Академический Документы

Профессиональный Документы

Культура Документы

Distinction Between Public Private Company

Загружено:

pavikuttyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Distinction Between Public Private Company

Загружено:

pavikuttyАвторское право:

Доступные форматы

Comparison between a Private & Public Limited Company under

Companies Act, 2013

The Companies Act of 2013 has done away with the relaxation to private companies in

several provisions. The concept of not applicable to private company is no more in

existence in the Act of 2013. Such a move in the Companies Act of 2013 has taken away

certain privileges enjoyed by private companies. The privileges are of two types. One is for

the directors and to their interest and the second one is for the private company itself. The

Directors were hitherto enjoying certain pleasure from the application of certain provisions

are now withdrawn. Further, the Companies Act, 2013 have mandated certain new

requirement like that of internal audit to both public and private companies.

Brief Description

Private Limited

Company

Public Limited

Company

Name of the

Company

Private Limited as

Last Word

Public Limited as

Last Word

Provision of

entrenchment in the

Articles

To be agreed and

approved by all the

members

To be agreed and

approved through a

Special Resolution

Issue of Securities

By way of Right Issue

or Bonus Issue

Through Private

Placement

To Public through

Prospectus (Public

Offer)By way of

Right Issue or Bonus

Issue Through Private

Placement

Acceptance of

Deposits

Not allowed to accept

deposit

Allowed if Paid up

share capital is Rs.

100 Crore or more or

Turnover of Rs. 500

Crore or more

Quorum of Meetings

Two members

personally present

Five in case of

Members

upto

1000;Fifteen in case

of Members more

than

1000,

upto

5000;Thirty in case of

Members

exceed

5000.

No. of Directors and

Independent Directors

2 (Two);Not required

to appoint

independent director

3 (Three); and In case

of Listed Companies,

at least One-Third as

independent

Contract of

Employment with

Managing Director /

Whole Time Director

Not Required

(Optional)

Compulsorily

Required

Restriction on

Managerial

Remuneration

No restriction on

amount of managerial

remuneration

Managerial

Remuneration

is:

Restricted to 11% of

Net profit (subject to

conditions); OR at

least Rs. 30 lakh p.a.

depending upon paid

up capital

Capital

Minimum Capital :

Rs. 100000

Minimum Capital : Rs.

500000

10

Provision of

entrenchment in the

Articles

To be agreed and

approved by all the

members

To be agreed and

approved through a

Special Resolution

11

Securities in Public

Offer to be listed in

Stock exchanges

Not Applicable

Securities offered in

Public Offer, to be

listed in Recognised

Stock Exchanges

Вам также может понравиться

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCОт EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCОценок пока нет

- Private and Public CompanyДокумент6 страницPrivate and Public CompanyRAJVEER PARMAR100% (1)

- Corporate Legal Framework Assignment 4Документ6 страницCorporate Legal Framework Assignment 4Yogesh KumarОценок пока нет

- CompCompanies Bill, 2012 Presentation From Sympro Consulting Pvt. LTD - Anies Bill, 2012 Presentation From Sympro Consulting Pvt. Ltd.Документ33 страницыCompCompanies Bill, 2012 Presentation From Sympro Consulting Pvt. LTD - Anies Bill, 2012 Presentation From Sympro Consulting Pvt. Ltd.pasupathy_vnОценок пока нет

- New Comapany Act 2013Документ30 страницNew Comapany Act 2013sowjanya kandukuriОценок пока нет

- THE Company ACT 1956 Group 1Документ26 страницTHE Company ACT 1956 Group 1Ajay KumarОценок пока нет

- Company Law NotesДокумент6 страницCompany Law NotesAAQIB SAFWAN HОценок пока нет

- DirectorsДокумент63 страницыDirectorsShubham SinghОценок пока нет

- Companies Act 2013 DetailedДокумент32 страницыCompanies Act 2013 DetailedMohammed SultanОценок пока нет

- One Person Company: An Analytical StudyДокумент9 страницOne Person Company: An Analytical Studyvijaya choudharyОценок пока нет

- 5-5-23 f124 cf-2453 Law AnsДокумент2 страницы5-5-23 f124 cf-2453 Law Ansindian kingОценок пока нет

- What Is A Company ?: "Company" Means A Company Formed and Registered Under This Act or An Existing CompanyДокумент20 страницWhat Is A Company ?: "Company" Means A Company Formed and Registered Under This Act or An Existing CompanySachin RajuОценок пока нет

