Академический Документы

Профессиональный Документы

Культура Документы

Infosys Invests in Stellaris Venture Partners (Company Update)

Загружено:

Shyam SunderИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Infosys Invests in Stellaris Venture Partners (Company Update)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

Media Statement: Infosys Invests in Stellaris Venture Partners

Bangalore November 23, 2016: Infosys (NYSE: INFY), a global leader in consulting, technology,

outsourcing and next-generation services, today announced that it has signed a definitive agreement to a

Limited Partner investment of INR 31.6 crores from its Innovation Fund in Stellaris Venture Partners, an

India-based early stage venture fund. This investment is towards the first close of Stellaris fund.

Indias startup ecosystem is witnessing rapid growth led by areas such as cloud computing, Internet of

Things (IoT), artificial intelligence and big data, as well as the widespread proliferation of smartphones. In

this environment, Stellaris aims to back entrepreneurs building applications for global businesses, Indian

SMBs and consumers in verticals such as financial services, retail, healthcare and education.

Stellaris investment team has significant experience working in global technology companies and a

strong track record in venture capital, with investments made in companies such as Taxisforsure and

Bigbasket to name a few. Stellaris has built a robust network of successful entrepreneurs and advisors to

source, evaluate and mentor the best Indian startups.

We believe Stellaris with their extensive operational and domain expertise in enterprise software and

services in both India and US, is uniquely positioned to leverage Indias capital efficient talent pool, to

harness the next wave of enterprise innovation in India. With this investment we look forward to gaining

early access to innovative new companies in India that are inventing the future of enterprises globally,

said Ritika Suri, Executive Vice President & Global Head of Corporate Development & Ventures at

Infosys.

India has a vibrant technology startup ecosystem today that has the potential to create breakthrough

companies on a global scale. We are very excited to partner with Infosys, whose deep technology

expertise, understanding of global enterprises and worldwide footprint can be immensely valuable to the

investment team as well as Stellaris portfolio companies, said Alok Goyal, co-founder at Stellaris.

The investment is expected to complete by December 15, 2016.

About Infosys

Infosys is a global leader in technology services and consulting. We enable clients in more than 50

countries to create and execute strategies for their digital transformation. From engineering to application

development, knowledge management and business process management, we help our clients find the

right problems to solve, and to solve these effectively. Our team of 199,000+ innovators, across the

globe, is differentiated by the imagination, knowledge and experience, across industries and technologies

that we bring to every project we undertake.

Visit www.infosys.com to see how Infosys (NYSE: INFY) can help your enterprise thrive in the digital age.

About Stellaris Venture Partners

Stellaris Venture Partners is an early stage, technology focused venture capital firm with offices in

Bangalore and Delhi NCR. Alok Goyal, Rahul Chowdhri and Ritesh Banglani, the founding partners of the

firm, are seasoned venture professionals who have previously led global technology businesses. In the

past, the partners have invested in market leaders such as Taxisforsure, Bigbasket, Shopclues, Axtria,

Lifecell and Simplilearn. Stellaris will back bold entrepreneurs who leverage technology to solve large

problems. Their investment focus areas include global SaaS, as well as applications for Indian SMBs and

consumers in large verticals such as healthcare, education, financial services and retail.

Safe Harbor

Certain statements in this press release concerning our future growth prospects are forward-looking

statements regarding our future business expectations intended to qualify for the 'safe harbor' under the

Private Securities Litigation Reform Act of 1995, which involve a number of risks and uncertainties that

could cause actual results to differ materially from those in such forward-looking statements. The risks

and uncertainties relating to these statements include, but are not limited to, risks and uncertainties

regarding fluctuations in earnings, fluctuations in foreign exchange rates, our ability to manage growth,

intense competition in IT services including those factors which may affect our cost advantage, wage

increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on

fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, industry segment

concentration, our ability to manage our international operations, reduced demand for technology in our

key focus areas, disruptions in telecommunication networks or system failures, our ability to successfully

complete and integrate potential acquisitions, liability for damages on our service contracts, the success

of the companies in which Infosys has made strategic investments, withdrawal or expiration of

governmental fiscal incentives, political instability and regional conflicts, legal restrictions on raising

capital or acquiring companies outside India, and unauthorized use of our intellectual property and

general economic conditions affecting our industry. Additional risks that could affect our future operating

results are more fully described in our United States Securities and Exchange Commission filings

including our Annual Report on Form 20-F for the fiscal year ended March 31, 2016. These filings are

available at www.sec.gov.Infosys may, from time to time, make additional written and oral forward-looking

statements, including statements contained in the company's filings with the Securities and Exchange

