Академический Документы

Профессиональный Документы

Культура Документы

GPH Ispat: Bangladesh steel producer

Загружено:

KB_mitИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GPH Ispat: Bangladesh steel producer

Загружено:

KB_mitАвторское право:

Доступные форматы

GPH ISPAT LIMITED

Company Overview

GPH Ispat Limited is an integrated steel manufacturing

company in Bangladesh that engaged in manufacturing of M.S.

Billet from Steel Scrap & M.S. Rod from M.S. Billet and

marketing of the same. It was incorporated in Bangladesh as a

Private Limited Company on May 17, 2006, commenced its

commercial production on 21 August 2008 and got listed to DSE

and CSE in 2012.

The principal activities of the company are manufacturing and

trading of structural bar of iron products and steel materials of

all kinds (60 grade, TMT 500W etc.) as well as other metallic or

allied materials of low & medium carbon and low alloy steel

billets (main ingredient of manufacturing graded steel bar) and

marketing thereof. Major clienteles are the Contractors,

Property Developers, Export Processing Zone, Road and Bridge

Construction Company etc. After nourishing internal demand,

GPH steel billets and Bars are exported to other countries.

Domestic market remained as the core revenue source

spawning about 100% of the companys revenue in year 201314 although the company earned 1.91% of its revenue from

export of billet in year 2012-13.

Currently, annual installed capacity of MS Rod and MS Billet is

120,000 MT and 168,000 MT respectively. In the year 2013-14

capacity utilization was 64.44% for MS Rod and 49.72% for MS

Billet.

The Companys main raw material is various steel scrap. The

second largest raw material is Sponge Iron. These two items

cover more than 96% of raw-material consumption. These raw

materials are sourced from local market through ship breaking

yard as well as from foreign market. The company has 27 MW

power connections. 15 MW load connection though 132/33 KV

substation and 33 KV H.T line from PDB and 12 MW gas fired

captive power plant named GPH Power Generation Limited.

Currently, as per the DSE website, 76.09% of the shares of the

company are held by its sponsor/ directors, 12.21% by

institutions and rest 11.7% by general public.

Industry Overview

Bangladesh has more than 400 steel, re-rolling and auto-rerolling mills with a combined annual production capacity of 80

lakh tones, against the total demand of only 40 lakh tones

(market value of BDT 200 billion). The government projects

account for nearly 40% of total steel consumption.

Bangladesh is one of the lowest consumers of steel products in

the world. Per capita steel consumption in Bangladesh now

stands at only 25 kilograms, while it is 55 Kilograms in India,

324 kilograms in developed nations. A number of companies of

the sector, including BSRM, GPH, RSRM, Rahim Steel and

Bashundhara Steel, are producing the raw material billet

locally. The local demand for billet is 4.0 million metric tonnes

annually while 1.5 million MT billet are imported to meet the

country's demand. At present, three big steelmakers -- BSRM,

Abul Khair Steel and KSRM -- supply more than 50% of the

country's annual need for 35-40 lakh tonnes of steel. The

smaller mills in Bangladesh are facing challenges such as price

1

DSE: GPHISPAT

BLOOMBERG: GPH:BD

fall in international steel market and a decline in domestic

demand for construction materials, which are forcing them out

of the market. Over capacity of the steel industry also indicates

enormous export potential, though the option is yet to explore

following some bottlenecks in the export process.

Since steel demand is derived from other sectors like

construction buildings, roads, consumer durables and

infrastructure, its fortune is dependent on the growth of these

user industries. However, Initiation of Padma Bridge

construction, acceleration of Governments big infrastructure

projects under Annual Development Program (ADP) and revival

of the local real-estate industry will undoubtedly boost-up the

steel consumption locally.

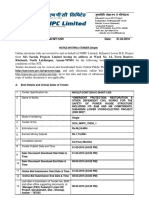

Company Fundamentals

Market Cap (BDT mn)

5,688.1

Market weight

0.18%

Free-float (Public +Inst.)

