Академический Документы

Профессиональный Документы

Культура Документы

Financial Accounting Harvard Pre Term

Загружено:

Devesh KumarАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Accounting Harvard Pre Term

Загружено:

Devesh KumarАвторское право:

Доступные форматы

4/25/2016

FinancialAccounting

ThisdocumentisauthorizedforuseonlybyChithraLoganathan.Copyorpostingisaninfringementofcopyright.

FinancialAccounting

PretestIntroduction

WelcometothepreassessmenttestfortheFinancialAccountingOnlineCourse.Thistestwillallowyoutoassessyourknowledgeofbasicandadvancedfinancialaccounting.

Allquestionsmustbeansweredforyourexamtobescored.

Navigation:

Toadvancefromonequestiontothenext,selectoneoftheanswerchoicesor,ifapplicable,completewithyourownchoiceandclicktheSubmitbutton.Aftersubmittingyouranswer,

youwillnotbeabletochangeit,somakesureyouaresatisfiedwithyourselectionbeforeyousubmiteachanswer.Youmayalsoskipaquestionbypressingtheforwardadvancearrow.

PleasenotethatyoucanreturntoskippedquestionsusingtheJumptounansweredquestionselectionmenuorthenavigationalarrowsatanytime.Althoughyoucanskipaquestion,

youmustnavigatebacktoitandansweritallquestionsmustbeansweredfortheexamtobescored.

Yourresultswillbedisplayedimmediatelyuponcompletionoftheexam.

Aftercompletion,youcanreviewyouranswersatanytimebyreturningtotheexam.

GoodLuck!

WelcometoFinancialAccounting

Youareabouttobeginaninteractiveexperiencethatwillintroduceyoutofinancialaccounting,thelanguageofbusiness.Successfulcompletionofthiscoursewillenableyoutounderstand

howaccountingsystemsareusedtorecordthedaytodayeconomicactivitiesofabusinessandtogeneratereportsaboutitsfinancialhealthandperformance.

UsingtheTutorial

ThestructureoftheHBSFinancialAccountingTutorialanditsnavigationaltoolsareeasytomaster.Ifyou'rereadingthistext,youmusthaveclickedonthenavigationitemlabeled

"UsingtheTutorial"ontheleft.

PleaseclickontheHelpiconintheupperrightcornerofthetutorialtoviewaclickableanimationonhowtousethistutorial.

TheSetting

ThisHBSFinancialAccountingTutorialusesabusinesscontexttohelpyoulearnthefundamentalsoffinancialaccounting.

YouaresettingupastorecalledGlobalGrocer.Itwillcarrygourmetfoodsandcondiments,unusualspicesandspecialtykitchenimplementsfromallovertheworld.GlobalGrocerisa

franchisebusinessitwillpayafranchisingcompany,GlobalGrocerInternational,afranchisefeefortheuseofthenameandformarketingsupport.Youareplanningtohaveagrand

1/160

4/25/2016

FinancialAccounting

storeopeninginearlySeptember,withabigsaleonitemsrelatedtovariousfallandharvestcelebrationsaroundtheworld.

Youhavealimitedamountofcashavailabletostartupthebusiness,butyouhopetoobtainbankloansandalsoraisecapitalfromoutsideinvestors.Youwillbekeepingtheaccounts(or

bookkeeping)fortheGlobalGrocerstore.Completingthistutorialwillprepareyouforthatrole.

TheAccountingProcess

Thistutorialisbasedonamodeloftheaccountingprocessinasmallbusiness.

Financialaccountingisafinancialinformationsystemthattracksandrecordsanorganization'sbusinesstransactionsandaggregatesthemintoreportsfordecisionmakersbothinside

andoutsidethebusiness.Atransactionisaneventthathasconsequencesforabusiness'financialcondition.Theeventcouldbeeitherexternalorinternaltothebusiness.

(1)Intherunningofabusiness,variousdecisionsaremadeandimplementedasbusinesstransactions.Forexample,inatypicalbusiness,managerswillraisecapitalfrominvestors

andbanks,rentorbuyequipment,andpurchaseandsellmerchandiseandservices.Eachbusinesstransactionisrelatedtooneofthreetypesofactivities:operating,investingand

financingactivities.

(2)Eventhemostsimpleorganizationshavenumerousbusinesstransactionsthathavetobetrackedandrecorded.Transactionsareformallyrecordedinadatabasecalledajournal,and

thenorganizedbyaccountsintoaledger.

(3)Reportpreparationrequirestheaggregationofaccountingtransactionsintostatementsorreportsthatdescribethefinancialstatusofthebusinessanditsperformance.Themost

commonfinancialaccountingreportsarethebalancesheet,theincomestatementandthestatementofcashflows.

(4)Financialstatementsareusedbydecisionmakersinsideandoutsidethebusiness.Forexample,managersusethemtodecidewhetherthefirmismakingaprofit,whether

customerincentivesareworking,orwhethertotakealoanandexpandthebusiness.

Ifabusinessraisescapitalfromoutsideinvestors,theinvestorswillexaminethecompany'sfinancialstatementstojudgewhetherthefundstheyhaveinvestedhavebeenusedwisely.

(5)Financialreportingconceptsandprinciplestelluswhenandhowtomeasure,recordandclassifybusinesstransactionsandaggregatethemintofinancialreports.Byfollowingthese

conceptsandprinciples,financialreportingsystemsprovideinformationthatisconsistentovertimeandacrossdifferentbusinesses,andaccountingbecomesalanguagethatiswidely

understood.

(6)Auditorsareindependentpartieswhoperiodicallyexamineacompany'sfinancialstatementsandthesystems,internalcontrolsandrecordsusedtoproducethestatements.Sincea

company'smanagersprodicetheirownreportcards,i.e.,thecompany'sfinancialstatements,auditorsplayanimportantroleasacontrolmechanism.Theyattestthatthefinancial

statementsconformtogenerallyacceptedaccountingprinciplesandtheyprovideassurancethatthecompany'saccountsarepresentedfairly.

(7)Basedontheiranalysesoffinancialstatements,financialstatementuserstakeactions,whichinturn,affectthefutureoperating,investingandfinancingdecisionsmadebythe

organization.Hence,thefinancialreportingsystemisaninformationfeedbackloopbetweenusersoffinancialstatementsandthedecisionmakerswithintheorganization.

ModuleOverview

Ineachchapterofthistutorial,youwilllearnnewfinancialaccountingtermsandconceptsandhowtousethisknowledgewithinthecontextoftheGlobalGrocersetting.Youwillalsobe

givenexercisestopracticeandtestwhatyouhavelearnedatseveralpointsineachchapter.

The"TermsandConcepts"chapterintroduceskeyfinancialaccountingtermsandfivefundamentalfinancialaccountingconcepts.Itprovidesabriefoverviewofthethreemost

importantfinancialstatements.

Thechapterslabeled"TheBalanceSheet,""TheIncomeStatement,"and"TheStatementofCashFlows"explainrelevantnewfinancialaccountingconceptsandusetheconceptsto

constructafinancialstatement.YouwillseehowGlobalGrocer'sfinancialstatementsareaffectedbyitsbusinesstransactionsduringthefirstmonthofoperations.

Inthe"AccountingRecords"chapteryouwilllearnhowtoformallyrecordGlobalGrocer'sbusinesstransactionsintoitsjournalandledgerandhowtousetheserecordstoprepareits

financialstatements.Indoingso,youwillrevisitandrecordalltheeventsthatoccurredatGlobalGrocerduringthefirstmonthonly,thistime,youwillusetheformalbookkeeping

structuresusedinfinancialaccountingsystems.

2/160

4/25/2016

FinancialAccounting

ModuleOverview(continued)

Chapters1through6coverthefinancialreportingbasics.BeginninginChapter7,"RevenuesandReceivables,"youwillbeginlearningaboutmoreadvancedfinancialreportingtopics.

Theadvancedaccountingchapterlabelsareindicativeofthetopiccovered.Theseinclude"InventoriesandCostofSales,""DepreciationandLongLivedAssets,""Liabilitiesand

FinancingCosts,""InvestmentsandInvestmentIncome,""DeferredTaxesandTaxExpense,"and"Owners'Equity."Ineachofthesechaptersyouwillhavetoresolveasetofaccounting

challengesfacingGlobalGrocer.YoursolutionstothoseaccountingchallengeswillbuildonthebasicfinancialaccountingknowledgeyouacquiredinyourstudyofChapters16.

Asyouwilllearn,accountingpracticesintheUnitedStatesaregovernedbyasetofaccountingrulesreferredtoasGenerallyAcceptedAccountingPrinciples(GAAP)Theserulesand

theirapplicationsarecoveredindepthinthistutorial.BecausethereisadistinctpossibilitytheserulesmaybereplacedbyanothersetofsimilarrulesreferredtoasInternational

FinancialReportingStandards(IFRS)in2015,thetutorial,whereappropriate,referstoIFRSaswellasitsGAAPcounterpart.

Exercise1.1

Financialaccountingisaninformationsystemthat:

Choosethewordthatbestcompletesthefollowingsentence:Infinancialaccounting,anorganization'sbusinesstransactionsareclassifiedintooperatingactivities,_________

activitiesandfinancingactivities.

Sinceauditorshavetoattesttothevalidityofacompany'sfinancialstatements,whatisanimportantcharacteristicforanauditorfromthefollowingchoices?

TermsandConcepts

Inthischapter,youwillexplorethethreemainfinancialstatementsinsomedetail,andyouwillbeintroducedtofivebasicfinancialaccountingconcepts:entity,moneymeasurement,

goingconcern,consistencyandmateriality.Youwillalsolearnabouttwoimportantqualitiesoffinancialaccountinginformationrelevanceandreliabilityandhowtheuseofaccrual

accountingandgenerallyacceptedaccountingprinciplesaidaccountantsintheirquestforthesequalities.

OverviewofFinancialReports

Inthissection,youwillbeintroducedtothethreemainfinancialreportsorstatements.Eachstatementwillbecoveredinmoredetailinthefollowingchapters.

3/160

4/25/2016

FinancialAccounting

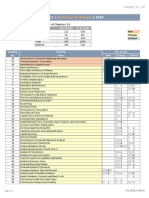

BalanceSheet

Abalancesheet,alsocalledastatementoffinancialposition,isareportoftheorganization'sfinancialsituationataparticularpointintime.Itliststheentity'sassets,liabilitiesand

owners'equity.Itiscalledabalancesheetbecauseitreportsthebalanceoramountineachasset,liabilityandowners'equityaccount.

ThisisGlobalGrocer'sbalancesheetonemonthafteritopensforbusiness.Wewilluseittoexplainkeybalancesheetrelatedterms.Thechapterlabeled"TheBalanceSheet"covers

thebalancesheetinmoredetail.

(1)Attopofeachfinancialstatementisthenameoftheorganizationorentityforwhichthestatementhasbeenprepared.Thetermentityisusedtoindicatetheseparateeconomic

unitforwhichfinancialrecordsarebeingkeptandfinancialstatementsprepared.Commontypesofaccountingentitiesarebusinesses,politicalandcharitableorganizations,city

governments,universities...anyorganizationthatneedstorecordandcommunicateitsfinancialactivities.

