Академический Документы

Профессиональный Документы

Культура Документы

Business Associations Fall 2016

Загружено:

Jenna AliaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Business Associations Fall 2016

Загружено:

Jenna AliaАвторское право:

Доступные форматы

BUSINESS ASSOCIATIONS GADINIS FALL 2016

BUSINESS ASSOCIATIONS FALL 2016

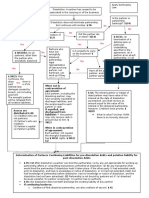

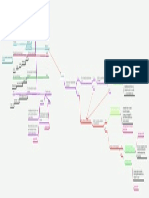

1. ATTACK OUTLINE

1.1.

2. INTRODUCTION

2.1.

Introduction to the Law of Enterprise Organization

A.

3. ACTING THROUGH OTHERS: THE LAW OF AGENCY

3.1.

Introduction to Agency

A.

3.2.

Agency Formation & Termination

A.

3.3.

Liability in Contract

A.

3.4.

Liability in Tort

A.

3.5.

The Governance of Agency

A.

4. THE PROBLEM OF JOINT OWNERSHIP: THE LAW OF

PARTNERSHIP

4.1.

Introduction to Partnership

A.

4.2.

Partnership Formation

A.

4.3.

Partnership Governance & Issues of Authority

A.

4.4.

Statutory Dissolution of Partnership at Will

A.

4.5.

Opportunistic Dissolution and the Partners Duty of Loyalty

A.

4.6.

Agency Conflicts Among Co-Owners: Fiduciary Duties

A.

4.7.

Limited Liability Successors of the General Partnership

Page 1 of 5

BUSINESS ASSOCIATIONS GADINIS FALL 2016

A.

5. THE CORPORATE FORM

5.1.

Introduction

A.

5.2.

Creation of a Fictional Legal Entity

A.

5.3.

Limited Liability

A.

5.4.

Transferable Shares

A.

5.5.

Centralized Management

A.

5.6.

State Competition in Corporate Law

A.

6. THE PROTECTION OF CREDITORS

6.1.

Mandatory Disclosure

A.

6.2.

Capital Regulation

A.

6.3.

Fraudulent Transfer & Equitable Subordination

A.

6.4.

Piercing the Corporate Veil

A.

6.5.

Multinationals and Veil Piercing

A.

7. NORMAL GOVERNANCE: THE VOTING SYSTEM

7.1.

The Role & Limits of Shareholder Voting

A.

7.2.

Electing & Removing Directors

A.

7.3.

Shareholder Meetings and Alternatives

A.

7.4.

Proxy Voting and Its Costs

A.

7.5.

Class Voting

Page 2 of 5

BUSINESS ASSOCIATIONS GADINIS FALL 2016

A.

7.6.

Shareholder Information Rights

A.

7.7.

Techniques for Separating Control from Cash Flow

A.

7.8.

Vote Buying

A.

7.9.

Controlling Minority Structures

A.

7.10. The Federal Proxy Rules

A.

7.11. Case Study: Shareholder Activism

A.

8. NORMAL GOVERNANCE: THE DUTY OF CARE

8.1.

Introduction

A.

8.2.

The Duty of Care & the Need to Mitigate Director Risk

Aversion

A.

8.3.

Statutory Techniques for Limiting Director & Officer Risk

Exposure

A.

8.4.

The Business Judgment Rule

A.

8.5.

The Boards Duty to Monitor: Losses Caused by Board

Passivity

A.

8.6.

Knowing Violations of the Law

A.

9. CONFLICT TRANSACTIONS: THE DUTY OF LOYALTY

9.1.

Duty to whom?

A.

9.2.

Self-Dealing Transactions

A.

9.3.

The Effect of Approval by a Disinterested Party

A.

9.4.

Controlling Shareholders and the Fairness Standard

Page 3 of 5

BUSINESS ASSOCIATIONS GADINIS FALL 2016

A.

9.5.

Corporate Opportunity Doctrine

A.

9.6.

Executive Compensation

A.

10.SHAREHOLDER SUITS

10.1. Distinguishing between Direct & Derivative Claims

A.

10.2. Solving a Collective Action Problem: Attorneys Fees and the

Incentive to Sue

A.

10.3. Standing Requirements

A.

10.4. Balancing Rights of Boards and Shareholders

A.

