Академический Документы

Профессиональный Документы

Культура Документы

SC rules zinc dross, flux skimming not liable for excise duty

Загружено:

Prabhat Bhat0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров2 страницы1324 Spot Lights

Оригинальное название

1324 Spot Lights

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ1324 Spot Lights

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров2 страницыSC rules zinc dross, flux skimming not liable for excise duty

Загружено:

Prabhat Bhat1324 Spot Lights

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Indian Tax Solutions

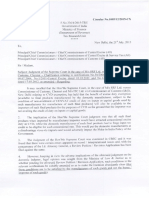

Zinc dross, flux skimming out of excise duty: SC

New Delhi, Oct. 15 (PTI):- The

Supreme Court has held that Zinc dross and Flux skimming produced during the

galvanisation process of aluminium cannot be termed as goods to be brought under

the ambit of excise duty.

Holding that though dross and skimming may have some saleable value, the apex

court said it would not render it as a 'manufactured product' for imposing duty.

A bench of Justice S B Sinha and Justice Dalveer Bhandari concurred with the

findings of a tribunal that dross and skimming were not amenable to duty.

As a result of oxidation of aluminium sheets a thin layer/film is formed, which

is removed by the process of skimming and the second layer so removed is called

dross.

The verdict was pronounced by dismissing the petition by Commissioner of Central

Excise, challenging an order passed by the Customs, Excise and Service Tax

Appellate Tribunal (CESTAT).

In its ruling, the bench referred to earlier apex court judgements in which it

was settled that merely selling does not mean that dross and skimming were

marketable commodities.

The court had referred to the verdict in which it was observed that "even

rubbish can be sold and everything which is sold is, however, not necessarily a

marketable commodity as known to commerce."

The Central Excise had contended that dross and skimming were not only

marketable but in fact contain high percentage of aluminium and in some cases up

to 78 per cent and so will come under the purview of the term goods for levying

Page 1/2

Indian Tax Solutions

duty.

However, the Indian Aluminium Company Ltd had maintained that dross was waste

material, not marketable and it did not come under the ambit of manufactured

item.

Page 2/2

Вам также может понравиться

- F IDT Select Casesl For May 2014Документ90 страницF IDT Select Casesl For May 2014Chandrikaprasad Kollegala SubbaramuОценок пока нет

- Summary of Case Laws of Idt 4 May Nov 14 ExamsДокумент9 страницSummary of Case Laws of Idt 4 May Nov 14 ExamsAnupam BaliОценок пока нет

- Case Digest CIR Vs ATLAS and CAДокумент4 страницыCase Digest CIR Vs ATLAS and CAMarlowe Cris MenceroОценок пока нет

- Hallmarking of Gold Jewellery in IndiaДокумент5 страницHallmarking of Gold Jewellery in IndiaJuie ShahОценок пока нет

- Indirect Tax Case LawsДокумент45 страницIndirect Tax Case LawsKamal Kant ChauhanОценок пока нет

- Legal Roundup Sep 09Документ7 страницLegal Roundup Sep 09api-3730218Оценок пока нет

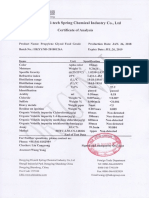

- Quick lime export certificate from Vietnam to BangladeshДокумент1 страницаQuick lime export certificate from Vietnam to BangladeshMashiur RahmanОценок пока нет

- Presentation On Dutiability of Waste and ScrapДокумент23 страницыPresentation On Dutiability of Waste and Scrapjonnajon92Оценок пока нет

- Spiral 2 Case LawДокумент398 страницSpiral 2 Case LawCRO0658286 DEEPANSHU GOYALОценок пока нет

- 07-Cus RecДокумент3 страницы07-Cus RecAshfaq AhmedОценок пока нет

- CIRvsCA 104151 1995 DigestДокумент1 страницаCIRvsCA 104151 1995 DigestJeremiahN.CaballeroОценок пока нет

- Process Certificates 2019 PDFДокумент13 страницProcess Certificates 2019 PDFBranZzZzZОценок пока нет

- 2b) Business Laws II BTypes of Courts July 2022Документ32 страницы2b) Business Laws II BTypes of Courts July 2022akash nakkiranОценок пока нет

- Legal Round Up - June 2009Документ4 страницыLegal Round Up - June 2009api-3730218Оценок пока нет

- Important Case Laws on Indirect TaxesДокумент30 страницImportant Case Laws on Indirect TaxesdhominicОценок пока нет