(2)Abalancesheet,alsocalledastatementoffinancialposition,isareportoftheorganization'sfinancialsituationataparticularpointintime.Itliststheentity'sassets,liabilities

andowners'equity.Itiscalledabalancesheetbecauseitreportsthebalanceoramountineachasset,liabilityandowners'equityaccount.Chapter3coversthebalancesheetin

greaterdetail.

(3)Eachbalancesheetispreparedasofaspecificdate,whichisrecordedatthetopofthestatement.Inthenextchapter,youwillpreparethisopeningbalancesheetforGlobal

Grocer,datedAugust31,2004.

(4)Assetsareeconomicresourcesacquiredinabusinesstransactionthatareobtainedorcontrolledbyanentity,andareexpectedtoproducefutureeconomicbenefits.Forexample,

thisbalancesheetshowsthatonSeptember30,2004,amongotherassets,GlobalGrocerhadacashassetrecordedat$95,500andawarehouseproperty(buildingandland)recorded

at$69,700.

(5)Aliabilityisanobligationtotransfereconomicresourcestoentitiesoutsidethebusiness.Liabilitiesrepresentthecapitalprovidedtothebusinessbycreditors.Forexample,aloan

fromabankisaliability,suchastheonelistedonGlobalGrocer'sSpetember30,2004balancesheetasshorttermdebt.Undertheloancontract,GlobalGrocerhasanobligationto

repaythebankfromwhichitobtainedtheloan.

(6)Owners'Equity,alsoknownasstockholders'orshareholders'equity,representstheresidualinterestoftheownersinthebusiness.Theowners'interestiswhat'sleftoverafter

deductingliabilitiesfromassets.ThecommonstocklistedonGlobalGrocer'sSpetember30,2004balancesheetindicatesthatitsownershavecontributedcapitaltothecompany,and

inreturn,havereceivedcommonstockcertificatesestablishingtheirownershipinterest.

IncomeStatement

Theincomestatementdetailstheentity'soperatingperformanceduringaspecificperiodoftime,knownastheaccountingperiod,displayedatthetopofthestatement.Inthis

incomestatementforGlobalGrocer,theaccountingperiodisthemonthofSeptember2014.

Theincomestatementliststherevenuesearnedandexpensesincurredduringtheperiodsubtractingexpensesfromrevenuesresultsinthemeasurementofnetincomeforthe

period.

Thechapterlabeled"TheIncomeStatement"coverstheincomestatementingreaterdetail.

4/160

4/25/2016

FinancialAccounting

(1)Justasinthebalancesheet,theincomestatementcontainsthenameoftheentityatthetop.

(2)Theincomestatementdetailstheentity'soperatingperformanceduringaspecificperiodoftimeknownastheaccountingperiod.Theincomestatementliststherevenuesearned

andexpensesincurredduringtheperiodsubtractingexpensesfromrevenuesresultsinthemeasurementofnetincomefortheperiod.Chapter4coverstheincomestatementin

greaterdetail.

(3)Thedateisdisplayedatthetopofthestatement.InthisexampleincomestatementforGlobalGrocer,theaccountingperiodisthemonthofSeptember2004.

(4)Sales,sometimesdenotedasSalesrevenueorRevenues,isthesumoftheeconomicbenefitstheentityhasearnedduringtheaccountingperiodinexchangeforthegoodsand

servicesithasprovidedtoitscustomers.Theeconomicbenefitsmaybeincreasesinassetsordecreasesinliabilities.

(5)Expensesaretheassetsusedorliabilitiesincurredbytheentityduringanaccountingperiodtoprovidethegoodsandservicesthatgeneratedrevenueduringtheperiod.

(6)Netincomeorprofit,ornetprofit,isthedifferencebetweenthesalesandexpensesoftheaccountingperiod.Becauseitappearsasthelastlineoftheincomestatement,itisoften

referredtoasthebottomline.

StatementofCashFlows

Thestatementofcashflowsdetailsthesourcesandusesofcashbytheentityoveranaccountingperiod.Fortheconvenienceoffinancialstatementusers,thestatementofcashflowsis

organizedbytypeofbusinessactivity:operating,investingandfinancing.

Thechapterlabeled"TheStatementofCashFlows"coversthestatementofcashflowsingreaterdetail.

(1)Justasinthebalancesheetandtheincomestatement,thestatementofcashflowsindicatesthenameoftheentityatthetop.

(2)Thestatementofcashflowsdetailsthesourcesandusesofcashbytheentityoveranaccountingperiod.Fortheconvenienceoffinancialstatementusers,thestatementofcash

flowsisorganizedbytypeofbusinessactivity:operating,investingandfinancing.Chapter6coversthestatementofcashflowsingreaterdetail.

(3)Thedateisdisplayedatthetopofthestatement.InthisstatementofcashflowsforGlobalGrocer,theaccountingperiodisthemonthofSeptember2004.

(4)Operatingactivitiesarethoseactivitiesthatarerelatedtothedeliveryofgoodsandservices.Thecashimpactofsuchactivitiesisrecordedintheoperatingactivitiessectionofthe

statementofcashflows.AtGlobalGrocer,thissectionofthestatementofcashflowswould,forexample,reportcashcollectedfromcustomers,cashpaidtosuppliersandcashpaidto

employeesaspartofitsdailybusinessactivities.

(5)Investingactivitiesarethoseactivitiesthatarerelatedtothepurchaseandsaleoflonglivedassets.Theimpactofsuchactivitiesonthecashaccountisrecordedintheinvesting

activitiessectionofthestatementofcashflows.AtGlobalGrocer,thissectionofthestatementofcashflowswould,forexample,reportthecashusedtopurchaseavan.

(6)Financingactivitiesrelatetoborrowingorretiringdebtandtoincreasingordecreasingowners'equityinthefirm.Theimpactofsuchactivitiesonthecashaccountisrecordedin

thefinancingactivitiessectionofthestatementofcashflows.AtGlobalGrocer,cashfrombankloansandamountsreceivedfromownersarereportedinthissectionofthestatement

ofcashflows.

Exercise2.1

TheBalanceSheetissonamedbecause:

5/160

4/25/2016

FinancialAccounting

Abalancesheetisprepared_________.

Anincomestatementisprepared__________.

Astatementofcashflowsisprepared_________.

Choosethepairofwordsthatbestcompletesthefollowingsentence:Cashheldbyabusinesswouldbestbelistedas_________onthebalancesheetabankloantakenbythe

businesswouldbelistedas_________.

ClassifythefollowingasOperating,InvestingorFinancingactivities:

Purchaseorsaleofbuilding

Raisingcashfrominvestors

Sellingproductsandservices

IntroductiontoConcepts

FinancialAccountingconceptsformthefoundationonwhichthefinancialaccountingsystemandreportsarebuilt.Entitiesandthenatureoftheireconomicactivitieschangeandevolve

overtime.Accountingmustbeabletoaccommodateandreflectthosechanges.Accountingconceptsprovideguidancetoresolveaccountingissuesthatmayarisetodayorinthefuture.

IntheUnitedStates,theFinancialAccountingStandardsBoard(FASB)setsaccountingstandards.Ithasadoptedasetofessentialaccountingconcepts.Theyformthebasisofalarge

numberofaccountingstandardsthatprovideguidancetoaccountantsonhowtoaccountforspecifictypesoftransactions.Thesestandardsandthedetailsonhowtoapplythem,if

printedinhardcopy,wouldnumberinthethousandsofpages.

Fivebroadaccountingconceptsentity,moneymeasurement,goingconcern,consistencyandmaterialitywillbediscussedinthissection.Otherconceptswillbediscussedin

subsequentchapters.

EntityConcept

Theentityconceptisthemostbasicaccountingconcept.Itstatesthataccountsarekeptforanentityasdistinctfromthepeoplewhoown,runordobusinesswiththeentity.

Theentityconceptissimplebutpowerful.Itallowstheaccountanttodrawavirtualboundaryaroundtheentityandhencelimittheactivitiesthatneedtobetrackedandrecorded.

MoneyMeasurementConcept

Themoneymeasurementconceptstatesthatfinancialaccountingdealsonlywiththingsthatcanberepresentedinmonetaryterms.Thisconceptissointuitivethatitisusually

takenforgranted.But,sinceitissoimportant,itisstatedasabasicaccountingconcept.

6/160

4/25/2016

FinancialAccounting

GoingConcernConcept

Goingconcernisaccounting'swayofsayingthatanentityisexpectedtoremaininoperationfortheindefinitefuture.Thegoingconcernconceptdirectstheaccountantto

explicitlymakethisassumptionintheabsenceofevidencetothecontrary.

Thesignificanceofthegoingconcernconceptcanbeunderstoodbyconsideringthealternative:thattheentityisabouttogooutofbusiness.Ifthiswasthecase,allitsresources

shouldbevaluedattheircurrentworthtopotentialbuyers.Thegoingconcernconceptdirectstheaccountant,underthenormalcourseofbusiness,toignorethisdoomsdayscenario.

ConsistencyConcept

Theconsistencyconceptstatesthatanentityshouldusethesameaccountingmethodsandproceduresfromperiodtoperiodunlessithasasoundreasontochangemethods.

Theconsistencyconceptneedstobeexplicitlystatedbecausesomeaccountingstandardsallowafairdegreeofvariationinhowtransactionsarerecorded.Theconsistencyconcept

reducesthelikelihoodofopportunisticorwhimsicalchangesinaccountingproceduresbyanentity.

Notethattheconsistencyconceptdoesnotforbidaswitchinaccountingprocedures.Ifanentitydoesmakeaproceduralaccountingchange,itsmanagementandauditorsarerequired

tonotethechangeintheirdiscussionoftheentity'saccounts.

Notealsothatinthecontextofaccountingconcepts,consistencymeansconsistencyovertime.

MaterialityConcept

Thematerialityconceptstatesthatanentityneedonlyapplyproperaccountingtoitemsthatarematerial,i.e.,significanttopotentialusersofthefinancialstatements.This

7/160

4/25/2016

FinancialAccounting

conceptallowstheaccountanttobepracticalinchoosingtheappropriatedegreeofprecisionintheaccounts.

Justwhatismaterialandnotmaterialisnotmadespecificinaccounting.Thegeneralruleisthat,"Anitemismaterialifitsdisclosurewouldimpactthedecisionsoftheusersofthe

accounts."Theapplicationofthisrulerequiresaccountantstojudgewhatusersoffinancialstatementswouldconsidersignificanttotheirdecisions.Asinmostmattersrequiring

judgments,reasonablepeoplecandiffer.Determiningmaterialityisnoexception.

Exercise2.2

Anonprofitagencycannotbeafinancialaccountingentity.

GlobalGroceristheentityforwhichyouwillkeepthebooks.WhichofthefollowingeventswillaffectGlobalGrocer'saccounts?

