Академический Документы

Профессиональный Документы

Культура Документы

Premarket DerivativesStrategist AnandRathi 30.11.16

Загружено:

Rajasekhar Reddy AnekalluАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Premarket DerivativesStrategist AnandRathi 30.11.16

Загружено:

Rajasekhar Reddy AnekalluАвторское право:

Доступные форматы

The Strategist

30 November 2016

Activity Tracking

Market Statistics

Product

No. of Contracts

Turnover (Rs.cr)

Index Futures

2,12,764

13,942.89

Stock Futures

4,50,142

29,961.92

Index Options

29,04,584

1,97,152.61

Stock Options

2,16,720

14,917.15

37,84,210

2,55,974.58

F&O Total

Stocks (Long Position)

Remarks

Ibulhsgfin, Jswenergy, Eichermot

Adaniports, Havells, Heromotoco

Suggesting strength in these counter

IDFCBank, HDFC, Bharatfin

Stocks (Short Covering)

Remarks

Godrejind, Ambujacem, NIITTech

Suntv, MRF, BEML

Suggesting strength in these counter

Jetairways, Lupin, Adanipower

Stocks (Short Position)

FII Derivatives Statistics

OI at end of the day

Buy

Sell

Contract Amount

Index futures

2147.09 1531.71

166452 10501.52

Index options

28502.02 27075.67

905902 56238.04

Stock futures

6438.95 5605.63

820676 49892.36

Stock options

2357.12 2344.58

44562 2859.05

Net Inflow/Outflow (Cr)

Remarks

Oil, IGL, Godrejcp

Inflow /

Outflow

615.38

1426.35

833.33

12.54

2887.60

Securities in Ban Period

Pageind, Glenmark, JISLJALEQS

Srtransfin, Andhrabank, Apollohosp

Suggesting weakness in these counter

Stocks (Long Liquidation)

Remarks

Hindzinc, TechM, Mindtree

Hindalco, Tataelxsi, ITC

IDFC, Arvind, Hindpetro

Suggesting weakness in these counter

Activity in F&O

Nifty future closed positive at 8172.05 levels. Nifty future OI increased by 1.97% with a rise in

NIL

price by 0.26%. It closed at a premium of 30 points as compared to the premium of 23 points in

Nifty Future/Option Trading Guide

NIFTY

Short term

Medium term

Support

7920

7600

Resistance

8220

8480

Nifty View for the Day

Now if it fails to deliver strength by holding 8180 zones then it

may drift towards 8100-8080 zones while holding above 8220

previous trading session. Market witnessed buying interest in Auto and Realty sector stocks

while selling pressure was seen in Banks, Metals, Pharma and IT sector stocks. The market

turnover increased by 18.94% in terms of number of contracts traded vis--vis previous trading

day and in terms of rupees it increased by 18.31%.

Indication

Put Call Ratio based on Open Interest of Nifty moved up from 1 to 1.03 levels as compared to

previous trading session. Historical Volatility fell down from 20.70 to 20.11 levels and Implied

Volatility also fell down from 16.26 to 15.81 levels.

Conclusion

might attract fresh move towards 8320 zones in next coming

Nifty future opened flat to positive and moved towards 8220 levels but failed to sustain it and in

sessions.

the last hour drifted towards 8150 levels. Now if it fails to deliver strength by holding 8180

Corporate Action

zones then it may drift towards 8100-8080 zones while holding above 8220 might attract fresh

move towards 8320 zones in next coming sessions. On the option front, maximum Put OI is at

8000 followed by 7900 strike while maximum Call OI is at 8300 followed by 8500 strike. We

have seen fresh Put writing at 8100, 8200 and 8300 strike while Call Writing is seen at 8200

and 8300 strike. Fight between Put writers and Call writers might keep the market in a trading

range for a while and broader trading range may remain in between 8000 to 8300 zones for

next coming weeks. Bank Nifty has been underperforming the broader market and registered

the lowest daily close in last four months. However it is respecting immediate support of 18150

zones and if that is taken out then it may start the fresh decline towards 17800-17700 zones.

On the upside it has immediate hurdle near to 18500 zones.