23.91%

Paid-up Capital (BDT mn)

1,247

3 Months Average Turnover (BDT mn)

15.22

3 Months Return

-14%

Current Price (BDT)

45.6

52-week price range (BDT)

44.1 - 59.4

Sector Forward P/E

22.18

2011-12

Financial Information (BDT mn):

Sales

4,386.3

PAT

672.4

Assets

254.2

LT Debt

5,199.6

Equity

352.6

Div. % (C/B)

10/20

Margin:

Gross Profit

18.5%

Operating Profit

15.3%

Pretax Profit

6.8%

Net Profit

5.8%

Growth:

Sales

18.9%

Gross Profit

26.4%

Operating Profit

27.7%

Net Profit

54.3%

Profitability:

ROA

9.8%

ROE

30.7%

Leverage:

62.8

Debt Ratio

%

197.5

Debt-Equity Ratio

%

Interest Coverage

1.77

Ratio

Valuation:

Price/Earnings

28.66

Price/BV

3.44

Restated EPS

1.59

(BDT) (BDT)

NAVPS

13.26

2012-13

2013-14

2014-15

5,387.4

718.6

250.1

4,865.0

249.9

15/10

4,687.2

711.7

278.9

5,846.5

280.1

15/5

5,132.0

734.0

281.4

6,260.6

242.0

-/-

16.3%

13.3%

6.3%

4.6%

18.5%

15.2%

8.7%

5.9%

17.5%

14.3%

8.3%

5.5%

22.8%

7.7%

6.9%

4.4%

-13.0%

-1.0%

-1.0%

30.1%

9.5%

3.5%

3.1%

4.4%

5.0%

14.4%

5.2%

14.9%

4.6%

14.0%

58.4%

156.6%

1.87

56.1%

169.9%

2.16

58.8%

176.3%

2.34

27.45

3.14

1.66

14.54

21.09

2.95

2.16

15.48

20.21

2.72

2.26

16.74

(Q2 Ann)

*As per latest corporate declaration for the year ended 2014-15

December 18, 2014

Investment Positives

5 year Restated EPS (BDT) & EPS Growth

As per the company annual report 2013-14, the company

has renovated their Continuous Casting Machine for

Billet Plant to increase the capacity utilization of the

plant. Moreover, as the price of billet fluctuates fiercely in

the international market which increases cost of steel

production, the company increased its billet production

capacity from 98,000 MT/annum to 168,000 MT/annum in

year 2013. This plant eradicated its dependency on

imported billet, reduced cost of production as well as

exposure to foreign exchange risk.

The company has subscribed 10% equity shares of GPH

steel Ltd, a newly established public limited company to be

engaged in manufacturing of MS Billet and MS Rod. The

paid up capital of the company is 10 mn. The company has

not started its commercial production yet.

Increased import duty on Bar and Rods from 10% to 25%

will increase the price of imported steels and also make

local manufacturers like GPH Ispat more competitive in the

indigenous market.

Investment Negatives

GPH Ispat Ltd. is heavily exposed to leverage. In 2013-14,

debt to total asset ratio stood at 56.1% High interest eatsup a significant portion of its profit. In addition, financial

expenses have accounted for 54% of operating profit in

year 2013-14.

The company is exposed to foreign exchange risk in certain

purchase of raw materials from abroad. Majority of the

foreign currency transactions are denominated in USD and

relate to procurement of raw-materials from abroad.

EPS

EPS Growth

2.16

2.50

2.00

1.50

1.59

2.26

100%

80%

1.66

60%

1.03

1.00

40%

0.50

20%

0%

2010

2011

2012

2013

2014 (Q2, Ann)

Source: Annual Report & ILSL Research

Pricing Based on Relative Valuation:

Sector Forward P/E

Sector Trailing P/E

Market Forward P/E

Multiple

Value (BDT)

22.18

23.06

17.67

50.03

49.85

39.87

Source: ILSL Research

Concluding Remark

GPH Ispat is operating in a high cost- low margin steel industry.

In 2013-14, revenues decreased by 13% mainly because of the

political instability coupled with no export earnings as well as

the average market price of the finished products declined.

Despite negative growth in revenue, net profit amplified up by

30%, riding on the reduction in cost of sales and reduced

financial expenses in year 2013-14. Half yearly annualized

revenue for the year 2014-15 witnessed 9.5% growth but net

profit grew only by 4% due to increased cost of sales and higher

tax expenses as the companys tax holiday period expired in July

2013.