WhichofthefollowingwillnotberecordedonGlobalGrocer'sbooksbecauseitviolatestheMoneyMeasurementconcept:

"Accountingdoesnotreportwhattheassetsofabusinesscouldbesoldforifthebusinessceasedtoexist".Thisisaresultofthe:

QualityAttributes

Inanyfinancialaccountingsystem,thereareanumberofdecisionstobemade:whethertorecordatransaction,whentorecorditandhowtorecordit.Also,therearedifferentwaysto

aggregatetheaccountbalancesinfinancialreports.Anysuchsystemmusthaveasetofcriteriaorguidelinestohelpmakethosedecisions.Thissectionaddressessomeofthoseissues.It

discussesdesiredfinancialaccountingqualityattributesandsomeoftheguidancethatflowsfromtheseattributes.

RelevanceandReliability

Infinancialaccounting,thequalityoftheoutputdependsontherelevanceandreliabilityofthedatapresented.

Relevancereferstothetimelinessandusefulnessoftheinformationtoitsusers.Reliabilityreferstotheobjectivityandverifiabilityoftheinformation.Differentwaysofrecognizing,

measuringandrecordinganeventmayyieldmoreorlessreliableormoreorlessrelevantaccountbalances.

Often,judgmenthastobeusedtomakethetradeoffbetweenrelevanceandreliability,i.e.,thereisn'tawaytorecordatransactionthatwillmaximizeboththesedesirable

properties.Insuchcases,reliabilityisgenerallygivenprecedenceoverrelevance.

8/160

4/25/2016

FinancialAccounting

Exercise2.3

Choosethepairofwordsthatbestcompletesthefollowingsentence:Sincefinancialaccountingreportsareusedtomakedecisionsthataffecttheentity,financialaccountingstrives

topresentinformationabouttheentitythatis__________and_________.

Choosethepairofwordsthatbestcompletesthefollowingsentence:Relevanceoffinancialinformationreferstoits___________and___________.

Whichofthefollowingpairsofattributesbestcontributestothereliabilityoffinancialdata:

Whenrelevanceandreliabilityareinconflict,financialaccountingwillfavorrelevance.

AccrualAccounting

Accrualaccountingisanimportanttoolinthequestforrelevanceinaccountingreports.Thismethodofaccountingprovidesinformationaboutacompany'sassets,liabilitiesandowners'

equitythatcannotbeobtainedbyaccountingforonlycashreceiptsandoutlays.

Accrualaccountingfocusesontheeconomiccharacteristicsoftransactionsratherthantheircashflows.

Accrualvs.CashBasis

Accrualaccountingattemptstorecordthefinancialeffectsonabusinessoftransactionsthathaveeconomicconsequencesforthebusinessintheaccountingperiodwhenthe

transactionoccursratherthanonlyintheperiodswhencashisreceivedorpaidbythecompany.

Atthisstage,somesimpleexampleswillhelpgivemeaningtothetermaccrualaccountingascontrastedwithcashbasisaccounting.

Whenappliedconsistently,accrualaccountingisameansofenhancingtherelevanceoffinancialstatements.Cashbasisaccountingresultsininadequateandmisleadingfinancial

statementsforallbutthemostsimpleofbusinesses.Asaresult,accrualaccountingistheaccountingsystemofchoicethroughouttheworldtoday.

Accrualaccountingattemptstorecordthefinancialeffectsonabusinessoftransactionsthathaveeconomicconsequencesforthebusinessintheaccountingperiodwhenthe

9/160

4/25/2016

FinancialAccounting

transactionoccursratherthanonlyintheperiodswhencashisreceivedorpaidbythecompany.

Atthisstage,somesimpleexampleswillhelpgivemeaningtothetermaccrualaccountingascontrastedwithcashbasisaccounting.

Whenappliedconsistently,accrualaccountingisameansofenhancingtherelevanceoffinancialstatements.Cashbasisaccountingresultsininadequateandmisleadingfinancial

statementsforallbutthemostsimpleofbusinesses.Asaresult,accrualaccountingistheaccountingsystemofchoicethroughouttheworldtoday.

GAAP

Financialaccountingreportsareusedbyinvestors,regulators,employees,customersandanumberofotherexternalparties.Sothatthisdiverselistofuserscanunderstandanentity's

financialstatements,accountantsmustfollowcertainguidelinesorstandardswhenpreparingfinancialaccountingreports.Theseprinciples,morenumerousthantheaccounting

concepts,areexplicitrulesthatareusedtoimprovethereliabilityandcomparabilityoffinancialreports.

GenerallyAcceptedAccountingPrinciples(GAAP)areguidelinesthataccountants,managersandauditorsmustfollowwhilepreparingandauditingaccountinginformationforexternal

reportingpurposes.Forexample,GAAPrequirestheuseofaccrualaccounting.TheapplicationofGAAPrulesresultsinreasonablyreliablefinancialinformation,whilealsopermitting

eachentitytoreasonablydescribeitsownbusinessstrategyandperformancethroughrelevantaccountinginformation.

Inthistutorial,youwilluseGAAPtorecordGlobalGrocer'sbusinesstransactions.However,youwillnotneedtoactuallylookuporrefertotheGenerallyAcceptedAccountingPrinciples

eachtime.Instead,thistutorialwillsimplyshowyouhowtorecordGlobalGrocer'stransactionsaccordingtoGAAP.

TheFinancialAccountingStandardsBoard(FASB)determinesGAAPintheUnitedStates.TherealsoexistsanInternationalAccountingStandardsBoard(IASB),which,amongother

activities,hasundertakenamajorefforttoharmonizeaccountingstandardsaroundtheworld.

IFRS

ConvergenceProject

TheInternationalAccountingStandardsBoard(IASB)publishesInternationalFinancialReportingStandards(IFRS).TheFASBandtheIASBhaveamajorprojectunderwaytobring

aboutaconvergenceofGAAPandIFRS.Asaresultofthisproject,usersofthistutorialcanassume,unlessnotedotherwise,thattheaccountingforaparticulartransactiondescribedin

thetutorialisessentiallythesameunderbothGAAPandIFRS.Asnotedearlier,IFRScouldreplaceGAAPasearlyas2015.

PrinciplesvsRules

PrinciplesBasedversusRulesBased

IFRStendstobestatedasintheformofbroadprinciples.Incontrast,muchofGAAPtendstobestatedintheformofbrightlinerules.Forexample,asyouwilllearnlateralongwith

variousaccountingrules,underGAAPifatermofaleaseisequalto75percentoftheeconomiclifeoftheleasedproperty,theleasewillbeaccountedforasacapitallease.Ontheother

hand,iftheleaseitemisequalto74percentorlessoftheleasedproperty'seconomiclife,theleasewillbeaccountedforasanoperatinglease.IFRStakesadifferentapproach.Itmakes

thedistinctionbetweenacapitalandanoperatingleasebasedonwhichpartythelessororthelesseesubstantiallybearstheriskandrewardofownership.

Thedistinctionbetweentheprinciplebasedandrulebasedaccountingstandardsisimportant.Underaprinciplestandardsmodel,theaccountingfortransactionsismorelikelyto

reflectthesubstanceofthetransaction.Underarulebasedstandardsmodel,theaccountingforatransactionismorelikelytoreflecttheformofthetransaction.

AsGAAPandIFRSconverge,itisanticipatedthatGAAPwillbecomemoreprinciplebased.

Recap

Inthischapter,youhave

brieflyexploredthreefundamentalaccountingstatements,

10/160

4/25/2016

FinancialAccounting

learnedabouttheentityconcept,themoneymeasurementconcept,thegoingconcernconcept,theconsistencyconceptandthematerialityconcept,

startedtoappreciatetheinherentconflictbetweenrelevanceandreliabilitythataccountantsmustresolveinsettingstandardsandpreparingfinancialreports,

beenintroducedtoaccrualaccountingandGAAPandtheiruseinfinancialaccountingpractice,and

learnedthatinthenearfutureGAAPmaybereplacedbyIFRS.

TheBalanceSheet

Inthischapter,youwilllearnhowabalancesheetisorganizedandaboutitsmainorganizingprinciple,theaccountingequation.Twoconceptsthatareimportantforthepreparationofthe

balancesheet,dualaspectandhistoricalcost,willbeexplained.Theywillbeusedtorecordtheoperating,investingandfinancingactivitiesyouhaveundertakentogetGlobalGrocerready

forbusiness.Finally,twofinancialratiosthatcanbecomputedfromthebalancesheetcurrentratioandtotaldebttoequityratiowillbediscussed.

Layout

Thebalancesheet,alsoknownasastatementoffinancialposition,isasnapshotataspecificpointintime,oftheresourcescontrolledbyanentity(assets),theclaimsagainstthose

resources(liabilities),andtheowners'residualinterestintheentity(owners'equity).Inthesidebysideformatshown,assetsarelistedontheleftsideofthebalancesheetliabilities

andowners'equityarelistedontheright.

HereisGlobalGrocer'sbalancesheetasitwillappearattheendofbusinessonSeptember30,afteramonthofoperations.

11/160

4/25/2016

FinancialAccounting

(1)GlobalGrocer,Inc.isnamedatthetop,andthebalancesheetdateisindicated.ThisisGlobalGrocer'sbalancesheetasitwillappearattheendofbusinessonSeptember30,2004,

afteramonthofoperations.

(2)Inthesidebysideformatshown,theentity'sassetsarelistedontheleftitsliabilitiesandowners'equityarelistedontheright.Notethattotalassetsequalstotalliabilitiesplus

owners'equity.

Exercise3.1

Whichoneofthefollowingbestdescribesabalancesheet?

Assets

Let'snowlookatthelefthandsideofthebalancesheet.Itliststheassetaccounts,whichrepresenttheeconomicresourcesofthefirm.Toberecordedasanasset,aneconomicresource

mustmeetfourrequirements:

Acquiredatmeasurablecost

Obtainedorcontrolledbytheentity

Expectedtoproducefutureeconomicbenefits

Arisesfromapasttransactionorevent

AssetExamples

HerearethreeassetsthatyouwillrecordonGlobalGrocer'sAugust31,2014balancesheet(notshown).Eachsatisfiesallfourcriteriaforbeingrecordedasanasset.

NotAssets

HerearesomeitemsthatGlobalGrocerwillnotlistasassetsonitsbalancesheet.Eachfailstosatisfyatleastoneofthefourcriteriaforbeingrecordedasanasset.

12/160

4/25/2016

FinancialAccounting

Tangibility

Anitemcanbeanassetwhetherornotithasphysicalsubstance,i.e.,whetherornotitcanbetouchedandfelt.Assetslikecomputersandbuildingshavingphysicalsubstanceare

tangibleassets.Otherassets,likelicensesandprepaidexpensesthatlackphysicalsubstance,areintangibleassets.

Liquidity

Onthebalancesheet,assetsareorganizedintotwocategories:currentandnoncurrent.Currentassetsincludecashandthoseassetsthatareexpectedtobeconvertedintocashor

consumedwithin12monthsofthebalancesheetdate.Noncurrentassetsareassetsthatareexpectedtoprovideeconomicbenefitsforperiodslongerthanayear.

ThefirstcurrentassetonGlobalGrocer'sSeptember30,2014balancesheetiscash.Itisfollowedbythreeotherassetswhoseeconomicbenefitsturnintocashorareexpectedto

expireduringthe12monthsfollowingthebalancesheetdate.Theyareaccountsreceivable(moneyowedtoGlobalGrocerbycustomers),merchandiseinventory(goodsavailable

forsale)andprepaidexpenses(rentpaidinadvanceforthestore).

