Академический Документы

Профессиональный Документы

Культура Документы

GST

Загружено:

Abinav0 оценок0% нашли этот документ полезным (0 голосов)

53 просмотров3 страницыGST

Оригинальное название

Gst

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документGST

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

53 просмотров3 страницыGST

Загружено:

AbinavGST

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

Introduction of a GST is very much essential in the

emerging environment of the Indian economy.

There is no doubt that in production and distribution of

goods, services are increasingly used or consumed and

vice versa. Separate taxes for goods and services, which

is the present taxation system, requires division of

transaction values into value of goods and services for

taxation, leading to greater complications, administration,

including compliances costs. In the GST system, when all

the taxes are integrated, it would make possible the

taxation burden to be split equitably between

manufacturing and services.

GST will be levied only at the final destination of

consumption based on VAT principle and not at various

points (from manufacturing to retail outlets). This will help

in removing economic distortions and bring about

development of a common national market.

It will also help to build a transparent and corruption-free

tax administration. Presently, a tax is levied on when a

finished product moves out from a factory, which is paid

by the manufacturer, and it is again levied at the retail

outlet when sold.

GST (Goods and Services Tax) is a tax levied when

a consumer buys a good or service.

The current tax regime is riddled with indirect

taxes which the GST aims to subsume with a single

comprehensive tax, bringing it all under a single

umbrella. The bill aims to eliminate the cascading

effect of taxes on production and distribution prices

on goods and services.

India is adopting a dual GST, wherein the Central

GST will be called CGST and state SGST. The main

road block is the coordination among states.

Centre and states have to come to a consensus on

uniform GST rates, inter-state transaction of goods

and services, administrative efficiency and

infrastructural preparedness to implement the new

tax reform.

How will GST remedy the situation?

GST will do away with Gordian knot of multiple taxrates which is a burden on the common man.

Dual GST means it will have a federal structure.

The GST will basically have only three kinds of

taxes - Central, state and another one called

integrated GST to tackle inter-state transactions.

Under the current GST tax reform, all forms of

'supply' of goods and services like transfer, sale,

barter, exchange, and rental will have a CGST

(central levy) and SGST (state levy).

GST will also help usher-in an era of a transparent

and corruption-free tax administration. It is set to

weed out the current shortcomings of the supply

chain owing to the complicated, multi-layered

policies.

First GST is fundamentally anti-federal. This is why

states have been resisting it so hard for years. Of course, they

can be compensated for any loss of revenue, as Arun Jaitley

has promised, but it still means they will not be able to raise or

lower taxes as they see fit politically. Also, once in, states will

not be able to opt out of GST.

Second GST more or less equalises taxation across products,

and hence may be iniquitous. For example, currently centre

and states can levy higher taxes on luxury goods and services

(five-star dinners, cars above a certain size) and this is fair.

Once GST kicks in, all goods and services may end up paying

the same tax. This means the rich who buy luxury goods may

pay less tax and the poor more than they should. This goes

against the basic tenets of taxing the rich more and the poor

less.

Of course, states and centre will make exceptions (like food

items and drugs), but this cant be done endlessly. Too many

exemptions and low duties for some categories of products will

defeat the very purpose of having a simplified tax structure. It

will also create endless disputes between company and taxman

as companies try to show their products are entitled to lower

taxes and the taxman the reverse.

Third, if we assume that those evading excise (legally or

otherwise) currently will henceforth start paying the tax, it

means they have to raise prices to stay profitable. Taxes up,

prices up. In the short-term, GST may boost the prices of

some segments of the economy

Second, if the unorganised sector is going to lose some of its

competitive edge initially, it means there will be pressures

for layoffs in companies that cant compete as a result of

GST implementation. In the short run, GST may end up

costing jobs till the smaller companies learn to compete. And

small companies are the biggest job creators anywhere in the

world.

Вам также может понравиться

- Corrosion SyllabusДокумент2 страницыCorrosion SyllabusAbinavОценок пока нет

- SqaДокумент2 страницыSqaAbinavОценок пока нет

- Optimize The Given Code For Expected OutputДокумент9 страницOptimize The Given Code For Expected OutputAbinavОценок пока нет

- Applying UML and PatternsДокумент39 страницApplying UML and PatternsAbinavОценок пока нет

- ResДокумент1 страницаResAbinavОценок пока нет

- Procedure Manual DEAДокумент8 страницProcedure Manual DEAAbinavОценок пока нет

- 8051 ExplainedДокумент16 страниц8051 ExplainedApurva DesaiОценок пока нет

- Data Security Using Honeypot SystemДокумент2 страницыData Security Using Honeypot SystemJubaira Samsudeen67% (3)