10.5. Special Litigation Committees

A.

10.6. Settlement and Indemnification

A.

10.7. When Are Derivative Suits in Shareholders Interests?

A.

11.TRANSACTIONS IN CONTROL

11.1. Seller of Control Blocks: The Sellers Duties

A.

11.2. Tender Offers: Buyer's Duties

A.

12.MERGERS & ACQUISITIONS

12.1.

A.

12.2.

A.

12.3.

A.

12.4.

A.

12.5.

Economic Motives for Mergers

Evolution of the U.S. Corporate Law of Mergers

The Allocation of Power in Fundamental Transactions

Overview of Transactional Form

The Appraisal Remedy

Page 4 of 5

BUSINESS ASSOCIATIONS GADINIS FALL 2016

A.

12.6. The De Facto Merger Doctrine

A.

12.7. The Duty of Loyalty in Controlled Mergers

A.

13.PUBLIC CONTESTS FOR CORPORATE CONTROL

13.1. Introduction

A.

13.2. Defending Against Hostile Tender Offers

A.

13.3. Private Law Innovation: The Poison Pill

A.

13.4. Choosing a Merger or Buyout Partner: Revlon, Its Sequels,

and Its Prequels

A.

13.5. Pulling Together Unocal and Revlon

A.

13.6. Protecting the Deal

A.

13.7. Proxy Contests for Corporate Control

A.

13.8. Current US Debate

A.

13.9. Corporations Outside of Business Law

A.

Page 5 of 5

Вам также может понравиться

- Basic Corporate Law OutlineДокумент59 страницBasic Corporate Law Outlinedylthethrill100% (2)

- Business Associations OutlineДокумент51 страницаBusiness Associations Outlinerugbgrrl5Оценок пока нет

- BA Outline 2009Документ48 страницBA Outline 2009EminKENОценок пока нет

- Business Associations OutlineДокумент52 страницыBusiness Associations OutlineChi Wen YeoОценок пока нет

- Corporations OutlineДокумент4 страницыCorporations OutlineKeith DyerОценок пока нет

- Corporations - Spring 2008Документ117 страницCorporations - Spring 2008herewegoОценок пока нет

- Business Associations Outline Fall 2011Документ63 страницыBusiness Associations Outline Fall 2011caro6032Оценок пока нет

- Business Associations OutlineДокумент114 страницBusiness Associations Outlinecahco281760Оценок пока нет

- MBCAДокумент172 страницыMBCAlissettm08Оценок пока нет

- LoPucki BusinessAssociation Fall 2014Документ203 страницыLoPucki BusinessAssociation Fall 2014thuiebooОценок пока нет

- Standard Test Chart Deal I MBC AДокумент16 страницStandard Test Chart Deal I MBC ADevorah GillianОценок пока нет

- Community Property TemplateДокумент3 страницыCommunity Property TemplateHaifa NeshОценок пока нет

- Corporations, Kraakman, Fall 2012Документ61 страницаCorporations, Kraakman, Fall 2012Chaim SchwarzОценок пока нет

- Babri EthicsДокумент24 страницыBabri EthicsuduhdhehОценок пока нет

- Business Associations OutlineДокумент170 страницBusiness Associations OutlineDave JohnsonОценок пока нет

- Corporations - Loewenstein - Spring 2007 - Alexande - Grade 97Документ45 страницCorporations - Loewenstein - Spring 2007 - Alexande - Grade 97a thaynОценок пока нет

- Corps Outline StoneДокумент63 страницыCorps Outline StoneBen VisserОценок пока нет

- My Ethics TemplatesДокумент52 страницыMy Ethics TemplatesAlejandro CuevasОценок пока нет

- Fall 2020 Barzuza CorporationsДокумент12 страницFall 2020 Barzuza Corporationsa thaynОценок пока нет

- The Corporate Form and The Specialized Roles of Shareholders, Directors, and OfficersДокумент28 страницThe Corporate Form and The Specialized Roles of Shareholders, Directors, and OfficersLeslie Lanay JonesОценок пока нет

- Business Associations Fall 2010 Fendler OutlineДокумент121 страницаBusiness Associations Fall 2010 Fendler OutlineJoshua Ryan Collums100% (1)