TheendofSeptemberbalancesheetalsoincludesseveralnoncurrentassets:land,awarehouse,somestorefixturesfordisplaypurposes,andafranchisefeeasset.Theseassets

areexpectedtoprovideeconomicbenefitsformorethanoneyearfromthebalancesheetdate.Sometangible,noncurrentassetswithlimitedlives,suchasthewarehouse

building,haveanassociatedcontraassetaccount,calledaccumulateddepreciation,thatreducestherecordedvalueoftheasset.

IntheU.S.,assetsarereportedinastandardorderonthebalancesheet.Currentassetsarelistedfirst,startingwithcash,andfollowinginorderofliquidityi.e.,availabilityto

meetcurrentobligations.Forexample,cashismorereadilyavailablethanaccountsreceivabletopaycreditorclaims.Prepaidexpenses,thelastitemlistedasacurrentasset,is

probablynotavailableatall.Noncurrentassetsarelistednext,typicallystartingwithland,plantandequipment,followedbyintangibleassets,suchasthefranchisefee.

Exercise3.2

Considereachitemlistedintheleftcolumnofthetablebelow.Usethedropdownmenusprovidedtoindicatewhethertheitemmeetseachofthefourassetcriteria.Itemsthatmeet

allfourcriteriaareassets.

13/160

4/25/2016

FinancialAccounting

Exercise3.3

Whichoneofthefollowingbestdescribesanassetthatisexpectedtoprovideeconomicbenefitsforthreeyearsanddoesnothavephysicalsubstance?

Liabilities

Nowweshiftourattentiontotherightsideofthebalancesheet,startingwithliabilities.Aliabilityrepresentsanobligationsoftheentitytootherparties.Toberecordedasaliability,an

obligationmustmeetthreerequirements:

Itinvolvesaprobablefuturesacrificeofeconomicresourcesbytheentity

Theeconomicresourcetransferistoanotherentity

Thefuturesacrificeisapresentobligation,arisingfromapasttransactionorevent

Examples

ConsiderthreeliabilitiesthatyouwillrecordonGlobalGrocer'sAugust31,2014balancesheet(notshown).Eachsatisfiesallthreecriteriaforbeingaliability.

14/160

4/25/2016

FinancialAccounting

NotLiabilities

HerearesomeitemsthatyouwillnotrecordasliabilitiesonGlobalGrocer'sbalancesheet.Eachfailstosatisfyatleastoneofthethreecriteriaforbeingrecordedasaliability.

LiabilityTypes

Liabilitiesareorganizedintotwocategories:currentandnoncurrent.Currentliabilitiesareobligationsthatareexpectedtobecomeduewithin12monthsofthebalancesheetdate.

Noncurrentliabilitiesareobligationsthatareexpectedtobecomeduemorethan12monthspastthebalancesheetdate.

TherearethreecurrentliabilitiesonGlobalGrocer'sSeptember30,2014,balancesheet:accountspayable(moneyowedbyGlobalGrocertoitssupplierswhowillbepaidduringthe

comingyear),taxespayable(moneypotentiallyowedtothetaxauthorities)andashorttermdebt(aloantoGlobalGrocerthatitmustpaybackwithinayearofthebalancesheet

date).

GlobalGrocerhasonenoncurrentliabilityonitsSeptember30,2014,balancesheet:amortgagepayable.Themortgageisalongtermloan.ItrepresentsmoneyowedbyGlobal

Grocertoabank,withpaymentstobemadeformorethan12monthsfromthebalancesheetdate.

Exercise3.4

Considertheitemslistedintheleftcolumnofthetablebelow.Usethedropdownmenusprovidedtoindicatewhethertheitemmeetseachofthethreeliabilitycriteria.Items

meetingallthreecriteriaareliabilities.

15/160

4/25/2016

FinancialAccounting

Owners'Equity

Owners'Equityistheresidualinterestoftheentity'sownersinthecompany'sassets.Itistheamountremainingafterliabilitiesaredeductedfromassets.

Exercise3.5

OnJune30,2014,Ardelcompanyhastotalassetsof$12,500,000.Ithastotalliabilitiesof$10,500,000.WhatistheamountofArdel'sowners'equityonJune30,2014?

TheAccountingEquation

Asimplerelationshipconnectsassets,liabilitiesandowners'equity.Thekeyfeatureofabalancesheetisthattotalassetsisalwaysequaltototalliabilitiesplusowners'equity.This

relationshipbetweenassetsandliabilitiesplusowners'equityisknownasthefundamentalaccountingequation.

Theleftsideoftheaccountingequationtotalassetsrepresentsallofanentity'sresourcesthathaveprobablefutureeconomicbenefitsthattheentityhasobtainedorcontrolsasaresult

ofpasttransactionsorevents.Therightsideoftheequationtotalliabilitiesplusowners'equityrepresentsthesourcesforthoseresources.Therefore,thetwosidesmustbeequalatall

times.

16/160

4/25/2016

FinancialAccounting

Exercise3.6

Whichoneofthefollowingbestdescribesthefundamentalaccountingequation?

Concepts

Inthissectionwewillintroducetwomoreaccountingconcepts,namelythedualaspectandhistoricalcostconcepts.Theyareparticularlyrelevanttothebalancesheet.Thesetwo

conceptsprovideguidanceonthevaluationofassets,liabilitiesandowners'equity.

DualAspect

Thedualaspectconceptformalizestheideathattherearetwosidestoeveryaccountingtransaction.Recordingbothsidesofeachtransactionisknownasdoubleentry

bookkeeping.

Thedualaspectconcepthasaveryimportantimplication:afterbothsidesofeachaccountingtransactionarerecordedontheentity'sbooks,thebasicaccountingequationshould

remainbalanced.

Exercise3.7

Thedualaspectconcepttellsusthat

17/160

4/25/2016

FinancialAccounting

HistoricalCost

Thehistoricalcostconcept,alsoknownasthecostconcept,providesguidanceastotheamountatwhichatransactionshouldbereportedinitiallyintheentity'saccounts.It

requiresthattransactionsberecordedintermsoftheiractualpriceorcostatthetimethetransactionoccurred.

GlobalGrocerisplanningtobuyawarehouseproperty.Thehistoricalcostconceptdirectsyoutorecordthewarehousepropertyatitsacquisitioncostof$70,000.Othersmaythinkthe

warehousepropertyisworthmoreorlessthantheamountGlobalGrocerpaid,buttheirviewsareirrelevant.Theaccountingrecordswillrecordthewarehousetransactioninitiallyat

theamountactuallypaidforit.

Relevance/Reliability

Thehistoricalcostconceptprovidesadegreeofreliabilityintheentity'saccounts.Itallowstheaccountanttoignoreopinionandhearsayaboutthemonetaryvalueofitems,andto

reportamountsbasedonactualtransactions.But,theuseofthehistoricalcostconceptalsomeansthatsomeamountsonanentity'sbalancesheetarebasedonhistoricalvalues,

determinedatthetimeofpurchase,whichcouldpredatethecurrentbalancesheetdatebyyears.Consequently,itisunlikelythattheassetamountsonthebalancesheetreflectthe

valuethattheassetswouldfetchiftheyweresoldtoday.Inthissense,thefinancialstatementsmaybe'lessrelevant'forthepurposesofusersoftheentity'sbalancesheets,thanif

currentmarketpriceswerereported.

Asnotedearlier,whenrelevanceandreliabilityhavetobetradedoff,financialreportingpracticetendstofavorreliability.Hencerelianceonthehistoricalcostconceptmay

sometimesyieldmorereliablebutlessrelevantfinancialinformation.

However,accountantsarenotblindtotherelevanceissue.Asyouwilllearninmoreadvancedaccountingclasses,manymonetaryassetsarerecordedinitiallyattheircost,and

subsequentlymeasuredandreportedinthebalancesheetattheirmarketvalue.Monetaryassetsareitemssuchasmarketablesecurities.Theirmarketvaluecangenerallybe

estimatedreasonablyreliably.Inaddition,youwilllearnhowaccountantsenhancerelevancebyrecordingsometransactionstoreflecttheirsubstanceratherthantheirform.

WhileIFRSfavorsthehistoricalcostmodel,itdoespresentasanacceptablealternativetreatmenttherevaluationoflandandbuildingstotheirmarketvalue,iftheirvaluecanbe

measuredreliablysubsequenttotheirinitialrecognitionatcost.

Exercise3.8

SunElectronicspurchasesastampingmachinefor$10,000.Almostimmediately,atradeembargorestrictsthenumberofstampingmachinesthatcanbeimportedintotheU.S.

Basedonwantadsinthecommercialsectionofthenewspaper,stampingmachineslikeSun'sarenowsellingfor$15,000.SunElectronicsshouldimmediately

Exercise3.9

Tousersofanentity'sfinancialstatements,whichofthefollowingisapotentiallimitationofthehistoricalcostconcept:

Review

Theexercisesinthissectioncoverallthematerialyouhavelearnedaboutthebalancesheetuptothispoint.Takeafewmomentstotestyourunderstandingofthismaterial.

Exercise3.10

Choosethepairofwordsthatbestcompletesthefundamentalaccountingequation:_________________=Liabilities+________________

Exercise3.11

Whichoneofthefollowingisnotarequirementforanitemtobeanasset:

Exercise3.12

GlobalGrocerhaspurchasedawarehousebuildingwithanexpectedusefullifeof10yearsfor$40,000.Whichofthefollowingisthebestdescriptionofthisnewasset?

Exercise3.13

Aliabilityonthebalancesheetrepresents_________________oftheentity.

Exercise3.14

OnJanuary1,2014,ScottManufacturinghasassetsof$1,600,000andliabilitiesof$900,000.Itsowners'equityis

Let'sGetGlobalGrocerStarted

18/160

4/25/2016

FinancialAccounting

YouhavespentmuchofAugustraisingfinancingandmakingthenecessaryinvestmentsandpreoperatingdecisionstogetGlobalGrocerreadytoopenitsdoorsonSeptember1.

AlthoughthetransactionstookplaceduringAugust,forsimplicity,youwillrecordthemalltogetheronAugust31stbeforethestoreopens.Ofcourse,youstartwithanemptybalance

sheet.

CommonStock

ShortTermDebt

FranchiseFee

19/160

4/25/2016

FinancialAccounting

PrepaidRent

WarehouseProperty

Mortgage

20/160

4/25/2016

FinancialAccounting

StoreFixtures

MerchandiseInventory

Hiring

21/160

4/25/2016

FinancialAccounting

Exercise3.15

SupposeBarnumandSonsobtainsa5year,$100,000bankloan,payableatmaturity.Whichoneofthefollowingdescribestheeffectofthistransactiononitsbalancesheet?

TransactionExercises

Theexercisesinthissectiondescribevarioustransactionsandaskyouhowtheyaffectthebalancesheet.Takeafewmomentstotestyourunderstandingofthismaterial.

Exercise3.16

Exercise3.17

OnJune2,2014,Mansfieldpurchasesacomputersystemfor$22,000fromInfostoreSystems.Mansfieldpays$10,000incashandpromisestopayInfostoretherestinequal

installmentsovertherestoftheyear.Thecomputersystemisexpectedtolast4years.Whichofthefollowingwouldyoudointhissituation?

