Академический Документы

Профессиональный Документы

Культура Документы

Resume Li Cui Jhu

Загружено:

api-340127718Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Resume Li Cui Jhu

Загружено:

api-340127718Авторское право:

Доступные форматы

Li Cui

443-370-0718 | lcui1@jhu.edu | Baltimore, MD

EDUCATION

Johns

Hopkins

Carey

Business

School

Baltimore,

MD

Master

of

Science

in

Finance

Candidate

August

2016

The

Pennsylvania

State

University

University

Park,

PA

Bachelor

of

Science

in

Finance,

Economics

and

Mathematics

Minor

May

2014

Deans

List:

2010-2012

PROFESSIONAL EXPERIENCE

Citic

Securities

Beijing,

China

Intern,

Investment

Banking

Division

January

2015May

2015

Facilitated

pre-IPO

investigation

process

by

efficiently

identifying

and

filtering

all

eligible

public

outsourcing

companies

listed

on

the

Chinese

and

Hong

Kong

stock

markets.

Rigorously

investigated

holding

companies

in

collaboration

with

one

of

Chinas

top

universities,

exhaustively

gathered

information

by

combing

annual

reports,

publically

available

resources,

and

the

Wind

financial

terminal,

and

produced

a

40-page

professional-quality

publication

using

PowerPoint

and

Word.

Hang

Tang

Wealth

Beijing,

China

Intern,

Financial

Product

Department

July

2014December

2014

Filtered

financial

products

by

carefully

reading

due-diligence

reports

from

various

Chinese

trust

funds

and

made

targeted

inquiries

regarding

product

details

provided

by

funds.

Helped

liaise

between

the

manager

of

KKR,

which

was

a

key

partner,

and

our

director

by

translating

a

highly

technical

contract

from

English

to

Chinese

and

explaining

unfamiliar

terms

to

both

executives.

Softbank

China

Venture

Capital

Shanghai,

China

Intern

May

2013August

2013

Discussed

post-investment

liquidity

issues

faced

by

target

firms

with

management

and

other

corporate

insiders,

seeking

to

identify

and

account

for

any

red

flag

issues.

Completed

insightful

investment

memoranda

on

three

portfolio

companies

operating

in

different

industry

sectors;

this

included

assessing

business

models,

valuations,

and

size-relative-to-market

in

order

to

reach

solid

conclusions

in

support

of

investment

decision-making.

Explored

causes

of

underperformance

by

a

key

portfolio

company

and

researched

principal

competitors

to

develop

a

comparable

baseline.

Goldman

Sachs

(Asia)

LLC

HongKong

Summer

ProgramPrivate

Wealth

Management

July

2012August

2012

Analyzed

financial

portfolios

of

Qualcomm,

Broadcom,

and

Starbucks

to

provide

investment

recommendations

based

on

company

fundamentals,

annual

reports,

and

market

conditions.

Conducted

SWOT,

P/E,

and

EV/EBITDA

analyses

on

blue-chip

firms

in

preparation

for

pitching

them

to

private

wealth

management

clients

as

investment

targets.

The

Blackstone

Group

Shanghai,

China

Intern

June

2012July

2012

Constructed

financial

models

for

a

hypothetical

transaction

valued

at

HK$13.3

billion,

pricing

shares

by

referencing

the

trading

prices

of

a

range

of

comparable

stocks.

Presented

to

the

Blackstone

executive

board

and

received

excellent

reviews

from

top

managers.

Discussed

typical

mergers

and

acquisitions

processes,

methods

for

identifying

potential

targets

or

suitable

comparison

firms,

and

methods

for

generating

relevant

forecasts

on

a

daily

basis.

RESEARCH EXPERIENCE

Penn

State

Economics

Department

University

Park,

PA

Teaching

Assistant

September

2011-

May

2012

Held

office

hours

during

the

absence

of

professor

and

received

good

feedback

from

most

students

Renmin

University

of

ChinaThe

School

of

Finance

Beijing,

China

Research

Assistant

March

2015-August

2015

Assisted

in

several

research

projects

including

problems

inside

VIE

structure

and

Parnership

inside

Alibaba

Group

Conducted

interviews

to

researchers

inside

Alibaba

Group

and

did

follow-ups

through

various

sources

Вам также может понравиться

- Juan Jose Castro - ResumeДокумент1 страницаJuan Jose Castro - ResumeJuan Jose Castro PereОценок пока нет