- Biz Orgs Outline: ÑelationshipsДокумент26 страницBiz Orgs Outline: ÑelationshipsTyler PritchettОценок пока нет

- Corps Final Outline WordДокумент30 страницCorps Final Outline Wordrmexico316Оценок пока нет

- Another BA OutlineДокумент97 страницAnother BA Outlineomidbo1100% (1)

- Business Associations Outline I. Entity Forms 1. S P O OДокумент29 страницBusiness Associations Outline I. Entity Forms 1. S P O OMattie ParkerОценок пока нет

- Community Property Math For Lawyers: The Moore FormulaДокумент6 страницCommunity Property Math For Lawyers: The Moore FormulaDenise NicoleОценок пока нет

- Biz Org OutlineДокумент151 страницаBiz Org OutlineMichael SihksnelОценок пока нет

- Corporations OutlineДокумент90 страницCorporations OutlinegsdqОценок пока нет

- Armour - Corporations - 2009F - Allen Kraakman Subramian 3rdДокумент153 страницыArmour - Corporations - 2009F - Allen Kraakman Subramian 3rdSimon Hsien-Wen HsiaoОценок пока нет

- Professional Responsibility OutlineДокумент30 страницProfessional Responsibility OutlineMarco FortadesОценок пока нет

- MPRE OutlineДокумент41 страницаMPRE Outlinekyw123Оценок пока нет

- UPA DissolutionДокумент1 страницаUPA DissolutionNiraj ThakkerОценок пока нет

- Trademark Law Beebe Fall 2013Документ45 страницTrademark Law Beebe Fall 2013a thaynОценок пока нет

- Corps - Clarke - Short OutlineДокумент14 страницCorps - Clarke - Short OutlineLal LegalОценок пока нет

- Corporations Characteristics: Corporation PartnershipДокумент16 страницCorporations Characteristics: Corporation PartnershipSamantha AbenesОценок пока нет

- Assignment #3 68-77 Assignment #5 106-115 Assignment #6 119-128Документ16 страницAssignment #3 68-77 Assignment #5 106-115 Assignment #6 119-128Marco Fortades0% (1)

- Blue TipsДокумент4 страницыBlue Tipsmaggie305Оценок пока нет

- Antitrust Kesselman Fall 2020Документ101 страницаAntitrust Kesselman Fall 2020Rhyzan CroomesОценок пока нет

- Business Associations OutlineДокумент4 страницыBusiness Associations OutlineJenna AliaОценок пока нет

- Wills Outline Summer 2007: Body of Law in NY Governing Wills & EstatesДокумент42 страницыWills Outline Summer 2007: Body of Law in NY Governing Wills & EstatesSiddoОценок пока нет

- Business Organizations Outline - Docx FINALДокумент67 страницBusiness Organizations Outline - Docx FINALHan FangОценок пока нет

- Antitrust - Longwell - Spring 2012Документ29 страницAntitrust - Longwell - Spring 2012fshahkОценок пока нет

- Entity ComparisonДокумент3 страницыEntity Comparisoncthunder_1Оценок пока нет

- O Gorton v. Doty, 1937Документ21 страницаO Gorton v. Doty, 1937Chris Miller0% (1)

- Fall Civ Pro I OutlineДокумент31 страницаFall Civ Pro I OutlineNicole AlexisОценок пока нет

- 36.1 Basic Concepts: Chapter 36 - AntitrustДокумент11 страниц36.1 Basic Concepts: Chapter 36 - AntitrustpfreteОценок пока нет

- Con Law Attack OLДокумент11 страницCon Law Attack OLAnonymous hyR5rKBINsОценок пока нет

- Con Law II NotesДокумент190 страницCon Law II NotesBОценок пока нет

- (Bus Org) (Moll) (Outline) (Spring 2009) DeLuccioДокумент85 страниц(Bus Org) (Moll) (Outline) (Spring 2009) DeLuccionabarrowОценок пока нет

- Antitrust-Law Outline 2011-Spring ElhaugeДокумент44 страницыAntitrust-Law Outline 2011-Spring Elhaugemusicalmitch724Оценок пока нет

- Zielinski V Philadelphia Piers, Inc.Документ2 страницыZielinski V Philadelphia Piers, Inc.crlstinaaaОценок пока нет