22/160

4/25/2016

FinancialAccounting

Exercise3.18

Exercise3.19

23/160

4/25/2016

FinancialAccounting

Ratios

Usersoffinancialstatementsuseatechniqueknownasfinancialratioanalysistoassessthefinancialpositionandperformanceofanentity.Financialratiosareratiosbasedonthe

amountsinthefinancialstatements.Twosimplebalancesheetbasedratiosareintroducedinthissection.Theyarethecurrentratioandthelongtermdebttoequityratio.

CurrentRatio

Anentity'sabilitytomeetitscurrentobligationsthoseduewithinthecomingyearisanimportantmeasureofitsfinancialhealth.Theseshorttermobligationsareusually

repaidinthenormalcourseofbusiness,astheentity'scurrentassetsareconvertedtocash.Forexample,cashisgeneratedwhenmerchandiseinventoryissoldforcash,orwhen

accountsreceivablesarecollectedincashfromcustomers.Thiscashcanthenbeusedtopayaccountspayable.

Thecurrentratio,or,ratioofcurrentassetstocurrentliabilitiesisameasureofanentity'sabilitytomeetitsmaturingshorttermobligations.

Inthecurrentratio,thenumerator,currentassets,representstheresourcesoftheentitythatareeithercashorexpectedtosoonbeconvertedintocash.Cashandtheseasset

conversionstocashcanbeusedtosatisfytheimmediateclaimsofshorttermcreditors.Thedenominator,currentliabilities,representsthecurrentclaimsofcreditorsthatmust

beextinguishedinthenearterm.

24/160

4/25/2016

FinancialAccounting

CurrentRatio=CurrentAssets

CurrentLiabilities

Interpretation

Whilethereisnosingleidealcurrentratio,financialstatementusersoftenemploytheruleofthumbthatahealthybusinesswillhaveaminimumcurrentratioof2.Because

theappropriatecurrentratiovariesbyindustries,financialstatementuserstendtofocusonanentity'scurrentratiorelativetothoseofother,similarbusinesses.IntheU.S.,

thepharmaceuticalindustryhashadanaveragecurrentratioof1.8overthepastdecadethesoftwareindustry,ontheotherhand,hashada2.9averagecurrentratiooverthe

sametimeperiod.Softwarecompanies,withtheirlimitedneedforfixedassets,traditionallyholdamuchlargerproportionoftheirassetsincashandmonetarycurrentassets,

andthisisreflectedintheirsignificantlyhighercurrentratios.

Iffinancialstatementusersnoticethatanentityhasacurrentratiothatsignificantlyhigherthanthatofitspeers,theymaybeconcernedthattheentityholdsmorecashor

inventorythanabusinessneeds.Thismaysignalthatitislockinguppotentiallyproductivecapital.If,ontheotherhand,anentityhascurrentratiothatissignificantlylower

thanthatofitspeers,financialstatementusersmayquestionitsabilitytosatisfyitscurrentobligationsinatimelymanner.

Exercise3.20

FarrahCompany'sDecember31,2014balancesheetshowscurrentassetsof$250,000andcurrentliabilitiesof$100,000.Itscurrentratiois

TotalDebttoEquityRatio

Thecompositionofacompany'slongtermcapitalstructureprimarilyitstotalinterestbearingdebtandowners'equityisofinteresttofinancialstatementusersseekingto

assessthelongtermfinancialviabilityofanentity.Ofparticularinterestistheratiooftotaldebt(capitalthataccruesinterestandhastoberepaidtolenders)toequitycapital

(capitalthatdoesnotdemandinterestanddoesnothavetoberepaid).

Thetotaldebttoequityratioisusefulforjudginganentity'slongtermfinancialviability.Asthenamesuggests,itistheratioofallinterestbearingdebtonthebalancesheet,to

totalequity.Thisratiomeasuresfinancialleverageorthedegreeoftheentity'sindebtednessrelativetoitsequityfunding.

Debtandequityareverydifferentkindsofcapital.Whenanentityassumesdebt,i.e.,acceptsaloan,ithastopayinterestandalsorepaytheloantothedebtholderoveran

agreeduponperiodoftime.Iftheentityrunsintohardtimesandfailstopayitsmaturingfinancialobligationstoitsdebtholders,theycanforcetheentityintobankruptcy.

Equitycapital,ontheotherhand,isaresidualclaimontheentity'sassets.Ifacompanybecomesinsolvent,equityholdersgetwhatremainsafterdebtholdershavebeen

satisfied.

So,thelargerthesizeofanentity'sdebtobligationsrelativetoequity,i.e.,thelargeritstotaldebttoequityratio,thegreateristheimpliedstrainontheentitytomakeregular

paymentstodebtholders,andthehigheristheriskofbankruptcy.

25/160

4/25/2016

FinancialAccounting

TotalDebttoEquityRatio=TotalDebt

TotalEquity

Interpretation

Thereisnosingleidealtotaldebttoequityratio.Overthepastcoupleofdecades,intheU.S.,theaveragetotaldebttoequityratioforpubliccompanieshasrangedfrom0.5to

1.0.However,itcanvaryconsiderablyfromoneindustrytoanother.Businessesinstableindustrieswithtangibleassetsthatmakegoodcollateraltendtoborrowheavilyto

financethoseinvestments,sotheytendtohavehightotaldebttoequityratios.Incontrast,volatilebusinesseswithfewtangibleassetstendtohavelowtotaldebttoequity

ratios.IntheU.S.,thesoftwareindustry,whichtraditionallyholdsverylittledebt,hashada0.10averagetotaldebttoequityratiooverthepastdecade.Ontheotherhand,

financialfirms,whichtraditionallyareveryhighlyleveraged,havehadatotaldebttoequityratioof3.3overthesametimeperiod.

Ifacompanyhasatotaldebttoequityratiothatissignificantlyhigherthanthatofitspeers,financialstatementusersmaybeconcernedaboutitsabilitytomaketherequired

paymentstoitsdebtholdersandthecompany'slongtermsolvencymaybequestioned.

If,ontheotherhand,acompanyhasatotaldebttoequityratiothatissignificantlylowerthanthatofitspeers,financialstatementusersmayquestionwhetherthecompanyis

beingaggressiveenoughinpursuingprofitablegrowthopportunitiesbyraisingdebtwhennecessarytofinancethoseopportunities.

Aswithotherfinancialratios,thereisnosingleperfecttotaldebttoequityratioforanybusiness.Whatisimportantisacompany'stotaldebttoequityratiorelativetothoseof

other,similarbusinesses,andalsohowtheratiochangesovertime.

Exercise3.21

Whichoneofthefollowingchoicesbestcompletesthissentence:Thetotaldebttoequityratioisusefulforjudging___________________.

RatioExercises

Theexercisesinthissectiontestyourunderstandingofthetwosimplebalancesheetbasedratios:currentratioandtotaldebttoequityratio.Pleasetakeamomenttocomplete

theseexercises.

Exercise3.22

Exercise3.23

26/160

4/25/2016

FinancialAccounting

Recap

Inthischapteryoulearned:

Howabalancesheetisorganized.

Assets,liabilitiesandowners'equityweredefined.

Thekeyrelationshiplinkingassets,liabilitiesandowners'equitythefundamentalaccountingequationwasexplained.

ThedualaspectandhistoricalcostconceptswereintroducedandusedtorecordallofGlobalGrocer'sbusinesstransactionsinAugust.

Howtocomputeandusetwosimplebutimportantbalancesheetratiosthecurrentratioandthetotaldebttoequityratio.

TheIncomeStatement

Inthischapter,youwilllearnmoreabouttheincomestatementandhowitisorganized.Youwillalsobeintroducedtothreenewaccountingconceptstherealization,matchingand

conservatismconceptsaswellashowtoapplythemtorecordtheresultsofGlobalGrocer'sbusinessoperationsduringthemonthofSeptember.Finally,youwilllearnabouttwo

ratiosthatareimportantmeasuresofoperatingperformance:thegrossmarginandreturnonsalespercentages.

27/160

4/25/2016

FinancialAccounting

Layout

Inthissection,youwilllearnhowtheincomestatementisorganized.Anincomestatementisafinancialdescriptionofanentity'soperatingperformanceduringanaccounting

period.Itreportstheentity'ssales,expensesandnetincomeorlossfortheperiod.Theincomestatement'sbasicequationisSalesminusExpensesequalsNetIncome.

HereisasampleincomestatementforGlobalGrocerforitsfirstaccountingperiod,themonthofSeptember.

(1)Theincomestatementheadingliststhenameoftheentity,GlobalGrocer.

(2)Thenextlineindicatestheaccountingperiodcoveredbytheincomestatementinthiscase,themonthofSeptember2004.

(3)Salesareincreasesinassetsordecreasesinliabilitiesduringaperiodresultingfromdeliveringgoods,renderingservicesorotheractivitiesconstitutingtheentity'scentral

operations.

(4)Fromsales,wesubtracttheexpensesassociatedwithgeneratingthesalesoftheperiod.Expensesaredecreasesinassetsorincreasesinliabilitiesduringaperiodresultingfrom

adeliveryofgoods,renderingofservices,orotheractivitiesconstitutingtheentity'scentraloperations.

GrossMargin

Thefirstsegmentoftheincomestatementshowsthecompany'ssales,thecostofthosesalesandthedifference,whichisknownasgrossmargin.

Wecalculatedgrossmarginbysubtractingfromsalesthecostofgoodssold("COGS").Nextwesubtracttheentity'sotherexpensesofrunningthebusinesstodeterminenet

income.

28/160

4/25/2016

FinancialAccounting

(1)FromSales,wesubtractthecostofthegoodssoldduringtheaccountingperiod.

(2)Theexcessofthesalesamountoverthecostofgoodssoldamountor,salesminuscostofgoodssoldisreferredtoasthegrossmarginorgrossprofit.Itiscalledgrossprofit

becauseoperatingexpenseshavenotyetbeenaccountedfor.

Thefirstsegmentoftheincomestatementshowsthecompany'ssales,thecostofthosesalesandthedifference,whichisknownasgrossmargin.

Wecalculatedgrossmarginbysubtractingfromsalesthecostofgoodssold("COGS").Nextwesubtracttheentity'sotherexpensesofrunningthebusinesstodeterminenet

income.

OtherLineItems

YouwillnoticeonGlobalGrocer'sincomestatementthattheexpensesofrunningthebusinesslistedbelowthegrossmarginaredisplayedinthreecategories:operating

expenses,interestexpenseandincometaxexpense.

(1)ForGlobalGrocer,expenseslistedbelowthegrossmarginareoperatingexpenses,interestexpenseandincometaxexpense.

(2)Operatingexpenses,astheirnameimplies,relatetotheoperationsofthebusiness.Theseincludethemarketing,sellingandadministrativeexpensesincurredinrunninga

business.Theyareoftenreportedasasingleaccount,selling,generalandadministrative(SG&A)expenses.