- Offer帮 Resume TemplateДокумент2 страницыOffer帮 Resume TemplateZeng ChengОценок пока нет

- Wei Luping3-2Документ2 страницыWei Luping3-2api-383973745Оценок пока нет

- 2021 Resume Book MBA Top Business SchoolДокумент409 страниц2021 Resume Book MBA Top Business SchoolSachin TichkuleОценок пока нет

- Resume Sample 4: General Membership in Campus Activities Can Be Listed in TheДокумент1 страницаResume Sample 4: General Membership in Campus Activities Can Be Listed in TheYuffi PradityaОценок пока нет

- Albert Manwaring Finance ExperienceДокумент1 страницаAlbert Manwaring Finance ExperienceKaarthik MandhulaОценок пока нет

- Master of Science in Finance Washington, DC Bachelor of Arts in Economics, Minor in Business at Stern New York, NYДокумент1 страницаMaster of Science in Finance Washington, DC Bachelor of Arts in Economics, Minor in Business at Stern New York, NYRobinson Silva Rajan SilvaОценок пока нет

- Resume GangliДокумент1 страницаResume Gangliapi-250766018Оценок пока нет

- CV NancyДокумент1 страницаCV NancyNancy BansalОценок пока нет

- Stanford Book 1 PDFДокумент117 страницStanford Book 1 PDFAnuprava ChatterjeeОценок пока нет

- Kamran Mohy-ud-Din's Finance ResumeДокумент2 страницыKamran Mohy-ud-Din's Finance ResumekamransОценок пока нет

- Resume Jensen LiuДокумент1 страницаResume Jensen Liujohn willeyОценок пока нет

- Sören Südhof's Resume Highlights Experience in Private Equity, Consulting, and Social ImpactДокумент1 страницаSören Südhof's Resume Highlights Experience in Private Equity, Consulting, and Social ImpactMatt RobertsОценок пока нет

- Abhay SinghДокумент2 страницыAbhay SinghGaurav JainОценок пока нет

- Igo B Resume DTCCДокумент1 страницаIgo B Resume DTCCapi-323659240Оценок пока нет

- Rohit Kamble Final SIP ReportДокумент52 страницыRohit Kamble Final SIP ReportKirti WajgeОценок пока нет

- Resume - Dr. Jamal PHD, CFA, MBA, DED, B.Com (Hons.)Документ5 страницResume - Dr. Jamal PHD, CFA, MBA, DED, B.Com (Hons.)Jamal Haider NaqviОценок пока нет

- Resume SidharthДокумент2 страницыResume SidharthSidharth SatpathyОценок пока нет

- CHEN Qixin (Crystal) : Semester Intern at Investment Banking Division, TMT (Return Offer Extended)Документ1 страницаCHEN Qixin (Crystal) : Semester Intern at Investment Banking Division, TMT (Return Offer Extended)qixin chenОценок пока нет

- Xiaomo Wang: Objective EducationДокумент1 страницаXiaomo Wang: Objective Educationapi-319344660Оценок пока нет

- Li Mengyuan Resume 1Документ1 страницаLi Mengyuan Resume 1api-324828749Оценок пока нет

- Professional Resume-Faria Hossain ArtheeДокумент1 страницаProfessional Resume-Faria Hossain ArtheeFaria ArtheeОценок пока нет

- Forrest Fontana June 2023 Citadel ResumeДокумент4 страницыForrest Fontana June 2023 Citadel Resumewangshuqing97Оценок пока нет

- Chetan SIP (FLY STAR) New Final 2Документ56 страницChetan SIP (FLY STAR) New Final 2www.msana7680Оценок пока нет

- CV 1Документ1 страницаCV 1Daniyal shahОценок пока нет

- A Study of The Impact of Social Media Marketing On Consumer BehaviorДокумент67 страницA Study of The Impact of Social Media Marketing On Consumer Behaviorsheina31 SFSОценок пока нет

- Graduate CV Template1Документ2 страницыGraduate CV Template1mihir joshiОценок пока нет

- SIP Final Report of SHANTANUДокумент53 страницыSIP Final Report of SHANTANUPrashant KolheОценок пока нет

- Final Sip - SuyashДокумент37 страницFinal Sip - Suyashshrikrushna javanjalОценок пока нет

