Академический Документы

Профессиональный Документы

Культура Документы

2016 VAT Rate Changes in Europe - Table - Digital

Загружено:

Julie CarpenterИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2016 VAT Rate Changes in Europe - Table - Digital

Загружено:

Julie CarpenterАвторское право:

Доступные форматы

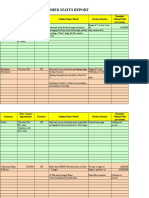

2016 VAT rate changes in Europe

comparison table

2015 rate

Country

Albania

Austria

Belgium

Czech

Republic

France

Greece

Hungary

Iceland

Italy

Kazakhstan

Standard

rate

20%

Reduced

rate

NA

Change in 2016

Standard

rate

No change

Reduced

rate

No change

Reduced rate increased from 10%

to 13%, applicable on the following

items:

Albania is discussing

cutting the VAT rate on

tourism from 20% to 5%

Changed plans

Reduced rate

21%

6% reduced VAT rate: Newspapers; hotels;

medical; housing and construction;

tourism; sporting events; art; immovable

property renovation

12% reduced VAT rate: Restaurants; social housing

21%

15% reduced VAT rate: Foodstuffs; livestock;

water and domestic fuel; books and newspapers;

construction; cultural and sports events;

household services

10% reduced VAT rate: Medicines,

pharmaceuticals, e-books and baby foodstuffs

No change

No change

NA

VAT law under which

a 17.5% unified VAT

rate was due to apply

with effect from 1

January, 2016 has

been abolished

20%

10% reduced VAT rate: Hotels; foodstuffs;

transport; restaurants

5.5% reduced VAT rate: Basic foodstuffs; print and

digital books and journals; water

2.1% reduced VAT rate: Print and

digital newspapers

No change

Increase in reduced VAT on e-books from

5.5% to 20%

1 January, 2016

23%

13% reduced VAT rate: Basic foodstuffs;

hotel accommodation

6% reduced VAT rate: Some foodstuffs

and medicines

NA

Another set of Greek islands to lose tax

privileges and witness a VAT hike from

1 June, 2016

27%

18% reduced VAT rates: Basic foodstuffs;

hotels 5% reduced VAT rate: Medical: books;

domestic heating

2016

24%

11% reduced VAT rate on: hotels; books; TV

broadcasting; foodstuffs

1 January, 2016

22%

10% reduced VAT rate: basic foodstuffs; domestic

energy; telephony

4% reduced VAT rate: livestock; print newspapers

No change

No change

No change

public museums and galleries

Domestic air travel

Sales of certain animal feeds

Hotel accommodation

Printed books, newspapers

and magazines

Residential property rent

No change

No change

No change

Reduced VAT on new build homes from

27% to 5% (Lawmakers approved a

bill to reduce VAT on new build homes

between 2016 and 2019)

No change

The reduced rate VAT will be applied to

passenger transportation for recreational

purposes and services provided by travel

agents and organisers

No change

18%

No change

25%

15% reduced VAT rate: Foodstuffs and beverages

11.11% reduced VAT rate: Supply of fish

8% reduced VAT rate: Certain cultural and

sporting activities

No change

23%

8% reduced VAT rate: Construction; broadcasting;

newspapers and journals; foodstuffs; catering

5% reduced VAT rate: Basic foodstuffs;

printed books

Romania

24%

9% reduced VAT rate: Hotels; cultural events;

medicine; books and newspapers

5% reduced VAT rate: Real estate

Serbia

20%

10% reduced VAT rate: Basic foodstuffs; gas;

tourism accommodation; live and cultural events

No change

Accommodation services in the tourism

industry will be subject to the reduced

VAT rate of 10%

Slovakia

20%

10% reduced VAT rate: Medical and

pharmaceuticals; printed materials

No change

The level of VAT will be reduced from

20% to 10% on freshwater fish (not

frozen), fresh bread, milk and butter

Note: NA denotes not applicable.

Source: VATlive, news articles.

No change

No change

7% reduced VAT rate: Hotels and accommodation

5% reduced VAT rate: Medical supplies;

books; live events and cultural attractions;