- Pors and Cons of Public & Private Co.Документ3 страницыPors and Cons of Public & Private Co.Swathi JainОценок пока нет

- One Person CompanyДокумент3 страницыOne Person Companyvivek guptaОценок пока нет

- Corporatization of MSMEДокумент11 страницCorporatization of MSMEfordОценок пока нет

- L-11-17 Company - ActДокумент90 страницL-11-17 Company - ActVanshika KapoorОценок пока нет

- Assignment On Private Company Vs Public Company in eДокумент5 страницAssignment On Private Company Vs Public Company in eSaravanagsОценок пока нет

- Very Short Notes of Company Act 2013Документ9 страницVery Short Notes of Company Act 2013Nitin C100% (7)

- Corporate AdministrationДокумент142 страницыCorporate AdministrationHarshitha VОценок пока нет

- New Companies Act 2013Документ9 страницNew Companies Act 2013ashishbajaj007100% (2)

- Difference Between Public Company and Private CompanyДокумент3 страницыDifference Between Public Company and Private CompanyMurali KrishnaОценок пока нет

- Concept of Small Shareholder DirectorДокумент4 страницыConcept of Small Shareholder DirectorRam IyerОценок пока нет

- BUS 360 - Lecture 12Документ8 страницBUS 360 - Lecture 12JabirОценок пока нет

- A Brief About The Companies Act, 2013Документ5 страницA Brief About The Companies Act, 2013tonyОценок пока нет

- Project Report On GSTДокумент32 страницыProject Report On GSTHiral Patel50% (4)

- Gautam Buddha University, Greater NoidaДокумент15 страницGautam Buddha University, Greater NoidaShubham ThakurОценок пока нет

- Key Highlights and Analysis: Companies Act, 2013Документ8 страницKey Highlights and Analysis: Companies Act, 2013Arya BarmaОценок пока нет

- Company Law NotesДокумент22 страницыCompany Law NotesDeepak KumarОценок пока нет

- Previleges of Small CompaniesДокумент9 страницPrevileges of Small CompaniesRahul ShahОценок пока нет

- Company Law NotesДокумент13 страницCompany Law NotesKriti SinghОценок пока нет

- Differentiate Between Public Company and Private CompanyДокумент7 страницDifferentiate Between Public Company and Private CompanymayankОценок пока нет

- One Person CompanyДокумент73 страницыOne Person Companyraajsekhar020Оценок пока нет

- Companies Act 2013Документ45 страницCompanies Act 2013Esha PandyaОценок пока нет

- Maximum Number of Members Restricted To 50. Maximum Number of MembersДокумент3 страницыMaximum Number of Members Restricted To 50. Maximum Number of MembersTaxation TaxОценок пока нет

- Companies Act 2013Документ6 страницCompanies Act 2013brightlight1989Оценок пока нет

- CLP Assignment 1 (Group 13)Документ73 страницыCLP Assignment 1 (Group 13)raajsekhar020Оценок пока нет

- Shareholders Rights and ObligationsДокумент18 страницShareholders Rights and Obligationsera_sharma06Оценок пока нет

- Companies Act, 2013: Management of CompanyДокумент89 страницCompanies Act, 2013: Management of CompanyDiksha Badoga100% (1)

- R & B M S C A: Ights Enefits To Inority Hareholders Under Ompanies CTДокумент5 страницR & B M S C A: Ights Enefits To Inority Hareholders Under Ompanies CTDeepanshu JharkhandeОценок пока нет

- Company Law: DR - Harpreet Kaur Kohli Deptt of Distance EducationДокумент73 страницыCompany Law: DR - Harpreet Kaur Kohli Deptt of Distance EducationAshimaОценок пока нет

- Company LawДокумент44 страницыCompany LawParth BhatiaОценок пока нет

- Study Material-Overview of The Companies Act, 2013-AM-IX-CL-IДокумент6 страницStudy Material-Overview of The Companies Act, 2013-AM-IX-CL-IannnooonnyyyymmousssОценок пока нет

- Salient Features of The Companies Act 2013Документ24 страницыSalient Features of The Companies Act 2013Ajay RoyОценок пока нет

- Companies Act GovernanceДокумент16 страницCompanies Act GovernanceSourabh GargОценок пока нет