- Cement Safety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/ UndertakingДокумент27 страницCement Safety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/ UndertakingjaymarОценок пока нет

- Aluminum Powder Paper (India)Документ5 страницAluminum Powder Paper (India)METFISОценок пока нет

- Casco V GimenezДокумент1 страницаCasco V GimenezGillian CalpitoОценок пока нет

- Mergers Commission Approves KPS Acquisition of Real Alloy Europe Subject To ConditionsДокумент2 страницыMergers Commission Approves KPS Acquisition of Real Alloy Europe Subject To Conditionsgrahambatchelor83Оценок пока нет

- 04 V605 - Shakambari Overseas Traders - ID-506881Документ4 страницы04 V605 - Shakambari Overseas Traders - ID-506881Vivek SharmaОценок пока нет

- September-October, 2010Документ8 страницSeptember-October, 2010Gagandeep KaurОценок пока нет

- 1b - RHI Clasil PlantДокумент21 страница1b - RHI Clasil Plantmahreza189100% (1)

- Proílenglicol ChinoДокумент1 страницаProílenglicol Chinojuan aguileraОценок пока нет

- Select Cases Idtl 2014 Paper 8Документ106 страницSelect Cases Idtl 2014 Paper 8Pooja MeenaОценок пока нет

- TribunalsДокумент88 страницTribunalsMaanvi RockzzОценок пока нет

- Mobilith SHC Greases for Heavy Duty & High Temp ApplicationsДокумент2 страницыMobilith SHC Greases for Heavy Duty & High Temp ApplicationsEmerson 2140Оценок пока нет

- CBIC-DIN:- Terminal Handling Charges levied by Terminal OperatorsДокумент2 страницыCBIC-DIN:- Terminal Handling Charges levied by Terminal Operatorssamartha1181Оценок пока нет

- RMP 1Документ10 страницRMP 1Anonymous l5X3VhTОценок пока нет

- Contract SPA (11) (8) - 061326Документ23 страницыContract SPA (11) (8) - 061326azeem khanОценок пока нет

- 2011UGME012Документ76 страниц2011UGME012Anshu GuleriaОценок пока нет

- Casco Phil Chemical Co Vs GIMENEZДокумент2 страницыCasco Phil Chemical Co Vs GIMENEZthefiledetectorОценок пока нет

- 2017 CGO 0002 Ver00Документ136 страниц2017 CGO 0002 Ver00j4javariaОценок пока нет

- Casco Philippine Chemical Co, Inc Vs GimenezДокумент1 страницаCasco Philippine Chemical Co, Inc Vs GimenezlckdsclОценок пока нет

- Buss OpS 2019 enДокумент20 страницBuss OpS 2019 enpeakglobal surveyОценок пока нет

- Zinc Oxide Pigments: Standard Specification ForДокумент2 страницыZinc Oxide Pigments: Standard Specification ForMadhavanОценок пока нет

- SOTACIB-Material Safety Data Sheet - Juillet 2017Документ10 страницSOTACIB-Material Safety Data Sheet - Juillet 2017lindaОценок пока нет

- A217 Grade WC6 Alloy Steel Casting Material Data SheetДокумент2 страницыA217 Grade WC6 Alloy Steel Casting Material Data SheetDika Wahyu WijayaОценок пока нет

- Sales and Purchase Contract Of: Indonesian Steam CoalДокумент21 страницаSales and Purchase Contract Of: Indonesian Steam Coalagus mentol50% (2)

- 2020-11 Product Data Sheet LiOH TG CMP PDFДокумент5 страниц2020-11 Product Data Sheet LiOH TG CMP PDFSergey GlazzОценок пока нет

- Show Brazing AluminiumДокумент6 страницShow Brazing Aluminiumneptuno97Оценок пока нет

- Casco Chemical Co v. GimenezДокумент1 страницаCasco Chemical Co v. GimenezEmir MendozaОценок пока нет

- 5800 Contract PT Sak Signed Upas OkДокумент14 страниц5800 Contract PT Sak Signed Upas OkMarvel IsmeОценок пока нет

- IBC, Arbitration Dispute Over Operational DebtДокумент26 страницIBC, Arbitration Dispute Over Operational DebtVishal MandalОценок пока нет

- Tax Alert Kone Elevator CaseДокумент4 страницыTax Alert Kone Elevator CaseShubham Singh RathoreОценок пока нет

- Casting Material: Alloy Steel A217 GR WC6Документ2 страницыCasting Material: Alloy Steel A217 GR WC6BiancaОценок пока нет