Anand Rathi

Research

The Strategist

30-Nov-16

Future STT Call

CADILAHC: Rs. 400

Execution Price Range

Stop Loss

Sell Between Rs. 405 to Rs. 409

Target

415

390

CADILAHC negated the positive price formation of making higher highs

higher lows and snapped the gains of last two sessions. It failed to surpass its

immediate hurdle of 415 zones and witnessed selling pressure at higher

levels. Fresh built up of short position was seen in the counter with open

interest addition of around 2%. One can sell the stock on a small bounce back

move with strict stop loss of 415 for the downside target of 390 levels.

Future STT Call

MARICO: Rs. 249

Execution Price Range

Sell Between Rs. 252 to Rs. 254

Stop Loss

258

Target

243

MARICO broke the support of 250 zones as failed to surpass the hurdle of

256-258 levels and started witnessed selling pressure. It has been witnessing

selling at every minor attempt to bounce indicating weakness in the counter. It

has added shorts of around 5% in last two trading sessions thus supporting

our negative view in the counter. We have fundamentally contrary view on the

stock but suggesting a trade for immediate profit booking decline towards 258

levels. Thus one can sell with the stop loss of 258 for the upside immediate

target of 243 levels.

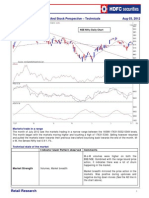

Graphic Snapshot

Anand Rathi

Research

The Strategist

30-Nov-16

Derivatives Lesson: LONG COMBO: SELL A PUT, BUY A CALL

A Long Combo is a Bullish strategy. If an investor is expecting the price of a stock to move up he can do a Long Combo strategy. It is constructed by selling an OTM

(lower strike) Put and buying an OTM (higher strike) Call.

This strategy simulates the action of buying a stock (or futures) but at a fraction of the stock price. It is an inexpensive trade, similar in pay-off to Long Stock, except

there is a gap between the strikes.

Max loss: Unlimited (Lower Strike + net debit)

Reward: Unlimited

Breakeven: Higher strike + net debit

Trading Laws:

A Trader not observing STOP LOSS cannot survive for long.

Never re-schedule your stop loss, square up first and then take a fresh view.

Book small losses by buying / selling near support / resistance, and look for big gains, this will maximize the gains.

Dont try to anticipate the change in main trend, so dont go against trend

DISCLAIMER: This report has been issued by Anand Rathi Securities Limited (ARSL), which is regulated by SEBI. The information herein was obtained from various sources; we do not guarantee its

accuracy or completeness. Neither the information nor any opinion expressed constitutes an offer, or an invitation to make an offer, to buy or sell any securities, options, future or other derivatives

related to such securities (related investment). ARS and its affiliated may trade for their own accounts as market maker/ jobber and /or arbitrageur in any securities of this issuer(s) or in related

investments, and may be on the opposite side of public orders. ARS, its affiliates, directors, officers, and employees may have a long or short position in any securities of this issuer(s) or in related

investment banking or other business from, any entity mentioned in this report. This research report is prepared for private circulation. It does not have regard to the specific investment objectives,

financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial situation and the particular needs of any specific investing in any securities

or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such

securities, if any, may fluctuate and that each security's price or value may rise or fall. Past performance is not necessarily a guide to future performance. Foreign currency rates of exchange may

adversely affect the value, price or income of any security or related investment mentioned in this report.

Anand Rathi

Research

Вам также может понравиться

- Interview With Andrew Cardwell On RSIДокумент27 страницInterview With Andrew Cardwell On RSIpsoonek86% (7)

- How To Not-To Lose Money in Stock Market-V2.0Документ21 страницаHow To Not-To Lose Money in Stock Market-V2.0Vikas Jain0% (1)

- The Four Types of Gaps and How To Play Them PDFДокумент17 страницThe Four Types of Gaps and How To Play Them PDFshaikiftakar100% (2)

- Rsi ReportДокумент17 страницRsi Reportzaveri4life100% (2)

- Day Trading Strategies For Beginners: Day Trading Strategies, #2От EverandDay Trading Strategies For Beginners: Day Trading Strategies, #2Оценок пока нет

