañaleОценок пока нет

- IAS 8 - Homework QuestionsДокумент2 страницыIAS 8 - Homework QuestionsTsekeОценок пока нет

- Projected Revenue Growth IT CompanyДокумент4 страницыProjected Revenue Growth IT CompanypranavОценок пока нет

- 3.2 Business Profit TaxДокумент49 страниц3.2 Business Profit TaxBizu AtnafuОценок пока нет

- Fiscal Regime For A Business Set UpДокумент13 страницFiscal Regime For A Business Set Upmurfa0019Оценок пока нет

- Capital Budgeting TutorialДокумент6 страницCapital Budgeting TutorialSanjay MehrotraОценок пока нет

- Synthesis - Problem Solving QuizДокумент3 страницыSynthesis - Problem Solving QuizEren CuestaОценок пока нет

- Accounting For Income TaxДокумент4 страницыAccounting For Income TaxShaira Bugayong0% (2)

- Beverage Co. Fruit Drink Project NPVДокумент5 страницBeverage Co. Fruit Drink Project NPVspectrum_480% (1)

- Unit 2 - Problem 1Документ1 страницаUnit 2 - Problem 1Ivana BalijaОценок пока нет

- Week 11 Dealings in Property 1Документ45 страницWeek 11 Dealings in Property 1Arellano Rhovic R.Оценок пока нет

- Ch19 Income TaxДокумент7 страницCh19 Income TaxVioni HanifaОценок пока нет

- Advanced Financial Accounting - II CH 1-4Документ24 страницыAdvanced Financial Accounting - II CH 1-4TAKELE NEDESAОценок пока нет

- LMT School of Management, Thapar University Masters of Business AdministrationДокумент9 страницLMT School of Management, Thapar University Masters of Business Administrationgursimran jit singhОценок пока нет

- Accounting For Income Tax-1Документ4 страницыAccounting For Income Tax-1CAIОценок пока нет

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFДокумент21 страницаAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFaemanОценок пока нет

- VAT Other Aspects - January 2024Документ5 страницVAT Other Aspects - January 2024Charisma CharlesОценок пока нет

- Categories of Income and Tax RatesДокумент5 страницCategories of Income and Tax RatesRonel CacheroОценок пока нет

- TaxationДокумент10 страницTaxationIshika ChauhanОценок пока нет

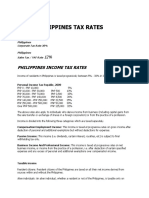

- Philippines Tax RatesДокумент7 страницPhilippines Tax RatesRonel CacheroОценок пока нет

- MCIT ReportДокумент13 страницMCIT ReportfebwinОценок пока нет

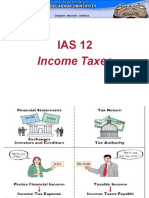

- IncomeTax IAS 12 Revised Edited GD 2020Документ46 страницIncomeTax IAS 12 Revised Edited GD 2020yonas alemuОценок пока нет

- Philippine Corporate TaxДокумент3 страницыPhilippine Corporate TaxRaymond FaeldoñaОценок пока нет

- Corporate TaxesДокумент6 страницCorporate TaxesfranОценок пока нет

- Income Tax Note 02Документ4 страницыIncome Tax Note 02Hashani Anuttara AbeygunasekaraОценок пока нет

- Philippines Tax RatesДокумент7 страницPhilippines Tax RatesJL GEN0% (1)

- AFAR Part 1 Page 1-20Документ2 страницыAFAR Part 1 Page 1-20Tracy Ann AcedilloОценок пока нет

- CorporationsДокумент24 страницыCorporationsdarlene floresОценок пока нет

- Japan Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreДокумент15 страницJapan Tax Profile: Produced in Conjunction With The KPMG Asia Pacific Tax CentreKris MehtaОценок пока нет

- Bài tập chủ đề 6Документ7 страницBài tập chủ đề 6thanhtrucОценок пока нет

- Tax XXXXДокумент60 страницTax XXXXGerald Bowe ResuelloОценок пока нет

- LMT School of Management, Thapar University Masters of Business AdministrationДокумент9 страницLMT School of Management, Thapar University Masters of Business Administrationtechnical sОценок пока нет

- Presumptive Taxation For Business and ProfessionДокумент17 страницPresumptive Taxation For Business and ProfessionRupeshОценок пока нет

- F1 Answers May 2010Документ12 страницF1 Answers May 2010mavkaziОценок пока нет

- Philippines Income Tax Rates Guide - Individual, Corporate, Capital GainsДокумент6 страницPhilippines Income Tax Rates Guide - Individual, Corporate, Capital GainsKristina AngelieОценок пока нет

- VAT IllustrationsДокумент2 страницыVAT IllustrationsBảo BờmОценок пока нет

- Deferred Tax Assets PDFДокумент23 страницыDeferred Tax Assets PDFAhmad AaomОценок пока нет

- Event Title: Event Intro Event SubtitleДокумент1 страницаEvent Title: Event Intro Event SubtitleNayanОценок пока нет

- Presentation 1Документ1 страницаPresentation 1Koffee FarmerОценок пока нет

- JOSEDДокумент2 страницыJOSEDKoffee FarmerОценок пока нет

- Lec 10Документ14 страницLec 10bettywrightОценок пока нет

- Solvency II balance sheet and capitalisation ratioДокумент53 страницыSolvency II balance sheet and capitalisation ratioKoffee FarmerОценок пока нет

- Ben Gethi NysДокумент1 страницаBen Gethi NysKoffee FarmerОценок пока нет

- Deferred TaxДокумент6 страницDeferred Taxtshikhs3372Оценок пока нет

- PWC Tax Accounting 101 2012 02 enДокумент73 страницыPWC Tax Accounting 101 2012 02 enKoffee Farmer100% (1)

- Strategic Finance Performance BlueprintДокумент32 страницыStrategic Finance Performance BlueprintKoffee FarmerОценок пока нет

- Request For Estimate of Deferred Taxes: InstructionsДокумент1 страницаRequest For Estimate of Deferred Taxes: InstructionsKoffee FarmerОценок пока нет

- Powerplan Powerttax Income Tax OverviewДокумент2 страницыPowerplan Powerttax Income Tax OverviewKoffee Farmer0% (1)

- Guidelines To Configuring Intercompany Profit - Controller 8xДокумент13 страницGuidelines To Configuring Intercompany Profit - Controller 8xKoffee FarmerОценок пока нет

- JosephineДокумент3 страницыJosephineKoffee FarmerОценок пока нет

- Final Sale Offer For Enape PlotsДокумент1 страницаFinal Sale Offer For Enape PlotsKoffee FarmerОценок пока нет

- Deferred Tax Guide On Manufacturing Incentives PDFДокумент11 страницDeferred Tax Guide On Manufacturing Incentives PDFKoffee FarmerОценок пока нет

- Adla 23546Документ1 страницаAdla 23546Koffee FarmerОценок пока нет

- Sample House Help-Family Employment Agreement: Work Hours and DatesДокумент3 страницыSample House Help-Family Employment Agreement: Work Hours and DatesKoffee FarmerОценок пока нет

- Live Pig MarketsДокумент25 страницLive Pig MarketsKoffee FarmerОценок пока нет

- Complete Guide To Ethics ManagementДокумент23 страницыComplete Guide To Ethics Managementmangala26Оценок пока нет