- Financial Analysis Training ReportДокумент71 страницаFinancial Analysis Training ReportSaurav PariyarОценок пока нет

- Literature Review On Private InvestmentДокумент5 страницLiterature Review On Private Investmentc5rm5y5p100% (1)

- Dardenresume PEДокумент36 страницDardenresume PEkk235197Оценок пока нет

- Haskayne Resume Template 1Документ1 страницаHaskayne Resume Template 1Mako SmithОценок пока нет

- (Shared Externally) JeffreySu - Resume2013Документ1 страница(Shared Externally) JeffreySu - Resume2013Michael BaileyОценок пока нет

- BTEC18 L3Nat Business DG U08Документ8 страницBTEC18 L3Nat Business DG U081426219267qq.comОценок пока нет

- Reogranized ResumeДокумент1 страницаReogranized Resumeapi-484382120Оценок пока нет

- Adam Harrison Policy Analyst ResumeДокумент1 страницаAdam Harrison Policy Analyst ResumeAnshu SenОценок пока нет

- Benjamin Yiu Chung KAN CV 060320Документ1 страницаBenjamin Yiu Chung KAN CV 060320Benjamin KanОценок пока нет

- MS Financial Engineering Candidate Seeks Risk Analysis PositionДокумент1 страницаMS Financial Engineering Candidate Seeks Risk Analysis PositionSophie YangОценок пока нет

- Intellectual Capital Et Performance FinanciéreДокумент7 страницIntellectual Capital Et Performance FinanciéreAsmae BakimОценок пока нет

- Project Report: Goenka College of Commerce and Business Administration College Roll No. - 111Документ60 страницProject Report: Goenka College of Commerce and Business Administration College Roll No. - 111Amit SinghОценок пока нет

- Yale_SOM_Resume_SamplesДокумент10 страницYale_SOM_Resume_Sampleswork.jennyngОценок пока нет

- Er Xie (Sheldon) : EducationДокумент1 страницаEr Xie (Sheldon) : EducationJonathan ShaoОценок пока нет

- Eric Zhang ResumeДокумент2 страницыEric Zhang Resumeapi-259538458Оценок пока нет

- "A Study On Profitability Analysis of Sebi": RR Institute of Advanced StudiesДокумент70 страниц"A Study On Profitability Analysis of Sebi": RR Institute of Advanced StudiesMayank PalОценок пока нет

- Working Capital Management of Shriniwas EnterprisesДокумент33 страницыWorking Capital Management of Shriniwas EnterprisesSaurabh NeveОценок пока нет

- Ayman ResumeДокумент2 страницыAyman ResumeM Noaman Akbar0% (1)

- Sources of FundsДокумент64 страницыSources of FundsravikumarreddytОценок пока нет

- THEJASVI SHETTY - Resume PDFДокумент2 страницыTHEJASVI SHETTY - Resume PDFrishabhОценок пока нет

- Comparative Analysis of Various Financial Institutions in The MarketДокумент114 страницComparative Analysis of Various Financial Institutions in The MarketAnonymous IDiPHQVmОценок пока нет

- CFO VP Finance Administration in Pittsburgh PA Resume Matthew BurlandoДокумент2 страницыCFO VP Finance Administration in Pittsburgh PA Resume Matthew BurlandoMatthew BurlandoОценок пока нет

- Sanchit Kukreja Finance 121 PDFДокумент1 страницаSanchit Kukreja Finance 121 PDFsanchit kukrejaОценок пока нет

- Wso Undergrad Resume Templatev7-11pt FontДокумент2 страницыWso Undergrad Resume Templatev7-11pt FontQuQОценок пока нет

- Simren Kohli Resume MBA Grad Business ExperienceДокумент1 страницаSimren Kohli Resume MBA Grad Business ExperienceMatt RobertsОценок пока нет

- Sample Resume For Students With Previous ExperienceДокумент3 страницыSample Resume For Students With Previous ExperienceAakash AakashОценок пока нет

- Huimin Zhao 012918Документ2 страницыHuimin Zhao 012918api-397730143Оценок пока нет

- Breakthrough Business Analysis: Implementing and Sustaining a Value-Based PracticeОт EverandBreakthrough Business Analysis: Implementing and Sustaining a Value-Based PracticeРейтинг: 1 из 5 звезд1/5 (1)

