Академический Документы

Профессиональный Документы

Культура Документы

Ch15 Raiborn SM

Загружено:

Mendelle MurryОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ch15 Raiborn SM

Загружено:

Mendelle MurryАвторское право:

Доступные форматы

170

Chapter 15

CHAPTER 15

CAPITAL BUDGETING

QUESTIONS

1.

Acapitalassetisalonglivedassetacquiredbyafirm.Capitalassetsprovide

the essential production and distributional capabilities required by all

organizations.

2.

Cashflowsarethefocusofcapitalbudgetinginvestmentsjustascashflows

arethefocusofanyinvestment.Accountingincomeultimatelybecomescashflow

butisreportedbasedonaccruals,deferrals,andotheraccountingassumptionsand

conventions.Theseaccountingpracticesandassumptionsdetractfromthepurity

ofcashflowsand,therefore,arenotusedincapitalbudgeting.

3.

Timelinesprovideclearvisualmodelsofaprojectsexpectedcashinflowsand

outflowsforeachpointintime.Thesegraphicsprovideanefficientandeffective

meanstohelporganizetheinformationneededtoperformcapitalbudgetinganalyses.

4.

The payback method measures the time expected for a firm to recover its

investmentinaproject.Themethodignoresthereceiptsexpectedtooccurafterthe

investmentisrecoveredandignoresthetimevalueofmoney.

5.

Return of capital means the investor is receiving the principal that was

originallyinvested.Return oncapitalmeanstheinvestorisreceivinganamount

earnedontheinvestment(i.e.,anamountinexcessoftheoriginalinvestment).

6.

AprojectsNPVisthepresentvalueofallcashinflowslessthepresentvalue

ofallcashoutflowsassociatedwiththeproject.IfNPViszero,theprojectis

acceptablebecause,inthatcase,itwillexactlyearntherequiredrateofreturn.

Also,whenNPVequalszero,theprojectsinternalrateofreturnequalsthecostof

capital.

7.

ItishighlyunlikelythattheestimatedNPVwillexactlyequaltheactualNPV

achieved because of the number of estimates necessary in the original

computation.Theseestimatesincludeprojectlifeandtimingandamountsofcash

inflowsandoutflows.Theoriginalinvestmentmayalsoincludeanestimateofthe

amountofworkingcapitalneededatthebeginningoftheprojectlife.

8.

The profitability index (PI) is calculated by dividing the discounted cash

inflowsbytheinitialinvestment.TheNPVmethodsubtractstheinitialinvestment

fromthediscountednetcashinflowstoarriveatthenetpresentvalue.Thus,each

computationusesthesameamountsindifferentways.Bymeasuringtheexpected

dollarsofdiscountedcashinflowsperdollarofprojectinvestment,PIattemptsto

measuretheplannedefficiencyoftheuseofthemoney(i.e.,outputtoinput).API

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

171

Chapter 15

equaltoorgreaterthan1isequivalenttoaNPVequaltoorgreaterthanzeroand

indicatesthattheinvestmentwillprovideanacceptablereturnoncapital.

9.

TheIRRistheratethatwouldcausetheNPVofaprojecttoequalzero.A

projectisconsideredpotentiallysuccessful(allotherfactorsbeingacceptable)if

thecalculatedIRRequalsorexceedsthecompanyscostofcapital.

10.

Theamountofdepreciationforayearisonefactorthathelpsdeterminethe

amountofcashoutflowforincometaxes.Therefore,althoughdepreciationisnot

acashflowitemitself,itdoesaffectthesizeofanotheritem(incometaxes)thatis

acashflow.

11.

Thefourquestionsare:

Istheactivityworthyofaninvestment?

Whichassetscanbeusedfortheactivity?

Oftheassetsavailableforeachactivity,whichisthebestinvestment?

Ofthebestinvestments forallworthwhileactivities,inwhichones

shouldthecompanyinvest?

1.

2.

3.

4.

12.

Riskisdefinedasthelikelyvariabilityofanassetsfuturereturns.Aspectsof

aprojectforwhichriskisinvolvedare:

Lifeoftheasset

Amountofcashflows

Timingofcashflows

Salvagevalueoftheasset

Taxratesoftheorganization

As risk increases, it should be taken into consideration in capital budgeting

analysis through raising the discount rate (or some other acceptable method)

which,inturn,lowerstheNPVofaproject.

13.

In capital budgeting, sensitivity analysis is used to

determinethelimitsofvalueforinputvariables(e.g.,discountrate,cashflows,

assetlife,etc.)beyondwhichtheprojectsoutcomewillbesignificantlyaffected.

Thisprocessgivesthedecisionmakeranindicationofhowmuchroomthereisfor

error in estimates for input variables and which input variables need special

attention.

14.

Postinvestment audits are performed to determine

whether the realized return matches the expected return on a project.

Postinvestmentauditsaretypicallyperformedatorneartheendofaprojectslife.

15.

The time value of money refers to the concept that

moneyhastimebasedearningspower.Moneycanbeloanedorinvestedtoearna

rateofreturn.Presentvalueisalwayslessthanfuturevaluebecauseofthetime

valueofmoney.Afuturevaluemustbediscountedtodetermineitsequivalent

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

(butsmaller)presentvalue.Thediscountingprocessstripsawaytheimputedrate

ofreturninfuturevalues,thuspresentvaluesarelessthanfuturevalues.

16.

ARR=AverageannualprofitsAverageinvestment

Unliketherateusedtodiscountcashflowsortocomparetothecostofcapitalrate,

theARRisnotadiscountratetoapplytocashflows.Itismeasuredfromaccrual

basedaccountinginformationandisnotintendedtobeassociatedwithcashflows.

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

172

173

Chapter 15

EXERCISES

17.

Investorsareultimatelymostinterestedincashflows.

Investorscannotspendaccountingincome;theycanonlyspendthecashthatis

derivedfromtheirinvestmentinthefirm.Investorsareinterestedinaccounting

earningsbecausetheyrevealinformationaboutpresentandfuturecashflowsthat

isnotrevealedinexaminingonlycashflows.Hence,accountingearningsareonly

usefultoinvestorsifthoseearningshelpinformtheinvestorsaboutcashflows.

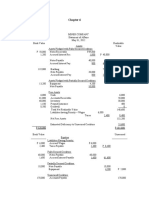

Cashflows

Period:

(Purchase)

Savings

18.

0

3,000,000

Accountingearnings

Period:

0

Expensesavings

Depreciation

Increase in

accounting earnings

19.

20.

900,000

900,000

3

900,000

900,000

900,000

3

4

900,000 900,000

600,000 600,000

5

900,000

600,000

1

2

900,000 900,000

600,000 600,000

300,000

300,000

300,000

300,000

300,000

Nosolutionprovided.