Commission and our reports to shareholders. Any forward-looking statements contained herein are based

on assumptions that we believe to be reasonable as of this date. The company does not undertake to

update any forward-looking statements that may be made from time to time by or on behalf of the

company unless it is required by law.

For further information, please contact:

Asia Pacific

EMEA

Sarah Gideon

Paul de Lara

Infosys, India

Infosys, UK

+91 80 4156 3998

+44 2075162748

Sarah_Gideon@infosys.com Paul_deLara@infosys.com

Americas

Pilar Elvira Wolfsteller

Infosys, USA

+1 (510) 944 4596

Pilar.Wolfsteller@infosys.com

Disclosure under SEBI Listing RegulationInvestment

Name of the target entity

Whether related party transaction(s) and whether

the promoter/ promoter group/ group companies

have any interest in the entity being acquired?

Industry to which the entity being invested into

belongs

Objects and effects of the investment

Any governmental or regulatory approvals

required

Indicative time period for completion

Nature of consideration

Cost of investment

Percentage of shareholding

Brief background

Stellaris Venture Partners India I (Fund), a scheme

of Stellaris Venture Partners India Trust

No

Venture Capital Investments

Stellaris Venture Partners is an India-based early

stage venture fund registered as a Category I,AIFVCF. Stellaris aims to back entrepreneurs building

applications for global businesses, Indian SMBs and

consumers in verticals such as financial services,

retail, healthcare and education.

None

Expected to be completed on or before December 15,

2016.

Cash

INR 31.6 crore investment as LP interest towards the

first close of the Fund.

A minority holding, not exceeding 20% of the

aggregate size of the Fund.

Stellaris Venture Partners is an early stage,

technology focused venture capital firm with offices in

Bangalore and Delhi NCR. Alok Goyal, Rahul

Chowdhri and Ritesh Banglani, the founding partners

of the firm, are seasoned venture professionals who

have previously led global technology businesses.

Stellaris will back bold entrepreneurs who leverage

technology to solve large problems. Their investment

focus areas include global SaaS, as well as

applications for Indian SMBs and consumers in large

verticals such as healthcare, education, financial

services and retail.

Вам также может понравиться

- Nile River VP Guide For StartupsДокумент78 страницNile River VP Guide For StartupsAbhilaksh LalwaniОценок пока нет

- Title: Final Term Project Company Name: Infosys Limited Subject: Financial Accounting For Managers Batch: 2014-16 Section: F Submitted By: Vaibhav GuptaДокумент13 страницTitle: Final Term Project Company Name: Infosys Limited Subject: Financial Accounting For Managers Batch: 2014-16 Section: F Submitted By: Vaibhav GuptaVaibhav GuptaОценок пока нет

- 47 Most Active Venture Capital Firms in India For StartupsДокумент21 страница47 Most Active Venture Capital Firms in India For StartupsfinvistaОценок пока нет

- VCs in IndiaДокумент25 страницVCs in IndiaBreejОценок пока нет

- Ebook Top 58 Venture Capital Firms PDFДокумент61 страницаEbook Top 58 Venture Capital Firms PDFPratyutpanna DasОценок пока нет

- Literature Review On Venture Capital in IndiaДокумент4 страницыLiterature Review On Venture Capital in Indiaigmitqwgf50% (2)

- Q1 Revenues Grew by 13.6% Year-On-Year 2.7% Quarter-On-QuarterДокумент6 страницQ1 Revenues Grew by 13.6% Year-On-Year 2.7% Quarter-On-QuarterNiranjan PrasadОценок пока нет