- RFBT B41 Final Pre-Board Exams (Questions & Answers)Документ18 страницRFBT B41 Final Pre-Board Exams (Questions & Answers)rav dano100% (3)

- Technical AnalysisДокумент93 страницыTechnical AnalysisAnshul Agrawal50% (4)

- Live Trading Session With Rishikesh SirДокумент6 страницLive Trading Session With Rishikesh SirYash GangwalОценок пока нет

- Financial Management - Midterm Exam - 1st DraftДокумент5 страницFinancial Management - Midterm Exam - 1st DraftRenalyn Paras100% (2)

- How To Calculate Support & Resistance Levels - Chart of MIC ElectronicsДокумент4 страницыHow To Calculate Support & Resistance Levels - Chart of MIC ElectronicsVisu SamyОценок пока нет

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.От EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Оценок пока нет

- How To Swing Trade by Brian PezimДокумент248 страницHow To Swing Trade by Brian PezimSravan KumarОценок пока нет

- Dow TheoryДокумент5 страницDow TheoryChandra RaviОценок пока нет

- FS PP Dung QuatДокумент199 страницFS PP Dung Quateagleonsky100% (1)

- SG 6941 Fx360 Favourite Strategies AW4Документ27 страницSG 6941 Fx360 Favourite Strategies AW4Zac CheahОценок пока нет

- Forex Trading Strategy: Trade Market Imbalance Using Supply and Demand StrategyОт EverandForex Trading Strategy: Trade Market Imbalance Using Supply and Demand StrategyРейтинг: 4 из 5 звезд4/5 (10)

- Allen and Gale. 1994. Financial Innovation and Risk SharingДокумент411 страницAllen and Gale. 1994. Financial Innovation and Risk SharingCitio Logos100% (1)

- Top 10 Technical Indicators For Agri Commodity Market Part 1Документ40 страницTop 10 Technical Indicators For Agri Commodity Market Part 1sharathОценок пока нет

- Derivatives Mock ExamДокумент5 страницDerivatives Mock ExamMatthew FlemingОценок пока нет

- FIN621 Solved MCQs Finalterm Mega FileДокумент23 страницыFIN621 Solved MCQs Finalterm Mega FileKashif Rana50% (4)

- Show NewsДокумент2 страницыShow NewsGaurav GuptaОценок пока нет

- Nifty Technical & Derivatives ReportДокумент5 страницNifty Technical & Derivatives ReportRajasekhar Reddy AnekalluОценок пока нет

- Tech Derivatives DailyReport 210416Документ5 страницTech Derivatives DailyReport 210416xytiseОценок пока нет

- 9th, December 2015: Nifty Outlook Sectoral OutlookДокумент5 страниц9th, December 2015: Nifty Outlook Sectoral OutlookPrashantKumarОценок пока нет

- Banking & IT Sector WatchДокумент4 страницыBanking & IT Sector WatchAnonymous y3hYf50mTОценок пока нет

- Sensex (38435) / Nifty (11372) : Benchmark Consolidates, Midcaps Continues Their Dream RunДокумент3 страницыSensex (38435) / Nifty (11372) : Benchmark Consolidates, Midcaps Continues Their Dream RunbbaalluuОценок пока нет

- Monthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012Документ5 страницMonthly Market, Sectoral and Stock Perspective - Technicals Dec 08, 2012GauriGanОценок пока нет

- Weekly 17022023Документ4 страницыWeekly 17022023rajesh bhosaleОценок пока нет

- Monthly Market, Sectoral and Stock Perspective - Technicals Aug 03, 2012Документ5 страницMonthly Market, Sectoral and Stock Perspective - Technicals Aug 03, 2012GauriGanОценок пока нет

- Banking & IT Sector WatchДокумент6 страницBanking & IT Sector WatchGauriGanОценок пока нет

- HSL Techno-Sector Buzzer: Retail ResearchДокумент6 страницHSL Techno-Sector Buzzer: Retail ResearchumaganОценок пока нет

- Monthly Market, Sectoral and Stock Perspective - Technicals June 29, 2013Документ6 страницMonthly Market, Sectoral and Stock Perspective - Technicals June 29, 2013GauriGanОценок пока нет

