Академический Документы

Профессиональный Документы

Культура Документы

Vat Configuration

Загружено:

sreekumarИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Vat Configuration

Загружено:

sreekumarАвторское право:

Доступные форматы

Value Added Tax (VAT)

Configuration Documentation

For

Value Added Tax (VAT)

2005

Siemens Information Systems Ltd

1 of 27

Value Added Tax (VAT)

INDEX

Structure for Jurisdiction code (OBCO).03

Jurisdiction Code for TAXINJ (OBCP)04

Condition Types for Sales / Purchases (OBQ1)...05

Condition Types for Sales / Purchases (OBQ1)...06

Excise Tax condition Types (OBQ1)...07

Tax Processing in Accounting (OBCN)..08

TAXINJ procedure (OBQ3).09

TAXINJ procedure....10

New Condition Types for SD V/06....12

Pricing Procedure: ZJDEPO..13

Pricing Procedure: ZJFACT..14

SD Condition Types V/06....16

UTXJ Condition Type V/06..17

GL account for new Tax transaction keys (FS00)...18

Customer Tax Classification - OVK3..20

Material Tax Classification OVK4.21

Tax Codes (VAT) in UTXJ- SD ..22

Tax Codes (VAT) in FTXP-MM...23

Business Places...24

Assign Business Places to Plants...25

Maintain Master Records26

Migration.27

Siemens Information Systems Ltd

2 of 27

Value Added Tax (VAT)

Delete the Structure for Jurisdiction code (OBCO)

Active Settings:

The tax procedure TAXINJ from Jurisdiction code structure at field Proc. (V_TTXDKALSM) is not present.

Remarks:

This is in compliance with SAP recommendation.

Siemens Information Systems Ltd

3 of 27

Value Added Tax (VAT)

Delete Jurisdiction Code for TAXINJ (OBCP)

Active Settings:

Jurisdiction Code for TAXINJ is deactivated.

Remarks:

This is in compliance with SAP recommendation.

Siemens Information Systems Ltd

4 of 27

Value Added Tax (VAT)

Define Condition Types for Sales / Purchases (OBQ1)

Active Settings:

For Inbound transactions three new Tax condition types to be introduced:

1. JIP4: A/P CST Non Deductible under VAT as a copy of JIP1.

2. JIP5: A/P VAT RM Deductible as a copy of JIP2

3. JIP6: A/P VAT RM Non Deductible as a copy of JIP3

For Outbound transactions new Tax condition type have introduced:

1. JIN6: A/R VAT Payable as a copy of JIN2

For all the above, Condition Category is maintained as D and the Access sequence

"MWST" is assigned.

Remarks:

The above condition types have been in place and in compliance per SAP

recommendations.

Siemens Information Systems Ltd

5 of 27

Value Added Tax (VAT)

Define Condition Types for Sales / Purchases (OBQ1)

Active Settings:

For Inbound transactions following conditions need to be maintained with Condition

Category D and Access Sequence MWST:

1. JIP1: A/P C Sales Tax Inv.

2. JIP2: A/P L Sales Tax Inv

3. JIP3: A/P Sales Tax setoff

For Outbound transactions following conditions need to be maintained with

Condition Category D and Access Sequence MWST:

1.

2.

3.

4.

JIN1: A/R Centr. Sales Tax

JIN2: A/R Local Sales Tax

JIN4: CST Surcharge

JIN5 : LST Surcharge

Remarks:

For all the above, Condition Category is maintained as D and the Access sequence

"MWST" is assigned which is in compliance with SAP recommendations.

Siemens Information Systems Ltd

6 of 27

Value Added Tax (VAT)

Change in Excise Tax condition Types (OBQ1)

Active Settings:

For following conditions Tax Category D & Access sequence "MWST" has to be

maintained:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

JMO1 - A/P Excise duty for Setoff

JAO1 - A/P AED for Setoff

JSO1 - A/P SED for Setoff

JMO2 - A/P Excise duty for Inventory

JAO2 - A/P AED for Inventory

JSO2 - A/P SED for inventory

JMOD - A/R Excise Duty

JAED - A/R Add. Excise Duty

JSED - A/R Sp. Excise Duty

JCES - A/R CESS

JECS - IN A/R Education Cess

JEC1 - A/P Ecess for setoff

JEC2 - A/P Ecess for Inven

Remarks:

For all the above, Condition Category is maintained as D and the Access sequence

"MWST" is assigned which is in compliance with SAP recommendations.

Siemens Information Systems Ltd

7 of 27

Value Added Tax (VAT)

Settings for Tax Processing in Accounting (OBCN)

Active Settings:

For following transaction keys for new tax conditions to be defined.