29/160

4/25/2016

FinancialAccounting

(3)Grossmarginminusoperatingexpensesyieldsoperatingincome(alsoknownasoperatingprofit).Itisameasureoftheprofitgeneratedfromthedaytodayrunningofthe

business.

(4)Interestexpenseisthecostofdebtfinancingfortheaccountingperiod.IfGlobalGrocerhadinvestedanyexcesscashduringthisaccountingperiod,interestincome,ifany,

wouldbereportedinthissectionoftheincomestatement.Operatingprofitminusinterestexpenseyieldsincomebeforeincometaxes.

(5)Incomebeforeincometaxesminusthetaxexpenseyieldsnetincome.Sincetaxeswillnotbedueuntilnextyear,thetaxexpenseisanestimateofthetaxesthatmighthaveto

bepaidontheprofitwhenGlobalGrocer's2004taxreturnisfiled.

(6)Thenetincomeforaperiod,i.e.,theearningsoftheentity,netofallexpenses,isoftencalledprofitornetprofitwhenitispositive(i.e.,saleshavebeengreaterthantotal

expenses),orlossornetlosswhenitisnegative(i.e.,saleshavebeenlessthantotalexpenses).

LinktoBalanceSheet

Thebalancesheetsatthebeginningandendofanaccountingperiodarelinked,bytheincomestatementfortheperiod,throughtheretainedearningsaccountintheowners'equity

sectionofthebalancesheets.

RetainedEarnings

Theretainedearningsaccountisthesumofthecompany'snetincometodate,lessdividends,ifany,paidtotheowners.Thenetincomefortheperiodisaddedtotheretained

earningsamountreportedontheperiod'sbeginningbalancesheettodeterminetheperiod'sendingretainedearnings,beforeanydividendpayments.

Dividends

Dividendsaredistributionsofearningstoowners,usuallyintheformofcash.ThepaymentofadividendreducestheRetainedEarningsaccount.

30/160

4/25/2016

FinancialAccounting

Summary

Insummary,twoeventschangetheretainedearningsaccountduringanaccountingperiod.First,theNetIncome(loss)earnedbytheentityduringtheperiodincreases

(decreases)theretainedearningsaccount.Second,anydividendspaid(distributionsmadetoinvestors)duringtheperiodreducetheretainedearningsaccount.

Thepaymentofdividendsisnotanexpenseitisadistributionofequitycapitaltoinvestors.Hence,thepaymentofdividendsisnotrecordedontheincomestatementinstead,

itdirectlyreducestheretainedearningsaccount.

Exercise4.1

31/160

4/25/2016

FinancialAccounting

DuringthemonthofApril2015,MansfieldCompanyrecordssalesof$5,000,andtotalexpensesof$3,000.WhatisMansfield'snetincomeforApril2015?

Exercise4.2

SupposeMansfieldhasaretainedearningsbalanceof$20,000onApril1,2015.DuringthemonthofApril,itearnsanetincomeof$2,000andalsopaysadividendof$500toits

investors.WhatisitsretainedearningsbalanceattheendofApril2015?

Concepts

Inthissection,wewillintroducethreemoreaccountingconcepts:therealization,matchingandconservatismconcepts.Theyareparticularlyrelevanttotheincomestatement.

Thesethreeconceptsprovideguidanceastothetimingoftherecognitionandamountsofsalesandexpensestoberecordedbytheentity.Liketheotherfinancialreporting

concepts,whenproperlyapplied,theyreflectabalancebetweenrelevanceandreliabilityinthereportedamounts.

RealizationConcept

Realizationistheprocessofconvertingassets,suchasmerchandiseforsale,intocash,cashequivalents,orgoodaccountsreceivable.

Realizationplaysanimportantroleindeterminingwhenrevenueisrecognized.Twoconditionsmustbesatisfied.First,therevenuemustbeearned,whichtypicallymeansthat

thecustomerhasreceivedthegoodorservice.Second,therevenuemusthavebeenrealizedorrealizable,implyingthatthecustomerhaspaidorisexpectedtopayforthe

merchandise.

Realizationistheprocessofconvertingassets,suchasmerchandiseforsale,intocash,cashequivalents,orgoodaccountsreceivable.

Realizationplaysanimportantroleindeterminingwhenrevenueisrecognized.Twoconditionsmustbesatisfied.First,therevenuemustbeearned,whichtypicallymeansthat

thecustomerhasreceivedthegoodorservice.Second,therevenuemusthavebeenrealizedorrealizable,implyingthatthecustomerhaspaidorisexpectedtopayforthe

merchandise.

32/160

4/25/2016

FinancialAccounting

IFRS

TheIFRSandGAAPrevenuerecognitionrulesdifferintheirwordingandunderlyingtheory.IFRSrecognizesrevenuewhenthe"risksandrewardsofownershipare

transferred."Incontrast,GAAP,amongotherrequirements,recognizesrevenuewhenitis"earned."Despitethesedifferences,inmostcasestheaccountingforrevenue

transactionswillbethesameundereitherconcept.

IFRSrecognizesrevenuewhenallthefollowingconditionshavebeensatisfied:

Thesellerhastransferredtothebuyerthesignificantrisksandrewardsofownershipofthegoods

Thesellerretainsneithercontinuingmanagerialinvolvementtothedegreeusuallyassociatedwithownershipnoreffectivecontroloverthegoodsold

Theamountofrevenuecanbemeasuredreliably

Itisprobablethattheeconomicbenefitsassociatedwiththetransactionwillflowtothesellerand

Thecostsincurredortobeincurredinrespectofthetransactioncanbemeasuredreliably.

Exercise4.3

FollowingGAAP,considereachsituationdescribedbelowandindicatewhetherrevenuehasbeenearnedandwhetheritisrealizedorrealizablebychoosingtheappropriate

entriesineachcell.

MatchingConcept

TheGAAPandIFRSrevenuerecognitioncriteriatellsuswhentorecognizerevenue.TheMatchingconceptindicateswhatexpensesshouldberecognizedwhenrevenueis

recorded.

Thetimingofexpenserecognitionisimportantsincerevenuelessexpensesequalsnetincome.TheMatchingConceptstipulatesthatexpensesshouldberecognizedinthesame

periodastherelevantrevenuesarerecognized.Costsrelatedtothisperiod'sactivitiesbutwhicharenotdirectlyrelatedtoproductsandservicessold,areexpensedthisperiod.

33/160

4/25/2016

FinancialAccounting

TheRealizationconcepttellsuswhentorecognizerevenue.TheMatchingconceptindicateswhatexpensesshouldberecognizedwhenrevenueisrecorded.

Thetimingofexpenserecognitionisimportantsincerevenuelessexpensesequalsnetincome.TheMatchingConceptstipulatesthatexpensesshouldberecognizedinthesame

periodastherelevantrevenuesarerecognized.Costsrelatedtothisperiod'sactivitiesbutwhicharenotdirectlyrelatedtoproductsandservicessold,areexpensedthisperiod.

TheRealizationconcepttellsuswhentorecognizerevenue.TheMatchingconceptindicateswhatexpensesshouldberecognizedwhenrevenueisrecorded.

Thetimingofexpenserecognitionisimportantsincerevenuelessexpensesequalsnetincome.TheMatchingConceptstipulatesthatexpensesshouldberecognizedinthesame

periodastherelevantrevenuesarerecognized.Costsrelatedtothisperiod'sactivitiesbutwhicharenotdirectlyrelatedtoproductsandservicessold,areexpensedthisperiod.

TheRealizationconcepttellsuswhentorecognizerevenue.TheMatchingconceptindicateswhatexpensesshouldberecognizedwhenrevenueisrecorded.

Thetimingofexpenserecognitionisimportantsincerevenuelessexpensesequalsnetincome.TheMatchingConceptstatesthatexpensesshouldberecognizedinthesame

periodastherelevantrevenuesarerecognized.Costsrelatedtothisperiod'sactivitiesbutwhicharenotdirectlyrelatedtoproductsandservicessold,areexpensedthisperiod.

34/160

4/25/2016

FinancialAccounting

ConservatismConcept

TheRealizationConceptanditsassociated"earned"requirementsprovideguidanceastowhentorecognizerevenuesandtheMatchingConceptprovidesguidanceastowhento

recognizeexpenses.TheConservatismConceptgoesonestepfurtherbyrecommendingthatprudencebeexercisedinrecordingrevenuesandexpenses.Itsaysthatrevenues

shouldberecognizedonlywhenreasonablycertain,butexpensesshouldberecognizedassoonasreasonablypossible.

Conservatisminfinancialaccountingmeansthatanentityshouldrecognizeonlythoserevenuesforwhichthereisahighdegreeofconfidencethattheywillbeearnedand

realized.

Expenses,ontheotherhand,shouldberecordedassoonastheyseemlikelytobeincurred.Iftheentityisuncertainwhethertorecognizeanexpenseorabouttheamountofan

expense,theconservatismconceptencouragesittoproactivelyestimatethecostandrecordtheexpense.

Theconservatismconceptalsoappliestothebalancesheet.Itsuggestsprudenceintherecordingofassets(recordwhenreasonablycertain)andintherecordingofliabilities

(recordassoonasreasonablypossible).Further,iftwodifferentestimatesofabalancesheetamountwereequallyacceptable,theconservatismconceptwouldguideaccountantto

recordthesmalleramountwhenmeasuringassetsandthelargeramountforliabilities.

Caremustbetakenwhenapplyingtheconservatismconcept.Otherwise,itcanleadtobiasinfinancialstatementsbyunderstatingprofitsinoneperiodonlytobefollowedby

overstatementinasubsequentperiod.

Let'sGetGoing

ItisSeptember1andthisisGlobalGrocer'sbalancesheet.DuringAugust,youraisedcapitalforGlobalGrocer,paidafranchisefee,boughtstorefixtures,purchasedawarehouse

property,rentedastoreandstockedupmerchandiseinventory.Youalsohiredtwoexperiencedemployeeswhowillstartworktoday.

35/160

4/25/2016

FinancialAccounting

(1)Thecurrentasset,accountsreceivable,andtheowners'equityaccountretainedearnings,whichhavezerobalancesatpresent,willbeaffectedbytheoperationsthatcommence

today.

TheFirstFewSales

ThestoreopensonWednesday,September1,andasexpected,thefirstfewdaysofstoreoperationsareslow.Severalpeoplestopbytobrowse,pickupbrochuresandtastethe

freesamples.Thestoremakesthreesalesbytheendofitsfirstdayofoperations.

Thedollaramountofeachsale,thecashreceived,creditprovidedtocustomersandrecordedasaccountsreceivableandthecosttoGlobalGrocerofthegoodssold(COGS)are

showninthistable.Ineachofthesesales,goodshavebeendeliveredtothecustomerandcashhaseitherbeencollectedorisexpectedbecollectedbyGlobalGrocer.Therevenues

havebeenearnedandarerealizedorrealizable.Therevenuerecognitionconceptrequiresthatyourecordtherevenuefromthesefirstdaysales.

Recording

Salesandexpensesareincomestatementaccounts.However,theyalsoaffectthebalancesheet,inparticular,theretainedearningsaccount.Inordertobuildonour

understandingofthefundamentalaccountingequation(Assets=Liabilities+Owners'Equity),wewillillustratetheimpactofthesefirstdaysalesonGlobalGrocer'sbalance

sheet,andalsobegintoconstructitsincomestatementforSeptember2014.Attheendoftheaccountingperiod,themonthofSeptember,wewillcompleteGlobalGrocer's

incomestatement.