some foodstuffs

Poland

Any ongoing

discussions

20%

Cultural events, including entrance to

NA

Norway

NA

Other changes applicable from

2016

10% reduced rate: Foodstuffs; books; hotels and

tourism; passenger transport; pharmaceuticals

12% reduced rate: Domestic wine production and

supply

19% reduced rate: Supplies from

the Jungholz region

12%

Malta

Time of

application

No change

VAT on sport activities, such as gym

memberships, fitness centres, football

nurseries and other sports facilities shall

be at 7% instead of 18%

Lowest rate of VAT will be increasing

from 8% to 10%

changes except

hotel VAT hike

applicable from

January, 2016

Hotel VAT hike

applicable from

May, 2016

NA

VAT exemption on plastic surgery

abolished: Plastic surgery (of a

non-therapeutic nature), medical care

and hospitalisation related to this

treatment will be subject to a 21%

standard rate from 1 January, 2016

For 2016, it was

envisaged that the

rate could rise to

24%. However, Italy

confirmed in its draft

budget for 2016

to the EU that its

standard rate of VAT

will not increase

Kazakhstan has approved plans to

withdraw its VAT regime next year. It

will be replaced with a simple Sales

Tax. This will be levied at 12%, too, on

cash payments. To discourage nondisclosure, there will be a discount

on this for invoices settled by bank

transfers the rate will be 7%

1 January, 2016

1 January, 2016

No change

No change

NA

Poland has

abandoned plans to

cut its standard VAT

rate from 23% to 22%

from 1 January, 2016

20%

No change

1 January, 2016

October, 2016

Beginning of 2016

tmf-group.com

Вам также может понравиться

- What Are Gmps AnywayДокумент4 страницыWhat Are Gmps Anywaymelfer100% (2)

- The Cheeses of ItalyДокумент113 страницThe Cheeses of ItalyCAPRINOS BAJA CALIFORNIA SUR, MEXICO100% (2)

- MarketingДокумент26 страницMarketingPatavi43% (14)

- Sweet Neighbour Business PlanДокумент43 страницыSweet Neighbour Business PlanLeona Consigo86% (7)

- ABM - AE12 - 003 - Economic Problems and Socio-Economic Statuso of The PhilippinesДокумент31 страницаABM - AE12 - 003 - Economic Problems and Socio-Economic Statuso of The PhilippinesAries Gonzales Caragan79% (14)

- Bag Filter Calculation1234567 IPДокумент24 страницыBag Filter Calculation1234567 IPsujith kumarОценок пока нет

- Nirc and Train PDFДокумент5 страницNirc and Train PDFCedricОценок пока нет

- TLE7 HE COOKERY Mod6 Calculating Cost of Production v5Документ24 страницыTLE7 HE COOKERY Mod6 Calculating Cost of Production v5Cristina Rhain WinterОценок пока нет

- Wharton Casebook 2008 For Case Interview Practice - MasterTheCaseДокумент84 страницыWharton Casebook 2008 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (1)

- Project Report Mother DairyДокумент54 страницыProject Report Mother DairyRavinder Kasana67% (9)

- Ireland Cuts VAT For Hotels and RestaurantsДокумент3 страницыIreland Cuts VAT For Hotels and Restaurantssmalathipriyacse1987Оценок пока нет

- Vat Polish ActДокумент2 страницыVat Polish Actcris_ileana_39763320Оценок пока нет

- Measures On The Revenue Side: The Main Priorities of The Tax Policy Are Aimed atДокумент3 страницыMeasures On The Revenue Side: The Main Priorities of The Tax Policy Are Aimed atRadulescuCristianОценок пока нет

- Micro IleriДокумент5 страницMicro IleriIleri PromiseОценок пока нет

- Remi Troch: Tax Changes of Fiscal Policy in Latvia. Comparison of Tax Rates in The Baltic StatesДокумент11 страницRemi Troch: Tax Changes of Fiscal Policy in Latvia. Comparison of Tax Rates in The Baltic StatesBDO TaxОценок пока нет

- VAT Romania 1aprilДокумент2 страницыVAT Romania 1aprilMaria Gabriela PopaОценок пока нет

- Taxation Trends in The European Union - 2012 68Документ1 страницаTaxation Trends in The European Union - 2012 68d05registerОценок пока нет

- Taxation Trends in The European Union - 2012 172Документ1 страницаTaxation Trends in The European Union - 2012 172d05registerОценок пока нет

- Rayan Sibari - Global Economics IAДокумент2 страницыRayan Sibari - Global Economics IARayan SibariОценок пока нет

- Poland VAT Payment Delays For Coronavirus Crisis Delays SAF-T Replacement of VATДокумент3 страницыPoland VAT Payment Delays For Coronavirus Crisis Delays SAF-T Replacement of VATtriptiiОценок пока нет

- Excise Duties System in Croatia Closer To The European SystemДокумент8 страницExcise Duties System in Croatia Closer To The European SystemDevi Albaiti JannatiОценок пока нет

- 9) La Taxe Sur La Valeur AjoutéeДокумент7 страниц9) La Taxe Sur La Valeur AjoutéesoukainaОценок пока нет