Akey

Description

JP4

A/P CST Non

Deductible

A/P VAT RM

Deductible

A/P VAT RM Non

Deductible

A/R VAT Payable

JP5

JP6

JN6

Tax Types

Non Deduct

Posting Ind.

2

2

1

2

X

3

2

Remarks:

The above transaction keys have been maintained as per SAP recommendation.

Siemens Information Systems Ltd

8 of 27

Value Added Tax (VAT)

Change TAXINJ procedure (OBQ3)

Active Settings:

In tax procedure TAXINJ, condition types JIP4, JIP5, JIP6 have been added

immediately after JIP1, JIP2 and JIP3.

Transaction/ Account Keys and Alternative Calculation type have been assigned

as follows

1. JIP4 - JP4 and 371 (ST inventory - India)

2. JIP5 - JP5 and 370 (ST setoff - India)

3. JIP6 - JP6 and 371 (ST inventory - India)

For the sales side, conditions JIN6 have been added in TAXINJ immediately after

JIN1, JIN2, JIN4 and JIN5 conditions.

Transaction/ Account Keys and Alternative Calculation type have been assigned

as follows:

1. JIN6 - JN6

Remarks:

Above is in compliance with SAP Recommendation.

Siemens Information Systems Ltd

9 of 27

Value Added Tax (VAT)

The details of the TAXINJ procedure as maintained is given below:

Step Cntr

100

110

120

150

155

160

162

165

170

175

180

182

213

214

215

216

217

218

219

221

222

223

230

231

243

248

260

270

280

440

460

470

480

485

490

510

511

512

513

514

515

517

518

520

530

532

534

535

CTyp Description

BASB Base Amount

Calculated call

Sub Total

JMO1 A/P Eduty for Setoff

JAO1 A/P AED for Setoff

JSO1 A/P SED for Setoff

JEC1 A/P Eduty for Inven

ZMO1 A/P AED for Inventry

JMO2 A/P SED for inventry

JAO2 A/P AED E-cess Inv

JSO2 A/P SED for inventry

JEC2 A/P Ecess for Inven

Sub total for Sales Tax

LSTT TOT%LST-Fullsalestax

JIP1 A/P C Sales Tax Inv

LSTX A/P L Sales Tax Inv

JIP3 A/P Sales Tax setoff

LSTC SURCHARGE%-LST

LPTT TOT%LST(formBD/15EC

LPTX A/P Local Purch Tax%

ZPI3 A/PSTsetoff(BD/15EC)

LPTC Surcharge%-Pur.Tax

ZPTX A/P Loc PurTax(Prov)

ZUTX A/P Loc PurTax(Unrg)

ZF31 Fm-31 ST Set off red

ZRST F31-Resale tax

JIP4 A/P CST Non deductib

JIP5 A/P VAT RM Deductibl

JIP6 A/P VAT RM Non-Deduc

ZRTU A/P RIGHT TO USE TAX

ZSER A/PService Tax Cenvt

ZSC1 A/P Ecess on ser cvt

JSER A/P SERVICE TAX

ZSC2 A/PEdu Cess on Serv

JSVD SERVICE TAX DEBIT

JMOD A/R Excise Duty

JAED A/R AED [Edu Cess]

JNED A/R N.C.C.D.

JSED A/R Sp. Excise Duty

JCES A/R Cess

Sub total

JECS A/R Education Cess

Total of all central taxes

JIN1 A/R Centr. Sales Tax

JIN2 A/R Local Sales Tax

JIN6 A/R VAT Payable

LST / VAT surch base

Subtotal

Siemens Information Systems Ltd

From

To

Man Mdt

Stat

SubTo

Reqt

AltCTy

AltCBV

ActKy Accrls

962

100

100

100

100

150

150

100

100

100

170

120

213

213

213

213

216

213

213

213

221

213

213

213

213

213

213

213

100

100

460

100

480

250

120

510

120

120

120

652

X

X

974

864

868

864

VS1

VS2

VS3

VS1

NVV

NVV

NVV

NVV

NVV

162

862

865

869

865

207

182

X

371

371

370

221

217

972

222

X

370

370

370

370

371

370

371

515

515 517

518

518

518

530 532

518 532

10 of 27

X

X

X

X

X

X

X

X

352

352

352

352

363

363

363

363

363

NVV

NVV

NVV

VS5

NVV

363 NVV

363 NVV

363

NVV

363 ZS5

363 ZS6

363 VS5

363 NVV

363 JP4

363 JP5

363 NVV

NVV

ZS1

ZS2

NVV

NVV

ESE

363

366

366

360

367

366

MW1

MW2

JN6

352

Value Added Tax (VAT)

540

550

555

560

570

580

590

JIN4

JIN5

ZJAS

ZTT1

ZTT2

ZST1

ZST2

CST surcharge

LST surcharge

LST surcharge- Addn

A/R TO Tax(incl. ST)

A/R TO Tax(Inc ST)

A/R SrvTx Payable

A/R E cess serv tax

Siemens Information Systems Ltd

520 520

534

534

518

535

100

580

11 of 27

MW3

MW3

ZAS

MW4

MW4

Value Added Tax (VAT)

Active Settings:

New SD condition types to be defined for VAT with Condition Category D.