Source: Annual Reports, DSE news, Company website, the Financial Express, the Daily Star, ILSL Research

Price Movement Since Listing (BDT)

100

80

60

40

20

0

Source: DSE & ILSL Research

ILSL Research Team:

Disclaimer: This document has been prepared by International Leasing Securities

Name

Designation

Rezwana Nasreen

Head of Research

Towhidul Islam

Research Analyst

Md. Tanvir Islam

Research Analyst

Md. Asrarul Haque

Jr. Research Analyst

Md. Imtiaz Uddin Khan

Jr. Research Analyst

Limited (ILSL) for information only of its clients on the basis of the publicly available

information in the market and own research. This document has been prepared for

information purpose only and does not solicit any action based on the material

contained herein and should not be construed as an offer or solicitation to buy or sell or

subscribe to any security. Neither ILSL nor any of its directors, shareholders, member of

the management or employee represents or warrants expressly or impliedly that the

information or data of the sources used in the documents are genuine, accurate,

complete, authentic and correct. However all reasonable care has been taken to ensure

the accuracy of the contents of this document. ILSL will not take any responsibility for

any decisions made by investors based on the information herein.

For any Queries: research@ilslbd.com

December 18, 2014

Вам также может понравиться

- Term Paper On: "Money Market Contribution in A Developing Economy Like Bangladesh"Документ30 страницTerm Paper On: "Money Market Contribution in A Developing Economy Like Bangladesh"Fahim MalikОценок пока нет

- The Structure of Financial System of BangladeshДокумент9 страницThe Structure of Financial System of BangladeshHn SamiОценок пока нет

- Performance Analysis of Standard Bank Limited For Financial Years 2012-13Документ16 страницPerformance Analysis of Standard Bank Limited For Financial Years 2012-13ZerinTasnimeОценок пока нет

- Stock Market CrashДокумент15 страницStock Market CrashsdaminctgОценок пока нет

- Affinity Adventure & TourismДокумент32 страницыAffinity Adventure & TourismToha Hossain UtshaОценок пока нет

- PEST Analysis of Marketing Communication in BangladeshДокумент12 страницPEST Analysis of Marketing Communication in BangladeshmizankdОценок пока нет

- International Trade Module GuideДокумент9 страницInternational Trade Module GuideSaad MasudОценок пока нет

- APEX FOOTEAR LIMITED Shakkhor2001980018Документ5 страницAPEX FOOTEAR LIMITED Shakkhor2001980018Yeasin AzizОценок пока нет

- Social Media Marketing: Growing Business Through Social NetworkingДокумент2 страницыSocial Media Marketing: Growing Business Through Social NetworkingIkey zamriОценок пока нет

- Tutorial Set 7 - SolutionsДокумент5 страницTutorial Set 7 - SolutionsChan Chun YeenОценок пока нет

- Role of Capital Market For Economic Development of BangladeshДокумент6 страницRole of Capital Market For Economic Development of Bangladeshfiroz chowdhury0% (1)

- Duties and Rights of Bankers and CustomersДокумент33 страницыDuties and Rights of Bankers and CustomersMichael TochukwuОценок пока нет

- What Are The Main Advantages and Disadvantages of Fixed Exchange RatesДокумент4 страницыWhat Are The Main Advantages and Disadvantages of Fixed Exchange RatesGaurav Sikdar0% (1)

- Summary Chapter 8Документ6 страницSummary Chapter 8Zahidul AlamОценок пока нет

- Product Life CycleДокумент4 страницыProduct Life CyclekqsyedОценок пока нет

- SWOT Analysis of Bangladesh EconomyДокумент14 страницSWOT Analysis of Bangladesh EconomyIqbal HasanОценок пока нет

- In Defence of The Auditor GeneralДокумент9 страницIn Defence of The Auditor GeneralThavam RatnaОценок пока нет

- Sources of international financing and analysisДокумент6 страницSources of international financing and analysisSabha Pathy100% (2)

- Shahjalal Islami Bank LTDДокумент25 страницShahjalal Islami Bank LTDShanu Uddin RubelОценок пока нет

- BDBL AssignmentДокумент9 страницBDBL AssignmentSamira IslamОценок пока нет

- Complete ProjectДокумент72 страницыComplete ProjectKevin JacobОценок пока нет

- Janata Bank's Credit Management and Financial PerformanceДокумент5 страницJanata Bank's Credit Management and Financial PerformanceazadОценок пока нет

- Internship ReportДокумент42 страницыInternship ReportBoby PodderОценок пока нет

- Techniques For Managing ExposureДокумент26 страницTechniques For Managing Exposureprasanthgeni22100% (1)

- FIN4646Final Summer2020sec7Документ2 страницыFIN4646Final Summer2020sec7Mahi100% (1)