- Dno 20 01 2015Документ2 страницыDno 20 01 2015Pronod BharatiyaОценок пока нет

- Tech Derivatives DailyReport 200416Документ5 страницTech Derivatives DailyReport 200416xytiseОценок пока нет

- Premarket MarketOutlook Motilal 20.12.16Документ5 страницPremarket MarketOutlook Motilal 20.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Sensex (37877) / Nifty (11178) : Nifty Finally Gives Up Around 11350Документ3 страницыSensex (37877) / Nifty (11178) : Nifty Finally Gives Up Around 11350bbaalluuОценок пока нет

- Market StrengthДокумент7 страницMarket Strengthsidd2208Оценок пока нет

- Premarket MarketOutlook Motilal 19.12.16Документ4 страницыPremarket MarketOutlook Motilal 19.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Nifty Trend at 17700 | Technical ReviewДокумент3 страницыNifty Trend at 17700 | Technical ReviewDivyesh PandeyОценок пока нет

- Nifty Snaps Six-Week Winning Streak, Still 11000 Defended SuccessfullyДокумент3 страницыNifty Snaps Six-Week Winning Streak, Still 11000 Defended SuccessfullybbaalluuОценок пока нет

- Short-Term Trading Strategies for Upcoming WeekДокумент4 страницыShort-Term Trading Strategies for Upcoming WeekSantosh RodeОценок пока нет

- 3rd Premium SubscriptionДокумент16 страниц3rd Premium SubscriptionManish SachdevОценок пока нет

- Nifty Nearing Crucial Hurdles, Still Better To Take Some Money Off The TableДокумент3 страницыNifty Nearing Crucial Hurdles, Still Better To Take Some Money Off The TablebbaalluuОценок пока нет

- Technical analysis of Hind. Petro suggests sell opportunityДокумент3 страницыTechnical analysis of Hind. Petro suggests sell opportunityGauriGanОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- Nifty Ends Higher Despite ChecksДокумент3 страницыNifty Ends Higher Despite ChecksbbaalluuОценок пока нет

- Weekly 16122022Документ4 страницыWeekly 16122022Bharat YadavОценок пока нет

- Sector Technical Watch: A Periodical Technical Report On Banking & IT SectorsДокумент6 страницSector Technical Watch: A Periodical Technical Report On Banking & IT SectorsGauriGanОценок пока нет

- Long Term Technical Stock Pick - Buy PC JEWELLER - 131218Документ4 страницыLong Term Technical Stock Pick - Buy PC JEWELLER - 131218VINOD KUMARОценок пока нет

- HSL Techno Edge: Retail ResearchДокумент3 страницыHSL Techno Edge: Retail ResearchDinesh ChoudharyОценок пока нет

- Notes To CryptoДокумент5 страницNotes To CryptoHina ShehzadiОценок пока нет

- Premarket Technical&Derivative Angel 15.12.16Документ5 страницPremarket Technical&Derivative Angel 15.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Technical Report 24th October 2011Документ5 страницTechnical Report 24th October 2011Angel BrokingОценок пока нет

- Weekly Trading Highlights & OutlookДокумент5 страницWeekly Trading Highlights & OutlookDevang VisariaОценок пока нет

- HSL Techno Edge: Retail ResearchДокумент3 страницыHSL Techno Edge: Retail ResearchDinesh ChoudharyОценок пока нет

- Weekly Derivative Foresight: Nifty, BankNifty Outlook and Stock PicksДокумент5 страницWeekly Derivative Foresight: Nifty, BankNifty Outlook and Stock PicksRomelu MartialОценок пока нет

- Weekly Update 17th Dec 2011Документ6 страницWeekly Update 17th Dec 2011Devang VisariaОценок пока нет

- Technical Report 14th October 2011Документ5 страницTechnical Report 14th October 2011Angel BrokingОценок пока нет

- HSL Weekly Insight: Retail ResearchДокумент4 страницыHSL Weekly Insight: Retail ResearchshobhaОценок пока нет