JIN6: A/R VAT Payable

Remarks:

Above SD Condition Type are already in place in following Pricing Procedures:

ZJDEPO

ZJFACT

ZJGDN1

ZJSCRP

ZJFSPR

ZJFSRT

ZJFSP1

ZJBRAN

YJFSPR

YJGDN1

ZAHBAJ

Siemens Information Systems Ltd

12 of 27

Value Added Tax (VAT)

ZJDEPO:

Proc.

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

Step Cnt Ctyp

r

100

180

190

250

ZDSP

ZP01

ZTTR

ZDF1

255

275

300

310

350

400

550

720

740

740

760

770

YDF1

772

775

777

778

780

ZJAS

785

YDF2

790

800

820

860

870

ZENT

ZPDI

ZVSC

ZVS2

880

ZSRA

882

ZSRC

885

ZSRW

ZDFP

ZND1

UTXJ

JMOD

JEX2

JCES

JIN1

JIN2

JIN6

JIN4

JIN5

ZTT1

ZTT2

ZDF2

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO

ZJDEPO 890

ZJDEPO 900

Description

Depot Selling Price

Taxable Insurance

Territorial Rebate

Dep Taxable Freight

Dep Add.Taxable

Frt

Tax Base

Tax Jurisdict.Code

Sub Total 1

A/R Basic Excise

A/R Basic Excise

A/R Cess

Central sales tax

Local sales tax

VAT Payable

CST surcharge

LST surcharge

LST surchargeAddn

Base Price+ST

Turnover Tax

Turnover Tax

Dep Non-tax Freight

Dep Add Non-Tax

Frt

Dealer Purchase

Price

Entry tax

Pre Delivery Inspect

Veh service charges

Veh ser chg Year II

Stock Reserve

Akurdi

Stock Reserve

Chakan

Stock Reserve

Waluj

Dep Freight payable

Net Dealer Price

Siemens Information Systems Ltd

From

To

Man.

Mdt Stat

P SubTo

X

X

X

X

1

4

5

602

ERL

INS

ERL

FRT

602

FRT

100

250

100

275

100

300

350

100

275

275

275

720

740

740

310

775

775

775

AltCTy

AltCBV

ActKy

260

X

652

260

X

X

190 X

X

X

X

720 X

740 X

740 X

772

X

775 X

X

X

X

X

X

X

X

X

X

X

X

X

780

775

Reqt

X

X

X

X

X

X

355

353

359

3

A

X

X

X

3

3

602

FRT

602

FRT

785

A

X

X

X

X

13 of 27

D

2

H

3

3

3

3

3

902

PDI

VSC

VS2

SR1

SR2

X

X

X

SR3

Accrls

Value Added Tax (VAT)

ZJFACT:

Proc.

Step

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

ZJFACT

Cntr

100

110

150

175

200

590

600

605

610

625

630

635

640

641

643

644

645

647

648

650

775

Description

Net Dealer Price

Special Price

Forwarding/ Handling

CSD Dealer Markup

Ass Value

Ass value

ZNCD (SED/NCCD)

UTXJ Tax Jurisdict.Code

JMOD A/R Basic Excise

Base Prices

JEX2 A/R Basic Excise

ZEX2 A/R Basic Excise

Base prices + BED

JCES A/R Cess

JCED A/R Cess

Basic Price + BED +

CESS

JSED A/R Special Exc.duty

JNED A/R NCCD

JAED A/R Add. Excise duty

JEXS A/R SED

JEXN A/R NCCD

JEXA A/R AED

BED

CESS

Sub total of central

taxes

JECS A/R Education Cess

JECX A/R Education Cess

Basic price

Sub total of central

taxes

Sp. Disc. For CSD

Sub TotalPrice+ED+Edu.cess

ZCDM CSD Dealer Mark-up

Ex-Factory Price

ZP01 Taxable Insurance

ZFR1 Taxable Freight

YFR1 Add. Taxable Freight

JIN1

Central sales tax

JIN2

Local sales tax

JIN6

VAT Payable

JIN4

CST surcharge

Base

Price+Excise+ST+Dis

count

From

To Man Mdt Stat P SubTo Reqt AltCTy AltCBV ActKy Accrls

.

