Академический Документы

Профессиональный Документы

Культура Документы

CIR V Manila Electric Company

Загружено:

angela lindleyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CIR V Manila Electric Company

Загружено:

angela lindleyАвторское право:

Доступные форматы

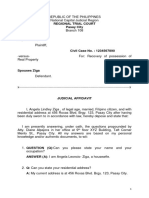

CIR v Manila Electric Company(MERALCO)

Facts:

On April 17, 1989, respondent filed an amended final corporate Income Tax Return

ending December 31, 1988 reflecting a refundable amount of P107,649,729 Respondent thus

filed on March 30, 1990 a letter-claim for refund or credit in the amount of P107,649,729

representing overpaid income taxes for the years 1987 and 1988.Petitioner not having acted on

its request, respondent filed on April 6, 1990 a judicial claim for refund or credit with the Court of

Tax Appeals.

Issue: whether respondent adduced sufficient evidence to prove its entitlement to a refund

Ruling:

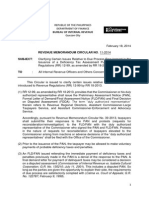

Sec. 69. Final Adjustment Return. Every corporation liable to tax under Section 24 shall

file a final adjustment return covering the total taxable income for the preceding calendar

or fiscal year. If the sum of the quarterly tax payments made during the said taxable year

is not equal to the total tax due on the entire taxable net income of that year the

corporation shall either:

(a)

Pay the excess tax still due; or

(b) Be refunded the excess amount paid, as the case may be.

In case the corporation is entitled to a refund of the excess estimated quarterly income

taxes paid, the refundable amount shown on its final adjustment return may be credited

against the estimated quarterly income tax liabilities for the taxable quarters of the

succeeding taxable year.

It is doctrinal that the factual findings of the Court of Tax Appeals, when supported by substantial

evidence, will not be disturbed on appeal, unless it is shown that it committed gross error in the

appreciation of facts.[24] Hence, as a matter of practice and principle, this Court will not set aside

the conclusion reached by the said court, especially if affirmed by the Court of Appeals as in the

present case. For by the nature of its functions, the tax court dedicates itself to the study and

consideration of tax problems and necessarily develops expertise thereon, unless there has

been an abuse or improvident exercise of authority on its part.[25] None such is appreciated by

this Court, however.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- CORPO FAQ'sДокумент21 страницаCORPO FAQ'santhonettealmojuelaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Vdocuments - MX - Torts Case Digest PDFДокумент3 страницыVdocuments - MX - Torts Case Digest PDFangela lindleyОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Bar Matter NoДокумент2 страницыBar Matter Noangela lindleyОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Northern Mini Hydro vs. CIR CTA CAse No. 7257 PDFДокумент13 страницNorthern Mini Hydro vs. CIR CTA CAse No. 7257 PDFGuiller C. MagsumbolОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- 02 GR - 212530 - 2016Документ15 страниц02 GR - 212530 - 2016Cherrylyn CaliwanОценок пока нет

- Regional Trial Court Pasay CityДокумент2 страницыRegional Trial Court Pasay Cityangela lindleyОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- RMC 11-2014Документ2 страницыRMC 11-2014Dennise TalanОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Casino V ValdezДокумент2 страницыCasino V Valdezangela lindleyОценок пока нет

- VOL. 214, SEPTEMBER 18, 1992 129: Hercules Industries, Inc. vs. Secretary of LaborДокумент7 страницVOL. 214, SEPTEMBER 18, 1992 129: Hercules Industries, Inc. vs. Secretary of Laborangela lindleyОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Derek Ramsay vs. CIR (2015)Документ24 страницыDerek Ramsay vs. CIR (2015)Marie MoralesОценок пока нет

- Nat Res CasesДокумент1 страницаNat Res Casesangela lindleyОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Cervantes Vs Pal Maritime Corp (Gr175209 January 16 2013) Clear Wordings of Master To Be 'Relieved' Is Resignation Not DismissalДокумент13 страницCervantes Vs Pal Maritime Corp (Gr175209 January 16 2013) Clear Wordings of Master To Be 'Relieved' Is Resignation Not DismissalBrian BaldwinОценок пока нет

- 694 Supreme Court Reports Annotated: Confederation of Citizens Labor Unions vs. NorielДокумент6 страниц694 Supreme Court Reports Annotated: Confederation of Citizens Labor Unions vs. Norielangela lindleyОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

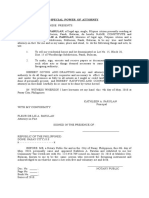

- Spa Atp HWДокумент1 страницаSpa Atp HWangela lindleyОценок пока нет

- 35 42Документ8 страниц35 42angela lindleyОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Republic of The PhilippinesДокумент37 страницRepublic of The Philippinesangela lindleyОценок пока нет

- 140 Supreme Court Reports Annotated: Timbungco vs. CastroДокумент6 страниц140 Supreme Court Reports Annotated: Timbungco vs. Castroangela lindleyОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- VOL. 214, SEPTEMBER 18, 1992 129: Hercules Industries, Inc. vs. Secretary of LaborДокумент7 страницVOL. 214, SEPTEMBER 18, 1992 129: Hercules Industries, Inc. vs. Secretary of Laborangela lindleyОценок пока нет

- Atty. Sandoval Notes-Constitutional Law (Political Law 2)Документ204 страницыAtty. Sandoval Notes-Constitutional Law (Political Law 2)Jeseth Marie De Vera100% (1)

- Fernandez V CabansagДокумент6 страницFernandez V Cabansagangela lindleyОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Stelco V CAДокумент6 страницStelco V CADence Cris RondonОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Batch 1Документ131 страницаBatch 1angela lindleyОценок пока нет

- Dar V Decs & Roxas V DambaДокумент4 страницыDar V Decs & Roxas V Dambaangela lindleyОценок пока нет

- 2015 United Nations Climate Change ConferenceДокумент23 страницы2015 United Nations Climate Change Conferenceangela lindleyОценок пока нет

- Legal Ethics Bar Exams 2015Документ34 страницыLegal Ethics Bar Exams 2015angela lindleyОценок пока нет

- Family Code PDFДокумент57 страницFamily Code PDFangela lindleyОценок пока нет

- Cases Consti 1Документ20 страницCases Consti 1angela lindleyОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Arrest and Seizure CasesДокумент2 страницыArrest and Seizure CasesKevin SerranoОценок пока нет

- in Re. Laureta and MaravillaДокумент23 страницыin Re. Laureta and Maravillaangela lindleyОценок пока нет