- Briefer On Sin Tax Law FINALДокумент2 страницыBriefer On Sin Tax Law FINALCHow GatchallanОценок пока нет

- MICRO ExternalitiesДокумент5 страницMICRO ExternalitiesOmar SrourОценок пока нет

- Press Release: Date ContactДокумент3 страницыPress Release: Date ContactAdrianaGrigoreОценок пока нет

- Tobacco in VietnamДокумент22 страницыTobacco in Vietnamvinhpp0308Оценок пока нет

- ECO FaДокумент3 страницыECO FakrishhthegreatОценок пока нет

- Vat On Importation: Presumptive Input TaxДокумент13 страницVat On Importation: Presumptive Input TaxNerish PlazaОценок пока нет

- Taxation Trends in The European Union - 2012 176Документ1 страницаTaxation Trends in The European Union - 2012 176d05registerОценок пока нет

- Tema 06 Gaci EnglishДокумент3 страницыTema 06 Gaci EnglishCari RomeroОценок пока нет

- The Croatian Tax ReformДокумент27 страницThe Croatian Tax ReformMeri DubretaОценок пока нет

- 2017 PWC-europe PDFДокумент715 страниц2017 PWC-europe PDFaammОценок пока нет

- Republic Act No. 10963Документ6 страницRepublic Act No. 10963Rochelle GalidoОценок пока нет

- ESPN - Flash Report 2016-11 - RS - January 2016Документ2 страницыESPN - Flash Report 2016-11 - RS - January 2016George AntonОценок пока нет

- 01 S&D - Closing The European Tax Gap 2Документ1 страница01 S&D - Closing The European Tax Gap 2Dimitris ArgyriouОценок пока нет

- Assessment 2A. International Monetary EconomicsДокумент6 страницAssessment 2A. International Monetary EconomicsBình MinhОценок пока нет

- The Impact of Increase in Taxes of Alcoholic Beverages On Filipinos' Alcohol ConsumptionДокумент17 страницThe Impact of Increase in Taxes of Alcoholic Beverages On Filipinos' Alcohol Consumptiongeyb awayОценок пока нет

- Travel in Finland: Euromonitor International November 2020Документ13 страницTravel in Finland: Euromonitor International November 2020studyhotelsОценок пока нет

- The Contribution Made by Beer 2011Документ290 страницThe Contribution Made by Beer 2011Alina AleksyeyenkoОценок пока нет

- Economics Article 6Документ2 страницыEconomics Article 6daria p.Оценок пока нет

- Tax Reform For Acceleration and Inclusion (TRAIN) LAW: FeaturesДокумент5 страницTax Reform For Acceleration and Inclusion (TRAIN) LAW: FeaturesAnni PagkatipunanОценок пока нет

- Financial Bill 2009Документ10 страницFinancial Bill 2009Tanuj GuptaОценок пока нет

- Consumer Prices Index - PTДокумент6 страницConsumer Prices Index - PTJosé António Cardoso RodriguesОценок пока нет

- Consumer Index: Inside This IssueДокумент13 страницConsumer Index: Inside This IssueFlorinDОценок пока нет

- España Analisis MacroeconomicoДокумент15 страницEspaña Analisis MacroeconomicoJaime SánchezОценок пока нет

- 130 2016 TT-BTC 323146Документ15 страниц130 2016 TT-BTC 323146LET LEARN ABCОценок пока нет

- Portugal Economy ReportДокумент17 страницPortugal Economy Reportsouravsingh1987Оценок пока нет

- Taxation Trends in The European Union - 2012 91Документ1 страницаTaxation Trends in The European Union - 2012 91d05registerОценок пока нет

- Activity 1. Problem-Solving SituationДокумент19 страницActivity 1. Problem-Solving SituationAnaОценок пока нет

- Press Release Beer Market 2012Документ4 страницыPress Release Beer Market 2012Andy ZanОценок пока нет

- Anant Chandani 207107 Section-A Industry Readiness Assignment-1Документ15 страницAnant Chandani 207107 Section-A Industry Readiness Assignment-1sauravОценок пока нет

- Excise Duties-Part I Alcohol enДокумент33 страницыExcise Duties-Part I Alcohol enscribd01Оценок пока нет

- Raport Luka Vat enДокумент44 страницыRaport Luka Vat enZam HiaОценок пока нет

- Impact of Covid-19 On World TourismДокумент8 страницImpact of Covid-19 On World Tourismvansh sharmaОценок пока нет

- Increasing The Value of Tax Free Shopping For EU Destination EconomiesДокумент5 страницIncreasing The Value of Tax Free Shopping For EU Destination EconomiesTatianaОценок пока нет