ZNDP

ZSPP

ZFHA

ZDR1

250

300

350

375

400

410

475

550

575

653

655

675

700

710

715

720

740

740

760

CTyp

Siemens Information Systems Ltd

X

X

100 175

X

X

X

X

1

1

652

355

353

EXD

X

X

959

353

EXC

X

X

X

X

X

X

H

H

H

959

959

959

353

353

353

EXD

EXN

EXD

959

353

EDC

702

ERL

602

602

959

INS

FRT

FRT

200

200

X

X

200

350

400

375 400

200

X

550

475 550

250

X

250

X

200

X

600

605

610

400

575

X

X

X

X

X

X

X

X

X

X

X

625 642

643

X

644

375

X

X

643

645 648

X

X

645 648

653 655

675

710

675 715 X

675 715 X

675 715 X

740

X

X

X

X

X

675 770

14 of 27

ERL

ERL

FLH

ERL

3

X

X

X

X

X

X

X

Value Added Tax (VAT)

777

ZFR2 Non Taxable Freight

Add. Non Taxable

779

YFR2 Fre

781

Copy of Ex factory

783

Taxes for Insurance

Non Taxable

785

ZP02 Insuranc

Dealer Purchase

790

Price

930

ZND1 Net Dealer Price

940

ZVS2 Veh ser chg Year II

950

ZENT Entry tax

960

ZPDI Pre Delivery Inspect

970

ZFDI Factory Direct Incen

980

ZDLR Dealer MarginInspect

990

ZVSC Veh service charges

777

675

720 760

602

FRT

959

FRT

602

INS

X

X

781 784

775 785

X

X

X

X

X

X

X

X

Above are examples of Pricing Procedures. The complete list is available with

BAL.

Siemens Information Systems Ltd

15 of 27

VS2

ENT

PDI

FDI

VS2

ENT

PDI

FDI

VSC VSC

Value Added Tax (VAT)

Maintain SD Condition Types V/06

Activity:

All SD Cenvat Conditions like JMOD, JEX2, JECX, JAED, JEXA, JCED, JCES,

JEXS, JECS, JECX should be maintained with Condition Category D.

Remarks:

Condition Types JMOD, JAED with Condition Category 1 has been changed to

Condition Category D and JECX, JEX2 with Condition Category _ has been

changed to Condition Category D.

Siemens Information Systems Ltd

16 of 27

Value Added Tax (VAT)

Maintain UTXJ Condition Type V/06

Activity:

Condition Category 1 should be maintained with Access Sequence ZCIN.

Remarks:

Condition Category 1 is maintained with Access Sequence ZCIN. However

ZCIN is having same tables 909 and 910 (copy of 11 and 368) with same fields.

These tables should be marked exclusive. Currently these tables were not

marked exclusively which was now maintained as exclusive.

Siemens Information Systems Ltd

17 of 27

Value Added Tax (VAT)

Create GL account for new Tax transaction keys (FS00)

Active Settings:

Following new accounts are proposed to be opened after VAT is implemented.

For input credits - in current asset group

461501

461502

461503

461511

461512

461513

VAT Receivable - Raw Material & Components

VAT Receivable - Capital Goods

VAT Receivable - Opening Stock

VAT credit on hold - Raw Material & Components

VAT credit on hold - Capital Goods

VAT credit on hold - Opening Stock

Remarks:

Above GL Accounts have been activated in PRD.

For VAT reversals on non-productive use/shortages etc. - in expenses group

680211

VAT Others

For reversal of input tax credit on depot/branch transfers. - in expenses group

660921

VAT reversal on depot transfers

For the Sales tax collected we propose to continue using the same account

codes that are in use today. The list is as under.

221351

221352

221353

221354

221355

221356

221357

221358

CST Current Year - Maharashtra

CST Current Year - Uttar Pradesh

CST Current Year - Bihar

CST Current Year - West Bengal

CST Current Year - Punjab

CST Current Year - Haryana

CST Current Year - Chandigarh

CST Current Year - Rajasthan

Siemens Information Systems Ltd

18 of 27

Value Added Tax (VAT)

221359

221360

221361

221362

221363

CST Current Year - Assam

CST Current Year - Tamilnadu

CST Current Year - Jammu and Kashmir

CST Current Year - Orissa

CST Current Year - New Delhi

221251

221252

221253

221254

221255

221256

221257

221258

221259

221260

221261

221262

221263

LST/VAT Current Year - Maharashtra

LST/VAT Current Year - Uttar Pradesh

LST/VAT Current Year - Bihar

LST/VAT Current Year - West Bengal

LST/VAT Current Year - Punjab

LST/VAT Current Year - Haryana

LST/VAT Current Year - Chandigarh

LST/VAT Current Year - Rajasthan

LST/VAT Current Year - Assam

LST/VAT Current Year - Tamilnadu

LST/VAT Current Year - Jammu and Kashmir

LST/VAT Current Year - Orissa

LST/VAT Current Year - New Delhi

Siemens Information Systems Ltd

19 of 27

Value Added Tax (VAT)