- II. Unfair Competition: Wilf Intellectual Property Spring 2016Документ35 страницII. Unfair Competition: Wilf Intellectual Property Spring 2016TR1912Оценок пока нет

- PPR Rules For MidtermДокумент11 страницPPR Rules For MidtermRonnie Barcena Jr.Оценок пока нет

- Review QuestionsДокумент80 страницReview QuestionsLandon HangОценок пока нет

- Outline - Agency & PartnershipДокумент19 страницOutline - Agency & PartnershipSaulОценок пока нет

- Constitutional Law OutlineДокумент41 страницаConstitutional Law OutlineLaura SkaarОценок пока нет

- BA Outline - ExamДокумент64 страницыBA Outline - ExamRegina SmithОценок пока нет

- Florida Real Estate Exam Prep: Everything You Need to Know to PassОт EverandFlorida Real Estate Exam Prep: Everything You Need to Know to PassОценок пока нет

- Contracts Sem 2Документ20 страницContracts Sem 2Zeeshan Ahmad R-67Оценок пока нет

- Be 20 6Документ25 страницBe 20 6ChelseaОценок пока нет

- Grantor O Grantee A 3rd Party B Present Interest (Possessory)Документ1 страницаGrantor O Grantee A 3rd Party B Present Interest (Possessory)Jenna AliaОценок пока нет

- Shepard Property OutlineДокумент75 страницShepard Property OutlineJenna AliaОценок пока нет

- Mbe - Contracts and SalesДокумент2 страницыMbe - Contracts and SalesJenna AliaОценок пока нет

- WILLS Bar Exam OutlineДокумент26 страницWILLS Bar Exam OutlineJenna Alia100% (2)

- Illinois Bar Exam Torts Outline With Illinois DistinctionsДокумент28 страницIllinois Bar Exam Torts Outline With Illinois DistinctionsJenna Alia100% (1)

- Illinois Bar Exam Torts Outline With Illinois DistinctionsДокумент28 страницIllinois Bar Exam Torts Outline With Illinois DistinctionsJenna Alia100% (1)

- Contracts KindaДокумент32 страницыContracts KindaJenna AliaОценок пока нет

- Business Associations OutlineДокумент4 страницыBusiness Associations OutlineJenna AliaОценок пока нет

- Secured Trans Bar Exam ChartsДокумент8 страницSecured Trans Bar Exam ChartsJenna Alia100% (1)

- Evidence: FRE 104 - Preliminary QuestionsДокумент77 страницEvidence: FRE 104 - Preliminary QuestionsLeah_McLaughli_77691% (11)

- Backup of BA OutlineДокумент24 страницыBackup of BA OutlineJenna AliaОценок пока нет

- Laycock ContentsДокумент12 страницLaycock ContentsJenna AliaОценок пока нет

- Of Points For Your Answer.: 1/3 Time On Reading and Thinking. 10 Mins 2/3 Time On Writing. 20 MinsДокумент2 страницыOf Points For Your Answer.: 1/3 Time On Reading and Thinking. 10 Mins 2/3 Time On Writing. 20 MinsJenna AliaОценок пока нет

- BusAss OutlineДокумент59 страницBusAss OutlineJenna AliaОценок пока нет

- LandUse Fall 2013Документ24 страницыLandUse Fall 2013Jenna AliaОценок пока нет

- Old Land Use OutlineДокумент49 страницOld Land Use OutlineJenna AliaОценок пока нет

- Latrun PDFДокумент94 страницыLatrun PDFJenna AliaОценок пока нет

- 2 - BA Attack OutlineДокумент41 страница2 - BA Attack OutlineJenna AliaОценок пока нет

- In Re Estate of Duke NotesДокумент2 страницыIn Re Estate of Duke NotesJenna Alia100% (2)

- 35 U.S.C. 100 (pre-AIA) DefinitionsДокумент3 страницы35 U.S.C. 100 (pre-AIA) DefinitionsJenna AliaОценок пока нет

- Counterclaims Analysis: The Answer To All Questions Must Be "Yes" For The Action To ProceedДокумент3 страницыCounterclaims Analysis: The Answer To All Questions Must Be "Yes" For The Action To ProceedJenna AliaОценок пока нет

- Outline - Land UseДокумент38 страницOutline - Land UseJenna Alia100% (1)

- Parol Evidence Rule OutlineДокумент32 страницыParol Evidence Rule OutlineJenna Alia100% (2)