Themainpointmadeshouldbethatstockpricesreflectthefirmsexpectedfuture

cashflowsdiscountedatanappropriateriskadjusteddiscountrate.Theriskadjusted

discountrateisafunctionofboththespecificsecuritysriskandtheprevailing

marketinterestrates.Asmarketinterestrateschange,thevalueofsecuritieschange

alsoespeciallythosethathavedistantfuturecashflowsthatcompriseasignificant

portionofthesecuritysvalue,e.g.,growthstocks.

21. a.Payback=$3,000,000$600,000peryear=5years

b.

Year

1

2

3

4

5

6

7

8

9

10

Amount

$300,000

300,000

300,000

300,000

300,000

400,000

400,000

400,000

400,000

400,000

CumulativeAmount

$300,000

600,000

900,000

1,200,000

1,500,000

1,900,000

2,300,000

2,700,000

3,100,000

3,500,000

Thepaybackiseightyearsplus[(3,000,0002,700,000)400,000]or8.75

years.

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

22.

174

a. Investment = $140,000 + $180,000 = $320,000

Year

Amount

CumulativeAmount

1

$70,000

$70,000

2

78,000

148,000

3

72,000

220,000

4

56,000

276,000

5

50,000

326,000

6

48,000

374,000

7

44,000

418,000

Payback=4years+[($320,000$276,000)$50,000]=4.9years

Based on the payback criterion, Houston Fashions should not invest in the

proposedproductline.

b.

Yes. Houston Fashions should also use a discounted cash flow

techniquesoastoconsiderboththetimevalueofmoneyandthecashflows

thatoccurafterthepaybackperiod.

PointinTime

CashFlows

0 $(1,800,000)

1

280,000

2

280,000

3

340,000

4

340,000

5

340,000

6

288,800

7

288,800

8

288,800

9

260,000

10

260,000

NPV

PVFactor

PresentValue

1.0000 $(1,800,000)

0.8929

250,012

0.7972

223,216

0.7118

242,012

0.6355

216,070

0.5674

192,916

0.5066

146,306

0.4524

130,653

0.4039

116,646

0.3606

93,756

0.3220

83,720

$(104,693)

BasedontheNPV,thisisanunacceptableinvestment.

24. a.

Thecontributionmarginofeachpartis$1(or$7.50$6.50)

Contributionmarginperyear=$1100,000=$100,000

PointinTime

CashFlows

0

$(500,000)

18

(20,000)

18 100,000

NPV

b.

c.

PVFactor

PresentValue

1.0000

$(500,000)

5.5348

(110,696)

5.5348

553,480

$(57,216)

BasedontheNPV,thisisnotanacceptableinvestment.

Otherconsiderationswouldincludewhetherrefusingtoproducethis

partforthecustomerwouldcausealossofotherbusinessfromthatcustomer.

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

175

Chapter 15

Thecompanyshouldalsoconsidergoingbacktothecustomerandaskingfora

higherpricethatwouldcausetheprojecttohaveapositiveNPV.

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

176

25.

PI=PVofcashinflowsPVofcashoutflows

=($18,000+$240,000)$240,000=1.08

26. a.

PVofinflows:$91,0006.4177 = $584,011

PVofinvestment:$600,000

PI=$584,011$600,000=0.97

b.

CedarCityPublicTransportationshouldnotaddthebusroutebecause

thePIislessthan1.00.

c.

Tobeacceptable,aprojectmustgenerateaPIofatleast1;aPIgreater

than1equatestoanNPV>0.

27. a.

PV=DiscountfactorAnnualcashinflow

$700,000=Discountfactor$144,000

Discountfactor=$700,000$144,000=4.8611

TheIRRis13percent(roundedtothenearestwholepercent).

b.

percent.

c.

Yes.TheIRRonthisproposalisgreaterthanthefirmshurdlerateof7

$700,000=5.9713Annualcashflow

Annualcashflow=$700,0005.9713

Annualcashflow=$117,227

28. a.

PV=DiscountfactorAnnualcashinflow

$1,800,000=Discountfactor$300,000

Discountfactor=$1,800,000$300,000=6.0000

TheIRRis10.5percent(roundedtothenearesthalfpercent).

TheprojectisacceptablebecausetheIRRexceedsthediscountrate.

b.

29.

Themainqualitativefactorswouldbetheeffectofthetechnologyon

theperceivedqualityofthefoodthatisprocessedbythenewmachinery.An

additionalconsiderationwouldbetheeffectofthetechnologyonemployees,

particularlyiftheinvestmentwouldcauselayoffs.

Investmentcost=$375,000Discountfactorfor14%,7years

=$375,0004.2883=$1,608,113

NPV=$375,000Discountfactor(10%,7years)$1,608,113

=($375,0004.8684)$1,608,113=$217,537

30. a.

Annualdepreciation=$1,000,0008years=$125,000peryear

Taxbenefit=$125,0000.30=$37,500

PV=$37,5005.7466=$215,498

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

177

Chapter 15

b.Acceleratedmethod

$1,000,0000.300.400.9259

$600,0000.300.400.8573

$360,0000.300.400.7938

$216,0000.300.400.7350

$129,600*0.300.6806

Total

=

=

=

=

=

$111,108

61,726

34,292

19,051

26,462

$252,639

Inthefinalyear,theremainingundepreciatedcostisexpensed.

c. Thedepreciationbenefitcomputedin(b)exceedsthatcomputedin(a)solely

becauseofthetimevalueofmoney.Thedepreciationmethodin(b)allowsfor

fasterrecaptureofthecost;therefore,thereislessdiscountingofthefuturecash

flows.

31. a. SLD=$18,000,0008years=$2,250,000peryear

BeforetaxCF

Lessdepreciation

BeforetaxNI

Lesstax(30%)

NI

Adddepreciation

AftertaxCF

$3,100,000

(2,250,000)

$850,000

(255,000)

$595,000

2,250,000

$2,845,000

PointinTime

CashFlows

0

$(18,000,000)

18 2,845,000

NPV

PVFactor PresentValue

1.0000 $(18,000,000)

6.4632

18,387,804

$387,804

TheprojectisacceptablebecausetheNPVispositive.

b.

BeforetaxCF

Lessdepreciation

BeforetaxNI

Tax(taxbenefit)

AftertaxNI

Adddepreciation

AftertaxCF

Years1and2

$3,100,000

(4,140,000)

$(1,040,000)

(312,000)

$(728,000)

4,140,000

$3,412,000

PointinTime

CashFlows

0

$(18,000,000)

12

3,412,000

38

2,656,000

NPV

Years38

$3,100,000

(1,620,000)

$1,480,000

444,000

$1,036,000

1,620,000

$2,656,000

PVFactor PresentValue

1.0000 $(18,000,000)

1.8594

6,344,273

4.6038

12,227,693

$571,966

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

The equipment investment is acceptable. Note, because of the more rapid

depreciationusedin(b)relativeto(a),theNPVismorepositivein(b)thanin

(a).