Maintain Customer Tax Classification - OVK3

Active Settings:

Following Key Indicators are currently defined for Customer Tax Classification:

Indicator

Description

0

Export Customer

Veh/Spares

3

Veh/Sp Part Dealer

6

Inter Div - IMS

7

Inter Div - OMS

8

Nepal / Bhutan 0%

9

Exempted Sale

A

Veh/sp dlr w/o Form 'C'

G

Matl/Scrap customer

Siemens Information Systems Ltd

20 of 27

Value Added Tax (VAT)

Maintain Material Tax Classification OVK4

Active Settings:

Following Key Indicators are currently defined for Material Tax Classification:

Indicator

0

1

I

J

K

L

M

N

B

Q

Description

Chemical

Veh Taxable

Pigment

MH, 4% , Trading

MH, 12.5% , Trading

MH, 0% , Factory Part

MH, 4% , Factory

Part

MH, 12.5% , Factory

Part

Agency Sale Business

Matl for proc srv tx

Siemens Information Systems Ltd

21 of 27

Value Added Tax (VAT)

Create Tax Codes in UTXJ

Activity:

Following Tax Codes have been generated for VAT in FTXP and created

condition records as below. Tax Codes have been assigned to respective GL

accounts.

REGIOPL

REGIO

CUSTCL

MATTCL

RATE

MAH

MAH

MAH

MAH

MAH

MAH

3

3

3

1

1

M

100%

100%

100%

TAX

CODE

1A

1B

1C

GL A/C

221251

221251

221251

0%

12.5%

4%

Above are examples of mapping Tax Codes. The complete list is available with

BAL.

Siemens Information Systems Ltd

22 of 27

Value Added Tax (VAT)

MM Tax Codes:

TX

RATE

JM01 JM02 JEC1 JEC2 JIP5

3P

3Q

3R

4A

4B

4C

4D

4E

4F

4G

4H

4I

4J

4K

4L

4M

4N

4O

4P

4Q

4R

4V

4W

4X

4Y

4Z

100%

0%

100%

100%

2%

100%

100%

2%

2%

100%

100%

2%

2%

100%

100%

2%

2%

100%

100%

2%

2%

100%

100%

2%

2%

100%

100%

2%

1%

1%

2%

100%

100%

100%

100%

2%

12.5%

12.5%

12.5%

4%

4%

4%

12.5%

12.5%

12.5%

2%

2%

2%

2%

4%

12.5%

Above are examples of mapping of MM related Tax Codes.

Siemens Information Systems Ltd

23 of 27

Value Added Tax (VAT)

Define Business Places J_1BBRANCV

Active Settings:

Presently following Business Places are maintained:

AK01

CH01 WA01 ZZ01 ZZ02 ZZ03 ZZ04 ZZ05 ZZ06 ZZ07 ZZ08 ZZ09 ZZ10 ZZ11 ZZ12 -

Akurdi

Chakan / Akurdi

Waluj

Guwahati

Sambalpur

Kharagpur

Faridabad

Hosur

Jammu

Kota

Patna

Luknow

Chandigarh

Zirakpur

Delhi

Siemens Information Systems Ltd

24 of 27

Value Added Tax (VAT)

Assign Business Places to Plants J_1BT001WV

Active Settings:

Business Places were assigned to Plants:

Remarks:

Following Plants / Depots have been assigned to Business Places:

Business Place

AK01

AK01

AK01

AK01

AK01

CH01

CH01

CH01

CH01

WA01

WA01

WA01

WA01

WA01

ZZ01

ZZ02

ZZ03

ZZ04

ZZ05

ZZ06

ZZ07

ZZ08

ZZ09

ZZ10

ZZ11

ZZ12

Plants / Depots

AK01

AK02

AK03

AK04

AK06

CH01

CH02

CH03

CH04

WA01

WA02

WA03

WA04

WA05

ZZ01

ZZ02

ZZ03

ZZ04

ZZ05

ZZ06

ZZ07

ZZ08

ZZ09

ZZ10

ZZ11

ZZ12

Maintain Master Records

Master Data Maintenance

Siemens Information Systems Ltd

25 of 27

Value Added Tax (VAT)

1. Customer Master Data:

Remove Jurisdiction Code: Maintain blank field in Jurisdiction Code field for all

customers.

Define correct Region of Customer: Ensure correct input of Customer Region.