- ILP ScoreBoardДокумент46 страницILP ScoreBoardAbinavОценок пока нет

- Even Sem (Higher) - UD RevisedДокумент3 страницыEven Sem (Higher) - UD RevisedAbinavОценок пока нет

- DWN 3796Документ9 страницDWN 3796AbinavОценок пока нет

- UD Fees Collection All UG & PG Nov16 - May17Документ3 страницыUD Fees Collection All UG & PG Nov16 - May17AbinavОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- PR-BERUCLEAN 3849 Ultrasonic ChemicalДокумент1 страницаPR-BERUCLEAN 3849 Ultrasonic Chemicalankarthik11Оценок пока нет

- How Corporate Strategy Impacts SalesДокумент2 страницыHow Corporate Strategy Impacts SalesRommel RoxasОценок пока нет

- Financial Ratios: Analysis of Financial StatementsДокумент16 страницFinancial Ratios: Analysis of Financial StatementsRiz NBОценок пока нет

- Managing corporate treasury risks with TableauДокумент46 страницManaging corporate treasury risks with TableauIonОценок пока нет

- Minutes BAC Charlie April 14 2020Документ4 страницыMinutes BAC Charlie April 14 2020Desiree AllonesОценок пока нет

- Practice Financial ManagementДокумент12 страницPractice Financial ManagementWilliam OConnorОценок пока нет

- PGXPM-DT - DTC - Step 7 - Establish Design CriteriaДокумент2 страницыPGXPM-DT - DTC - Step 7 - Establish Design CriteriaRajan13579Оценок пока нет

- Oil company department responsibilitiesДокумент2 страницыOil company department responsibilitiesKristan EstebanОценок пока нет

- MBA Syllabus Guide for Organizational Change and DevelopmentДокумент144 страницыMBA Syllabus Guide for Organizational Change and Developmentprasadkh90Оценок пока нет

- 2012 The Darwinian Workplace.Документ4 страницы2012 The Darwinian Workplace.kasireddyvarun98Оценок пока нет

- English 3Документ20 страницEnglish 3Shanggavee VelooОценок пока нет

- Chapter 1. Introduction To Consumer BehaviourДокумент8 страницChapter 1. Introduction To Consumer BehaviourjentitularОценок пока нет

- Chapters 1-2 Practice Test: Nguyễn Thị Thu Thủy - SAMI - HUSTДокумент2 страницыChapters 1-2 Practice Test: Nguyễn Thị Thu Thủy - SAMI - HUSTThanh NgânОценок пока нет

- Scientific CommunicationДокумент4 страницыScientific Communicationsilly GooseОценок пока нет

- BrochureДокумент2 страницыBrochureEdward GutierrezОценок пока нет

- Lect 03Документ14 страницLect 03Nguyen Quoc KhaiОценок пока нет

- AEG Enterprises Financial AnalysisДокумент5 страницAEG Enterprises Financial AnalysisGing freexОценок пока нет

- 2019 ListДокумент37 страниц2019 ListJagadish TОценок пока нет

- Stores and Inventory ManagementДокумент19 страницStores and Inventory Managementjagdeep_naidu92% (50)

- HSR 2019 Summary NWP PDFДокумент81 страницаHSR 2019 Summary NWP PDFjayadush100% (1)

- Leading Gear Measuring TechnologyДокумент40 страницLeading Gear Measuring Technologyadi utomoОценок пока нет

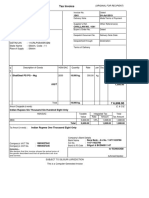

- Tax Invoice DetailsДокумент2 страницыTax Invoice DetailsLama RessuОценок пока нет

- Honda Two WheelerДокумент20 страницHonda Two WheelerAryaman SolankiОценок пока нет

- JIT, Creation of Manufacturing Cells, Behavioral Considerations, Impact On Costing PracticesДокумент2 страницыJIT, Creation of Manufacturing Cells, Behavioral Considerations, Impact On Costing PracticesKim FloresОценок пока нет

- Jesha Del Macia Mazapa1Документ16 страницJesha Del Macia Mazapa1Angelika Faith GerianeОценок пока нет

- Assignment No 2Документ6 страницAssignment No 2Amazing worldОценок пока нет

- MKT 333 Imc ProjectДокумент25 страницMKT 333 Imc Projectapi-692969461Оценок пока нет

- Dll-5th-Week - EntrepreneurshipДокумент8 страницDll-5th-Week - EntrepreneurshipJose A. Leuterio Jr.Оценок пока нет

- Service and Customer Satisfaction of Nepal Telecom: A Project Work ReportДокумент49 страницService and Customer Satisfaction of Nepal Telecom: A Project Work ReportMadan DhakalОценок пока нет

- CSG PProcgsДокумент1 страницаCSG PProcgsS Sivarao JonnalagaddaОценок пока нет