- Daily Technical Report: Sensex (16213) / NIFTY (4867)Документ5 страницDaily Technical Report: Sensex (16213) / NIFTY (4867)Angel BrokingОценок пока нет

- Technical Report 10th October 2011Документ4 страницыTechnical Report 10th October 2011Angel BrokingОценок пока нет

- Premarket Technical&Derivatives Angel 16.11.16Документ5 страницPremarket Technical&Derivatives Angel 16.11.16Rajasekhar Reddy AnekalluОценок пока нет

- 9th, September 2015: Nifty Outlook Sectoral OutlookДокумент5 страниц9th, September 2015: Nifty Outlook Sectoral OutlookPrashantKumarОценок пока нет

- Positive Momentum Continues: Punter's CallДокумент3 страницыPositive Momentum Continues: Punter's CallDivakar MamidiОценок пока нет

- Nifty sideways as ascending triangle hints at upside breakoutДокумент3 страницыNifty sideways as ascending triangle hints at upside breakoutumaganОценок пока нет

- Mentum Stocks: Sector Technical WatchДокумент5 страницMentum Stocks: Sector Technical WatchGauriGanОценок пока нет

- Daily Technical Report: Sensex (16719) / NIFTY (5068)Документ4 страницыDaily Technical Report: Sensex (16719) / NIFTY (5068)Angel BrokingОценок пока нет

- Day Trading Guide - Day Trading Guide For Monday - The Economic TimesДокумент3 страницыDay Trading Guide - Day Trading Guide For Monday - The Economic TimesAnupОценок пока нет

- Technical and Derivatives Review | June 15, 2019Документ3 страницыTechnical and Derivatives Review | June 15, 2019Hardik ShahОценок пока нет

- Premarket OpeningBell ICICI 15.12.16Документ8 страницPremarket OpeningBell ICICI 15.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MorningGlance SPA 15.12.16Документ3 страницыPremarket MorningGlance SPA 15.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MarketOutlook Angel 15.12.16Документ14 страницPremarket MarketOutlook Angel 15.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket Technical&Derivative Ashika 16.12.16Документ4 страницыPremarket Technical&Derivative Ashika 16.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket CurrencyDaily ICICI 15.12.16Документ4 страницыPremarket CurrencyDaily ICICI 15.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Morning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersДокумент6 страницMorning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersRajasekhar Reddy AnekalluОценок пока нет

- Premarket MarketOutlook Motilal 20.12.16Документ5 страницPremarket MarketOutlook Motilal 20.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MorningReport Ashika 15.12.16Документ6 страницPremarket MorningReport Ashika 15.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MorningReport Dynamic 20.12.16Документ7 страницPremarket MorningReport Dynamic 20.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket Technical&Derivative Angel 15.12.16Документ5 страницPremarket Technical&Derivative Angel 15.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket CurrencyDaily ICICI 20.12.16Документ4 страницыPremarket CurrencyDaily ICICI 20.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket WakeUpCall Wallfort 20.12.16Документ2 страницыPremarket WakeUpCall Wallfort 20.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MorningGlance SPA 20.12.16Документ3 страницыPremarket MorningGlance SPA 20.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket WakeUpCall Wallfort 21.12.16Документ2 страницыPremarket WakeUpCall Wallfort 21.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket OpeningBell ICICI 21.12.16Документ8 страницPremarket OpeningBell ICICI 21.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket CurrencyDaily ICICI 21.12.16Документ4 страницыPremarket CurrencyDaily ICICI 21.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MarketOutlook Angel 9.12.16Документ11 страницPremarket MarketOutlook Angel 9.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Technical Derivatives Report SummaryДокумент5 страницTechnical Derivatives Report SummaryRajasekhar Reddy AnekalluОценок пока нет

- Premarket MarketOutlook Angel 20.12.16Документ14 страницPremarket MarketOutlook Angel 20.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MorningReport Ashika 21.12.16Документ6 страницPremarket MorningReport Ashika 21.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MorningGlance SPA 21.12.16Документ3 страницыPremarket MorningGlance SPA 21.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket CurrencyDaily ICICI 19.12.16Документ4 страницыPremarket CurrencyDaily ICICI 19.12.16Rajasekhar Reddy AnekalluОценок пока нет