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

178

179

Chapter 15

c. BeforetaxCF

Lessdepreciation

BeforetaxNI

Lesstax(40%)

NI

Adddepreciation

AftertaxCF

$3,100,000

(2,250,000)

$850,000

(340,000)

$510,000

2,250,000

$2,760,000

PointinTime

CashFlows

0 $(18,000,000)

18 2,760,000

NPV

PVFactor

PresentValue

1.0000 $(18,000,000)

6.4632

17,838,432

$(161,568)

TheequipmentinvestmentisunacceptablebecausetheNPVisnegative.

BeforetaxCF

Lessdepreciation

BeforetaxNI

Tax(taxbenefit)

AftertaxNI

Adddepreciation

AftertaxCF

Years1and2

$3,100,000

4,140,000

$(1,040,000)

(416,000)

$(624,000)

4,140,000

$3,516,000

PointinTime

CashFlows

0 $(18,000,000)

12 3,516,000

38 2,508,000

NPV

Years38

$3,100,000

1,620,000

$1,480,000

592,000

$888,000

1,620,000

$2,508,000

PVFactor

PresentValue

1.0000 $(18,000,000)

1.8594

6,537,650

4.6038

11,546,330

$83,980

Theequipmentinvestmentisacceptable.

32. a. Tax:$99,000$18,000=$81,000

Financialaccounting:$99,000$35,000=$64,000

b. CFAT=CurrentmarketvalueTaxes

=$37,000[($37,000$18,000)0.30]=$31,300

c. CFAT=$9,000[($9,000$18,000)0.30]=$11,700

33. a. payback

b. NPV,PI

c. IRR

d. payback,NPV,PI,IRR

e. allmethods

f. payback

g. ARR

34. a. payback,NPV,PI,IRR

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

180

b. payback

c. ARR

d. payback,ARR

e. payback,NPV,PI,IRR

f. allmethods

g. IRR

h. payback,IRR,ARR,PI

35. a.ProjectName

Filmstudios

Cameras&equipment

Landimprovement

Motionpicture#1

Motionpicture#2

Motionpicture#3

Corporateaircraft

NPV

$3,578,910

1,067,920

2,250,628

1,040,276

1,026,008

3,197,320

518,916

b. Rankingaccordingto:

NPV

1.

Film

studios

2.

MP#3

3.

Land

improvement

4.

Cameras&

equip.

5.

MP#1

6.

MP#2

7.

Corp.

aircraft

PI

1.18

1.33

1.45

1.06

1.09

1.40

1.22

IRR

13.03%

18.62

19.69

12.26

14.09

21.32

18.15

PI

Landimprovement

IRR

MP#3

MP#3

Cameras&equip.

Landimprovement

Cameras&equip.

Corp.aircraft

Corp.aircraft

Filmstudios

MP#2

MP#1

MP#2

Filmstudios

MP#1

c. Suggestedpurchases:

NPV

1.

Motion picture #3 @

$3,197,320

$8,000,000

2.

Land improvement @

2,250,628

$5,000,000

3.

Cameras & equipment @

1,067,920

$3,200,000

4.

Corporate aircraft @

518,916

$2,400,000

TotalNPV

$7,034,784

36. a. CashflowAnnuityfactor=$160,000

Cashflow3.7908=$160,000

Cashflow=$42,207

b. $160,000$42,207=3.79years

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

181

Chapter 15

37. a. NPV=($28,0004.8684)$100,000=$36,315

b.

Annuityfactor$28,000=$100,000

Annuityfactor=$100,000$28,000=3.5714

Thisfactorcorrespondsmostcloselyto20%

38. PV=FVDiscountfactor

$80,000=FV0.7473

FV=$80,0000.7473=$107,052

39. Cost=$8,000+PV($800annuity)=$8,000+($80037.9740*)=$38,379.20

*

Discountfactorfor48months,1%

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

182

40. a. PV=FuturevalueDiscountfactor

=$50,0000.6302

=$31,510shouldbeinvestedtoachievethegoal

b. PV=FuturevalueDiscountfactor

=$400,0000.3769

=$150,760wouldbeequivalenttoday

c. PV=FuturevalueDiscountfactor

=$60,0000.2146

=$12,876

d. Presentvalue=AnnuityAnnuitydiscountfactor

=$200,0003.9927

=$798,540

e. Year1receipt:

Year2receipt:

Year3receipt:

Year4receipt:

Year5receipt:

Year6receipt:

Year7receipt:

Year8receipt:

Year9receipt:

Year10receipt:

Presentvalue

$50,0000.9346=

$55,0000.8734=

$60,0000.8163=

$100,0000.7629=

$100,0000.7130=

$100,0000.6663=

$100,0000.6228=

$100,0000.5820=

$70,0000.5439=

$45,0000.5084=

$46,730

48,037

48,978

76,290

71,300

66,630

62,280

58,200

38,073

22,878

$539,396

f. No.Usinganydiscountrateabove0,thepresentvalueofthefutureannual

cashflowsiswellbelow$1,000,000.

41. a. Changeinnetincome=$20,000,000($72,000,0005)=$5,600,000

ARR=$5,600,000($72,000,0002)=15.6%

Payback=$72,000,000$20,000,000peryear=3.6years

b. No.Althoughthedredgemeetsthepaybackcriterion,itfailstomeettheARR

criterionof18percent.

42.a.Annualcashreceipts

Cashexpenses

Netcashflowbeforetaxes

Depreciation

Incomebeforetax

Taxes

Netincome

Depreciation

Annualaftertaxcashflow

$15,000

(3,000)

$12,000

(6,667)

$5,333

(1,600)

$3,733

6,667

$10,400

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

183

Chapter 15

b. Payback=$40,000$10,400peryear=3.8years

c. ARR=$3,733($40,0002)=18.7%

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

184

PROBLEMS

43. a. Aleaseisfoundappealingbyconsumersbecauseitoftenresultsinalower

monthly payment than that which would have been required to purchase a

specific car. Alternatively, the consumer could opt to make the payment

required to purchase the specific car but obtain a more expensive car under

lease financing.

b. No.Aconsumershouldbeprovidedwithallnecessaryinformationtomakea

faircomparisonbetweentheleaseandpurchasealternative.

c. Asanaccountant,youcouldprovideafinancialcomparisonoftheleaseand

purchase alternatives. Using a discounted cash flow approach, you could

comparethepresentvalueofpurchasingthevehicletothepresentvalueof

leasingthevehicle.