- Individual Assignment International InvestmentДокумент10 страницIndividual Assignment International InvestmentMaziana PiramliОценок пока нет

- An Empirical Analysis of The Determinants of Private Investment in ZimbabweДокумент17 страницAn Empirical Analysis of The Determinants of Private Investment in ZimbabweAnonymous traMmHJtV100% (1)

- Foreign Exchange On First Security Islami Bank LTDДокумент60 страницForeign Exchange On First Security Islami Bank LTDAhadul Islam100% (2)

- 6 Key Factors That Influence Exchange RatesДокумент9 страниц6 Key Factors That Influence Exchange RatesRizwan BashirОценок пока нет

- SIR Report 2016Документ136 страницSIR Report 2016Polash DattaОценок пока нет

- Deco503 International Trade and Finance English PDFДокумент391 страницаDeco503 International Trade and Finance English PDFkhushal kumarОценок пока нет

- Money Market in BangladeshДокумент34 страницыMoney Market in Bangladeshjubaida khanamОценок пока нет

- Central BankДокумент6 страницCentral BankMd Shahbub Alam SonyОценок пока нет

- Satyajit 2Документ30 страницSatyajit 2Raihan WorldwideОценок пока нет

- Bangladesh SME Sector ReportДокумент41 страницаBangladesh SME Sector ReportArman Hakim100% (8)

- Stephen - Ndebele GBS750 TestДокумент8 страницStephen - Ndebele GBS750 TestChongo S NdebeleОценок пока нет

- Consumer FinanceДокумент15 страницConsumer FinanceforamnshahОценок пока нет

- Capital Market of BangladeshДокумент25 страницCapital Market of BangladeshrashelОценок пока нет

- Nedbank Group Financial StatementsДокумент132 страницыNedbank Group Financial StatementsNeo NakediОценок пока нет

- Assignment On Star KababДокумент8 страницAssignment On Star KababHasibul Borhan100% (1)

- Assignment On Money Market in BangladeshДокумент14 страницAssignment On Money Market in BangladeshOmar Faruk OviОценок пока нет

- Monetary Policy India Last 5 YearsДокумент28 страницMonetary Policy India Last 5 YearsPiyush ChitlangiaОценок пока нет

- A Study On Home Loan Activities of Rupali Bank LimitedДокумент77 страницA Study On Home Loan Activities of Rupali Bank Limitedapi-418419207100% (1)

- Business EnvironmentДокумент1 страницаBusiness Environmentnani66215487Оценок пока нет

- Appraisal of DSE & CSEДокумент31 страницаAppraisal of DSE & CSEMohammad Shaniaz IslamОценок пока нет

- Human Resource Management in Nepal Rastra BankДокумент16 страницHuman Resource Management in Nepal Rastra BankPragya PandeyОценок пока нет

- VaR Implementation in G-SEC PortfolioДокумент193 страницыVaR Implementation in G-SEC PortfolioDharmender KumarОценок пока нет

- Retail Banking and Wholesale BankingДокумент6 страницRetail Banking and Wholesale BankingNiharika Satyadev Jaiswal100% (2)

- AssignmentДокумент5 страницAssignmentASHHAR AZIZОценок пока нет

- Internship Report On SIBLДокумент56 страницInternship Report On SIBLRafsun RahatОценок пока нет

- Executive Summary DSEДокумент10 страницExecutive Summary DSENazrul Hosen AyonОценок пока нет

- The Service Quality ModelДокумент2 страницыThe Service Quality Modelvishalsharma127100% (1)

- Financial System of BangladeshДокумент24 страницыFinancial System of Bangladeshmoin06100% (2)

- BBA 3002 Financial StatementДокумент45 страницBBA 3002 Financial StatementVentusОценок пока нет

- Foreign Exchange Operation of Commercial BankДокумент24 страницыForeign Exchange Operation of Commercial BankShawon100% (1)

- 9197 FIM Assignment Money Market Instruments in BangladeshДокумент17 страниц9197 FIM Assignment Money Market Instruments in BangladeshTahsin RahmanОценок пока нет

- About Destiny and Their Tree Plantation Activities. How They Fraud People.Документ64 страницыAbout Destiny and Their Tree Plantation Activities. How They Fraud People.Md Mahabub100% (2)

- Equity Note - GPH Ispat LimitedДокумент2 страницыEquity Note - GPH Ispat LimitedOsmaan GóÑÍОценок пока нет