- US$ INR Currency Futures OutlookДокумент4 страницыUS$ INR Currency Futures OutlookRajasekhar Reddy AnekalluОценок пока нет

- Premarket MorningReport Dynamic 21.12.16Документ7 страницPremarket MorningReport Dynamic 21.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MorningReport Dynamic 19.12.16Документ7 страницPremarket MorningReport Dynamic 19.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MarketOutlook Angel 19.12.16Документ14 страницPremarket MarketOutlook Angel 19.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket MarketOutlook Motilal 19.12.16Документ4 страницыPremarket MarketOutlook Motilal 19.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Premarket OpeningBell ICICI 09.12.16Документ8 страницPremarket OpeningBell ICICI 09.12.16Rajasekhar Reddy AnekalluОценок пока нет

- Monthly Call: Apollo TyresДокумент4 страницыMonthly Call: Apollo TyresRajasekhar Reddy AnekalluОценок пока нет

- Techno Funda Pick Techno Funda Pick: R Hal Research AnalystsДокумент10 страницTechno Funda Pick Techno Funda Pick: R Hal Research AnalystsRajasekhar Reddy AnekalluОценок пока нет

- Report PDFДокумент26 страницReport PDFMayank MishraОценок пока нет

- Capital Market in IndiaДокумент33 страницыCapital Market in IndiaAnonymous Rz2JhIОценок пока нет

- d076 Study GuideДокумент15 страницd076 Study GuideMonique CruzОценок пока нет

- Buffet Checklist v4 PDFДокумент4 страницыBuffet Checklist v4 PDFapluОценок пока нет

- Main ProjectДокумент74 страницыMain ProjectNeha SachdevaОценок пока нет

- HDFC Bank StrategyДокумент214 страницHDFC Bank StrategyMukul Yadav0% (1)

- 1.2 Corporate Accounting PDFДокумент6 страниц1.2 Corporate Accounting PDFRech MJОценок пока нет

- FIN 460 Final ProjectДокумент36 страницFIN 460 Final Projectnafiz_iubОценок пока нет

- Online Gambling Company Fights Iroquois' War of Words - Growth Capitalist 6.11.2014Документ4 страницыOnline Gambling Company Fights Iroquois' War of Words - Growth Capitalist 6.11.2014Teri BuhlОценок пока нет

- Lesson 2 Financial Statement AnalysisДокумент81 страницаLesson 2 Financial Statement AnalysisRovic OrdonioОценок пока нет

- Appollo Ispat Complex LTDДокумент155 страницAppollo Ispat Complex LTDMahbub E AL MunimОценок пока нет

- Disclosure No. 132 2016 Top 100 Stockholders As of December 31 2015Документ6 страницDisclosure No. 132 2016 Top 100 Stockholders As of December 31 2015Mark AgustinОценок пока нет

- Investment Scenario ExplainedДокумент37 страницInvestment Scenario ExplainedLokesh GowdaОценок пока нет

- Stochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017Документ27 страницStochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017doomriderОценок пока нет

- Income From Other SourcesДокумент27 страницIncome From Other Sourcesanilchavan100% (1)

- Claritas Syllabus OverviewДокумент24 страницыClaritas Syllabus Overviewginos_tОценок пока нет

- Assignment For DerivativesДокумент17 страницAssignment For DerivativesMohammad ArsalanОценок пока нет

- Portfolio Analysis of Micro Finance Portfolio Management and Security AnalysisДокумент12 страницPortfolio Analysis of Micro Finance Portfolio Management and Security AnalysisBasanta BhetwalОценок пока нет

- Behavioral Finance and Its Impact On InvestingДокумент43 страницыBehavioral Finance and Its Impact On InvestingEduardo FleuryОценок пока нет

- Menggabungkan Indikator Bollingerband Dan Moving: Average Untuk Analisis Harga SahamДокумент114 страницMenggabungkan Indikator Bollingerband Dan Moving: Average Untuk Analisis Harga SahamIsaac KaunangОценок пока нет

- Cebu AirДокумент22 страницыCebu AirCamille BagadiongОценок пока нет