- California Instestate SuccessionДокумент32 страницыCalifornia Instestate SuccessionJenna AliaОценок пока нет

- Answer The Statements Below by Boxing The Past Perfect TenseДокумент1 страницаAnswer The Statements Below by Boxing The Past Perfect TenseMa. Myla PoliquitОценок пока нет

- Jesus Hold My Hand EbДокумент2 страницыJesus Hold My Hand EbGregg100% (3)

- Seminars - 09-12-2022 - Vanessa AQUINO CHAVESДокумент3 страницыSeminars - 09-12-2022 - Vanessa AQUINO CHAVESVanessa AquinoОценок пока нет

- NURS FPX 6021 Assessment 1 Concept MapДокумент7 страницNURS FPX 6021 Assessment 1 Concept MapCarolyn HarkerОценок пока нет

- Robert FrostДокумент15 страницRobert FrostRishi JainОценок пока нет

- Adrenal Cortical TumorsДокумент8 страницAdrenal Cortical TumorsSabrina whtОценок пока нет

- Lyndhurst OPRA Request FormДокумент4 страницыLyndhurst OPRA Request FormThe Citizens CampaignОценок пока нет

- Peer-to-Peer Lending Using BlockchainДокумент22 страницыPeer-to-Peer Lending Using BlockchainLuis QuevedoОценок пока нет

- WIKAДокумент10 страницWIKAPatnubay B TiamsonОценок пока нет

- Chapter 14AДокумент52 страницыChapter 14Arajan35Оценок пока нет

- Comparing ODS RTF in Batch Using VBA and SASДокумент8 страницComparing ODS RTF in Batch Using VBA and SASseafish1976Оценок пока нет

- Grammar: English - Form 3Документ39 страницGrammar: English - Form 3bellbeh1988Оценок пока нет

- Haryana at A Glance: Geographical AreaДокумент1 страницаHaryana at A Glance: Geographical AreasonuОценок пока нет

- Cui Et Al. 2017Документ10 страницCui Et Al. 2017Manaswini VadlamaniОценок пока нет

- Pengaruh Abu Batu Sebagai Subtitusi Agregat Halus DanДокумент10 страницPengaruh Abu Batu Sebagai Subtitusi Agregat Halus Danangela merici rianawatiОценок пока нет

- Skylab Our First Space StationДокумент184 страницыSkylab Our First Space StationBob AndrepontОценок пока нет

- Mythologia: PrologueДокумент14 страницMythologia: ProloguecentrifugalstoriesОценок пока нет

- Highway Capacity ManualДокумент13 страницHighway Capacity Manualgabriel eduardo carmona joly estudianteОценок пока нет

- Part A Questions and AnswersДокумент10 страницPart A Questions and Answerssriparans356Оценок пока нет

- Why The American Ruling Class Betrays Its Race and CivilizationДокумент39 страницWhy The American Ruling Class Betrays Its Race and CivilizationNinthCircleOfHellОценок пока нет

- Honey ProcessingДокумент5 страницHoney Processingvenkatrao_gvОценок пока нет

- University of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveДокумент4 страницыUniversity of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveSupriyo BiswasОценок пока нет

- Deep MethodДокумент13 страницDeep Methoddarkelfist7Оценок пока нет

- Batman Animated (1998) (Scan) (Stacalkas)Документ169 страницBatman Animated (1998) (Scan) (Stacalkas)João Gabriel Zó100% (11)

- Rotation and Revolution of EarthДокумент4 страницыRotation and Revolution of EarthRamu ArunachalamОценок пока нет

- Horgolás Minta - PulcsiДокумент5 страницHorgolás Minta - PulcsiCagey Ice-RoyОценок пока нет

- Tim Horton's Case StudyДокумент8 страницTim Horton's Case Studyhiba harizОценок пока нет

- Evolution Epidemiology and Etiology of Temporomandibular Joint DisordersДокумент6 страницEvolution Epidemiology and Etiology of Temporomandibular Joint DisordersCM Panda CedeesОценок пока нет

- 61 Point MeditationДокумент16 страниц61 Point MeditationVarshaSutrave100% (1)

- Judicial Review of Legislative ActionДокумент14 страницJudicial Review of Legislative ActionAnushka SinghОценок пока нет