44. a. Althoughthe8percenthurdleratemaybeappropriateformostprojects,it

may be inappropriate to insist that a project such as a pollution abatement

projectberequiredtomeetanyfinancialhurdlerate.

b.

In the future, the company could face not only

significantfinesfromgovernmentregulators,butalsofinancialclaimsfiledby

personsharmedbythearsenic.

c.

Hernandez should justify the investment based

both on the potential future financial claims and that it is the socially and

ethicallycorrectactionforthecompanytotake.

45.a.($000somitted)

Investment

NewCM

Oper.costs

Cashflow

b. Year

1

2

3

4

5

6

t0

(190)

(190)

CashFlow

$40,000

33,000

33,000

33,000

30,000

30,000

t1

t2

t3

t4

t5

t6

t7

t8

60 60 60 60 60 60 60 60

20 27 27 27 30 30 30 33

40

33

33

33

30

30

30

27

CumulativeCashFlow

$40,000

73,000

106,000

139,000

169,000

199,000

Payback=5+[($190,000$169,000)$30,000]=5.7years

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

185

Chapter 15

c. Time

CashFlow

0 $(190,000)

1

40,000

2

33,000

3

33,000

4

33,000

5

30,000

6

30,000

7

30,000

8

27,000

NPV

46.a.Time:

Amount:

b.Year

1

2

3

4

5

6

t0

($41,000)

PVFactorfor8% PresentValue

1.0000 $(190,000)

0.9259

37,036

0.8573

28,291

0.7938

26,195

0.7350

24,255

0.6806

20,418

0.6302

18,906

0.5835

17,505

0.5403

14,588

$(2,806)

t1

$5,900

CashFlow

$5,900

8,100

8,300

8,000

8,000

8,300

t2

$8,100

t3

$8,300

t4

$8,000

t5

$8,000

t6

$8,300

Cumulative

$5,900

14,000

22,300

30,300

38,300

46,600

Payback=5years+[($41,000$38,300)$8,300]=5.3years

c.

CashFlow

Description

Purchasethetruck

Costsavings

Costsavings

Costsavings

Costsavings

Costsavings

Costsavings

Costsavings

NPV

47.a.Year

0

17

7

NPV

Time Amount

t0 $(41,000)

t1

5,900

t2

8,100

t3

8,300

t4

8,000

t5

8,000

t6

8,300

t7

9,200

CashFlow

$(5,000,000)

838,000

400,000

Discount

Present

Factor

Value

1.0000 $(41,000)

0.9259

5,463

0.8573

6,944

0.7938

6,589

0.7350

5,880

0.6806

5,445

0.6302

5,231

0.5835 5,368

$(80)

PVFactor

PV

1.0000 $(5,000,000)

5.5824

4,678,051

0.6651

266,040

$(55,909)

b. No,theNPVisnegative;thereforethisisanunacceptableproject.

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

t7

$9,200

Chapter 15

186

c. PI=($4,678,051+$266,040)$5,000,000=0.99

d. PVofannualcashflows=$5,000,000$266,040

PVofannualcashflows=$4,733,960

PVofannualcashflows=Annualcashflow5.5824

$4,733,960=Annualcashflow5.5824

Annualcashflow=$4,733,9605.5824=$848,015

Minimumlaborsavings=$848,015+Operatingcosts

=$848,015+$112,000

=$960,015

e. Thecompanyshouldconsiderthequalityofworkperformedbythemachine

comparedtothequalityofworkperformedbytheindividuals;thereliabilityof

the mechanical process compared to the manual process; and perhaps most

importantly, the effect on worker morale and the ethical considerations in

displacing14workers.

48. a.Paybackperiod=$140,000($47,500$8,500)=3.6years

Theprojectdoesnotmeetthepaybackcriterion.

b. Discountfactor=InvestmentAnnualcashflow

=$140,000$39,000=3.5897

Discountfactorof3.5897indicatesIRR4%

ThisisanunacceptableIRR.

c. Fostershouldconsidertwomainfactors:(1)theeffectofthecomputersystem

ontaxreturnaccuracyandqualityofservicedeliveredtoclientsand(2)the

effect of firing one employee on both the dismissed employee and the

remainingemployees.

49. a.Theincrementalcostofthereplacementequipment:$580,000$12,000=

$568,000

Description

Incrementalcost

Costsavings

NPV

Time

t0

t1t8

CashFlow

Amount

$(568,000)

120,000

Discount

Factor

1.0000

5.3349

Present

Value

$(568,000)

640,188

$72,188

PI=$640,188$568,000=1.1

Yes,thereplacementequipmentshouldbepurchasedbecausetheNPV>0and

thePI>1.

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

187

Chapter 15

b. Payback=$568,000120,000peryear=4.7years

c. NetinvestmentAnnualannuity=DiscountfactorofIRR

$568,000120,000=4.7333

Discountfactorof4.7333isbetween13.0and13.5percent;therefore,tothe

nearestwholepercent,theIRRis13percent.

50. a.Computationofnetannualcashflow:

Increaseinrevenues

Increaseincashexpenses

Increaseinpretaxcashflow

Lessdepreciation

Incomebeforetax

Incometaxes(30percent)

Netincome

Adddepreciation

Aftertaxcashflow

Description

Initialcost

Annualcashflow

Time

t0

t1

t20

$46,000

(21,000)

$25,000

(9,750)

$15,250

(4,575)

$10,675

9,750

$20,425

CashFlow Discount

Amount

Factor

$(195,000) 1.0000

20,425

9.1286

NPV

Present

Value

$(195,000)

186,452

$(8,548)

b. ThisisnotanacceptableinvestmentbecausetheNPVislessthan$0.

c. MinimumannualaftertaxcashflowDiscountfactor=$195,000

Minimumannualaftertaxcashflow9.1286=$195,000

Minimumannualaftertaxcashflow=$21,361

$21,361=(Minimumcashrevenues$21,000$9,750)(1Taxrate)+$9,750

$11,611=(Minimumcashrevenues$21,000$9,750)(10.30)

$16,587=Minimumcashrevenues$30,750

Minimumcashrevenues=$47,337

Proof:Computationofnetannualcashflow:

Increaseinrevenues

Increaseincashexpenses

Increaseinpretaxcashflow

Lessdepreciation

Incomebeforetax

Incometaxes(30percent)

Netincome

Adddepreciation

Aftertaxcashflow

$47,337

(21,000)

$26,337

(9,750)

$16,587

(4,976)

$11,611

9,750

$21,361

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

188

51. a.Cashflowaftertax(CFAT):

