Академический Документы

Профессиональный Документы

Культура Документы

Accounting Group3 Pricing Methods

Загружено:

Aingtea0100 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров3 страницыpricing

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документpricing

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

7 просмотров3 страницыAccounting Group3 Pricing Methods

Загружено:

Aingtea010pricing

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

PRICING POLICIES

1. Marginal Cost Pricing

Case Study

Leisure Furniture Inc. leads the market of tailor made furniture for hotel is applying

‘the marginal (variable) cost pricing method to generate higher sales. This method

calculates the selling price at slightly above the variable cost of production, which

ensures the lowest price available in Maastricht's furniture market.

Example: If the variable cost of producing a lounge furniture is €30 000, fixed cost is

€4000, the company set a margin factor of 20%, the price would be calculated as:

€30 000 + (€30 000 x 20%) = €36000.

Advantages

‘* Lower price point increases customer demand and generates high volume of

sales,

‘* Suitable for highly competitive market, attracts customers sensitive to prices.

* Suitable for mass production (utilizing idle capacity) where the fixed costs

have been covered by basic/main production.

Disadvantages

‘* Unacceptable for long-term price setting because the omission of fixed costs

Which might result in loss.

* It ignores market prices, opportunities may be lost by setting a price below

the market

‘* Focuses on cost reduction to maintain low prices with less consideration to

quality and therefore it will be difficult to move to higher quality market.

By this method, the company earns a minimum profit per sale with the risk of loss if

market conditions changes (new competitors, inflation). Therefore marginal cost

pricing is not recommended for normal/usual pricing activities, but for specific or

strategic activities such as entering new products or discounts on particular orders

and should be used cautiously.

2. Mark-Up Pricing

‘At Home Furniture LTD, we use Markup based pricing strategy. This means that we

add a specific percentage to the total cost to allow for profit margin and in case of

production we add percentage that includes both for profit and non-production

cost. Because of low economic activity, consumers spending on household

durables has decreased recently and as a result the company is experiencing low

demand on orders for the standard lounge suits.

Because such pricing method ignores production efficiency, it does not incentivize

the company to decrease its prices and adapt to the new market condition and

therefore it is failing to increase demand on this product.

This pricing method has several advantages and disadvantages

Advantages:

* Itis easy to implement.

© Profit percentage is always built in the markup.

‘© It requires little information; and

‘* Its useful to test the market price demand for newly launched product.

Disadvantages:

* It ignores efficiencies.

‘* It slightly ignores competition this is due to the percentage of profit margin

that is based on the return the company is looking to achieve and not the

competitors prices.

'* This pricing method is tight. For example, as the percentage of profit margin

is based on assumption, in case the company has to react quickly and

conduct marketing campaigns, it will be very difficult as the marketing cost

might not be builtin the percentage.

3. Learning and Conclusions

From this case study, we can conclude that the pricing method depends largely on

the company's objectives, market condition and the industry in which the business

operates. Marginal Pricing will create higher sales volume by setting low prices but

in the long-run, it might result in the loss. However, Mark-up Pricing is easy to use

in built-in profit, but it ignores efficiencies.

4, Bibliography

* (n.d. Accountings Tools. Retrieved from:

http://www. intingtools.com/marginal-cost-pricin

* (n.d). Accountings Tools. Retrieved from:

http://www. accountingtools.com/cost-plus-pricing

Вам также может понравиться

- Letter of GuaranteeДокумент1 страницаLetter of GuaranteeAingtea010100% (1)

- Research PresentationДокумент24 страницыResearch PresentationmohitОценок пока нет

- Bob Sadino - WikipediaДокумент3 страницыBob Sadino - WikipediaAingtea010Оценок пока нет

- Biography of Bob Sadino - Entrepreneur Success From Indonesia - My ArticleДокумент4 страницыBiography of Bob Sadino - Entrepreneur Success From Indonesia - My ArticleAingtea010Оценок пока нет