- Stock To Watch Daily 15 Nov 2018Документ8 страницStock To Watch Daily 15 Nov 2018The EquicomОценок пока нет

- Bhorukha AluminiumДокумент76 страницBhorukha Aluminiumtanujaigoor100% (3)

- The Spirit of Cimm GroupДокумент26 страницThe Spirit of Cimm GroupMuhammad Riaz, 0092-3138432432Оценок пока нет

- Bhushan Steel's Summer Training ReportДокумент54 страницыBhushan Steel's Summer Training ReportsandeepОценок пока нет

- It SVJДокумент6 страницIt SVJrathОценок пока нет

- SAT PARKASH MOOT PROBLEM NO 2 LALA-converted JAI HOДокумент21 страницаSAT PARKASH MOOT PROBLEM NO 2 LALA-converted JAI HOSat Parkash100% (1)

- German Industrial Bonds Under The Dawes PlanДокумент13 страницGerman Industrial Bonds Under The Dawes PlanHamad FalahОценок пока нет

- KM Newsletter Competition Law January 2022Документ9 страницKM Newsletter Competition Law January 2022AkshatОценок пока нет

- ASM Chemical Industries Ltd. Hydrochloric Acid (HCL) : 2. PropertiesДокумент1 страницаASM Chemical Industries Ltd. Hydrochloric Acid (HCL) : 2. PropertiesAnik AichОценок пока нет

- SECTION 09220 Portland Cement Plaster Rev 0Документ30 страницSECTION 09220 Portland Cement Plaster Rev 0sk mukhtarОценок пока нет

- International Designations and Chemical Composition Limits For Aluminum HardenersДокумент23 страницыInternational Designations and Chemical Composition Limits For Aluminum HardenersEko PrasetyoОценок пока нет

- LOI-A7-revised1 - 25 FEB 2022Документ4 страницыLOI-A7-revised1 - 25 FEB 2022Trindra PaulОценок пока нет

- Judgement in Case of SRFДокумент2 страницыJudgement in Case of SRFPrabhat BhatОценок пока нет

- Important Case Laws on Indirect TaxesДокумент30 страницImportant Case Laws on Indirect TaxesdhominicОценок пока нет

- Important Case Laws on Indirect TaxesДокумент30 страницImportant Case Laws on Indirect TaxesdhominicОценок пока нет

- STRL 24 Berco UndercarriagesДокумент4 страницыSTRL 24 Berco UndercarriagesPrabhat BhatОценок пока нет

- Day Trading Shares StrategyДокумент10 страницDay Trading Shares StrategyPrabhat BhatОценок пока нет

- Analysis of Supreme Court Judgement in Fiat CaseДокумент6 страницAnalysis of Supreme Court Judgement in Fiat CasePrabhat BhatОценок пока нет

- Rule 6 0f Cenvat Credit Rules 2004Документ13 страницRule 6 0f Cenvat Credit Rules 2004Prabhat BhatОценок пока нет

- Health and Hygiene STD Viii Biology NotesДокумент5 страницHealth and Hygiene STD Viii Biology NotesPrabhat BhatОценок пока нет

- Quantum Vision SystemДокумент58 страницQuantum Vision SystemCupertino Castro85% (26)

- Treating MelasmaДокумент7 страницTreating MelasmaPrabhat BhatОценок пока нет

- Bank Nifty Option Strategies BookletДокумент28 страницBank Nifty Option Strategies BookletMohit Jhanjee100% (1)

- Raghee Horner Daily Trading EdgeДокумент53 страницыRaghee Horner Daily Trading Edgepsoonek100% (8)

- SC On IspatДокумент37 страницSC On IspatPrabhat BhatОценок пока нет

- Notes RCM 66F Reimbursement 29-5-15Документ22 страницыNotes RCM 66F Reimbursement 29-5-15Prabhat BhatОценок пока нет

- Beginners Guide To Short Selling With Toni TurnerДокумент28 страницBeginners Guide To Short Selling With Toni Turnermasktusedo785Оценок пока нет

- Biology (Science Paper 3)Документ8 страницBiology (Science Paper 3)AmanОценок пока нет

- MATHSДокумент7 страницMATHSdnageshm4n244Оценок пока нет

- ICSE 2017 Chemistry Science Sample Paper 2 PDFДокумент7 страницICSE 2017 Chemistry Science Sample Paper 2 PDFPrabhat BhatОценок пока нет

- Biology (Science Paper 3)Документ8 страницBiology (Science Paper 3)AmanОценок пока нет