Define correct Customer Tax Classification: Ensure correct input of Customer

Tax Classification.

Define TIN Number: Maintain correct TIN Number for Customers.

2. Material Master Data:

Define correct Material Tax Classification: Ensure correct input of Material Tax

Classification.

3. Condition Records for UTXJ:

Domestic: New condition records need to be created for the access sequence

i.e. Region of Delivering Plant / Region of Ship to Party / Customer Tax

Classification1 / Material Tax classification1 -Tax Code.

Siemens Information Systems Ltd

26 of 27

Value Added Tax (VAT)

Migration

Activity:

BAL have foreclosed all Purchase and Sales Orders so that smooth migration can be

availed.

Siemens Information Systems Ltd

27 of 27

Вам также может понравиться

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОт EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОценок пока нет

- SAP Financials - Tax Collected at Source ManualДокумент5 страницSAP Financials - Tax Collected at Source ManualSurya Pratap Shingh RajputОценок пока нет

- Tax JurisdictionДокумент13 страницTax JurisdictionabbasxОценок пока нет

- SAP GST - Smajo Rapid Start RoadMap V1.0Документ25 страницSAP GST - Smajo Rapid Start RoadMap V1.0satwikaОценок пока нет

- SAP Threeway Match Functionality & Configuration - SAP BlogsДокумент6 страницSAP Threeway Match Functionality & Configuration - SAP Blogsshiv0308Оценок пока нет

- Design Document Co Profitabilty Analysis Author/ApproverДокумент19 страницDesign Document Co Profitabilty Analysis Author/ApproverAncuţa CatrinoiuОценок пока нет

- Key Data StructureДокумент38 страницKey Data StructureroseОценок пока нет

- SAP S/4HANA Retail: Processes, Functions, CustomisingОт EverandSAP S/4HANA Retail: Processes, Functions, CustomisingРейтинг: 5 из 5 звезд5/5 (1)

- First Steps in Sap Production Processes PPДокумент6 страницFirst Steps in Sap Production Processes PPMichael Platt OlabodeОценок пока нет

- Implementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesОт EverandImplementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesОценок пока нет

- New GL Migration TipsДокумент3 страницыNew GL Migration Tipsgirija_krОценок пока нет

- GL Determination Document - SAP B1Документ9 страницGL Determination Document - SAP B1Kaushik ShindeОценок пока нет

- SAP CO PPT'sДокумент5 страницSAP CO PPT'sTapas BhattacharyaОценок пока нет

- FI FM 003 PresentationДокумент72 страницыFI FM 003 Presentationbiswajit6864Оценок пока нет

- Year End Closing Activities PDFДокумент60 страницYear End Closing Activities PDFRaju Raj RajОценок пока нет

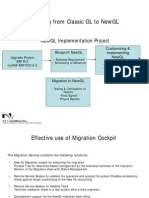

- Migrating From Classic GL To NewglДокумент8 страницMigrating From Classic GL To NewglTushar BhavsarОценок пока нет

- Master Data and Tax ConfigurationДокумент26 страницMaster Data and Tax ConfigurationVijay VadgaonkarОценок пока нет

- 7 Steps For SAP Fixed Assets Migration in SAP - SAP ExpertДокумент13 страниц7 Steps For SAP Fixed Assets Migration in SAP - SAP ExpertPraveen KVОценок пока нет

- New Asset AccountingДокумент19 страницNew Asset AccountingShruti ChapraОценок пока нет

- ABC Textile India LTDДокумент207 страницABC Textile India LTDShamik ChowdhuryОценок пока нет

- Difference Between SAP ECC and SAP S4HANA FINANCEДокумент13 страницDifference Between SAP ECC and SAP S4HANA FINANCEShobhnath Singh100% (1)

- SAP ASAP DocumentationДокумент28 страницSAP ASAP DocumentationQassam_BestОценок пока нет

- Difference Between Withholding Taxes and Extended TaxesДокумент2 страницыDifference Between Withholding Taxes and Extended Taxesrohit12345aОценок пока нет

- WWW Stechies Com Sdfi IntegrationДокумент14 страницWWW Stechies Com Sdfi IntegrationRajan S PrasadОценок пока нет

- SAP FICO Documents - SAP SIMPLE Docs PDFДокумент21 страницаSAP FICO Documents - SAP SIMPLE Docs PDFrushiket8618Оценок пока нет

- Sap Fico T100Документ246 страницSap Fico T100Chikkandlapalli VenkateshОценок пока нет

- Configuration of Tax Calculation Procedure TAXINNДокумент8 страницConfiguration of Tax Calculation Procedure TAXINNdharmesh6363Оценок пока нет

- SAP Question and AnswerДокумент13 страницSAP Question and AnswerDurga Tripathy DptОценок пока нет