- Assignment: Name: Deepesh Goyal Roll No: 20/120 Subject: Company Laws Submitted To: Dr. BhupenderДокумент8 страницAssignment: Name: Deepesh Goyal Roll No: 20/120 Subject: Company Laws Submitted To: Dr. BhupenderSuman GoyalОценок пока нет

- The Companies Act 2013 29 Chapters, 470 Sections & 7 SchedulesДокумент16 страницThe Companies Act 2013 29 Chapters, 470 Sections & 7 Schedulessuraj ksОценок пока нет

- Companies Act, 2013Документ11 страницCompanies Act, 2013Sushant TaleОценок пока нет

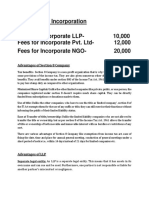

- Quatation of Incorporation Fees For Incorporate LLP-10,000 Fees For Incorporate Pvt. LTD - 12,000 Fees For Incorporate NGO - 20,000Документ3 страницыQuatation of Incorporation Fees For Incorporate LLP-10,000 Fees For Incorporate Pvt. LTD - 12,000 Fees For Incorporate NGO - 20,000Manish JainОценок пока нет

- A Project Report On LLPДокумент10 страницA Project Report On LLPPiyush Saraogi0% (1)

- Unit-3 MeetingsДокумент16 страницUnit-3 MeetingsOjas ChawlaОценок пока нет

- Legal Business FormsДокумент20 страницLegal Business FormsAnkur AryaОценок пока нет

- Companies Act 2013Документ19 страницCompanies Act 2013Gurpreet Singh100% (1)

- September, 2021 - Corporate LawsДокумент11 страницSeptember, 2021 - Corporate LawsHarshvardhan MelantaОценок пока нет

- Presentation On New Companies Bill, 2013: A. N. Gawade & CoДокумент13 страницPresentation On New Companies Bill, 2013: A. N. Gawade & CoMukesh ManwaniОценок пока нет

- Module - 4 Company Management and AdministrationДокумент59 страницModule - 4 Company Management and Administrationkavitagothe100% (1)

- MRL2601 StudyNotesДокумент73 страницыMRL2601 StudyNotesShivam NaikОценок пока нет

- Self Made Company NotesДокумент34 страницыSelf Made Company NotesZxyerithОценок пока нет

- Memorandum of Association MOA and ArticlДокумент13 страницMemorandum of Association MOA and ArticlNeelakanta AОценок пока нет

- Summer Internship Project Report Content - BP DraftДокумент2 страницыSummer Internship Project Report Content - BP DraftpavikuttyОценок пока нет

- ITC Report and Accounts 2016 PDFДокумент276 страницITC Report and Accounts 2016 PDFpavikuttyОценок пока нет

- ITCДокумент6 страницITCpavikuttyОценок пока нет

- Difference Between Share and StockДокумент1 страницаDifference Between Share and StockpavikuttyОценок пока нет

- Introduction To Law: Prof - Maria Monica.MДокумент70 страницIntroduction To Law: Prof - Maria Monica.MpavikuttyОценок пока нет

- New Microsoft Excel WorksheetДокумент8 страницNew Microsoft Excel WorksheetpavikuttyОценок пока нет

- Business Law Syllabus PDFДокумент3 страницыBusiness Law Syllabus PDFpavikuttyОценок пока нет

- ICICIMAINДокумент66 страницICICIMAINpavikuttyОценок пока нет

- Summary of The CaseДокумент2 страницыSummary of The CasepavikuttyОценок пока нет

- Managerial Statistics - CIM Lavasa - 2016Документ3 страницыManagerial Statistics - CIM Lavasa - 2016pavikuttyОценок пока нет

- Answer Key Mid Term 2016Документ8 страницAnswer Key Mid Term 2016pavikuttyОценок пока нет

- Chapter - 1 Introduction of Company Profile of Automobile Industry of IndiaДокумент47 страницChapter - 1 Introduction of Company Profile of Automobile Industry of IndiapavikuttyОценок пока нет

- Marketing Ethics and CSRДокумент17 страницMarketing Ethics and CSRpavikutty100% (2)

- Chapter - 1 Introduction of Company Profile of Automobile Industry of IndiaДокумент47 страницChapter - 1 Introduction of Company Profile of Automobile Industry of IndiapavikuttyОценок пока нет