CashSale

Let'srecordthesaleofthegiftbasket,wherethecustomerpaidtheentireamountincash.

Let'srecordthesaleofthegiftbasket,wherethecustomerpaidtheentireamountincash.

36/160

4/25/2016

FinancialAccounting

Let'srecordthesaleofthegiftbasket,wherethecustomerpaidtheentireamountincash.

Let'srecordthesaleofthegiftbasket,wherethecustomerpaidtheentireamountincash.

CreditSale

Let'srecordthesaleoftheItalianpesto,wherethecustomerputtheentireamountoncredit.

37/160

4/25/2016

FinancialAccounting

Let'srecordthesaleoftheItalianpesto,wherethecustomerputtheentireamountoncredit.

Let'srecordthesaleoftheItalianpesto,wherethecustomerputtheentireamountoncredit.

Exercise4.4

Recordtheeffectofthethirdandfinalsaleoftheweek:100poundsofColombiancoffeearesoldfor$400.Thecustomerpaid$150incashandput$250onacreditaccount

withGlobalGrocer.Whichoneofthefollowingchoicescorrectlydescribestheeffectonbalancesheetoftherevenuerecognizedfromthissale?

38/160

4/25/2016

FinancialAccounting

NowrecordthematchedCOGSexpenserelatedtothesaleof100poundsofColombiancoffee.GlobalGrocerpaid$2.60perpoundforthecoffeeinitsinventory.Whichoneof

thefollowingchoicescorrectlydescribestheeffectonbalancesheetoftheCOGSexpenserecordedforthissale?

BalanceSheetEffect

Theeffectonthebalancesheetofthisprofitablesaleof100poundsofColombiancoffeeforcashandcreditisshownhere.Thecashaccountincreasedby$150,accounts

receivableincreasedby$250,merchandiseinventorydeclinedby$260andretainedearningsincreasedby$140.Thefundamentalaccountingequationremainsinbalance.

OverallEffect

Thethreesalesonthefirstdayresultinrevenuesof$1,000(giftbasket,$100+pesto,$500+coffee,$400)andrelatedcumulativeCOGSof$600(giftbasket,$40+pesto,

$300+coffee,$260).$250ofthesalesrevenuewascollectedincashand$750wasrecordedasareceivable.Inventorywasreducedby$600.Thesetransactionsresultedina

$400increaseinretainedearnings.

Onthepartialincomestatementweareconstructing,werecordthecumulativesalessofarof$1,000andCOGSof$600.Thegrossmarginearnedsofaris$400,exactlyequal

totheincreaseinretainedearningsduetotheseprofitablesales.

Let'sTallySept.Operations

OvertherestofSeptember,asGlobalGrocer'sreputationspreads,salespickup.Duringthefirstaccountingperiod,September1throughSeptember30,salestotaled$16,000

(includingthethreefirstdaysales),ofwhich$11,000wascollectedincashand$5,000wasputonaccount.Costofgoodssoldamountedto$7,500.Customersdidnotmakeany

paymentstowardstheircreditaccounts,andnoinventorywaspurchased.

YouhavetrackedandrecordedsalesandCOGS,andcalculatedgrossmarginforthemonthofSeptember.Itistimetorecordtheotherexpensesoftheaccountingperiod.

ExpensesofthePeriod

Youwillnowrecordtheoperating,interestandtaxexpensesfortheperiod.Thesearecoststhatarenotassociatedwithfuturerevenues,sowewillmatchthemtotherevenue

recognizedforthemonth.

39/160

4/25/2016

FinancialAccounting

Salaries

First,werecordthesalariesexpenserelatedtoemployeesalaries.Youandthetwoemployeeseachwerepaid$1,000incashforthemonth'swork,foratotalmonthlysalary

expenseof$3,000.Thistransactionincreasestheoperatingexpensesontheincomestatementby$3,000.Likeallexpenses,thisexpensereducesretainedearningsonthe

balancesheet.Thesalarieswerepaidincash,sothecashaccountalsodecreasesby$3,000.

Utilities

Theutilitiesexpenseforthemonthwas$500,alsopaidincash.

RentExpense

Storerentis$1,000permonth.GlobalGrocerhadalreadyprepaidthreemonths'rent,reflectedintheprepaidexpensesbalanceof$3,000ontheAugust31balancesheet.

Recognitionoftherentexpenseof$1,000forthemonthofSeptemberrequiresanequalreductionintheprepaidexpensesassetaccount.Takespecialnoteofthistransaction:

nocashisexchangedatthispoint,buttherentexpenseassociatedwiththepassageofthemonthisrecorded.Thisisaccrualaccounting.

40/160

4/25/2016

FinancialAccounting

Depreciation

Thenextoperatingexpenseswewillrecordareassociatedwiththeuseoftangiblenoncurrentassetsthewarehousebuildingandstorefixtures.GlobalGroceracquiredthese

assetswiththeexpectationthattheywouldprovideeconomicbenefitsforanumberofyears.Thematchingconceptrequiresthatthecostofeachoftheseassetsbespreadover

itsusefullife,andineachaccountingperiodanexpenseberecordedtoreflectthereductionintheusefullifeoftheasset.ThisexpenseiscalledDepreciationExpense.

Depreciationofatangiblelonglivedassetalsoreducesthebalancesheetvalueoftheasset.Thisisaccomplishedusinganaccumulateddepreciationaccount,acounterpart

totheassetaccount,butwiththeoppositesign.Itsneteffectisareductionintherecordedvalueofanasset.Anasset'shistoricalcost(itsdepreciablepurchaseprice)minusits

accumulateddepreciationyieldsitsnetbookvalue.Thenetbookvalueofeachlonglivedassetisusedtocomputetotalassetsonthebalancesheet.

NetBookValue=HistoricalCostAccumulatedDepreciation

Warehouse

Weestimatethatthewarehousedepreciationexpenseforeachmonthofitsuseis$300.Thecontraassetornegativeassetaccount,accumulateddepreciationonthe

warehousebuilding,isincreasedby$300,andthedepreciationexpensereducesretainedearningsbythesameamount.Ineffect,the$300increaseintheaccumulated

depreciationcontraassetaccountdecreasestotalassetsby$300,andthefundamentalaccountingequationismaintained.

OntheSeptember30balancesheet,thewarehousebuildingwillhaveanetbookvalueof$39,700,andthisamountwillbeincludedinthecalculationofGlobalGrocer'stotal

assetsattheendofSeptember.

NetBookValue=HistoricalCostAccumulatedDepreciation

=$40,000$300=$39,700

StoreFixtures

GlobalGrocerhasanotherlongliveddepreciabletangibleasset,storefixtures.ItshouldalsobedepreciatedtoreflectitsreducedexpectedusefullifeattheendofSeptember.

Onemonth'sdepreciationonthestorefixturesisestimatedat$100.Thisishowwerecordthe$100monthlydepreciationexpenserelatedtothestorefixtures.

41/160

4/25/2016

FinancialAccounting

Land

GlobalGrocerhasanotherlonglived,tangibleasset:land.Forfinancialreportingpurposes,landisassumedtohaveanindefinitelife.Asaresult,itsusefullifeisassumedto

remainundiminishedduringthepassageofanaccountingperiod.Therefore,landisneverdepreciated.Untilitissold,thelandwillremainonGlobalGrocer'sbalancesheet

atitshistoricalcostof$30,000.

Exercise4.5

Thestorefixtureswerepurchasedfor$5,000attheendofAugust.AttheendofSeptember,therelatedaccumulateddepreciationonthatassetis$100.Whatisthenetbook

valueofthestorefixturesassetontheSeptember30balancesheet?

Amortization

Foranintangiblelonglivedasset,werecordareductioninitsremainingusefullifebyrecordinganamortizationexpensethatdirectlyreducesthevalueoftheassetonthe

balancesheet.Notethatamortizationanddepreciationexpensesbothreflectthediminishingusefullivesofassets.However,theeffectofeachisrecordeddifferentlyonthe

balancesheet.Depreciationexpenseisrecordedforeachdepreciabletangibleassetanditaccumulatesinarelatedcontraassetaccountonthebalancesheet.Amortization

expenseisrecordedforeachamortizableintangibleasset,andthereisnoassociatedcontraassetaccount:amortizationexpensedirectlyreducestherelatedintangibleasset

accountonthebalancesheet.

FranchiseFee

Thefranchisefeeisalonglived,intangibleasset.Itwillbenefitthestorefortwoyears,attheendofwhichitwillexpire.TheSeptemberamortizationexpenseonthe

franchisefeeisestimatedtobe$750.

42/160

4/25/2016

FinancialAccounting

OperatingExpenses

Let'sgatherupallofGlobalGrocer'soperatingexpensesforthemonthofSeptember.Thesalaries,utilities,rent,depreciationandamortizationexpensetotaled$5,650.With

Salesof$16,000,COGSof$7,500andoperatingexpensesof$5,650,GlobalGrocer'sSeptemberoperatingincomeis$2,850.

DebtService

Let'snowrecordGlobalGrocer'sinterestexpenseforSeptember.ThedebtonGlobalGrocer'sbalancesheetinvolvesacontractualobligationtopayinterest.GlobalGrocerhas

twooutstandingdebtobligations.

ShortTermInterest

First,let'srecordtheinterestexpenseonthe$50,000shorttermdebt,andthepaymentmadetothelender.Forthisloan,GlobalGrocerwillrecordaSeptemberinterest

expenseof$250anda$250reductioninthecashaccount.

43/160

4/25/2016

FinancialAccounting

MortgageInterest

GlobalGrocer'smortgageisalongtermloanwiththewarehousebuildingascollateral.Thecashpaymentof$250coversthe$150interestforSeptemberandreducesthe

loanprincipalby$100.First,recordtheSeptemberinterestexpenseof$150onthisloan,paidincashtoWebsterBank.

MortgagePrincipal

Wealsohavetorecordthepaymentofanadditional$100incashthismonthtoaccountforthereductionintheoutstandingmortgageloanprincipal.Thistransactionhasno

effectontheincomestatement.Itreducescashandthemortgagepayableaccountby$100each.

InterestExpense

GlobalGrocer'stotalinterestexpenseforthemonthofSeptemberis$400:$250interestexpenseontheshorttermloan,and$150interestexpenseonthemortgage.

44/160

4/25/2016

FinancialAccounting

TaxExpense

TocompleteGlobalGrocer'sSeptemberincomestatement,youmustrecorditsincometaxexpenseforthemonth.Youestimatethatthisperiod,GlobalGrocerwillowe$950

(reflectingataxrateof38%)ofitsincomebeforeincometaxestothetaxauthorities.Therefore,itrecordsataxexpenseof$950forthemonthofSeptember.

Congratulations!

Congratulations!YouhavecompletedGlobalGrocer'sincomestatementforthemonthofSeptember.GlobalGrocerearnedanetincomeof$1,500duringitsfirstmonthof

operations.