- EEI2019 Cuba enДокумент6 страницEEI2019 Cuba enohpppОценок пока нет

- Edit (Econ)Документ7 страницEdit (Econ)Anonymous B6CLMEYHKiОценок пока нет

- Spain After BREXITДокумент1 страницаSpain After BREXITLikhit RustagiОценок пока нет

- Autumn Statement 2014Документ5 страницAutumn Statement 2014Martin ForsytheОценок пока нет

- Value Added Tax in Romania VAT TVAДокумент6 страницValue Added Tax in Romania VAT TVAmondlyОценок пока нет

- Drinken Case 1 Int KMKTGДокумент10 страницDrinken Case 1 Int KMKTGangie tatianaОценок пока нет

- Nirc and TrainДокумент5 страницNirc and TrainJasmine Marie Ng CheongОценок пока нет

- The Political Economy of Tobacco TaxationДокумент28 страницThe Political Economy of Tobacco TaxationJo-LieAngОценок пока нет

- Reserve Bank of AngolaДокумент10 страницReserve Bank of AngolaKahimbiОценок пока нет

- Cosmetics, Beauty Supplies & Perfume Store Revenues World Summary: Market Values & Financials by CountryОт EverandCosmetics, Beauty Supplies & Perfume Store Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesОт EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesОценок пока нет

- Full-Service Restaurant Lines World Summary: Market Values & Financials by CountryОт EverandFull-Service Restaurant Lines World Summary: Market Values & Financials by CountryОценок пока нет

- Pharmacies & Drug Store Revenues World Summary: Market Values & Financials by CountryОт EverandPharmacies & Drug Store Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- 7C08 Pillsbury DR2RBДокумент6 страниц7C08 Pillsbury DR2RBNaveed YousafОценок пока нет

- Dangerous Food AdditivesДокумент1 страницаDangerous Food AdditivesMartin EverettОценок пока нет

- Setting Up: Assignment On My Business PlanДокумент15 страницSetting Up: Assignment On My Business PlanBasheer HaiderОценок пока нет

- Chipsmore Final PropasalДокумент3 страницыChipsmore Final PropasalJia HuiОценок пока нет

- Decline Stage in The Product Life Cycle With Sample CompanyДокумент2 страницыDecline Stage in The Product Life Cycle With Sample CompanyJerome CarbonellОценок пока нет

- WWW Joaa Net English Teikei HTM Ch1Документ17 страницWWW Joaa Net English Teikei HTM Ch1Paul GhingaОценок пока нет

- A Community-Based Mothers and Infants CenterДокумент10 страницA Community-Based Mothers and Infants CenterRazonable Morales RommelОценок пока нет

- Demographic Segmentation Criteria Include AgeДокумент3 страницыDemographic Segmentation Criteria Include AgeDaniella Mae ElipОценок пока нет

- Customer Status Update Report 27th January 2015 ColourДокумент20 страницCustomer Status Update Report 27th January 2015 ColourmaryОценок пока нет

- 7 - Ps - of - Marketing - in - Service - Industry As On123 PDFДокумент2 страницы7 - Ps - of - Marketing - in - Service - Industry As On123 PDFRajan SisodiyaОценок пока нет

- Tender No. SH/01/2017-2019Документ15 страницTender No. SH/01/2017-2019State House Kenya100% (7)

- Implications of Wto On Indian Agriculture SectorДокумент55 страницImplications of Wto On Indian Agriculture Sectorveronica_rachnaОценок пока нет

- Marketing KFCДокумент27 страницMarketing KFCapi-264963079Оценок пока нет

- Checklist Gmpplus b1 en 20170701Документ26 страницChecklist Gmpplus b1 en 20170701Aiko Mara VillanuevaОценок пока нет

- Quest Story PDFДокумент2 страницыQuest Story PDFTarannum Yogesh DobriyalОценок пока нет

- Agricultural Cooperatives in VietnamДокумент17 страницAgricultural Cooperatives in VietnamAnonymous T4ptPKXОценок пока нет

- Gold Anchor F&B and Culinary Review 2010A IndependenceДокумент66 страницGold Anchor F&B and Culinary Review 2010A Independencegellu77Оценок пока нет

- Business Law Textbook 2017Документ388 страницBusiness Law Textbook 2017BitrusОценок пока нет

- KyotoGuidebook PDFДокумент30 страницKyotoGuidebook PDFhantarto5844Оценок пока нет

- Usbn 2018 Inggris Soal (Paket 1 2013)Документ14 страницUsbn 2018 Inggris Soal (Paket 1 2013)Daffa RamadhaniОценок пока нет

- Discounts For DCPS Teachers May 2014Документ4 страницыDiscounts For DCPS Teachers May 2014DC Public SchoolsОценок пока нет