Year

PreTaxCF Depreciation

1

$104,000

$64,000

2

118,000

102,400

3

118,000

60,800

4

102,000

48,000

5

86,000

44,800

Timeline:

t0

$(320,000)

b.Year

1

2

3

4

t1

$90,000

t2

$112,540

NetCashFlow

$90,000

112,540

97,980

83,100

Tax

$14,000

5,460

20,020

18,900

14,420

t3

$97,980

CFAT

$90,000

112,540

97,980

83,100

71,580

t4

$83,100

t5

$71,580

CumulativeCashFlow

$90,000

202,540

300,520

383,620

Payback=3years+[($320,000$300,520)$83,100]=3.2years

Netpresentvalue:

Time

0

1

2

3

4

5

NPV

Amount

$(320,000)

90,000

112,540

97,980

83,100

71,580

DiscountFactor

PresentValue

1.0000 $(320,000)

0.9259

83,331

0.8573

96,481

0.7938

77,777

0.7350

61,079

0.6806

48,717

$47,385

Profitabilityindex=($320,000+$47,385)$320,000=1.1

IRRis14percent.

52. a. MapleCommercialPlaza:

t0

t1t10

$(800,000) $210,000

HighTower:

t0

$(3,400,000)

t1t10

$830,000

b.MapleCommercialPlaza:

Calculationofannualcashflow:

Pretaxcostsavings

Depreciation($800,00025)

Pretaxincome

t10

$400,000

t10

$1,500,000

$210,000

(32,000)

$178,000

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

189

Chapter 15

Taxes(40percent)

Aftertaxincome

Depreciation

Aftertaxcashflow

t0

$(800,000)

(71,200)

$106,800

32,000

$138,800

t1t10

$138,800

t10

$432,000*

Includes$32,000fromtaxlossonsale[0.40($400,000$480,000)]

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

190

HighTower:

Calculationofannualcashflow:

Pretaxcostsavings

Depreciation($3,400,00025)

Pretaxincome

Taxes

Aftertaxincome

Depreciation

Aftertaxcashflow

t0

$(3,400,000)

t1t10

$552,400

$830,000

(136,000)

$694,000

(277,600)

$416,400

136,000

$552,400

t10

$1,716,000*

Includes$216,000fromtaxlossonsale[0.40($1,500,000$2,040,000)]

c. AftertaxNPV,MapleCommercialPlaza:

Year

Amount DiscountFactor PresentValue

0

$(800,000)

1.0000 $(800,000)

110

138,800

5.8892

817,421

10

432,000

0.3522

152,150

NPV

$169,571

AftertaxNPV,Hightower:

Year

Amount

DiscountFactor

0

$(3,400,000)

1.0000

110

552,400

5.8892

10

1,716,000

0.3522

NPV

PresentValue

$(3,400,000)

3,253,194

604,375

$457,569

BasedontheNPVcriterion,Hightoweristhepreferredinvestment.

d.

Year

0

110

110

10

NPV

AftertaxNPV,Hightower:

Amount

DiscountFactor PresentValue

$(3,400,000)

1.0000 $(3,400,000)

180,400

5.8892

1,062,412

372,000*

4.1925

1,559,610

1,716,000

0.3522

604,375

$(173,603)

Rentalportionofcashflow=$620,000(1Taxrate)

=$620,0000.60

=$372,000

Inthiscircumstance,MapleCommercialPlazaisthepreferredinvestment.

53. a.Depreciationperyear=$1,500,00014=$107,143

Beforetaxcashflows=[3000.80($70$20)50]$250,000

=$350,000peryear

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

191

Chapter 15

BeforetaxCF

Lessdepreciation

Incomebeforetax

Lesstax(25%)

Netincome

Adddepreciation

Aftertaxcashflow

$350,000

(107,143)

$242,857

(60,714)

$182,143

107,143

$289,286

PVof14yr.annuityof$289,286@10%

Lesscost

NPV

$2,131,083

(1,500,000)

$631,083

b.

Discountfactor=$1,500,000$289,286=5.1852

Discountfactorof5.1852correspondsto17%.

c.

CashflowDiscountfactor=$1,500,000

Cashflow(7.3667)=$1,500,000

Cashflow=$203,619

d.

$1,500,000$289,286=5.1852

5.1852isthediscountfactorfor10percentandfallsbetweenthe10percent

discountfactorscorrespondingtosevenandeightyears.

54.a.Incrementalannualaftertaxcashflows:

Purchaseofnewequipment

Onetimetransferexpense,netoftax($80,0000.6)

Saleofoldequipment,netoftax($5,0000.6)

Totalinitialcashoutflow

Year0

$(300,000)

(48,000)

3,000

$(345,000)

ANNUALOPERATIONS

Year1

Year2

Year3

Cashoperating

savings

$90,000

$150,000

$150,000

Lesstaxeffect(40%)

(36,000) (60,000)

(60,000)

Cashsavingsaftertax

$54,000

$90,000

$90,000

Depr.taxshield

(seesched.below)

48,000

36,000

24,000

Aftertaxoperating

cashflows

$102,000

$126,000

$114,000

Year4

$150,000

(60,000)

$90,000

12,000

$102,000

DepreciationSchedule

DepreciableBase:$300,000

Life:FourYearLimit

Method:SumoftheYearsDigits

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

Year

1

2

3

4

b.

192

Rate

4/10

3/10

2/10

1/10

Depreciation

$120,000

90,000

60,000

30,000

Depr.Shield

$48,000

36,000

24,000

12,000

ThecompanyshouldrejecttheproposalsincetheNPVisnegative.

Year

0

1

2

3

4

NPV

CashFlow

$(345,000)

102,000

126,000

114,000

102,000

11%PVFactor

PresentValue

1.0000 $(345,000)

0.9009

91,892

0.8116

102,262

0.7312

83,357

0.6587

67,187

$(302)

(CMAadapted)

55. a. Thebenefitsofapostinvestmentauditprogramforcapitalexpenditureprojects

include:

b.

Comparison of actual and projected results to validate that a project is

meetingexpectedperformance,totakeanynecessarycorrectiveaction,or

toterminateaprojectnotachievingexpectedperformance.

Evaluationoftheaccuracyofprojectionsfromdifferentdepartments.

Improvement of future capital project revenue and cost estimates by

analyzing variations between expected and actual results from previous

projects.

Motivationaleffectonpersonnelarisingfromtheknowledgethatapost

investmentauditwillbedone.

Practicaldifficultiesthatwouldbeencounteredincollecting

andaccumulatinginformationinclude:

Isolatingtheincrementalchangescausedbyonecapitalprojectfromallthe

other factors that change in a dynamic manufacturing and/or marketing

environment.