- ITC MenuДокумент1 страницаITC MenuKB_mitОценок пока нет

- Tamron 150 600mm F 5 6.3 Di VC USD LensДокумент2 страницыTamron 150 600mm F 5 6.3 Di VC USD LensRatul RanjanОценок пока нет

- Manali - Sight Seeing PlacesДокумент2 страницыManali - Sight Seeing PlacesKB_mitОценок пока нет

- Section Vi Technical SpecificationДокумент61 страницаSection Vi Technical SpecificationKB_mitОценок пока нет

- Aadhar Enrolment Correction FormДокумент2 страницыAadhar Enrolment Correction Formapi-249989744Оценок пока нет

- Nit 1Документ9 страницNit 1KB_mitОценок пока нет

- Tokyo Trip TransactionДокумент1 страницаTokyo Trip TransactionKB_mitОценок пока нет

- Combined Cycle Power PlantДокумент3 страницыCombined Cycle Power PlantKB_mitОценок пока нет

- S. NO - House/Stat E Tenure From Tenure TO Assemb Ly Seat: Date of Poll Date of Counting Date of CompletionДокумент1 страницаS. NO - House/Stat E Tenure From Tenure TO Assemb Ly Seat: Date of Poll Date of Counting Date of CompletionKB_mitОценок пока нет

- LehДокумент3 страницыLehKB_mitОценок пока нет

- Haryana Power Corrigendum+No.+4 (NIT-701)Документ10 страницHaryana Power Corrigendum+No.+4 (NIT-701)KB_mitОценок пока нет

- Bank WiseДокумент1 страницаBank WiseKB_mitОценок пока нет

- NHPC Limited tender for construction of elevated security postДокумент9 страницNHPC Limited tender for construction of elevated security postKB_mitОценок пока нет

- Nit 1Документ3 страницыNit 1KB_mitОценок пока нет

- Nit 1Документ5 страницNit 1KB_mitОценок пока нет

- Nit 1Документ3 страницыNit 1KB_mitОценок пока нет

- GT S Comm Security Audit Tender DocumentДокумент39 страницGT S Comm Security Audit Tender DocumentKB_mitОценок пока нет

- Nit 1Документ3 страницыNit 1KB_mitОценок пока нет

- Nit 1Документ9 страницNit 1KB_mitОценок пока нет

- Chapter IX Price ForecastДокумент26 страницChapter IX Price ForecastKB_mitОценок пока нет

- No of Dealers District-Wise 1Документ28 страницNo of Dealers District-Wise 1KB_mitОценок пока нет

- Nit 1Документ5 страницNit 1KB_mitОценок пока нет

- Tamilnadu Cement Industry Units ListДокумент24 страницыTamilnadu Cement Industry Units ListKB_mitОценок пока нет

- Hyderabad Visit Nov 2016Документ1 страницаHyderabad Visit Nov 2016KB_mitОценок пока нет

- World PopulationДокумент44 страницыWorld PopulationIsmail Andi BasoОценок пока нет

- Perur Desal 400 MLDДокумент1 страницаPerur Desal 400 MLDKB_mitОценок пока нет

- PQWeb Notice Kiru Eand MДокумент8 страницPQWeb Notice Kiru Eand MKB_mitОценок пока нет

- TANTRANSCO Bidding Document for Erection of 230KV and 110KV LinesДокумент46 страницTANTRANSCO Bidding Document for Erection of 230KV and 110KV LinesKB_mitОценок пока нет

- Chennai Desalination PlantДокумент10 страницChennai Desalination PlantjhonnyОценок пока нет

- Hamilton EssayДокумент4 страницыHamilton Essayapi-463125709Оценок пока нет

- Nursing Care Plan: Assessment Planning Nursing Interventions Rationale EvaluationДокумент5 страницNursing Care Plan: Assessment Planning Nursing Interventions Rationale Evaluationamal abdulrahman100% (2)

- Principles of Administrative TheoryДокумент261 страницаPrinciples of Administrative TheoryZabihullahRasidОценок пока нет

- Consent of Action by Directors in Lieu of Organizational MeetingsДокумент22 страницыConsent of Action by Directors in Lieu of Organizational MeetingsDiego AntoliniОценок пока нет

- NBA Live Mobile Lineup with Jeremy Lin, LeBron James, Dirk NowitzkiДокумент41 страницаNBA Live Mobile Lineup with Jeremy Lin, LeBron James, Dirk NowitzkiCCMbasketОценок пока нет