- Profit Center ProcessДокумент21 страницаProfit Center Processjiljil1980Оценок пока нет

- Guided Configuration in S - 4HANA - SCNДокумент7 страницGuided Configuration in S - 4HANA - SCNLipsitaDas50% (2)

- Sab BookДокумент15 страницSab BookAnkita SharmaОценок пока нет

- Asset Accounting User ManualДокумент30 страницAsset Accounting User ManualImim Yoma0% (1)

- Business Processes Master List Financial Accounting & ControllingДокумент21 страницаBusiness Processes Master List Financial Accounting & ControllingPrathamesh ParkerОценок пока нет

- 002 Business Consolidation (SEM-BCS) PDFДокумент170 страниц002 Business Consolidation (SEM-BCS) PDFparivijjiОценок пока нет

- SAP FI ALL-SAP Document Split Configuration and Manual-V1.1-Trigger LauДокумент20 страницSAP FI ALL-SAP Document Split Configuration and Manual-V1.1-Trigger LauSubramanian ChandrasekarОценок пока нет

- SAP Query - User Group Creation: SQ03Документ21 страницаSAP Query - User Group Creation: SQ03nagendraОценок пока нет

- S4 HANA Group ReportingДокумент36 страницS4 HANA Group ReportingHernan NovodvorskiОценок пока нет

- Different Depreciation Key For One Asset ClassДокумент9 страницDifferent Depreciation Key For One Asset ClassAnanthakumar AОценок пока нет

- Configuration of Leased Asset AccountingДокумент2 страницыConfiguration of Leased Asset AccountingPavan UlkОценок пока нет

- GL in ObycДокумент5 страницGL in Obychitarth135Оценок пока нет

- GST Implementation Detailed Document For ConsultantДокумент9 страницGST Implementation Detailed Document For Consultantmahesh gaikwadОценок пока нет

- SAP S 4HANA Finance 2022 Introduction 1683550397Документ50 страницSAP S 4HANA Finance 2022 Introduction 1683550397Thirumalai ShanmugamОценок пока нет

- ABC Blue PrintДокумент80 страницABC Blue Printanand chawan100% (1)

- Current: Double Click To See All Projects and To Use FiltersДокумент2 страницыCurrent: Double Click To See All Projects and To Use FiltersvenkatvavilalaОценок пока нет

- SAP Finance NotesДокумент131 страницаSAP Finance NotesMohammed MisbahuddinОценок пока нет

- Finance ExtenДокумент15 страницFinance Extensmile1alwaysОценок пока нет

- Sap Fi-Co User Manual: ©2020 Cloud Corner Solutions Pvt. LTD, All Rights ReservedДокумент120 страницSap Fi-Co User Manual: ©2020 Cloud Corner Solutions Pvt. LTD, All Rights ReservedNithin MohanОценок пока нет

- Asset ImpairmentДокумент9 страницAsset ImpairmentsmnabeelОценок пока нет

- HANA Vs S - 4HANAДокумент85 страницHANA Vs S - 4HANAharish GiriОценок пока нет

- Rar CoceptsДокумент18 страницRar CoceptsMoorthy EsakkyОценок пока нет

- SFIN Demo - Configuration DocumentДокумент105 страницSFIN Demo - Configuration DocumentPavan SharmaОценок пока нет

- BBP Sample As Is Process Mapped To Sap To Be ProcessДокумент252 страницыBBP Sample As Is Process Mapped To Sap To Be ProcessSaandip DasguuptaОценок пока нет

- Extended Withholding Tax ConfigurationДокумент57 страницExtended Withholding Tax Configurationmur143Оценок пока нет

- Intigration Between FiДокумент144 страницыIntigration Between Fisreekumar100% (1)

- Ticket AnswerДокумент2 страницыTicket AnswersreekumarОценок пока нет

- Sap Cin-MM Customizing For Tax Procedure - Taxinn: Hide TOCДокумент7 страницSap Cin-MM Customizing For Tax Procedure - Taxinn: Hide TOCsreekumarОценок пока нет

- Five Understand Product Costing in SAP FICOДокумент7 страницFive Understand Product Costing in SAP FICOsreekumarОценок пока нет

- Ecc ReportsДокумент9 страницEcc ReportssreekumarОценок пока нет

- Bank Pass Sheet 1Документ1 страницаBank Pass Sheet 1sreekumarОценок пока нет

- Work Breakdown Structure (WBS)Документ14 страницWork Breakdown Structure (WBS)sreekumarОценок пока нет

- End User Procedure For Locating and Viewing A Purchase Order and Attachments in Records ManagementДокумент15 страницEnd User Procedure For Locating and Viewing A Purchase Order and Attachments in Records ManagementsreekumarОценок пока нет