Identifying the impact of inflation on all costs in the capital project

justification.

Updating the original proposal for approval of changes that may have

occurredaftertheinitialapproval.

Having a sufficiently sophisticated information accumulation system to

measureactualcostsincurredbythecapitalproject.

Allocatingsufficientadministrativetimeandexpensesforthepostinvestment

audit.

(CMAadapted)

56. a. Year

14

58

Revenue

$115,000

175,000

VC

$69,000

105,000

FC

$20,000

20,000

NetCashFlow

$26,000

50,000

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

193

Chapter 15

910

100,000

60,000

20,000

20,000

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Chapter 15

194

Year

0

14

58

910

10

NPV

CashFlow

$(140,000)

26,000

50,000

20,000

10,000

b.Year

14

58

910

Revenue

$120,000

200,000

103,000

Year

0

14

58

910

10

NPV

CashFlow

$(127,500)

27,000

52,500

11,050

23,500

c.

PVFactor

PV

1.0000 $(140,000)

3.1699

82,417

2.1651

108,255

0.8096

16,192

0.3855

3,855

$70,719

VC

$78,000

130,000

66,950

FC

$15,000

17,500

25,000

NetCashFlow

$27,000

52,500

11,050

PVFactor

PV

1.0000 $(127,500)

3.1699

85,587

2.1651

113,668

0.8096

8,946

0.3855

9,059

$89,760

Thebiggestfactorsaretheincreasedlevelofvariablecosts,

additionalworkingcapital,lowerinitialrevenues,andlowercostofproduction

equipment.

57. a.

Year

1

2

3

4

5

Cash

Receipts

$3,000,000

3,200,000

3,720,000

5,120,000

6,400,000

Cash

Expenses

$2,530,000

2,400,000

2,582,000

3,232,000

3,520,000

Net

Inflows

$470,000

800,000

1,138,000

1,888,000

2,880,000

Cumulative

CashFlows

$470,000

1,270,000

2,408,000

4,296,000

7,176,000

Payback=4+[($6,400,000$4,296,000)$2,880,000]=4.7years

b. Year

CashFlow

0

$(6,400,000)

1

470,000

2

800,000

3

1,138,000

4

1,888,000

5

2,880,000

6

2,880,000

7

1,632,000

8

648,000

NPV

PVFactor

1.0000

0.9259

0.8573

0.7938

0.7350

0.6806

0.6302

0.5835

0.5403

PV

$(6,400,000)

435,173

685,840

903,344

1,387,680

1,960,128

1,814,976

952,272

350,114

$2,089,527

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

195

Chapter 15

c. Year

NetIncome

1 $(330,000)

2

0

3

338,000

4

1,088,000

5

2,080,000

6

2,080,000

7

832,000

8

(152,000)

$5,936,000

Averageannualincome=$5,936,0008=$742,000

Averageinvestment=(Cost+Salvage)2

=($6,400,000+$0)2=$3,200,000

ARR=$742,000$3,200,000=23.2%

d.

Although there are no stated evaluation criteria for

accounting rate of return or payback, the NPV criterion meets the standard

thresholdof$0.Therefore,theproductlineshouldbeadded.

58. a.Initialcost:t0=$(1,460,000)+$340,000=$(1,120,000)

Annualcashflow:

$264,000

Additionalrevenue($1.20220,000)

60,000

Laborsavings($160,000 $100,000)

Otheroperatingsavings($192,000$80,000)

112,000

Total

$436,000

NPV=$(1,120,000)+($436,0006.1446)=$1,559,046

b.

Discountfactor=$1,120,000$436,000=2.5688

TheIRRexceedsnumbersreportedinthepresentvalueappendix.Bycomputer,

theIRRisfoundtobe37percent.

c.

$1,120,000$436,000=2.6years

d.

ARR=($436,000$62,000)[($1,120,000+$0)2]=

66.8%

e.

BecausetheprojectgeneratesaveryhighNPVandIRR,as

wellasahighARR,thefirmshouldbuythenewlathe.

(CMAadapted)

2013 Cengage Learning. All Rights Reserved. May not be scanned, copied, duplicated, or posted to a publicly

accessible website, in whole or in part.

Вам также может понравиться

- Performance Measurement SolmanДокумент55 страницPerformance Measurement SolmanJoseph Deo CañeteОценок пока нет

- Mas 09 - Working CapitalДокумент7 страницMas 09 - Working CapitalCarl Angelo LopezОценок пока нет

- Summary of StandardsДокумент3 страницыSummary of StandardsYumi KumikoОценок пока нет

- 02 CVP Analysis PDFДокумент5 страниц02 CVP Analysis PDFJunZon VelascoОценок пока нет

- CH 07Документ24 страницыCH 07xxxxxxxxxОценок пока нет

- Module 5&6Документ29 страницModule 5&6Lee DokyeomОценок пока нет

- Full Pfrss Vs Pfrs For Smes Vs Pfrs For Small Entities: Gato, Abdul Barri IndolДокумент4 страницыFull Pfrss Vs Pfrs For Smes Vs Pfrs For Small Entities: Gato, Abdul Barri IndolBheybi ZianОценок пока нет

- Solution Chapter 5 Rev FinalДокумент84 страницыSolution Chapter 5 Rev FinalMiya Crizxen RevibesОценок пока нет

- 1617 1stS MX NBergonia RevДокумент11 страниц1617 1stS MX NBergonia RevJames Louis BarcenasОценок пока нет

- Long Problems For Prelim'S Product: Case 1Документ7 страницLong Problems For Prelim'S Product: Case 1Mae AstovezaОценок пока нет

- Naqdown - Final QuestionsДокумент41 страницаNaqdown - Final QuestionssarahbeeОценок пока нет

- MAS 2017 01 Management Accounting Concepts Techniques For Planning and ControlДокумент5 страницMAS 2017 01 Management Accounting Concepts Techniques For Planning and ControlMitch Delgado EmataОценок пока нет

- STANDARD COSTING AND VARIANCE ANALYSIS (Repaired)Документ24 страницыSTANDARD COSTING AND VARIANCE ANALYSIS (Repaired)Arlyn Alonzo100% (1)

- Chapter 2Документ12 страницChapter 2Cassandra KarolinaОценок пока нет

- Psa 510Документ9 страницPsa 510Rico Jon Hilario GarciaОценок пока нет

- 13 Consolidated Financial StatementДокумент5 страниц13 Consolidated Financial StatementabcdefgОценок пока нет

- As 12 - Full Notes For Accounting For Government GrantДокумент6 страницAs 12 - Full Notes For Accounting For Government GrantShrey KunjОценок пока нет