Preparingforthefuture

AsSeptemberprogresses,youassessGlobalGrocer'sfinancialsituationandpreparefortheupcomingholidayseason.Apartfromtheoperationswhoseeffecthasjustbeenrecorded

onGlobalGrocer'sSeptemberincomestatement,youalsoundertakesomeactivitiesthatdonotaffectthismonth'snetincomestatement.

45/160

4/25/2016

FinancialAccounting

Exercise4.6

OnSeptember28,yourparents,thrilledatGlobalGrocer'searlysuccess,invest$30,000inthebusinessandinreturnreceivecommonstock.Howwillthistransactionaffect

GlobalGrocer'sfinancialcondition?

Exercise4.7

BusinessispickingupatGlobalGrocer,andyouneedavanforthegrowingvolumeofpurchasesanddeliveries.OnSeptember10,youpurchaseasecondhandvan.Itisthen

repairedandpaintedwiththeGlobalGrocerlogo.ItisdeliveredtoyouonSeptember30.Thetotalcostis$10,000.Youpayincashondeliveryofthevan.

HowdoesthepurchaseofthevanonSeptember30affectGlobalGrocer'sSeptemberincomestatement?

Exercise4.8

GlobalGrocer'smerchandisestockhasbeengettingseriouslydepletedduringthissuccessfulfirstmonth.OnSeptember20,youordered$8,500ofinventory.Itarriveson

September30.Youpay$2,500cashandputtherestonacreditaccountwithGlobalGrocerInternational.TheeffectofthistransactiononSeptember'sincomestatementwould

be:

Exercise4.9

Asagreed,startinginOctoberGlobalGrocerwillhavetopayGlobalGrocerInternationalforinventorypurchasedinSeptemberoncredit.Also,youwillneedtostockupforthe

upcomingholidayseason.Allofthiswillusecash.Accordingly,youpresentGlobalGrocer'saccountstoWebsterBankand,onSeptember30obtaina$20,0003monthshortterm

loan,interestandprincipaltobepaidatmaturity.

RecallthatGlobalGrocerhasamonthlyaccountingperiod.Whichoneofthefollowingwillbethemostappropriateaccountingtreatmentoftheinterestexpenseonthisnew

loan?

EndofPeriod

ThisisGlobalGrocer'sSeptember30balancesheet.ItincludesallthechangesthatoccurredduetooperationsduringthemonthofSeptember.Italsoincludestheinvestingand

financingactivitiesyouundertooktopreparefortheholidayseasonandforfuturebusinessexpansion,insofarasthoseactivitiesimpacttheSeptemberaccounts.

46/160

4/25/2016

FinancialAccounting

Ratios

Usersoffinancialstatementsuseanumberoffinancialratiosbasedonincomestatementnumbers.Wewilldiscusstwoofthemoreimportantones:grossmarginasapercentageof

salesandreturnonsalespercentage.Bothratioscanhelpusevaluateacompany'ssuccessatmaintainingitschosenprice/coststrategy.

GrossMarginPercentage

Grossmarginasapercentageofsalesisdollargrossmargindividedbysales,expressedasapercentage.Dollargrossmarginissalesminuscostofgoodssold.Itrepresentsthe

markuponthecostoftheproductssoldbyacompany.

Byexpressingdollargrossmarginasapercentageofsales,wecancomparethegrossmarginofacompanyatdifferentpointsintime,orthegrossmarginpercentagesofdifferent

companiesinsimilarbusinesses.Thistypeofanalysisprovidesfinancialstatementusersusefulinsightsintoacompany'spricingstrategyandpractices.

Comparison

Forexample,considerCompanyAwith$100millioninsalesand$60millioninCOGS.Itsdollargrossmarginis$40million,anditsgrossmarginpercentageis40%.Now

considerCompanyB,inthesameindustry,with$200millioninsalesand$140millioninCOGS.B'sdollargrossmarginis$60million,anditsgrossmarginpercentageis

30%.

47/160

4/25/2016

FinancialAccounting

Acompany'sgrossmarginpercentageisinfluencedbyitsindustry,itsownpricingstrategy,andtheefficiencywithwhichitproducesitsgoodsandservices.Acomparisonof

CompanyAandCompanyB'sgrossmarginpercentagesraisesseveralquestions:Whyisthereadifferencebetweenthegrossmarginpercentagesoftwocompaniesinthe

sameindustry?IsCompanyAfollowingahighpricestrategy?IsCompanyBfollowingadiscountedpricestrategy?Doesitplantosellalargervolumebydiscountingpriceto

earnahigherdollargrossmargin?Thistypeofanalysisisparticularlyusefulwhenacompany'sperformanceiscomparedagainstthatofindustrybenchmarksorstandards.

Interpretation

Overthepastdecade,U.S.softwareandpharmaceuticalcompanieshaveaveragedgrossmarginpercentagesofabout70%.Incomparison,overthesameperiod,grossmargin

percentagesintheU.S.automotiveindustryhaveaveragedabout22%.

Thehighgrossmarginpercentagesinsoftwareandpharmaceuticalsispartlyexplainedbythefactthatintheseindustries,researchexpenses,whichrepresentamajorshareof

totalexpenses,arenotincludedinthecostofgoodssold.Theactualcostofproducingasoftwareprogramonadiskinasoftwarebusinessorofproducingtabletsforpatientsata

pharmaceuticalcompanythecostofgoodssoldisextremelysmall,resultinginverylargegrossmarginsrelativetosales.Also,patentprotectionscanlimitproductcompetition

andresultinhigherprices.Thecostofproducingautomobiles,ontheotherhand,ishighrelativetotheirsellingpriceandtheindustryisverycompetitive.Thislimitsthe

abilityofautomobilecompaniestoachievehighgrossmarginpercentages.

Exercise4.10

ReturnonSalesPercentage

Returnonsalespercentageiscalculatedasnetincomeperdollarofsales,ornetincomedividedbysales,expressedasapercentage.

48/160

4/25/2016

FinancialAccounting

Byexpressingnetincomeasapercentageofsales,i.e.,byusingreturnonsales,wecancomparetheperformanceofacompanyatdifferentpointsintime,ortheperformancesof

differentcompaniesinsimilarbusinesses.Thistypeofanalysisprovidesfinancialstatementusersusefulinsightsintoacompany'spricingstrategyanditsabilitytocontrolcosts.

Comparison

Forexample,CompanyP,withsalesof$100million,hasagrossmarginpercentageof50%and,withanetincomeof$20million,areturnonsalespercentageof20%.

CompanyQ,withsalesof$200million,alsohasagrossmarginpercentageof50%,but,withanetincomeof$30,hasareturnonsalespercentageof15%.

Acompany'sreturnonsalespercentagedependsonthenatureoftheindustrythecompanyisin,itsownbusinessstrategy,anditsefficiencyindeliveringitsgoodsand

services.Becausenetincomeisaffectedbyinterestandtaxexpense,unlikethegrossmarginpercentage,returnonsalesisaffectedbythecompany'scapitalstructureandits

taxregime.

Interpretation

Overthepastdecade,returnonsalespercentagesintheU.S.softwareindustryhaveaveragedabout4%,thatis,negativefourpercent!Despitetheirextremelyhighgross

marginpercentages,averagingabout70%,asagroup,softwarecompanieshavehadnegativereturnonsales.

Duringthesameperiod,U.S.pharmaceuticalcompanieshaveaveragedreturnofsalesofabout10%.Thepharmaceuticalindustry,likethesoftwareindustry,incurshigh

researchcosts,butithasmanagedtoconvertitshighgrossmarginpercentages,alsoaveragingabout70%,intohighreturnsonsalespercentages.Forcomparisonpurposes,

returnonsalespercentageshaveaveragedabout3%intheautomotiveindustryduringthesametimeperiod.

Exercise4.11

49/160

4/25/2016

FinancialAccounting

Recap

Inthischapteryoulearned:

Howanincomestatementisorganizedandconstructed.

Salesanddifferentcategoriesofexpensesaredefinedandtherelationshipbetweentheincomestatementforaperiodandthebalancesheetsatthebeginningandendof

theperiod.

Therevenuerecognition,matchingandconservatismconceptsandhowtheyareusedtorecordthefinancialeffectsofGlobalGrocer'soperationsduringthemonthof

September.

Thedefinitionanduseoftwoimportantincomestatementratiosthegrossmarginpercentageandthereturnonsalespercentage.

AccountingRecords

Inthischapter,youwilllearnasimpleversionofthestepsbywhichaccountingsystemstrackandrecordfinancialaccountingtransactionsduringanaccountingperiod.Youwillalso

learnhowtoprepareabalancesheetandanincomestatementattheendofanaccountingperiod.YouunderstandtheeconomicandaccountingimpactofGlobalGrocer'sAugustand

September2014accountingtransactionsinthischapter,youwillrecordtheminthejournalandledgerwhichwillbeusedtopreparethebalancesheetandincomestatementfor

thoseperiods.Attheendofthechapter,youwillbeabletopracticewhatyouhavelearned.

50/160

4/25/2016

FinancialAccounting

Overview

Inanyaccountingsystem,aseriesofsystematicstepshelptheentityanditsaccountantstrackandrecorditsfinancialactivitiesduringanaccountingperiodandtopreparethe

desiredfinancialstatementsattheendoftheperiod.Thisflowchartdepictsasimpleaccountingsystem.

(1),(2)Astransactionsoccur,eachisanalyzedtodecidewhichaccountsitaffectsandhow.Thissteprequiresaknowledgeofaccountingconceptsandjudgmentonthepartofthe

personrecordingthetransaction.ThisistheanalysisweperformedinearlierchapterstorecordincreasesanddecreasesinvariousaccountseachtimeGlobalGrocercompleteda

transaction.

(3)Next,thetransactionisrecordedinajournal.Ajournalisachronologicalrecordoftheentity'stransactionsastheyoccur.Notethatoncethetransactionanalysishasbeendone,

makingajournalentry,orjournalizingthetransaction,isapurelymechanicalstep.

(4)Afterthejournalentryismade,thetransactionisrecordedorpostedtotheledger.Postingtheentryintotheledger,too,isamechanicalstep.Theledgerisagroupingof

transactioninformationbyaccount.Accountsintheledgerareclassifiedaseitherbalancesheetaccounts(forexample,thecashaccount)orincomestatementaccounts(forexample,

thesalesaccount).

(5)Theaccountingentrieswehavemadetodatearecalledoriginalentries.Theywereinitiatedbytransactionswithinternalandexternalparties.Attheendoftheaccounting

periodanotherkindofentryadjustingentriesmustberecordedsothattheaccountbalancesreflectfairlythesituationattheendoftheperiod.Thesetransactionsdonotinvolve

internalandexternalparties.Forexample,anentrymustbemadetoreflectadepreciationexpensefortheperiodduetothepassageoftime.

(6)Attheendoftheaccountingperiod,afteralloftheoriginalandadjustingentrieshavebeenenteredinthejournalandpostedtotheledger,thevariousledgeraccountswillshow

abalance.Thebalancesheetaccountbalancesarecarriedforwardtothenextperiod.Theincomestatement(temporaryaccounts)areclosedandresettozerobytransferring(inour

simplesystem)theirbalancestoretainedearnings.