- Role of Venture Capital in Indian EconomyДокумент53 страницыRole of Venture Capital in Indian EconomySanket Patkar0% (1)

- Swot Analysis of InfosysДокумент16 страницSwot Analysis of InfosysNavya Punyah83% (6)

- Role of Venture Capital in Indian Economy: Mrs. M Haritha, Mr. Ravi V, Mr. Maruthi ReddyДокумент25 страницRole of Venture Capital in Indian Economy: Mrs. M Haritha, Mr. Ravi V, Mr. Maruthi ReddyInternational Organization of Scientific Research (IOSR)Оценок пока нет

- Bps Word FileДокумент33 страницыBps Word Filesamiksha.123poonamОценок пока нет

- Zodius Capital II Fund Launch 070414Документ2 страницыZodius Capital II Fund Launch 070414avendusОценок пока нет

- Infosys Statement On Announcement Made by Royal Bank of Scotland On Williams & Glyn (Company Update)Документ2 страницыInfosys Statement On Announcement Made by Royal Bank of Scotland On Williams & Glyn (Company Update)Shyam SunderОценок пока нет

- Group 10 - The Story of Synergos UnfoldsДокумент15 страницGroup 10 - The Story of Synergos UnfoldsRamandeep Kaur56% (9)

- Research Paper On Venture Capital in India PDFДокумент4 страницыResearch Paper On Venture Capital in India PDFfvf237cz50% (2)

- Telstra To Establish India Captive Centre With InfosysДокумент2 страницыTelstra To Establish India Captive Centre With InfosysDynamic LevelsОценок пока нет

- Presentation BEДокумент16 страницPresentation BEKishan KeshriОценок пока нет

- Infosys Expands Operations in JapanДокумент8 страницInfosys Expands Operations in JapanmadhurendrahraОценок пока нет

- Venture Capital in India Research PaperДокумент8 страницVenture Capital in India Research Paperhkdxiutlg100% (1)

- Final From Preface To End On 31108Документ72 страницыFinal From Preface To End On 31108Tabrez AliОценок пока нет

- Indian Startups-Issues, Challenges and OpportunitiesДокумент9 страницIndian Startups-Issues, Challenges and Opportunitiessomya gadiaОценок пока нет

- Venture Capital in IndiaДокумент3 страницыVenture Capital in IndiajuhikabondОценок пока нет

- Venture Cap. NameДокумент13 страницVenture Cap. NameHimansu BhusanaОценок пока нет

- Kore - Ai FTV Announcement - Embargo - KORE Draft - For - Approval - FTVДокумент3 страницыKore - Ai FTV Announcement - Embargo - KORE Draft - For - Approval - FTVzayntk07Оценок пока нет

- India Business GuideДокумент8 страницIndia Business Guidesachin251Оценок пока нет

- A Report Report On Karvy Acquires Itrust, Gurgaon Based Personal Finance StartupДокумент5 страницA Report Report On Karvy Acquires Itrust, Gurgaon Based Personal Finance StartupRonak GinoyaОценок пока нет

- Assignment 7Документ5 страницAssignment 7Ankush YedaviОценок пока нет

- Economics Project Report FinalДокумент11 страницEconomics Project Report Finaldivyanshu.221ch018Оценок пока нет

- Anandu S March 2023Документ3 страницыAnandu S March 2023NanduОценок пока нет

- Infosys Rated Amongst World's Best in Employee Training and DevelopmentДокумент2 страницыInfosys Rated Amongst World's Best in Employee Training and Developmentbrijesh_1112Оценок пока нет

- Role of Foreign Venture Capital Funds in IndiaДокумент10 страницRole of Foreign Venture Capital Funds in IndiaJames ManishОценок пока нет