- Chapter 16Документ16 страницChapter 16redearth29Оценок пока нет

- English Iii: University of Guayaquil Facultad Piloto de OdontologíaДокумент4 страницыEnglish Iii: University of Guayaquil Facultad Piloto de OdontologíaDianitaVelezPincayОценок пока нет

- Chapter 3 Liquidation ValueДокумент11 страницChapter 3 Liquidation ValueJIL Masapang Victoria ChapterОценок пока нет

- JakeДокумент5 страницJakeEvan JordanОценок пока нет

- Bus. Combi Probs and SolnДокумент3 страницыBus. Combi Probs and SolnRyan Prado AndayaОценок пока нет

- Solution Chapter 6Документ17 страницSolution Chapter 6Mazikeen DeckerОценок пока нет

- MAS Long QuizДокумент3 страницыMAS Long QuizFiona MoralesОценок пока нет

- Mutual Aid Pact Internally Provided Backup Empty Shell Recovery Operations Center ConsiderationsДокумент2 страницыMutual Aid Pact Internally Provided Backup Empty Shell Recovery Operations Center ConsiderationsRedОценок пока нет

- Law On Sales Agency and Credit TransactionsДокумент3 страницыLaw On Sales Agency and Credit TransactionsYanaОценок пока нет

- STDM Sample QuestionsДокумент6 страницSTDM Sample QuestionsAyra PelenioОценок пока нет

- Ans To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsДокумент188 страницAns To Exercises Stice Chap 1 and Hall Chap 1234 5 11 All ProblemsLouise GazaОценок пока нет

- Part I: Installment Part I: Installment Sales (1-140) Sales (1-140)Документ77 страницPart I: Installment Part I: Installment Sales (1-140) Sales (1-140)Gale RasОценок пока нет

- Concept Of: The Basic NatureДокумент35 страницConcept Of: The Basic NatureChan100% (1)

- Long Term Construction Contracts AssignmentДокумент10 страницLong Term Construction Contracts AssignmentAlleli Cruz100% (2)

- At Last Minute by HerculesДокумент19 страницAt Last Minute by HerculesFranklin ValdezОценок пока нет

- PSA 501: Audit Evidence - Specific Consideration For Selected Items InventoryДокумент3 страницыPSA 501: Audit Evidence - Specific Consideration For Selected Items InventoryhanselОценок пока нет

- Mas Ho No. 2 Relevant CostingДокумент7 страницMas Ho No. 2 Relevant CostingRenz Francis LimОценок пока нет

- Cash Price Equivalent at The Deferred Beyond Normal CreditДокумент5 страницCash Price Equivalent at The Deferred Beyond Normal CreditSharmin ReulaОценок пока нет

- DocxДокумент3 страницыDocxyvonneberdosОценок пока нет

- Week 10 Control Self AssessmentДокумент24 страницыWeek 10 Control Self AssessmentMark Angelo BustosОценок пока нет

- Additional Data For The Period Were ProvidedДокумент3 страницыAdditional Data For The Period Were Providedmoncarla lagon100% (1)

- Stock Edited PDFДокумент29 страницStock Edited PDFCzarina PanganibanОценок пока нет

- Chapter 2 Cost Terminology Cost BehaviorsДокумент40 страницChapter 2 Cost Terminology Cost BehaviorsReina CamanoОценок пока нет

- 4 Franchise Ifrs 15 2020Документ15 страниц4 Franchise Ifrs 15 2020natalie clyde matesОценок пока нет

- Dayag - Chapter 5 PDFДокумент25 страницDayag - Chapter 5 PDFKen ZafraОценок пока нет

- Consolidation Workpaper - Year of AcquisitionДокумент78 страницConsolidation Workpaper - Year of AcquisitionJames Erick LermaОценок пока нет

- MODULE 2 CVP AnalysisДокумент8 страницMODULE 2 CVP Analysissharielles /Оценок пока нет

- De Leon Solman 2014 2 CostДокумент95 страницDe Leon Solman 2014 2 CostJohn Laurence LoplopОценок пока нет

- MSC-Audited FS With Notes - 2014 - CaseДокумент12 страницMSC-Audited FS With Notes - 2014 - CaseMikaela SalvadorОценок пока нет

- Chapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementДокумент33 страницыChapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementYukiОценок пока нет

- Mas-07: Responsibility Accounting & Transfer PricingДокумент7 страницMas-07: Responsibility Accounting & Transfer PricingClint AbenojaОценок пока нет

- Exercise Chapter 4Документ3 страницыExercise Chapter 4Nela HasanОценок пока нет

- ACCT201 Accounting For Special TransactionsДокумент7 страницACCT201 Accounting For Special TransactionsMiles SantosОценок пока нет

- Unit I: Overview of The Audit Process Audit Planning: Applied AuditingДокумент8 страницUnit I: Overview of The Audit Process Audit Planning: Applied AuditingAlexis Erica Bansuan OvaloОценок пока нет

- MAS Responsibility Acctg.Документ6 страницMAS Responsibility Acctg.Rosalie Solomon BocalaОценок пока нет

- AFAR 2303 Cost Accounting-1Документ30 страницAFAR 2303 Cost Accounting-1Dzulija TalipanОценок пока нет

- 4 Probability AnalysisДокумент11 страниц4 Probability AnalysisLyca TudtudОценок пока нет

- CH 15Документ20 страницCH 15grace guiuanОценок пока нет

- Chapter 19Документ9 страницChapter 19Marc Siblag IIIОценок пока нет

- Practical Accounting Two PDFДокумент35 страницPractical Accounting Two PDFDea Lyn Bacula100% (1)

- AFAR ReviewДокумент11 страницAFAR ReviewPaupauОценок пока нет

- FM Asgmt Cycle 2Документ13 страницFM Asgmt Cycle 2Bhavana PedadaОценок пока нет

- BlackbookДокумент3 страницыBlackbookrajat dayamОценок пока нет

- Ch9 Raiborn SMДокумент34 страницыCh9 Raiborn SMMendelle Murry100% (1)

- Influence of AccountingДокумент7 страницInfluence of AccountingMendelle MurryОценок пока нет

- Ch18 Raiborn SMДокумент23 страницыCh18 Raiborn SMMendelle Murry100% (1)

- Emerging Management Practices: QuestionsДокумент14 страницEmerging Management Practices: QuestionsAlbert Delos SantosОценок пока нет

- Ch13 Raiborn SMДокумент45 страницCh13 Raiborn SMNab Ban AnbОценок пока нет

- Ch6 Raiborn SMДокумент48 страницCh6 Raiborn SMAhren Soriano67% (3)