- Paper To Talk - Original PDFДокумент6 страницPaper To Talk - Original PDFAingtea010Оценок пока нет

- Comparing Top Tech Giants' Business Models: Apple, Alphabet, Microsoft, Amazon & FacebookДокумент3 страницыComparing Top Tech Giants' Business Models: Apple, Alphabet, Microsoft, Amazon & FacebookAingtea010Оценок пока нет

- Strategic Development and SWOT Analysis PDFДокумент10 страницStrategic Development and SWOT Analysis PDFAingtea010Оценок пока нет

- SWOT Uae PDFДокумент20 страницSWOT Uae PDFAingtea010Оценок пока нет

- Global 20170228 Global Middle ClassДокумент32 страницыGlobal 20170228 Global Middle ClassAingtea010Оценок пока нет

- Success Story of Bob Sadino - Success StoriesДокумент3 страницыSuccess Story of Bob Sadino - Success StoriesAingtea010Оценок пока нет

- Indomie - PaperДокумент9 страницIndomie - PaperHari Zainuddin Rasyid0% (1)

- The Choice of Entry Mode For Successful Business in An Emerging MarketДокумент108 страницThe Choice of Entry Mode For Successful Business in An Emerging MarketAingtea010Оценок пока нет

- Uber Vs Grab Presentation1-160326175230Документ13 страницUber Vs Grab Presentation1-160326175230Aingtea010Оценок пока нет

- Instant Noodles Market Indonesia - Difficult To Compete With Indomie - Indonesia InvestmentsДокумент4 страницыInstant Noodles Market Indonesia - Difficult To Compete With Indomie - Indonesia InvestmentsAingtea010100% (1)

- Noodle Market Brazil EN - MARKET - VOLUME - 3LG - A4 - 2016 PDFДокумент2 страницыNoodle Market Brazil EN - MARKET - VOLUME - 3LG - A4 - 2016 PDFAingtea010Оценок пока нет

- Nissin Ajinomoto Alimentos LtdaДокумент4 страницыNissin Ajinomoto Alimentos LtdaAingtea010Оценок пока нет

- Indomie SwotДокумент1 страницаIndomie SwotAingtea010100% (1)

- Guide To Writing A Killer Marketing PlanДокумент26 страницGuide To Writing A Killer Marketing PlanMohammad Ibrahim NehmeОценок пока нет

- Marketing Plan OutlineДокумент16 страницMarketing Plan OutlineAttila GárdosОценок пока нет

- Supply Chain Integration PDFДокумент9 страницSupply Chain Integration PDFAingtea010Оценок пока нет

- VRIO Framework ExplainedДокумент2 страницыVRIO Framework ExplainedAingtea010Оценок пока нет

- Chap 005Документ30 страницChap 005Anggriani Profita RyathОценок пока нет

- Investment Analysis of No-Fat Pizza LineДокумент4 страницыInvestment Analysis of No-Fat Pizza LineAingtea010Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Chapter 15 & 16 Study Guide Micro StudentДокумент9 страницChapter 15 & 16 Study Guide Micro StudentShahzad KouserОценок пока нет

- 10% of The Indians Speak English, 45% of The Indians Are Women. So The Proportion of Women English Speakers in India Is 45% of 10% 4.5%Документ11 страниц10% of The Indians Speak English, 45% of The Indians Are Women. So The Proportion of Women English Speakers in India Is 45% of 10% 4.5%Aastha SharmaОценок пока нет

- 24 - Muhammad Sulthan Akbar Bahrul Alam - PPIC - Quiz1Документ5 страниц24 - Muhammad Sulthan Akbar Bahrul Alam - PPIC - Quiz1Sulthan AlamОценок пока нет

- MBA Marketing Lecture Notes Chapter 1Документ51 страницаMBA Marketing Lecture Notes Chapter 1kariem100% (4)

- Valuation of Inventories: A Cost-Basis Approach: True-FalseДокумент5 страницValuation of Inventories: A Cost-Basis Approach: True-FalseCarlo ParasОценок пока нет

