Академический Документы

Профессиональный Документы

Культура Документы

Kontrak Perkuliahan Analisa Bisnis & Valuasi Genap 2015-2016

Загружено:

Inanda Shinta AnugrahaniАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Kontrak Perkuliahan Analisa Bisnis & Valuasi Genap 2015-2016

Загружено:

Inanda Shinta AnugrahaniАвторское право:

Доступные форматы

KONTRAK PERKULIAHAN

BUSINESS ANALYSIS AND VALUATION

PROGRAM STUDI MAGISTER ILMU AKUNTANSI

FAKULTAS EKONOMI DAN BISNIS - UNIVERSITAS AIRLANGGA

KONTRAK PERKULIAHAN

BUSINESS ANALYSIS AND VALUATION

Deskripsi Mata Kuliah

Mata kulliah ini mengajarkan kepada mahasiswa tentang bagaimana para analis

keuangan, calon investor, investor memanfaatkan informasi keuangan yang disajikan

dalam laporan keuangan untuk mengevaluasi kondisi keuangan suatu perusahaan dan

valuasi sebagai bahan pertimbangan dalam pengambilan keputusan investasi pada surat

berharga. Disamping ittu juga dipakai sebagai bahan evaluasi terhadap kinerja

perusahaan, sehingga dapat diketahui kekuatan dan kelemahan perusahaan untuk

pertimbangan keputusan manajemen dalam rangka peningkatan nilai perusahaan.

Tujuan Instruksional Umum

Setelah mempelajari mata kuliah ini, mahasiswa diharapkan dapat menganalisis dan

mengevaluasi informasi keuanganyang disajikan dalam laporan keuangan. Sebagai bahan

pertimbangan dalam menentukan nilai (valuasi) dan risiko untuk pengambilan keputusan

investasi dan keputusan manajemen bagi pihak emiten dalam rangka peningkatan nilai

perusahaan.

Metode Kuliah

Pengajaran mata kuliah ini diselenggarakan dalam bentuk diskusi kelas. Peserta diberi

tugas membuat resume dari pokok-pokok bahasan yang ada pada buku wajib maupun

buku tambahan, mempresentasikan di kelas dan diskusi dengan pengarahan dosen yang

mengajar.

Penilaian Prestasi

Mekanisme Penilaian

Item Penilaian

-

Tugas dan Kuis

Bobot

30 %

- Partisipasi dalam diskusi

30 %

- Ujian

40 %

Ketentuan lain yang harus dipenuhi

1. Kehadiran kuliah mahasiswa minimal 75%

dari total Tatap Muka.

2. Tugas dibuat untuk didiskusikan dan harus

dikumpulkan pada minggu berikutnya

(setelah tugas diumumkan).

Total

100 %

3. Kuis diberikan se waktu waktu

Buku Wajib

1. Palepu, Healy, Bernard, 2013. Business Analysis and Valuation, 5th edition,

South-Western College Publishing. (code : PHB)

2. Wild, John J, Subramanyan, Halsey, 2009. Financial Statement Analysis,

10th edition, Mc Graw Hill (code: WSH)...11th edition

3. Ellis J. Williams, David, 1993. Corporate Strategy and Financial Analysis,

Pearson Education Limited.

4. Foster, George, 1986. Financial Statement Analysis, 2nd edition, Prentice

Hall, New Jersey. (code : GF)

Rencana Kuliah

Minggu

Pokok

ke

Bahasan

1

A Framework

of for Business

Analysis and

Valuation

Using Financial

Stataement

dan Business

Strategy

Analysis

2,3

Overview and

implementing

Accounting

Analysis

Sub Pokok Bahasan

Bacaan

- The role of financial reporting in capital

PHB Ch.1,2

market

- The demand and supply for financial GF Ch. 1, 2

statement information

- From business activities to financial

WSH Ch. 1

statement

- From financial statement to business

analysis

- Industry analysis

- Degree of actual and potential competition

- Bargaining power in input and output

markets

- The power of supply and buyers

- Competitive strategy analysis

- Corporate strategy analysis

- Institutional framework for financial

PHB Ch. 3,4

reporting

- Accrual accounting

GF Ch. 4,5

- Delegation of reporting to management

Dosen

SMS

WDW

Financial

Analysis

Prospective

Analysis:

Forecasting

Prospective

Analysis:

Valuation

Theory and

Concepts

Prospective

Analysis:

Valuation

Implementation

- Factors influencing accounting quality

- Steps in performing accounting analysis

- Value of accounting data and accounting

analysis

- Recasting financial statement

- Overstated and understated assets

- Understated liabilities

- Equity distortion

- Ratio analysis

- Decomposing profitability

- Assessing operating management

- Evaluating investment management

- Evaluating financial management

- Assessing sustainable growth rate

- Cash flow analysis

-

Overall structure of forecast

Practical framework of forecast

Performance behavior

Sales growth behavior

Earnings behavior

Relationship of forecasting to other

analysis

Making forecasts

Sensitivity analysis

Defining value for shareholder

Discounted dividends valuation models

Discounted abnormal earnings valuation

models

Valuation using price multiples

Shortcut forms of earnings based

valuation

Discounted cash flow model

Comparing valuation methods

Computing a discount rate

Detailed forecasts of performance

Terminal values

Computing assets and equity va;ues

Some practical issues in valuation

WSH Ch. 2,

3, 4, 5, 6.

PHB Ch.5

WDW

GF Ch.3,6,7

WSH Ch. 7,

8

PHB Ch. 6

GF Ch. 8

SMS

WSH Ch. 9

PHB Ch. 7

SMS

GF Ch. 12

WSH Ch 9

PHB Ch. 8

SMS

WSH Ch 9

UJIAN TENGAH SEMESTER

8

Capital Market

and Financial

Information

- Investor objective and investment vehicle

- Equity security analysis and market

efficiency

- Active and passive managementinvestment approach

PHB Ch. 9

GF Ch. 9,11

SMS

Assets Pricing

and Financial

Statement

Information

10

Loan Decisions

and Financial

Information

11

Debt Rating,

Credit Analysis

and Distress

Prediction

12

Corporate

Restructuring

and Financial

Information

13

Communication

and

Governance

- Capital market reaction to firm oriented

announcements

- Association between security returns and

account earning

- Market efficiency anomalies

- Equilibrium theories of equity security

expected returns (CAPM, APT and

linkage between CAPM and APT)

- Equilibrium theory of option pricing

- Economic determinants of beta and

variance

- Estimation of beta and variance

- Information source for loan decisions

- Descriptive analysis of existing loans

decision

- Quantitative approach to loan decision

- Existing loan decision and accounting

alternatives

- Rating of debt securities

- Market for credit

- Credit analysis process in private debt

markets

- Financial statement analysis and public

debt

- Prediction of distress and turnaround

- Explaining corporate restructuring behavior

- Source of value in corporate restructuring

- Information source about firm value

- Motivation for merger and acquisition

- Acquisition pricing

- Acquisition financing and form of payment

- Acquisition outcome

- Governance overview

- Management communication with

investor

- Communication through financial

reporting

- Communication through financial policies

- Alternate forms of investor

communication

GF Ch. 10

NA

GF Ch. 16

NA

WSH Ch 11

PHB Ch. 10

PHB Ch. 10

NA

GF Ch.14,

15

PHB Ch. 11

GF Ch. 13

NA

PHB Ch. 12

NA

14

Kasus- Kasus

UJIAN AKHIR SEMESTER

Dosen:

Dr. Wiwiek Dianawati, MSi., Ak.

Prof. Dr. Hj Sri Maemunah Soeharto, SE.

Nartyan Adhana, SE., MBA.

(WDW) PJMK

(SMS)

(NA)

Вам также может понравиться

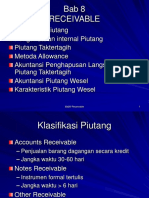

- Bab 8-ReceivableДокумент12 страницBab 8-ReceivableInanda Shinta AnugrahaniОценок пока нет

- Saks Fifth Avenue Case AuditДокумент5 страницSaks Fifth Avenue Case AuditInanda Shinta AnugrahaniОценок пока нет

- Perbedaan Belajar Dan PembelajaranДокумент9 страницPerbedaan Belajar Dan PembelajaranInanda Shinta Anugrahani0% (2)

- Lembar Jawaban Akuntansi ETAPДокумент15 страницLembar Jawaban Akuntansi ETAPInanda Shinta AnugrahaniОценок пока нет

- Teori ValuasiДокумент10 страницTeori ValuasiInanda Shinta AnugrahaniОценок пока нет