- Chapter 11 Cost Allocation For Joint Products and By-Product/ScrapДокумент35 страницChapter 11 Cost Allocation For Joint Products and By-Product/ScrapRayn Gamilde100% (1)

- Ch.12 Kinney 9e SM - FinalДокумент13 страницCh.12 Kinney 9e SM - FinalJudy Anne SalucopОценок пока нет

- Ch.05 Kinney 9e SM FinalДокумент34 страницыCh.05 Kinney 9e SM FinalChrissa Marie Viente100% (1)

- Ch10 Raiborn SMДокумент26 страницCh10 Raiborn SMNab Ban AnbОценок пока нет

- Ch7 Raiborn SMДокумент49 страницCh7 Raiborn SMAdrian Francis0% (2)

- Ch.08 Kinney 9e SM - FinalДокумент42 страницыCh.08 Kinney 9e SM - FinalJudy Anne SalucopОценок пока нет

- Ortha, George II O. Corporation and Securities LawДокумент2 страницыOrtha, George II O. Corporation and Securities LawCinja ShidoujiОценок пока нет

- Chapter 14 - Firms in Competitive MarketsДокумент3 страницыChapter 14 - Firms in Competitive Marketsminh leОценок пока нет

- Meseret FeteneДокумент22 страницыMeseret FeteneGetaneh YenealemОценок пока нет

- Laporan Keuangan Triwulan 1 Good PDFДокумент102 страницыLaporan Keuangan Triwulan 1 Good PDFRudi Cawir Tuahta GintingОценок пока нет

- A Study On Pricing Strategies of Asian PaintsДокумент38 страницA Study On Pricing Strategies of Asian Paintsswainananta336Оценок пока нет

- ZMSQ-08 Capital BudgetingДокумент15 страницZMSQ-08 Capital BudgetingMIKHAELALOUISSE MARIANOОценок пока нет

- The Market Profiling GuideДокумент119 страницThe Market Profiling Guide960804326100% (1)

- Channel Trading StrategyДокумент51 страницаChannel Trading StrategyVijay86% (7)

- Formula Sheet Corporate FinanceДокумент19 страницFormula Sheet Corporate FinancePatricia TekgültekinОценок пока нет

- Buscom Quiz: Book Value Fair ValueДокумент2 страницыBuscom Quiz: Book Value Fair ValueNairah M. TambieОценок пока нет

- IC Detailed Financial Projections Template 8821 UpdatedДокумент27 страницIC Detailed Financial Projections Template 8821 UpdatedRozh SammedОценок пока нет

- 128574361X 459054 PDFДокумент23 страницы128574361X 459054 PDFPines MacapagalОценок пока нет

- Comparison of Basel 1 2 3Документ6 страницComparison of Basel 1 2 3anastasyadustiraniОценок пока нет

- Cost Concepts Classification BehaviorДокумент46 страницCost Concepts Classification BehaviorrhearomefranciscoОценок пока нет

- Journal EntryДокумент8 страницJournal EntryAnklesh kumar GuptaОценок пока нет

- CHAPTER 11 Without AnswerДокумент3 страницыCHAPTER 11 Without Answerlenaka0% (1)

- Stock Market: Presented by Zaid ShahsahebДокумент16 страницStock Market: Presented by Zaid ShahsahebZaid Ismail ShahОценок пока нет

- 12 Things You Need To Know About Financial StatementsДокумент7 страниц12 Things You Need To Know About Financial StatementsRnaidoo1972100% (1)

- Why Do People Still Invest in Hedge Funds?: Mark SpitznagelДокумент5 страницWhy Do People Still Invest in Hedge Funds?: Mark Spitznagelvistagoal0% (1)

- Business Simulation: Rubyrosa C. Nazal Teacher IIДокумент22 страницыBusiness Simulation: Rubyrosa C. Nazal Teacher IINeighvestОценок пока нет

- Assignment Week 2 - Maya Wulansari - 09111840000040Документ4 страницыAssignment Week 2 - Maya Wulansari - 09111840000040mayasari50% (2)

- Deep IPO NationalizationДокумент29 страницDeep IPO NationalizationdsfasfdОценок пока нет

- Asx24 Contract SpecificationsДокумент42 страницыAsx24 Contract SpecificationsJohn SalazarОценок пока нет

- General Tyre Balance Sheet Analysis (2006-1010)Документ48 страницGeneral Tyre Balance Sheet Analysis (2006-1010)Shazil AhmadОценок пока нет

- MFRS 102Документ17 страницMFRS 102Ethan Ong0% (1)

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution ManualДокумент91 страницаFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition by Williams Haka Bettner and Carcello ISBN 125969240X Solution Manuallaurel100% (28)

- 9 Strategic ChoiceДокумент38 страниц9 Strategic ChoiceMugayak1986Оценок пока нет

- Netscape's Initial Public OfferingДокумент9 страницNetscape's Initial Public OfferingRasheeq Rayhan100% (1)

- Screener Setup - GersteinДокумент86 страницScreener Setup - Gersteinsreekesh unnikrishnanОценок пока нет

- Types of StrategiesДокумент15 страницTypes of Strategiesmayaverma123pОценок пока нет

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successОт EverandReady, Set, Growth hack:: A beginners guide to growth hacking successРейтинг: 4.5 из 5 звезд4.5/5 (93)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthОт EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthРейтинг: 4 из 5 звезд4/5 (20)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Creating Shareholder Value: A Guide For Managers And InvestorsОт EverandCreating Shareholder Value: A Guide For Managers And InvestorsРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- Mind over Money: The Psychology of Money and How to Use It BetterОт EverandMind over Money: The Psychology of Money and How to Use It BetterРейтинг: 4 из 5 звезд4/5 (24)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Value: The Four Cornerstones of Corporate FinanceОт EverandValue: The Four Cornerstones of Corporate FinanceРейтинг: 4.5 из 5 звезд4.5/5 (18)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОт EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОценок пока нет

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursОт EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursРейтинг: 5 из 5 звезд5/5 (13)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsОт EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsРейтинг: 5 из 5 звезд5/5 (1)

- The Value of a Whale: On the Illusions of Green CapitalismОт EverandThe Value of a Whale: On the Illusions of Green CapitalismРейтинг: 5 из 5 звезд5/5 (2)

- Product-Led Growth: How to Build a Product That Sells ItselfОт EverandProduct-Led Growth: How to Build a Product That Sells ItselfРейтинг: 5 из 5 звезд5/5 (1)

- Applied Corporate Finance. What is a Company worth?От EverandApplied Corporate Finance. What is a Company worth?Рейтинг: 3 из 5 звезд3/5 (2)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsОт EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsОценок пока нет

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)От EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Рейтинг: 4 из 5 звезд4/5 (5)