- Finlatics Investment Banking Experience Program - Project 3 1. "Don't Put All Your Eggs in One Basket" It Was The Line Told by Mr. Warren Buffett. AДокумент4 страницыFinlatics Investment Banking Experience Program - Project 3 1. "Don't Put All Your Eggs in One Basket" It Was The Line Told by Mr. Warren Buffett. AYuddhaveer Singh SuryavanshiОценок пока нет

- PHD Thesis On Venture Capital in IndiaДокумент8 страницPHD Thesis On Venture Capital in Indiachristinavaladeznewyork67% (3)

- A Study On Foreign Exchage and Its Risk ManagementДокумент45 страницA Study On Foreign Exchage and Its Risk ManagementBhushan100% (1)

- Infosys Analysis For Finlatics FMEPДокумент5 страницInfosys Analysis For Finlatics FMEPyogeshОценок пока нет

- Infosys: - Shareholding Pattern of The CompanyДокумент5 страницInfosys: - Shareholding Pattern of The CompanyKeyur MahadikОценок пока нет

- India Investors List 2020 PDFДокумент157 страницIndia Investors List 2020 PDFshashank katariya33% (3)

- To All Stock Exchanges Bse Limited National Stock Exchange of India Limited New York Stock ExchangeДокумент4 страницыTo All Stock Exchanges Bse Limited National Stock Exchange of India Limited New York Stock Exchangevedantniru01Оценок пока нет

- IFCI Venture Capital FundsДокумент7 страницIFCI Venture Capital FundsamaaniperОценок пока нет

- Company OverviewДокумент18 страницCompany OverviewManu SinghОценок пока нет

- Kotak TechnologynfundДокумент7 страницKotak TechnologynfundRanjan SharmaОценок пока нет

- How To Plan India Entry Strategy PDFДокумент6 страницHow To Plan India Entry Strategy PDFSHIVAM KUMAR SINGHОценок пока нет

- List of VCFsДокумент3 страницыList of VCFspoddar_ruchitaОценок пока нет

- List of VCFsДокумент3 страницыList of VCFspoddar_ruchitaОценок пока нет

- Finlatics IBEP 3Документ11 страницFinlatics IBEP 3Narayan ToshniwalОценок пока нет

- Effective Decision MakingДокумент3 страницыEffective Decision MakingDr-Rahat KhanОценок пока нет

- JD TextilesДокумент1 страницаJD Textilesneha050501Оценок пока нет

- Private Equity in India MbaДокумент94 страницыPrivate Equity in India MbaHOME 4Оценок пока нет

- 1.1 VC Industry Profile in IndiaДокумент11 страниц1.1 VC Industry Profile in Indiakrunal joshiОценок пока нет

- Project 3: 1.industry Agnostic Is A Term That Refers To Private Equity Firms or Investment Banks That Don'tДокумент4 страницыProject 3: 1.industry Agnostic Is A Term That Refers To Private Equity Firms or Investment Banks That Don'tAKSHAY GHADGEОценок пока нет

- India Fintech: 2 Edition - Executive SummaryДокумент22 страницыIndia Fintech: 2 Edition - Executive SummaryStacy100% (1)

- Venture Capital Research PaperДокумент5 страницVenture Capital Research Paperuyqzyprhf100% (1)

- Infosys SWOT: OpportunitiesДокумент3 страницыInfosys SWOT: Opportunitiesanon_307537838Оценок пока нет

- New Microsoft Word DocumentДокумент24 страницыNew Microsoft Word DocumentSukhdeep SinghОценок пока нет

- How To Enter Indian MarketДокумент13 страницHow To Enter Indian MarketRohit ChaturvediОценок пока нет

- Foreign Exchange Hedging HCL TechДокумент61 страницаForeign Exchange Hedging HCL TechNilesh Mandlik100% (1)

- Fe and Risk ManagementДокумент61 страницаFe and Risk ManagementAnonymous iBiM9MaОценок пока нет

- AI4 Corporations Volume III: Navigating AI Compliance With Confidence: AI4От EverandAI4 Corporations Volume III: Navigating AI Compliance With Confidence: AI4Оценок пока нет