- Purpose: Work InstructionДокумент12 страницPurpose: Work InstructionsreekumarОценок пока нет

- AB08ReverseAssetTrans PDFДокумент14 страницAB08ReverseAssetTrans PDFsreekumarОценок пока нет

- 371 - Umoja Bank Reconciliation - User Guide - v1.0 PDFДокумент86 страниц371 - Umoja Bank Reconciliation - User Guide - v1.0 PDFsreekumarОценок пока нет

- GoldenДокумент1 страницаGoldenGOLDEN MOTORSОценок пока нет

- Akash62 2324Документ4 страницыAkash62 2324rishabh.vermaОценок пока нет

- IndexДокумент2 страницыIndexMAYANK GUPTAОценок пока нет

- Cycle 3 Notes-3 Class 11 GSTДокумент6 страницCycle 3 Notes-3 Class 11 GSTtmoОценок пока нет

- No Plastic Packaging: Tax InvoiceДокумент14 страницNo Plastic Packaging: Tax InvoiceALOK RANAОценок пока нет

- Suitcase 2019 BillДокумент1 страницаSuitcase 2019 BillSonali SinglaОценок пока нет

- Ilovepdf MergedДокумент4 страницыIlovepdf MergedShikhar GuptaОценок пока нет

- Tax Invoice Zee Laboratories LTD.: Bill ToДокумент1 страницаTax Invoice Zee Laboratories LTD.: Bill ToLabo SuisseIndiaОценок пока нет

- Flipkart Labels 23 Aug 2021 04 16Документ42 страницыFlipkart Labels 23 Aug 2021 04 16Sudip SenОценок пока нет

- PDF Manuel Dx27instructions Minicap Flex CompressДокумент91 страницаPDF Manuel Dx27instructions Minicap Flex CompressShoaib AhmedОценок пока нет

- Sanitiser Tax InvoiceДокумент1 страницаSanitiser Tax InvoiceSanjeev RanjanОценок пока нет

- Idt - GSTДокумент35 страницIdt - GSTArush KothariОценок пока нет

- Costco Invoice PDFДокумент2 страницыCostco Invoice PDFvertoxmediaОценок пока нет

- PVT TD: Kswagen No Da A S-Sec 6 Noida G B Nagar U P No1Da 2Документ2 страницыPVT TD: Kswagen No Da A S-Sec 6 Noida G B Nagar U P No1Da 2vikalpmitrОценок пока нет

- B.K.Enterprisers: Continued... 2Документ33 страницыB.K.Enterprisers: Continued... 2Alok NayakОценок пока нет

- Flipkart Labels 23 Feb 2024-12-13Документ9 страницFlipkart Labels 23 Feb 2024-12-13chhavientzОценок пока нет

- Anshul MedicailДокумент2 страницыAnshul MedicailSHEKHAR SHARMAОценок пока нет

- No Plastic Packaging: Tax InvoiceДокумент2 страницыNo Plastic Packaging: Tax Invoicepgpm20 SANCHIT GARGОценок пока нет

- 4 Avril PDFДокумент1 страница4 Avril PDFBastien RabierОценок пока нет

- Chapter 27 Sales Interstate Exempted EntryДокумент3 страницыChapter 27 Sales Interstate Exempted EntryTEJA SINGHОценок пока нет

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountДокумент1 страницаBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPramod HansОценок пока нет

- Zone Commissionerate/ Directorate Name of Officer Designation Contact DetailsДокумент45 страницZone Commissionerate/ Directorate Name of Officer Designation Contact DetailsRaj KarkiОценок пока нет

- (04.07.23) Vinod Electrical & HardwareДокумент1 страница(04.07.23) Vinod Electrical & HardwareAbhinaz AlamОценок пока нет

- 2016 TAXATION BAR QUESTION With Suggested AnswerДокумент3 страницы2016 TAXATION BAR QUESTION With Suggested AnswerGail Fabroa Navarra90% (10)

- GST Pune ZoneДокумент21 страницаGST Pune ZoneRam RОценок пока нет

- Order Types in SAPДокумент88 страницOrder Types in SAPRamesh MОценок пока нет

- Bill Ms 95Документ3 страницыBill Ms 95onlineanoop786Оценок пока нет

- VAT Invoice - 2024-01-31 - 00000007031318-2401-18359960Документ2 страницыVAT Invoice - 2024-01-31 - 00000007031318-2401-18359960mhzp4ckj47Оценок пока нет

- Invoice 1608380715020Документ1 страницаInvoice 1608380715020Prakash KumarОценок пока нет

- Sap SDДокумент8 страницSap SDramesh BОценок пока нет