- AEC 12 Application 4 - Group 4 ACBДокумент55 страницAEC 12 Application 4 - Group 4 ACBPRINCESS JUDETTE SERINA PAYOTОценок пока нет

- Solved CAT 2003 (L) Paper With SolutionsДокумент74 страницыSolved CAT 2003 (L) Paper With Solutionsammar ahmadОценок пока нет

- Mba-Mcom Business Law PDFДокумент8 страницMba-Mcom Business Law PDFBikash PradhanОценок пока нет

- Br2e Adv Readingfile03Документ2 страницыBr2e Adv Readingfile03PressCall AcademyОценок пока нет

- Supply and DemandДокумент16 страницSupply and DemandStevenzel Eala EstellaОценок пока нет

- Hyperinflationary EconomiesДокумент19 страницHyperinflationary EconomiesJade AlyssonОценок пока нет

- Unit 2 Theory of Demand, Supply and EquilibriumДокумент77 страницUnit 2 Theory of Demand, Supply and EquilibriumNitesh BhattaraiОценок пока нет

- KFC's competitive advantages and environmental threatsДокумент5 страницKFC's competitive advantages and environmental threatsAbuzar DawoodОценок пока нет

- Fast Track TradingДокумент5 страницFast Track TradingTomasrdОценок пока нет

- Faculty Business Management 2023 Session 1 - Pra-D 230717 130249Документ12 страницFaculty Business Management 2023 Session 1 - Pra-D 230717 130249Khairul AdibОценок пока нет

- Capitlyo (Ceiling Mounted 2.5hp)Документ1 страницаCapitlyo (Ceiling Mounted 2.5hp)Herbs DelОценок пока нет

- Karnataka II PUC ECONOMICS Sample Question Paper 2020Документ6 страницKarnataka II PUC ECONOMICS Sample Question Paper 2020Sangamesh AchanurОценок пока нет

- How I Built A Profitable Dropshipping Business in 14 Days (Without Spending Money On Ads) PDFДокумент34 страницыHow I Built A Profitable Dropshipping Business in 14 Days (Without Spending Money On Ads) PDFJulianFootball100% (4)

- MCQ Chap 4Документ6 страницMCQ Chap 4Diệu QuỳnhОценок пока нет

- Benchmark (Crude Oil)Документ3 страницыBenchmark (Crude Oil)Anoj pahathkumburaОценок пока нет

- 21 Differential Cost Analysis PDFДокумент18 страниц21 Differential Cost Analysis PDFMichael Robin B. SevillaОценок пока нет

- FACT SHEET - Pahimakas Sa Isang AhenteДокумент2 страницыFACT SHEET - Pahimakas Sa Isang AhentePaulo PerezОценок пока нет

- The Diary of A Spanish MerchantДокумент26 страницThe Diary of A Spanish MerchantJabzy JoeОценок пока нет

- Revised Dealership ContractДокумент7 страницRevised Dealership ContractChay CruzОценок пока нет

- Introducing Advanced Macroeconomics:: Growth and Business CyclesДокумент36 страницIntroducing Advanced Macroeconomics:: Growth and Business CyclesOruc MeherremliОценок пока нет

- Dairy Fram BerutДокумент45 страницDairy Fram Berutcarol100% (1)

- Employee share schemes explainedДокумент4 страницыEmployee share schemes explainedSteve MedhurstОценок пока нет

- Here's How Traders Can Use Delta and Gamma For Options TradingДокумент3 страницыHere's How Traders Can Use Delta and Gamma For Options TradingGagandeep Singh LoteyОценок пока нет

- Brooke Bond Supreme Brand Management ReportДокумент19 страницBrooke Bond Supreme Brand Management ReportFaizmeen N. Shehzad33% (3)

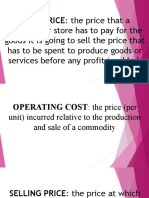

- COST PRICE: The Price That AДокумент47 страницCOST PRICE: The Price That AAlma Agnas100% (3)