- Bible Verses Proving Jesus Is GodДокумент5 страницBible Verses Proving Jesus Is GodBest OfAntonyОценок пока нет

- Soviet Middle Game Technique Excerpt ChessДокумент12 страницSoviet Middle Game Technique Excerpt ChessPower Power100% (1)

- Anthony VixayoДокумент2 страницыAnthony Vixayoapi-533975078Оценок пока нет

- Senate Hearing, 110TH Congress - The Employee Free Choice Act: Restoring Economic Opportunity For Working FamiliesДокумент83 страницыSenate Hearing, 110TH Congress - The Employee Free Choice Act: Restoring Economic Opportunity For Working FamiliesScribd Government DocsОценок пока нет

- Entrance English Test for Graduate Management StudiesДокумент6 страницEntrance English Test for Graduate Management StudiesPhương Linh TrươngОценок пока нет

- Module in Introduction To The World ReligionДокумент70 страницModule in Introduction To The World ReligionAlex Antenero93% (44)

- Fs 6 Learning-EpisodesДокумент11 страницFs 6 Learning-EpisodesMichelleОценок пока нет

- Year 2019 Current Affairs - English - January To December 2019 MCQ by Sarkari Job News PDFДокумент232 страницыYear 2019 Current Affairs - English - January To December 2019 MCQ by Sarkari Job News PDFAnujОценок пока нет

- 1940 Doreal Brotherhood PublicationsДокумент35 страниц1940 Doreal Brotherhood Publicationsfrancisco89% (9)

- Reaction Paper On GRP 12Документ2 страницыReaction Paper On GRP 12Ayen YambaoОценок пока нет

- Quant Congress - BarCapДокумент40 страницQuant Congress - BarCapperry__mason100% (1)

- Book - Social Work and Mental Health - Third Edition (Transforming Social Work Practice) - Learning Matters Ltd. (2008)Документ192 страницыBook - Social Work and Mental Health - Third Edition (Transforming Social Work Practice) - Learning Matters Ltd. (2008)All in OneОценок пока нет

- Fortianalyzer v6.2.8 Upgrade GuideДокумент23 страницыFortianalyzer v6.2.8 Upgrade Guidelee zwagerОценок пока нет

- Aircraft Accident/Incident Summary Report: WASHINGTON, D.C. 20594Документ14 страницAircraft Accident/Incident Summary Report: WASHINGTON, D.C. 20594Harry NuryantoОценок пока нет

- Baccmass - ChordsДокумент7 страницBaccmass - ChordsYuan MasudaОценок пока нет

- 6 Lee VS PPДокумент2 страницы6 Lee VS PPSarah De GuzmanОценок пока нет

- The Constitution of The Student Council of Pope John Paul II Catholic High SchoolДокумент4 страницыThe Constitution of The Student Council of Pope John Paul II Catholic High Schoolapi-118865622Оценок пока нет

- Rationale For Instruction: Social Studies Lesson Plan TemplateДокумент3 страницыRationale For Instruction: Social Studies Lesson Plan Templateapi-255764870Оценок пока нет

- Business Studies HSC Sample Answers 12 PDFДокумент8 страницBusiness Studies HSC Sample Answers 12 PDFMikeОценок пока нет

- Qustion 2020-Man QB MCQ - MAN-22509 - VI SEME 2019-20Документ15 страницQustion 2020-Man QB MCQ - MAN-22509 - VI SEME 2019-20Raees JamadarОценок пока нет

- 1 292583745 Bill For Current Month 1Документ2 страницы1 292583745 Bill For Current Month 1Shrotriya AnamikaОценок пока нет

- The Basketball Diaries by Jim CarollДокумент22 страницыThe Basketball Diaries by Jim CarollEricvv64% (25)

- Tugas Kelompok 3 Bahasa InggrisДокумент5 страницTugas Kelompok 3 Bahasa InggrisAditya FrediansyahОценок пока нет

- CIR vs. CA YMCA G.R. No. 124043 October 14 1998Документ1 страницаCIR vs. CA YMCA G.R. No. 124043 October 14 1998Anonymous MikI28PkJc100% (1)

- ePass for Essential Travel Between Andhra Pradesh and OdishaДокумент1 страницаePass for Essential Travel Between Andhra Pradesh and OdishaganeshОценок пока нет