- Business Innovation: How companies achieve success through extended thinkingОт EverandBusiness Innovation: How companies achieve success through extended thinkingОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Investments - Background and Issues: Financial Versus Real AssetsДокумент5 страницInvestments - Background and Issues: Financial Versus Real AssetsLex Acads100% (1)

- Asiaciti Trust Fact Sheet - About SingaporeДокумент3 страницыAsiaciti Trust Fact Sheet - About SingaporesatnerepОценок пока нет

- Derivatives Interview QuestionsДокумент14 страницDerivatives Interview Questionsanil100% (3)

- AGP-AMDe Ethiopia Warehouse Receipt System A Case For Expansion ReportДокумент35 страницAGP-AMDe Ethiopia Warehouse Receipt System A Case For Expansion ReportpoorfarmerОценок пока нет

- Estimation and Forecasting of Stock Volatility With Range - Based EstimatorsДокумент22 страницыEstimation and Forecasting of Stock Volatility With Range - Based EstimatorsRahul PinnamaneniОценок пока нет

- Public Islamic Sector Select FundДокумент4 страницыPublic Islamic Sector Select FundArmi Faizal AwangОценок пока нет

- Bonanza Portfolio Ltd...Документ60 страницBonanza Portfolio Ltd...Ashish Gupta100% (2)

- Business PlanДокумент30 страницBusiness PlanDeepak SinghОценок пока нет

- Nest TraderДокумент74 страницыNest Traderpercysearch100% (1)

- Options TradingДокумент29 страницOptions TradingArmi Faizal Awang78% (9)

- Dan Sheridan Adjust Condors in Volatile MarketДокумент49 страницDan Sheridan Adjust Condors in Volatile MarketOptionPoncho100% (2)

- Saudi Budget Raises Prospect of Prolonged Oil Market Glut: Email Is For Oldies New Brooms Still WatersДокумент26 страницSaudi Budget Raises Prospect of Prolonged Oil Market Glut: Email Is For Oldies New Brooms Still WatersstefanoОценок пока нет

- Foundations of Finance MidtermДокумент2 страницыFoundations of Finance MidtermVamsee JastiОценок пока нет

- 2 Fin. Intermediaries & InnovationДокумент29 страниц2 Fin. Intermediaries & InnovationIbna Mursalin ShakilОценок пока нет

- How To Define Illegal Price Manipulation by Albert S Kyle and S ViswanathanДокумент12 страницHow To Define Illegal Price Manipulation by Albert S Kyle and S ViswanathanJim ChappellОценок пока нет

- 2019 FRM Pe1 PDFДокумент156 страниц2019 FRM Pe1 PDFPrachet Kulkarni86% (7)

- Page 59Документ24 страницыPage 59Diana SalomaОценок пока нет

- Chapter 3Документ94 страницыChapter 3Lee Eng ShengОценок пока нет

- TCS Letter of Offer - 160520171432Документ40 страницTCS Letter of Offer - 160520171432deipakguptaОценок пока нет

- Mini Project MBAДокумент12 страницMini Project MBAsandeepreddy1886Оценок пока нет

- Tao of AlphaДокумент11 страницTao of Alphakibrahim55Оценок пока нет

- January March 08 Co 5Документ4 страницыJanuary March 08 Co 5Pranav ViraОценок пока нет

- Volatility Contraction PatternДокумент1 страницаVolatility Contraction PatternJames MelchorОценок пока нет

- 7284Документ85 страниц7284Leomerson PicarОценок пока нет

- Web: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Документ57 страницWeb: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Luke RobinsonОценок пока нет

- Vietnam Airlines ProspectusДокумент116 страницVietnam Airlines Prospectusabbdeals67% (3)

- Capital ExposureДокумент12 страницCapital ExposureNatalie SkinnerОценок пока нет

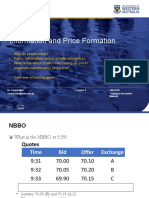

- Information and Price FormationДокумент36 страницInformation and Price FormationDylan AdrianОценок пока нет

- Chapter 05 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Документ196 страницChapter 05 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (3)