- Researching the Value of Project ManagementОт EverandResearching the Value of Project ManagementРейтинг: 2.5 из 5 звезд2.5/5 (4)

- Internship Report MCB Marketing Virtual University VUДокумент82 страницыInternship Report MCB Marketing Virtual University VUKhurram_Rao_210475% (8)

- Credit Management at Janata BankДокумент58 страницCredit Management at Janata BankRubicon InternationalОценок пока нет

- Koppel Vs Yatco G.R. No. 47673Документ7 страницKoppel Vs Yatco G.R. No. 47673JetJuárezОценок пока нет

- BSBSTR801 Lead Innovative ThinkingДокумент4 страницыBSBSTR801 Lead Innovative ThinkingFasih ur Rehman Abid0% (1)

- Tai Tong Chuache & Co. v. Insurance CommissionДокумент1 страницаTai Tong Chuache & Co. v. Insurance CommissionmastaacaОценок пока нет

- (Paper Size 8.11x13) Economic Survey FormДокумент3 страницы(Paper Size 8.11x13) Economic Survey FormKevin Jove Yague100% (1)

- Introduction To Venture Capital 5thДокумент37 страницIntroduction To Venture Capital 5thSaili Sarmalkar100% (1)

- Did Toyota Work Culture Cause Its ProblemДокумент8 страницDid Toyota Work Culture Cause Its ProblemDanieОценок пока нет

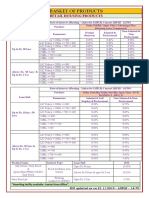

- BASKET OF RETAIL PRODUCTS RATESДокумент3 страницыBASKET OF RETAIL PRODUCTS RATESVirendra K VermaОценок пока нет

- American Wheels Chinese RoadsДокумент2 страницыAmerican Wheels Chinese RoadsDean RussellОценок пока нет

- Environmental Justice and Nigerian OilДокумент26 страницEnvironmental Justice and Nigerian OilLiz Miranda100% (1)

- AFI Gift Card partner stores in Cotroceni (Bucharest) and PloiestiДокумент3 страницыAFI Gift Card partner stores in Cotroceni (Bucharest) and PloiestiOtilia BîlbîieОценок пока нет

- Careers in Corporate FinanceДокумент7 страницCareers in Corporate FinanceDigambar JangamОценок пока нет

- Uni 2Документ15 страницUni 2Vinayak_Bandka_6783Оценок пока нет

- Subhiksha's rapid expansion and IT woes lead to bankruptcyДокумент3 страницыSubhiksha's rapid expansion and IT woes lead to bankruptcypravinОценок пока нет

- United Parcel ServiceДокумент16 страницUnited Parcel ServiceDevin Fortranansi Firdaus0% (1)

- Week 10 Compiled PDFДокумент12 страницWeek 10 Compiled PDFChaОценок пока нет

- Chapter 5Документ35 страницChapter 5Suzanne PadernaОценок пока нет

- Depreciation Methods and CalculationsДокумент3 страницыDepreciation Methods and CalculationsAhmed Hayat WagganОценок пока нет

- Accredited partners in constructionДокумент2 страницыAccredited partners in constructionHershey GabiОценок пока нет

- Last Resort 2Документ2 страницыLast Resort 2Francis TutorОценок пока нет

- Seating Arrangement: Directions (Q. 1-5) Study The Following Information To Answer The Given QuestionsДокумент7 страницSeating Arrangement: Directions (Q. 1-5) Study The Following Information To Answer The Given QuestionsbrmОценок пока нет

- Summary of Significant CTA Decisions (February 2011)Документ2 страницыSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialОценок пока нет

- Corporate ProfileДокумент2 страницыCorporate Profilesachin1065Оценок пока нет

- FranchiseДокумент5 страницFranchiseNilesh JadhavОценок пока нет

- ChennaiДокумент28 страницChennaiPrabhu Ta100% (1)

- General Environment AnalysisДокумент2 страницыGeneral Environment AnalysisClio Margaret CuevasОценок пока нет

- The Audit Market: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 2Документ29 страницThe Audit Market: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 2Cherry BlasoomОценок пока нет

- Business Law Final ExamДокумент13 страницBusiness Law Final ExamMohamed AlMazroueiОценок пока нет